Book contents

- The International Law of Sovereign Debt Dispute Settlement

- Cambridge Studies in International and Comparative Law: 171

- The International Law of Sovereign Debt Dispute Settlement

- Copyright page

- Dedication

- Contents

- Acknowledgements

- Table of Cases

- Table of Statutes, Bills and Treaties

- Abbreviations

- Introduction

- Part I Regulation through Contract and Litigation

- Part II Regulation through Treaty and Arbitration

- Bibliography

- Index

- Cambridge Studies in International and Comparative Law

- References

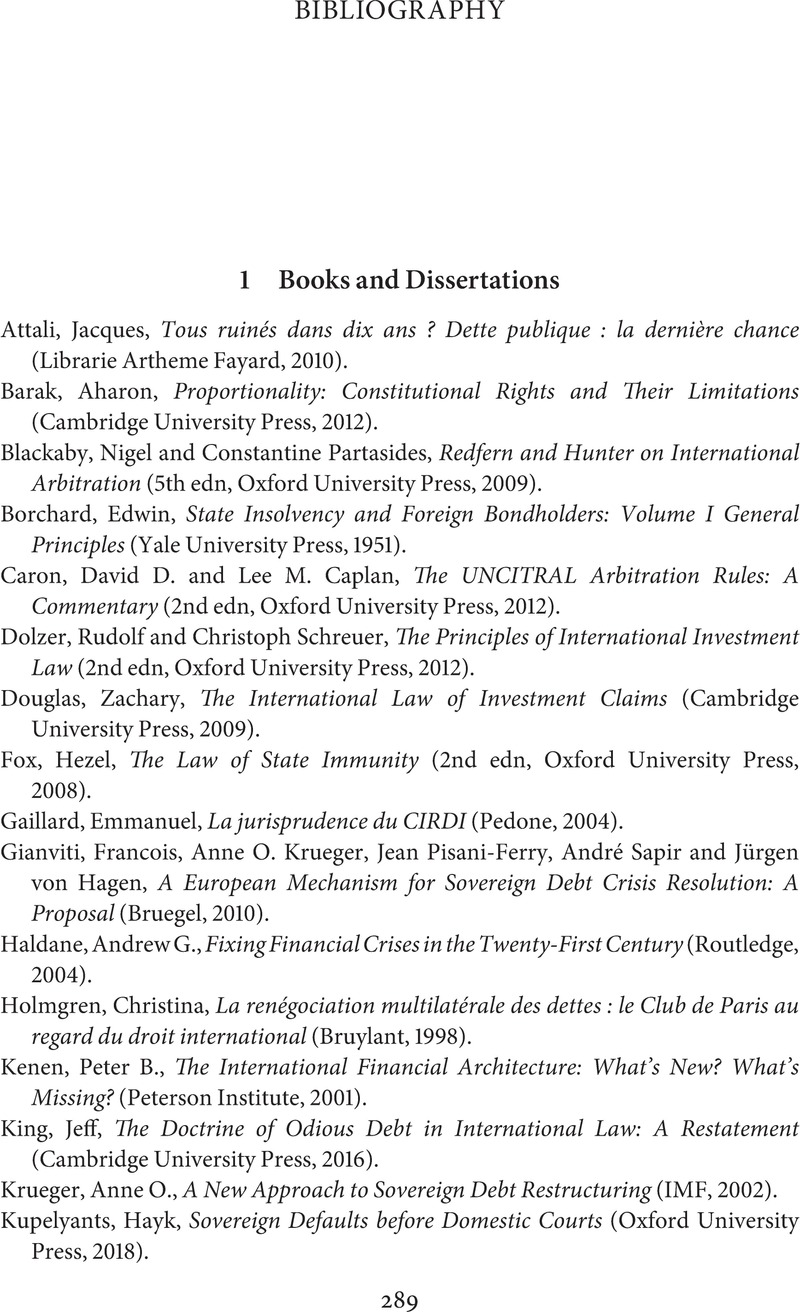

Bibliography

Published online by Cambridge University Press: 15 September 2022

- The International Law of Sovereign Debt Dispute Settlement

- Cambridge Studies in International and Comparative Law: 171

- The International Law of Sovereign Debt Dispute Settlement

- Copyright page

- Dedication

- Contents

- Acknowledgements

- Table of Cases

- Table of Statutes, Bills and Treaties

- Abbreviations

- Introduction

- Part I Regulation through Contract and Litigation

- Part II Regulation through Treaty and Arbitration

- Bibliography

- Index

- Cambridge Studies in International and Comparative Law

- References

Summary

- Type

- Chapter

- Information

- The International Law of Sovereign Debt Dispute Settlement , pp. 289 - 335Publisher: Cambridge University PressPrint publication year: 2022