13.1 Introduction

South Africa is a highly carbon-intensive country. Its government has committed to domestic climate change mitigation policy and international treaties to reduce emissions. At the same time, the government also continues to support the production and use of fossil fuels directly (through supporting coal-fired electricity and the conversion of coal into liquid fuels) and indirectly (through the provision of supporting infrastructure). While the dominance of fossil fuels has been explained through the historical co-evolution of state, business and mining interests (Fine and Rustomjee Reference Fine and Rustomjee1996; Marquard Reference Marquard2006; Baker Reference Baker2012), little is known about the extent of current government support for fossil fuel industries and why such support persists. This chapter quantifies fossil fuel production subsidies in South Africa over the period 2007–15 and offers an analysis of the politics underpinning such subsidies.

Any study of the politics and reform of fossil fuel subsidies in South Africa requires an investigation into the existence of subsidies and their scale, who benefits from them, the actors providing them and their justifications for doing so. To date, only one analysis has attempted to describe and quantify fossil fuel production subsidies in South Africa, for 2013 and 2014 (Garg and Kitson Reference Garg and Kitson2015). This chapter extends their analysis, first, by highlighting how historical state support has created a system of ‘cheap’ fossil fuels through long-running formal and informal institutions and, second, by quantifying subsidies over a longer time period (2007–15). Remarkably, given that there are indeed extensive subsidies in South Africa to fossil fuel production, the South African government has indicated to the Group of 20 (G20) that it has no ‘inefficient’ subsidies.

In quantifying the scale of fossil fuel subsidies, we outline the rationales underpinning the varying mechanisms of support the state provides. We show that subsidies are used to support government objectives related to energy security and economic development. We argue that key drivers of subsidies include apartheid-era industrial and energy policies that have become locked in over time. Despite major political change at the end of apartheid in 1994, many sustaining subsidies have persisted, while whereas new subsidies have emerged with justifications that echo the apartheid state. The South African state does not frame such support as fossil fuel production subsidies – which could spark a national debate around their role in economic development (contrasted against mitigation policies such as carbon taxes) – but instead frames subsidies as supporting ‘vital’ or ‘strategic’ investments (e.g. Transnet 2007; National Treasury 2010; DoE, 2016). Such policies often have a distinctly distributive aim (Whitley Reference Whitley2013). Echoes of the distributive policies of the apartheid state remain in the political allocation of coal contracts and in the lack of reform of liquid fuels pricing. Subsidies that have persisted or emerged since the end of apartheid ostensibly support new beneficiaries, but the analysis shows how the structure of these benefits continues to advantage the existing beneficiaries of production subsidies.

While there has been limited public debate on fossil fuel subsidies, there is debate on South Africa’s future development pathways and the role of fossil fuel extraction and use within that (Winkler and Marquard Reference Winkler and Marquard2009; Altieri et al. Reference Altieri, Trollip and Caetano2015; Baker et al. Reference Baker, Burton, Godinho and Trollip2015). Subsidies have not been a crucial part of the debate either within or outside of government. We suggest that this may be because the scale of subsidies is not well known, and much of the detail is obscured or hidden.

The support of fossil fuel production needs to be seen against the backdrop of the broader political economy of energy in South Africa, which has historically been characterised as the ‘minerals-energy complex’. This denotes a particular set of interlinked sectors and relationships between industry, state-owned enterprises (SOEs) and the state (Fine and Rustomjee Reference Fine and Rustomjee1996). Support for these sectors persists because they are viewed as key to economic development; the state’s industrial policies are often based on the assumption that growth is encouraged through large infrastructure investments, which frequently support minerals extraction and heavy industry (NPC 2011).

Methodologically, this chapter draws on the analysis of national and departmental budgets, estimates of national expenditure, annual reports of SOEs and personal communications with civil society and government representatives. The chapter begins by outlining the current structure and historical development of the coal, electricity and liquid fuels sectors in South Africa to highlight the extent of historical support that has locked in the structure of the energy sector. This is followed by a quantification of recent fossil fuel subsidies and a description of their rationales. The chapter then analyses the politics of reform.

13.2 Historical Development of South Africa’s Fossil Fuel Subsidies

The South African fossil fuel subsidy regime mainly sustains the production of coal for export and for conversion into electricity and liquid fuels. The energy sector heavily relies on coal and was shaped by the unique politics of energy security and the country’s international isolation during apartheid. The minerals sectors shaped energy-intensive industrial development along with SOEs, such as the vertically integrated monopoly utility Eskom and (formerly state-owned) liquid fuels producer Sasol (Fine and Rustomjee Reference Fine and Rustomjee1996; Marquard Reference Marquard2006; Baker Reference Baker2012). From the 1970s onwards, the apartheid state intervened via regulation and continuously stimulated demand for coal through the state-owned electricity, coal-to-liquids, railway and steel industries. This demand built up significant reliance on fossil fuels.

Coal accounts for 65 per cent of primary energy consumed in South Africa (DoE 2010). Eskom generates 95 per cent of South Africa’s electricity, of which 90 per cent is coal fired (Eskom 2014). Sasol’s energy- and emissions-intensive coal-to-liquids process accounts for 25 per cent of liquid fuels consumption. Eskom and Sasol account for roughly 90 per cent of domestic coal consumption and about 55 per cent of South Africa’s emissions (Eberhard Reference Eberhard2011; DEA 2014).

Support for fossil fuel production is concentrated on relatively few large actors that are primarily state owned. Eskom has received government support and has passed this on in the form of ‘underpriced’ electricity (Steyn Reference Steyn2001; NPC 2011). Benefits have accrued to producers and to very large, mostly corporate consumers of electricity, which account for roughly 44 per cent of Eskom’s electricity sales (EIUG 2015). Sasol has received state subsidies since its inception, and the liquid fuels pricing regime continues to ensure large profits in the coal-to-liquids business. Transfers have primarily been from the state and consumers to private firms and Sasol (Rustomjee et al. Reference Rustomjee, Crompton, Maule, Mehlomakulu and Steyn2007). This is unlike other fossil fuel–producing countries, where consumers are often beneficiaries and subsidies play an important role in maintaining political stability (Victor Reference Victor2009). Coal mining benefits from infrastructure provision and from the subsidy-enhanced demand from Eskom and Sasol, although direct subsidisation of coal mining is limited.

13.3 Quantifying Fossil Fuel Subsidies in South Africa

‘Fossil fuel production’ refers to production in the coal, oil and gas sectors, including access, exploration and appraisal; development, extraction, preparation and transport of fossil fuel resources; plant construction and operation; distribution and decommissioning; and fossil fuel electricity generation (Bast et al. Reference Bast, Doukas, Pickard, van der Burg and Whitley2015: 9). We use the definition proposed by the Global Subsidies Initiative, which reflects the full range of benefits provided to the fossil fuel industry. This definition includes the mechanisms of subsidisation specified in the World Trade Organization’s Agreement on Subsidies and Countervailing Measures (see Chapter 7), as well as additional support mechanisms (GSI 2010: 4–5). Earlier work found that the value of national production subsidies was an average of 213 million South African rands per year (or USD 20 million) in 2013–14 (Garg and Kitson Reference Garg and Kitson2015).Footnote 1

There are several mechanisms through which fossil fuel production is subsidised. The most ‘visible’ form of subsidisation, and most easily measured, is direct transfers or budgetary outlays (Koplow Reference Koplow2015: 4; OECD 2015: 27). Under the World Trade Organization definition of a subsidy, a loan qualifies as a ‘potential’ direct transfer from the government. Fossil fuel producers can also be subsidised through tax expenditures (see Chapter 2). Similar to direct transfers, these measures effectively reduce the cost of producing fossil fuels below the costs that would prevail under a standard tax treatment. Finally, fossil fuel production is subsidised through market price transfers, which result from policy interventions and produce transfers between consumers and producers (OECD 2010: 19). In this case, liquid fuels producers receive guaranteed returns, with large transfers from consumers to producers via the regulated fuel price.

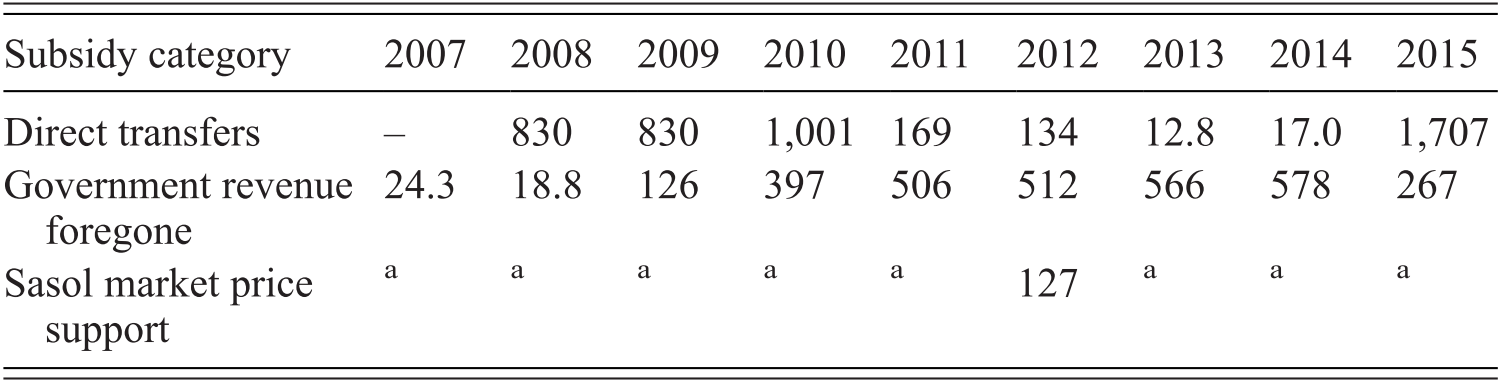

Table 13.1 shows the subsidies to fossil fuel production via direct transfers, government revenue foregone and Sasol market price support in the period 2007–15. We exclude public finance for production but note that this is an important and growing mechanism of support. Public finance for 2013–14 is included in Garg and Kitson (Reference Garg and Kitson2015) and Bast et al. (Reference Bast, Doukas, Pickard, van der Burg and Whitley2015). For example, public finance for fossil fuel electricity production within South Africa was USD 198 million in 2013 and USD 45 million in 2014 (Lott et al. Reference Lott, Burton and Rennkamp2016), and support for coal mining was USD 35.6 million in 2014–15 (IDC 2015).

Table 13.1 Annual subsidy estimates by category for South Africa

| Subsidy category | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|---|---|---|

| Direct transfers | – | 830 | 830 | 1,001 | 169 | 134 | 12.8 | 17.0 | 1,707 |

| Government revenue foregone | 24.3 | 18.8 | 126 | 397 | 506 | 512 | 566 | 578 | 267 |

| Sasol market price support | a | a | a | a | a | 127 | a | a | a |

Note: All amounts in 2016 USD million.

a No transfers for that subsidy in a given year or lack of data.

The subsidies shown in Table 13.1 are part of substantial and long-running support to fossil fuel production in South Africa. The following sections describe this history – showing how subsidies have become locked in because they support state objectives of energy security and economic growth – and explain how the substantial subsidisation shown in Table 13.1 is an extension of the minerals-energy complex in South Africa.

13.3.1 Historical Subsidies to the Coal Sector and Eskom

Coal mining benefited historically from various apartheid laws that lowered the cost of doing business, including exemptions from the usual environmental protections and the ability to pay very low wages to mine workers and provide them with little or no labour, health or safety protections. State take via royalties did not exist until 2010.Footnote 2 This created a system of cheap fossil fuels, with benefits accruing to either coal suppliers or electricity users, who were frequently the same firms and who enjoyed unparalleled access to the state, including Anglo American and Gencor (later BHP Billiton) (Fine and Rustomjee Reference Fine and Rustomjee1996; Burton Reference Burton2011).

Eskom’s coal costs were furthermore kept low via two contracting models. In the first model, Eskom provided capital to ‘cost-plus mines’, supporting coal producers by financing production and guaranteeing off-take. Eskom remains responsible for capital investment in these mines, as well as for liabilities such as mine rehabilitation. The second model involved fixed-price contracts with mines, where coal sold to Eskom was subsidised from exports, with low coal costs passed through Eskom to benefit electricity users (Eberhard Reference Eberhard2011; Matthews Reference Matthews2015).

The allocation of coal contracts was politicised. Contracts were shared out among companies and were used to develop local mining capacity and companies with political/ethnic ties to the state, creating new (white) ‘Afrikaner’ capital as distinct from (white) English or ‘imperial’ interests (Fine and Rustomjee Reference Fine and Rustomjee1996). The coal sector has evolved since 1994, but it remains reliant on Eskom as the largest user of coal, and there are crucial similarities that persist. There are links between coal mining interests and the ruling African National Congress (ANC) Party. Eskom also uses its market power to promote Black Economic Empowerment in coal. Black Economic Empowerment describes economic policies that are intended to redress the racial inequities of apartheid through privileging black or historically disadvantaged individuals. Eskom’s procurement policy is explicitly distributive and favours new black-owned mining firms that may or may not have competitively priced coal; Eskom’s support for new producers is thus based on racial economic development objectives (Burton and Winkler Reference Burton and Winkler2014).

Eskom’s provision of support for mining is seldom analysed in terms of the distributive consequences for the broader economy. This is similar to liquid fuels pricing, discussed later, where a regulated price is maintained due to concerns about downstream employment and new black ownership in the retail sector.

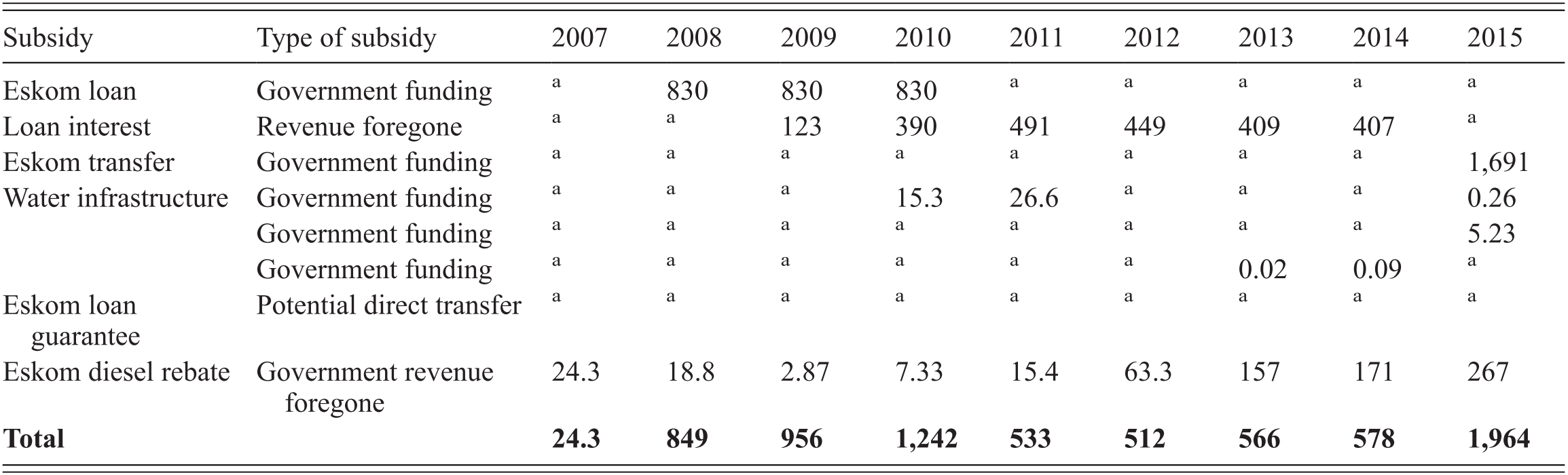

Recent examples of direct transfers to Eskom are shown in Table 13.2. Government support of Eskom is not new; when the utility was undertaking a large expansion programme in the 1970s and 1980s, it received subsidies through government guarantees for foreign loans and through state-supplied forward cover on currency risk (Steyn Reference Steyn2001).Footnote 3 As we explain, current support includes transfers to ensure the financial stability of Eskom and promote supply security in the electricity sector, which have been necessary given the utility’s financial and supply problems.

Table 13.2 Subsidies to coal and electricity production in South Africa

| Subsidy | Type of subsidy | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|

| Eskom loan | Government funding | a | 830 | 830 | 830 | a | a | a | a | a |

| Loan interest | Revenue foregone | a | a | 123 | 390 | 491 | 449 | 409 | 407 | a |

| Eskom transfer | Government funding | a | a | a | a | a | a | a | a | 1,691 |

| Water infrastructure | Government funding | a | a | a | 15.3 | 26.6 | a | a | a | 0.26 |

| Government funding | a | a | a | a | a | a | a | a | 5.23 | |

| Government funding | a | a | a | a | a | a | 0.02 | 0.09 | a | |

| Eskom loan guarantee | Potential direct transfer | a | a | a | a | a | a | a | a | a |

| Eskom diesel rebate | Government revenue foregone | 24.3 | 18.8 | 2.87 | 7.33 | 15.4 | 63.3 | 157 | 171 | 267 |

| Total | 24.3 | 849 | 956 | 1,242 | 533 | 512 | 566 | 578 | 1,964 |

In response to rolling power cuts in 2008, the national government issued a loan of USD 5.45 billion to Eskom (RSA 2008: 2) to recommission three mothballed coal plants and finance two new coal power stations. In 2014, the state converted a portion of the loan to equity (USD 2.52 billion) (Nene Reference Nene2015), resulting in direct transfers of USD 840 million between 2008 and 2011. We estimate that interest foregone on the loan between 2009 and 2014 totals USD 2.29 billion (Lott et al. Reference Lott, Burton and Rennkamp2016).

Eskom received a further direct transfer in 2015 when Parliament enacted the Eskom Special Appropriation Act to assist Eskom in expanding electricity generation capacity (RSA 2015: 2). The value of this bailout was USD 1.63 billion.

Potential direct transfers can also be identified in the provision of government loan guarantees. These loan guarantees link Eskom’s debt to the sovereign’s investment rating, lowering Eskom’s cost of borrowing by lowering the risk associated with Eskom debt. The government assumes a financial liability in the case of default. Eskom has borrowed a total of USD 12.8 billion against the total loan guarantee of USD 23.8 billion (National Treasury 2016b).

Direct transfers of USD 47.5 million from the National Treasury and Department of Water Affairs were made for water infrastructure in the Waterberg mining basin. The water infrastructure is explicitly for supplying water to Eskom’s Matimba and Medupi coal power plants and for de-bottlenecking coal supplier Exxaro’s existing pipeline. Phase two of the project is ‘a prerequisite to enable the further development of the Waterberg coalfields’ (TCTA 2014: 47; see also National Treasury 2014b, 2015: 40, 2016a: 953).

The National Treasury considers such transfers a ‘funding mechanism’ for ‘strategic projects’ that contribute to water and energy security (National Treasury 2016c). User charges go to pipelines and transfer schemes, and the government supplies guarantees to enable strategic projects. To what extent user charges cover the full costs is not known; in rail, Transnet has indicated that contracts do not fully cover the costs of new rail expansions on the coal line (Creamer Reference Creamer2015). Since these developments are run through SOEs, there is very little information publicly available on long-term financing.

Support for fossil fuels in the electricity sector has seldom been understood as a ‘fossil fuel subsidy’. Rather, subsidies have been used for energy security and industrial development in sectors that are considered by the state to be important drivers of development. Quantifying and reframing this support as a subsidy to fossil fuels are thus key in promoting discussion and debate in South Africa about the role of this support.

13.3.2 Historical Subsidies to the Liquid Fuels Sector and Sasol

The liquid fuels industry has received considerable historical support from the South African government in terms of direct and indirect subsidies. A favourable regulatory regime guaranteed ‘the profitability and the financing of every segment of the fuel value chain’ (Roberts and Rustomjee Reference Roberts and Rustomjee2010: 63).

The liquid fuels subsidy regime that developed between 1950 and early 2000 privileged synthetic fuelFootnote 4 producers Sasol and Mossgas/PetroSA. In addition, so-called other oil companies (OOCs) operate in South Africa, including Shell, BP, Total, Chevron and Engen. These actors also historically benefited from favourable policies and regulations, though to a lesser extent. The regulated price of petroleum was introduced to encourage industrialisation and import substitution by providing favourable pricing to OOCs. Profits for OOCs had to be maintained through the regulatory regime to ensure that domestic refining capacity would remain in apartheid South Africa. As such, fuel pricing in South Africa has historically been based on an import parity priceFootnote 5 that guarantees returns for domestic refiners. However, the synthetic fuel producers emerged as the primary beneficiaries of direct and indirect subsidies due to the state’s interest in reducing the country’s dependence on imported fuel. The emphasis on energy security grew in the 1970s in response to the oil crises and apartheid oil embargoes.

Support for Sasol took several forms. The first was the provision of an import parity price to Sasol when it was established in 1947. Sasol also enjoyed tariff protection when the price of oil fell below a defined threshold, which was first introduced when the coal-to-liquid plant Sasol 1 was commissioned. The South African government further stipulated that the OOCs uplift (purchase and sell) 100 per cent of production from Sasol.Footnote 6 Importantly, each of these provisions was extended when Sasol expanded in the 1980s. The upliftment agreements, designed to give preference to Sasol’s synthetic fuels in the inland market,Footnote 7 were ‘effectively a government-brokered and sanctioned form of private regulation’ (Competition Tribunal 2006: 19). To accommodate Sasol’s production, the OOCs mothballed 30 per cent of their refining capacity, receiving state compensation in the form of levies and guaranteed returns on investment paid to the refiners (Competition Tribunal 2006: 22).

In 1992, the government commissioned state-owned Mossgas. Similarly to Sasol, Mossgas received tariff protection and upliftment agreements with the OOCs, as well as transfers through levies on the fuel price (Rustomjee et al. Reference Rustomjee, Crompton, Maule, Mehlomakulu and Steyn2007: 61). In 1999, PetroSA was formed as a merger between Mossgas and the state-owned oil and gas exploration company Soekor. PetroSA continues to receive state support.

The apartheid state’s emphasis on the development of local refineries and petrochemicals capacity established the synthetic fuel producers as entities through which the government could pursue these objectives. Post-apartheid energy policy reform has not been accompanied by any fundamental pricing reform, highlighting the persistence of regulatory support for the sector.

Indeed, although South Africa altered its fuel pricing regime in 2003 to be a more accurate reflection of an import parity price, it is well documented that this price remains above a competitive price and confers a benefit to liquid fuel producers through market price transfers (Competition Tribunal 2006: 51). The Department of Energy set a 2010 deadline for the deregulation of pricing (Competition Tribunal 2006: 31), but this goal has not been met in part because the department claims deregulation will affect the sector’s new Black Economic Empowerment entrants by removing protection for retailers (where small black-owned firms are active). Sasol is therefore protected by its own important supply position in the inland market (where refinery and pipeline capacity limits conventional supply) and by the other distributive policies of the state regarding Black Economic Empowerment, even though Sasol benefits only indirectly from these latter objectives. The company’s own lobbying efforts are also important; the Competition Commission, for example, has noted Sasol’s opposition to pricing reform.

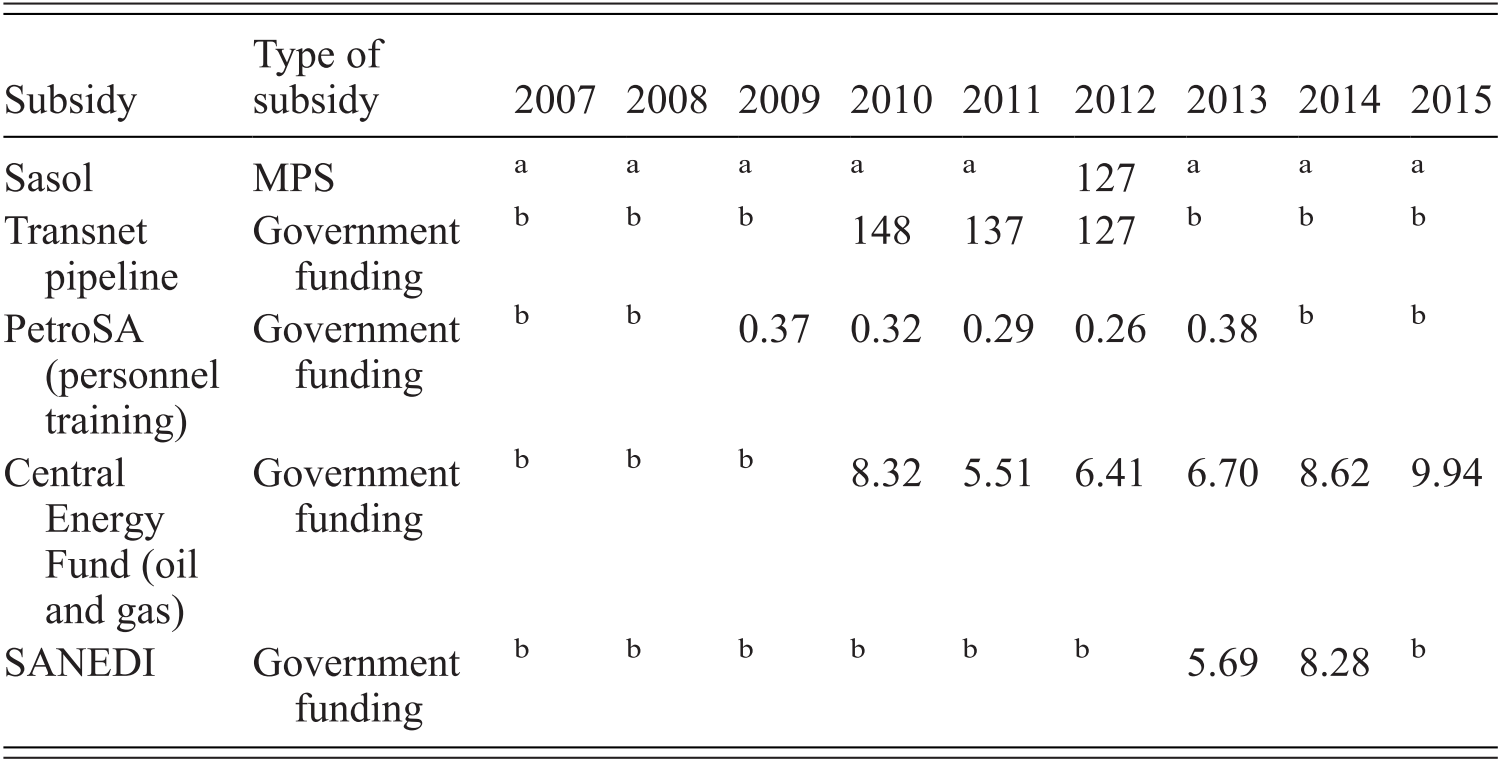

Sasol is presently the primary beneficiary of fuel pricing regulation due to its low production costs, which has resulted in the company receiving economic rents through the import parity price (on top of the direct subsidies it received). Sasol’s excessive profits as a result of the pricing rules have been a bone of contention (Competition Tribunal 2006). We estimate the value of the market price transfers to Sasol for 2012 (the only year for which data were available) at USD 127.44 million (in 2016 USD) (Lott Reference Lott2016: 78).

Support to the liquid fuels sector has also taken the form of direct transfers to finance infrastructure in support of energy security. The Department of Energy, for example, transferred USD 411.46 million to Transnet – the operator of state-owned ports, railways and pipelines – between fiscal year 2011 and fiscal year 2013 to support the commissioning of a large new pipeline.

Finally, SOEs also received direct transfers for personnel training, the promotion of oil and gas exploration and production and research and development on hydraulic fracturing and carbon capture and storage (PetroSA 2010, 2012, 2013; Maqubela Reference Maqubela2014: 18; National Treasury 2014a, 2015, 2016a). These subsidies are shown in Table 13.3.

Table 13.3 Subsidies to the liquid fuels industry in South Africa

| Subsidy | Type of subsidy | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|

| Sasol | MPS | a | a | a | a | a | 127 | a | a | a |

| Transnet pipeline | Government funding | b | b | b | 148 | 137 | 127 | b | b | b |

| PetroSA (personnel training) | Government funding | b | b | 0.37 | 0.32 | 0.29 | 0.26 | 0.38 | b | b |

| Central Energy Fund (oil and gas) | Government funding | b | b | b | 8.32 | 5.51 | 6.41 | 6.70 | 8.62 | 9.94 |

| SANEDI | Government funding | b | b | b | b | b | b | 5.69 | 8.28 | b |

13.4 The Politics of Fossil Fuel Subsidies and Their Reform in South Africa

Legitimate reasons for subsidies – such as energy security – blend with the long-term lock-in of entrenched institutions and the interest groups that have formed around them in the mix of different subsidies and their rationales (Victor Reference Victor2009). There is no public debate on fossil fuel incentives in South Africa, as the scale of support for fossil fuel production remains largely unknown. These subsidies form the core of long-running economic-development interventions by the state and its support for particular sectors. Finally, subsidies are inextricably linked to the distributive politics and racial economic transformation goals of the post-apartheid state.

Questions of subsidy definition and policy problem definition in South Africa have effectively kept the issue off the institutional or decision agenda (cf. Kingdon Reference Kingdon2014). There is no agreement on what constitutes a subsidy or the scale of subsidisation, particularly for production subsidies. Many national civil society organisations define non-priced externalities as subsidies, with their work focused on community impacts. For example, we found only one non-governmental organisation active in the energy sector that has carried out considerable research on public support to large industries (Centre for Environmental Rights et al. 2016).

The Treasury has a narrower focus on the consumption subsidies and taxes over which it has institutional influence, with little focus on production subsidies, which cross institutional boundaries (Machingambi Reference Machingambi2014). The Treasury does engage with international groups (e.g. G20) around subsidies, and the international level provides some impetus to reform subsidies and to adopt broader low-carbon policies (National Treasury 2016b).

The above-mentioned rationales for the subsidies are often linked to broader economic development plans and thus reflect ideas within the state and the ruling ANC Party about the nature and form of economic development and the state’s role in that context. Many policy documents outline the ANC’s goal for the ‘developmental state’ to take an active part in shaping the country’s economic trajectory; such documents also emphasise the importance of resource utilisation (the use of coal and other minerals) as a basis for industrialisation (Mohamed Reference Mohamed and Edighji2007). Providing infrastructure is an important component of this developmental approach. The National Development Plan, New Growth Path, and internal ANC policy documents all emphasise this role and the role of SOEs such as Eskom in supporting growth (ANC 2007, 2010; NPC 2011). For example, ‘investment in energy, rail, roads, ports and other infrastructure remains a cornerstone of [the] government’s economic strategy’ (National Treasury 2010: 96).

Eskom in particular has received large state bailouts – which essentially support coal-fired power and mining – because unbundling the ailing monopoly has not been politically feasible. Attempts to liberalise the electricity sector in the late 1990s as part of the new post-apartheid energy policy process met with resistance from unions and parts of the ANC, who perceived liberalisation as the first step to privatisation of a sector that is intended to provide a public good and is a core component of the developmental state. Eskom also opposed being broken up or sidelined (Eberhard Reference Eberhard, Victor and Heller2007; Baker and Burton Reference Baker, Burton, Goldthau, Keating and Kuzemko2018).

The contradictions between climate change mitigation and the use and support of fossil fuels for development are widespread. Such contradictions reflect long-running internal contestations in the government and within the ANC about industrial policy, even as research has shown that shifting away from resource-based industrialisation would have better economic outcomes (Altieri et al. Reference Altieri, Trollip and Caetano2015). Diversification away from minerals has been a prominent goal of industrial policy, but the blunt-force ‘heavy industry’ approach of state provision of railways, pipelines and other infrastructure has continued to receive substantial support. Such support has been concentrated in sectors that are core to the minerals-energy complex.

This may be because this type of ‘heavy industrialisation’ – which is closely aligned with types of industry that are based on, support or use fossil fuels – is easier for states to implement when they have limited capabilities. Forward-looking strategies in the National Development Plan focus extensively on the development of state capability as part of an economic diversification strategy. However, the tension between diversification and minerals/heavy industry has not been resolved in policy (neither in the National Development Plan nor in industrial policies), with persistent subsidisation for sectors deemed important for the economy.

Climate policy has emerged alongside older policies and is based in parts of the government not necessarily responsible for the original subsidy. For example, climate policy is based in the Department of Environmental Affairs, and the carbon tax is based in the Tax Directorate in National Treasury. Yet liquid fuels pricing, which perversely guarantees profits for the carbon-intensive coal-to-liquids sector, is the ambit of the Department of Energy and is not a Treasury mandate (National Treasury 2016c). Indeed, the state has continued to subsidise production while attempting to introduce a carbon tax on emissions as a reform measure to promote economic efficiency. While this is inefficient in terms of transaction costs, it may reflect diverging objectives in government (since many departments make direct on-budget transfers for infrastructure development), as well as the relative power of different state departments, their own interests and their relationships to and shared ideas with interest groups. While Treasury manages state finances, departments are responsible for overseeing their policy spaces and managing their budgets. SOEs report to the Department of Public Enterprises or to ministries in that sector.

Finally, these notions of development further link to the distributive elements of fossil fuel subsidies. Eskom has for many years been central to the system of accumulation of the minerals-energy complex. The coal sector indirectly benefits from the support given to state-owned companies such as Eskom (and previously Sasol). The rationale for the creation and maintenance of subsidies historically and currently is often implicitly related to industrial policy and is explicitly distributive – to create new capitalists in the coal sector, for example, or to ensure ‘radical economic transformation’ in the liquid fuels sector (Fine and Rustomjee Reference Fine and Rustomjee1996; Marquard Reference Marquard2006; Whitley Reference Whitley2013; DoE 2014). In the case of Sasol, the benefits that accrue to the company are not seen as a transfer from consumers to a producer, and a new pricing system for liquid fuels is not a priority on the policy agenda. This is partly because of the persisting narrative that Sasol is key to energy security, as well as the company’s perceived strategic importance to the economy in terms of security of supply, investment, tax, job creation and value added, i.e. beneficiation of coal into higher value products domestically (RSA 2007: Rustomjee et al. Reference Rustomjee, Crompton, Maule, Mehlomakulu and Steyn2007). Reform also would threaten new Black Economic Empowerment entrants in the retail sector.

Benefits continue to accrue to fossil fuel producers and reflect the lock-in of the transfers to corporations set up by the authoritarian apartheid state. These subsidies are not socially, environmentally or economically efficient, but they remain unchanged because of concerns about potential risks to security of supply and the state’s limited capability to regulate different market structures. Many of the large transfers are embedded in the specificities of the South African energy sectors and have rationales beyond merely reproducing a fossil fuel system. These include the lack of other options and ideas regarding industrialisation and development, which may account for much of the ongoing support.

Quantifying the scale and extent of support is an important first step towards reform of production subsidies (Rentschler and Bazilian Reference Rentschler and Bazilian2017). Reform will require the emergence of as-yet-unseen conditions, including coalitions between non-state actors and the state. As in other areas of policy, the government faces opposition from those who benefit (e.g. in the case of Sasol). In many cases the benefits of reform may be clearly more equitable or efficient, but the potential for organised opposition and reform of subsidies is limited without knowledge on who benefits, how and why.

13.5 Conclusion

Our analysis has shown that fossil fuel production has been and continues to be supported in various ways in South Africa. Since 2008, direct transfers have ranged between USD 454 million and USD 2.09 billion per year, whereas quantified revenues foregone have been between USD 2.45 million and USD 336 million. This increases considerably when we include the price support received by Sasol via the regulated fuel price. Beyond this, substantial unquantifiable subsidies exist but require further research to quantify.

Quantifying these subsidies contributes to the debate on fossil fuel subsidies in South Africa, which until now has been largely hindered by a lack of information and secrecy around subsidisation. We have distilled key elements of state support for fossil fuels and extended prior analyses. Quantifying subsidies to fossil fuels will enable the necessary research to understand the economic and distributional impacts of reform. However, further research is required to understand the options for reform in different sectors and departments, as well as within the ANC. While we have outlined some substantial subsidies to fossil fuels, these also require further research to analyse the political dynamics of the ministries responsible.

Given the importance of state intervention in fossil fuel production in South Africa, our findings raise important questions about the role of the state in economic development, the costs of intervention, and policymaking processes in South Africa more broadly. Mitigation is viewed as ‘too costly’ (Baker et al. Reference Baker, Burton, Godinho and Trollip2015), yet the state continues to support fossil fuels. Liquid fuels pricing reform remains off the policy agenda despite the large rents accruing to Sasol through the pricing system. This is partly explained by the borders of different policy spaces, where new policies have emerged alongside (rather than in place of) existing support in different parts of the state. Understanding the internal dynamics of different ministries and their perception of their role in subsidising fossil fuel sectors is an important avenue for future research.

Support for fossil fuel production cannot be divorced from more general analyses of the political economy of particular states and sectors, nor from broader questions regarding politics and economic strategies. The distributive implications of reform must be better understood, especially since Black Economic Empowerment objectives are supported by policies that promote subsidies for fossil fuels.

Reform will require determined action from civil society and other groups opposed to subsidies. South Africa needs debate, discussion and consultation about reforms, as well as further economic analyses of the outcomes of individual subsidy reform. Quantification is a necessary first step in understanding the scale of fossil fuel subsidies in South Africa. Ultimately, long-term economic development planning may need reinvigoration and new ideas to infuse into the state and the ANC. Without revising the current industrial development plans and pathways, state support for fossil fuels will remain locked in and continue to support a high-carbon development pathway. Fossil fuel subsidy reform may offer a narrow mechanism where disparate groups can agree on reform, especially in South Africa, where production obviously benefits so few, usually large, corporate actors.