How might innovation ecosystems fit into a government’s innovation policy? In this chapter the case of China is examined based on a policy report prepared by the author of the present book for the then-incoming Chinese government of Xi Jinping. The differing roles of national, sectoral, regional, company, and societal challenge innovation ecosystems are distinguished.

Background

In 2012 the Chinese government, in preparation for the new leadership of Xi Jinping, decided to invite a number of Fortune 500 companies to prepare several reports for the new government suggesting what the companies thought the government should do. Four areas were selected. The first of these was on innovation. The six companies invited to address this area were Caterpillar, Dow Chemical, Hitachi, Mastercard, Michelin, and Renault.

I, the author of the present book, was invited by the China Development and Research Foundation (CDRF) of the Chinese State Council, the institution entrusted with organising the project, to join this innovation team. The topic that the team was invited to address was ‘Innovation and New Wave Industrialisation’. For the companies a condition of their participation was that their CEO would sign off on the team’s final report. As an appointee of CDRF I was specifically asked to act as a ‘sparring partner’ to the multinational companies with the aim of sharpening the analysis provided in the final report.

After the team’s final report was submitted I was requested by CDRF to prepare my own report to be titled: ‘Innovation, New Waves of Industrialisation, and the Implications for China’. The present chapter is largely a reproduction of my original report with only a few omissions and some minor additions.

The CDRF asked the following six questions of the multinational companies, the fifth of which dealt specifically with innovation ecosystems:

1. What exactly are the trends of the third technology revolution?

2. What are the trends of innovation models at the global level and the trends of innovation policy?

3. What are the mechanisms of the collaborative innovation?

4. What could be the relationships between the government and the market?

5. How to create a sustainable and effective innovation ecosystem?

6. How to secure that the Report addresses the government’s interests and [in] the appendix the company interests?

Introduction

China has embarked on a remarkable transition – from a country whose economic dynamic has been largely based on low cost (though often high quality) manufacturing, using technologies and practices that have come mainly from outside, to a country increasingly capable of internally generating novelty.

However, this transition, of the greatest importance not only for the Chinese people but also for the functioning of the global economy, is inherently problematical.

Let us begin with novelty itself. It is novelty that is the main driver of the capitalist economy, making it, as Joseph Schumpeter observed, a restless system, incessantly in a process of change. Novelty is the essence of innovation, which Schumpeter defined as including not only new products and services, and new technologies and processes, but also new forms of organisation and new markets, ways of marketing, and business models. To this we should also add new ways of thinking.

However, Schumpeter, drawing explicitly and heavily on Karl Marx, also pointed to the two-edged sword that is innovation. Novelty generates new possibilities. But it also destroys the old, often with difficult consequences. Furthermore, as we are now only too aware, if we extend the discussion of innovation as Schumpeter did to the dynamic interplay between innovation and the financing of, and investment in, innovation, we have to come to grips with other drivers of the restless capitalist system such as irrational exuberance, greed, panic, and contagion in financial markets. Apparently, the generation of novelty is not an unmixed blessing.

But the problem goes even deeper. The reason is that novelty can never be an end in itself. It can only be a means. Something new is not necessarily in all respects better than something old. Furthermore, the new, even when it is obviously significantly more advanced than the old, is not always demanded. Concorde, the superior supersonic airplane, failed to pass the market-selection fitness test and soon became commercially obsolete.

The main implication is that the spotlight necessarily then moves to focus our attention on the ends. But this only deepens our problems. What are our ultimate goals for our societies and, indeed, for person-kind generally? This is a crucial but troubling question. It is also paradoxical. Because although almost all of us have, at one time or another, had the good fortune to experience that state of mind to which we might attach words such as ‘fulfilment’ or ‘happiness’, we find it extremely difficult to turn this sought-after frame of mind into practical goals that may serve to orient society’s actions and interactions. We also find it a hard task to define the conditions that are necessary and sufficient to produce this state of mind in a large proportion of the population.

But, of course, these difficulties do not imply that we should desist from posing the crucial question of what we should be aiming to achieve. For even if this will not produce a consensual answer, the mere posing of the question is likely to stimulate discussion and debate that will encourage the self-examination and critical awareness that surely is an essential part of any healthy society.Footnote 1

Long and Short Waves of Economic Activity

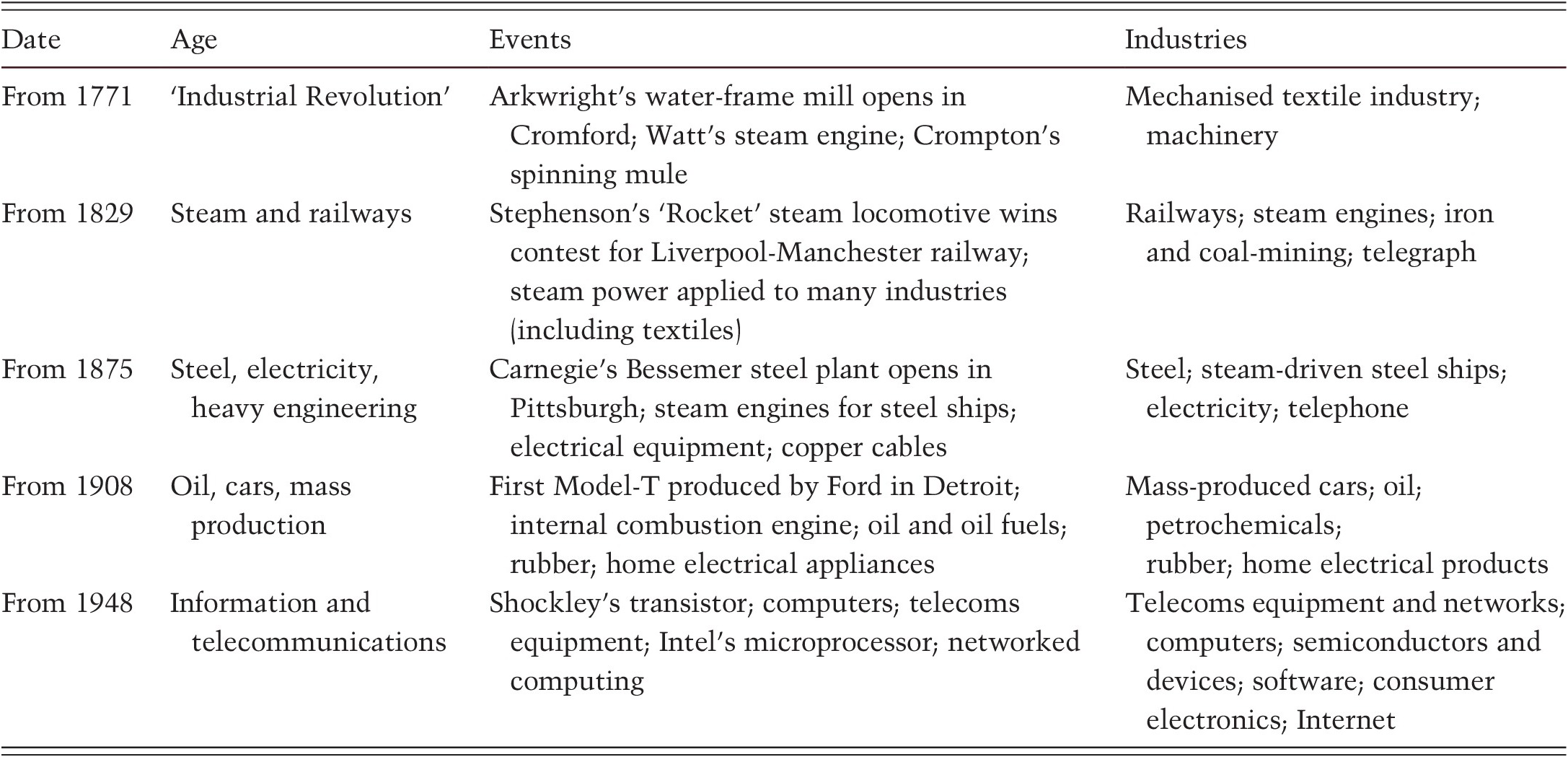

As Schumpeterian economists have observed, the history of capitalist development has been punctuated by periods when clusters of radically new technologies have emerged. Five such periods have been identified since the first industrial revolution began in the 1770s in Great Britain. These are shown in Exhibit 9.1.

Exhibit 9.1 Long Waves of Economic Activity

Technical Change and Economic Growth: Five Periods

| Date | Age | Events | Industries |

|---|---|---|---|

| From 1771 | ‘Industrial Revolution’ | Arkwright’s water-frame mill opens in Cromford; Watt’s steam engine; Crompton’s spinning mule | Mechanised textile industry; machinery |

| From 1829 | Steam and railways | Stephenson’s ‘Rocket’ steam locomotive wins contest for Liverpool-Manchester railway; steam power applied to many industries (including textiles) | Railways; steam engines; iron and coal-mining; telegraph |

| From 1875 | Steel, electricity, heavy engineering | Carnegie’s Bessemer steel plant opens in Pittsburgh; steam engines for steel ships; electrical equipment; copper cables | Steel; steam-driven steel ships; electricity; telephone |

| From 1908 | Oil, cars, mass production | First Model-T produced by Ford in Detroit; internal combustion engine; oil and oil fuels; rubber; home electrical appliances | Mass-produced cars; oil; petrochemicals; rubber; home electrical products |

| From 1948 | Information and telecommunications | Shockley’s transistor; computers; telecoms equipment; Intel’s microprocessor; networked computing | Telecoms equipment and networks; computers; semiconductors and devices; software; consumer electronics; Internet |

The emergent new technologies have had two immediate principal effects. First, they have created new possibilities and new opportunities. Second, they have resulted in dramatic falls in relative prices of at least an order of magnitude (e.g. a huge drop in the cost of power from the water-powered loom, to steam-engine driven machinery, to electrical machinery; significant falls in the cost of transport with the emergence of the steam engine and the later development of the internal combustion engine; and the substantial decrease in the cost of processing, storing, and communicating information with the advent of information and communications technologies.)

These new possibilities and opportunities, together with the high-powered incentives created by the radical fall in relative prices, created new channels for lucrative investment. As investment is made in the newly opening areas so total factor productivity increases and with it so does GDP and employment. Although, as we have noted, the opposite side of the same coin is the destruction of some older industries, products, technologies, and markets (however, usually not total destruction), on balance the new industries driven by the new technologies have provided sufficient impetus to increase significantly aggregate output and employment.

But the ball does not stop here. And this is where financial markets enter the picture. Some investors soon discover that there are relatively attractive returns to be earned in the new areas. As Charles Kindleberger,Footnote 2 the great scholar of booms and busts, observed, there is nothing that gets colleagues, friends, and neighbours excited as much as the knowledge that a great deal of money is being made. Expectations about these areas, accordingly, become exuberant. And financial markets seem, under these conditions, inevitably to overshoot, despite all the lessons from the past that council caution – from Tulipomania to the South Sea Bubble and on. Eventually, financial asset prices, and the prices of some real assets, become unsustainable and the inevitable then happens – panic and rapid asset depreciation occur.

In the real economy, at the level of companies, the first successful movers into the new areas, being the first to acquire the distinctive new competences required, and therefore with limited entry by competitors, enjoy a temporary monopoly power and earn relatively high profits. This fuels the financial bonanza. But soon, as Schumpeter observed, competitors jump on the bandwagon and profit margins unavoidably become eroded, contributing to the downturn. Eventually, average profits fall and productivity slows down, leading to a moderation of economic growth and even, depending on the severity of the disruption in financial markets, to a decline in growth.

Radically new technological revolutions usually require new institutions and new facilitating conditions if they are to have a significant impact. These may include new supporting and complementary technologies; new skills and new approaches provided by schools, training institutions, and universities; new infrastructure; and perhaps new forms of funding, state intervention, and regulation. These requirements and the costs and difficulties of providing them often make it difficult for the countries that have dominated preceding waves to make the adaptations needed to maintain their position in the new wave. Great Britain provides a good example having initiated the first wave (in textile machinery) and performed successfully in the second (steam and railways). Remarkably, for example, at the beginning of the First World War the Clyde River alone in Glasgow, Scotland, built one-third of British shipping tonnage and almost one-fifth of world tonnage, a total greater than all German shipyards combined. But in the third, fourth, and fifth waves Britain fell rapidly behind as, notably, the United States and Germany soared ahead.Footnote 3

The new revolutions create new opportunities for some emerging countries that are able to leapfrog over the previous waves and create the conditions needed for the new wave. A good example is the catch-up, first of Japan and then Korea and Taiwan, in the area of information and communications technologies, technologies that were not invented in East Asia.Footnote 4 This new entry and the global competition it has provided has given a significant boost not only to the new entrant countries and their companies but also to the global economy.

However, these great leaps forward are few and far between. In the more normal times technical change is incremental rather than radical, causing ripples of new economic activity rather than huge waves. Although Schumpeter focused on radical technical change, the cumulative effect of incremental technical change should not be underestimated. The example of smartphones is a case in point.

Some have suggested that at the present time we are witnessing the emergence of the beginnings of a new long wave of economic activity. They point to the technological advances that have taken place in areas such as information and communications technologies, biotechnology, stem cells and regenerative medicine, nanotechnology and new materials, renewable energy, 3-D printing, etc. Others, however, are more cautious, not denying the breakthroughs in areas such as these, but more sceptical that collectively they are sufficient to generate the kind of aggregate growth-raising impetus created by the five earlier long waves.Footnote 5 To the extent that an order-of-magnitude fall in the real price of key products, services, and technologies is a necessary precondition for long wave impacts, there are reasons for caution on this issue. Time will be the ultimate arbiter.

The Importance of Growing Globally Competitive Indigenous Companies and the Implications for China

Introduction

It is clear from economic history that it is enterprises (aided by institutional innovations such as the advent of the joint stock company) that play the leading role in seizing the opportunities provided by the new technologies and turning them into profits and national growth in output and employment. This is evident from Britain’s transformation in the first industrial revolution and from the performance of catch-up countries thereafter. Indeed, growing globally competitive indigenous companies is a necessary condition for successful performance both in the new wave of radical technological change and in the ripples of incremental change that occur thereafter. But the growth of both companies and their global competitiveness does not happen automatically. It is something that must be made to happen. For China this is one of the most important challenges, the success of which will heavily influence the achievement of many of the country’s other goals.

What Needs to Be Done to Grow Globally Competitive Indigenous Companies in China? Trade, Investment, and Market Failure

Any catch-up country starts with a great dilemma. Both its companies and its institutions (what Nobel Laureate Douglass North calls ‘rule of the game’) as well as supporting organisations – such as banks and other financing bodies, universities, other research organisations, and legal systems – are weak relative to those in the leading countries. It therefore faces an uphill struggle.

But this does not mean that the catch-up country has no weapons in its armoury. Amongst its weapons are lower factor costs (particularly skilled labour), perhaps a favourable exchange rate, and the fact that the very weakness of its institutions and supporting organisations may make them more flexible and adaptable to the new conditions required by the new technologies (vested interests in these bodies may be relatively weak precisely because of their overall ineffectiveness). With good policy and strong state leadership it is possible that over time these weapons can be mobilised and turned to the purpose of building globally competitive indigenous companies together with the facilitating institutions and organisations that they require.

It is here that the question of the respective roles of the state and the market, one of the key questions posed by the CDRF to the six multinational companies, becomes important. To what extent can the task at hand – growing globally competitive indigenous companies together with supporting institutions and organisations – be left to the market (i.e. to the collective decisions of private firms, consumers, and non-government-controlled entities)? To what extent is it necessary for the state to intervene and in what ways?

These questions soon become pressing at the country’s borders. To what extent should the inflow of foreign goods and services and foreign direct investment be left to global markets and the domestic market to decide? In answer to this important question some like to tell an optimistic story of the benefits that will flow to all in the global system as largely unrestrained markets allocate resources globally according to the endowments of each country (i.e. endowments of labour, capital, and natural resources) thus optimising not only global social welfare but also the social welfare of each country. This is the conventional economic theory of comparative advantage.

Historically, however, this optimistic story has soon run into difficulties. The first problem is that left to themselves global markets and the flows of trade and investment that they drive are likely to leave little room for the growth of globally competitive companies in follower countries. While relatively low factor costs (i.e. costs of labour or capital) and/or raw material costs may provide some opportunities in these countries under free trade conditions for some viable corporate growth, the historical experience on the whole has been that these opportunities have been deemed insufficient by the political decision-makers in the follower countries. Accordingly, the general rule – from the first catch-up countries, the United States and Germany, to later catch-up countries such as Japan, Korea, and Taiwan – has been for the state to interfere with free global markets through the use of indigenous enterprise–encouraging tools such as import quotas, tariffs, subsidies, and restrictions on inward investment. The ultimate success of these countries despite their interference with market forces stands in strong contrast to the optimistic story of free trade referred to earlier. However, once indigenous companies and their competences become more competitive globally, so more and more room is created for market forces to play a greater role.

The second problem with the free market story is that sometimes markets simply do not work efficiently. One of the most important findings in economic research over the last few decades is the rigorous demonstration of this fact. A few examples will make this clearer.

To begin with, markets produce their best results when all the players in the system have the same perfect information. In reality, however, players usually have asymmetric information (some have information that others do not) and their information is incomplete (they do not know what they must know in order to make optimal decisions). Significant further problems are presented by irreducible uncertainty (which exists when probability distributions cannot be defined and therefore probabilistic decisions cannot be made and optimal decisions, accordingly, cannot be determined).

This is particularly important in the area of innovation where, by definition, uncertainty rules. (If we know the outcomes of ex ante investments in innovation, even probabilistically, we would not have to undertake the search that is the essence of research.) Under conditions of uncertainty, by definition, we do not know the outcomes and can only imagine them. Under such conditions it is not possible to define optimal outcomes.

It can be demonstrated that key markets in the capitalist economy are subject to significant market failure, for example, credit, labour and knowledge markets.Footnote 6

In the case of credit markets, for instance, think of an entrepreneur who supposes she has a great new innovation to commercialise. But in order to do so she needs money. How does she persuade the provider of money (e.g. venture capitalist or bank) to lend it to her? How is the lender to evaluate the information she gives? Is she being too optimistic and ‘spinning’ the opportunity? Even if the lender believes she is being honest, how does the lender deal with the possibility that the would-be borrower is being overly optimistic? Of course, there is also a chance that the borrower is being downright opportunistic, lying about the prospects. If the lender turns to a third party for advice how do they decide whether the judgement of the third party is any more reliable, and besides, what are the costs of this advice? It is because of problems such as these that early-stage innovation (particularly when there are no prototypes that may aid decision-making) is often underfunded by the market, leaving the state to fill the gap in order to fuel innovation.

In the case of labour markets there is often a problem with market failure relating to in-firm training. The problem is that having invested in the training of an employee the employer may fail to appropriate an adequate reward from the investment if the employee is headhunted by another employer. This may result in underinvestment in crucial in-firm training if left entirely to the labour market. There are, however, institutional innovations designed to deal with this problem. The Japanese, for example, developed lifetime employment as a solution. However, while this practice has many benefits (including, apart from a stronger incentive to invest in training, loyalty and sometimes good intrafirm flows of information), it also has its costs. These include limited interfirm flows of knowledge and difficulties for companies unable to reduce labour costs through dismissal in times of economic downturn.

In the knowledge market, another crucial capitalist market, major market failures arise from uncertainty (already discussed). Uncertainty considerably reduces the market incentive to invest in knowledge creation because the investor does not know what returns are likely. This is a key justification in all countries, not only catch-up ones, for state investment in schools, universities, and government-funded research programmes or institutes.

These and other market failures carve out a sizable domain where not only is it legitimate (logically) for states to intervene but where state intervention provides the only way forward. This is as true for the Chinese state as for any other.

The Role of Global Innovation Ecosystems (GIEs)

The Conceptualisation and Role of GIEs

Like motherhood and apple pie, ‘innovation ecosystems’ have come to be seen as one of the ‘great goods’. Construct your innovation ecosystem, like Apple for example, and the world will be yours. Unfortunately, however, the concept of ‘innovation ecosystem’ has not been well defined, is used in inconsistent ways by different writers and in different settings, and has obscured significant complexity.

At the heart of the concept is the assumption that those who jointly create value through innovation interact with one another and are interdependent with the result that they may, collectively, reasonably be seen as part of a single system.

But this raises the first conceptual problem: Where are the boundaries of any particular innovation ecosystem that include some but omit others? This is a problem because in a modern economy there are many links of various kinds that connect large numbers of the economy’s agents. In dealing with this problem a subjective judgment needs to be made regarding who is mainly responsible for creating and implementing the many processes that lead to innovation in a given area. Inevitably, this subjectivity means that different analysts may come up with different innovation ecosystems.

Solving the boundary problem also entails selecting the components of the system, i.e. the ‘players’ in the system as well as those who determine the rules of the game (institutions) according to which the players play and the facilitating and frustrating factors that also shape the innovation process.

Significantly, this discussion implies that ‘innovation ecosystems’ are not real objects that exist in the world the way, say, atoms, elephants, and machines do. Rather, they are conceptual constructs that can be constructed in different ways with different contents.

The Players in the Innovation Ecosystem

But who are the players who jointly create value through innovation that are the object of attention? To answer this question, we need to define what we mean by ‘innovation’.

In doing so we will follow Schumpeter, whose definition informs the currently internationally accepted definitions of innovation adopted by organisations such as the OECD. According to Schumpeter, innovation includes new products and services; new processes and technologies; new forms of organisation; new markets, business models, and ways of marketing; and, we should add, new ways of thinking. Other definitions are, of course, also possible.

Business Enterprises

From Schumpeter’s definition it follows that business enterprises, and in particular those within them who ‘carry out’ the processes in these enterprises that lead to innovation, constitute the engine of the innovation ecosystem. The reason is that in general it is enterprises that create new products and services, new processes and technologies, etc., rather than other players in the ecosystem such as funders, universities, regulators, etc.

But this first approximation in defining the players in the ecosystem creates further problems since ‘enterprises’ and ‘universities’ etc. are also conceptual constructs that have to be deconstructed and disaggregated if we are to understand innovation.Footnote 7

Indeed, these players in an innovation ecosystem are themselves complex subsystems of the innovation ecosystem. Take as an example large companies. As we will see later, we may think of a large company as consisting of a number of functionally differentiated players who jointly possess the knowledge embodied in the competences and routines that allow the company to do what it needs to in order to survive and hopefully thrive. As far as the company’s innovation is concerned, it may make sense to distinguish the following internal players: those in corporate strategy; research, usually located in specialised research laboratories; development, located in the firm’s business units; and marketing and sales, also in the business units. But even these ‘players’ need to be disaggregated since not all of their members are involved in the generation of novelty (i.e. innovation).

As this brief discussion makes clear, defining the ‘players’ involved in the innovation processes of an innovation ecosystem is no simple matter.

Customer-Users

This brings us to a key issue. The overall goal of innovation ecosystems, paradoxically, is not innovation per se (e.g. creating a new product or process). Rather, it is to generate added value for the customer-users of the innovation. The incentives of the ecosystem are geared towards added value, not innovation itself. A new product or process may or may not add value. The ultimate test is whether the innovation is adopted in the market by customer-users. More generally, for an innovation to be economically significant it must be diffused (a requirement on which Schumpeter insisted).

It is crucial, therefore, that our conceptualisation of innovation ecosystems includes customer-users as a crucial set of players in the system. This requires a focus on the process of value-creation, a process that may be facilitated by innovation.

But we also need to explore further the symbiotic relationship (symbiosis = living together) between customer-users and the companies that create value for them. This relationship is complex and can take many different forms with different degrees of customer involvement.

However, in all company–customer relationships there is one essential characteristic: companies specialise in producing the goods and services concerned, while customer-users specialise in consuming them. Production and consumption generate two overlapping, but nonidentical, sets of knowledge. In order to innovate, companies need feedback from the customer-users of their products and services (although they will often have to go beyond this feedback in making imaginative conjectures regarding how they might create additional value for their customer-users). Furthermore, in some circumstances it may be possible to construct processes that will allow customers to become more directly involved in the innovation process so that they become co-innovators, by generating customer-created innovations. In this way the sharp distinction between the producers of innovations and the consumers of these innovations may become blurred with both producers and customers playing a part in the innovation process.

Universities

A key player in most innovation ecosystems is universities that train skilled person-power, do research, and, increasingly, commercialise that research. As largely publicly funded organisations they are designed in part to overcome the knowledge-creation market failure referred to earlier.

But universities are also complex sub-ecosystems, acting as players in broader innovation ecosystems. Their goals and the aims of their members, particularly in the area of research/knowledge creation, are fundamentally different from those of companies.

The goal of companies is to generate value in the form of revenue that is sufficient to at least cover costs and earn a profit that will make it worthwhile staying in business. Failure to do so means either bankruptcy or getting subsidies from the state or financial institutions. (The ability of Chinese state-owned enterprises sometimes to get such subsidies is a crucial factor influencing their innovation behaviour since it gives them a ‘soft budget constraint’ that allows them to carry on doing things that would have been ruled out under a ‘hard’ budget constraint.)

In pursuit of this goal, innovative companies try to create new knowledge. Generally, however, they do so in a top-down way. Typically, R&D budgets are created (usually according to a rule of thumb based on an assumed desirable R&D to sales ratio). This budget is managed by R&D managers who have agreed on specific R&D value-related objectives. R&D projects are then selected with researchers and developers encouraged to contribute to the objectives.

In universities, however, the knowledge-creation process is typically bottom-up. Usually university researchers are employed according to their expertise in specialised areas but are given a wide degree of freedom to choose areas in which to research. Their main constraint is not whether or not they create commercial value, as in the case of company researchers, but whether they contribute to knowledge. The latter is usually judged according to publication in peer-reviewed journals and acknowledgement by learned societies, although increasingly patents have been added as a supplementary measure of performance. Frequently, university researchers are motivated just as much by the status bestowed by promotion and the prestige provided by being regarded as a high-flying academic as they are by money.

But researchers are not the only player in universities who matter in terms of innovation. There are also the university’s leaders and top management who have additional goals such as fund-raising, attracting students, and acquiring better reputations; commercialisation managers who try to generate value, including spin-offs and start-ups, from research; students themselves, who are generally motivated by many other considerations; and those who fund universities in one way or another. All these interacting ‘players’ make universities what they are and influence the role they play in the broader innovation process in innovation ecosystems.

Given the very different motivations and knowledge-generation processes in companies and universities, it is no surprise that their symbiotic interface is difficult to design and manage and that the benefits to each vary widely. Exhortation by government policymakers to ‘link universities and companies more closely’ often fails to come to grips with the complexities involved. A deeper analysis of the problems and a more careful consideration of the optional ways of designing this interface would often bear fruit.

Other Players, Institutions, and Facilitators and Frustrators

There are many other key players in innovation ecosystems including the providers of capital (e.g. banks, venture capitalists and angels, and capital market players), intermediaries who may assist both the creation and diffusion of innovations, knowledge-intensive professionals (such as consultants, lawyers, accountants), regulators, and policymakers. There is no room here, however, for a more detailed analysis of their role.

In addition, there are the institutions (defined by Nobel Laureate Douglass North as ‘the rules – both formal and informal – of the game’) in which the players are embedded, which shape and constrain their behaviour, and which define both incentives and disincentives. These institutions can facilitate and, in some cases, frustrate the innovation process. They include legal institutions (e.g. law of property, law of contract, IP law, the rule of law, competition law, etc.), standardisation (which may facilitate modularisation, coordination, and interoperability but may also constrain these processes), and de facto practices (an interesting recent example of which is the de facto – rather than de jure – redefinition of the acceptability boundary between tax evasion and tax avoidance in the wake of the global financial and fiscal crisis).

These must be added in order to understand the innovation process, making an innovation ecosystem a complex system consisting of complex subsystems.

The Performance of Innovation Ecosystems

Given the complexity of GIEs it should come as no surprise that there is no reason for believing that they are, or will over time become, ‘efficient’ or ‘optimal’. Indeed, for the same complexity reason, it is impossible to define analytically what should be meant by ‘efficient’ or ‘optimal’ in this context. The inherent uncertainty that is a key characteristic of GIEs is a major contributor to the problem.

This does not mean, however, that no attempt can be made to measure (and therefore monitor) the performance of the GIE (although attributing causality to the different factors that drive performance is a difficult, perhaps even impossible, matter to solve).

So how should the performance of GIEs be measured?

The first point to make is that measuring innovation itself is problematical. The three main indicators – R&D, patents, and citations – are riddled with imperfections. For example, R&D is an input measure, but it is output that we want. More R&D expenditure does not necessarily mean more innovation and value-creation.Footnote 8 The total number of granted patents, a measure that is often used, tells us little about the values that result, and weighting patents by revenue generated is a difficult task. The same problem arises in the case of citations. It is as a result of these defects that organisations such as the OECD have tried to extend the measurement of innovation to include data on other outcomes such as proportion of a company’s revenue that comes from new products, processes, and forms of organisation. While these measures do help, their usefulness is limited by asymmetric information constraints that result from making firms themselves the measurers of their own performance.

More important is the fact that, as mentioned earlier, it is not innovation itself that we are interested in but its use as a means to achieve other final objectives. In the case of companies these include increases in competitiveness, productivity, profits, and growth, while in the case of countries they include total factor productivity, GDP, and employment growth as well as social objectives such as improved health, education, and environmental conditions. Furthermore, we would like to know how globally competitive the players in the GIE are, not only the companies but also the other players such as universities, other research organisations, hospitals, and schools. For if the players are behind the global frontier it is possible for their performance to be improved. Innovation, we know, makes the most important contribution to the achievement of these final objectives, but the precise causal link is often difficult to establish.

One of the measures of GIE performance should be global performance. Here two indicators are potentially helpful. The first is exports, both at company level (e.g. the proportion of sales exported out of China) and at country level (e.g. exports from China as a proportion of world exports by product category).Footnote 9 These measures allow us to distinguish company competitiveness from country competitiveness. These two do not necessarily go together. In many areas China enjoys country competitiveness while its own companies are not globally competitive in the area. The second measure, relevant at company level, is data on market share by product category. Japan has put these measures to good effect in a critical evaluation of Japanese performance in the ICT sector.Footnote 10

Many measures of GIE performance can and should be made so as to get a reasonable idea of how the ecosystem is performing since, as noted, there is no inherent reason to assume it is performing well or that its performance is improving over time. But it is as well to be aware that the overall judgement of performance is likely to be a tricky affair.

Globalisation and Global Competitiveness

Innovation ecosystems have simultaneously both a local and a global existence. In any country the players in the innovation ecosystem are embedded in local interactions with other players under the influence of local institutions, facilitators, and frustrators. But at the same time, they are also part of a global innovation ecosystem. This is most obviously the case for those players that have a direct global involvement through activities such as exports, imports, outward and inward investment, participation in international trade fairs and conferences, etc. But even those players producing only for the local market will be aware through multiple channels of relevant things happening abroad.

As we have already noted, an important issue regarding the performance of innovation ecosystems relates to the global competitiveness of key players. The more globally competitive they are, the more opportunities they will have to engage in various ways outside China and hence learn from and access global knowledge pools. The increasing importance of knowledge located in other countries is one of the most important trends to emerge in the last decade, a trend that is fundamentally reshaping the global economic system and the way it works. The reason is that R&D, and innovation more general, goes together with GDP. And global GDP is being rapidly redistributed globally away from the traditional ‘developed countries’, such as the United States, European countries, and Japan.

This has two important implications for innovation ecosystems. First, more knowledge will be generated outside the so-called developed countries, making it increasingly important to connect to knowledge in the ‘growth countries’. Second, no country – even China and India, which are expected to be the largest economies in 2050 – will be able to generate all or even most of the knowledge it will require. Increasingly, therefore, innovation ecosystems must go global, plugging into the knowledge that is generated outside the home country while at the same time fostering the symbiotic relationships between players domestically that will drive innovation within the country.

Lessons from Japan, Korea, and Taiwan

It is here that Japan, Korea, and Taiwan offer important lessons for China.

In my view the most important lesson from Korea and Taiwan (and Japan in its early catch-up phase) is how to grow globally competitive indigenous companies that power domestic GIEs while driving the growth of GDP, employment, and social development. Summarising complex processes, it may reasonably be concluded that in these countries the state played a key role in facilitating the emergence of indigenous companies and enabling them to rapidly learn from abroad by fostering, and for a long while protecting, the learning process. In all these countries key sectors were selected, sectors that would not have survived in the short run under free trade, and high-powered incentives were used to encourage firm learning in a way that produced increasing global competitiveness.

From the mid-1960s Korea and Taiwan in particular required that their companies in the selected sectors (that did not immediately enjoy a global competitive advantage) first prove themselves in export markets in order to qualify later for the ‘carrots’ that were provided as rewards (such as subsidised-interest loans from state financial institutions, tax breaks of various kinds, favourable exchange rates for exporters, other forms of state assistance in export markets, etc.). This requirement ensured that emerging companies in Korea and Taiwan plugged rapidly into global markets, learning from global customers and competitors (unlike other emerging countries at the time in Latin America and places like India and Pakistan where companies and industries were protected under import-substituting policies and incentivised to produce for protected local markets).

Furthermore, unlike in Europe where single national champions were frequently chosen,Footnote 11 the authorities in Japan, Korea, and Taiwan ensured that there was strong competition between multiple rivals in domestic markets (e.g. cars, semiconductors, computers, consumer electronics, etc.).

At the same time as encouraging these high-growth, innovation-intensive sectors where they did not immediately enjoy a competitive advantage, the policymakers of these countries took advantage of sectors where they did have a competitive advantage (such as textiles, clothing, plywood, trainers, toys, etc.). This policy of ‘walking on two legs’ took full advantage of global markets and knowledge and eventually, after several decades, resulted in the achievement of global competitiveness that was first elusive in the chosen protected and nurtured markets.

The Japanese Paradox

The more recent experience of Japan presents an important paradox. Japan leads the world in areas of innovation such as gross expenditure on R&D as a proportion of GDP, business expenditure on R&D as a proportion of GDP, patents, and broadband speed. These are the targets that many policymakers such as the European Commission have prioritised. However, Japan has not performed particularly well in terms of indicators like growth in real GDP and global market share of Japanese companies in important sectors such as ICT (although in other sectors like motor cars, cameras, and optical devices Japanese companies have done much better). Why this discrepancy?

There are multiple factors that enter into an explanation of the Japanese Paradox. These include the bursting of the Japanese financial bubble in 1989 and the subsequent ‘lost decade’, which negatively impacted on Japanese companies, dependent to a significant extent on the local market; the relatively high yen exchange rate; and relatively high Japanese labour costs. But together with these causes there has been another crucial determinant: the inward-looking nature of many Japanese companies, measured by their relatively low ratio of sales outside Japan to total sales, compared with their main global competitors.

Japanese policymakers sometimes refer to this cause as the Galapagos Effect, alluding to Darwin’s explanation of the evolution of unique species on the individual, separated islands of Galapagos. They suggest that in many cases the goods and services of Japanese companies, while well adapted to the high-income, sophisticated markets of Japan, have not necessarily been as well suited to the tastes and preferences of other global markets. In strong contrast, for example in the ICT sector, companies from Korea and Taiwan – such as Samsung, LG, TSMC, HTC, and Acer – with relatively small domestic markets and with strong export encouragement from their governments from the mid-1960s, have focused far more on the most important global markets. The result has at times been startling. For example, ‘Samsung Electronics posted four times as much net profit in the third quarter [of 2011] as Japan’s 19 main listed technology and consumer electronics companies combined.’Footnote 12

The Seductiveness of the Chinese Market: A Chinese Danger

The Japanese Paradox has important implications for the growth of globally competitive Chinese companies, whether state-owned enterprises (SOEs), privately owned enterprises (POEs), small- and medium-sized enterprises (SMEs), or emerging Chinese multinational corporations (MNCs).

The problem is the lure of the domestic Chinese market, which, like the Japanese market from the 1950s to the 1970s, is growing rapidly and which in many cases offers handsome rewards in terms of profitability and growth. However, it would be a big policy mistake to allow this inward-looking focus to go unchallenged. The reason is that an inward focus will mean that Chinese companies, both large and small, will forgo the opportunities for learning and knowledge acquisition that could result from global innovation involvements. An important challenge for Chinese policymakers, therefore, is to incentivise greater global involvement by all categories of Chinese companies. This is equally important for Chinese SMEs (as illustrated, for example, by the ‘born global’ Indian software SMEs that have made such an important contribution to India’s burgeoning software sector, which has contributed significantly to the transformation of the Indian economy).

The Importance of Encouraging Variety in Innovation Ecosystems

In this chapter both the complex nature of innovation ecosystems and the ubiquitous importance of uncertainty have been highlighted. In short, we simply do not know, and cannot know, what will happen to technologies, products and services, and markets in the longer-term future. How should policymakers deal with the predicament that this creates?

One key answer is that they should try and ensure that their innovation ecosystems generate variety. As Schumpeterian-evolutionary economics has demonstrated, variety plus selection are the main drivers of the evolutionary processes that transform economic systems.Footnote 13 It is innovation that generates variety. The market provides one of the most important mechanisms for selecting from this variety (although there are also many other mechanisms that coexist with the market in selecting, such as in-firm ways of selecting or rejecting R&D projects and the research selection procedures of government and other research-funding bodies). Under conditions of complexity and uncertainty, although we cannot know which technologies, products and services, and markets will ultimately be selected, we can try to ensure that global innovation ecosystems generate a variety of alternatives so that there is a wider range of opportunities from which to select. For this reason, it is suggested that a healthy global innovation ecosystem is one that succeeds in generating significant variety.

There Is No Magical Model for GIE Design and Management

Just as with marriage and parenting, there is no magical model for GIE design and management. Its effectiveness depends on many things: the players concerned and their strengths and weaknesses, the quality of its institutions, the political priorities and constraints that exist, and the presence of facilitating and frustrating institutional forces.

Having said this, however, and again just as with marriage and parenting, a good deal of progress may be made through careful analysis, thoughtful and sensitive policy design, and a healthy dose of common sense. Nevertheless, as in the other two areas, this does not mean that we should succumb to the error of thinking that we are, or ever can be, in full control. For we are dealing with a complex system of complex systems that have their own dynamics that we may be able to influence but will never fully control.

How Should China Use the Idea of Global Innovation Ecosystems?

Chinese policymakers should use the idea of GIEs as an important conceptual policy tool at five interconnected levels:

1. The national level

2. The sector level

3. The regional level

4. The company level

5. The societal challenge level.

The National-Level Global Innovation Ecosystem

It is at the national level that the official Chinese document aimed at ‘speeding up the building of a National Innovation System’ focuses as part of implementing The National Guideline for Medium- and Long-Term Plans for Science and Technology Development, 2006–2020.Footnote 14 This guideline sets out the goal for China to become an innovative country by 2020 and a scientific and technological leader by 2050. Achieving this goal will require significant changes in the structure and dynamics of the country’s innovation ecosystems and in particular in its enterprises – SOEs, POEs, SMEs, and emerging Chinese MNCs – and innovation-related institutions.

At the national level the concept of GIEs is useful for Chinese policymakers as a way of mapping, first, the kinds of enterprises (SOEs, POEs, SMEs, and emerging Chinese MNCs) that are the engines of the ecosystem and, second, the main institutions and facilitators that can support them.

State-Owned Enterprises

Here the vexed and ongoing debate about the role, strengths, and weaknesses of the SOEs is of great importance because of the size, number, and positioning of these enterprises in the Chinese economy. This is not the place to delve into the important considerations and debates involved. However, from an innovation and innovation ecosystems perspective, a key set of questions deals with the ways in which innovation currently happens, and in some cases fails to happen, in SOEs in different parts of the economy.

My own view, in brief, is that it is not state ownership per se that constrains innovation in China’s SOEs. There are too many examples of large companies that have grown to become globally competitive under state ownership – including the cases of Pohang Steel in Korea, Embraer aircraft in Brazil, and national rail companies in countries like Japan, France, and Germany – for state-ownership in itself to pose a problem. Of far greater importance is a combination of the external environment of SOEs – in particular the extent to which they face fiercely competitive rivals and their symbiotic positioning in dynamic GIEs – and their internal organisation, especially their incentive structures and the ways in which they design and manage their innovation processes. The successful performance of some of the spin-out companies from Chinese research institutes (such as the Institute of Computer Technology of the Chinese Academy of Science) that were in effect state owned but, crucially, not state managed but independently managed by incentivised managers, suggests that under the right conditions such enterprises can rapidly become globally competitive. Legend Computer, now Lenovo, which emerged from the Institute of Computer Technology, is a shining example.

However, a key issue, in addition to a strongly competitive environment, is SOEs’ soft budget constraint provided by state-led financial support for enterprises that run into trouble and are deemed by policymakers to be too important to fail. (The bailout of Western banks in the wake of the global financial crisis, however, has taught us that this problem is not confined to China.) There is little that concentrates the innovative mind in enterprises so much as a threatening external environment coupled with a hard budget constraint.

These kinds of issues need to be examined, with detailed empirical evidence, in order to decide what needs to be done to make SOEs more innovative and globally competitive. This requires a large study programme.

Privately Owned Enterprises

Huge strides have been made by China’s POEs with a few truly outstanding innovative and globally competitive companies such as Huawei, Lenovo, and Haier leading the pack. The lessons that are to be learned by other Chinese companies from the experiences, learning, and innovation processes of these leaders are extremely important. But these leading companies are still only the tip of the iceberg and their total number is not great.

A key issue, as discussed earlier in this chapter, is how more Chinese POEs can become globally competitive. This involves making sure that they do not become totally seduced by the attractions of the Chinese market but that they simultaneously use this market as a springboard for a range of innovation-related involvements outside China, especially in key global markets. One way of doing this, à la Korea and Taiwan, is by incentivising not exports per se but the broader innovation process of learning by exporting, which is very different from simply selling goods and services abroad, involving as it does innovation employees in the company and not only sales and marketing people. Another key way is by encouraging the development of company-level global innovation ecosystems (discussed in more detail below). China needs to avoid the pitfalls of the Japanese Paradox discussed earlier.

Research Institutes

Key questions with which Chinese policymakers have long been grappling relate to the transformation of research institutes (such as universities, Chinese Academy of Sciences institutes, and ministry and other government-funded research institutes). Again, there is insufficient space here to delve into the major issues and so I will confine myself to only a few points.

The main point is the importance, referred to earlier, of generating variety of research in Chinese GIEs. The policy implication of this requirement is that as far as feasible there should be multiple sources available for the funding of research. This will encourage different approaches, priorities, and objectives of research. Often it will be sensible to separate policy-making and implementation from research. One way of achieving this is to have research funds allocated by peer-researchers to competing funding applicants. This is particularly useful in the funding of basic research, which tends to be underrepresented in company research. Attention also needs to be given to the research selection procedure to ensure that both quality and variety are objectives. Opening Chinese research programmes to global participation is one important way of giving GIEs the international exposure that they need, and another is the engagement of Chinese researchers in overseas research programmes.

The desirable connections that should be created between nonenterprise research organisations and Chinese and foreign enterprises is another important issue. This has been briefly touched on earlier in the discussion of universities, but far more needs to be said, which, unfortunately, cannot be discussed here.

Sector-Level Global Innovation Ecosystems

A good deal of the attention of Chinese policymakers concerned with innovation should be paid to identifying and analysing sector GIEs. However, as far as I am aware, official Chinese documents make little or no reference to sector GIEs.

The reason why the sector is a crucial unit of analysis is that the dynamics of innovation and the role of institutions as facilitators and frustrators of innovation differ fundamentally by sector. Furthermore, countries are globally competitive in only some sectors; none is or can be competitive in all.

For example, the ICT, bio-medical, financial services, automobile, and alternative energy sectors, conceived of in terms of GIEs, are fundamentally different and work in different ways. The players in each sector are different, as are the institutions, facilitators and frustrators, and science and technology bases supporting them. Accordingly, policies that make sense in one sector may not work in another. It is therefore essential to differentiate science, technology, and innovation policy by sector. Taking these points on board it is significant that at the end of 2012 the British government (specifically the Department of Business, Innovation and Skills) declared that it would be focusing more attention on sectors in its policies.Footnote 15

The first thing that Chinese policymakers should do is make the strategic choice regarding which sectors should be prioritised. The selection of sectors, in addition to obvious political and security considerations, should also take into account that China should not, and indeed cannot, try to become globally competitive in all sectors. Accordingly, account must be taken of the international division of labour, and the sectors in which China already is, or may become, globally competitive, in sector selection.

A detailed analysis of the GIE in each sector then needs to be developed in order to understand the components of the sector ecosystem, how it works, and its strengths and weaknesses. This requires the creation of an evidence database for each sector that will provide the information to aid the analysis of each sector GIE in order to deal with the questions and issues raised in this chapter. The database also must provide the information that will be used to judge the performance of the GIE and its major players.

The final step is the policy-making process. Here, in view of the complexity of GIEs and the omnipresence of uncertainty already discussed, it is suggested that policy be conceived of as a process, rather than as a static instrument such as a plan. The process might involve the preparation of an initial report on the sector GIE, identifying the main players (and in particular the main enterprises involved by name), the key institutions, facilitators and frustrators, and various performance indicators. The strengths and weaknesses of the GIE should be clearly identified. Finally, possible policy measures should be suggested.

This report should be used not as a final statement of government policy but as an open-ended iterative process that is aimed at encouraging discussion and debate by the players in the GIE and by relatively independent analysts such as academics and journalists. (In making this suggestion it is also necessary to acknowledge and accept that all GIEs also contain vested interests and conflicts between players that should be expected and should be viewed as part of the political economy of the modus operandi of GIEs. As far as possible these vested interests and conflicts should be made explicit rather than hidden and therefore subject possibly to sensible policies. Since these issues are often very sensitive and difficult for government politicians and bureaucrats to handle, it may be that relatively independent analysts such as academics and journalists could play this role.)

Based on the representations and comments received, the report should regularly be updated. This process will allow the evolution of the GIE to be encouraged and policy adapted to changing circumstances.

It is worth noting here another key market failure that justifies an important role for the state. The point simply is that the players in any GIE are not able to analyse objectively and critically the innovation ecosystem as a whole, and its performance, of which they are a part. To begin with, individual players lack the necessary information. But, more importantly, they are and must inevitably be self-interested players with vested interests who accordingly cannot be expected to articulate and evaluate the ecosystem as a whole.

This leads me to the next suggestion. This is that whichever agency of the Chinese state is given responsibility for the analysis and policy of the selected sector GIEs, it is necessary for Sector GIE Teams to be set up. The role of these teams is to develop an in-depth understanding of the sector, how it works, and its strengths and weaknesses and to take overall responsibility for doing so. The members of these teams will be able over time to develop expert understanding of ‘their’ sectors and will also be able to develop networks, both within China and globally, to include people and organisations with an analytical interest in the sector as a whole or some of its key parts.

But there is a further complication that affects all countries. This is that the organs of government are themselves fragmented so that it is difficult for any one organ to analyse a sector GIE as a whole. Typically, for example, the areas of enterprise, science and technology, finance, education and universities, and international trade are the responsibility of different ministries and bodies. This raises an important question: Who should be responsible in government for the governance (including analysis and policy) of sector GIEs; i.e. where in government should this function be located? (In the Chinese case it may be that the Development Research Center of the State Council is well placed to play this role because of its supra-positioning vis-à-vis ministries and other government bodies. Another candidate would be the National Development and Reform Commission.)

Example of a Sector GIE

[The original report to the Chinese government included my study of the ICT ecosystem as an example of a sector GIE. Since this topic is the theme of Chapter 4 of the present book it has been omitted here.]

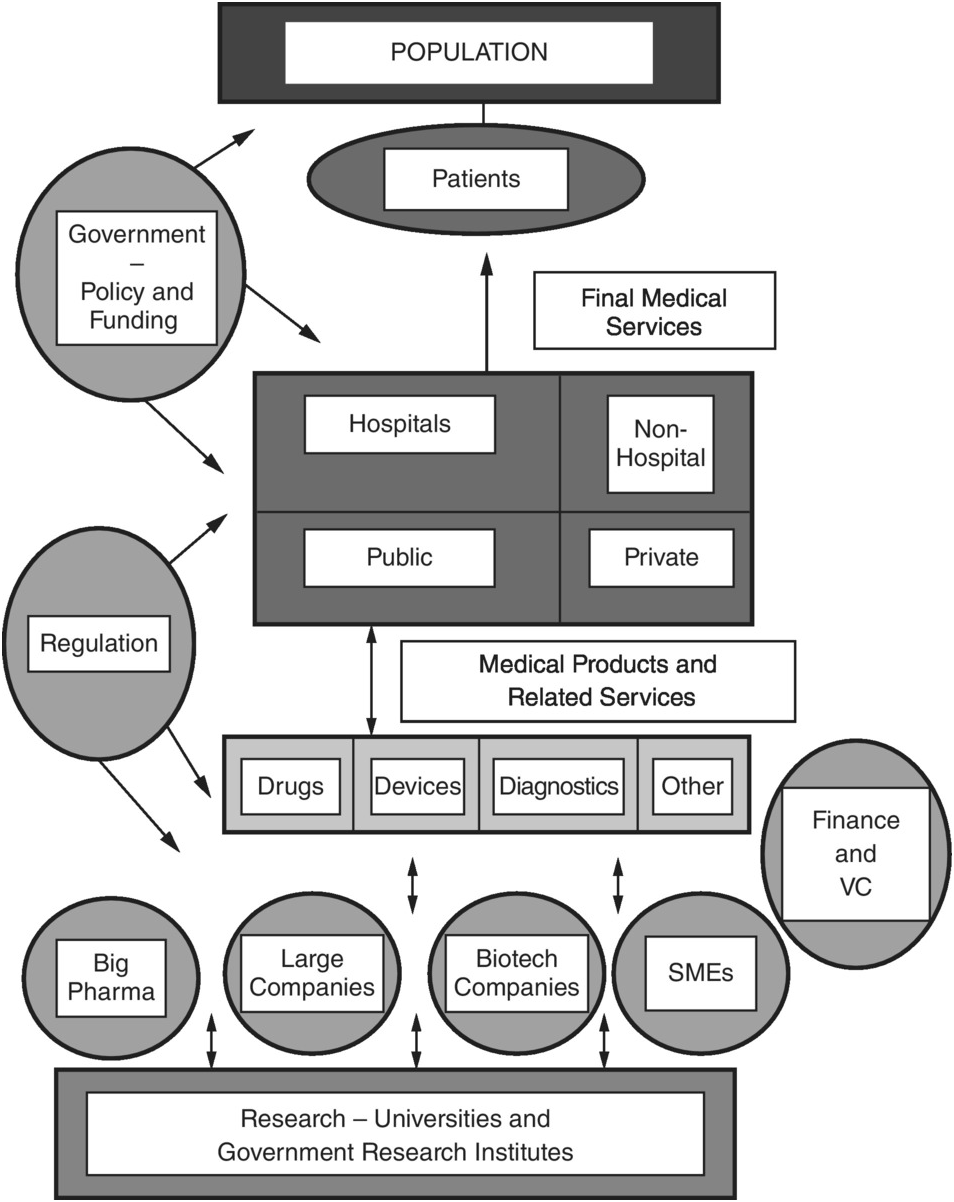

The Bio-Medical Global Innovation Ecosystem

An example of a sector innovation ecosystem is the Bio-Medical Global Innovation Ecosystem, a simplified diagram of which is shown in Exhibit 9.2. This diagram shows the Bio-Medical Innovation Ecosystem and comes from research I am currently doing on connecting the British and Chinese Bio-Medical Innovation Ecosystems. It shows the main players in the ecosystem who jointly create value for the customer-users of the ecosystem.

Exhibit 9.2 The Bio-Medical Global Innovation Ecosystem

The first group of players are the companies, divided here into big pharmaceutical companies, other large companies, specialist biotechnology companies, and small- and medium-sized companies (e.g. contract research organisations). It is these companies that produce the main medical products and related services that are used by the health system. These medical products and services may be divided into drugs, medical devices, diagnostics, and other products and services. The health system and its various players (doctors, nurses, medical technicians, support staff, etc.) use these products and services in order to provide health services. Supporting these players are researchers in universities, government research institutes (such as the National Institutes of Health in the United States and the Chinese Academy of Sciences in China) and the R&D laboratories of companies. But this research needs to be funded. The players who provide some of this funding are shown in the grey circle on the right.

Specialised institutions (that define both formal and informal rules of the game) play a key role in this innovation ecosystem. Examples are the regulations that govern clinical trials necessary for the introduction of new drugs and devices, practices that deal for instance with the rules that will be used in deciding who should get particularly expensive drugs, and ethical considerations that determine what medical staff should and should not do.

Government policymakers also play a key role, for example, deciding what share of national resource should be allocated to health and what kinds of organisations and practices are needed for the delivery of health services.

A particularly important, but extremely complicated, question is how well the health system is performing, both absolutely and relative to other systems both nationally and globally. As we know, a great deal of sensitivity attaches to different performance measures, which affect different agents in different ways and which therefore have significant political consequences. A detailed discussion is essential in order to decide what performance measures should be adopted to judge the performance of any particular Bio-Medical Innovation Ecosystem.

But is any value provided by analysing the bio-medical sector in this way? My answer is that value is added as a result of the use of the system concept, which identifies the key players and highlights interdependencies, bottlenecks, and opportunities for improving the performance of the ecosystem. A good example is the detailed strategic analysis of the Life Sciences Ecosystem produced by the British Department of Business, Innovation and Skills pointed to earlier.Footnote 16 Interested readers are invited to read this document in order to form their own opinions on this question.

Regional-Level Global Innovation Ecosystems

As we know very well, economic activity is not spread evenly in geographical terms but tends to cluster in specific locations. The iconic example is Silicon Valley in California. These ‘industrial districts’ where complementary companies cluster, and where innovation is, in the words of nineteenth-century Cambridge economist Alfred Marshall, ‘in the atmosphere’, have long been a focus of attention for economists. There is a huge and growing literature on the analysis and policy of so-called clusters and much is to be learned from the experiences documented. It remains the case, however, that contrary to the hopes and aspirations of regional policymakers in virtually all countries of the world, there are no ‘Silicon Valleys’ outside the real Silicon Valley, including in the United States. Having said this, a good deal of progress can be made through a combination of the right kind of companies collocated in an appropriate area, the right kind of facilitators, and the right kind of policies.

China may not be able to grow its own Silicon Valley, but if any country is to have a good shot at trying to do so, it is China. The reason, simply, is China’s absolute size; its absolute and relative GDP growth rate; its rapidly increasing supply of skilled person-power; its fast-growing science, technology, and innovation capabilities and related institutions; the physical presence in China of some of the world’s most talented players; and the gradual emergence in China of globally competitive Chinese companies, whether SOEs, POEs, SMEs, or Chinese MNCs.

China’s three main Regional Global Innovation Ecosystems are in the greater areas of Beijing, Guangdong (including Shenzhen and Hong Kong), and Shanghai, although other regions are also trying to compete. As with any GIE if the most is to be made of the systemic interdependencies that exist among the components of the innovation ecosystem, it will be necessary for a single agency to have responsibility for its analysis and policy. This suggests that, as in the case of sector GIEs, it is necessary to establish (if they do not already exist) region-specific Regional GIE Teams. Presumably, these should be based in the regions concerned to facilitate their communication with the players in the regional GIE, rather than being centralised in Beijing.

However, it is important that there is a degree of coordination and information-sharing between those with overall responsibility for the development of national, sector, and regional GIEs because of the interactions and interdependencies that exist between them. For example, any regional GIE is bound to have representation from more than one sector, suggesting that there will be issues at the sector level that will also have implications at the regional level. Similarly, sector and regional GIEs will be heavily influenced by national institutions and policies. I see this coordination and information-sharing being realised through cooperation between the GIE teams that have responsibility for analysis and policy formulation at the national, sector, regional, and societal challenge levels.

Company-Level Global Innovation Ecosystems

Not to be neglected are company-level GIEs, although the overall design, organisation, and management of these should be left to the focal companies themselves to undertake even though government may be able to provide support in various ways. A greater interest in company-level GIEs is a result of the increasing division of labour, both within companies and between them. This was foreseen long ago by Alfred Marshall, who stressed that ‘organisation aids knowledge [creation]; it has many forms, e.g. that of a single business, that of various businesses in the same trade, that of various trades relatively to one another, and that of the State providing security for all and help for many’.Footnote 17

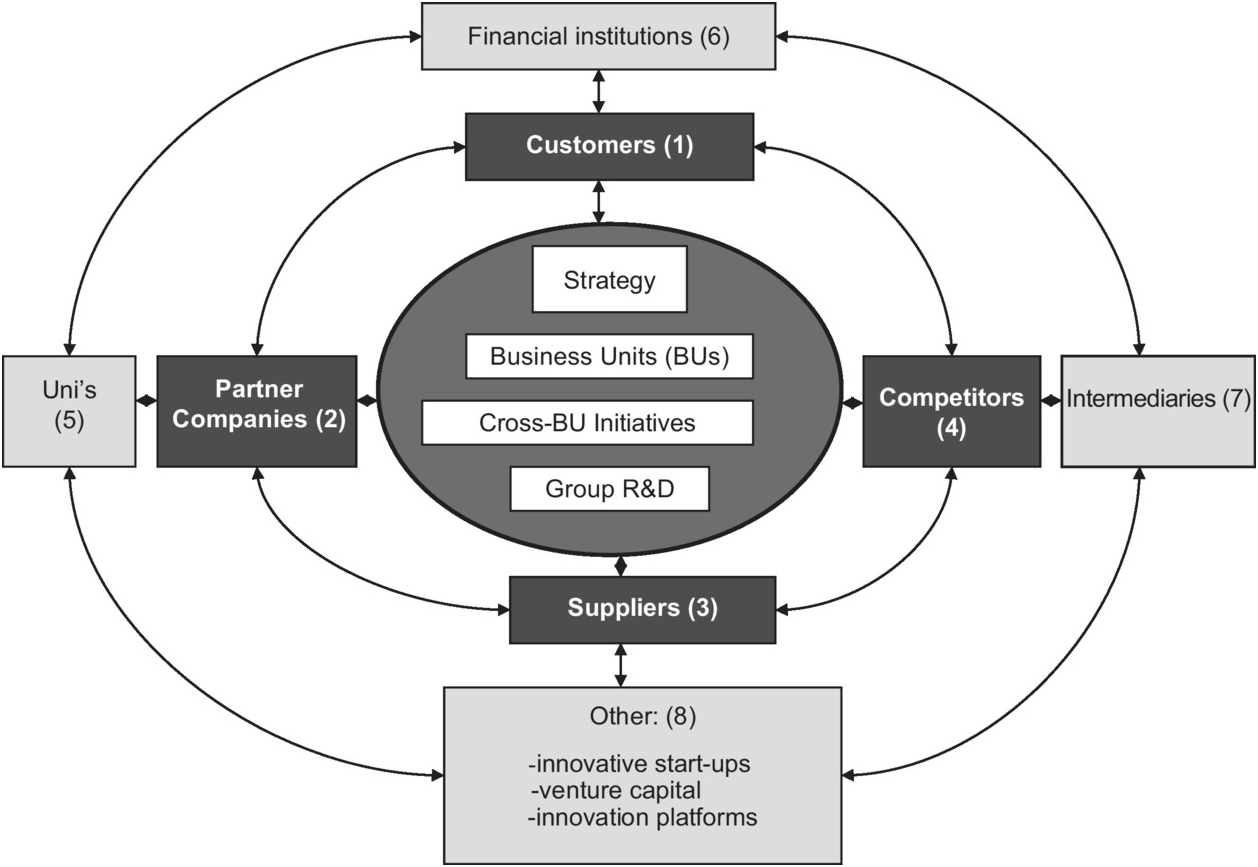

Indeed, from an innovation perspective it does not make sense to see a single firm as the appropriate unit of analysis. Firms are always embedded in a dense web of other firms and organisations. The knowledge that they acquire over time is always a function not only of their own internal knowledge-creating activities but also of knowledge acquired from their interactions with other firms and organisations. This is shown in Exhibit 9.3.

Exhibit 9.3 A Generic Company-Level Global Innovation Ecosystem (GIE)

Exhibit 9.3 comes from my own research on the evolution and design of company-level GIEs. It shows a number of symbiotic innovation relationships between the focal firm (shown in the centre) and the other players in its web beginning with four prime co-innovating groups of players, namely customers, suppliers, partners, and competitors. The diagram goes on to show a wider circle of other players with whom focal firms often also establish symbiotic innovation relationships. The focal firm itself is not homogeneous. Intrafirm players, involved closely in the firm’s innovation processes, include players in the areas of corporate strategy, researchers in research laboratories, developers in business units, and people in marketing and sales (the latter are not shown in the diagram).

In the diagram the focal firm is involved in external symbiotic innovation relationships with a total of eight groups of external players. In constructing, organising, and managing a global innovation ecosystem, the challenge that the firm faces lies in designing these symbiotic relationships so that all the players in the innovation ecosystem are incentivised and therefore motivated to jointly create value through innovation, value that will significantly benefit the focal firm and its customer-users.

In some cases, the focal firm’s symbiotic relationships with other players are structured by its innovation platforms around which the firm constructs its global innovation ecosystem. An innovation platform is something – e.g. a product, technology, or software – that serves as a foundation for complementary value-adding activities by other players. Good examples are the innovation platforms of Apple, Android/Google, and Samsung in the area of smartphones. There is a large literature on innovation platforms but unfortunately there is not enough space here to discuss it.

Research on company innovation ecosystems is revealing that the traditional model of company R&D is becoming obsolete, and, as a result, companies are experimenting with new innovative forms of organisation as they seek to more effectively acquire and use external knowledge. According to the traditional model, there is a relatively clear distinction between research and development. Development, which usually accounts for the bulk of companies’ R&D expenditures, is almost always located in the company’s business units. However, research is located in separate laboratories. The aim of these laboratories is twofold: first, to do exploratory research aimed at developing new and improved products/services and technologies for ‘tomorrow’ and, second, to respond to requests from the business units for assistance in making incremental improvements to ‘today’s’ technologies and products/services.

However, under the influence both of ‘open innovation’ thinking and the incentives provided by the greater creation of relevant knowledge externally, companies are increasingly realising that the research and knowledge that they need do not necessarily have to be produced by themselves. It can be done by outside players.

This much is obvious and well known. Less well known and well tested, however, are answers to questions such as: Who in the company should play the External Knowledge Search role? Where in the company’s internal division of labour should these External Knowledge Seekers be located and where globally? How should they be doing their jobs? How should they design the new external-knowledge-acquiring symbiotic relationships that they are forging with different kinds of external players in different parts of the world? And, finally, how should they be organising and managing their increasingly complex Global Innovation Ecosystem as a whole?Footnote 18

Clear answers have not yet emerged to these kinds of complex questions. As a result, companies are still searching and experimenting with possible answers. There is much learning still to take place, both within and between companies. The implications are enormous for the attempt to grow increasingly globally competitive Chinese companies, whether SOEs, POEs, SMEs, or Chinese MNCs.

Societal-Challenge Global Innovation Ecosystems

The idea of Global Innovation Ecosystems is also useful in the area of societal challenges in fields such as health and the environment.Footnote 19 It can provide a governance and organisational framework for activities intended to meet the challenges. Several steps are needed in order to establish such GIEs (although the ordering of these steps can be altered).

To begin with and having selected a societal challenge, it is necessary to establish a Societal-Challenge GIE Team that will be given responsibility for establishing, coordinating, and monitoring the GIE that will generate the innovations needed to meet the challenge. As discussed earlier, the decision will also have to be made regarding where in the government structure the team should be located.

The next step is for the team to specify in detail two issues. The first is the nature of the societal challenge and the detailed objectives that are to be achieved. The second related issue is the specification of the performance criteria that are to be used in evaluating the success of the GIE. The clarification of these two issues will allow the players in the GIE to be clear about what they are trying to achieve and how their performance will be evaluated.

The third step is to decide who should be invited to become major players in the GIE. Since companies will be the engine of the GIE, they will have to be immediately identified. In some societal challenge areas, foreign MNCs will be potentially important players. However, as discussed earlier, careful thought will also have to be given to the question of which Chinese companies (SOEs, POEs, SMEs, and emerging Chinese MNCs) should also be included in order to facilitate their development and growth. In selecting companies, an important question, obviously, relates to the innovations that will be required to meet the challenge and, correspondingly, the innovation capabilities possessed by potential corporate players.

An important consideration that must constantly be kept in mind – one that is stressed in the designation of this organisation as a global innovation ecosystem – is that it is necessary to have an understanding of good activities and practices in this area in other parts of the world so as to learn from them and perhaps emulate some of their methods and activities. The monitoring of relevant activities and practices elsewhere is a key task that will have to be performed by the GIE team.

Fourth, it will be necessary to decide which other players, apart from the companies, should be included in the GIE. Examples are universities; other research institutions; financers; intermediaries such as lawyers, accountants, and consultants; and regulators. It will be necessary to give careful thought to the role that these players are expected to play and how they may be incentivised to play this role. This is a difficult issue since effective cooperation between the players in the GIE cannot be taken for granted.

Fifth, an analysis will have to be undertaken by the team of the facilitators that will be required and the frustrators that may inhibit the achievement of the GIE’s goals. A key question here is whether steps can be taken to strengthen the facilitating factors and to weaken the frustrating factors. Government policymakers and regulators may have to be included in order to do so.

Once all this has been done and the GIE has been successfully established, it will be necessary for the team to ‘embed’ itself amongst the players by establishing organic connections with them (e.g. formal and informal methods of listening to and working with players and sharing information and concerns with them regarding how the goals may be achieved and effectiveness increased). In addition, the team will also have to measure and monitor performance and provide the results to all the players. It is also desirable that the team network with best-practice similar projects in other parts of the world so that mutual learning can take place. This is an area where innovative solutions can play an important role (e.g. the creation of information-sharing and interactive websites). Independent players should also be involved in these activities such as academics and high-level analysts and journalists who could make an important contribution.

Inevitably, there will be many problems and pitfalls that will arise in taking these steps. Coordinating and motivating independent players and creating the right set of facilitating (rather than frustrating) conditions is no easy task. But this is not to say that important progress cannot be made, particularly when careful attention is paid to the design of the GIE and the incentives and motivation engendered by this design. Openness, transparency, and honesty regarding what is being achieved and, even more importantly, what is failing to be achieved will also be a crucial ingredient of the design.

An Important Requirement for All Kinds of GIEs: Embeddedness and Coordination Rather than Command and Control