No CrossRef data available.

Article contents

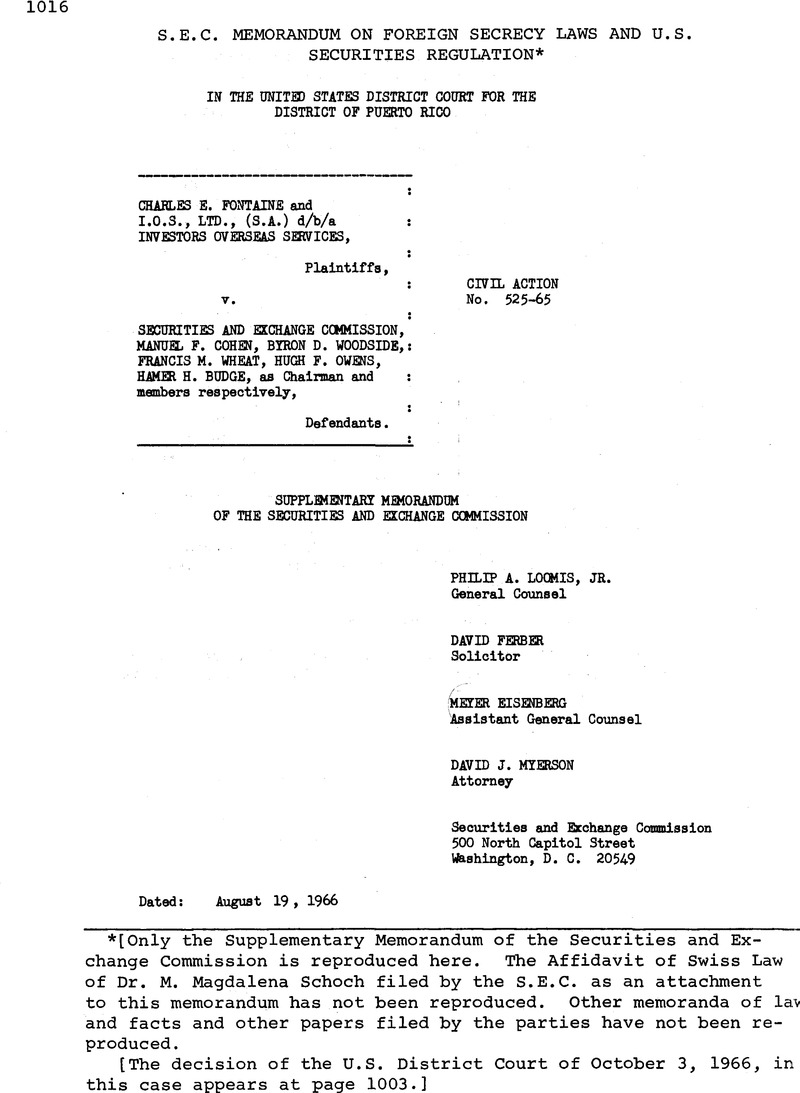

S. E. C. Memorandum on Foreign Secrecy Laws and U. S. Securities Regulation*

Published online by Cambridge University Press: 04 April 2017

Abstract

- Type

- Judicial and Similar Proceedings

- Information

- Copyright

- Copyright © American Society of International Law 1966

Footnotes

[Only the Supplementary Memorandum of the Securities and Exchange Commission i s reproduced here. The Affidavit of Swiss Law of Dr. M. Magdalena Schoch file d by the S.E.C. as an attachment to this memorandum has not been reproduced. Other memoranda of law and facts and other papers filed by the parties have not been r e produced.

[The decision of the U.S. District Court of October 3, 1966, in this case appears at page 1003.]

References

l/ A prior decision in this action which concerned Section 30(b) of the Exchange Act, i.e. Ferraioli v. Cantor. CGH Sec. Law Rep. Para. 91,615 (S.D.N.T., 19^5), was discussed by both parties in earlier briefs. In the most recent decision, the Court held that the amended complaint stated a cause of action under Rule 10(b)(5) of the Exchange Act although all negotiations leading up to the allegedly fraudulent sale and the sale itself took place in Canada. The court stated that the alleged fraud involved the transfer of control of a corporation which would be exercised in the United States and that the mails and instrumentalities of interstate commerce were used to obtain resignations essential to the fraud.

2/ Sections 30(a) and 30(b) of the Exchange Act expressly contemplate application of the Act “without the jurisdiction of the United States”— a principle which is consistent with the anti-trust cases—if business is transacted in contravention of the Commission’s rules and regulations, as I0S is charged with conducting its business.

3/ This principle was recognized by the leading international law case on jurisdiction, Case of S.S. Lotus, P. CPI, J., Ser A., No. 9 (1927) (Permanent Court of International Justice) reprinted in Bishop, International Law: Cases and Materials 443-457 (2d ed. 1962).

4/ The Court noted that although nominally a plaintiff, the position of a claimant belatedly challenging the government’s seizure under that Act is more analogous to that of a defendant. 357 U.S. at 210.

5/ 357 U.S. at 204-206. The court further held, however, that Rule 37(b) should not be interpreted to permit denial of a hearing by a dismissal of the action for a failure to comply with Hie discovery rules when a Master had found a good faith attempt by the Societe to comply therewith (357 U.S. at 212) and the7 production of some 190,000 documents pursuant thereto. There was, of course, no administrative agency or procedure, to provide the Societe with due process as there is in this action; nor was there a Congressionally conceived and Implemented regulatory scheme whose direct protection of the public interest, as opposed to the litigants ‘ interest, would be effectively rendered impotent by extending comity to foreign law.

6/ Kerr Steamship Co. v. United States. 284 F.2d 61 (C.A. 2, I960) Judgment vacated with direction to dismiss as moot. 369 U.S. 422.

7/ Montship Lines Ltd. v. Federal Maritime Board, supra. 295 F.2d at 154. Kerr Steamship and Montship Lines. Ltd. were appeals from the same order of the Maritime Board which required, inter alia, production of certain documents concerning agreements made without the United States and allegedly protected by foreign secrecy laws, as part of an investigation to acquaint the Board with the practices of the carriers it regulates.

8/ While this decision was vacated as moot and thus lost its precedential significance, the opinion does represent the unanimous view of a very distinguished bench—Judges Hand, Lumbard and Friendly—considering the very point at issue here.

9/ “Secrecy laws” exist in nations other than Switzerland, e.g., Liechtenstein (Articles 2 and 4 of the 1949 Law for the Protection of the State); Yugoslavia and the Netherlands (See, Montship Lines, Ltd. v. United States, supra. 295 F.2d at 156); Panama (See, First National City Bank v. Internal Revenue Service, supra, 271 F.2d 616); Cuba and Canada (See, Matter of Equitable Plan Co. 185 F. Supp. 57 (S.D. N.Y. 1960), modified sub. nom., Ings v. Ferguson, 282 F.2d 149 (C.A. 2, 1960); Mexico (See, Securities and Exchange Commission v. Minas de Artemisa, 150 F.2d 215 (C.A. 9, 1945).

10/ Even if the Commission were to permit a withdrawal of IOS’s registration, upon an application for withdrawal which IOS has not yet filed, the statute permits the imposition of “such terms and conditions as the Commission may deem necessary in the public interest or for the protection of investors.” Section 15(b)(6) of the Exchange Act. There is no authority for withdrawal without considering whether conditions are necessary.

11/ In Montship Lines Ltd. v. Federal Maritime Board the court of appeals vacated and remanded to the Maritime Board because of the absence of a statement of purpose, its order requiring carriers subject to the regulatory scheme of the Shipping Act to file certain documents or copies thereof with the Board. The court of appeals specifically directed the petitioning carriers to raise their objections that foreign secrecy laws precluded compliance with the order before the Board on the remand. Id. at 156.

12/ See p. 6 , Affidavit of Dr. Schoch.

13/ E.g. Russel L. Irish. SBC Exchange Act Rel. No. 7678 (1965) (Findings, Opinion and Order revoking registration), stay granted pending review. (Sept. 17, 1965) (unreported), petition for review pending. (C.A. 9, Docket No. 20,472)j MacRobbins & Co. Inc. SEC Exchange Act Rel. 6527 (1961), remanded sub, nam. Kahn v. Securities and Exchange Commission, 297 F.2d 112 (C. A. 2, 1961 ) , and Berko v. Securities and Exchange Commission, 297 F.2d 116 (C.A. 2, 1961); R. H. Johnson & Co. SEC Exchange Act Rel. 5258 (1955), (stay granted pending application to the court of appeals for a stay pending review) modifying. 36 S.E.C. 467 (1955), affirmed sub nom. R.H. Johnson v. Securities and Exchange Commission. 231 F.2d 523 (C.A.D.O. 1956). certiorari denied. 352 U.S. 844; Arleen W. Hughes. 27 S.E.C. 952. 956 (1948). modifying. 27 S.E.C. 629, affirmed sub, nom. Hughes v. Securities and Exchange Commission. 174 F.2d 969 (C.A.D.C. 1949)

14/ San Francisco Mining Exchange v. Securities and Exchange Commission. Docket No. 20,930 (C.A. 9, May 4, 1966) (Stay of Commission Order Withdrawing registration of National Securities Exchange Granted) (unreported); Philadelphia Co. v. Securities and Exchange Commission. 164 F.2d 889. 902 (C.A.D.C. 1947). certiorari denied. 333 U.S. 828, (Stay of Order Revoking Exemption from Provisions of Public Utility Holding Company Act Granted).