1. Introduction

During times of frequent weather shocks, climate adaptations are essential. This debate is of highest relevance for farmers in the developing world whose welfare is highly weather-dependent. Recent literature has focused on a wide range of resilience-enhancing agricultural inputs such as climate-tolerant seeds (Karaba et al., Reference Karaba, Dixit, Greco, Aharoni, Trijatmiko, Marsch-Martinez, Krishnan, Nataraja, Udayakumar and Pereira2007) or efficient irrigation systems (Lybbert and Sumner, Reference Lybbert and Sumner2012). Financial innovations include agricultural index insurance (Barnett and Mahul, Reference Barnett and Mahul2007).

Crop index insurance is an insurance concept that estimates and compensates harvest losses based on a climate index that is chosen to have the highest correlation with local yields. By avoiding problems of traditional crop insurance (high transaction costs and low operational transparency), index insurance is regarded as a promising climate adaptation (e.g., Barnett and Mahul, Reference Barnett and Mahul2007). However, in practice, index insurance adoption rates remain low across the globe (e.g., Takahashi et al., Reference Takahashi, Ikegami, Sheahan and Barrett2016). As stated by Vasilaky et al. (Reference Vasilaky, Diro, Norton, McCarney and Osgood2020), fundamental research on farmers’ uptake barriers is vital.

Most related publications treat index insurance as the only climate adaptation available (Cole et al., Reference Cole, Giné, Tobacman, Topalova, Townsend and Vickery2013; Giné et al., Reference Giné, Townsend and Vickery2008; Hill et al., Reference Hill, Hoddinott and Kumar2013; Takahashi et al., Reference Takahashi, Ikegami, Sheahan and Barrett2016). Few examples focus on the combination of index insurance with alternative risk instruments in bundled products (Freudenreich and Mußhoff, Reference Freudenreich and Mußhoff2018; Ward and Makhija, Reference Ward and Makhija2018). The influence of index insurance on other climate adaptations, which are applied simultaneously but are formally unbundled, has not received much recognition yet.

This article analyzes climate adaptation portfolio decisions that consist of four potential strategies: (1) no climate adaptation, (2) only precautionary savings, (3) only index insurance, and (4) savings and index insurance. The relevance of investigating insurance and savings simultaneously is suggested by Rampini and Viswanathan (Reference Rampini and Viswanathan2017). The authors describe insurance as “state-contingent savings” due to its intertemporal character that transfers money across states.

Within the adoption literature, most studies focus on economic determinants: basis risk, price, and income (e.g., Cole et al., Reference Cole, Giné, Tobacman, Topalova, Townsend and Vickery2013), whereas trust and understanding have recently been gaining attention (Platteau et al., Reference Platteau, Bock and Gelade2017). In this context, peers may be crucial in times of deficient trust or in early diffusion steps. Instead of learning about an innovation via formal information channels, farmers may learn from or through their peers (Platteau et al., Reference Platteau, Bock and Gelade2017). In what Manski (Reference Manski2000) defines as observational learning, individuals observe their peers’ decisions and resulting consequences and respond subsequently. An alternative peer interaction is peer imitation. It describes the phenomenon of imitating one’s peers’ behavior simultaneously without any experiential knowledge effects. Hence, peer imitation contrasts observational learning in not knowing decision outcomes yet. In early dissemination phases, peer imitation can simplify complex innovation decisions by reducing searching and transaction costs (Lieberman and Asaba, Reference Lieberman and Asaba2006), and it is our main variable of interest.

Several studies explored peer-induced information transfers without differentiating between information of existence versus experiential knowledge (Xiong et al., Reference Xiong, Payne and Kinsella2016). Within this niche, studies on agricultural technology uptake have nearly exclusively considered observational learning/experiential knowledge (Bandiera and Rasul, Reference Bandiera and Rasul2006; Conley and Udry, Reference Conley and Udry2010; Krishnan and Patnam, Reference Krishnan and Patnam2014; Shikuku, Reference Shikuku2019, Wang et al., Reference Wang, Möhring and Finger2023). One exception is the work by Matuschke and Qaim (Reference Matuschke and Qaim2009) in the uptake of hybrid seeds. While Platteau et al. (Reference Platteau, Bock and Gelade2017) underline the importance of social learning in microinsurance, some studies explore social spillovers in index insurance adoption and find evidence of observational learning (Cai, de Janvry, and Sadoulet Reference Cai, de Janvry and Sadoulet2015; Cole et al., Reference Cole, Stein and Tobacman2014; Giné et al., Reference Giné, Townsend and Vickery2008; Karlan et al., Reference Karlan, Osei, Osei-Akoto and Udry2014). So far, only Moritz et al. (Reference Moritz, Kuhn and Bobojonov2023) detected pure imitation effects in index insurance uptake in Kyrgyzstan. Yet, its external validity is still unclear, and a better understanding where potential imitation attitudes stem from (trust, conformity, reputation, etc.) is required.

We conducted a lab-in-the-field experiment with 199 Uzbek farmers. In Uzbekistan, index insurance is in its early steps of diffusion, and our participants are the target group for the local insurance pilot. Having 7 to 30 farmers attending one experiment session, we can observe how farmers interact in a group setting and how this influences individual choices. While there is exogenous session participation, we assume that randomly selected farmers who know each other sit in closer proximity. A detailed seating plan allows us to analyze these interactions in more detail. After identifying preferred risk strategies, we apply choice models to address three research questions: (1) What is the role of peer imitation in innovative climate adaptations? (2) Which peer has the strongest influence: farmers sitting in the bigger versus closer surroundings (geographical distance) during the game? and (3) Which are other main determinants?Footnote 1

This article makes important contributions to the existing literature. First, the study contributes to the social learning literature. In contrast to observational learning, we elicit detailed peer imitation patterns. Deriving underlying motives allows us to enhance the understanding of peer influences in innovation uptake.

The second contribution is methodological in nature: we designed a lab-in-the-field experiment (Gneezy and Imas, Reference Gneezy, Imas, Gneezy and Imas2017) in Uzbekistan. It is a lab experiment, which incorporates agricultural field context to approximate real-life decision-making. The experiment simulates farming seasons in which farmers allocate money across different investment options. In reality, participants were allowed to (non)verbally communicate. Additionally, the experiment captures real farm and market characteristics and an index insurance option that a local insurer designed for soon implementation. Mimicking five subsequent farming years enables us to identify preferences of real insurance uptake and its key determinants prior to commercial launch. This is in contrast to related experimental studies that study the most preferred but hypothetical attribute combinations of index insurance schemes (e.g., Ghosh et al., Reference Ghosh, Gupta, Singh and Ward2020; Hill et al., Reference Hill, Hoddinott and Kumar2013; Patt et al., Reference Patt, Peterson, Carter, Velez, Hess and Suarez2009; Patt, Suarez, and Hess, Reference Patt, Suarez and Hess2010). While related literature mainly focuses on the product design, this study is one of the few (e.g., Norton et al., Reference Norton2014) that aims at an improved index insurance implementation. Following Carter et al. (Reference Carter, De Janvry, Sadoulet and Sarris2017), we need to pinpoint more efficient implementation processes for index insurance in the Global South.

Finally, studying climate adaptations as a portfolio analysis allows us to consider precautionary savings as a prevailing risk instrument. Similar to Clarke et al. (Reference Clarke, Das, Nicola and Hill2012) and Norton et al. Reference Norton(2014), this article explores index insurance with another unbundled risk instrument. As farmers in reality tend to choose several climate adaptations (di Falco et al., Reference di Falco, Doku and Mahajan2020), the approach improves the estimation of adaptation choices where insurance is only one option.

In a nutshell, this analysis provides rich insights into (1) the general acceptance of a marketable index insurance option in Uzbekistan prior to market launch, (2) dominating social learning patterns facilitating adoption, and (3) its relation to an established saving preference.

The article proceeds as follows. After background information in Section 2, Section 3 describes the experimental approach and data, and Section 4 is dedicated to the empirical approach. Empirical results are presented and discussed in Section 5. Section 6 concludes.

2. Background

Index insurance and savings have similar connotations that argue for a common analysis. First, savings is a “self-insurance” mechanism. Second, to smooth consumption and assets during shocks, both instruments associate with foregone costs – the premium paid and money stored. In contrast to insurance, the efficacy of precautionary savings depends on the savings amount and the shock frequency (Platteau et al., Reference Platteau, Bock and Gelade2017). Therefore, one strand of literature identifies a substitutionary relationship between index insurance and individual savings (Clarke et al., Reference Clarke, Das, Nicola and Hill2012; Hill et al., Reference Hill, Hoddinott and Kumar2013; Platteau et al., Reference Platteau, Bock and Gelade2017; Stein and Tobacman, Reference Stein and Tobacman2016). Other scholars argue for a complementary nexus (Cai, Reference Cai2016; Norton et al., Reference Norton2014), which may particularly hold in the presence of basis risk that harms the efficiency of index insurance by design. Yet, Norton et al. (Reference Norton2014) observe a dominating insurance preference over high-interest savings.

In our study area Uzbekistan, above-mentioned discussion is novel. Due to subsidized credit offers, rural formal savings have not received much attention (Tadjibaeva, Reference Tadjibaeva2019). Further, there is distrust in local banks, which results from their prominent role in tax collection and the transmission of agricultural financial state support. These conflicting issues induced lower- and middle-income households to rely on informal alternatives (Lamberte et al., Reference Lamberte, Vogel, Moyes and Fernando2006). Other major players in the rural financial market are agricultural insurers. Nowadays, roughly 30% of all crops are insured and insurance coverage serves as a credit liability (Muradullayev and Bobojonov, Reference Muradullayev and Bobojonov2014). However, premiums of this indemnity insurance are expensive, and insurances are typically not offered in years with systematic drought predictions (Muradullayev and Bobojonov, Reference Muradullayev and Bobojonov2014). In 2019, the Uzbek government initiated a reform to subsidize 20% of the indemnity payouts (Uzbek Government, 2019), but index insurance is expected to be more effective (Muradullayev and Bobojonov, Reference Muradullayev and Bobojonov2014). With 23% of the Uzbek population employed in agriculture (World Bank, 2021) and predictions of increasingly arid climate conditions during summers (Intergovernmental Panel on Climate Change, IPCC, 2021), it is fundamental to implement locally sustainable climate adaptations.

Global index insurance research has identified that (nonagricultural) insurance experience, high subjective and objective climate risk, low basis risk, and lower premiums increase the purchase willingness (Cole et al., Reference Cole, Giné, Tobacman, Topalova, Townsend and Vickery2013; Hill et al., Reference Hill, Hoddinott and Kumar2013; Patt et al., Reference Patt, Suarez and Hess2010; Takahashi et al., Reference Takahashi, Ikegami, Sheahan and Barrett2016). Credits are also essential. While Giné et al. (Reference Giné, Townsend and Vickery2008) observe that credit-rationing translates into a lower index insurance participation, results by Cole et al. (Reference Cole, Giné, Tobacman, Topalova, Townsend and Vickery2013) and Hill et al. (Reference Hill, Hoddinott and Kumar2013) point at a substitute relationship.

Moreover, a lack of trust seems to hamper insurance adoption (Cai et al., Reference Cai, Chen, Fang and Zhou2015; Patt et al., Reference Patt, Peterson, Carter, Velez, Hess and Suarez2009; Stein, Reference Stein2018; Tadesse et al., Reference Tadesse, Alfnes, Erenstein and Holden2017). Low trust in insurance products may evoke farmers to rather store money. However, if farmers are seeking for hitherto unknown solutions, farmers may use heuristics to make decisions, and the adoption behavior of their peers can become vital (Xiong et al., Reference Xiong, Payne and Kinsella2016). Following Manski (Reference Manski2000), peer influence may arise from a mental overload in evaluating the most efficient strategy and trusting other’s perceptive skills more than one’s own. Other scholars argue for reasons of conformity (Bernheim, Reference Bernheim1994), assistance in fast decision-making under risk, social comparison (Lieberman and Asaba, Reference Lieberman and Asaba2006), or competitive pressure (Majumdar and Venkataraman, Reference Majumdar and Venkataraman1998).

Aiming to infer peer influence, Manski (Reference Manski1993, Reference Manski2000) makes three distinctions:

-

1. endogenous effects: individual behavior follows peers’ average behavior (peer imitation);

-

2. exogenous effects: individual behavior alters with mean peers’ features;

-

3. correlated (peer-fixed) effects: similar behavior between individuals and their peers results from the reflection of related properties and not peer interaction.

Differentiating between these three factors is essential for a causal investigation of peer imitation effects.

3. Experimental design and data

This section explains the experimental design, the sample selection procedure, and shows descriptive results. By gaining a better understanding of the studied sample, it serves as essential background information for later analyses.

3.1. Experimental design

Aiming to make farmers become familiar with agricultural index insurance and to elicit adoption preferences prior to the real implementation, we conducted a lab-in-the-field experiment. Following Gneezy and Imas (Reference Gneezy, Imas, Gneezy and Imas2017), lab-in-the-field experiments use a standardized lab setting and introduce field context in there, that is, incorporating naturalistic parameters that are relevant in real decision-making and sampling the population of interest.Footnote 2 Our experiment mirrors investments with properties that the participating farmers from the pilot region are familiar with fixed costs, household consumption, fertilizer, and savings. This is expanded to an innovative and marketable index insurance option.Footnote 3 All investment costs, weather events, and revenues replicate local farm conditions. Embedding field context in an intuitive way, facilitates participants to quickly adjust to the experimental environment, and reduces bias arising from unrealistic assumptions on farmers’ decision-making (Saenger et al., Reference Saenger, Qaim, Torero and Viceisza2013). We neglect tailor-made artificial environments in peer interaction (e.g., different treatment groups) to avoid unwanted spurious behavior that may result in a desirable social reaction (e.g., Hawthorne effect). The experiment is designed for farmers in Central Asia to reveal their preferences in a subjectively safe environment. It serves as a testbed to identify an efficient implementation strategy of index insurance in the Uzbek environment (Hudson, Reference Hudson2003).Footnote 4

All experiment sessions followed a standardized procedure. Every session started with a participant registration, and participants individually chose a seat where they stayed until the session ended. After outlining the session structure, we described the general concept of agricultural insurance and index-based agricultural insurance in particular, both in a visual presentation (see translated poster in Appendix Figure A1). The provided information treatment was neutral and identical across sessions. Next, we introduced participants to the insurance game (see translated poster in Appendix Figure A2) and answered all remaining questions. We then divided participants into game groups based on their seating order, which in turn depended on their arrival time. Participants within one game group shared enumerators. As per the experiment group, farmers were randomly assigned to one of three initial endowment levels (1,235,000 Uzbek Sum (UZS); 1,320,000 UZS; and 1,415,000 UZS), each occurring with the same probability.Footnote 5 Subsequently, farmers received games sheets that illustrated the available investment options including their weather-dependent payout structure. For simplicity, the payouts for fertilizer and index insurance were displayed as gains relative to the no-investment decision. As in a real implementation, we explained that index insurance coverage requires to pay a fixed premium at the beginning of the season (ex ante) that only translates into indemnity payments in a drought season (ex post) and is sunk costs otherwise. Appendix Figure A3 shows the translated game sheet.

In the game setup, every participant was allocated one hypothetical hectare (ha) of rainfed wheat cultivation. The game then started and contained four steps (for a visual summary, see Appendix Figure A4):

-

1. Participants received game endowment (play money) to allocate.

-

2. Participants paid fixed costs to maintain their farm business and spent a minimum amount for household consumption.

-

3. Participants could spend additional money on household consumption,Footnote 6 invest a fixed sum for risky but profitable fertilizer input, purchase index insurance to formally hedge against drought, and/or spend a variable amount to precautionary savings under a local deposit rate. Participants could always take a credit with an annual interest rate.

-

4. Once allocation choices had been made, we revealed the season’s accumulated rainfall (normal, little, or very little rainfall). Its probability was ex ante unknown to participants.

-

5. Depending on previous individual investments and the season’s experimental weather, farmers received end-season income. Insured drought seasons triggered insurance payouts. The resulting income served as new endowment in the following round.

The same procedure was repeated for four subsequent rounds and created a dynamic and individualistic game. After the last round, participants with the highest final net income per initial endowment group were awarded a symbolic prize. We assume that the nonmonetary reward incentivized participants to make economically efficient investment decisions and served as a mechanism to reveal true preferences (Camerer, Reference Camerer2011).Footnote 7

As mentioned earlier, we put strong efforts in creating a realistic experimental approach: (1) all numerical values (input prices, production costs, and profit) replicate the local farming environment. The fixed sequence of weather events follows historical local rainfall data for the past 5 years.Footnote 8 (2) The offered agricultural index insurance option was developed and priced by a local insurer without subsidies. The experimental setup was identical across all sessions and resembled the local dissemination of index insurance, if it had been implemented 5 years prior to the experiment.

To allow for natural peer effects, the open experiment properties permitted participants to communicate and influence each other. Participants interacted similarly, and we did neither observe solitary attitudes nor opinion leaders. Participants could closely observe their closer peer surroundings (seating neighbors), whereas they could grasp a general (innovative) investment attitude of their bigger surroundings (all other participants in one’s game session or game group).

Assuming profit-maximizing participants, the dominant game strategy per round is written as:

In times of (ex ante unknown) rain deficits, the dominant strategy is to invest in index insurance, potentially supplemented with savings and fertilizer if not liquidity constrained. Fertilizer dominates insurance in normal rainfall seasons. If choosing one climate adaptation over all rounds, the dominant strategy is an insurance–fertilizer mix, even if it requires external borrowing including its interests. The pure insurance strategy only dominates the portfolio mix for credit-averse participants in the low-endowment group. Hence, game design favors climate adaptation choices that include innovative index insurance during drought and when selecting one rigid investment strategy over all rounds. Savings always dominate consumption expenditures but only make economic sense as a complementary investment to insurance and/or fertilizer. The object of this study is to assess realistic individual adoption behavior if index insurance constitutes a financially attractive climate adaptation (as often the case).

3.2. Sample selection

The sample area is the Jizzakh province in Uzbekistan. In 2016, agriculture accounted for roughly 50% of Jizzakh’s gross domestic product (GDP), and the region is known for its rainfed wheat production (Baboev et al., Reference Baboev and Muminjanov2015). For these reasons, Jizzakh was selected as Uzbekistan’s index insurance pilot region (for wheat) and is our region of interest.

Data were collected at two points in time: (1) in March 2019, local partners interviewed all 696 rainfed wheat producers in Jizzakh from our sampling frame that we received by the local agricultural office. (2) One month later, we conducted the experiment in the building of the local agricultural administration, aiming at sampling one-fourth of the target population for the experiment. Prior to each experiment session, the agricultural administration randomly invited rainfed farmers from the population, who had not been drawn before, for session participation. As no preselection was done within the sampling frame, all farmers had the same invitation probability (simple random sampling). To avoid bias due to participation self-selection, we cooperated with the local agricultural office, whose invites are considered binding by local farmers, and farmers were offered one alternative appointment when they were tied up with urgent matters. The overall rejection rate among 234 invitees was 15%. Strictly speaking, our sample is regarded as an approximately random sample.

In total, there were 12 experiment sessions with 199 sample farmers. One hundred and seventy-three participants successfully completed the experiment and answered all relevant survey questions. Since our experiment mimics five farming seasons, we generate a panel dataset with 863 observations.Footnote 9

3.3. Sample characteristics

As shown in Table 1, 93.6% of the sample farmers state drought as the most severe climate shock, whereas excessive rainfall (3.5%) and frost (2.9%) seem minor issues. In the last 15 years, droughts caused average harvest defaults of 68.7%. To cope with these shocks, farmers mostly prefer to (in)formally invest in savings (63.6%), diversify their income sources (19.7%), and rely on family support (15.6%).

Table 1. Perceived climate shocks, yield losses, and coping mechanisms

Notes: Climate shocks and coping mechanisms are multiple choice answers. Options with lower approval rates are excluded.

Our experiment offers four potential climate adaptation strategies. Over all experimental rounds, the baseline probabilities for these climate adaptation portfolio choices are: 15.6% of the farmers adopt neither the savings nor index insurance option, 7.0% opt for savings only,Footnote 10 36.6% prefer index insurance alone, and 40.8% invest in index insurance and savings. The latter is hereafter termed as the full (climate adaptation) portfolio.

Figure 1 depicts these portfolio decisions over five subsequent experimental rounds. In the first round, 38.2% decide to invest neither in index insurance nor in savings. This initial reluctance may imply a defensive strategy due to unfamiliarity with the experiment procedure and the concept of index insurance. Yet, 56.7% are curious about index insurance and adopt it – 53.8% even as the only climate adaptation. For subsequent rounds, farmers’ aggregated dominant preference relation is full portfolio package ≻ only index insurance ≻ only savings ≻ none. Farmers only deviate from it when suffering heavy income losses in round 4. The high experimental insurance uptake may point at a loss aversion attitude that subjectively overweighs the loss probability.

Figure 1. Portfolio choices over experiment rounds. Notes: The experimental rainfall sequence is: (1) normal, (2) little, (3) very little, (4) normal, and (5) normal.

We learn that farmers are generally interested in index insurance that is tailored to their main climate risk (drought). For summary statistics of all variables, see Appendix Table A1.

4. Empirical approach

We use a multinomial logit model to analyze individual climate adaptation choices and their determinants. Our outcome variable captures four possible portfolio options: none, only savings, only index insurance, and insurance and savings (full portfolio). These options are nominal.

To account for the five consecutive experiment rounds, we compute a pooled multinomial logit model (Wooldridge, Reference Wooldridge2010). We assume that a farmer i receives utility U from each portfolio strategy j:

$$\eqalign{ {U_{ij}} =&{\beta _{j0}} + {\beta _{j1}}{\rm{PeerDecisio}}{{\rm{n}}_{it}} + {\beta _{j2}}{\rm{PeerCharacteristic}}{{\rm{s}}_i} \cr \,\,\,\,\,\,\,\,\,\,\, &+ {\beta _{j3}}{\rm{PeerFixedEffect}}{{\rm{s}}_i} + {\boldsymbol{\gamma _{{j}}{{{X}}_{{it}}}}} + {\varepsilon _{ij}} \cr} $$

$$\eqalign{ {U_{ij}} =&{\beta _{j0}} + {\beta _{j1}}{\rm{PeerDecisio}}{{\rm{n}}_{it}} + {\beta _{j2}}{\rm{PeerCharacteristic}}{{\rm{s}}_i} \cr \,\,\,\,\,\,\,\,\,\,\, &+ {\beta _{j3}}{\rm{PeerFixedEffect}}{{\rm{s}}_i} + {\boldsymbol{\gamma _{{j}}{{{X}}_{{it}}}}} + {\varepsilon _{ij}} \cr} $$

whereas

![]() $\beta_{j0}$

is a constant term,

$\beta_{j0}$

is a constant term,

![]() $\boldsymbol{X}$

is a vector of control variables, and

$\boldsymbol{X}$

is a vector of control variables, and

![]() $\epsilon_{ij}$

is the stochastic error term. Farmer i chooses j to maximize utility.

$\epsilon_{ij}$

is the stochastic error term. Farmer i chooses j to maximize utility.

Our main independent variable,

![]() $PeerDecision$

, expresses the average climate adaptation option (0 = no strategy, 1 = only savings, 2 = only index insurance, and 3 = savings and index insurance) of farmer i’s peers (endogenous effect). The average peer option is measured as the “leave-out” mean, in which the mean group behavior is reduced by the individual’s own behavior. A higher value in the variable PeerDecision indicates that more peers decide for the full portfolio. If the individual decision-maker simultaneously follows suit, then it signals peer imitation. Intending to causally explore imitation influences, we follow Manski (Reference Manski1993, Reference Manski2000) and control for peer characteristics (exogenous effects) and peer-fixed effects (correlated effects). Peer characteristics comprise peers’ average land size, education, and age. Peer-fixed effects then control for unobserved heterogeneity in the specific peer composition.

$PeerDecision$

, expresses the average climate adaptation option (0 = no strategy, 1 = only savings, 2 = only index insurance, and 3 = savings and index insurance) of farmer i’s peers (endogenous effect). The average peer option is measured as the “leave-out” mean, in which the mean group behavior is reduced by the individual’s own behavior. A higher value in the variable PeerDecision indicates that more peers decide for the full portfolio. If the individual decision-maker simultaneously follows suit, then it signals peer imitation. Intending to causally explore imitation influences, we follow Manski (Reference Manski1993, Reference Manski2000) and control for peer characteristics (exogenous effects) and peer-fixed effects (correlated effects). Peer characteristics comprise peers’ average land size, education, and age. Peer-fixed effects then control for unobserved heterogeneity in the specific peer composition.

The vector of covariates includes experiment characteristics (previous season’s weather, credit uptake, endowment groups, and round trend), individual characteristics (age, education, household size, risk aversion, index insurance distrust, and sophisticated index insurance understanding), and farm characteristics (rainfed cropland, % farm income, and subjective and objective drought risk).Footnote 11

In this specification, risk aversion captures the preference for certain over risky outcomes (Kahneman and Tversky, Reference Kahneman and Tversky1979) and measures the respondent’s affirmative to rather double one’s investment (p = 1) over quadrupling it, if the weather is good, and losing it otherwise (p = 0.5). Index insurance distrust measures the respondent’s answers to either not having trust to receive reimbursement during adverse weather years and/or stating distrust in the insurance product. The variable sophisticated index insurance understanding expresses perfect theoretical index insurance understanding combined with trust in internet-based weather information, which are both self-stated in the survey.

One common issue in identifying causal peer effects is Manski’s (Reference Manski1993) reflection problem. It describes simultaneity in linear-in-means models and requires linear dependency between the peer decision and peer characteristics. Our random assignment of session groups induces exogenous peers on the session level. It eliminates unobserved peer-related background characteristics and thus endogeneity problems (Moffitt, Reference Moffitt and Moffitt2001). Moreover, applying discrete choice models avoids the reflection problem in its structural properties (Brock and Durlauf, Reference Brock and Durlauf2001). Another aspect of simultaneity consists of one’s peer influencing the individual, while the individual simultaneously inserts influence on the peer. Common approaches to overcome this endogeneity issue is to employ a dynamic model with lagged peer behavior, or an instrumental approach. Using the lag of the endogenous variable requires a “temporal pattern” (Manski, Reference Manski1993). This does not hold in environments like ours that are characterized by variable weather, strongly determining individual decision-making. Attempting to find a valid instrument failed, and we rely on a rational argumentation: the larger the peer group, the lower the probability for a single individual to shape peer behavior.

For this reason, we analyze peer imitation attitudes in three different peer compositions that vary in peer size and geographical proximity to the decision-maker: (1) all other participants attending the same experiment session (session peer); (2) all other participants in one’s game group (game group peer); and (3) one’s left and/or right seating neighbors (neighbor peer). Figure 2 compares the average size of the three peer compositions. Nevertheless, a robustness test will analyze how peer imitation is conditioned on peer size in each peer composition.

Figure 2. Visual peer compositions. Notes: (1) session peer, (2) game group peer, and (3) neighbor peer.

Two peer composition-related differences are salient: peer size and residence. While the size of session peers ranges from 7 to 30 (Ø = 19), 3 to 10 peers constitute one game group (Ø = 8), and there are 1 to 2 seating neighbors (Ø = 1.73). Among all session participants, 50.99% (standard deviation (SD): 29.46) reside in the same village, whereas this share is 59.48% (SD: 29.09) in one game group and 49.71% (SD: 0.47) among seating neighbors. When looking at the share of one’s peer group that resides in one’s own village the picture varies. During experiment participation, 46.75% (SD: 0.315) have village peers in their session peer, and this share is at 52.21% (SD: 0.351) in their game group and at 63.58% (SD: 0.418) in their neighbor peer. These peer group differences are not surprising – farmers randomly invited to one session individually decided where they sit and stay seated until the session ended. Farmers from one village tend to be more familiar with each other, may have known about the experiment invitation ex ante, were more likely to share transportation to the experiment session, arrive together, and thus tend to be inclined to sit in close proximity. Comparing imitation effects for these three peer compositions elicits the most seemingly influential peer group. From there, we can learn more about social interactions and who may shape farmers’ climate adaptations choices.Footnote 12

5. Results and discussion

This section presents and discusses the regression results of three models that vary in their peer composition. All regression models apply serial correlation robust standard errors, and selected variables do not indicate multicollinearity. A bivariate probit model identifies a positive and significant correlation between the insurance and savings choice (p = 0.022), validating their simultaneous estimation.

5.1. Estimation results

We first define one’s peer as one’s experiment session (7–30 farmers) in equation (1). Table 2 displays the determinants of individual climate adaptation choices when controlling for session peer imitation. If the simultaneous average portfolio option of farmers attending the same session (own behavior excluded) has a stronger preference for choosing index insurance and savings, the model predicts a probability for an individual to follow suit of 25.84 percentage points (p < 0.0001). In analogy, it relates to a decreased probability to not invest in any climate adaptations (12.65 percentage points, p < 0.0001) or only formally insure (15.79 percentage points, p = 0.001).Footnote 13

Table 2. Average marginal effects of portfolio choices with session peer imitation

Notes: Serial correlation robust standard errors are in parentheses: ***p < 0.01, **p < 0.05, *p < 0.1.

Among peer group characteristics, one’s session peers’ land size is slightly negatively associated with any insurance option (p = 0.066–0.132). This may stem from learning about alternative but costly risk instruments mostly relevant for large-scale producers (e.g., irrigation). Estimates of peer education and age are low in size and statistical power (p≥0.288), and peer-fixed effects are correlated with individual response (p ≥ 0.0001). However, we discern that imitating one’s session peers’ behavior exhibits one of the largest scale effects and seems the only peer influence that motivates the full portfolio choice.Footnote 14 To better understand imitation attitudes, we explore underlying dynamics in extension models. Appendix Table A5 shows climate adaptation choices when controlling for past peer behavior. From model 1, we learn that if more session peers had invested in the full climate adaptation portfolio in the previous season, it may decrease the probability for an individual to imitate this behavior (p ≥ 0.0001) but probably increase the noninsurance decisions (p ≥ 0.028). Further, when controlling for an individual’s lagged portfolio choice in Appendix Table A6 (model 1), the decision-maker appears to no longer imitate peer behavior (p ≥ 0.0001) and rather learn from one’s own experience (p ≥ 0.0001).

Other characteristics of interests are financial liquidity and product (dis)trust as well as understanding. Farmers in the highest initial endowment group, on average, relate to a 14.52 percentage points (p = 0.003) higher willingness to choose the full portfolio strategy, compared to farmers with the lowest endowment. Similarly, farmers raise an experimental credit that correlates with a 27.11 percentage points greater probability to only hedge for index insurance (p < 0.0001), and farmers who distrust index insurance may prefer to solely store money by 5.11 percentage points (p = 0.067).Footnote 15 Counterintuitive seems that sophisticated theoretical index insurance understanding is associated with a 4.84 percentage points (p = 0.092) higher probability to neither invest in savings nor insurance, nor place money solely into a savings plan (p = 0.081). Yet, having played more experimental rounds, expressing practical understanding, tends to favor the full portfolio by 3.69 percentage points (p < 0.0001).

Control variables indicate that farmers with a higher share of agricultural income appear to not invest in any climate adaptation. Farmers with higher yield losses and larger rainfed land holdings in reality seem to prefer to not hedge against insurance. Liquidity constraints due to experiencing severe drought in the previous season do not relate to investing into the full portfolio. Lastly, more educated and risk-averse farmers may be more likely to favor index insurance as a climate adaptation strategy.

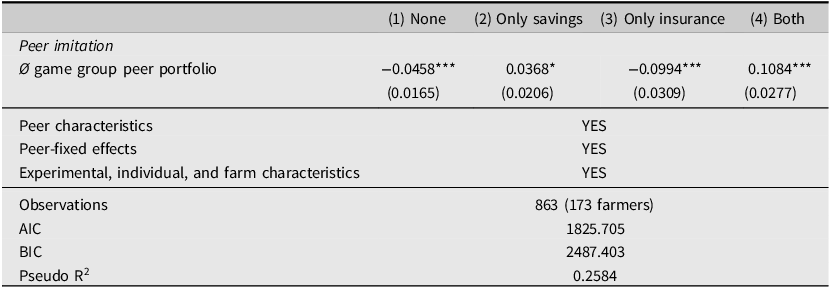

The second model estimated in equation (1) controls for climate adaptation choices of farmers in one’s game group (3–10 peers). In this peer composition, farmers sit in near proximity and can communicate and observe each other’s behavior in more detail. Table 3 presents its estimates. Being closer surrounded by farmers that tend to simultaneously invest in savings and index insurance, on average, relates to an increased probability to follow suit by 10.84 percentage points (p < 0.0001). Compared to session group imitation, this estimate is predicted to be more than half the effect size.

Table 3. Selected average marginal effects of portfolio choices with game group peer imitation

Notes: Serial correlation robust standard errors are in parentheses: ***p < 0.01, **p < 0.05, *p < 0.1. Appendix Table A3 shows the full model estimates.

Due to similarity to the previous model, we only summarize three features:

-

1. All (significant) estimates have the same direction.

-

2. Most estimates have very similar magnitudes.

-

3. Common selection criteria (Akaike information criterion (AIC) and Bayesian information criterion (BIC)) indicate the session group imitation model to have a better model prediction.

Finally, we estimate equation (1) defining peer as ones direct (left and/or right) seating neighbors during the experiment. Sitting in the closest proximity may allow participants to precisely observe the decision-making of their peer. Table 4 displays its findings. If one’s seating neighbors invest in the full climate adaptation portfolio, it associates with a higher probability for the individual to follow suit by 13.46 percentage points (p < 0.0001). Having a peer imitation effect that appears as almost half the effect size compared to session peer indicates a lower relative relevance. Yet, it is predicted to be 2.62 percentage points higher than the game group imitation estimate. Except a negative but low effect of the average neighbor land size (p = 0.037) on the no climate adaptation choice, all implications from the static model with game group imitation hold.

Table 4. Selected average marginal effects of portfolio choices with neighbor peer imitation

Notes: Serial correlation robust standard errors are in parentheses: ***p < 0.01, **p < 0.05, *p < 0.1. Appendix Table A4 shows the full model estimates.

a Every participant has a unique neighbor peer, and we cannot control for correlated peer effects via individual dummy variables. Following Wydick et al. (Reference Wydick, Karp Hayes and Hilliker Kempf2011), we argue that any significant correlated peer effects are manifested in one’s peers’ characteristics. If this is not the case, they may also be captured in the estimate of peer behavior.

However, in the dynamic perspective, findings may change. Model 3 in Table A5 finds that the lagged behavior of one’s neighbor peer associates with a positive influence on the individual. If one’s seating neighbors opted for the full portfolio package in the previous season, it relates to a higher probability for the individual to behave the same way by 8.30 percentage points (p = 0.002). Similarly, when controlling for one’s own lagged investment behavior in Appendix Table A6, the peer imitation effect seems to remain significant and positive. The ceteris paribus estimate of having invested in a more protective portfolio choice (insurance and savings) in the last season associates with a 9.95 percentage point increase (p < 0.0001) to repeat the investment choice. At the same time, if the average neighbor adaptation choice tends to reach the full portfolio, the individual may imitate this investment behavior by 7.05 percentage points (p = 0.008).

5.2. Further robustness tests

Previously, we argued that the estimated imitation behavior is based on the influence the peer behavior has on the individual, and not vice versa. For robustness, we condition peer imitation on the respective peer size in Appendix Figure A7. We find that the peer imitation patterns appear to intensify with a growing peer size in all three peer compositions. The peer imitation estimates are predicted to increase by 15.92 percentage points (p < 0.0001) in the session peer, by 15.46 percentage points (p ≤ 0.008) in the game group peer, and by 2.00 percentage points in the neighbor peer. If the estimated peer imitation seems higher in larger peer surroundings, we may rule out the possibility that the estimated peer effect in fact expresses the influence the individual has on one’s peer. Simultaneity in our estimated peer effect seems nonexistent.

Given the relative small number of farmers, it is likely that experiment participants know each other outside the experimental setting. Therefore, we condition peer imitation behavior on the share of village peers in one’s experimental peer group (see Figure A6). We assume that social interactions with one’s village peer are driven by experiences gained outside the experiment and may initiate more trust into peer decision-making.Footnote 16 From Figure A6, we learn that peer imitation attitudes tend to slightly decline if more of one’s larger experimental peer group are also village peers. The decrease is predicted to be 2.29 percentage points (p ≤ 0.030) in the game group peer and 2.18 percentage points (p < 0.0001) in the session peer, whereas we find a positive estimate of 1.37 percentage points (p < 0.0001) in the neighbor peer.

In section 3.2, we stated to have an approximately random sample. To account for potential self-selection bias in experiment participation, we compare important sample and population statistics (see Appendix Table A1). On the basis of remarkable differences (>10%) in risk aversion and rainfed arable land, we construct sample/population weights. Using these sample weights, we rerun all regressions to obtain weighted estimators for Uzbekistan’s index insurance pilot region. We find that direction effects seem identical for weighted and unweighted data, and estimated scale effects have a comparable magnitude. We conclude that our implications can be generalized to the population (i.e., the pilot region).

5.3. Discussion

In our experiment, financial resources, trust, and understanding seem to be important determinants of index insurance adoption. In the climate adaptation decision in our experiment, credits may be used to just finance index insurance purchases, which is in contrast to Cole et al. (Reference Cole, Giné, Tobacman, Topalova, Townsend and Vickery2013) and Hill et al. (Reference Hill, Hoddinott and Kumar2013). These authors argue that credits and index insurance are substitutes in terms of risk management. Our estimated positive relationship between index insurance and credit holds for all endowment levels, whereas the scale effects are highest for the lower endowment groups. Our results indicate that credit-bundling might in fact realize a combination of ex ante and ex post risk management. It implies that credit-bundled products tend to remedy liquidity shortages, which seem most beneficial for farmers with lower incomes and follows an argumentation by Binswanger-Mkhize (Reference Binswanger-Mkhize2012). This finding of a complementary relationship contributes to the debate on the insurance–credit nexus raised by Platteau et al. (Reference Platteau, Bock and Gelade2017).

Additionally, distrust might hamper index insurance adoption, and practical understanding may explain higher insurance adoptions in later game rounds. While sophisticated theoretical index insurance understanding seems to exert a negative influence, its interpretation requires caution. It only measures insurance understanding from the survey and cannot consider the perceived educational input during the experiment. Yet, the two small understanding effects corroborate findings by Luo et al. (Reference Luo, Yang, Zhao and Sun2019). Due to the high complexity associated with the index insurance decision, one’s rationale alone may not affect adoption behavior. Farmers seem to apply heuristics. Based on seminal work by Kahneman (Reference Kahneman2011), individuals tend to simplify complex decision-making. As the analytical mind (“system 2”) is lazy, the intuitive mind (“system 1”) generates an easy answer by responding to a related but easier question instead. Along these lines, our model predicts that imitating the innovation behavior of surrounding farmers may compensate for a risk attitude not favoring insurance uptake and may diminish the importance of practical product understanding in the purchase decision. “Do I want to purchase index insurance?” seems to be partially replaced by “Do others purchase index insurance?” But how may peers shape individual climate adaptations?

First, our analysis predicts that peer behavior is not the only significant peer influence, and we cannot establish imitation inference (see Manski, Reference Manski1993, for a discussion). However, due to the seemingly dominating size effects, we conclude peer imitation behavior to matter more for innovative drought protection than peer characteristics. In the static perspective, the session peer may shape individual investment decisions the most, followed by the neighbor peer and least influential seems the game group peer. Further, our results may eliminate observational learning effects for the bigger peer groups. The lagged behavior of one’s session and game group peer does not tend to motivate farmers to follow suit one season later. However, the lagged innovation choice of one’s neighbor peer still seems to be influential in lag 1. What farmers can closely observe may have a more enduring influence than grasping the more general (and superficial) attitude of the bigger peer groups. This may also explain why peer imitation in the larger peer groups might lose its positive effect once controlling for one’s own lagged climate adaptation choice. The negative and significant result may even indicate to loss trust in their decision-making. While the individual might anticipate changing experimental weather, the individual may not expect one’s larger peer to behave the same in the dynamic perspective. Implications vary for the neighbor peer. Here, neighbor imitation still seems to be positive and significant, when controlling for one’s lagged behavior. This again confirms the above interpretation of a longer-lasting peer influence in contexts of more detailed observations in the neighbor peer groups – one’s trusted neighbors.

The remaining question is why farmers seem most influenced by behavior of their session peer in the static perspective. As the sum effect of the smaller peer behavior may not explain the session peer imitation effect, we assume that the bigger group induces an imitation-enhancing dynamic. Grasping a general innovation/investment attitude of more farmers in the same decision-situation seems more relevant in the ad hoc innovation decision. During uncertainty, peer imitation may be driven by superior trust in other’s perceptive skills. This may be labeled conformity. The bigger surrounding might form a safe environment that evokes connotations (social norms) of suitable innovative climate adaptations, whereas the closer surrounding appears to lack the sufficient critical mass to be perceived as most conclusive. This assumption is further supported by the peer size effect: peer imitation seems to intensify with a growing peer size in all peer classifications. From behavioral economic theories, we interpret peer imitation to serve as a heuristic in the complex index insurance decision. Farmers may have problems judging the probability of uncertain outcomes (drought) and their necessity to decide for a climate adaptation strategy. Peers’ behavior can be seen as a social reference point (Kahneman and Tversky, Reference Kahneman and Tversky1979), and the individual might want to minimize relative losses. This corroborates research by Mengel et al. (Reference Mengel, Tsakas and Vostroknutov2016), who find that individuals show a less risky behavior in times of imperfect information settings. An alternative approach is the anchoring effect, which motivates individuals to rely more on the first piece of information (Tversky and Kahneman, Reference Tversky and Kahneman1974). In our context, peer behavior can be regarded as an anchor, a cognitive bias based on substantially irrelevant information that may stimulate individuals to imitate.

Community-based promotions seem economically effective and may provide relevant social dynamics to encourage innovation adoption. Although understanding the village effect on peer imitation requires more research, we at this point only attempt an interpretation. Within our sample, one village community in Uzbekistan seem to be purely build not only on trust but also on competition. This may stem from quotas for wheat production and the pressure to fulfill these in three consecutive years to not lose their agricultural land to another farmer (from one’s village).Footnote 17 A competitive farming atmosphere in one village may be amplified through limited access to subsidized resources such as leasing harvesters, diesel, and fertilizer, as well as excess demand for hired harvester (and the respective driver) and seasonal labor. Derived from the “access to resources” framework (e.g., Turner et al., Reference Turner, Ayantunde, Patterson and Patterson III2011) and various studies on farm subsidy programs (e.g., Lunduka et al., Reference Lunduka, Ricker-Gilbert and Fisher2013; Mason et al., Reference Mason, Jayne and Mofya-Mukuka2013), access to these limited resources can be perceived as unequally distributed due to individual political relationships and may disrupt harmony among some farmers in one village. It can be one reason for the estimated decreased peer imitation attitude, if more of one’s village peers constitute one’s session and game group peer during the experiment. In turn, the respective positive imitation effect for the neighbor peer may indicate that trusted villagers sit in close proximity during the experiment – in their relationship, trust dominates competition. We derive that the community chosen for index insurance extension services shall have diverse village backgrounds. In such a setting, individuals can collectively learn from each other without being deterred by negative associations (e.g., bribe behavior or nepotism) of some familiar village farmers.

Our results seem to be driven by the information of a credible innovation strategy, which may be solely expressed in peer action without knowing the decision outcome yet. While this was hypothesized by Platteau et al. (Reference Platteau, Bock and Gelade2017), Moritz et al. (Reference Moritz, Kuhn and Bobojonov2023) provide the first evidence of simultaneous peer imitation patterns in Kyrgyzstan. However, its external validity is still lacking. Within the existing literature, our findings validate peer imitation attitudes in rural Uzbekistan and present the first attempt to identify underlying imitation motives. This contrasts extensive evidence of pure observational learning (e.g., Cai, de Janvry, and Sadoulet Reference Cai, de Janvry and Sadoulet2015; Krishnan and Patnam, Reference Krishnan and Patnam2014; Shikuku, Reference Shikuku2019) and enriches studies not differentiating between different peer influences at all (e.g., di Falco, Doku, and Mahajan Reference di Falco, Doku and Mahajan2020).

6. Conclusion

In times of climate change, index insurance is a promising climate adaptation but suffers low demand. It is vital to comprehend key drivers of index insurance adoption. Therefore, we explore how peer imitation along other social and financial characteristics determines portfolio choices between novel index insurance and established precautionary savings. Our results are based on a lab-in-the-field experiment in Uzbekistan.

We conclude: (1) when deciding for a risk portfolio strategy including index insurance and precautionary savings, farmers tend to strongly imitate the simultaneous choice of other experiment participants without knowing what the outcome will be. With an increasing peer number, the innovative peer decision may be regarded as socially accepted or simply constitute an anchor and finally be adopted by the individual. We argue that learning from one’s peers seems to consist of the sole peer action that serves as an important heuristic in innovative and complex decision-making. While behavior of the larger peer group tends to stimulate a powerful impulse response, observing neighbor decision-making seems to have more sustained influences in the dynamic perspective. We need to acknowledge various group dimensions – impulsive peer size and trusted neighbors – in index insurance uptake and integrate these insights into promotion activities.

(2) Other important influences on individual portfolio choice are credit uptake, provider trust, and practical product understanding. Similar to Moritz et al. (Reference Moritz, Kuhn and Bobojonov2023), Patt et al. (Reference Patt, Peterson, Carter, Velez, Hess and Suarez2009), Platteau et al. (Reference Platteau, Bock and Gelade2017), and Vasilaky et al. (Reference Vasilaky, Diro, Norton, McCarney and Osgood2020), we advocate community-based extension treatments. Not only are promoting activities of index insurance in bigger groups cost-efficient, but they can also exploit positive peer dynamics and improve related trust and understanding. This also allows for detailed observations of one’s close peer, which may be less influential in the short term but is associated with long-lasting effects. These findings may foster the successful dissemination of index insurance in the developing world. In Uzbekistan, the local administrative administration regularly organizes meetings with farmers to discuss news (e.g., plant diseases). Community-based extension treatments could be incorporated in there. (3) Index insurance may be more attractive for farmers with lower agricultural incomes. Since these farmers often require credits to invest in risk management, we endorse credit-bundled options to overcome financial constraints for resilience-enhancing investments. This recommendation complements research by Kuhn and Bobojonov (Reference Kuhn and Bobojonov2023) who find that credit constraints are partially caused by missing risk-sharing options.

Although trying to tackle common endogeneity problems in peer interactions, we find significant (but inferior) effects of other peer characteristics on individual decision-making. We cannot causally interpret the estimated imitation effect and view results as merely suggestive. As our experimental setup does not control for basis risk and weakens liquidity constraints, two main uptake barriers (Carter et al., Reference Carter, De Janvry, Sadoulet and Sarris2017), we expect our high adoption rates to be slightly upward biased. In our experiment design, the dominant aim was to build a trustworthy environment that facilitates understanding, commitment, and revelation of natural preferences. In the next step, an experiment focusing on the introduction of a randomized treatment is planned. Future investigations should test the external validity of our findings as well as give more details on the negative village effect on the otherwise strong peer imitation behavior.

It is fundamental that research explores farmers’ complex innovative decision-making from a more holistic view. Our findings are an important first step in evincing social dynamics and finances in agricultural innovation adoption, relevant for researchers, practitioners, and policymakers in developing countries.

Supplementary material

The supplementary material for this article can be found at https://doi.org/10.1017/aae.2023.38

Acknowledgements

We are very grateful to the GROSS Insurance company in Uzbekistan, Hannover Re and Sarvarbek Eltazarov (Leibniz Institute of Agricultural Development in Transition Economies) for calculating the marketable index insurance product used in our analysis. We also thank our partner Nuriddin Muradullaev (Tashkent State Economic University) for his field assistance during data collection. This work was part of the KlimALEZ project that was developing and implementing real index insurance options in Central Asia.

Financial support

This work was supported by the German Ministry of Research and Education (grant number: 01LZ1705A).

Data availability statement

All data used in this study are self-collected. Data and codes can be made available upon request.

Competing interests

Laura Moritz, Lena Kuhn, Ihtiyor Bobojonov, and Thomas Glauben declare none.