The UK's decision to leave the EU is the main factor contributing to the downward revision of our world forecast. We believe that the most likely scenario – and this is our baseline – is that the UK has a Free Trade Agreement with the EU with free access to goods markets but limited access to services markets (similar to the so-called Swiss model). This will have adverse consequences for the financial services sector leading to greater ‘balkanisation’ of EU wholesale finance.

As highlighted in our previous Review, ‘balkanisation’ of EU finance comes at a time of financial fragility in the Eurozone banking system. This has added to the financial pressure on some of the largest European banks and the whole banking sector in Italy. As a consequence, growth in the Eurozone is revised down from 1.7 to 1.3 per cent in 2017. A key issue is whether the ‘bail in’ of creditors at the heart of the EU's Bank Resolution and Recovery Directive can be honoured.

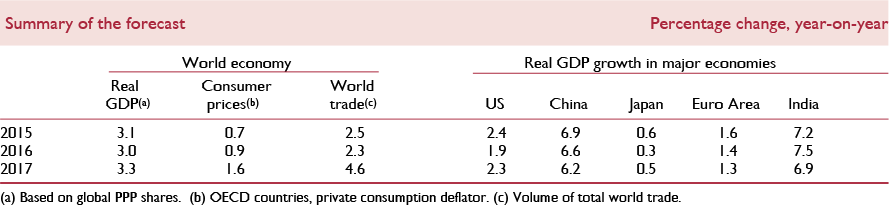

These downward revisions are only partially offset by upward revisions to growth in Brazil, Japan and Russia. India is likely to remain the fastest growing major economy. The US is expected to grow by 2.3 per cent in 2017, with the Fed likely to raise interest rates only very gradually.

Inflation is expected to be slightly lower than previously projected. We expect OECD average inflation to remain well below central banks' targets through to 2018. The exception is the UK where we expect a short-term rise reflecting the depreciation of sterling.

The Bank of England and the ECB stand ready to provide more monetary stimulus, including through unconventional measures if necessary. This is likely to be further quantitative easing, perhaps supported by more direct private sector funding measures. However, given current record low government bond yields it is not clear how much further stimulus this will provide. We expect central banks to be very cautious about introducing significantly negative policy rates because of concerns about the impact on the financial sector. We argue that the limited scope for further monetary stimulus makes the case for fiscal support even stronger.

We note that there is evidence of the growing use of trade restrictions. Even the enthusiasm for regional trade agreements seems to be weakening. Ratification of the Trans-Pacific Partnership agreed earlier this year faces opposition. If this were to fail, then the environment for striking meaningful trade deals will be even more challenging.