In China, the landscape of the powdered infant formula (formula) supply chain and the regulations governing it have dramatically changed over the past decades. Under globalization, even before China officially became a member of the World Trade Organization (WTO) in 2001, twelve out of the twenty largest international dairy companies had established their production facilities in China (China Central Television, 2002). The largest formula manufacturers, such as Nestle, Wyeth, Abbott and Mead Johnson have all opened factories in China. These companies are producing differentiated dairy and formula products, either from their overseas factories or the Chinese factories which serve different consumer segments within the Chinese market.

The 2008 melamine crisis brought the dairy industry in China to a major crossroads. The crisis involved milk and infant formula being adulterated with melamine, a dangerous chemical, resulting in catastrophic societal impacts, including the hospitalization of over 50 000 infants and the death of 6 (Chen, Reference Chen2009). Consumer confidence in domestically branded and produced formulas plummeted. In the years subsequent to the melamine crisis, China instigated a campaign to strengthen food safety control in the country. For example, during the past decade it has released its most stringent Food Safety Law in history and launched over 20 policies and regulations specifically focused on dairy products (State Council of P.R. China, 2013). The Chinese dairy industry has also taken steps to regain consumer confidence, for example, the introduction of state-of-the-art production facilities from overseas, consolidation among infant formula enterprises, creation of large-scale milk production units and standard farms, and more emphasis on food safety at all stages of the supply chain (Institute for Agriculture and Trade Policy, 2014; Xinhua Net, 2016). By 2018, 6 Chinese dairy companies had reached a revenue of over ten billion RMB (1.42 billion US dollars), with Yili and Mengniu ranked as the two largest players in the Asian dairy industry (Xinhua Net, 2019). These companies have also expanded their upstream agribusiness value chain overseas (Zhao, Reference Zhao2017). By the end of 2018, 17 Chinese dairy companies have invested in New Zealand, Australia, Ireland, France, Canada, Russia, and Southeast Asia, in areas such as the production of formulas and raw milk powders, as well as dairy farming (Xinhua Net, 2019). In China, it is becoming increasingly common to see domestically produced formulas using milk powders sourced from overseas, and imported formulas produced by Chinese companies from their oversea factories (Zhao, et al., Reference Zhao, Mu and Freeman2019). With the phenomenon of globalization, dairy companies can now source ingredients and manufacture finished product across the world. The boundary between ‘imported/foreign’ vs. ‘domestic’ products has blurred significantly. As a result of globalization, the geographical origin of formulas has become more complex and increasingly difficult for the consumer to identify or to use as a quality signal.

It is not always a simple task for a consumer to tell the quality of a product. Three categories are often used in relevant literature to characterize goods based on the different levels of difficulties involved in the quality assessment and the associated information search by consumers (Loureiro and McCluskey, Reference Loureiro and McCluskey2000). The quality of search goods (e.g. a flower) can be identified relatively easily by visual observation at the time of purchase. To assess the quality of experience goods (e.g. a bottle of wine), consumption and certain level of expertise will be required. When it comes to evaluating the quality of credence goods (e.g. vitamin supplements), observations and consumption may not be sufficient. Infant formula can be seen as mainly experience goods, the nutritional compositions and origin associations of which also exhibit credence attributes. Asymmetric information problems often occur for experienced goods and credence goods, therefore, consumers often rely upon different types of instruments to reduce the risk caused by the asymmetric information problems and to lower the cost of searching. Such instruments may include quality certifications from regulatory authorities, the reputation of the manufacturer brand, or the perceived quality based on the product origin, etc. (Caswell and Padberg, Reference Caswell and Padberg1992; Loureiro and McCluskey, Reference Loureiro and McCluskey2000; Aprile et al., Reference Aprile, Caputo and Nayga2012; Xie et al., Reference Xie, Gao, Swisher and Zhao2016; Yang et al., Reference Yang, Ramsaran and Wibowo2018; Wang et al., Reference Wang, Gao, Heng and Shi2019; Vuong and Khanh Giao, Reference Vuong and Khanh Giao2020).

Often seen by consumers as a quality signal, the country of origin (COO) labelling aggregates many intrinsic and extrinsic product attributes linked to the product origin (Loureiro and Umberger, Reference Loureiro and Umberger2007). The use of COO labels on food products has expanded quickly in the last decade, reflecting the increasing importance of using this attribute as a way of product differentiation in the marketplace. Different levels of geographical regions can form the base of the COO related labels: a country can be used as the product origin (e.g. Made in Germany); a smaller geographical area within a country, where given quality, reputation, or other characteristic of the good is essentially attributable to, can be used to promote certain products (e.g. Parma ham, Burgundy wines) and a group of countries can also be promoted under the same ‘umbrella’ geographical origin (e.g. product from the EU) to capitalize the collective reputation beyond country borders (Menapace, et al., Reference Menapace, Colson, Grebitus and Facendola2011; EU Commission, 2015).

Extensive research studies have documented the effects of COO labelling on consumers' perception of product quality and consequently the influence on consumer preference and purchasing behaviours. Evidence has shown that consumers exhibit different levels of preference for products from different countries or regions, COO labels have an effect on consumers' purchase intention, and consumers are often willing to pay a price premium for products that carry certain origin attributes (Maheswaran, Reference Maheswaran1994; Loureiro and McCluskey, Reference Loureiro and McCluskey2000; Loureiro and Umberger, Reference Loureiro and Umberger2007; Diamantopoulos, et al., Reference Diamantopoulos, Schlegelmilch and Palihawadana2011; Menapace, et al., Reference Menapace, Colson, Grebitus and Facendola2011; Aprile, et al., Reference Aprile, Caputo and Nayga2012; Gao, et al., Reference Gao, Wong, House and Spreen2014; Xie, et al., Reference Xie, Gao, Swisher and Zhao2016; Wang, et al., Reference Wang, Gao, Heng and Shi2019). Previous studies have shown that product origin exerts substantial influence on Chinese consumers' (especially first-time parents) evaluation and purchasing of formula, with imported products being preferred by a large proportion of consumers because of their high confidence in product quality and safety from developed Western countries (El-Benni, et al., Reference El-Benni, Stolz, Home, Kendall, Kuznesof, Clark, Dean, Brereton, Frewer, Chan, Zhong and Stolze2019; Gong and Jackson, Reference Gong and Jackson2013; Li, et al., Reference Li, Bai, Gao and Fu2017; Kendall, et al., Reference Kendall, Naughton, Kuznesof, Raley, Dean, Clark, Stolz, Home, Chan, Zhong, Brereton and Frewer2018; Yang, et al., Reference Yang, Ramsaran and Wibowo2018; Zhang, et al., Reference Zhang, Jin, Zhang and Yu2018). Country stereotypes, consumer ethnocentrism, product familiarity and experience, product involvement and some cultural value differences were found to drive the country-of-origin effects (Chattalas, et al., Reference Chattalas, Kramer and Takada2008; Yang, et al., Reference Yang, Ramsaran and Wibowo2018).

One main critique of the research literatures on COO effect is the lack of consistency and clarity of the COO construct, in other words, there has been high level of confusion as to what ‘origin’ and its associated terms mean (Roth and Diamantopoulos, Reference Roth and Diamantopoulos2009; Gürhan-Canli et al., Reference Gürhan-Canli, Sarial-Abi and Hayran2018; Ingenhoff, et al., Reference Ingenhoff, White, Buhmann and Kiousis2019). The cross-board and multi-country nature of the global value chain structure and the increasing complexity of production facilitation for global companies means that the COO construct has become more complex. Loosely using the terms of ‘country of origin’ to conduct COO research may lead to insufficient research design and derives findings and implications that are less relevant in providing practical insights to regulators and marketers.

There is no precise definition of ‘product origin’: its meaning depends on each individual company's communication and consumer perception (Yang, et al., Reference Yang, Ramsaran and Wibowo2018). The origin of infant formula can involve three dimensions: brand origin (i.e. the place/country/region where the brand was founded and developed), origin of the main ingredients (i.e. the origin of the milk from which the various milk powders and proteins were derived) and manufacturing origin (i.e. place of production and packaging) (Li, et al., Reference Li, Wang and Yang2011; Yang, et al., Reference Yang, Ramsaran and Wibowo2018). These dimensions have been highlighted in the marketing and advertising of formulas (Zhao, et al., Reference Zhao, Mu and Freeman2019). In addition, there is a fourth element: place-of-purchase. Some affluent Chinese consumers have low confidence in formulas sold domestically, and make direct purchase of formulas from foreign countries, usually through their friends and relatives overseas, purchasing agents, and overseas eCommerce platforms (Hanser and Li, Reference Hanser and Li2015). It has been estimated that direct overseas acquisition accounts for nearly 20% of China's formula market share over the past few years (Li, et al., Reference Li, Zhu, Chen and Yi2019).

There is limited understanding on Chinese consumers' conceptualization and knowledge of formula's origin. Preliminary qualitative studies suggest that Chinese consumers lack the ability to correctly interpret cues about origin. For instance, they were not necessarily able to distinguish some domestic and foreign brands, and they had low awareness of the complex supply chain underlying international brands (Gong and Jackson, Reference Gong and Jackson2012; Hanser and Li, Reference Hanser and Li2015; Kendall, et al., Reference Kendall, Naughton, Kuznesof, Raley, Dean, Clark, Stolz, Home, Chan, Zhong, Brereton and Frewer2018). There is a lack of quantitative insights on this issue. On the market, Chinese consumers are confronted with a wide range of choices from formulas imported in their original packaging (with either foreign or Chinese brands), to domestically produced formulas (either Chinese or foreign branded). It is unknown how these product categories are perceived differently by Chinese consumers.

To address these knowledge gaps, the current quantitative study mainly aims to investigate (1) how Chinese consumers learn about and confirm the geographical origin of infant formula; (2) their knowledge level on issues around this and (3) their perceptions and preferences between categories of formulas from different origins. The consumer insights generated from this study can help dairy companies to navigate their advertising and supply-chain distribution strategies, and to assist any public communication campaigns to empower the decision making of formula consumers.

Materials and methods

Data collection and sample

An online anonymous survey was carried out to collect data in March 2020. Given that females typically are more engaged in child-raising and food shopping, the participants were Chinese mothers with children between 0 and 3 years, who had purchased infant formula during the past three years, including baby formula (0–6 month), follow-on formula (6–12 month) and toddler formula (from 12 month on). To be eligible, the participant must have had a role in the purchasing decisions. On behalf the research team, a well-known global market research firm administrated the survey and recruited the participants from their existing mothers' panel, which has over 500 000 active members across different geographical regions, and socio-economic backgrounds. Participants were recruited from 57 cities in 31 provinces/municipalities (i.e. China's highest level of administrative divisions) across all seven geographical regions (i.e. Northwest China, North China, Northeast China, East China, Southwest China, Central China and South China). Soft quotas were set up to make sure the sample reflected the national population's geographical distribution, and to make sure 50% of participants were from developed cities (i.e. tier 1 and 2 cities) and the other 50% were from less-developed cities (i.e. low-tier cities). The survey was scripted online. Participants accessed the survey through their digital devices such as computers, tablets and mobile phones. The survey took approximately eight minutes to complete. The research received research ethics exemption (reference number: LS-E-20-10-Shan-Wall) from the Office of Research Ethics at University College Dublin. Informed consent was obtained from each participant.

Questionnaire

The questionnaire was led by a consumer scientist and co-designed with a professional working in the formula industry. Both of them were Chinese native speakers, thus the questionnaire was initially developed in the Chinese language, and the translation was only used for discussions with team members who are English speakers. Demographic and background questions were placed at either the beginning or the end of the questionnaire, depending on whether the question was used for screening eligible participants.

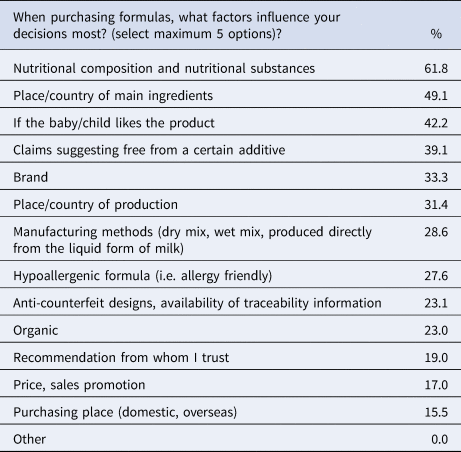

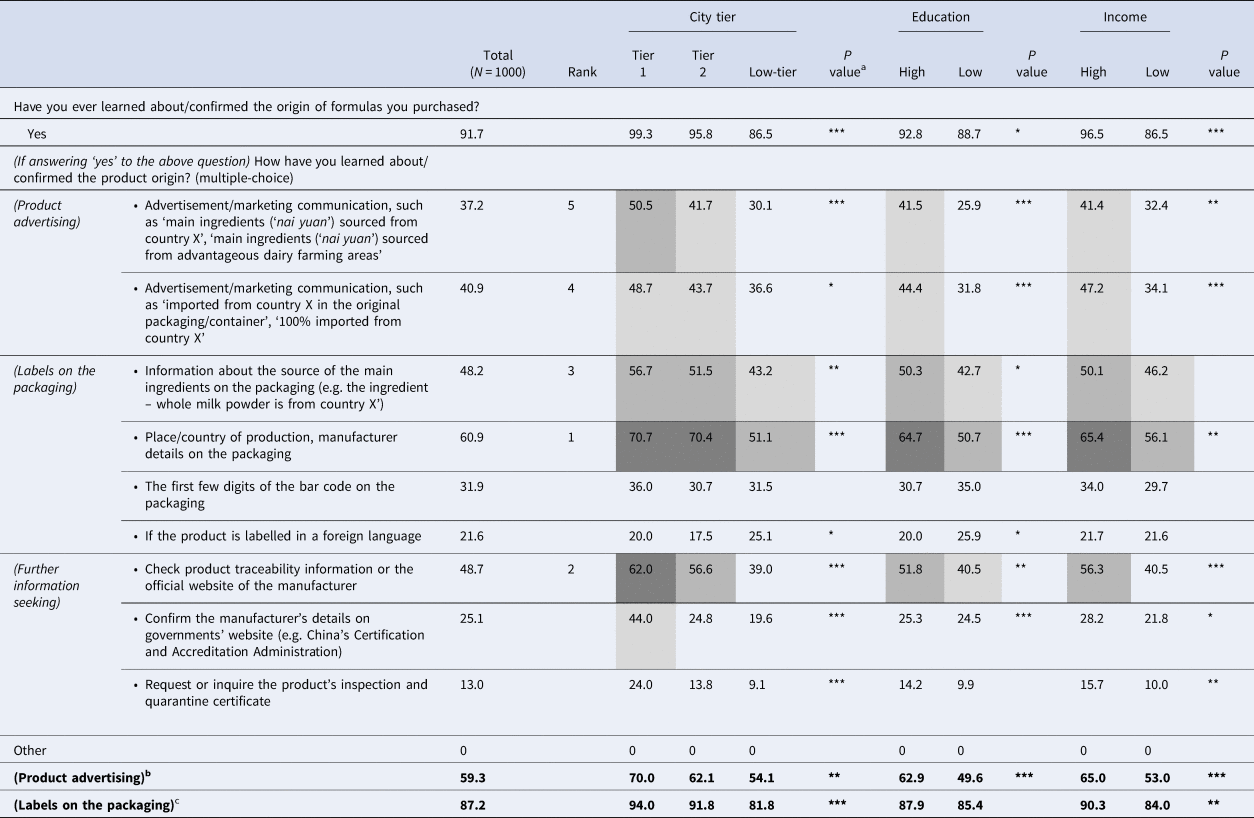

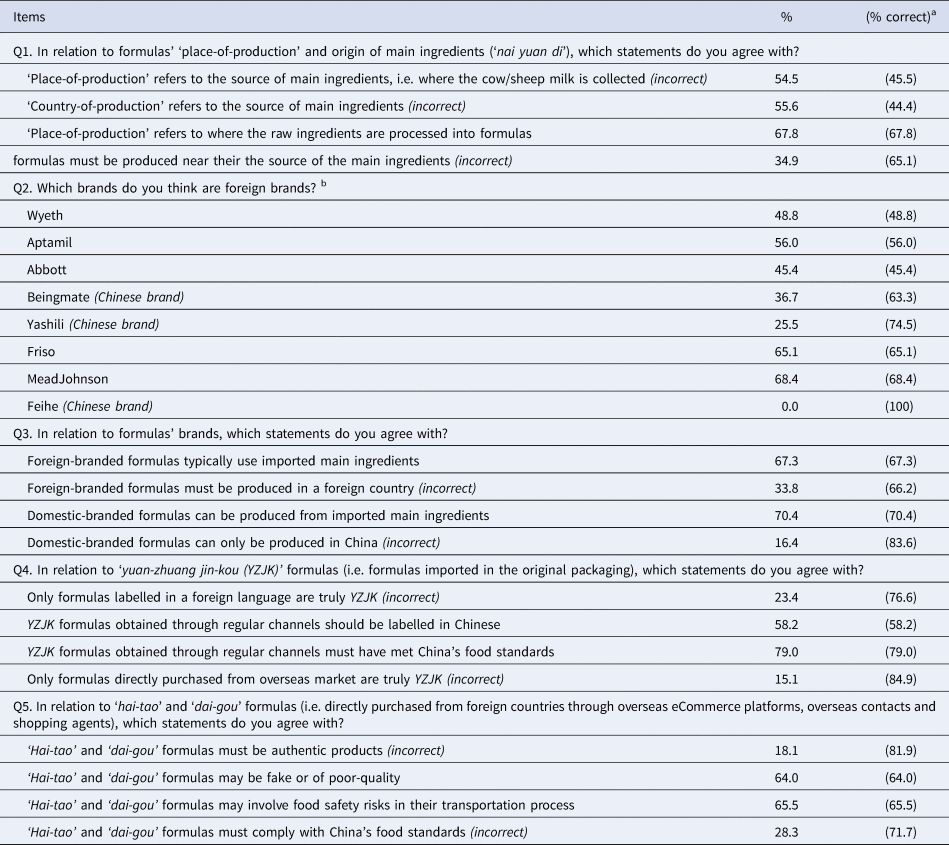

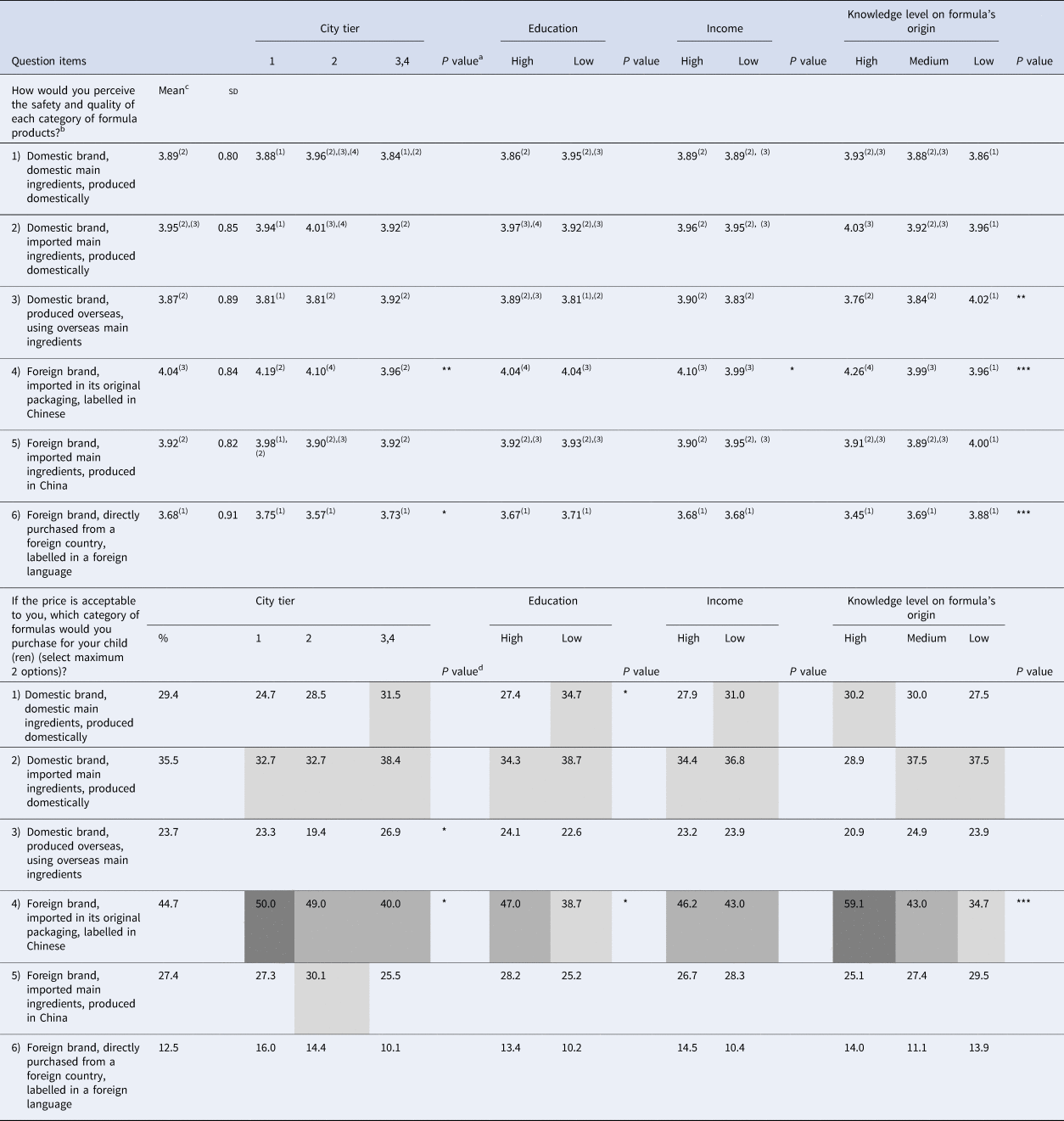

The survey began with a question on factors influencing formula purchasing decisions, in order to understand the importance of product origin in a wide decision-making context (Table 2). Response options for this question were informed by literature (El-Benni, et al., Reference El-Benni, Stolz, Home, Kendall, Kuznesof, Clark, Dean, Brereton, Frewer, Chan, Zhong and Stolze2019; IIMedia Research, 2019). Next, participants were asked about whether and how they had learned about/confirmed the origin of formulas (Table 3). The response options were based on expert tips for formula consumers (State Administration for Market Regulation, 2016, 2018; Xinhua Net, 2017), and a quick review of companies' communications about formulas origin on JD.com and Tmall.com (i.e. Alibaba) – China's top two eCommerce platforms. The third section included five questions identifying Chinese mothers' knowledge level on formula origin (Table 4). The questions were based on the landscape of formula production, formula-related national policies and standards (Ministry of Health of P.R. China, 2011; State Administration for Market Regulation, 2016) and previously identified consumer concerns and knowledge gaps as reported in media and literature (Hanser and Li, Reference Hanser and Li2015; Xinhua Net, 2017; Kendall, et al., Reference Kendall, Naughton, Kuznesof, Raley, Dean, Clark, Stolz, Home, Chan, Zhong, Brereton and Frewer2018; IIMedia Research, 2019). Lastly, two questions (Table 5) were included to examine Chinese mothers' risk perception and preferences for six categories of formulas that are currently on the market. These categories have different brand origins, main ingredient origins, manufacturing origins and purchasing places.

The questionnaire was pilot tested with seven Chinese mothers who had purchased formulas. A further test was conducted after the questionnaire was scripted online, to make sure all logical paths functioned properly, and that the survey interface was user-friendly on different digital platforms.

Data analysis

Data analyses were conducted using IBM SPSS Statistics version 24. To enable cross-groups comparison, education status was recoded into two categories – high (with university degrees) and low. Income levels were merged into two categories – high (15 000 RMB and above per capita per month) and low. By using 15 000 RMB as the threshold, we ended with two groups with similar sample size. Knowledge about formula origin was computed as a score: the full score was 5 points (i.e. 1 point for each of the five questions); and for each question, the score was the percentage of answering options that the participant selected correctly. Participants' knowledge scores were normally distributed as shown in the histogram, and were merged into three categories: high (3.89–5.00, i.e. top 23.5%), medium (2.89–3.88, i.e. middle 51.4%), and low (lower than 2.89, i.e. bottom 25.1%). χ2 tests were carried out to compare population groups on categorical variables. Independent T tests and one-way ANOVA tests were used on continuous variables, depending on whether the comparisons were between two or three groups. A one-way repeated measures ANOVA with the post-hoc Bonferroni test was applied to compare participants' risk perceptions of different categories of formulas.

It is worth mentioning that following a reviewer's suggestion, the authors performed another classification of participant's knowledge scores – high (top 33.3%, middle 33.3% and bottom 33.3%), and re-run all the analysis to check the stability of results. The old and new classifications showed very similar results, which confirmed the stability of our results.

Results

Participant characteristics

Participant characteristics have been summarized in Table 1. A majority of the participants were young mothers below 35 years (90.8%) and had completed university-level education (72.6%). The sample was biased towards better educated mothers, partly because all participants were recruited from cities. Around half of the participants (51.1%) purchased both domestic and foreign formulas; 26.2% solely relied on foreign products and 22.5% solely relied on domestic products. Offline maternal and infant shops (70.3%) and domestically-based cross-border eCommerce platforms (49.7%) were participants most-used purchasing channels.

Table 1. Characteristics of the sample (N = 1000)

a Population statistics is based on census data (National Bureau of Statistics of P.R. China, 2011).

b Screening question: participants who selected ‘under 18 yrs’ or ‘50 + ’ were screened out, because it is very rare that a women older than 50 years is a mother of 0–3 year-old kids.

c The Chinese city tier system is a hierarchical classification of cities, which has been widely used by analysts to study consumer behaviour, income level, and local trends to help business strategies. Cities at a higher tier are larger and more prosperous than cities at a lower tier. Tier 1 cities include: Beijing, Shanghai, Guangzhou and Shenzhen. Tier 2 cities include Tianjin, Chongqing (i.e. two out of four municipalities under the direct administration of central government) and a majority of provincial capitals. Low-tier cities mainly include prefectural-level cities.

d Screening question: participants who selected ‘The decision was made by others’ was screened out.

e Screening question: participants who selected ‘Neither’ was screen out.

f Screening question: participants who selected ‘I have not purchased any of the above products in the past three years’ was screened out.

Factors influencing the purchase of formulas

Purchasing decisions were mostly influenced by the nutritional profile (61.8%), followed by place/country of main ingredients (49.1%), the baby/infant's reaction to the product (42.2%) and claims suggesting no additives (39.1%) (Table 2). Factors relevant to the origin of the formula demonstrated various levels of importance: main ingredient origin was highly important, especially among tier 1 (62.7%) and tier 2 cities (52.7%), and higher-income groups (52.6%). Brand (33.3%) and manufacturing origin (31.4%) were moderately important, and the purchasing place was least important (15.5%).

Table 2. Factors influencing Chinese mothers' purchasing decisions of formulas (N = 1000)

Note: answering options were presented in a randomized order for each participant.

Strategies used to learn about/confirm the origin of the formula

Over 90% of participants had engaged in learning about or confirming the origin of formulas (Table 3). Different strategies were used by the participants to do this. Almost 60% of participants had paid attention to communications of product origins in formula advertisements. Participants primarily relied on labels on the packaging (especially the origin of the main ingredient, details on the production place) and manufacturer's traceability platform/official website to verify the product origin. It is worth noting that 31.9% of participants would also check the prefix code within the bar code – a country code indicating where the manufacturer is registered. Only a small percentage of participants would check the manufacturer's record or the product's certificate made available by the government. Cross-group comparisons revealed substantial differences among groups. A general pattern was that participants at a higher social-economic status (i.e. high-tier cities, higher income and education levels) were more likely to use a variety of strategies to learn about or verify formulas' origins.

Table 3. Percentages of participants who used a given strategy to learn about or confirm the origin of formulas

Background colour: dark grey – over 60%; grey – 50.1–60%; light grey – 40.1–50%.

a Level of the significance of statistical differences between demographical groups, based on χ2 tests.

b Percentages of participants who selected any item under the ‘product advertising’ category.

c Percentages of participants who selected any item under the ‘labels on the packaging’ category.

*P < 0.05; **P < 0.01; ***P < 0.001

Knowledge of formulas' origins

Participants performed better on some questions than others (Table 4) and the results did show a few knowledge gaps. Over half of the participants incorrectly considered ‘place/country-of-production’ as ‘origin of the main ingredient’ (Q1). The former concept, according to the national rules for food labelling (GB7718-2011), refers to the manufacturing place, which in many cases is not the place where the milk is collected. A large proportion of participants were not aware of the ‘foreign’ nature of certain brands which have gained high market share in China (e.g. Wyeth, Abbott, Aptamil) (Q2). Participants performed relatively well on the rest of the test: a majority were aware that the brand origin may not indicate the main ingredient origin or manufacturing origin (Q3), consumers can obtain authentic imported formulas through domestic regular channels (Q4), and formulas directly purchased from foreign countries involve high risks (Q5). It is worth noting that over 40% of participants did not know that China now requires that imported pre-packaged foods (including formulas) must bear Chinese labels (Q3, the third item). Overall, participants from different demographic groups performed similarly on this knowledge test.

Table 4. Participants’ knowledge on origins of formulas (N = 1000)

a Percentages of participants who answered a given item correctly

b All brands selected are among popular brands in the Chinese market (Chinabaogao.com, 2019; IIMedia Research, 2019; Yang and Yu, Reference Yang and Yu2019).

Note: for each question, there was an answering option ‘none of the above’, which was not included in the table

Risk perception and purchase intention of formulas from different origins

Chinese mothers were presented with six categories of formulas from different origins. In terms of product safety and quality, all categories were perceived ‘reliable’ or close to ‘reliable’ (except for category 6 – foreign-branded formulas directly purchased from overseas market through unofficial channels) (Table 5). ‘Foreign-branded formulas imported in their original packaging’ (category 4) were perceived safer and better quality than other categories by a small margin.

Table 5. Participants' risk perception and purchase intention of formulas from different origins (N = 1000)

Background colour: dark grey – 50% and above; grey – 40–49.9%; light grey – 30–39.9%.

a Level of the significance of statistical differences between demographical groups, based on independent T tests or one-way ANOVA tests.

b A five-point scale was used for this question, where 1 = very unreliable; 2 = unreliable; 3 = neutral; 4 = reliable; 5 = very reliable.

c Values with different superscript numbers are significantly different based on Bonferroni's test (P < 0.05).

d Level of the significance of statistical differences between demographical groups, based on χ2 tests.

*P < 0.05; **P < 0.01; ***P < 0.001.

Despite minor between-category differences in terms of risk perception, when being asked about the purchase intention, participants expressed clear preferences for certain categories over the other. The top two favoured categories were foreign-branded formulas imported in their original packaging (category 4, 44.7%) and domestically branded and produced formulas using imported main ingredients (category 2, 35.5%). An interesting pattern observed was that participants from Tier 1/2 cities and those at a higher socio-educational status expressed a strong preference for category 4 over category 2; in comparison, their counterparts almost equally preferred these two categories. Lastly, participants expressed least interest in formulas directly purchased from a foreign country through unofficial channels (category 6, 12.5%).

Discussion

The current study offers unique insights with regards to Chinese consumer perceptions of formulas' origin. Drawing on a big sample of Chinese mothers from cities of four tiers in different geographical regions, our study investigated how consumers learn about formulas' product origin, what their knowledge levels are and their preferences between formulas from different origins. The findings have strong implications for the dairy industry both in China, and globally.

Our study confirmed the importance of product origin in consumers' formula purchasing behaviour. Especially in Tier 1 and 2 cities, and among those at a higher social-educational status, product origin was second only to the product's nutritional profile in influencing consumers' purchasing decision-making. Over 90% of Chinese mothers made an effort to learn about and confirm the production origin.

In China, product origin is frequently featured in formula advertisements on different media channels, conveying messages such as ‘100% produced and packaged overseas’, and imported good-quality main ingredient (‘nai yuan’), which is usually accompanied by imagery of green pastures and blue skies – symbols of an unpolluted natural environment (Gong and Jackson, Reference Gong and Jackson2013; Zhao, et al., Reference Zhao, Mu and Freeman2019). Our results showed that Chinese mothers did pay attention to the product origin information in the advertisements, however they also intensively used other means (especially labels on the packaging, and manufacturer's official website/product traceability platform) to confirm. From a cultural perspective, Chinese consumers are risk averse – they tend to collect more information to reduce uncertainties and avoid risks (Yang, et al., Reference Yang, Ramsaran and Wibowo2018). For dairy companies, this suggests the importance of carefully providing complete and consistent product origin information across all selected communication channels. We noticed that up to 31.9% of Chinese mothers relied on the prefix code (i.e. country code) to verify product origin. This is probably due to the fact that some formula companies, for their own interest, have explicitly educated consumers about using the prefix code as an indicator of country of production, based on our observation on formulas' advertisements on eCommerce platforms. However, such communication can be misleading and undermine fair competition, since the prefix code only indicates the manufacturer's registration place (GS1 China, 2013). For international formula companies with multiple brands and production lines across the world, a product's registration place can be very different from its actual manufacturing place (Sina, 2011). Furthermore, our results showed that Chinese mothers seldom use the Chinese governments' certification website or product inspection certificate to confirm product origin, potentially due to low awareness or a perception that the source is not credible (Zhang et al., Reference Zhang, Chen, Hu, Chen and Zhan2016; Ismagilova et al., Reference Ismagilova, Slade, Rana and Dwivedi2020). More efforts are required to promote the availability of these platforms to consumers.

In relation to consumer knowledge of formulas' origin, our study revealed two major knowledge gaps. A substantial proportion of Chinese mothers viewed ‘origin of the main ingredients’ as ‘the place/country of production’, possibly due to their lack of knowledge on the production process, i.e. they might consider the liquid form of milk being directly mixed with other nutrients and then dried into the powder (i.e. the ‘wet-mix’ process). In practice, many manufacturers are using a ‘dry-mix’ or a ‘dry and wet combined’ process, which allows them to use main ingredients sourced from a foreign country or region (Blanchard, et al., Reference Blanchard, Zhu, Schuck, Bhesh Bhandari, Bansal, Zhang and Schuck2013). Similar to previous qualitative findings (Gong and Jackson, Reference Gong and Jackson2012; Hanser and Li, Reference Hanser and Li2015), our results indicated that Chinese mothers were not necessarily able to recognize between foreign and domestic brands, although all the brands we selected were popular brands (IIMedia Research, 2019; Yang and Yu, Reference Yang and Yu2019). This finding should be considered in a wider context as the Chinese formula market has drawn many domestic and overseas players: in 2018 there were 30 big brands occupying 75.3% of market, and a number of smaller brands occupying the rest of the market (Yang and Yu, Reference Yang and Yu2019). Overwhelmed by so many brands, consumers may choose to only pay attention to companies or brands from their preferred country (Yang, et al., Reference Yang, Ramsaran and Wibowo2018). In addition, Chinese dairy companies' overseas acquisition in recent years, may have added more mystery to the brand origin (Reuters, 2019; Xinhua Net, 2020).

We presented six categories of formulas from different origins to participants. Previous studies have shown that Chinese consumers consider brands from developed western countries as a symbol of high quality, and they still lack confidence in the safety of domestic infant formulas (Zhu, et al., Reference Zhu, Xu and Jiang2016; Li, et al., Reference Li, Zhu, Chen and Yi2019). In contrast, we observed that, in terms of product safety and quality, domestically branded and produced formulas were perceived comparable with authentic foreign products (especially among consumers in low-tier cities), and formulas directly purchased from overseas through unofficial channels were perceived least reliable. This suggests that consumer confidence in domestic formulas has improved. In recent years, China has strengthened the supervision and communication of the safety and quality of formula products. Domestic formula products have reached a qualification rate of 99%, and problems were almost only found in small/medium sized manufactures (Legal Office FAOLEX, 2017; State Council of P.R. China, 2017). Meanwhile, there have been a few food safety incidents reported on foreign formulas (e.g. the salmonella outbreak in a French formula company, Aptamil baby milk formula complaints in the UK) (World Health Organization, 2017; BBC News, 2018), receiving very negative publicity in China (Xinhua News, 2017; Guancha, 2018). The ‘halo’ effect of the foreign brand on product safety perception appears to have weakened in recent years, even though the COO effect for foreign brand still exists.

In relation to product preferences, from our results, authentic foreign branded, produced and packaged products (i.e. ‘yuan-zhuang-jin-kou’ formulas) showed a high popularity in Tier 1&2 cities and among richer and more knowledgeable consumers. In low-tier cities, these products are not necessarily more popular than domestically branded and produced formulas using imported main ingredients. This echoes the different marketing strategies used by foreign vs. domestic formula companies: foreign companies normally target the high-end market in big cities, whereas domestic companies tend to take advantages of their rich resources and deeper roots to occupy a great number of small cities spreading out in the country (Yang and Yu, Reference Yang and Yu2019).

Our study found that ‘foreign main ingredients’ is considered by formula consumers as one of the most important COO factors that influence purchasing decisions. This finding reveals the potential opportunity for companies to develop ingredient brand as a co-branding strategy which may increase the overall brand equity of the final product. The value of such ingredient branding can be further explored by ingredient producers as well as final product manufacturers through product promotion and marketing communications.

Our results implied that, for domestic companies, the use of imported main ingredients would increase product attractiveness. It is important to educate consumers regarding the difference between the origin of production and main ingredient origin, which should be incorporated into the companies' promotion and marketing communication strategies. However, placing the factory in a foreign country may result in decreased consumer interest. Historically, before China had tightened the rules on overseas production and the importation of formulas in 2014, a Chinese company can register a ‘foreign-sounding’ brand in a western country, and engage a local less-qualified manufacturer to produce customized formulas for the Chinese market (Chemlinked, 2014; Lexology, 2014; Shenzhen Consumer Council, 2015). Many Chinese consumers bought these products, then realized these ‘foreign’ brands did not exist in the foreign markets at all and subsequently felt cheated (Shenzhen Consumer Council, 2015). Consumers may still be under the shadow of that memory and may have become more suspicious about a Chinese company moving their production facilities overseas. Increased information transparency facilitated by Chinese authority will be welcomed to reduce asymmetric information problem and to allow consumers to make informed purchase decisions. For foreign brands, based on our results, having the product manufactured in its Chinese factories (as opposed to overseas factories) would reduce the appeal of the products, but only to a small extent if the main product ingredient still come from overseas. However, this strategy can help the company to expand production scale, lower production and transportation costs, and consequently increase revenue in China (Hu, Reference Hu2009).

In the past, and particularly in the aftermath of the melamine crisis, it was often the case that worried Chinese parents reached out to available overseas contacts/resources, or even made personal trips to buy imported formulas, causing retailors in Hong Kong and some western developed countries to put restrictions on such purchases (BBC News, 2013; The New York Times, 2013). Chinese mothers' enthusiasm for formulas directly purchased overseas through unofficial channels seems to have decreased, according to our findings. For instance, our participants expressed minor concerns on the purchasing place and the language printed on the packaging, as well as high risk perception and low purchase intention of such products.

Findings from this paper reinforce the importance of using a multi-dimensional origin construct to carry out COO effects research. Chinese consumers' perception and purchasing intentions for formula are affected differently by the origin of the main ingredients, compared to the origin of the brand and place of production. A more simplified origin conceptual framework design that does not distinguish the origins of main ingredients, the brand and the place of production will be insufficient to capture the essential value chain structure of the IMP industry, and thus inadequate to identify the relevant COO impact on consumers' perception, preference, and purchasing intensions for IMP products.

The present study has its limitations. In the survey environment, by presenting a series of questions upfront and six categories of formulas, we had somehow educated participants about the complexity around formulas' origins on the market. In reality, when consumers (especially first-time parents) are confronted with a wide range of product options, it can be questioned to what extent they are aware of the existence of different categories of domestic and foreign formulas, and how well they are able to interpret cues on product origin correctly. Experiments using real product examples or in-market observation-based studies can be carried out to answer these questions. Another limitation is that our sample is biased to well-educated city people. In addition, we only included mothers in the study sample and did not consider other family members who may have played roles such as the initiator, influencer, and decider. Despite these limitations, this study offers new insights on the perceptions and attitudes of Chinese consumers for the international dairy industry and can support the development of more targeted approach to product development and product marketing.

In conclusion, Chinese consumers have substantial concerns about the origin of infant formulas and make efforts to verify the information, although they may not necessarily interpret product-origin related cues correctly. Their previous one-sided endorsement towards foreign formulas appears to have weakened over the years. To serve the Chinese market, domestic and foreign formula companies can source the main ingredients and establish the production facilities across the world. Their decisions on where to source the main ingredients, and the manufacturing place would influence the attractiveness of the final products, and the specific consumer segments they should target.

Acknowledgements

This study was financially supported by the Kerry Group Newman Fellowship 2018–2020 (University College Dublin Foundation), and the EU-China-Safe project (Delivering an effective, resilient and sustainable EU-China food safety partnership) project (the European Union's Horizon 2020 research and innovation programme under grant agreement No. 727864). The funders played no role in the study, nor in the writing of the report or in the decision to submit the article for publication.