INTRODUCTION

Although industry exit often brings the negative connotation of failure (Decker & Mellewigt, Reference Decker and Mellewigt2007), it is worthy of study because it is a crucial requirement for creation, resource reallocation, industry evolution, and strategic reorientation to occur (Rosenbaum & Lamort, Reference Rosenbaum and Lamort1992; Burgelman, Reference Burgelman1996; Chang, Reference Chang1996; Geroski, Reference Geroski2003; Adner & Levinthal, Reference Adner and Levinthal2004). Despite its importance, industry exit, in particular the exit process, has not been widely studied from a managerial perspective (Evans & Siegfried, Reference Evans and Siegfried1992; Burgelman, Reference Burgelman1996; Brauer, Reference Brauer2006; Decker & Mellewigt, Reference Decker and Mellewigt2007; Elfenbein & Knott, Reference Elfenbein and Knott2015). Examination of the exit process is important to build our understanding of how firms manage exit barriers (Porter, Reference Porter1976; Harrigan, Reference Harrigan1980; Porter, Reference Porter1980), and to identify ways that firms can realize better outcomes by carefully crafting their approach to exit (Nanda & Williamson, Reference Nanda and Williamson1995). Extant theoretical literature has discussed cooperative arrangements in terms of a partial exit mode (Harrigan, Reference Harrigan1980), however empirical research has not documented or examined this phenomenon from a process perspective.

Evidence suggests that the context of national business systems (e.g., Witt & Redding, Reference Witt and Redding2014) can affect industry structure and exit. Researchers have identified barriers to exit specific to the context of the Japanese business system (Porter & Sakakibara, Reference Porter and Sakakibara2004; Redding, Reference Redding2005), and noted that exit rates in Japan are low (Inui, Kneller, Matsuura, & McGowan, Reference Inui, Kneller, Matsuura and McGowan2009; Iwatani, Reference Iwatani2009). However, managerial research on exit in the Japanese context remains rare.

In this inductive research, I present historical evidence of exits from the Japanese flat panel display (FPD) industry, first broadly through industry wide observations, and then in five firm-level case studies to describe and examine the sequence in which exit processes unfolded (Lawrence, Reference Lawrence1984; Van de Ven, Reference Van de Ven1992; Langley, Smallman, Tsoukas, & Van de Ven, Reference Langley, Smallman, Tsoukas and Van de Ven2013). The case studies include historical narratives of the sequence of events observed over time as the firms de-committed to (Ghemawat, Reference Ghemawat1991) and exited from the industry (Langely, Reference Langley2009). I seek to identify patterns of similarity and difference among these, and assemble a visual map of exit based upon case study observations, to shed light on the underlying mechanisms of change (van de Ven, Reference Van de Ven1992; Langely, Reference Langley1999; Pentland, Reference Pentland1999). This paper contributes to the exit literature by describing and analyzing the process of industry exit in the context of the Japanese FPD industry. Cooperative arrangements and top management succession are identified as playing important facilitating and triggering roles in a multi-staged de-commitment process terminating in industry exit.

LITERATURE REVIEW

Exit is a topic that has not been widely studied in the managerial literature, despite its clear importance to the individual employees and managers, firm performance and strategic direction, industry evolution, and the competitive environment and society in general (e.g., Porter, Reference Porter1976; Rosenbaum & Lamort, Reference Rosenbaum and Lamort1992; Burgelman, Reference Burgelman1996; Chang, Reference Chang1996). Exit research has often focused on barriers to exit, which are important because they may result in firms continuing to operate in cases where overall welfare would be improved from them exiting (Caves & Porter, Reference Caves and Porter1976; Porter, Reference Porter1976). Barriers can exist inside the organization, and can also result from the industry, societal, and legal context the firm operates in.

Japanese exit barriers

Japan has been given as an example where exit barriers are systematically different from other national contexts. Evidence suggests that the exit rate is low in Japan (Westney, Reference Westney2006; Inui et al. Reference Inui, Kneller, Matsuura and McGowan2009; Iwatani, Reference Iwatani2009).The difficulties of exiting businesses in Japan have been cited as a reason contributing to high levels of diversification of Japanese firms, the low profitability of Japanese companies compared to their US counterparts, and Japan’s inability to respond effectively to environmental change (Westney, Reference Westney2006; Iwatani, Reference Iwatani2009). Porter and Sakakibara (Reference Porter and Sakakibara2004) proposed several Japan-related barriers to exit. These included lack of pressure from banks and financial markets which provide capital (Porter & Takeuchi, Reference Porter and Takeuchi1999; Yafeh, Reference Yafeh2000; Inagaki, Reference Inagaki2013; Nakauchi & Wiersema, Reference Nakauchi and Wiersema2015), the Japanese legal system, Japanese governance practices in general, and problems with bankruptcy rules (Porter & Sakakibara, Reference Porter and Sakakibara2004). The need to protect lifetime employment for regular employees – who have historically been the most important stakeholder group in Japan – has been suggested to form another exit barrier (Itami, Reference Itami1994; Kang & Shivdasani, Reference Kang and Shivdasani1997; Porter & Sakakibara, Reference Porter and Sakakibara2004; Harrigan, Reference Harrigan2014). In a nutshell, these exit barriers reflect the impact of the Japanese business system upon exit. They can be considered on top of generic exit barriers hypothesized and observed outside of Japan such as structural barriers, corporate strategy-related barriers, and barriers relating to managerial and organizational preferences and limitations, as well as sunk costs (Porter, Reference Porter1976, Reference Porter1980; O’Brien & Folta, Reference O’Brien and Folta2009).

On a cultural level, Kagono and Kobayashi (Reference Kagono and Kobayashi1994) frame exit as the act of leaving established relationships. In a society like Japan, that emphasizes the importance of lasting relationships (Nakane, Reference Nakane1970), exiting a business implies losing face both because of the need to sever these relationships because the exit is likely to be construed as a failure (Hill, Reference Hill1995).

Vertical integration and strategic centrality barriers in the Japanese context

In addition to the more or less Japan-specific exit barriers, there are several exit barriers which are generic in nature, but appear to take on special significance in Japanese business. Vertical integration has been examined in the broader exit literature (Harrigan, Reference Harrigan1980, Reference Harrigan1985); the Japanese preference for vertical integration gives it particular significance here (Noguchi, Reference Noguchi2012). Tight coordination between different activities in the value chain (e.g., design and production) through vertical integration has been a hallmark of Japanese manufacturing (Sturgeon, Reference Sturgeon2006). Vertical keiretsu have been discussed as a way to facilitate quasi-vertical integration, particularly in the auto industry (e.g., Tabeta, Reference Tabeta1998; Ahmadjian & Lincoln, Reference Ahmadjian and Lincoln2001; McGuire & Dow, Reference McGuire and Dow2009). The move from analog to digital technology has, in many cases, reduced the benefits and increased costs and investment requirements of vertical integration, however, these changes do not appear to have resulted in changes to managerial preferences (Baldwin & Clark, Reference Baldwin and Clark2000; Sturgeon, Reference Sturgeon2006; Noguchi, Reference Noguchi2012). Vertical integration has been commonly observed in the Japanese FPD industry, although the levels and aims of integrations have varied over time and across the different industry players.

Businesses that are central to the company’s strategy face higher exit barriers than non-central businesses (e.g., Porter, Reference Porter1976; Harrigan, Reference Harrigan1980). Exiting strategically central businesses can be a wrenching process, because of past investments and sunk costs, and identification with and attachment to the business in the minds of top management, employees, and the greater corporate culture. Additionally, to the extent the business is relatively large in the scheme of the company, the prospect of shrinking revenue presents a difficult political reality for decision makers. Given the lack of pressure from outside stakeholders and the importance of employees as primary stakeholders in the Japanese context, exiting strategically central businesses may be particularly difficult. In this study, I use these two exit barriers to add structure to my sampling and analysis.

Exit process and exit modes

As mentioned above, exit process has received little attention in the literature. For example, out of 89 studies included in recent literature reviews on divestiture and exit by Brauer (Reference Brauer2006) and Decker and Mellewigt (Reference Decker and Mellewigt2007), only seven studies examined some aspect of process. Burgelman’s (Reference Burgelman1994, Reference Burgelman1996) process models describing Intel’s exit from the memory industry were the only industry exit process models introduced. While not directly examining the entire process, some theory papers have discussed the potential for sequential exit through partial ownership arrangements (e.g., Harrigan, Reference Harrigan1980). Damaraju, Barney, and Makhija (Reference Damaraju, Barney and Makhija2015) stands out as a rare example of an empirical study considering staged exit. Overall, given the number of studies of specific modes such as sell-offs and spin-offs, the rarity of studies on sequential exit suggests it is unusual in the sample populations studied, which tend to be US samples (out of the 89 empirical studies included in recent reviews mentioned above, 77 used US samples). The fact that Nanda and Williamson (Reference Nanda and Williamson1995) go to the trouble to prescribe use of a staged approach to acquisitions and divestments further supports the notion that it is not a common practice. Extant research does not necessarily say that exit is a discrete event, and yet with the unusual exceptions noted above, it fails to suggest it is more than that.

The Japanese context may affect the way the firm chooses to exit, including through dissolution, divestiture, and other exit modes. Dissolution means closing the business and selling off assets that have value. Given the discussion above, dissolution appears to be relatively unattractive in the Japanese environment as it requires letting go of employees or finding new positions and businesses for them to work in. It would also require severing ties and losing face. Dissolution is also likely to appear wasteful (mottainai) in the Japanese mentality because the knowledge and abilities developed in the business are lost forever. Divestiture may also a difficult proposition in the Japanese context. The Japanese preference for organic growth over acquisition to increase opportunities for maintaining employment (Dore & Sako, Reference Dore and Sako1989) may reduce the potential to find an acquirer. As Schaede (Reference Schaede2008) noted, the level of merger and acquisition activity in the 2000s was higher than in the past, although starting from a low base. The 2000s witnessed consolidation in several Japanese industries including banking and pharmaceuticals through mergers between large prominent firms (Iwatani, Reference Iwatani2009). Because small firms are low in prestige, and thought to have higher employment risk (Noguchi, Reference Noguchi2012), staffing carve-outs and spin-offs can be challenging, reducing the attractiveness of these exit modes.

The discussion above suggests Japanese firms face particular challenges in exiting industries, and therefore, that they may manage exit differently than Western firms. Indeed, my interest in this research originated from observations of the behavior of Japanese firms exiting the FPD industry which did not fit with my expectations based upon the exit literature. Below, I describe these observations and how the observed patterns at the industry level.

OBSERVATIONS FROM THE INDUSTRY LEVEL

This inductive research developed descriptions and theory based upon observation of historical evidence of exits from the Japanese FPD industry (Lawrence, Reference Lawrence1984). Below, I briefly introduce the industry context. After introducing the data used, and I then present observations at the industry level.

The Japanese FPD industry has a long history with deep roots in Japan. Japanese firms played a pivotal role in developing FPDs and were the first to commercialize most of the FPD technologies including plasma display panels (PDP) and liquid crystal display (LCD) (Johnstone, 1999; Numagami, Reference Numagami1999; Murtha, Lenway, & Hart, Reference Murtha, Lenway and Hart2001). FPDs are used in many different end products, including computers, portable electronics, projectors, automotive applications, cell phones, and less obvious markets such as pachinko machines (e.g., Fuji-Chimera, 1998–2007). Driven by the broad usefulness of FPDs, firms entered into the display business from a variety of different industries. FPD players included, for example, the general electric companies Hitachi, Mitsubishi and Toshiba, consumer electronics firms Panasonic, Pioneer, Sanyo, Sharp, and Sony, computer manufacturers Fujitsu and NEC, and others including Seiko Epson and Casio.

The industry has consolidated significantly and there are numerous examples of exit both from the display business and closely related industries, such as flat panel televisions (e.g., Fuji-Chimera, 2012). Price erosion due to commoditization and entry of firms from lower cost production countries, such as South Korea, Taiwan, and China put pressure on the profitability of Japanese firms. Dramatic swings in the market prices of display panels, due to the crystal cycle (Mathews, Reference Mathews2005), a boom and bust cycle in the LCD industry resulting from large changes in supply and demand for panels and the accompanying over-capacity and under-capacity, represented an additional cause of uncertainty and a threat to profitability. Difficult market conditions, and the ability of firms to compete under such conditions, appear to have been underlying causes of some exits. However, exit was also observed in cases where technologies appeared to reach dead-ends, or were incapable of competing with more highly developed alternatives, such as Futaba’s exit from field emission displays, Canon’s exit from ferroelectric liquid crystal displays, and Sony’s exit from plasma addressed liquid crystal technology.

At the industry level, I examined all exits observed over the period 1995–2010. My aim in doing this was to gain perspective the way that firms exited and the level of commitment (Ghemawat, Reference Ghemawat1991) they had made to FPD before exit. The exits discussed below were significant enough to be publicly announced, but may not include some exits from pre-mass production technologies or exit by small firms where announcements were not made. I discuss the data used in more detail below.

Data acquisition and sources

To facilitate examination of the industry and firms over time, I developed a historical timeline database of Japanese firms in the FPD industry including observations of technological developments, investments, prototype announcements, entries, exits and other important events (Gordon, Reference Gordon1991; Phelps, Chan, & Kapsalis, Reference Phelps, Chan and Kapsalis2001). The database was comprised of observations from industry publications including the Fuji-Chimera series (1998–2007), the Nikkei (1990–Reference Nikkei2009) FPD series, and the Sangyo Times series (1990, 1992–2010). These sources, which were published annually in Japanese, were selected because they were considered reputable with practitioners and academics I interviewed who follow the field. The timeline database spans a period from early discoveries related to FPD technologies until 2010.

I augmented the timeline data with company press releases, analyst reports, news reports, and other publicly available data to document the sequence of events each firm went through in the process of exit (Eisenhardt, Reference Eisenhardt1989). Quotes included in the analysis were translated from Japanese originals by two individuals who are bilingual in Japanese and English and cross-checked to ensure accuracy of translation.

Overview of observed exits

Table 1 presents 17 exits observed from the Japanese FPD industry. Comparing across the observations, exits from mass production followed largely different pathways than exits from lower levels of involvement such as small volume production and exit from R&D. All of the exits from mass production involved cooperative arrangements, with the single exception of NEC’s Plasma business which was divested. However, the kinds of cooperative arrangements and the timing of entry and exit varied. In the Fujitsu PDP and Hitachi LCD cases, the firm exited an existing joint venture originally set up to increase commitment to the technology. In Fujitsu LCD, Hitachi PDP, Pioneer PDP, and Sanyo LCD cases, the firms entered into cooperative arrangements which reduced their commitment levels, and were followed by exit. Seiko Epson transferred its business to Sony, but through a staged, cooperative arrangement that took place over time, rather than a straightforward single transaction. After ending a joint venture with Toshiba, IBM Japan entered into a JV with Taiwan’s Chimei and CMO, in which it continued to hold a minor stake for several years before exiting.

Table 1 Observed exits from Japanese FPD industry, 1995–2010

Notes. FED=field emission display; FLCD=ferroelectric liquid crystal display; FPD=flat panel display; LCD=liquid crystal display; PALC=plasma addressed liquid crystal technology; PDP=plasma display panels.

Source. Compiled by author based upon company annual reports, Nikkei BP Reference Nikkei1990–2009 and Sangyo Times 1992–2010.

In contrast, with the exceptions of Toshiba and Sharp cases, all of exits from non-production failed technologies occurred through dissolution. This does not mean that these exits were rapid or easily arrived at. By the time these firms concluded that the technology in question was going to lose, so had many other firms. Cooperative arrangements may not have even been an option for this reason. Toshiba and Sharp exited failing technologies by leaving cooperative arrangements. In both of these cases, the purpose of the prior arrangements was to develop and move toward commercialization of the technology in question, and therefore the JVs were entered during a phase of increasing commitment and not decreasing. Exits from small scale production, most of which were also failed technologies, also were through dissolution.

All of the firms exiting the FPDs industry were diversified into multiple businesses, but in some cases the firms considered FPDs to be a core business central to their strategy, while in other cases FPDs were merely one of many different businesses. The degree of strategic importance or strategic centrality, therefore, varied significantly across these firms. Furthermore, some of the firms had vertically integrated production of panels and end products, while others did not. Taken together, these observations imply that the firms in the industry faced substantially different exit barriers despite the similarities discussed above.

FIRM LEVEL CASE STUDIES

Next, I developed firm level case studies examining the exit process in more detail, to develop a general understanding of the sequence of events over time (Langley et al., Reference Langley, Smallman, Tsoukas and Van de Ven2013) and search for mechanisms of change. The five cases presented were selected because they exhibited theoretically relevant differences, allowing me to search for commonality and differences across these cases (Eisenhardt, Reference Eisenhardt1989; Yin, Reference Yin2014). After selecting cases, my analysis followed a recursive process of examining the evidence and then extant literature (Eisenhardt & Graebner, Reference Eisenhardt and Graebner2007).

Case selection and definition of key constructs

For the purpose of this study, suitable cases needed to meet several criteria. First, in order to examine the phenomenon of interest, the case must include an industry exit (Yin, Reference Yin2014). In principle, I was interested in examining firms exiting the industry through a multi-staged process I had observed. However, I also decided to include the single firm which did not exit through such a process (NEC Plasma) to examine potential reasons for its difference.

Given the importance of strategic centrality and vertical integration as exit barriers (e.g., Porter, Reference Porter1980; Harrigan, Reference Harrigan1985) and the variation observed in the industry, I decided to use these to guide case selection. Because strategic centrality and vertical integration can change over time, I examined evidence of their presence at a point in time when each firm was maintaining its commitment to FPD, before evidence of reduction of commitment levels. Strategic centrality was considered present if company statements such as the annual reports stated that the FPD technology, investment, or business was a priority, or was part of the company’s strategy or direction, and absent if not discussed in these ways. For the purpose of this study, I considered vertical integration to be present when the firm sold most of its production to internal customers and absent when it did not. Vertical integration observations were obtained from the timeline databases discussed above. Among the firms exiting through a process involving cooperation, I selected firms representing the four different possible combinations of strategic centrality and vertical integration. Pioneer’s PDP and PDP-TV businesses were vertically integrated and strategically central. Fujitsu had vertically integrated LCD production but LCD was not strategically central. Seiko Epson’s LCD business (not including high temperature polysilicon LCD) was not vertically integrated, but was strategically central. Sanyo’s LCD business was neither vertically integrated nor strategically central, as was the case for NEC Plasma. Table 2 lists selected background information about the five cases.

Table 2 Background information on cases

Notes. LCD=liquid crystal display; HTPS=high temperature polysilicon; PDP=plasma display panels.

a Does not include Seiko Epson’s HTPS-LCD business.

While not a selection criterion, extant literature suggests top management succession as potentially playing a role in the exit process (e.g., Ravenscraft & Scherer, Reference Ravenscraft and Scherer1991; Hayward & Shimizu, Reference Hayward and Shimizu2006), therefore I also examined succession in these cases. Succession can be either routine or non-routine. In the Japanese context, routine succession typically occurs at a regular time of the year, and in routine successions, the CEO (Shacho)Footnote 1 typically becomes Chairman (Kaicho), and a senior manager from the firm is promoted to CEO. Non-routine succession is any pattern which varies from this, for example when the CEO leaves the firm rather than serving on the board (Kang & Shivdasani, 1995; Nakauchi & Wiersema, Reference Nakauchi and Wiersema2015) or the succession is triggered by a dismissal or resignation of the CEO and/or Chairman. Outsider CEO successions were not observed in this study, which is not surprising as such successions are rare in Japan (Imai & Komiya, Reference Imai and Komiya1994). Below, I present narratives of the five cases in alphabetical order.

Narrative of Fujitsu’s LCD exit process

Fujitsu was an information technology company that had a long history of developing and producing displays, beginning PDP research in 1967 and LCD in 1970 (Sangyo Times, 1992; Kawamura, Reference Kawamura2005). The company produced and sold displays using both technologies.

Fujitsu had been motivated to enter LCD in order to produce laptop computers and other IT applications; it had produced black and white passive matrix LCDs for internal consumption starting in 1986, and exhibited prototype active matrix LCD laptops as early as 1990 (Sangyo Times, 1990, 1994). Fujitsu announced it would build its first mass production LCD line in 1993 (Sangyo Times, 1993). Over a period of years, it continued to invest in more production capacity while also making some breakthroughs in LCD technology (Sangyo Times, 1998). However, no major new investments in plant and equipment were announced after 1997 (Sangyo Times, 1998–2005). In 2000, Fujitsu announced it planned to meet additional demand through outsourcing, and began doing so with Taiwan’s Chimei, a display manufacturer (Sangyo Times, 2000). In 2001, it announced it would change its strategy that of a solution based business model using cutting edge technology (Sangyo Times, 2003), signaling it was moving it away from commodity panel business. However as of 2002, Fujitsu’s own LCD operations were vertically integrated with other products; 60–70% of Fujitsu’s LCD revenues were from internal customers (Sangyo Times, 2002). Despite being vertically integrated, display panels were not strategically central to the firm and represented less than 6% of total revenues (Fujitsu Corporation, 2002).

Fujitsu integrated its different LCD operations into a single entity called Fujitsu Yonago and sold a 20% stake in it to the Taiwanese display manufacturer AUO in 2002 (Sangyo Times, 2003). In 2003, Fujitsu announced a routine top management succession (Fujitsu Corporation, 2003). In the same year, AUO and Fujitsu entered an additional cooperative agreement providing technological support to AUO and outsourcing additional production to AUO (Fuji Chimera, 2004). Fujitsu increasingly supplied its LCDs to other companies to the point in 2005 where only 20% of Fujitsu’s LCD production was consumed internally (Sangyo Times, 2005).

In June 2005, Fujitsu sold its LCD operations including patents, engineering staff, and plant and equipment, to Sharp Corporation (Sangyo Times, 2006). Fujitsu’s LCD plant had been losing money (Fuji Chimera, 2005). Sharp’s wish to acquire Fujitsu’s LCD engineering talent had motivated the transaction (Sangyo Times, 2006). Although Fujitsu as a whole was profitable during the period 1997–2004, the business segment which displays belonged to operated at a loss for five out of these eight years. Fujitsu also exited PDP in 2005. Both FPD exits were undertaken as part of a strategic reorientation focusing more on the company’s logic LSI semiconductor business (Fujitsu Corporation, 2006).

Narrative of NEC’s PDP exit process

Information and communications technology company NEC began producing plasma displays in the 1970s (Fuji Chimera, 2003), when PDPs were making their debut as computer displays. In 1988, the company began research on color PDP for large screen applications including TV sets (Fuji Chimera, 2003). It announced numerous developments and prototypes in the 1990–1994 period (Kawamura, Reference Kawamura2005), and in 1995 began construction of a PDP production line (Sangyo Times, 1997). NEC’s subsidiary, NEC Home Electronics, began selling plasma TVs in 1997 (Sangyo Times, 1999), however it later exited TV set production and liquidated its Home Electronics subsidiary in 2001 (NEC, 2001). In 1998, the company began producing at a cutting edge mass production facility using a substrate larger than other firms (Sangyo Times, 1999). In 2001, NEC announced it would build an additional PDP line (Sangyo Times, 2002). NEC reorganized its PDP-related activities into a single business it renamed NEC Plasma Display Inc. in 2002 (Sangyo Times, 2003). NEC had some technological advantages in PDP, for example, in 2003, NEC was the only firm that could reliably manufacture 61’ panels (Nikkei BP, Reference Nikkei2004).

In 2004, NEC announced that Pioneer would acquire NEC Plasma Display (NEC, 2004a; Sangyo Times, 2005), including NEC’s production facilities, patents and PDP-related manufacturing know-how. Although NEC had strong technology and had been growing its PDP revenues, the company stated that PDP had been losing money in PDP (NEC, 2004b), and PDP required additional ongoing investment (NEC, 2004a). The PDP sale was part of a restructuring of NEC’s Electron Device subsidiary’s money losing businesses (NEC, 2004b), and also was intended to increase the company’s focus on its core IT business to which the primarily TV set focused plasma display production no longer belonged (NEC, 2004a).

Narrative of Pioneer’s PDP and PDP-TV exit process

The consumer electronics company Pioneer developed PDP technology starting in 1991 (Nikkei BP, Reference Nikkei1995) and became a significant player in the PDP TV set market early on. The company pursued a differentiation strategy based upon vertical integration and superior TV display quality, in which it was considered the leader (Katzmaier, Reference Katzmaier2011). In the midst of rapid growth in the late 1990s and up until 2005, Pioneer increased its commitment to PDP and PDP-TV, announced it was central to the company’s strategy in 1998 (Pioneer, 1998), invested heavily in plant and equipment, and developed several generations of new PDPs (Sangyo Times, 1997, 2002, 2003; Nikkei BP, Reference Nikkei1998, Reference Nikkei2008). In 2004, Pioneer acquired the PDP operations of NEC Corporation, to increase economies of scale and compete with the larger manufacturers (Mainichi Shimbun, 2004; Nikkei BP, Reference Nikkei2005). Pioneer’s President Itoh commented: ‘The market will grow from here on. I bet the company on PDP’ (Mainichi Shimbun, 2004).

However, due to improvements in LCD technology (den Boer, Reference den Boer2005) and decreases in LCD prices, PDP and LCD began to compete more directly than in the past, when large displays had been dominated by Plasma. LCD prices were volatile due to a boom and bust cycle called the ‘crystal cycle’ (Mathews, Reference Mathews2005), and the entrance of large number of producers into LCD also had a large impact on price levels.

Pioneer found it increasingly difficult to reduce costs at a pace that could keep up with price erosion in the marketplace (Sankei Shimbun, 2005b), and began to lose money in PDP (Sankei Shimbun, 2005a), leading to overall losses for the fiscal year ending in March 2005 (Pioneer, 2005a). In November of that year, the firm announced a non-routine top management succession, replacing president and chairman, both of whom were relatives of the company’s founder, with a non-relative manager from Pioneer’s mobile entertainment business (Pioneer, 2005c). In December, the company cut its dividend and delisted from New York, Amsterdam, and Osaka stock exchanges to reduce fixed costs (Pioneer, 2005b, 2005d). Incoming president Sudo commented lamented: ‘We invested a lot in PDP, but did not get a return.’ (Nikkan Kogyo Shimbun, 2005).

Pioneer’s financial situation continued to worsen. For the fiscal year ending in March 2006, Pioneer recorded a return on equity (ROE) of −2.6% due to losses in its home electronics segment, to which PDP and PDP-TV belonged (Pioneer, 2006b). In 2006, the company cut dividends in March and again in September (Pioneer, 2006a, 2006c), and implemented an early retirement program in April (Pioneer, 2006d). Pioneer recorded an ROE of −28.1% for the fiscal year ending in March 2007, due primarily to a 35 billion yen loss in the home electronics segment (Pioneer, 2007).

Pioneer reduced it sales target for PDP TVs for 2007, and postponed construction of a new PDP plant, but continued investing in new products and maintained its premium pricing strategy even though its competitors were reducing their prices rapidly (Nakane, Reference Nakane2007). Pioneer sold equity to friendly companies including Sharp and Honda to raise cash (Datamonitor, 2010).

Pioneer continued to suffer heavy losses for the fiscal year ending March 2008, resulting from losses in its home electronics business (Pioneer, 2008c). In March of 2008, the company further cut PDP sales targets, then stated it would reorganize its display business, and cut its dividend again (Pioneer, 2008a, 2008b). Pioneer announced it would enter into a cooperative arrangement with Panasonic, which would receive Pioneer engineering staff and knowhow, and produce PDPs for Pioneer in the future (Ono, Reference Ono2008; Pioneer, 2008d). Pioneer announced it would close down PDP production facilities and write off the relevant assets (Nakane & Harada, Reference Nakane and Harada2008; Pioneer, 2008a). These were not subsequently acquired or used by other firms in the industry (Sangyo Times, 2008, 2009, 2010). In October, Pioneer announced another non-routine top management succession (Pioneer, 2008e).

Pioneer’s sales of PDP TV sets continued to fall and price erosion became more severe (The Mainichi Newspaper, 2009b) in the midst of recession. The company continued to lose money for the fiscal year ending in March 2009, although only a portion of this was attributable to PDP (Pioneer, 2009c).

On February 12, 2009, Pioneer announced it would stop the development and production of TVs, and completely exit the TV market and all display businesses by March of 2010 (Pioneer, 2009a; The Mainichi Newspaper, 2009b). In the process, Pioneer would also close plants in the United States and United Kingdom (Pioneer, 2009a). The president described the decision to exit as heartbreaking but necessary to save the company (The Mainichi Newspaper, 2009a, 2009b). In March, the company eliminated its dividend (Pioneer, 2009b). In October, the company announced that 1204 employees had accepted an early retirement program as part of the exit (Pioneer, 2009d).

Narrative of the Sanyo and Seiko Epson LCD exit processes

The Sanyo and Seiko Epson exits are presented together because they are intertwined. Sanyo was an electronics firm that had been considered a pioneer in LCD technology (Sangyo Times, 1994). It was the first company to successfully develop a color active matrix LCD using amorphous silicon (Sangyo Times, 1994), the technology later adopted in most laptop computers and television applications among others. Over the period 2000–2001, Sanyo made major investments in an LCD facility to mass-produce large displays (Sangyo Times, 2000, 2001), and later began production at an additional line in 2003 (Sangyo Times, 2004). Although Sanyo’s product lineup included numerous products incorporating LCD displays, the company’s LCD production was not vertically integrated (Deutsche Bank, 2003). In 2004, the company reported poor financial performance, which analysts blamed on its LCD operations.

Like Sanyo, Seiko Epson had also been an early entrant into the FPD business, beginning production of clock LCDs in 1973 (Sangyo Times, 1990). It too had developed a number of LCD variants, including passive matrix STN LCD and several active matrix technologies including its high temperature polysilicon LCD, a display technology for projectors and viewfinders, in which Seiko Epson was the top player. Seiko Epson was also the second ranked player in cell phone displays (Deutsche Bank, 2004a). Seiko Epson had vertically integrated production of high temperature polysilicon and projectors, but not for the other technologies. Unlike Sanyo, Seiko Epson produced only small displays, and did not have production lines capable of making large displays.

In March 2004, Sanyo and Seiko Epson announced they would set up a joint venture, which was to be majority owned by Epson, with a 55% stake (Fuji-Chimera, 2004). The JV included most of the two companies’ display technologies with the exception of organic light-emitting diode and high temperature polysilicon LCD (Deutsche Bank, 2004b). Each company contributed different technologies to the JV, which was pitched as offering a full lineup of small and mid-sized LCDs. Seiko Epson’s strong sales and design capabilities were thought to offer opportunities for Sanyo’s production facilities to switch to higher value added products from commodity products (Deutsche Bank, 2004a). The combined LCD business was expected to be the fourth largest in the industry (Japan Corporate Watcher, 2004).

However, there were issues with the LCD operations at both firms predating the JV (Deutsche Bank, 2003, 2004a, 2004b, Seiko Epson, 2004). Furthermore, both companies had exposure to technologies that were either commoditized or in the process of being abandoned by the marketplace. The small and middle-sized display markets targeted by the joint venture required customization but had short lifecycles and the price levels in these markets were falling at a 30% annual pace (Sankei Shimbun, 2004). In this difficult operating environment, revenues for the JV were below expectations almost from the start (Seiko Epson, 2004). Competition, new entry, and commoditization had hit the cell phone display market where Epson had historically been strong (Credit Swiss First Boston, 2005).

In 2005, Sanyo experienced a non-routine CEO succession while Seiko Epson implemented a routine CEO succession. Sanyo experienced continued financial difficulties in 2006, and sold its stake in the venture to Seiko Epson (Sanyo, 2007). While the JV had lost 33 billion yen after tax for the fiscal year ending in March 2006 (Yomiuri Shimbun, 2006), Sanyo’s financial woes at this time were not limited to the JV.

Under Seiko Epson, the former JV was renamed Epson Imaging Devices. Seiko Epson planned to stay in the LCD business despite the losses, and even though the JV Epson’s 2006 annual report admitted that the JV’s cost reductions could not keep up with the price erosion in the market (Seiko Epson, 2006). After absorbing the JV, Epson announced it planned to rationalize its display business, which it considered strategically central, however efforts to reorient toward new markets did not proceed as intended (Deutsche Bank, 2007a, 2007b). Displays were singled out as the reason Seiko Epson had to revise its earnings downwards (Credit Swiss First Boston, 2007). In 2008, Seiko Epson again announced a routine top management succession (Seiko Epson, 2008a) among continued efforts to restructure the display business (Seiko Epson, 2008b).

In the end, Seiko Epson exited the parts of the business that had been included in Sanyo Epson Imaging Devices. In March 2009, Seiko Epson and Sony announced a planned alliance on small and mid-sized LCDs, which included an ‘orderly transfer’ of the business to Sony from Epson (Seiko Epson & Sony, 2009a). In the final arrangement, there was to be no payment for the transfer, which included plant and equipment, intellectual property and personnel, which was to take place over a ten month time period (Seiko Epson & Sony, 2009b).

Analysis

With the exception of NEC Plasma, each of the cases exhibited a de-commitment process that occurred over time and involved a cooperative arrangement with another firm. PDP was central to the strategies of Pioneer and Seiko Epson, whereas displays were not central to the other firms’ strategies. Display production was vertically integrated at Pioneer and Fujitsu, but not at NEC, Sanyo, or Seiko Epson before the firms de-committing. Among the cases, Pioneer faced relatively high internal barriers to exit, NEC Plasma and Sanyo faced relatively low internal barriers, with Fujitsu and Seiko Epson facing middle levels of exit barriers.

Several other aspects of the situations faced by firms differed in important ways. First, the observed exits occurred in different years. Accordingly, the recession that began in 2008 did not affect all of these cases, although it did some. Second, two of the firms, Pioneer and Sanyo, entered into crisis situations and replaced their CEOs in non-routine successions.

There are several other differences between the cases worthy of note at this point. In the cases of the IT companies Fujitsu and NEC, the observed exit was part of a greater reorganization, which was not true for the other cases. Additionally, these two companies both created standalone business units holding the operations they would later exit from in advance of the exit. To further analyze the process based upon the narratives, I developed a visual map of the exit process.

Visual mapping of the exit process

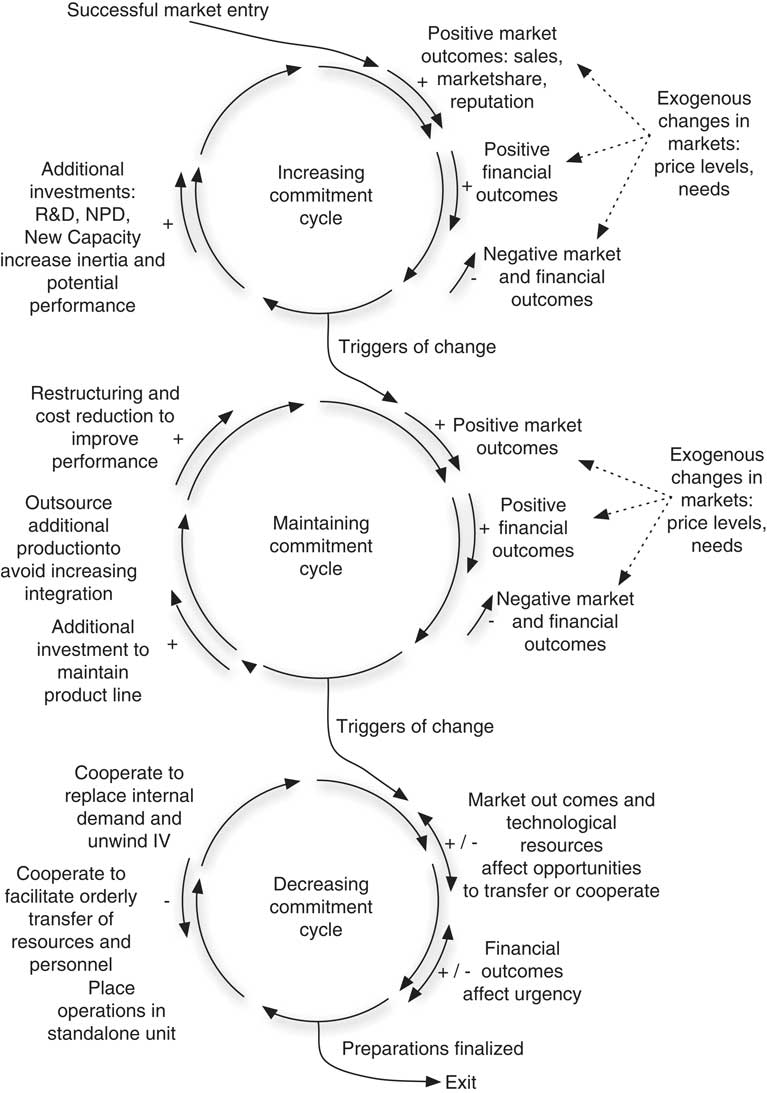

To develop this map, I began with Pioneer’s exit process because it faced higher exit barriers than the other cases, due to strategic centrality and vertical integration of its PDP operations. Beginning with the map as a template, I then mapped the other cases. I integrated the areas of similarity to create the final overall map presented in Figure 1 below. In doing so, I attempted to reveal the main mechanisms at a manageable level of abstraction. Some firms followed different sub-patterns, as I explain later.

Figure 1 Visual map of the exit process

The visual map I propose consists of three cycles. Plusses indicate increasing commitment and minuses indicate decreasing commitment. After a successful entry into the technology and market, the firm enters an increasing commitment cycle. In this cycle, the firm makes additional investment in production capacity, R&D, and new product development. The market conditions change over time, and positive market outcomes such as increasing sales, market share, and reputation provide reason for increasing commitment, as do positive financial outcomes. In the face of such positive outcomes, further investments are made, and the commitment increases. This cycle maintains inertia to the extent that positive feedback and investments continue. Vertical integration and strategic centrality reinforce this inertia, making it more difficult to exit this cycle.

One or more triggers cause the firm to stop increasing commitment and to move to one of the two cycles below: the maintaining commitment cycle or the decreasing commitment cycle. In the maintaining commitment cycle, the firm restructures and implements cost reductions to improve its financial performance, but continues to make investments required to maintain its product line, such as new product development. The firm may also take actions to avoid further increasing its levels of vertical integration by outsourcing production to meet additional demand rather than building capacity. Improvements in market and financial outcomes provide reasons to further maintain commitment levels, while degrading outcomes provide reasons to decrease these levels. Additional triggers cause the firm to stop maintaining commitment and move to the decreasing commitment cycle or exit.

In the decreasing commitment cycle, firms start to make changes facilitating future exit. This includes cooperating with other firms to unwind vertical integration, and facilitate orderly transfer of resources and personnel. Firms may also reorganize to make the operations into a standalone unit to facilitate transfer. Market outcomes affect the opportunities to join into cooperative arrangements or transfer the business to other firms. Financial outcomes affect the urgency to decrease commitment and exit. Finally, the firm exits.

There are a number of potential triggers of movement out of one of these cycles. Substantial financial losses and CEO succession events were associated with several of these moves, and may have acted as triggers. Company wide reorganization events were observed in Fujitsu and NEC cases. In the NEC case, it appears possible that the reorganization may have been triggered by CEO succession. I discuss succession and exit in further detail in another section below. Opportunity may also be considered a trigger. For example, interest in acquisition of NEC’s plasma operations by Pioneer and Fujitsu’s LCD operations by Sharp may have facilitated these exits at earlier times than they might otherwise have occurred.

Comparison of the cases across the different cycles yields some interesting observations (see Table 3). First, firms that exhibited vertical integration and/or strategic centrality, and thereby relatively high exit barriers, showed evidence of being active in all three cycles. Second, the length of time it took from the point the firm stopped increasing its commitment (entering the maintaining commitment cycle) to the point it exited did not appear to be directly related to the level of exit barriers. The company with the longest time was Fujitsu, which arguably had substantially lower levels of commitment of Pioneer.

Table 3 Timing and observations across the three cycles

Notes. FPD=flat panel display; LCD=liquid crystal display; PDP=plasma display panels; TFT=thin-film transistor.

Third, the cases in which neither vertical integration nor strategic centrality was observed both skipped one of the cycles. NEC went from a maintaining cycle directly to exit, skipping the decreasing commitment cycle. Sanyo went from increasing commitment cycle to the decreasing commitment cycle skipping the maintaining commitment cycle.

Fourth, in cases where the firms exhibited strategic centrality, the maintaining commitment cycle sometimes took on a wavering quality. Pioneer continued to develop and introduce cutting edge PDP-TVs in the midst of financial difficulties and cost cutting. Seiko Epson continued to try to restructure and turnaround the LCD business despite heavy losses. In both of these cases there appears to be a very strong inertia to stay in the business at the same time as a strong need to dramatically improve the financial situation.

Fifth, the firms observed could have decided to move from one of the lower cycles back up to an increasing commitment cycle, however none of them actually did. By maintaining and then reducing commitment over time before exit, the firms had essentially kept open the option to change their mind and begin increasing commitment again in the future should the business or industry improve in the future.

Cooperative arrangements in exit

This research has noted that cooperative arrangements frequently played a role in the exit process, however, the type of arrangements and its function varied somewhat between the cases. Table 4 compares the different cooperative arrangements observed in the study.

Table 4 Cooperative arrangements observed in declining commitment cycle

Note. LCD=liquid crystal display.

The cooperative arrangements entered into by Pioneer and Fujitsu, both vertically integrated firms, included technology transfer and outsourcing of production. In both cases, these served to facilitate de-integration, and thereby the barriers to eventual exit. Technology transfer was part of the arrangements in order for the outsourced production to meet the needs of Pioneer and Fujitsu. Sanyo’s JV with Seiko Epson was pitched by the companies as creating a large, efficient, LCD producer leveraging the strengths of both companies (although some industry pundits argued that it was weak because it incorporated weaknesses of both). From a practical standpoint, it created an opportunity for Sanyo to exit by selling its stake if and when it wanted to. It also helped Sanyo in the short term because the company no longer had to consolidate earnings from this loss making business. Seiko Epson’s arrangement with Sony was aimed at transferring the business from the beginning, and still this was done in a step-by-step fashion over time, essentially delaying the exit and final transfer.

DISCUSSION AND CONCLUSION

Below, I discuss top management succession as a trigger of change, and then examine how long-term employment directly and indirectly affects the exit process in the Japanese context, and the role of cooperative arrangements in it, based upon the findings above. I then move on to present the contributions, managerial implications, and limitations of the study.

Top management succession and exit process

CEO succession was observed in all of the cases, however the timing and nature of these successions is of interest. In Pioneer’s case, two non-routine top management successions occurred; one punctuating the firm’s departure from the increasing commitment cycle, and a second during the decreasing commitment cycle. This first succession from Itoh to Sudo put the company in the hands of someone who had not been responsible for the firm’s increased commitment to PDP and PDP-TV, and who could more comfortably change the direction of the firm (Miller, Reference Miller1991). Given Itoh’s involvement with PDP, the non-routine succession may have been necessary for the firm to stop increasing its commitment (Nakauchi & Wiersema, Reference Nakauchi and Wiersema2015). Sudo’s departure took place after the firm had begun decreasing its commitment levels by announcing its cooperation with Panasonic and exit from PDP manufacturing, but before the company’s exit from PDP-TV. The Pioneer case suggests that more than one CEO succession may be required to exit industries which the firm has made very large commitments to.

Succession events were observed to occur shortly before exit in several other cases. In Sanyo’s case, a non-routine CEO succession in 2005 preceded exit in 2006. NEC exited in 2004 after a routine CEO succession in 2003. Seiko Epson entered an agreement to cooperate with Sony on an orderly transfer of LCD assets in 2009 after a routine CEO succession in 2008. While these observations do not clearly show causality, they are nonetheless in agreement with observations that divestiture is more likely after CEO change (e.g., Ravenscraft & Scherer, Reference Ravenscraft and Scherer1991; Hayward & Shimizu, Reference Hayward and Shimizu2006).

Long-term employment and exit process

The need to provide livelihoods for regular employees can be an important barrier to exit. The external market for talent is often quite limited in Japan, reducing alternative employment opportunities and making this barrier more substantial. When industries become unattractive or many firms seek to exit, it is particularly difficult to place the redundant workers into other companies due to the lack of a fluid market. The exit modes taken by Fujitsu, NEC, Sanyo, and Seiko Epson included transfer of employees to the new organization. Having said that, evidence suggests that at least some of these firms also reassigned some affected employees before exit. Pioneer transferred some engineers to Panasonic as part of the cooperative agreement, however, others remained with the company. A careful reading of the evidence in Pioneer’s case shows that the company repeatedly looked for ways to maintain employment, either in other parts of the company or in other companies. However, it ended up resorting to early retirement programs twice. Dividends were cut or eliminated around the time early retirements occurred.

The above discussion suggests that managing the impact upon employees is an important part of any exit process in Japanese business. This may take time, because it contributes additional requirements for exit planning and execution.

Delaying and maintaining the option not to exit

The multi-stage exit process observed delayed the exit decision, preserving the option for the company to change its mind later and not exit. The notion that Japanese firms might value the option to change their mind fits with Hofstede’s (Reference Hofstede2001) observations of the high levels of uncertainty avoidance in Japanese culture. On a practical level, it may be easier to generate consensus – which typically matters a great deal in Japan – for a plan of action that maintains such an option instead of a more decisive plan that does not. Part of the job of the Japanese CEO is to maintain relationships among internal factions with different agendas. If one or more factions are against the direction of change, a more gradual approach may save face and decrease the hurdles to change. By not taking the decisive change, the CEO is leaving the door open to not exiting in the future. These factional considerations can be particularly important in Japan because the affected employee groups will not simply leave the company if they are unhappy, as they might in other countries.

Interestingly, none of the cases studied here identified a firm changing their mind and returning to a higher commitment cycle. To the best of my knowledge, such a change has not occurred with any of the major Japanese FPD producers. Considering this, the value of delaying and maintaining the option appears to primarily lie in the political benefits.

The role of cooperative arrangements in de-commitment and exit

This research identified cooperative arrangements as playing a role in maintaining commitment, reducing commitment and facilitating eventual exit from an industry. They were observed to play several roles. In the maintaining commitment cycle, cooperative arrangements including technology transfer and outsourcing allowed the firm (here, Fujitsu), to maintain commitment without having to make additional investments in new or updated production facilities and still meet customer demand. Cooperative arrangements were used to unwind vertical integration while still allowing the company to continue to operate in the downstream businesses. Cooperative arrangements can also facilitate the transfer of knowledge, facilities and personnel to another firm intending to remain in the industry in an orderly manner over time. While much of the literature on cooperative arrangements suggest cooperation as a way to facilitate growth in new business, the observations here suggest Japanese firms have found it to have substantial application in de-committing and exit as well.

Contributions

This paper makes several contributions. It identifies and documents the roles of cooperative arrangements in exits in the Japanese context. It proposes a three cycle model of industry de-commitment and exit based upon case study narratives. This research finds evidence that CEO turnover can become a trigger of change in the context of this model, and suggests that the decree of commitment to the business in question influences what type of succession (routine vs. non-routine) and frequency (single succession vs. multiple successions) are needed in order to achieve exit. It proposes the notion that long-term employment affects exit process directly and indirectly. Directly, it increases the requirements to manage the effect of exit upon employees, and indirectly, it increases the importance of consensus and may also result in political resistance to exiting industries.

Managerial implications

Changing the conceptualization from exit as a discrete decision to that of exit as a process can result in new opportunities for managers. If de-commitment is framed as a process retaining the option not to exit until later stages, the political and psychological stakes involved in entering into the process can be reduced. While this does not imply that the staged result will necessarily be better from a purely financial standpoint than a well-timed discrete decision (Damaraju, Barney, & Makhija, Reference Damaraju, Barney and Makhija2015), such a process may facilitate exits earlier than would otherwise be feasible.

This research also has implications for boards of directors. Because only the board of directors has the power to replace the CEO, boards have a potentially powerful mechanism for affecting change and encourage industry exit where needed. However, boards also need to understand that it may be difficult for new CEOs to exit strategically central industries.

The findings of this study provide implications for managers of Japanese firms and foreign companies operating or seeking to operate in Japan. Understanding the nuances of exit from a Japanese perspective may allow foreign firms to cooperate in order to gain control of Japanese operations of firms who want to exit, either through a staged, cooperative exit, or through a cooperative approach to M & A. Such approaches may provide excellent opportunities for foreign firms to gain access to Japan. Indeed, foreign firms may receive much warmer welcomes than usual when they provide such a solution to a Japanese company seeking to exit.

Japanese managers may also find this study instructive. The word risutora (restructuring in Japanese) carries powerful negative connotations. However, this study suggests that Japanese firms can indeed find ways to restructure themselves by de-committing step-by-step, over time. Furthermore, the variety of situations encountered by the firms in the ad-hoc study suggests that creative managers can find a pathway especially suited to their condition and constraints.

Generalizeability and limitations

This study examined firms facing different kinds of exit barriers. Vertical integration and strategic centrality are exit barriers found in a variety of different industries and national contexts. They may take on more or less meaning in the Japanese context than others. Some of the contextual factors affecting exit, in particular lifetime employment, are relatively Japan specific. In turn, these factors appear likely to affect the value of delaying the definitive exit decision and the use of cooperative arrangements to facilitate eventual exit. While the three cycle model itself does not appear to be Japan-specific, the propensity of use of the different cycles may vary considerably according to national and industrial context.

This research has some important limitations. This study examined exits from the FPD industry by Fujitsu, NEC, Pioneer, Sanyo, and Seiko-Epson. This industry has specific dynamics, such as the crystal cycle (Mathews, Reference Mathews2005), and is characterized by large investment requirements to build economic scale production facilities while also being knowledge intensive. Focusing on one industry facilitated case identification and selection, however it may have reduced the generalizability of this research. Future research should examine the prevalence and roles of multi-stage de-commitment and exit processes, and what roles if any cooperative parties play in de-commitment, in other industries and in non-Japanese contexts.

This study examined how firms exited the Japanese FPD industry. It would be particularly interesting to know the ways managers thought about exiting the industry. Unfortunately, given the connotation of failure, obtaining company cooperation to perform studies on exit is extremely difficult. However, if future research is able to gain access to key decision makers in the exit decisions, it could contribute significantly to the literature on exit.

Conclusion

This research examined the process of industry exit in the Japanese context. With one exception, all the firms with mass production capabilities that exited the industry entered into cooperative arrangements in a multi-staged de-commitment process culminating in exit. The cooperative arrangements facilitated exit in several ways, such as providing alternative production sources for vertically integrated firms. The processes also delayed exit, when compared with simpler divestment decisions. Such processes may facilitate consensus building and provide opportunities to plan and manage negative effects of exit upon long-term employees. In numerous cases, top management succession events preceded exit and other de-commitment decisions.

ACKNOWLEDGEMENTS

The author would like to thank Kunal Banerji, Yoshiharu Kuwana, Chanchai Tangpong, and Rod White for their support and insights relating to this work.