Book contents

- Double Taxation and the League of Nations

- Cambridge Tax Law Series

- Double Taxation and the League of Nations

- Copyright page

- Contents

- Tables

- Preface

- Acknowledgements

- Abbreviations

- 1 Introduction

- 2 Background

- 3 Personality, Politics, and Principles

- 4 The ICC and the Development of the 1928 Models

- 5 Turning Resolutions into Treaties

- 6 The ‘Great Powers’ and the Development of the 1928 Models

- 7 One Beget Three

- 8 Lessons from History

- Book part

- Bibliography

- Index

- References

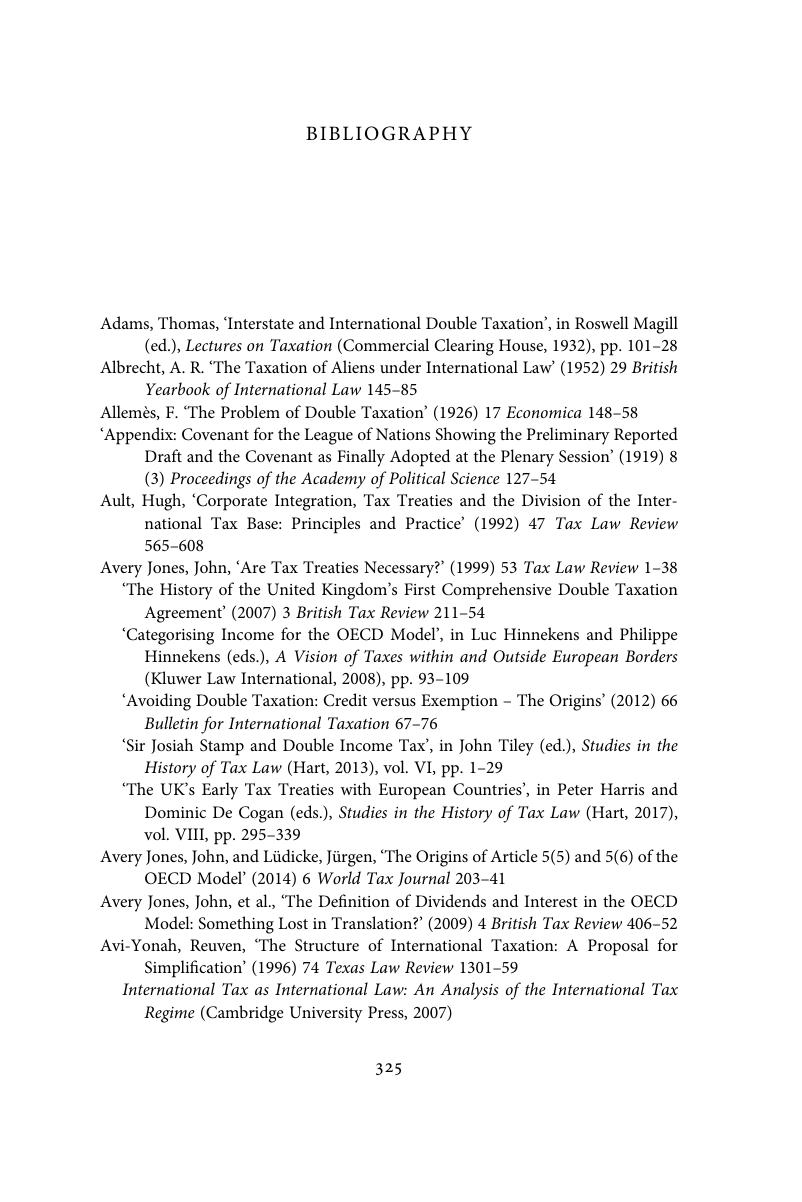

Bibliography

Published online by Cambridge University Press: 28 April 2018

- Double Taxation and the League of Nations

- Cambridge Tax Law Series

- Double Taxation and the League of Nations

- Copyright page

- Contents

- Tables

- Preface

- Acknowledgements

- Abbreviations

- 1 Introduction

- 2 Background

- 3 Personality, Politics, and Principles

- 4 The ICC and the Development of the 1928 Models

- 5 Turning Resolutions into Treaties

- 6 The ‘Great Powers’ and the Development of the 1928 Models

- 7 One Beget Three

- 8 Lessons from History

- Book part

- Bibliography

- Index

- References

Summary

- Type

- Chapter

- Information

- Double Taxation and the League of Nations , pp. 325 - 331Publisher: Cambridge University PressPrint publication year: 2018