At corporations where ownership and control are separated from each other, agency problems occur because chief executive officers (CEOs) tend to make decisions that primarily serve their own interests at the expense of shareholders (Eisenhardt, Reference Eisenhardt1989; Fama & Jensen, Reference Fama and Jensen1983). In order to minimize these agency problems, shareholders rely on internal governance mechanisms (e.g., incentive pay and board of directors) or external governance mechanisms (e.g., M&A markets and CEO labor markets) (Fama, Reference Fama1980; Walsh & Seward, Reference Walsh and Seward1990).

While governance researchers have paid a great deal of attention to the role of internal governance mechanisms in reducing agency problems (Bloom & Milkovich, Reference Bloom and Milkovich1998; Chakraborty, Sheikh, & Subramanian, Reference Chakraborty, Sheikh and Subramanian2007; Larraza-Kintana, Wiseman, Gomez-Mejia, & Welbourne, Reference Larraza-Kintana, Wiseman, Gomez-Mejia and Welbourne2007; Walsh & Seward, Reference Walsh and Seward1990), studies on the role of external governance mechanisms, particularly studies on the role of external CEO labor markets (henceforth, ‘CEO labor markets’) have been scantFootnote 1. The lack of research on this topic is rather surprising in that agency theorists have long argued that the CEO labor market has a great potential to be a powerful governance mechanism. Fama (Reference Fama1980), for instance, argued that if the CEO labor market functions efficiently, CEOs’ self-interest-seeking behaviors will be effectively disciplined because the efficient CEO labor market would increase the sensitivity of CEOs’ employment to their performance.

One reason for the lack of research on the role of CEO labor market is that the CEO labor market has been assumed to be inefficient (Ang, Lauterbach, & Vu, Reference Ang, Lauterbach and Vu2003; Finkelstein, Hambrick, & Cannella, Reference Finkelstein, Hambrick and Cannella2009; Khurana, Reference Khurana2002a, Reference Khurana2002b; Zhang, Reference Zhang2008). First, firms were posited to have difficulty in finding a suitable candidate from the CEO labor market because talented individuals are in short supply in the market (Howard, Reference Howard, Zaccaro and Klimoski2001). Second, firms seeking to hire an external CEO might run a great risk due to high risk and low legitimacy associated with infrequent external CEO successions in the market. These two CEO labor market conditions – short supply of external CEO candidates and infrequent external CEO succession in the market – were believed to make the market inefficient and discouraged firms from hiring external CEOs. As such, firms tended to select their new CEO primarily from within the firm as opposed to outside the firm (Ocasio, Reference Ocasio1999).

The number of externally hired CEOs, however, has been increasing (Ocasio, Reference Ocasio1999; Zhang & Rajagopalan, Reference Zhang and Rajagopalan2003). Murphy and Zabojnik (Reference Murphy and Zabojnik2004), for example, found that while outside hires accounted for 15 and 17% of all CEO replacements in the 1970s and the 1980s, respectively, in the 1990s, 26.5% of new CEO openings were filled through external hires. Similarly, Khurana (Reference Khurana2002a, p. 242) argued that ‘at least one-third of all CEO successions in large, publicly-held corporations are outsider successions.’ With the increasing mobility of top executives across firms, the potential of CEO labor markets to be an effective external force has been also on the rise.

In this study, we attempt to examine whether the CEO labor market can effectively discipline CEO behaviors. Specifically, we investigate if CEOs in high-tech industries increase R&D investment when CEO labor market becomes more efficient. Governance researchers have long argued that the level of firm investment in R&D signifies the degree of managerial risk taking that is fundamental to the calculus of agency problem. CEOs who are assumed to be risk-averse have a strong incentive to reduce R&D investment, while shareholders desire their CEO to increase R&D investment (Baysinger & Hoskisson, Reference Baysinger and Hoskisson1989; Hoskisson, Hitt, & Hill, Reference Hoskisson, Hitt and Hill1993; Miller & Bromiley, Reference Miller and Bromiley1990; Sanders & Hambrick, Reference Sanders and Hambrick2007; Wiseman & Gomez-Mejia, Reference Wiseman and Gomez-Mejia1998). The cost of sub-optimal investment in R&D will be highest in high-technology firms because, in the high-technology industries, reduction in R&D investment will damage the firm's long-term competitiveness. If CEOs at high-technology firms reduce R&D investment, firms will soon fall behind the competition and struggle to survive (Balkin, Markman, & Gomez-Mejia, Reference Balkin, Markman and Gomez-Mejia2000). CEOs in high-technology firms are thus required to maintain a high level of R&D investment for continuous innovation. When CEOs in high-technology firms avoid high-risk/high-return investments, shareholders should devise internal governance mechanisms capable of discouraging such behaviors (Balkin, Markman, & Gomez-Mejia, Reference Balkin, Markman and Gomez-Mejia2000; Makri, Lane, & Gomez-Mejia, Reference Makri, Lane and Gomez-Mejia2006; Siegel & Hambrick, Reference Siegel and Hambrick2005). For instance, boards at high-technology firms design CEO pay in such a way so as to promote CEOs’ innovative behaviors (Balkin, Markman, & Gomez-Mejia, Reference Balkin, Markman and Gomez-Mejia2000; Makri, Lane, & Gomez-Mejia, Reference Makri, Lane and Gomez-Mejia2006).

To examine the role that the CEO labor market plays in firm's R&D investment in high-technology industries, we focus on two CEO labor market conditions. First, we investigate whether the supply condition in CEO labor markets affects CEO's decisions regarding investment in R&D in high-technology firms. Second, we examine whether the rate of external CEO succession in the market affects CEO's R&D investment decision at individual firms. We further investigate whether there is a complementary effect between these two CEO labor market conditions.

Theory and hypotheses

R&D investment in high-tech industries

According to agency theory, CEOs are hired professional managers who are responsible for maximizing shareholder value; however, CEOs, unlike shareholders who can diversify their investment risk in securities markets cannot diversify their risks regarding their employment and income (Morck, Shleifer, & Vishny, Reference Morck, Shleifer and Vishny1989). Accordingly, CEOs are assumed to be risk-averse. In particular, prior studies argue that CEOs tend to avoid R&D investments because R&D investments entail high uncertainty and long-term horizons and, thus, high risk (Rosenberg, Reference Rosenberg, Landau, Taylor and Wright1996). Moreover, although R&D investment requires substantial levels of continuous effort from CEOs, it only pays off in the long term (Makri, Lane, & Gomez-Mejia, Reference Makri, Lane and Gomez-Mejia2006). For these reasons, governance researchers argue that opportunistic CEOs tend to invest less in R&D unless their behaviors are effectively controlled by governance mechanisms (Baysinger & Hoskisson, Reference Baysinger and Hoskisson1989; Fong, Reference Fong2010; Hoskisson, Hitt, & Hill, Reference Hoskisson, Hitt and Hill1993; Miller & Bromiley, Reference Miller and Bromiley1990; Sanders & Hambrick, Reference Sanders and Hambrick2007).

Although reduction in R&D investment may constitute agency problems, however, not all firms would require their CEO to maintain R&D investment to the same degree. For example, CEOs at firms in high-tech industries are required to invest more in R&D activities than those in low-tech industries because intensive R&D investment for innovation is more essential to firms’ competitiveness and survival in high-tech than in low-tech industries (Balkin, Markman, & Gomez-Mejia, Reference Balkin, Markman and Gomez-Mejia2000; Hill & Snell, Reference Hill and Snell1988). A high-technology firm ‘invests significantly in R&D, is heavily dependent on new product formulations and designs, and is focused on achieving research-based breakthroughs’ (Siegel & Hambrick, Reference Siegel and Hambrick2005, p. 260). Thus, CEOs’ opportunistic behavior to reduce R&D investment is more problematic in high-tech than in low-tech industries. To capture this concern, we limit our focus to firms in high-tech industries where reduction in R&D investment by opportunistic CEOs may harm the competitiveness of the firm and, thus, shareholder values.

CEO labor market as an external governance mechanism

According to Fama (Reference Fama1980), an efficient CEO labor market has the potential to be an important governance mechanism because CEOs become more vulnerable to the disciplining force of CEO labor markets as the markets become more efficient. In an efficient CEO labor market, CEOs’ performance is continuously evaluated and the updated information on CEO performance would result in changes in their employment contract or pay contract. Thus, CEOs bear a greater risk regarding firm performance if they compete in a more efficient CEO labor market than in less efficient one. CEOs who make decisions that do not help to enhance firm performance are more likely to be replaced by external CEO candidates if CEO labor market functions efficiently.

Governance researchers, however, argued that CEO labor markets may not properly function as an effective governance mechanism because of the supply inelasticity of the market's talented individuals who are capable of running large firms (Crystal, Reference Crystal1991; Khurana, Reference Khurana2002b). In addition to the short supply of potential candidates for CEO positions, information about these potential candidates is not readily available for firms that plan to replace their CEO, a situation that makes firms reluctant to consider external CEO succession (Ang, Lauterbach, & Vu, Reference Ang, Lauterbach and Vu2003; Khurana, Reference Khurana2002a, Reference Khurana2002b).

Khurana (Reference Khurana2002a, Reference Khurana2002b) conducted extensive research on the role played by executive search firms in CEO labor markets. He argued that the ‘CEO labor market is not a market in the ordinary sense. It is not even like the market for other executive positions’ (Khurana, Reference Khurana2002b, p. 27). He further claimed that the efficiency of the CEO labor market suffers from three unique features of the market – that is, the small numbers of buyers and sellers, high risk to participants, and concerns about legitimacy. First, there are relatively few buyers (i.e., firms seeking to hire a new CEO) and sellers (i.e., potential CEO candidates) in CEO labor markets, and buyers and sellers both lack a sufficient range of information regarding the opportunities that exist in the market. As such, transactions (i.e., external CEO succession) are discouraged. Second, both buyers and sellers in CEO labor markets bear substantial risks in participating in market transactions. The hiring firms, facing information asymmetry, are likely to make poor CEO succession decision (i.e., adverse selection) that is followed by frequent dismissal of newly appointed CEOs (Zhang, Reference Zhang2008). Candidates also run a great risk in participating in the market because most external CEO candidates are already employed and thus do not want their employing firm to know that they have any intention to leave. During the search process, therefore, both buyers and sellers in CEO labor markets want to maintain extreme confidentiality, which makes it more difficult for the two parties to obtain necessary information and to actively participate in market transactions. Third, both buyers and sellers in CEO labor markets have concerns about the legitimacy of the market. In a market that lacks legitimacy, buyers and sellers hesitate to participate in the market, whereas buyers and sellers tend to openly engage in transactions in a legitimate market. In sum, Khurana (Reference Khurana2002a, Reference Khurana2002b) suggested that a CEO labor market is inefficient because of (1) the short supply of external CEO candidates and (2) high risk and low legitimacy associated with infrequent external CEO successions.

We, however, argue that not all CEO labor markets will be equally inefficient. CEO labor market conditions will vary substantially across industries. Zhang and Rajagopalan (Reference Zhang and Rajagopalan2003, p. 329) supports this view of CEO labor market by arguing that ‘supply and demand factors should be specific to a (CEO labor) market and hence, different managerial labor markets should reflect different supply and demand conditions.’ Similarly, managerial discretion literature argues that a CEO's degree of discretion (i.e., latitude of action) will vary by industries and thus most CEO-related factors will also differ across industries (Finkelstein & Hambrick, Reference Finkelstein and Hambrick1990; Haleblian & Finkelstein, Reference Haleblian and Finkelstein1993; Hambrick & Abrahamson, Reference Hambrick and Abrahamson1995; Hambrick & Finkelstein, Reference Hambrick, Finkelstein, Cummings and Staw1987). In high-discretion industries, for example, CEOs can make greater impact on firm performance and therefore they receive a higher amount of compensation and higher incentive pay than CEOs in low-discretion industries. Although, because CEOs take greater responsibilities for firm performance in high-discretion industries, involuntary CEO turnover will be more frequent (i.e., higher employment risk for CEOs) and board of directors will make greater efforts to find the best CEO candidate, often from outside the firm (Hambrick & Finkelstein, Reference Hambrick, Finkelstein, Cummings and Staw1987). These interindustry differences will make CEO labor markets heterogeneous rather than homogeneous. In a more attractive CEO labor market with high managerial discretion (Hambrick, Reference Hambrick, Smith and Hitt2005), there will be a larger pool of talented individuals who compete for CEO positions, increasing the efficiency of the market.

CEO labor market supply

According to Khurana (Reference Khurana2002a, Reference Khurana2002b), CEO labor markets will become more efficient in exerting disciplining pressure on individual CEOs as the supply side of the market grows because firms will have a larger number of external CEO candidates in a well-supplied CEO labor market than in a short-supplied one.

Firms with a large pool of external CEO candidates do not need to retain their CEO when the CEO's performance falls short of the firm's expectations because these firms can find many alternative candidates available in the CEO labor market. Increases in the CEO labor market supply will, therefore, strengthen the likelihood that firms will make timely decisions regarding CEO replacement (Fredrickson, Hambrick, & Baumrin, Reference Fredrickson, Hambrick and Baumrin1988; Ungson & Steers, Reference Ungson and Steers1984). Extant studies find evidence that the size of the external CEO candidate pool is positively associated with the likelihood of external CEO succession (Zhang & Rajagopalan, Reference Zhang and Rajagopalan2003).

As such, if a CEO in a high-technology firm does not sufficiently invest in R&D activities the CEO is more likely to be replaced when the firm has a large supply of external CEO candidates than when it has a small supply of external CEO candidates. In the former context, firms can more easily find an external CEO candidate who is willing to take as much risk as shareholders desire than in the latter context (Pfeffer & Moore, Reference Pfeffer and Moore1980). In sum, the larger the potential pool of the external CEO candidates, the stronger the disciplining force of the CEO labor market will be. In this circumstance, CEOs will perceive their position as less secure and thus will be disciplined to increase R&D investment. Thus, we hypothesize as follows:

Hypothesis 1: The level of CEO labor market supply will be positively associated with a firm's investments in R&D.

External CEO succession rate

Khurana (Reference Khurana2002a, Reference Khurana2002b) also suggested that CEO labor markets will become more efficient as more firms hire their new CEO from the CEO labor market. If there is a strong market-level tendency to consider internal CEO candidates over external ones, high risk and low legitimacy problems will persist. Hence, individual firms will hesitate to hire their new CEO from the external CEO labor market. As a result, the CEO labor market is not likely to function as an effective governance mechanism. In contrast, if the number of firms in the market that hire external CEO increases, it will help reduce the high risk and low legitimacy problems associated with external CEO succession.

First, if more firms in the market hire their CEO from the external CEO labor markets, external CEO succession will become more legitimated in the market and thus firms will face less risk in selecting an external CEO. Ocasio (Reference Ocasio1999) argued that boards’ CEO succession decisions follow institutionalized rules. According to Ocasio (Reference Ocasio1999, p. 391), in modern corporations, internal CEO succession was a ‘formalized procedure for executive succession.’ Firms, therefore, had shown a strong tendency to limit their attention to the internal candidates for their CEO position. In such circumstances where internal CEO succession is more legitimated, firms would run a risk when tapping into an external CEO labor market. However, as the number of firms that hire external CEO increases, external CEO succession will gain more legitimacy and firms will, therefore, exhibit an increasing tendency to hire an external CEO because they will face lower risk by adopting legitimized practices (Ahmadjian & Robinson, Reference Ahmadjian and Robinson2001; DiMaggio & Powell, Reference DiMaggio and Powell1983; Ocasio, Reference Ocasio1999). Williamson and Cable (Reference Williamson and Cable2003) found evidence that firms’ executive selection decisions are affected by inter-organizational imitation. They found that when hiring top executives, firms imitate the hiring patterns which are adopted by a large number of other firms.

Second, increasing external CEO successions will reduce information problems that firms should experience in searching for external CEO candidates. In a CEO labor market where external succession is more frequent, information agents such as executive search firms and board networks will be more active in collecting and disseminating information on executive talents (Granovetter, Reference Granovetter1985; Khurana, Reference Khurana2002b). The increasing availability of information will enable firms to make better-informed and timely decisions regarding CEO replacement, reducing the possibility of adverse selection, an inherent risk in external CEO succession. In such markets, firms will be able to replace their poorly performing CEO with an external CEO candidate with confidence.

Taken together, if the rate of external CEO succession increases in the market, this broader market-level tendency will increase the likelihood that individual firms will replace their CEO who makes inappropriate decisions such as a decrease in R&D investment in high-tech industries with external CEO candidate. Thus, we hypothesize as follows:

Hypothesis 2: The rate of external CEO succession in the CEO labor market will be positively associated with a firm's investment in R&D.

Interaction between the two CEO labor market conditions

Besides the main effects of the two CEO labor market conditions, we argue that there will be an interactive effect between the two conditions. Specifically, we argue that the disciplining force of well-supplied CEO labor markets will further increase as the rate of external CEO succession in the market increases. In such a circumstance, firms will have a large pool of external CEO candidates and also bear a low risk in actually hiring external CEO. CEOs in such markets will therefore perceive higher job insecurity and greater pressure to take investment risks by increasing R&D investment. In contrast, even when a firm has a large number of external CEO candidates, if there is a strong tendency among other firms in the market to promote internal CEO candidates rather than hire external ones, the firm cannot readily select an external CEO because it is not legitimated and thus not well accepted in the market. In this situation, the large supply of external CEO candidates will have little impact on CEOs at individual firms. Therefore, we hypothesize as follows.

Hypothesis 3: The positive relationship between the level of CEO labor market supply and a firm's investment in R&D will be stronger when the rate of external CEO succession in the CEO labor market is high than when it is low.

Method

Data and sample

We tested our hypotheses using a sample of high-technology manufacturing firms from the S&P 1500 firms in United States from 2011 to 2019. Following prior studies (Organisation for Economic Co-operation & Development (OECD), 2011; Quintana-Garcia and Elvira, Reference Quintana-Garcia and Elvira2017), we identified high-tech industries using OECD definition of high-tech industries: (1) aircraft and spacecraft, (2) pharmaceuticals, (3) office, accounting, and computer machinery, (4) radio, TV, and communications equipment, and (5) medical, precision, and optical instruments. OECD classification is appropriate for our study because it focuses on firms’ input-side activities (i.e., R&D investment) as a major criterion to classify high-tech industries. Since OECD definition of high-tech industries is based on ISIC (International Standard Industrial Classification) codes, we matched the ISIC codes with four-digit SIC codes in Compustat using the concordance table provided by the United States Office of Management Budget, Statistics Canada, and Statistical Office of the European Communities. We then identified 2,000 firm-year observations that fall within the high-tech industry category. After removing firms that did not provide proper information, our final sample consisted of 1,534 firm-year observations.

We collected data on the CEO-related variables from ExecuComp service and each company's annual reports and proxy statements, which the companies report to the Securities and Exchange Commission. If neither an annual report nor a proxy statement provided appropriate information on CEO, we used Bloomberg’ CEO profile information. Financial data were drawn from Compustat. Board structure data were taken from governance databases compiled by the Institutional Shareholder Services (ISS, formerly Risk Metrics).

Dependent variable

R&D investment

To test our hypotheses regarding CEO labor market and R&D investment, we measured R&D investment as the natural logarithm of R&D expenses. In prior corporate governance research, R&D investment has been widely used as a proxy for CEOs’ risk-taking behaviors (Baysinger & Hoskisson, Reference Baysinger and Hoskisson1989; Bushee, Reference Bushee1998; Hoskisson, Hitt, & Hill, Reference Hoskisson, Hitt and Hill1993; Lee & O'Neill, Reference Lee and O'Neill1994; Miller & Bromiley, Reference Miller and Bromiley1990). In an additional analysis not reported here, we used R&D intensity (i.e., R&D expenditures divided by total sales) to measure R&D investment. The results were identical.

Independent variables

CEO labor market supply

Following prior studies (e.g., Zhang & Rajagopalan, Reference Zhang and Rajagopalan2003), we argue that potential pool of external CEO candidates will be limited to top executives at other firms in the same industry because industries substantially differ from one another in terms of technology and environment, thereby increasing the value of industry-specific knowledge and experiences that cannot be easily transferred between firms in different industries (Castanias & Helfat, Reference Castanias and Helfat1991). Thus, intra-industry succession is less risky for both CEOs and firms than inter-industry succession, and top executives in different industries are less likely to be perceived as potential candidates (Harris & Helfat, Reference Harris and Helfat1997; Parrino, Reference Parrino1997). McCann and Hinkin (Reference McCann and Hinkin1984) analyzed executive transitions and found that most executive replacements indeed come from similar firms within the same industries as the hiring firms. Studying top executives in different industries, Palia (Reference Palia2000) also found significant pay differentials and low industry-to-industry migration, ascribing these findings to differential returns on human capital between industries.

Specifically, high-technology firms value industry-specific skills and experiences related to technology. Hence, CEOs in high-tech industries are required to have these industry-specific managerial skills and experiences to effectively maintain firms’ innovation efforts, which makes intra-industry CEO succession more preferable than inter-industry CEO succession. Prior research found that CEOs in high-technology firms tend to have different demographic characteristics from those in low-technology firms (Barker & Mueller, Reference Barker and Mueller2002; Hambrick & D'Aveni, Reference Hambrick and D'Aveni1992; Peterson et al., Reference Peterson, Walumbwa, Byron and Myrowitz2009), a finding that further suggests that high-technology firms will preferably seek CEO candidates from within the industry, not from outside the industry.

As such, we classified firms as belonging to the same CEO labor market if they share the same two-digit SIC code. Prior research found that two-digit SIC grouping better captures similarities and dissimilarities among firms than three- or four-digit SIC groupings (Clarke, Reference Clarke1989). For this reason, the two-digit SIC industry definition has been commonly used in prior studies that examine the effects of industry categorization on CEO compensation (e.g., Gibbons & Murphy, Reference Gibbons and Murphy1990; Porac, Wade, & Pollock, Reference Porac, Wade and Pollock1999) and CEO succession (e.g., Parrino, Reference Parrino1997). For example, Parrino (Reference Parrino1997) identified 977 CEO succession events at US firms between 1969 and 1989. In total, 147 new CEOs were outsiders and only 26 new CEOs were from outside the same two-digit industry who had no apparent firm or industry experiences (at the two-digit SIC level). His result suggests that firms, when considering external CEO succession, primarily search for external CEO candidates from within the same two-digit SIC industry.

Prior studies suggest that the number of firms is a good proxy for the size of external CEO candidate pool (e.g., Fredrickson, Hambrick, & Baumrin, Reference Fredrickson, Hambrick and Baumrin1988; Zhang & Rajagopalan, Reference Zhang and Rajagopalan2003). In addition, Zhang and Rajagopalan (Reference Zhang and Rajagopalan2003) argued that the actual pool of external CEO candidates is limited to top executives at similarly sized or larger firms in the industry (Zhang & Rajagopalan, Reference Zhang and Rajagopalan2003). Thus, following prior studies, we measured CEO labor market supply by counting the total number of firms whose sizes are similar or larger than the focal firm. The lowest limit on the size of the potential supplier of external CEO candidates for the focal firm was defined by the half of the focal firm's total sales. To account for skewness, we took the natural logarithm of the value.

External CEO succession rate

To examine whether a broader market-level tendency to hire external CEOs affects R&D investment at individual firms, we measured this tendency (external CEO succession rate) by using the proportion of firms in the same CEO labor market that have hired an external CEO in the past 5 years. When there had been no CEO succession event in the past 5 years, we examined the origin of the current CEO. CEOs were identified as external CEOs if their firm tenure prior to becoming a CEO was less than 2 years (Ocasio, Reference Ocasio1999; Zhang & Rajagopalan, Reference Zhang and Rajagopalan2003).

Control variables

Internal governance mechanisms

To properly examine the disciplining effect of the CEO labor market on individual CEOs, we need to control the effect of other governance mechanisms. Governance researchers have extensively examined the effectiveness of various internal governance mechanisms in reducing agency problems. Prior studies have specified CEO incentive pay and board monitoring as key elements of internal governance mechanisms (Beatty & Zajac, Reference Beatty and Zajac1994; Rutherford, Buchholtz, & Brown, Reference Rutherford, Buchholtz and Brown2007; Tosi, Katz, & Gomez-Mejia, Reference Tosi, Katz and Gomez-Mejia1997; Walsh & Seward, Reference Walsh and Seward1990).

According to agency theory, CEO incentive pay is a primary device that can mitigate agency problems between CEOs and shareholders (Barkema & Gomez-Mejia, Reference Barkema and Gomez-Mejia1998; Tosi, Werner, Katz, & Gomez-Mejia, Reference Tosi, Werner, Katz and Gomez-Mejia2000). CEO incentive pay helps align CEO interests with shareholder interests by tightly linking CEO income to shareholder wealth (Coughlan & Schmidt, Reference Coughlan and Schmidt1985; Hoskisson, Hitt, Turk, & Tyler, Reference Hoskisson, Hitt, Turk and Tyler1989; Kerr & Bettis, Reference Kerr and Bettis1987; Murphy, Reference Murphy1985; Walkling & Long, Reference Walkling and Long1984). Given that CEO incentive pay has the potential to induce desirable behaviors from CEOs, it has been argued that CEOs will increase R&D investment when a substantial portion of their pay is linked to long-term firm performance (Coles, Daniel, & Naveen, Reference Coles, Daniel and Naveen2006). Thus, we measured CEO incentive pay by using the proportion of CEO long-term pay to CEO total pay. CEO long-term pay includes stock options, restricted stocks, and other long-term incentive plans (Carpenter, Reference Carpenter2000).

Agency theory also posits that a board of directors is a central component of firms’ overall efforts to control CEOs’ self-serving behaviors (Fama & Jensen, Reference Fama and Jensen1983). Prior studies identified board independence as a key determinant of board vigilance and found evidence that a CEO's attempt to reduce R&D investment is less successful as the corresponding board becomes more independent from the CEO (Finkelstein, Hambrick, & Cannella, Reference Finkelstein, Hambrick and Cannella2009). Board independence generally decreases as CEO's relative power over the board increases. Thus, following prior studies (Westphal & Zajac, Reference Westphal and Zajac2001), we measured CEO–board relative power by using four measures: CEO duality, the proportion of directors appointed after the CEO, CEO's tenure relative to the average tenure of board members, and director ownership. We combined these four measures into a single index of CEO–board relative power using principal components analysis. In addition, we controlled board size and outsider directors, measured as the number of total directors and the number of outside directors on the board, respectively.

Other control variables

Our primary goal is to examine the role of external CEO labor market; however, ‘reliance on internal labor markets for managerial succession is a central institutional characteristic of managerial capitalism in U.S. industrial corporations’ (Ocasio, Reference Ocasio1999, p. 390). Thus, an actively functioning internal CEO labor market will decrease the disciplining role of an external CEO labor market. To properly examine the role of external CEO labor market, it seems necessary to sort out the effects of internal CEO labor market on CEO behaviors. Because the most common form of formal internal CEO labor market is the designation of an heir apparent, we controlled for the effects of internal CEO labor market by using the heir apparent variable, which was coded ‘1’ if there was any officer who held the title of president or chief operating officer and ‘0’ otherwise (Vancil, Reference Vancil1987).

In addition, based on prior studies on R&D investment, we controlled for the following variables that might affect firm R&D investment: prior R&D investment, industry R&D investment, firm size, prior firm performance, liquidity, and CEO characteristics. Prior studies reported that prior R&D investment has a positive impact on current R&D investment (Hansen & Hill, Reference Hansen and Hill1991; Kim, Kim, & Lee, Reference Kim, Kim and Lee2008). Thus, we included prior R&D investment by using a 1-year lagged dependent variable. Industry R&D investment also affects R&D investment (Baysinger, Kosnik, & Turk, Reference Baysinger, Kosnik and Turk1991; Zona, Reference Zona2016). Specifically, in high-technology industries where firms intensively compete on the basis of new technologies that require high-level of continuous R&D investment, how much other firms invest in R&D will affect the level of R&D investment at focal firm. Thus, we included industry R&D investment, measured as the average of a 1-year lagged R&D investment of all the other firms in the same industry. Previous studies found that firm size has a substantial effect on R&D investment (Baysinger & Hoskisson, Reference Baysinger and Hoskisson1989; Baysinger, Kosnik, & Turk, Reference Baysinger, Kosnik and Turk1991; Hill & Snell, Reference Hill and Snell1988). Therefore, we included the natural logarithm of firm sales to control the effect of firm size. Prior firm performance also affects R&D investment either positively (Hundley, Jacobson, & Park, Reference Hundley, Jacobson and Park1996) or negatively (Hitt, Hoskisson, Ireland, & Harrison, Reference Hitt, Hoskisson, Ireland and Harrison1991). More importantly, CEO succession research found a robust relationship between poor firm performance and CEO replacement and also identified poor firm performance as a major determinant of external CEO succession (Finkelstein, Hambrick, & Cannella, Reference Finkelstein, Hambrick and Cannella2009). Thus, we controlled for the effect of prior firm performance using a firm's return on assets lagged by 1 year. Liquidity affects the amount of internal capital that firms can invest in R&D activities. Hence, we measured liquidity by using a firm's current ratio, which is the ratio of a firm's current assets to the firm's current liabilities (Baysinger & Hoskisson, Reference Baysinger and Hoskisson1989). Several CEO characteristics that might affect R&D investment were also considered (Barker & Mueller, Reference Barker and Mueller2002; Chaganti & Sambharya, Reference Chaganti and Sambharya1987; Thomas, Litschert, & Ramaswamy, Reference Thomas, Litschert and Ramaswamy1991). For example, CEO ownership (%) was controlled. Agency theory suggests that substantial CEO ownership helps align CEO interests with shareholder interests and, therefore, predicts a positive relationship between CEO stock ownership and R&D investment (Fama & Jensen, Reference Fama and Jensen1983; Jensen & Meckling, Reference Jensen and Meckling1976). However, behavioral agency theory suggests that CEO stock ownership will make the CEO more risk-averse and, therefore, predicts a negative relationship between CEO stock ownership and R&D investment (Sanders, Reference Sanders2001). It has been suggested that long-tenured CEOs might pursue less innovation (Barker & Mueller, Reference Barker and Mueller2002). Thus, CEO tenure was controlled as the number of years that the person has been a CEO. Research on CEO personality, particularly on CEO hubris, has shown a positive association between CEO hubris or CEO overconfidence and firm risk taking (Li & Tang, Reference Li and Tang2010). Thus, we measured CEO hubris by using CEO–TMT (top management team) relative pay as the ratio of CEO total pay relative to the total pay of second-highest-paid top executive. This measure has commonly been used as a measure of CEO hubris or CEO self-importance in prior studies (Hambrick & D'Aveni, Reference Hambrick and D'Aveni1992; Hayward & Hambrick, Reference Hayward and Hambrick1997; Henderson & Fredrickson, Reference Henderson and Fredrickson2001). Because this variable was skewed we used the log-transformed variable in our analysis. When we used the ratio of CEO total pay relative to the average total pay of four other highest-paid top executives, the results were identical. Finally, we included dummy codes for each year.

Analysis

To test our hypotheses, we used generalized estimating equations (GEEs), which can analyze both within- and between-firm variations (Wade, Porac, Pollock, & Graffin, Reference Wade, Porac, Pollock and Graffin2006). To test our hypotheses, we reported a control model and then a fully specified model(s) that include all control and theoretical variables. To address potential multicollinearity between main effects and interaction term, we centered the variables prior to calculating the interaction (Jaccard, Turrisi, & Wan, Reference Jaccard, Turrisi and Wan1990).

Results

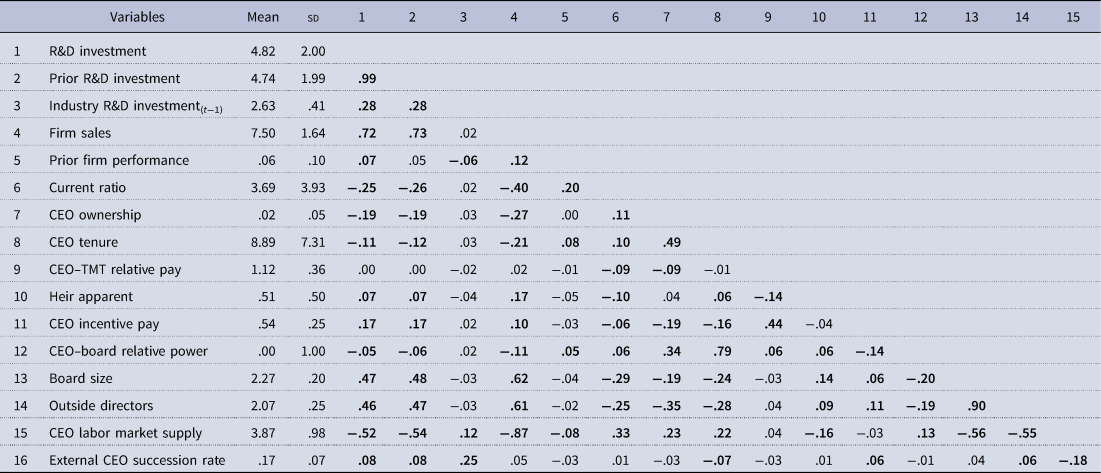

Table 1 presents descriptive statistics for the variables used in our analyses. The average of the number of similarly sized or larger firms was 67.48 and the variation was 49.06Footnote 2. A total of 16.67% of sample firms had hired an external CEO in the past 5 years or their current CEO was an outsider CEO. The average firm in the sample invested 743.15 million dollars, or 13.64% of their total revenue, which is far above the 5% benchmark for R&D intensity that prior studies have used to identify high-technology firms (Balkin, Markman, & Gomez-Mejia, Reference Balkin, Markman and Gomez-Mejia2000). In addition, 54.33% of CEO pay was tied to firms’ long-term performance, and the average CEO tenure was 8.89 years.

Table 1. Descriptive statistics for variables

Note: N = 1,534; p < .05 for correlations in bold; two-tailed test.

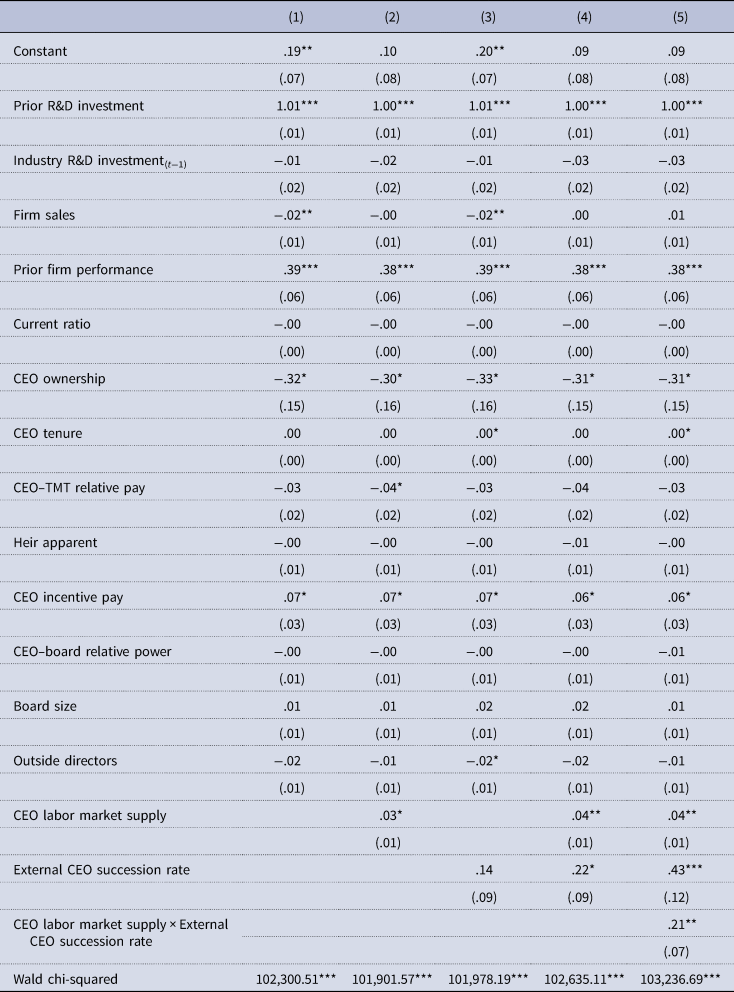

Table 2 presents our GEE models that we used to examine our hypotheses regarding the role of the CEO labor market in R&D investment. Model 1 reports results for control variables.

Table 2. Results of GEE estimation of the effects of CEO labor markets on R&D investment

Note: N = 1,534; standard errors are in parentheses.

*p < .05, **p < .01, ***p < .001.

In model 2, we tested hypothesis 1, wherein we predicted that CEOs in a well-supplied CEO labor market are more likely to increase R&D investment. The coefficient for the CEO labor market supply variable was significant in the expected direction (β = .027, p < .05). This result provides support for hypothesis 1. Our results indicate that CEOs will be more disciplined to increase R&D investment when their firms are operating in a well-supplied CEO labor market than in a short-supplied CEO labor market.

In model 3, we tested hypothesis 2, which predicts that the rate of external CEO succession in the market will increase R&D investment at individual firms. Hypothesis 2 was not supported. It can be argued that a CEO might feel rather pressured to increase R&D investment in a CEO labor market where the external CEO succession rate is low because incumbent CEOs will have difficulty in finding alternative job opportunities in such a market. This argument points to a U-shaped relationship between the two variables; however, in an additional analysis, we found no evidence to support this argument.

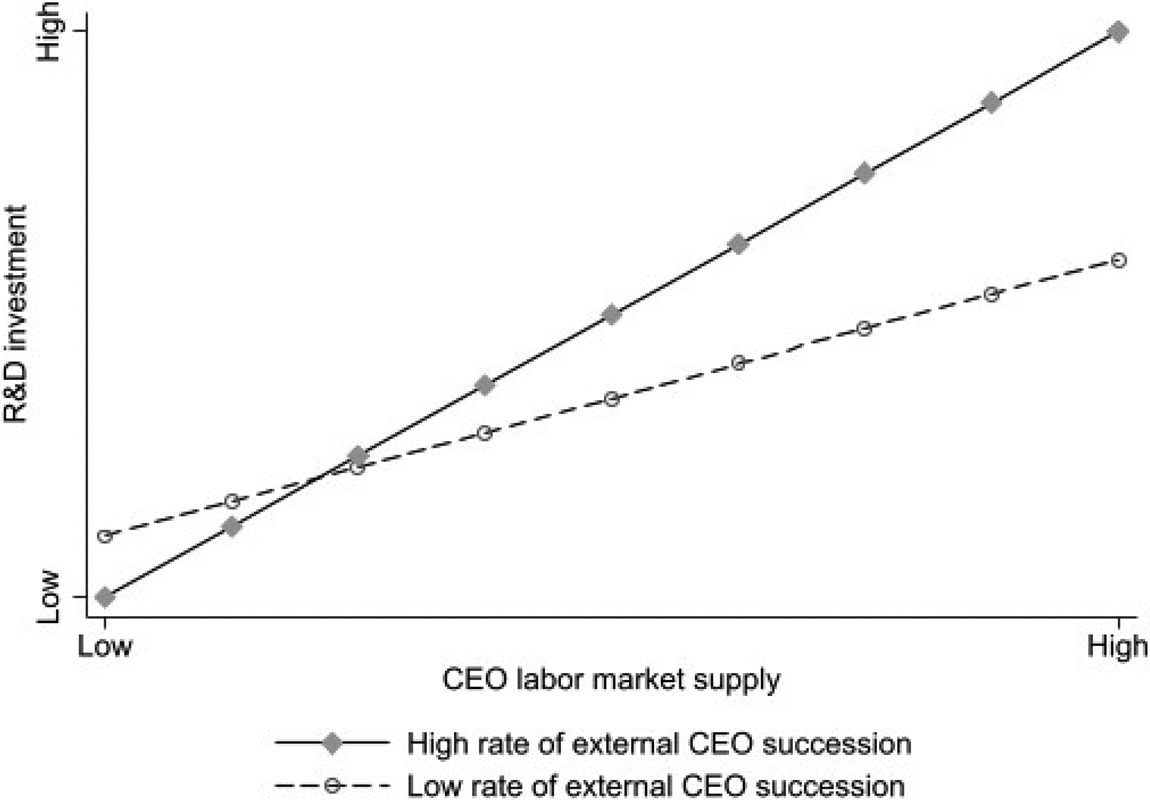

In model 5, we examined whether the effect of a well-supplied CEO labor market on R&D investment becomes stronger as the rate of external CEO succession in the market increases. Hypothesis 3 was supported. Results show that CEOs in a well-supplied CEO labor market will tend to further increase R&D investment when external CEO succession is more frequent in the market and thus legitimated. In a CEO labor market where external CEO succession is more frequent (i.e., one standard deviation greater than the mean), if CEO labor market supply increases by 10%, CEOs are predicted to increase R&D investment by .55% (p < .001), which is approximately 4.12 million dollar increase at a firm with average R&D investment (i.e., 743.15 million dollars). In contrast, if external CEO succession is less frequent (i.e., one standard deviation less than the mean), the predicted increase in R&D investment for 10% increase in CEO labor market supply was only .27%, which is approximately 1.99 million dollar increase at a firm with average R&D investment. Furthermore, this relationship was not statistically significant at the 5% significance level (p < .057). These results indicate that the disciplining effect of CEO labor market supply is largely contingent on the rate of external CEO succession in the market.

Figure 1 plots the moderating effect of external CEO succession rate in the CEO labor market on the relationship between CEO labor market supply and R&D investment.

Figure 1. Moderation of external CEO succession rate between CEO labor market supply and R&D investment.

Discussion

In this study, we examined whether CEO labor markets have the potential to be an effective external governance mechanism in controlling CEO's self-serving behaviors. Using longitudinal panel data from S&P high-technology firms, we found that CEOs in high-tech industries are more disciplined to increase investment in R&D when their firm has a larger pool of potential external CEO candidates; however, market-level tendency to hire external CEOs did not affect R&D investment at individual firms. We also found that the interaction effect between CEO labor market supply and external CEO succession rate variables was statistically significant and positive. Our results indicate that the disciplining effect of CEO labor market supply is contingent on the external CEO succession rate in the market.

This study makes important contributions to the corporate governance research. First, we found evidence that CEO labor market has the potential to discipline CEO behaviors. If a firm operates in an efficient CEO labor market, even without the provision of costly internal governance mechanisms, the firm will likely achieve desirable behaviors from its CEO (Fama, Reference Fama1980). In this regard, our study empirically demonstrates the validity of Fama's (Reference Fama1980) argument that ‘market forces alone will frequently remove moral hazard problems because managers will be concerned about their reputations in the labour market. Thus, there will be no need to resolve incentive problems using explicit contracts, since markets already provide efficient implicit incentive contracts’ (Holmstrom, Reference Holmstrom1999, p. 170).

In practice, however, CEO labor markets can hardly be perfectly efficient. CEO labor market alone, therefore, cannot fully eliminate agency problems at individual firms and, therefore, internal governance mechanisms should play an important role in controlling CEOs’ self-interest-seeking behaviors. Nonetheless, because firms in more efficient CEO labor markets do not need to heavily rely on internal governance mechanisms, our study suggests that the potential contribution of internal governance mechanisms in reducing agency problems will be contingent upon the efficiency level of the CEO labor market to which firms belong.

Our study thus suggests that governance researchers should first consider how efficient a CEO labor market is when examining the effectiveness of internal governance mechanisms at individual firms. An efficient CEO labor market may substitute for internal governance mechanisms to some degree, reducing the marginal contribution of additional internal corporate governance mechanisms. According to the substitution argument, firms generally rely on multiple governance mechanisms to control CEO behaviors, and these multiple governance mechanisms substitute for each other. If any governance mechanism is already in place, additional mechanisms are less necessary because there are cost–benefit tradeoffs between governance mechanisms. The substitution argument thus maintains that the effectiveness of corporate governance mechanisms at individual firms should not be assessed by examining any single mechanism and that more meaningful results can be obtained when the interrelatedness among governance mechanisms is taken into account (Hill & Snell, Reference Hill and Snell1988; Rediker & Seth, Reference Rediker and Seth1995; Zajac & Westphal, Reference Zajac and Westphal1994).

In this regard, our study provides one feasible explanation to the longstanding corporate governance problem around CEO pay. The lack of sensitivity of CEO pay to firm performance has been regarded as a manifestation of corporate governance failure and thus has been at the center of corporate governance research (Bebchuk & Fried, Reference Bebchuk and Fried2003, Reference Bebchuk and Fried2006). Our study, however, suggests that even effective boards may yield low sensitivity of CEO pay to firm performance when firms are operating in an efficient CEO labor market. In such market, boards can induce desirable CEO behaviors with less use of CEO incentive pay.

Second, our study contributes to the research stream that investigates the role of external governance contexts in firm-level outcomes. Prior governance research on this topic has narrowly focused on the role of inter-organizational networks formed by interlocking directors in spreading governance mechanisms (Davis, Reference Davis1991; Haunschild, Reference Haunschild1993, Reference Haunschild1994). With a few exceptions (e.g., Ocasio, Reference Ocasio1999; Zhang & Rajagopalan, Reference Zhang and Rajagopalan2003), almost no research has examined the role of CEO labor markets in firm-level governance outcomes. With the increasing mobility of top executives across firms, however, it seems necessary to pay more attention to the role of CEO labor markets in corporate governance research. We hope our study triggers interests among governance researchers in the role of external contexts wherein individual firms are embedded, specifically CEO labor markets (Granovetter, Reference Granovetter1985).

Our findings have important implications for boards of directors, shareholders, and policymakers. First, our study suggests that it is generally desirable to design policies that can make the CEO labor market more efficient. This is because a policy that can encourage external CEO succession or eliminate barriers to external CEO succession will help reduce agency problems at individual firms. For example, a regulation that requires firms to report detailed information about their top executives to shareholders or a policy that facilitates the activities of executive search firms will help promote external CEO succession by reducing information problems in the CEO labor market and thereby will help reduce agency problems at individual firms. Our study also indicates that to design cost-effective internal incentive and monitoring mechanisms at individual firms, boards and shareholders need to pay close attention to the conditions of the CEO labor market that surrounds the firm because CEO labor market efficiency determines the monitoring potential of costly internal governance mechanisms.

Second, recognizing the positive potential of efficient CEO labor markets in protecting the wealth of shareholders at firms in the market, our study suggests that boards need to stimulate the market development by more actively hiring external CEO. One of the most robust findings in CEO succession literature is that firms tend to hire external CEO mostly when poor performance demands and justifies the hiring of external CEO (Finkelstein, Hambrick, & Cannella, Reference Finkelstein, Hambrick and Cannella2009). Our study suggests that even when external CEO succession is yet legitimated in the market, boards need not to be reluctant to hire external CEO, because it will enable boards to select the best CEO from larger pool of qualified candidates and also help the boards to effectively control CEO behaviors by imposing a greater employment risk on the CEO. In addition, since firms tend to repeat their past experiences with insider succession or outsider succession (Ocasio, Reference Ocasio1999) and firms imitate other firms’ executive succession decision patterns (Williamson & Cable, Reference Williamson and Cable2003), small number of early external CEO succession cases will soon expedite the legitimation process in the market, reducing risks associated with external succession. It is also important to note that even without actually hiring external CEO, boards can heighten the employment risk for their CEO by paying a keen attention to external CEO candidates. By exposing firms to the external CEO labor market, boards should maintain the adequate level of employment risk as well as pay risks for their CEO, to more effectively and efficiently control CEO behaviors (Holmstrom, Reference Holmstrom1979). Therefore, it is important for boards to have an ongoing CEO succession plan that includes a short list of both internal and external CEO candidates.

Limitations and directions for future research

This research has several limitations. First, although we argued that CEOs in an efficient CEO labor market face greater employment risk, we did not directly measure how much employment risk CEOs actually perceive from the conditions of the market. CEOs in the same CEO labor market may perceive different degrees of employment risk, depending on individual and organizational characteristics such as personality, CEO power, and firm performance. Although we endeavored to control some of these factors, future research that collects data from extensive surveys or qualitative studies such as interviews will help remedy these measurement problems. Second, although we assumed that shareholders would prefer more investment in R&D, research has found that some investors are short-term oriented and therefore prefer their CEO to reduce R&D investment (Bushee, Reference Bushee1998). Although we tested our theory using data from high-technology firms where R&D investment is essential, we were not able to consider shareholders’ heterogeneous investment horizon in our empirical model.

Next, we defined CEO labor markets by industry categorization; however, actual CEO labor markets can be more narrowly or broadly formed. It is also highly likely that a firm hires its new CEO from outside the industry. In addition, we limited our sample to publicly traded firms. Although it can be risky, and thus less common, for listed firms to hire new CEO from private firms because of the lack of reliable performance data, it is still possible that publicly-traded firms hire their new CEO from private firms, or vice versa. Further research on the boundaries of CEO labor markets is required.

We found evidence that CEO labor markets have the potential to be an effective external corporate governance mechanism; however, more research on the role of CEO labor market is needed. A fruitful avenue for future research would be to further examine the relationship between CEO labor market conditions and other governance mechanisms. Prior studies on the joint effects of multiple governance mechanisms have not examined the joint effects between external and internal governance mechanisms. Also, it seems necessary to examine whether other forms of agency problems are also reduced in more efficient CEO labor markets. For example, it would be interesting to examine whether CEOs pursue unprofitable growth strategy less in CEO labor markets that are more efficient than in those that are less efficient. Finally, it would also be interesting to examine whether CEO pay is more tightly linked to firm performance or less tightly linked to firm performance in an efficient CEO labor market. Our study suggests that incentive pay scheme is less necessary for CEOs when the CEO labor market is efficient because of the disciplining power of the CEO labor market. In contrast, it can be also argued that CEO pay will be more tightly linked to firm performance in a more efficient CEO labor market because boards can better evaluate their CEO's performance. Future study on this topic will uncover the relationship.

Jeongil Seo is a professor of strategy at Sogang University, Korea. He received his PhD from the School of Business, University of Wisconsin-Madison. He has published his research papers in journals, including Strategic Management Journal, Journal of Management, Journal of Business Ethics, Human Resource Management, and Psychological Reports. His research interests include strategic decision making, corporate governance, and top management teams.

Gyeonghwan Lee is an assistant professor of strategy at Donga University, Korea. He obtained his PhD in 2020 from Sogang University, Korea. His research interests include CEOs, board of directors, and organizational changes. He has published his research paper in Journal of Business Ethics.

Choelsoon Park is a professor of strategy and international management at Seoul National University, Korea. He received his PhD from the Graduate School of Business, Columbia University. He has published academic papers in leading international journals, including Academy of Management Journal, Strategic Management Journal, Journal of Management Studies, Long Range Planning, Corporate governance: An International Review, and Journal of World Business. His research interests include top management teams, strategic innovation, and corporate governance.