1. Executive summary

Solvency II allows insurers to assess regulatory minimum (“Pillar 1”) capital requirements based on insurers’ own internal models of risks, subject to these models meeting regulatory standards. In addition to the measurement of individual risks, a key element of these models is the level of diversification assumed between risks. This can reduce the amount of capital required by up to 70%Footnote 1 compared to the sum of individual risk capital requirements before diversification.

There is a need to justify such diversification benefits given the size of these, both in terms of empirical data (where available) and also with regard to underlying economic and other inter-dependencies between risks. This paper focuses on identifying the variables driving dependencies between risks to help justify diversification benefits, and is split into two parts.

The first part of this paper considers dependencies between different market and credit risks. There is generally sufficient empirical data to assess the degree to which different markets are correlated under normal conditions, but such correlations may overstate the degree of diversification in stressed conditions where there is less data available. There is a need to overlay empirical correlations with expert judgement to allow for how risks may interact at the tail which drives capital requirements.

Based on analysis of historical market crashes; academic, industry and other papers; and forward-looking scenarios, the paper identifies three components to stressed markets:

-

• fragilities which build up in the financial system such as excessive credit growth, or financial de-regulation;

-

• initial shocks to the system such as rate rises or economic downturns which can expose these fragilities; and

-

• transmission of shocks between markets, for example due to reduced investor appetite and/or forced sales coupled with monetary and fiscal responses.

From this we can identify linkages between market and credit risks in stressed market conditions to help adjust correlation assumptions for tail dependency.

The second part of the paper considers wider dependencies with other risk categories such as insurance risk (including lapse and expense risk) and operational risk. There is usually little data to assess correlations with these risks, which also vary from company to company, so there is a greater degree of reliance on expert judgement and consideration of drivers of dependency. Key drivers identified include:

-

• economic downturns which may affect lapses and other risks;

-

• pandemics and other extreme scenarios which can impact financial markets; and

-

• reputation damage which can lead to lower sales, higher lapses and higher unit costs.

This paper is intended to provide a basis for insurers to identify dependencies between risks to meet regulatory requirements, and to ensure correlation assumptions driving diversification benefits are sound.

2. Introduction

As part of the Statistical Quality Standards which insurers’ internal models must meet under Solvency II, Delegated Regulation Article 234 (Diversification Effects) specifies:

“The system used for measuring diversification effects referred to in Article 121(5) of Directive 2009/138/EC shall only be considered adequate where all of the following conditions are met:

-

(a) the system used for measuring diversification effects identifies the key variables driving dependencies;

-

(b) the system used for measuring diversification effects takes into account all of the following:

-

i. any non-linear dependence and any lack of diversification under extreme scenarios;

-

ii. any restrictions of diversification which arise from the existence of a ring-fenced fund or matching adjustment portfolio;

-

iii. the characteristics of the risk measure used in the internal model;

-

-

(c) the assumptions underlying the system used for measuring diversification effects are justified on an empirical basis.”

This paper seeks to identify key variables driving dependencies as per delegated Article 234 (a) above, and also to highlight any lack of diversification in extreme scenarios as per (b) (i). The paper does not seek to measure diversification effects on an empirical basis, though empirical data is investigated as it is a prima facie indicator of dependency between risks.

The paper focuses on Market, Credit, Insurance and Operational Risks which contribute to Solvency II capital requirements. It does not consider Liquidity Risk nor Strategy Risk in detail.

Dependencies are generally modelled using either copula or variance-covariance matrix approaches, both of which are based on correlation assumptions between different risk pairs. Note that while dependency is used interchangeably with correlation throughout this paper, there are differencesFootnote 2 . The paper does not aim to cover different measures of correlation nor aggregation methods in detail. Instead, the author would refer the reader to Dorey et al. (Reference Dorey, Joubert and Vencatasawmy2005) and Shaw et al. (Reference Shaw, Smith and Spivak2010) which provide good coverage of these topics.

Correlation estimates used to investigate dependencies are generally based on the Pearson correlation measure, and are classed as low for correlations <30%; medium for correlations ≥ 30% and <60%; and high for correlations ≥60%. To understand the impact of different correlation assumptions, Appendix I illustrates the impact of sample correlation assumptions.

While the author’s experience predominantly relates to UK life insurance, it is hoped that this paper will be of wider interest to those modelling diversification benefits for Solvency IIFootnote 3 and economic capital modelling purposes.

2.1. Limitations of the paper

The topic of dependencies between risks is wide ranging and difficult to cover completely. The author would draw the reader’s attention to the following limitations of this paper:

-

• The focus of the paper is on dependencies over a 1-year period consistent with the timeframe of Solvency II, but considering longer timeframes may give a different perspective of dependencies: for instance, climate change may have little impact on mortality rates and assumptions over a 1-year period, nor on bond defaults and downgrades, but considering say a 20-year period, climate change could have a significant impact both on mortality rates and on default rates for certain bond sectors such as oil and gas.

-

• The paper’s focus is on the drivers of dependency rather than the calculation of empirical correlation estimates, which are just used as indicators of dependency. For simplicity, empirical estimates of correlations are generally based on the Pearson linear correlation measure but there are a number of limitations to this measure compared to other measures such as the Spearman rank measure of correlation – see Embrechts et al. (Reference Embrechts, McNeil and Straumann1999) for a more detailed discussion of correlation measures.

-

• The author was unable to analyse data for private equity and private credit and therefore was unable to draw on conclusions on dependencies between these asset classes and other markets and risks.

Part I Market and credit risk dependencies

3. Empirical analysis

Empirical correlations can be estimated from market data in liquid markets and these are a starting point for correlation assumptions between most market and credit risks. However, a key contention of this paper is that while empirical correlations can point to dependencies between risks, they are flawed, and need to be supplemented with wider analysis.

For the purposes of this paper, empirical correlations have been estimated from:

-

• MSCI local currency equity price indicesFootnote 4 ;

-

• Government bond yields from the Bank of EnglandFootnote 5 and US Federal ReserveFootnote 6 ;

-

• Currency rates from the Bank of EnglandFootnote 7 ;

-

• Commodity prices in US Dollars from the US Federal ReserveFootnote 8 ;

-

• Credit spreads: ICE Bank of America Merrill Lynch (BofAML) US Corporate indexFootnote 9 ;

-

• CBOE VIX index of equity option volatilityFootnote 10 ;

-

• Inflation and GDP statistics from OECDFootnote 11 ;

-

• US Commercial Property data sourced from the US Federal ReserveFootnote 12 ; and the

-

• Wilshire US Real Estate Investment Trust (REIT) Total Market IndexFootnote 13 .

However, there are issues with empirical correlation estimates for property risk: these are discussed in section 3.4.4 below.

Comparison is also made with global default data from Moody’s 2021 annual corporate bond default surveyFootnote 14 , but data is limited – see section 3.4.5.

Note that many other sources of data are available, and these may yield different correlation estimates.

3.1. Correlations between different risk types

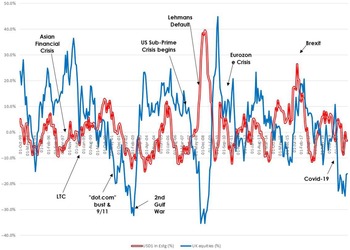

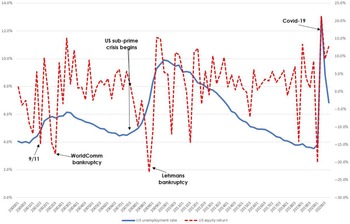

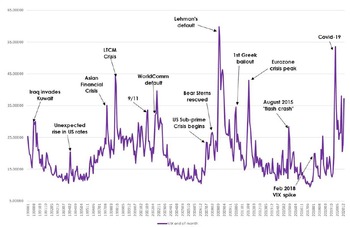

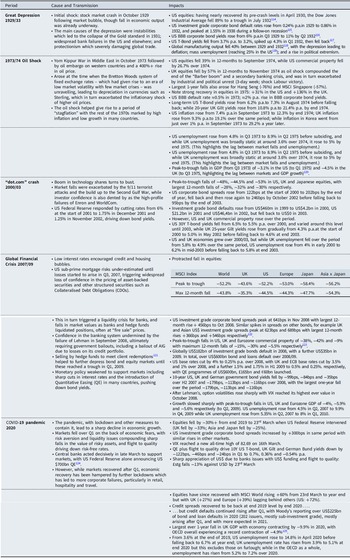

Chart 1a below highlights the links between rolling (overlapping) 12-month changes in bond spreads, equities and point-in-time option implied volatilities based on data from 1997 (from when spread data is available from ICE) to end 2020.

Chart 1a. Key market variables and events – Equities, Bond Spreads and Volatility.

From this chart we can see that there is a significant positive correlation between falling equity markets and rising bond spreads (or negative correlation between rising equity markets and rising spreads), particularly in stressed markets such as those during the Global Financial Crisis of 2007/09. A similar relationship can also be seen between equity market movements and implied volatility levels. As we shall see, in stressed conditions, risk aversion can lead to a re-pricing of risks with adverse consequences for equity and corporate bond values, as well as higher option prices and implied volatilities.

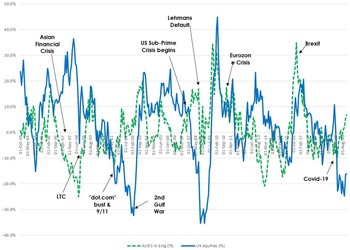

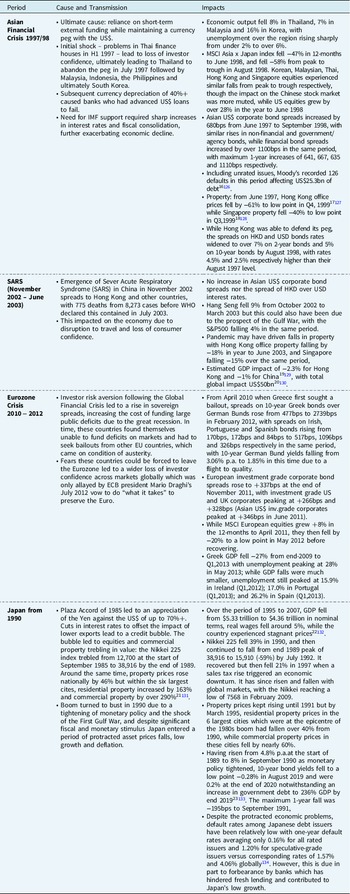

Considering equity market correlations with safer assets, for the purposes of this paper, US Treasury Bonds (“T-bonds”) are considered to be risk-free assets with nominal yields on US T-bonds a proxy for interest ratesFootnote 15 . From Chart 1b below, we may discern a correlation between falling equity markets and falls in US T-bond yields. In part this reflects risk aversion in stressed markets which will lead to investors switching into highly rated government bonds and other low risk assets, driving down yields on these. Also, central banks tend to react to falling markets by lowering interest rates and, since 2009, by using Quantitative Easing (QE) to print money which is then used to buy assets and support markets, driving down bond yields in the process.

Chart 1b. Key market variables and events – Equities and T-bond yields.

These relationships are reflected in empirical correlation estimates which suggest medium/high correlations between most market variables as the following Table 1 shows.

Table 1. Estimated Correlations between Market Variables from 1997 to 2020

Note that the positive correlation between equity market falls and US T-bond yields decreases with bond termFootnote 18 . This may be because in the past the US Federal Reserve has cut short-term base rates as a response to market crashes. However, this relationship may no longer be valid as base rates have been cut close to zero and there is limited potential for base rates to go negative, while QE has increasingly been used to support markets and this will drive down yields at longer terms.

Looking only at changes since 2009, correlations between the MSCI World equity index and 2-, 10- and 30-year US T-bond rates are 20%, 59% and 59% respectively, highlighting the sensitivity to the time period used. The low short-term correlation may be due to low, stable base rates since 2009, with the US target federal funds rate unchanged between 2008 and 2015 at 0.25% and never exceeding 2.5% p.a. sinceFootnote 19 . Meanwhile the impact of QE can be observed most recently in early 2020, when sharp market falls due to COVID-19 triggered unprecedented central bank intervention, with the combination of QE and “flight to quality” pushing US 10-year T-bond rates from 1.92% p.a.at the start of the year to 0.66% p.a. by mid-year.

As well as the time period over which they are assessed, correlations between equities and T-bond rates are also sensitive to the measure of change. The figures above are based on absolute changes in rates, defined as:

If instead we based correlations on relative changes in rates defined as:

Change @ time t = [{T-bond rate @ t}/{T-bond rate @ t-12 months}] – 1we get revised correlations between the MSCI World equity index and 2-, 10- and 30-year US T-bond rates of 49%, 46% and 37% which are noticeably lower, highlighting the sensitivity of empirical correlation estimates to different measures such as absolute or relative changes.

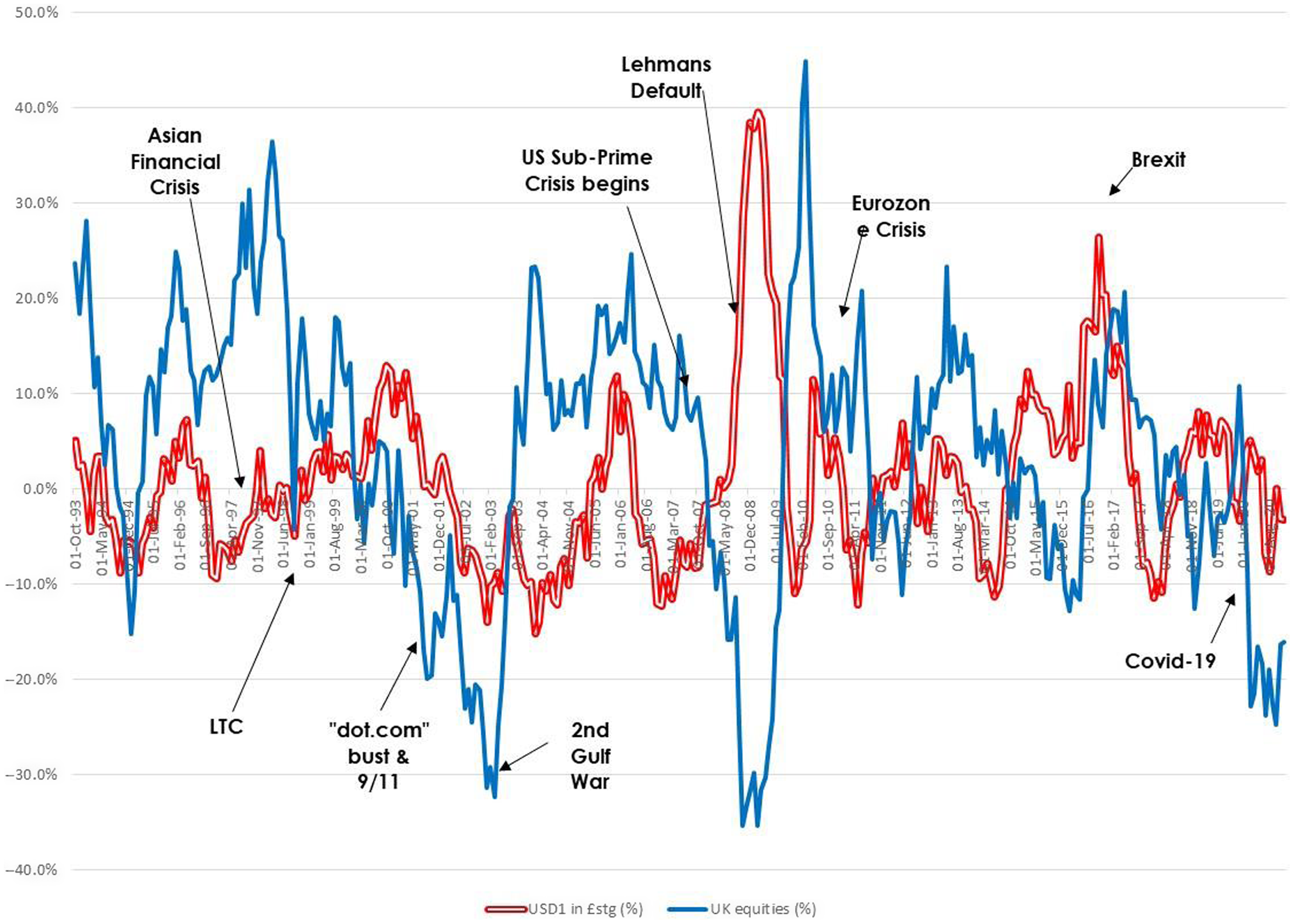

3.1.1. Correlations between currencies and other market risks

A key market risk not considered above is currency risk. Here correlations with other market risks can be less clear cut as they may depend on the exchange rate in question. By way of example consider the following Table 2 of correlations for rolling 12-month movements in the Sterling values of the US Dollar, Japanese Yen and the Australian Dollar with other market variables from October 1993 (12 months after “Black Wednesday” and Sterling’s exit from the European Exchange Rate Mechanism (ERM) to float freely on markets) to 2020:

Table 2. Estimated Correlations between FX Rates and Other Market Variables from 1997

From these correlation estimates, we can observe the following:

First, correlations between different exchange rates differ – for instance there is a high correlation between changes in the Sterling value of the US Dollar and Japanese Yen, but a low correlation of the former with changes in the Sterling value of the Australian Dollar.

Second, there would appear to be at least a low/medium negative correlation between rising equity markets and rising Sterling values of the US Dollar and Yen assets (or a low/medium positive correlation of US Dollar and Yen exchange rates rising against the pound and falling equities). This could be because in stressed market conditions, investors tend to buy US Dollars and Yen as part of a “flight to safety” to safer assets and currencies.

By contrast, the correlation between the Sterling value of the Australian Dollar is slightly positive with equity markets.

The following Charts 2a and 2b compare changes in the Sterling value of US and Australian Dollars with UK equity movements.

Chart 2a. Sterling: USD exchange rates and UK equities from 1992.

Chart 2b. Sterling: AUD exchange rates and UK equities from 1992.

Of note is the sharp rise in the value of the US Dollar against the Pound during the Global Financial Crisis arising in conjunction with a sharp fall in UK equities. This may point to a higher degree of dependence at the tail between UK equity market falls and Sterling deprecation against the US Dollar than might be suggested by the empirical correlation estimate.

This correlation between sterling depreciation and falling equity markets is not observed when considering the value of the Australian Dollar against the Pound. If anything, the Australian Dollar has often depreciated when UK markets are falling. One reason for this may be the “carry trade” where investors borrow money in Yen and other currencies with low interest rates to invest in currencies with higher interest rate – such as the Australian Dollar during the mid-2000s. This is a risky strategy as it leaves investors exposed to falls in the higher interest rate currencies, and is sensitive to investor appetite. In stressed conditions where investors become more risk averse, they will seek to unwind positions in the higher interest rate currencies, which may explain the depreciation of the Australian Dollar during the Global Financial Crisis. However, looking forward, this relationship between the Australian Dollar and the carry trade may no longer hold, highlighting the perils of trying to infer future correlations from the past.

Finally, considering exchange rates and bond yields, there is a negative low/medium correlation between rising UK Gilt yields and rises in US Dollar and Yen against Sterling. Examining possible drivers for this correlation:

-

• This correlation could be because of higher UK interest rates and yields boosting the value of Sterling.

-

• Alternatively, it could be because better UK economic prospects are driving up both bond yields and Sterling – correlation does not imply causation, and often there may be other underlying variables (in this case UK GDP growth) driving the correlation.

-

• As we shall see, the Bank of England’s 2019 stress test for banks involved a “run” on Sterling pushing up UK bond yields, i.e. implying a strong positive correlation between rising UK bond yields and rises in US Dollar and Yen against Sterling, highlighting how empirical estimates may not capture tail risks such as a loss of investor confidence in the UK.

Again, the correlation between UK bond yields and changes in the Sterling value of the Australian Dollar exhibits a different pattern.

The above highlights that there is no “one size fits all” correlation assumption when it comes to currency dependencies. Depending on exposures to different currencies, there may be a need to either set correlations by currency, or to group exposures to currencies with similar characteristics (like the US Dollar and Yen above).

3.1.2. Correlations between commodities and other market risks

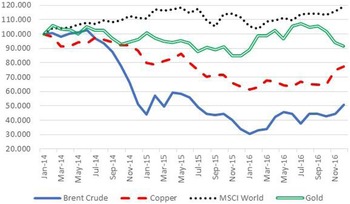

Another market risk where correlations vary by sub-type is commodity risk. Within commodities, we can distinguish between different types of commodity such as copper, oil and gold. While the first two are commodities required by the real economy, the third is more a store of value and is seen as a “safe haven” in turbulent markets.

As a result, correlations with equities and bond yields will vary by type, as can be seen from the following Table 3 of correlations estimated from 12-month changes from January 1991:

Table 3. Estimated Correlations between Commodities RatesFootnote 20 and Other Market Variables

All other things being equal, higher oil prices increase production costs and dampen demand, but they will be a boon for oil and gas stocks, so the impact of oil prices will vary by equity market depending on the weighting of the market to oil and gas stocks. Moreover, higher oil and copper prices may also be indicative of broader economic growth which may also help drive up share prices, illustrating the multi-faceted nature of dependencies between commodities and shares, and between market risks more widely.

The link between economic growth and prices of commodities like oil and copper may also be a reason for the medium positive correlations observed between these and bond yields.

By contrast, gold’s status as a safe asset in turbulent times leads to low negative correlations between gold and both equities and bond yields with gold prices often rising in stressed markets when equities are falling along with bond yields. This relationship is not clear cut however and there are other factors which affect the gold price such as production and consumer demand.

Finally, the correlations above are based on US Dollar prices of commodities as commodity prices are typically quoted in US Dollars. Correlation estimates will change if looking at say the Pound Sterling equivalent of commodity prices, though these estimates would implicitly capture an element of currency risk as well.

3.1.3. Correlations between inflation and other market risks

Another key market risk variable is inflation. In assessing correlations between inflation and other market risks, there is a need to distinguish between:

-

• Actual inflation relating to changes in retail prices over the past month/year; and

-

• Implied inflation which is inferred between from the difference between nominal and index-linked bonds, and which is a measure of market expectations of future inflation.

Implied inflation will vary by term, and will be relevant to the market consistent valuation of future inflation-linked liabilities and expenses, as well as values of general insurance claims where there is an inflationary element to claim payouts. For economic capital purposes, we will be looking to model changes in implied inflation rates. However, for the purposes of modelling expense and claim outflow over the coming year, actual inflation would be more relevant.

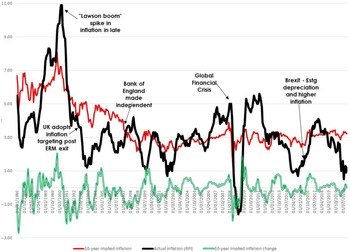

The following Chart 3 compares UK actual and implied inflation from 1986Footnote 21 :

Chart 3. UK Actual v Implied Inflation.

We can see there is a significant disconnect between actual inflation at a given point in time, being the change in prices over the past 12-months, and implied inflation at that point in time inferred from nominal and real Gilt yields, highlighting the need to consider these separately when analysing dependencies.

As an example of this disconnect, we can discern a shift in actual inflation following Sterling’s exit from the European Exchange Rate Mechanism (ERM) in September 1992, after which the Bank of England adopted an inflation targeting approach to monetary policyFootnote 22 . This has proved successful in taming inflation which has generally remained below 5% p.a., with the Retail Price Index (RPI) measure averaging 2.7% p.a. since October 1992, consistent with the Bank of England’s target of 2.5% p.a. for RPI. However, market expectations of inflation took some time longer to adjust, and only started to align with the Bank of England’s target after the Bank of England was made independent in 1997.

Since 1997, market implied UK inflation has generally been around 3% p.a. This is higher than the Bank of England’s target rate, which could reflect the risk the Bank of England might abandon this for a looser target, but it may also have to do with demand from pension scheme and others for index-linked Gilts to hedge inflation-linked liabilities. This will reduce index-linked Gilt yields relative to nominal Gilt yields and push up implied inflation, highlighting another difference between actual and implied inflation.

Examining correlations between UK actual and implied inflation rates with rolling 12-month changes in 10-year Gilt yields and global equities in Table 4 below, we can see significant differences in correlations depending on which measure we consider:

Table 4. Estimated Correlations between Inflation Rates and Other Market Variables from 1986

From above, we can see that actual changes in prices in the past 12-months have a high correlation with current implied inflation, which we may expect, but will have little relevance to changes in implied inflation which will impact on economic capital.

Changes in UK implied inflation are highly correlated with changes in UK nominal Gilt yields, which is what we might expect given the link between inflation and bond yields, while there is a low correlation between global equity movements and changes in UK implied inflation (correlations between UK equities and UK implied inflation will be covered in section 3.4.1 below).

3.2. Correlations between government bond yields

As well as dependencies between different types of market risk (equity, interest rate etc.), we also need to consider dependencies within market risk types, including interest rates in different countries and currencies. Table 5 below considers correlations between rolling 12-month absolute changes in US, UK, German and Japanese 10-year government bond yields from 1990.

Table 5. Correlations between 10-Year Bond Yield Changes from 1990

There is broadly a high correlation between bond yields of these highly rated sovereign issuers. The lower correlations for Japanese bond could in part be because Japanese bond yields were significantly lower over the period, with yields less than 2% p.a. since 2000. Just looking at changes over the 1990s, the correlations between Japanese bond yields and US, UK and German yields are significantly higher at 62%, 75% and 83% respectively.

The high correlations may be expected as interest rates in one currency will be influenced by interest rates available in other currencies. US bond yields in particular have a strong bearing on other yields. This was illustrated by the spike in US bond yields in 1994 following unexpected tightening of US monetary policy. This led to US 10-year bond yields rising 201bps from 5.83% p.a. at the start of the year to 7.84% p.a.at year end. This helped drive similar rises elsewhere with 10-year UK Gilts yields rising by 234bps from 6.25% to 8.59% p.a., 10-year German Bunds rising 163bps from 5.83% to 7.46% p.a. and 10-year Japanese government bonds rising 116bps from 3.40% to 4.56% p.a. over the year.

Another example of the impact of US monetary policy on wider bond yields was the “taper tantrum” that followed the announcement of the US Federal Reserve in May 2013 that it was going to scale back bond purchases under its QE programme. US 10-year T-bond yields rose sharply from 1.7% in April to 3.0% p.a. by year end. Over the same period and UK and German 10-year bond yields rose by 137bps and 60bps respectively, though Japanese 10-year bond yields only rose by 10bps.

Note for lesser rated sovereigns such as Greece, it may be better to assess government bonds yield dependencies based on the yields on highly rated sovereign bonds (e.g. German Bunds) plus a sovereign spread. The latter is likely to widen in stress conditions.

Also, bond markets where there are currency restrictions (e.g. Malaysia) may be substantially uncorrelated with other bond markets as these restrictions will lead to a disconnect between local and global rates.

3.3. Correlations between equity markets

Examining correlations between rolling 12-month changes in MSCI price indices from December 1987 (December 1992 for China)Footnote 23 in Table 6a below:

Table 6a. Correlations between Changes in MSCI Price Indices from 1987

As we might expect there is generally high degree of correlation between developed equity markets, except perhaps for Japan. Asian and emerging markets also exhibit a high degree of correlation which is to be expected as China and other Asian markets form a large part of the MSCI Emerging Market index.

There appears to be lower levels of correlation between western and Asian/emerging markets but this is due to the Asian Financial Crisis of 1997/98 where Asian shares saw significant falls while western markets were growing. If we just look at rolling 12-month returns based on data from January 1999 (first 12-month period to January 2000) in Table 6b below, correlations between western and Asian/emerging markets are ca.20% higher:

Table 6b. Correlations between Changes in MSCI Price Indices from 1999

It is worth noting recent increases in China’s weight in global equity indices. In 2019, MSCI quadrupled the weight given to Chinese A shares in its ACWI global (developed + emerging markets) index, so that Chinese equities now account for over 5% of that indexFootnote 25 . Not only will this increase global equity portfolio allocations to Chinese equities, it will also increase the degree of correlations between global indices and Chinese shares.

Other observations:

-

• The high degree of correlation between the MSCI World index and US equities is to be expected given that the US accounts for ca. 2/3rds of that indexFootnote 26 .

-

• Smaller markets may be dominated by individual firms or sectors which may have a bearing on correlation. For example, the insurer AIA currently accounts for over 27% of MSCI’s Hong Kong equity indexFootnote 27 while financial services accounts for 47% of that index.

-

• Linked to this, different correlations may exist between broad and narrow indices of the same market. For example, looking at the broader MSCI UK All Cap index which is available from November 2007, the correlation of rolling 12-month returns with the MSCI World index is slightly higher than the correlation between the standard MSCI UK index, with its narrower market coverage, and the World index (86% v 84%)Footnote 28 .

3.4. Limitations of empirical analysis

There are a number of notable limitations in using empirical analysis to identify dependencies:

Nature of dependencies

-

1. Empirical correlations provide an indication of the direction and strength of dependencies between risks, but they don’t really provide an explanation for why the dependency exists in the first place.

-

2. Being based on historical data, they implicitly assume that historic dependencies between risks continue, but there may have been changes in the interaction between risks which mean historic relationships are no longer relevant. Empirical analysis needs to be supplemented with a forward-looking view of dependencies.

-

3. Depending on the time period used, there is the possibility that empirical estimates straddle periods where the relationships between risks was different, with the resulting correlation not a satisfactory measure of either period – see 3.4.1 below.

-

4. Empirical correlations may not fully capture tail dependence for risks which are not closely correlated in normal market conditions but which may be heavily correlated in stressed conditions – they may implicitly average out correlations resulting in an estimate that doesn’t reflect either state of the markets.

-

5. Some empirical correlations may be spurious, driven by random coincidence rather than any true dependency between risks.

-

6. Correlations do not necessarily imply causation – it may be that two risks are not directly linked but both may be affected by another variable.

Data issues

-

7. Empirical estimates are based on the shortest dataset, for example correlations involving credit spreads may only be based on data back to 1997 where spread data is based on that available from ICE which is only available from that date.

-

8. Results may be sensitive to the frequency of data, the length of the dataset and the correlation measure used – see section 3.4.2 below.

-

9. There will be a degree of statistical error around empirical correlations depending on the length of datasets – see section 3.4.2.1 below.

-

10. Following on from 4.above, where risks are more heavily correlated in stress conditions, empirical correlations may drift downwards over time as data is added when conditions are benign, but can then spike up again in stress conditions.

-

11. Risks may be correlated but with a time lag, in which case there will be a need to identify the extent of the lag and correct correlation estimates where appropriate – see for example the links between equity market and GDP falls in section 3.4.3.

-

12. Correlation estimates may be distorted by implicit smoothing in data, for example in valuation-based property indices – see section 3.4.4.

Consistency

-

13. Unadjusted empirical correlations may be inconsistent with each other, resulting in correlation matrices which do not meet Positive Semi Definite (PSD) criteria of consistency which underpins copulas and other aggregation methodsFootnote 29 .

3.4.1. Changes in dependency over time

An example of changing relationships between risks, and the distortion they can create with empirical estimates, is the correlation between UK equities and Gilt yields changes. If we look at rolling 12-month changes in Gilt yields and the MSCI UK equity index, we get very different answers depending on how far back we go, as illustrated by the following Table 7:

Table 7. Correlations Between Changes in UK Equity Prices and Gilt Yields

We can see that there has been a marked change in the correlation between UK equities and Gilt yields, from a negative correlation between falls in equities and Gilt yields (positive correlation between Gilt yield rises and equity falls) in data going back to 1970, to a positive correlation between falls in both equities and yields.

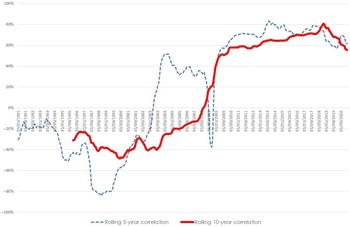

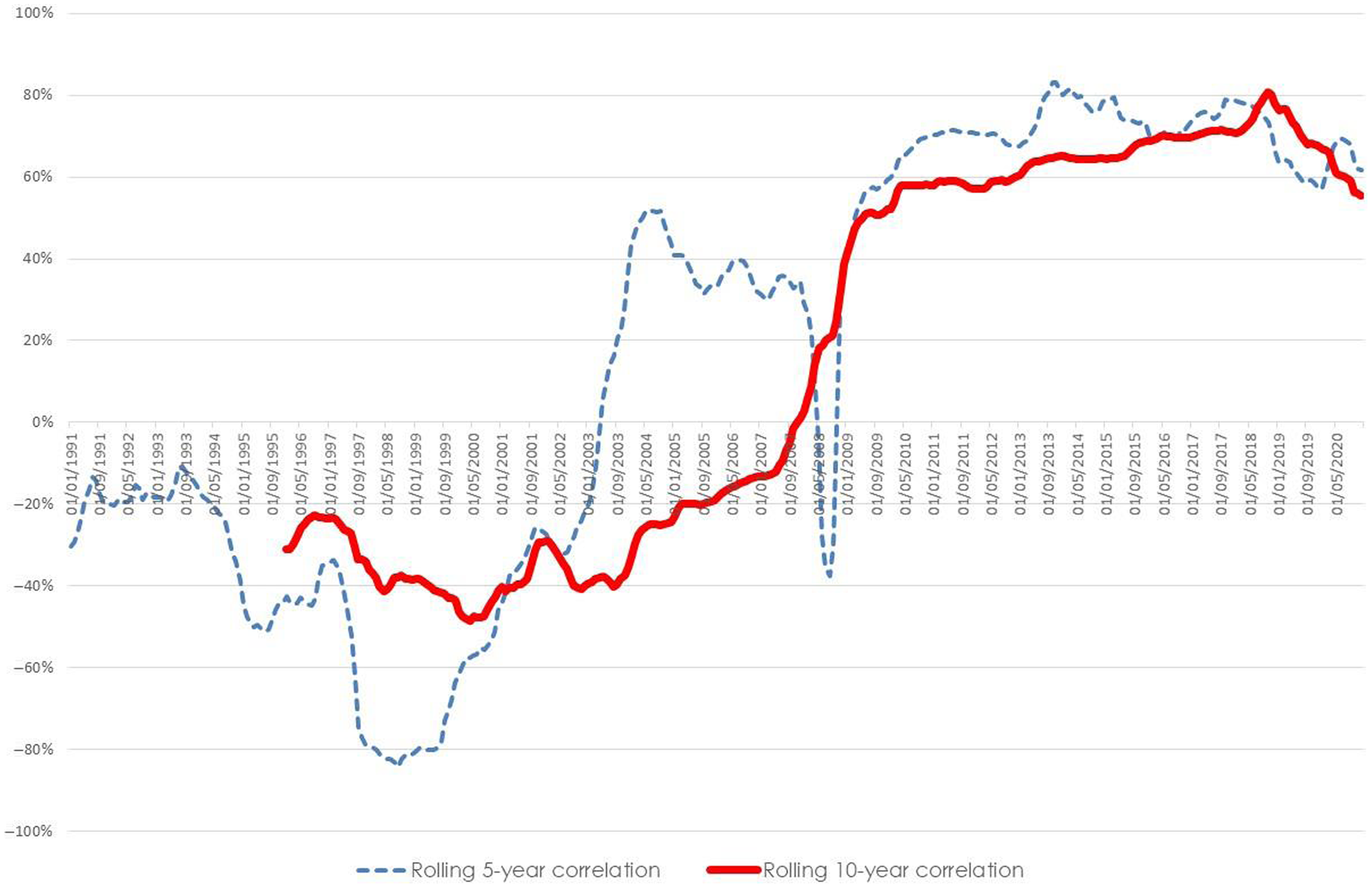

Looking at rolling 5- and 10-year correlations between 10-year Gilt yields and equities in Chart 4a below, the shift appears to occur in the early 2000s.

Chart 4a. Rolling correlations between changes in UK equities and 10-year Gilt yields.

An explanation for the change would be the shift from the high-inflation, high interest rate environment that existed from the 1970s to the early 1990s to a lower inflation and rate paradigm. Prior to Sterling’s exit from the ERM in September 1992, there were frequent spikes in inflation, either due to oil price and other shocks or due to an overheating economy. These drove up Gilt yields and base rates, which in turn led to economic downturns and equity market falls, hence the correlation between yield rises and equity falls.

As noted in section 3.1.2, following the ERM exit, the Bank of England adopted an inflation targeting approach to monetary policy which proved successful in taming inflation and “boom and bust” economic cycles. Now, rather than rate rises triggering equity market falls, interest rates and Gilt yields may be more driven by equity market falls, with the Bank of England responding to market crises such as the Global Financial Crisis of 2007/09 and more recently market falls due to COVID-19 by cutting rates and buying bonds under QE. This would explain why the current direction of correlation relates to falls in both Gilt yields and equities.

It is interesting to note that correlations between changes in UK equities and implied inflation in Chart 4b below show a similar pattern:

Chart 4b. Rolling correlations between changes in UK equities and 10-year implied inflation.

Again, until the early 2000s, rises in implied inflation were negatively correlated with equity market rises (/positively correlated with equity falls) as higher inflation – and higher market expectations of inflation, as reflected in implied inflation – would have fed through into higher base rates which will have had a negative impact on equities.

More recently, that direction has changed so that now equity falls are correlated with reductions in implied inflation. It may be that QE in response to more recent equity market falls has driven down implied inflation as well as nominal Gilt yields and/or that market falls have led to lower expectations for economic growth and inflation.

These examples highlight the need for care in choosing the timeframe over which we base empirical correlation estimates. Consideration needs to be given to paradigm shifts such as the shift a low inflation environment in the 1990s, and whether data before is relevant. In the case of UK equities and Gilt yields, while we have data going back to 1970, using this data leads to correlation estimates which do not reflect the current correlation between Gilt yields and equity markets, so it would be probably more appropriate to base correlations on data from the 1990s or later.

However, as we shall see, the dynamic that previously existed between rising rates and Gilt yields driving down equity markets has not disappeared altogether, and there may be a case for carrying out sensitivity testing to the impact of a future change in the direction of UK equity and Gilt yield correlations.

3.4.2. Sensitivity of estimates

Empirical correlation estimates are not just sensitive to the time period over which they are assessed, they are also sensitive to the choice of risk variable. From section 3.1, we saw how correlations between rolling 12-month changes in equities and bond yields varied depending on whether we were looking at absolute or relative changes in yields.

Another example would be the correlation between the MSCI World index of equities and VIX. The correlation in Table 1 of −58% was based on the correlation between the 12-month change in the equity index with the point-in-time value of VIX. If instead we looked at the correlation of rolling 12-month changes in the equity index with (a) rolling 12-month absolute changes in VIX; and (b) rolling 12-month relative changes in VIX, we would get revised correlation estimates of −56% and −49% respectively.

Yet another example would be where we looked at monthly changes as opposed to rolling 12-month changes. From Table 1, the correlation between rolling 12-month changes in MSCI World equities and absolute changes in US 10-year T-bond yields is +54%, but if we looked at monthly changes, the correlation estimate would be significantly weaker at just +33%.

In practice, we would base correlation estimates on measures corresponding to individual calibrations of risk. For instance, if our model of corporate bond spreads was based on rolling 12-month absolute changes in spreads, then this is the measure we would use in estimating correlations, but it would be useful to consider the sensitivity of correlation estimates to different measures.

Finally, the above correlations relate to the Pearson measure of correlation. If instead we used the Spearman measure of rank correlationFootnote 30 between rolling 12-month changes in MSCI World equities and US corporate bonds spreads, we would get a revised correlation estimate of −48% as opposed to −58% based on the Pearson measure.

Further details on the sensitivity of correlation estimates can be found in section 7.5 of Shaw et al. (Reference Shaw, Smith and Spivak2010).

3.4.2.1. Parameter estimation error

As well as the sensitivity to different data and measures, there will also be a degree of statistical parameter estimation error in empirical estimates, which can sometime be substantial. Taking the example of equity returns and corporate bond spreads, from Table 1, we arrived at an empirical correlation estimate of −58% based on 276 overlapping 12-month periods from 1997 to 2020. Using the Fisher transformationFootnote 31 to assess the degree of statistical error around this estimate gives a range of −49% to −65%, and this would be larger for smaller datasets, which illustrates how significant parameter estimation error can be.

3.4.3. Lag effects

An example of lag effects we may need to allow for in correlation estimates is that between equity returns and GDP growth. If we take the example of US quarterly GDP growth rates and equity returns from 1970, the unadjusted empirical correlation is only +4%, and only +7% based on data from 2000. This seems counter-intuitive as we would expect a link between stock markets and economic growth.

However, markets often react in anticipation of events so they may rise or fall before rises and falls in GDP come through in economic statistics, while market crashes such as those during the Global Financial Crisis can in themselves trigger a wider recession. For these reasons, we may expect a lag between markets and GDP changes. If we allow for a one quarter lag between equities and GDP, the revised correlation estimate based on data from 1970 is +31%, and +44% based on data from 2000.

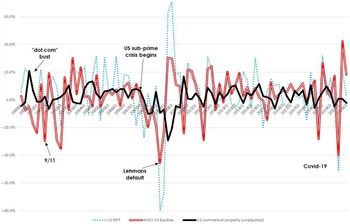

Lag effects can also be observed between equities and unemployment rates, as the following Chart 5 of US equities and unemployment rates illustrates.

Chart 5. Quarterly US equity returns and unemployment rates from 2000.

Of particular note is the unemployment rate during the Global Financial Crisis. This peaked at 9.9% in Q4, 2009 by which time equities (and bonds) were recovering from their trough in Q1 2009.

Similar effects can be seen during the “dot.com” bust of 2000/03 where peak unemployment was reached in Q2/Q3 2003 when markets were recovering strongly, and during the COVID-19 pandemic, where there was a sharp fall in markets in Q1 2020 but unemployment rose sharply in Q2 despite central bank intervention leading to a sharp recovery in markets. The lag between markets and unemployment rates may be expected as it may take time for economic downturns to translate into job losses.

Lag effects are significant in the context of a one-year value at risk (VaR) assessment such as that required under Solvency II. While over the 2–3 years of a market downturn like that of the Global Financial Crisis we may see significant declines in both equities and GDP say, over the 12-month period where we might see the worst equity market falls, only part of the fall in GDP may come through due to a lag effect. It may be appropriate to scale back correlations between the one-year impact of GDP falls with one-year equity returns and other market variables to reflect this partial impact.

3.4.4. Property risk

The empirical analysis above does not include property risk but index data is available such as MSCI’s Investment Property Databank (IPD) indices for commercial property, and residential property indices like the Nationwide House Price Index for UK housing.

However, caution should be exercised in using commercial property index data to assess correlations. These indices are usually based on subjective property valuations (though transaction-based indices may also be available in some cases). A problem with valuation-based indices is that there can be implicit smoothing in the index in part because of valuations being anchored on historic transactions. This results in the volatility of commercial property being understated and could also distort empirical correlation estimates with other risks.

Implicit smoothing is covered in the Investment Property Forum’s 2007 paper on index smoothingFootnote 32 and also Booth and Mercato (Reference Booth and Mercato2003). These also set out approaches to “de-smooth” indices, correcting for historic bias in valuations. Empirical property correlations should be calculated based on de-smoothed as well as unadjusted indices in order to gauge the impact of smoothing on correlation estimates.

Booth and Mercato (Reference Booth and Mercato2003) also highlights differences in performance assessed against different indices, and different indices could also give rise to different empirical correlation estimates. Where data for different indices exists, the sensitivity of empirical correlations to different data sources should be assessed.

As an alternative to valuation-based indices, correlations could be calculated based on indices of Real Estate Investment Trusts (REITs) where available. These should reflect market views on the value of property assets and may be a timelier reflection of changes in value than valuation-based indices. However, a problem with basing property correlations on REITs is that being listed on stock exchanges, REITs will be affected by wider rises and falls in other shares and so will be more correlated with equity markets than direct investment in property.

To illustrate the difficulties of assessing property correlations empirically, consider the following example of US commercial property price correlations with US equities. Sourcing commercial property price data from the US Federal Reserve and looking at quarterly changes from Q1 1978 against quarterly returns on the MSCI US equity price index, the standard deviation of unadjusted property price changes is 2.9%, and the correlation of this unadjusted data series with US equities is slightly negative at −7.5%.

There is a significant degree of correlation (ca.40%) between returns in successive quarters suggesting smoothing in data. De-smoothing the data in line with the adjustment outlined in section 3.6 of Booth and Mercato (Reference Booth and Mercato2003), the standard deviation of quarterly changes is substantially higher at 4.4% but in this instance the correlation with US equities is only slightly larger at −11%.

Considering next the alternative of using REIT indices, data for the Wilshire US Real Estate Investment Trust Total Market Index goes back to Q1 1978. The standard deviation of quarterly changes in this index is higher again at 5.3% but crucially, the correlation between this index and the MSCI US equity price index is +60%, i.e. a high positive correlation compared to the slightly negative correlation assessed based on the US Federal Reserve’s commercial property data. Comparing quarterly changes graphically from 2000 in Chart 6 below:

Chart 6. US equity, REIT and commercial property quarterly returns from 2000.

We can perhaps see a degree of correlation between US REIT and broader US equity indices, particularly during the Global Financial Crisis. The sharper fall in the REIT index in Q4 2008 may be due to concerns over commercial property valuations following the default of Lehman’s, which had a significant property portfolio to be realised.

Notwithstanding the low negative empirical correlation estimates above, we also see a sharp fall in the unadjusted (smoothed) commercial property index in this period, albeit with a lag with the index reaching its trough in Q1 2010 when equities had recovered strongly from their trough in Q1 2009. We could adjust the calculation of empirical correlations between property and equity returns allowing for say a 2-quarter lag, which would change the correlation from −7.5% to +14%, but even this revised figure doesn’t reflect the sharp falls in both US equity and commercial property indices during the Global Financial Crisis.

This example highlights the difficulties of basing property risk correlations using empirical data. The high correlation between equities and REITs could be due to REITs being stock market vehicles as much as any links between equity and property markets, but the low correlation between the US Federal Reserve commercial property data and US equities does not properly capture tail events seen in historic data. Significant expert judgement is required to arrive at a suitable correlation figure.

Complicating matters is the lag between changes in equities and property values. This could be a function of implicit smoothing in property valuations but it could also reflect underlying delays in the transmission of market shocks to property markets: market falls could in time lead to a “credit crunch” affecting the roll over commercial property loans, triggering distressed sales. As noted in section 3.4.3 above, this lag is significant in the context of a one-year value at risk (VaR) as while over the 2–3 years of a market downturn we may see significant falls in both property and equity markets, over the 12-month period where we might see the worst equity market falls, only part of the fall in property values may come through due to a lag effect. It may be appropriate to scale back correlations between one-year property returns with equities and other market variables to reflect this partial impact.

3.4.5. Bond default and downgrade risk

From section 3.1, there is strong correlation between corporate bond spread indices with equities and other markets, but these index changes mostly relate to general movements in spreads as opposed to defaults and downgrades. Spread changes will be driven as much by changes in investor sentiment regarding credit risk as actual defaults and downgrades.

Spread changes will also be affected by bond market liquidity issues, with forced sales in stressed markets pushing down mark-to-market prices and pushing up spreads. In some instances, liquidity issues could cause spreads to exceed even pessimistic forecasts of defaults: in the aftermath of Lehman’s for instance, US investment grade corporate bond spreads exceeded 6% p.a. By contrast, the worst single year of the Moody’s 2021 Corporate Bond Default Survey was 1938 when the investment grade default rate reached 1.55%Footnote 33 .

Given the impact of investor perceptions of credit risk as well as market liquidity factors on spreads, there is a need to consider bond default and downgrades separately from spreads in assessing correlations.

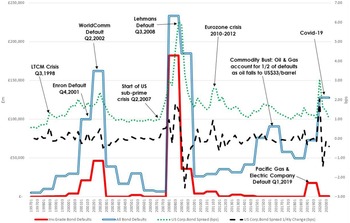

Chart 7 below compares Moody’s yearly data on global investment grade and aggregate bond defaults with the investment grade US corporate bond spread index from 1997 (see section 3.1) as a proxy for global bond spreads.

Chart 7. Moody’s bond defaults and US IG corporate bond spreads 1997-2020.

In terms of correlations, the key issue to note is the limited data on investment grade defaults which are zero in most years, while others just relate to a single default – for example, the 2019 investment grade default figure is due to the bankruptcy of the Pacific Gas and Electric Company following forest fires in California for which it was held partially culpableFootnote 34 . This is likely to distort any empirical correlation estimate.

This could be addressed by incorporating downgrade losses, which are likely to be more important for investment grade bond portfolios anyway. Moody’s supply details of downgrade (and upgrade) rates as part of their annual default study, and losses on downgrade could be estimated by reference to historic differentials in corporate bonds yields for different ratings and terms, though this would not be a trivial exercise.

Notwithstanding the issues with limited data, from Chart 7, we can draw two broad conclusions. First, as we may expect, there is a link between bond defaults and bond spreads, particularly in stressed market conditions like the Global Financial Crisis. This isn’t perfect however, as spread rises may be driven as much by investor fears (e.g. of systemic risk issues during the Eurozone crisis) and liquidity issues as credit risk.

The other thing to note is the lag between spread rises, with their concurrent market falls, and defaults emerging. Taking the Global Financial Crisis as an example, spread started rising in H2, 2007 due to a mixture of credit concerns and a squeeze in liquidity caused by the US sub-prime crisis. The big surge in defaults however arose in 2008, and continued into 2009, even though bond spreads had started to recover after Q1, 2009.

This lag between market expectations of default, as expressed in spreads, and defaults themselves is to be expected, particularly as bonds usually go through a number of downgrades before finally defaulting. There may also be a lag in terms of how market downturns and financial crises transmit to the wider economy through a “credit crunch” triggering recession and defaults by non-financial issuers. As for property risk, there may be a case to scale back bond default and downgrade correlations with spreads, equities and other market variables for a one-year VaR assessment to allow for lag effects so that only part of any stress to defaults and downgrades comes through in the worst 12-month period for spreads etc.

3.4.6. Other counterparty default and downgrade risk

In terms of other counterparty defaults and downgrades, such as reinsurers and derivative counterparties, it will generally be impractical to assess these on an empirical basis due to the more limited number of counterparties involved. Instead, correlations are likely to be based on expert judgement.

3.4.7. Addressing limitations in empirical analysis

Given the limitations of empirical analysis, there is a need to supplement this with qualitative analysis to form a better understanding of dependencies. This should encompass analysis of

-

• historic periods of stress to better understand tail dependence;

-

• academic research and other papers on dependencies between risks, how these have changed in the past, and how these may change in the future; and

-

• forward-looking scenarios, again to understand how risks could interact in the future.

These are considered in the following sections.

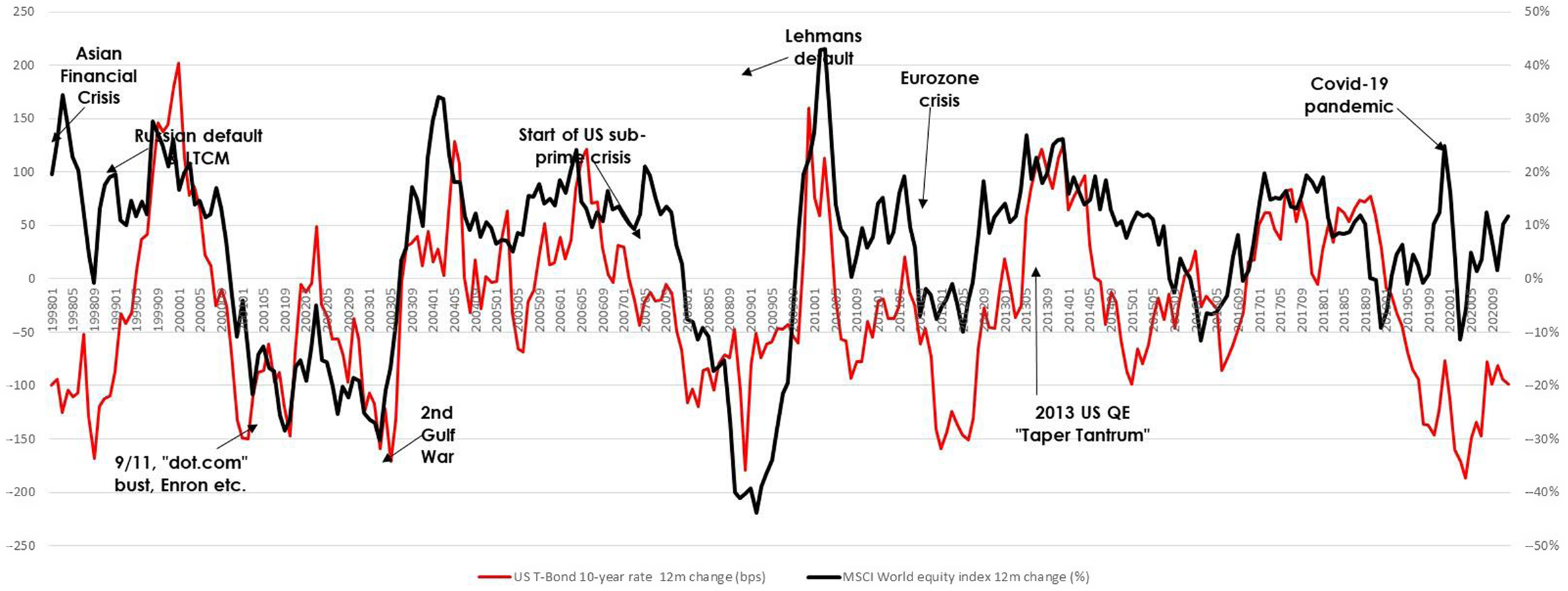

4. Analysis of stressed financial conditions

Appendix II includes details of historic stress periods and how these affected multiple risks. Based on an analysis of these, the following observations can be made on the relationships between markets at the tail.

4.1. Equities and corporate bond spreads in stressed market conditions

There is a strong degree of correlation between equity falls and corporate bond spread rises in stressed conditions, though the link is not perfect. If we consider the peak 12-months movement in the ICE BofAML US Corporate Bond (C0A0) spread index from 1997, this was a rise of +456bps in the year to 31st October 2008, compared with the 99.5th percentile of the empirical distribution of rolling 12-month changes from 1997 of +428bpsFootnote 35 . The MSCI US equities index fell −37.5% in the same period, which would be close to the 98th percentile fall in the empirical distribution of US equities from 1997Footnote 36 . The peak fall in US equities since 1997 was −44.5% in the 12-months to February 2009 when the 12-month change in (C0A0) spreads was +296bps which would equate to the 98th percentile of the empirical distribution of spread changes.

The 98th percentile movement in equities/spreads when spreads rises/equity falls peaked suggest very high correlation but not 100% – otherwise both would have peaked at the same time. The close correlation can be explained by investor risk aversion affecting both corporate bond and equity markets in light of losses on US sub-prime securities and the subsequent default of Lehman’s in September 2008.

If we look at the “dot.com” bust, there were fewer extreme movements in both spreads and equities. The maximum fall in US equities over 2000/03 was −28% in the 12-months to end September 2001, which is unsurprising given the events of 9/11. This equates to a 97th percentile fall from the empirical distribution of US equity price changes from 1997Footnote 37 . However, there was only a + 32bps rise in spreads in this month, and spreads were only up +19bps on the year before, which equates to the 66th percentile of one-year movements from 1997.

The peak rise in spreads in the period 2000/03 was +86bps in the 12-months to end 2000, which would equate to the 92nd percentile of the empirical distribution of spreads. Over the same period, US equities fell by −14% which would equate to the 88th percentile of the empirical distribution of returns while the MSCI World index fell by −11%, which would be roughly the 84th percentile.

Another notable spread shock was the rise of +77bps in the 12-months to end July 2002, shortly after the WorldCom bankruptcy, one of the largest in US history. This equates to the 90th percentile of empirical spread movements. US equities fell by −7% in this month and were down −25.5% over 12-months which would be around a 96th percentile fall from the empirical distribution of price changes. From Appendix I, given a 95th percentile movement in risk A, the average movement in risk B is the 90th percentile assuming a + 75% correlation and a Gaussian copulaFootnote 38 , so we could infer a correlation of around +75% from the combination of spread and equity changes in the 12-months to end July 2002.

In general, the period of the “dot.com” bust again illustrates the close correlation of equities and spreads in stress conditions, but also that the correlation is less than perfect. This reflects different drivers – for instance, equity market falls were driven in part by a bust in internet stocks which were not major issuers of corporate bonds.

Finally, considering the recent COVID-19 pandemic, the initial shock led to a spike in spreads and sharp equity falls in February/March 2020 before intervention by the US Federal Reserve and other central banks on 23rd March stemmed market falls. At this stage, US corporate bonds had peaked at 401bps, up +276bps on the year before. This would be close to the 98th empirical percentile of spread changes. US equities fell −20.3% in the 12 months to 23rd March, broadly akin to the 92nd empirical percentile fall. Again, this points to a high but not perfect correlation between bonds spread and equity changes in stress conditions.

4.1.1. Bond default and downgrades in stressed market conditions

From section 3.4.5, Chart 7, we can see a clear link between bond defaults and downgrades and spread rises – and from above equity falls – in stress conditions such as the “dot.com” bust of 2000/03 and the Global Financial Crisis of 2007/09. Falls in the value of property and other collateral will exacerbate losses on default.

However, the correlation is not perfect. For instance, from the Moody’s 2021 default study, there was over US$2bn of investment grade defaults in 2005 in what was a positive year for equities, with the MSCI World index of developed market equities up nearly +14% on the year. Looking back further, there were no investment grade defaults in 1987 or 1988, despite the large equity market falls in October 1987.

Following on from section 3.4.5, there is also a lag between market falls and defaults coming through. This is illustrated by the continued rise in defaults caused by the COVID-19 pandemic over 2020 while markets recovered from their trough in March 2020: of US$228m of (mostly sub-investment grade) bonds and loans defaulting in 2020, 92% have arisen after Q1, at a time when bond spreads have fallen back to end 2019 levels and equity markets have risen on average by +60% since 23rd March 2020.

4.1.2. Derivative counterparty default and downgrades in stressed market conditions

Considering first derivative counterparties, the example of the Lehman’s default during the Global Financial Crisis highlights both how stressed markets could trigger counterparty default and how such a default could amplify a crisis. Amongst other things, market falls reduced the value of collateral held, while rising option prices post-Lehman’s increased the price of replacement hedges, exacerbating losses on default.

Looking forward, the move towards central clearing of derivatives should limit the impact of individual counterparty default, but it will not remove this entirely: even if central clearing can mitigate counterparty losses, the removal of an investment bank counterparty will limit market capacity to provide hedging solutions and will drive up the price of option protection and implied volatility.

Central clearing also creates a tail risk in respect of the failure of the central clearing house. While remote, this is not improbable: a notable feature of the 1987 stock market crash was the failure of the Hong Kong Futures Exchange clearing house, which required a government bailout, highlighting that even clearing houses could fail in extreme market eventsFootnote 39 . Were a major clearing house to fail, the impact on markets could be even greater than that of Lehman’s.

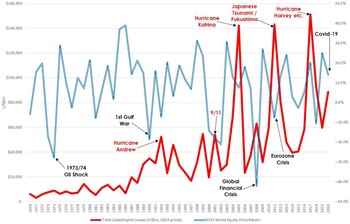

4.1.3. Reinsurance counterparty default and downgrades in stressed market conditions

Reinsurers are a key counterparty for most insurers. A notable failure during the Global Financial Crisis was AIG which amongst other things was a major reinsurance counterparty, as well as a key writer of bond default protection for other insurers. AIG was bailed out by the US Government due to the potential impacts of a default on other market participants, but this “near miss” highlighted the potential for market stresses to undermine reinsurance counterparties – and also that the Global Financial Crisis could have been so much worse.

Other victims of the crisis were monoline insurers such as Ambac and MBIA. These were AAA-rated insurers who obtained a premium from issuers to cover investor losses should the issuer default. This guarantee allowed issuers to share in the insurers’ AAA-rating, but heavy losses from US sub-prime and related bonds they insured led to Ambac declaring bankruptcy in 2010 while MBIA was downgraded to B in the same year. The failure of these guarantors led to mass downgrades of the bonds they guaranteed, further contributing to downgrade losses in the crisis.

Aside from AIG and the monoline insurers, other reinsurers suffered losses as a result of the crisis which resulted in many being downgraded. Among these was Swiss Re which was downgraded in 2008 due to market and credit losses which gave rise to a loss of CHF864mFootnote 40 . Looking forward, such reinsurer downgrades may give rise to losses due to the need to increase counterparty adjustments to reinsurance assets in the calculation of insurers’ technical provisions, highlighting the link between stressed markets and reinsurer counterparty losses.

Note that as well as market losses impacting on reinsurer financial strength and credit rating, catastrophic events can lead to large insured losses and drive down markets. An example of this would be 9/11. This gave rise to one of the largest cumulative insured losses of all time at US$26bnFootnote 41 . Of 20 major reinsurers, 14 were downgraded in the following two yearsFootnote 42 . Meanwhile MSCI US and World indices fell by −7.7% and −9.0% respectively in September 2001, and by −23% and −22% respectively over the following 12-months, while US investment grade corporate bond spreads rose by +52bps over the year.

That said, the costliest event for insurers to date was Hurricane Katrina in August 2005, with total losses of US$82bn. While this triggered reinsurer downgrades, the impact on markets was more muted: MSCI US and World equity indices only fell by −1.1% and −0.1% respectively that month with little impact on corporate bond spreads.

On balance, while reinsurers do seem to be vulnerable to the risk of downgrade in stressed market conditions, and while catastrophic events can also trigger market falls as well as large insured losses, the link is far from perfect. There may be no more than a medium correlation between reinsured default and downgrade and market falls.

4.1.4. Retail loan defaults in stressed market conditions

From section 3.4.3, falling markets are correlated with lower economic growth and higher unemployment, albeit with a lag. If we look at the Global Financial Crisis, market falls led to a “credit crunch” which transmitted market falls to the wider economy leading to recession and higher unemployment. In the UK for example, there was a peak-to-trough fall in GDP of ca. −6% while unemployment rose from 5.35% in Q2, 2007 to 8.0% by Q1, 2010.

The economic downturn and higher unemployment led to a marked increase in mortgages in arrears with UK mortgage arrears rising from just over 40,000 at the end of Q2, 2007 to a peak of nearly 81,500 in Q1 2009Footnote 43 . They then decreased as banks took possession of homes and sold these off. Exacerbating losses, UK house prices declined by nearly −20% in the same period, though they recovered from Q1, 2009Footnote 44 .

Note that even before the crisis, unsecured loan losses were rising in the UK with the number of personal insolvencies in the UK spiking upwards by 60% in 2006 to 100,000Footnote 45 . It is likely that high house prices were masking underlying issues with mortgage creditworthiness that were then exposed by the fall in house prices during the crash. In this way falls in house prices during a crash can crystallise credit losses on mortgages, which may in turn lead to losses on bonds linked to these.

The link between market downturns and mortgage and other loan defaults is far from perfect however. During the 2000/03 stock market downturn, while US unemployment rose, UK unemployment declined and UK house prices grew strongly during the period.

More recently, although the COVID-19 pandemic led to sharp market falls initially as well as a modest increase in UK unemployment from 4% to 5.8%, arrears totals have stayed broadly similar over 2020 at just under 40,000, while UK house prices have risen +7% over 2020.

4.2. Property in stressed market conditions

From section 3.4.4, there were sharp fall in US commercial property markets during the Global Financial Crisis. UK and other commercial property markets also experiencing sharp falls at this time, while there were also sharp falls in house prices, with US house prices falling −17.5% between June 2007 and March 2009Footnote 46 and UK house prices falling −20%. This suggests at least a medium correlation between property, equities and bond spreads.

However, one would argue against a high correlation for two reasons. First, as noted in section 3.4.4., there is a lag effect which should temper correlation assumptions. The US property index only reached its trough 12 months after the low point for US equities in Q1 2009. The UK reached its trough sooner in Q2 2009, but again this was at a time when UK equities were recovering strongly. Average US house prices, which were already falling before the crisis began, continued falling as markets recovered from March 2009, not reaching their trough until early 2012, by which stage they had fallen a further −8%.

Second, it is also worth noting that during the “dot.com” bust, property prices were generally growing while equity prices were falling, so the connection between property and equity markets is not as strongly linked as say equity and corporate bonds.

4.3. Interest rates in stressed market conditions

Mindful of the potential knock-on impact of market falls on the wider economy, central banks have frequently responded by easing monetary policy. For instance, during the “dot.com” bust, having initially increased federal funds rates from 5.5% to 6.5% p.a. over 2000, the US Federal Reserve then cut base rates to 1.75% p.a. by end 2001, 1.25% by early 2002 and 1.00% by June 2003. Similarly, having increased base rates to 6% p.a. in 2000, the Bank of England then cut these to 3.5% by July 2003.

The rate cuts helped drive down bond yields with 10-year US T-bond yields decreasing from 6.45% p.a.at the end of 1999 to 3.37% by May 2003, though the reduction in 30-year yields was smaller, falling from 6.48% p.a.at the end of 1999 to 4.59% by May 2003. The fall in UK Gilt yields was more muted, with 10-year yields falling from 5.38% p.a. at the end of 1999 to 4.16% by May 2003 while the 25-year yield was generally higher over the period than 4.23% at end 1999.

During the Global Financial Crisis, central banks responded to falling markets not just by cutting short-term base rates but also by buying bonds under QE programmes. In doing so, monetary policy started to directly impact on longer-term bond yields.

The US federal funds rate was cut from 5.25% p.a.to 4.25% by end 2007, to 2% by April 2008 and then to 0.25% by the end of 2008Footnote 47 , with the US Federal Reserve also starting to buy US$600bn in mortgage-backed securities from November 2008 as part of QEFootnote 48 . Similarly, the Bank of England cut base rates from 5.75% p.a. in July 2007 to 2% by end 2008 and 0.5% from March 2009Footnote 49 , at which stage it started buying £165bn of Gilts as part of QE. The European Central Bank (ECB) cut its deposit facility rate from 3% p.a.in mid-2007 to 2% at end 2008 and 0.25% in April 2009Footnote 50 , with a €60bn QE programme buying covered bonds starting in May 2009.

Combined with investor risk aversion and flight to quality, this monetary stimulus pushed down government bond yields. 10-year US T-bond yields fell from 5.03% p.a.at the end of June 2007 (when troubles were starting to emerge with US sub-prime assets) to 4.04% at end of 2007 (−99bps over H2 2007), then to 3.83% by the end of August (pre-Lehman’s) and 2.25% by end 2008, a fall of −179bps over the year, before recovering to 3.53% by mid-2009.

UK 10-year Gilt yields did not fall as far, but still fell from 5.36% p.a.at the end of June 2007 to 4.52% p.a. (−84bps) at the end of 2007 and 3.39% by end 2008 (−113bps over the year). They then spiked upward by nearly +70-bps in January 2009 as there were concerns over the solvency of the UK government following the bailout of banks. The price of insuring UK government bonds over 5 years rose from less than 20bps in August 2008 to more than 100bps by the end of the year and to ca.150bps by mid-January 2009Footnote 51 . However, the introduction of QE in March 2009 helped drive 10-year Gilt yields down to 3.30% at end March, before yields recovered to 4.20% p.a.by the end of 2009.

German 10-year Bund yields also saw significant falls, from 4.56% at mid-2007 to 4.21% by end 2007 (–35bps) and 3.05% by end 2008 (a fall of −116bps over the year). Ominously, however, the yields on 10-year Greek government bonds rose from 4.53% p.a. at end-2007 to 5.08% at end-2008, as the 10-year spread over Bunds rose from +32bps to +203bps. This rise in sovereign spreads would ultimately lead to the Eurozone crisis of 2010/12.

From the Global Financial Crisis, we can see a link between equities and spreads on the one hand and interest rates and highly rated government bond yields on the other. Central banks respond to market turmoil by cutting rates and pushing down longer-term bond yields using QE. Yields on US T-bonds and other highly rated government bonds will also be driven down by a flight to quality into safer issues, but for lesser rated sovereign issuers, the same investor risk aversion could see government bond yields rise due to a rise in sovereign spreads.

This dynamic was also seen more recently with the response to the COVID-19 pandemic. The US Federal Reserve cut its federal funds rate by −150bps in March 2020 to near zero. While other central banks had less scope to cut rates, the Bank of England also cut its base rate from 0.75% p.a. to 0.1% p.a.at this time.

Central banks also expanded QE programmes. The Federal Reserve announced US$700bn of asset purchases, and crucially expanded the range of bonds it would buy to include some sub-investment grade bonds which stemmed a rout in markets for these. The Bank of England bought another £200bn of Gilts while the ECB launched a €750bn programme to drive yields down.

Coupled with a flight to quality, this result was a sharp fall in government bond yields with 10-year US, UK and German bond yields falling by −122bps, −46bps and −24bps in Q1 2020 to 0.7%, 0.36% and −0.54% p.a. respectively. However, investor risk aversion saw yields on 10-year Greek bonds rise from 1.42% to 1.97% p.a. over Q1 and 2.05% by the end of April, before falling back to 1.32% at the end of Q2 as markets recovered.

4.3.1. Upward shocks to interest rates

It is important to note that the experience of the Global Financial Crisis and COVID-19 may not always hold for future market crises. There is another dynamic between interest rates and markets where interest rates may be the cause of market falls as opposed to just being driven down by these. An upward shock to rates, particularly if unexpected, can trigger falls in equities and other markets.

An example of this is the sharp rise is US T-bond yields in 1994 (see section 3.2). In the first instance, US stocks fell initially but recovered, in part because the rate rise came to be seen as indicative of the health of the US economy. However, UK, European and Asian (ex Japan) shares ended down −9.9%, −8.4% and −20.5% respectively due to the impact of higher rates.

This link is far from perfect, and even unexpected monetary tightening may not trigger wider market falls. For instance, the “taper tantrum” of 2013 – where mooted reductions in QE by the US Federal Reserve triggered a spike in global bond yields – did not stop the MSCI World index rising +26.3% over the year, with little impact on corporate bond spreads. However, the MSCI Emerging Markets index fell −5.0% over the year, so these markets are likely to be more vulnerable to tighter US monetary policy.

Another dynamic to consider is the impact of inflationary shocks on both interest rates and equity markets. A classic case of this is the 1973/74 oil shock, which led to the MSCI World index falling by −39.2% in the 12 months to end September 1974 while long-term US T-bond yields rose by +88bps in the same period. While central banks have been successful in keeping inflation low in recent times, there is still a risk of a shock to inflation either because of a geopolitical event like the Yom Kippur War in 1973, or at an individual country level, because of a sharp depreciation in currency. This could lead to higher base rates to combat inflation which would push up bond yields and also depress economic demand, which could in turn lead to equity falls and rising bond spreads.

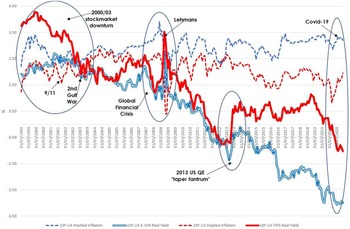

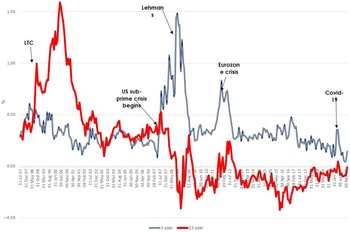

4.3.2. Real yields and implied inflation rates in stressed conditions

Rises in inflation can trigger interest rate and wider market stresses, but market stresses will also have a bearing on real yields and market implied inflation rates. The following Chart 8 highlights UK and USFootnote 52 real yields and implied inflation rates, highlighting periods of market stress.

Chart 8. Change in US and UK real yields and implied inflation rates from 2000.

Looking first at real yields, like nominal yields, QE and a “flight to quality” could drive these down in stress conditions, as happened with the COVID-19 pandemic.

However, the experience of the Global Financial Crisis suggests other factors at play: while generally US and UK real yields were falling from the start of the crisis in June 2007 to August 2008, they spiked upwards after Lehman’s: 10-year US real yields rose + 174bps from 1.78% p.a. at the end of August to 3.52% by the end of October 2008 before falling back, while 10-year UK real yields rose + 181bps from 0.97% p.a. at the end of August to 2.78% by the end of November 2008. Real yields at other terms also rose in this period – from August to October 2008, US 5- and 20-year yields rose by +235bps and +106bps, while from August to November 2008, UK 5- and 20-year real yields rose by +292bps and +83bps respectively.

The spike in real yields after Lehman’s is puzzling as nominal yields were falling in the same period. Index linked government bond markets are smaller and less liquid than nominal markets, and these could have been more affected by forced sales, for example to raise cash to meet margin calls.

In any case, rising real and falling nominal yields resulted in a significant reduction in implied inflation. In the UK,10-year implied inflation fell from 3.56% p.a. at the end of August to 1.23% by the end of November 2008, before rising to 2.23% p.a. by March 2009 and 3.31% by end 2009. Similarly, US 10-year implied inflation fell from 2.33% p.a.at the end of August to 0.39% by the end of November 2008, before rising to 1.45% p.a. by March 2009 and 2.58% by end 2009. This highlights the potential shifts in implied inflation rates in stressed conditions which could have significant implications for valuations based on these.

Examining other periods of stress, the fall in US real yields and more limited reductions in UK real yields during the 2000/03 downturn are broadly consistent with changes in nominal yields in the same period, while the rise in real yields during the 2013 US QE “taper tantrum” is again broadly consistent with rises in nominal yields.

In summary, in stressed conditions, drivers of nominal yield changes are likely to have a similar impact on real yields, but other factors could lead to a disconnect like that in the months after Lehman’s, so the correlation between the two will be far from perfect. Different changes in real and nominal yields could lead to significant variations in implied inflation at the tail.

4.4. Currencies in stressed market conditions

The evidence of the Global Financial Crisis of 2007/09 is that in stressed market conditions safe haven currencies such as the US Dollar and, to a lesser extent, the Yen, Euro and Swiss Franc tend to appreciate against other countries. For instance, during the Global Financial Crisis, the Pound Sterling depreciated by −29% against the US Dollar, −27% against the Euro and by −43% against the Yen between June 2007 and March 2009. This could have been due to concerns over the UK’s prospects following its bank bailouts, but the Australian Dollar also depreciated by −18% against the US Dollar over the same period. Given the falls in equities and rises in corporate bond spreads in this period, this points to at least a medium correlation between these and US Dollar appreciation.

More recently the COVID-19 pandemic again highlighted the role of the US Dollar in particular as a safe haven currency. Between the end of 2019 and the 23rd March, when the US Federal Reserve took action to stabilise markets, the Pound Sterling and Australian Dollar had depreciated by −13% and −18% respectively against the US Dollar and even the Euro and Yen had depreciated by −4% and −2% respectively in a period which also saw sharp falls in equities and spikes in bond spreads. As well as its status as a safe haven currency, this appreciation of the US Dollar may have also been due to issues with US Dollar funding markets.

The “dot.com” bust also saw depreciation in the Pound Sterling and Australian Dollar against the US Dollar initially, with falls of −12% and −26% from end 1999 to March 2001. However, these currencies recovered to end up stronger against the US Dollar by end 2003 than at end 1999 due to better economic conditions than the US with unemployment latterly falling in the UK and Australia as it was rising in the US. This highlights another dynamic in currency movements beyond flight to quality into safe haven currencies, relating to relative impacts on economic growth in different countries (/currency zones) and hence on interest rates.

Another dynamic to consider is fixed exchange rates and how these may come under pressure in stressed market conditions. For instance, the Eurozone crisis of 2010/12 brought the future of the Euro into question and the Euro fell by −10% against the US Dollar in the 12-months following the first bailout of Greece in May 2010. It subsequently recovered from May 2011 and it is worth noting that the major falls in European equities arose in the subsequent 12-months to May 2012.

A more serious example is the collapse of the pegs to the US Dollar during the Asian Financial Crisis of 1997/98, starting with the Thai Baht in July 1997 and then encompassing Malaysia Indonesia, the Philippines and South Korea. This led to depreciation of −40% or more against the US Dollar which in turn led to a banking crisis as borrowers could no longer service US Dollar loans. This and the resulting economic downturn led to a fall in the MSCI Asia ex Japan index of −58% from July 1997 to a trough in August 1998, with spreads on Asian US Dollar-denominated bonds increasing by 680bps to September 1998 and significant falls in property values.

4.5. Commodities in Stressed Market Conditions