How should we distinguish between ethical and unethical ways of pursuing profit in a market? This research question is of fundamental importance to the field of business ethics. It also pertains to practical issues arising from theories of strategic management. Practitioner-oriented work in strategic management often provides frameworks for managers to use when trying to better understand which tactics will allow them to create and capture economic value (e.g., Brandenburger & Stuart, Reference Brandenburger and Stuart1996; Porter, Reference Porter1996, Reference Porter2008). However, prescriptive theories about how to act and make decisions that are based on a teleological goal—such as appropriating rents or gaining competitive advantage—must include constraints on how those goals may be pursued if they are to be plausible (Schmidtz, Reference Schmidtz1995).

But what are the some of the main ethical considerations to which managers ought to be attuned when selecting tactics for their teams to implement? Are there categories of tactics for gaining and maintaining competitive advantage that we can identify as especially ethically valuable or problematic? Is there anything general that can be said in response to questions such as these? Though the field of normative business ethics has given some consideration to these questions, it has not yet addressed them adequately.

Some of the field’s most prominent theoretical approaches can provide the beginnings of answers to the aforementioned questions. For example, integrative social contracts theory contains a set of “moral minima” that market actors must respect regardless of the social or cultural context the actors occupy (Donaldson, Reference Donaldson1989; Donaldson & Dunfee, Reference Donaldson and Dunfee1994, Reference Donaldson and Dunfee1999). These moral minima place certain constraints on how market actors may pursue profit. Kantian approaches to business ethics articulate a set of duties that market actors must fulfill (Bowie, Reference Bowie2017). These duties place certain constraints on how market actors may pursue profit.

We can also find the beginnings of answers to the preceding questions in some of the business ethics literature that addresses particular applied topics. Debates about commodification have implications for which sorts of things market actors may permissibly buy and sell in pursuit of profit (Brennan & Jaworski, Reference Brennan and Jaworski2015; Dick, Reference Dick2018; Satz, Reference Satz2010). Debates about the permissibility of deception in business have implications for whether it is permissible for market actors to pursue profit by using deceptive tactics (Carr, Reference Carr1968; Carson, Reference Carson1993; Strudler, Reference Strudler2005). Debates about sweatshops and exploitation have implications for whether it is permissible for market actors to pursue profit by relying on sweatshops in their supply chains (Arnold & Bowie, Reference Arnold and Bowie2003; Kates, Reference Kates2015; Zwolinski, Reference Zwolinski2007). Debates about marketing and manipulation have implications for whether market actors may permissibly pursue profit by employing persuasive advertising techniques or by marketing to vulnerable populations (Arrington, Reference Arrington1982; Brenkert, Reference Brenkert1998; Crisp, Reference Crisp1987).

However, because they pertain to business conduct in general, rather than conduct aimed at pursuing profit specifically, general theories of business ethics cannot provide sufficiently detailed or systematic answers to the question of how we should distinguish between ethical and unethical ways of pursuing profit.Footnote 1 Similarly, although they have some implications for how market actors may pursue profit, debates over specific topics in business ethics cannot provide an overall theoretical picture of the ethical considerations that are especially pertinent for answering the research question that motivates this article. What is missing from the preceding considerations is a specific conception of the appropriate function of profit-seeking behavior in the institutional context of competitive markets. Determining which means of pursuing profit are permissible, and which are not, requires getting clear on the ethical and social goals that the profit motive ought to promote.

One prominent stream of business ethics research appears to address this gap in the literature. However, as I will argue, it is ultimately unsuccessful. I am referring to a family of views that has at various times been labeled the implicit morality of the market (McMahon, Reference McMahon1981), the self-regulation approach (Norman, Reference Norman2011), and the market failures approach (MFA; Heath, Reference Heath2014). I choose to focus on Heath’s MFA because it is the most developed of the three. However, given their similarities (Moriarty, Reference Moriarty2019), much of what I say about Heath’s view will apply to the others as well.

In recent work, Heath has helpfully clarified that the MFA should be understood as Paretian: it identifies achieving Pareto efficiency as the “point” of economic market institutions and uses this to justify restrictions on how market actors may seek profit (Heath, Reference Heath2013, Reference Heath2014). I argue, however, that Heath’s emphasis on Pareto efficiency is misguided. Pareto efficiency cannot explain our basic intuitions—intuitions Heath appears to share—about which sorts of profit-seeking tactics are permissible or impermissible. Heath’s Paretian approach also fails to illuminate areas where intuition gives out and cannot provide clear normative guidance. My argument in this article is thus importantly different from many previous critiques of the MFA that object to its narrow focus on economic efficiency and its neglect of other important ethical values (e.g., Hsieh, Reference Hsieh2017; Martin, Reference Martin2013; Silver, Reference Silver2016; Singer, Reference Singer2018). My claim is that the MFA fails on its own terms to provide a plausible, clear answer to the important question Heath raises.

This article does not just advance a negative criticism of the MFA. It also offers a solution (or at least the beginnings of one) to the problems it highlights. I propose that it is not Pareto efficiency but rather the creation of wealth to which we should look to understand some basic constraints on how market actors may pursue profit. My claim is not that wealth is the single unifying value that can explain everything about the ethics of business and markets—I am skeptical that any such value exists. Still, wealth is a significant value for business and market ethics, and it plays a large role in our understanding of the ethical constraints on pursuit of profit in market contexts. I propose a Wealth Creation Principle, which holds that firms may not employ combinations of strategic tactics that appropriate more wealth than they create on net. The upshot of the principle is that market actors should seek profit by engaging in productive, rather than unproductive or destructive, entrepreneurial activities (Baumol, Reference Baumol1996).

The article proceeds as follows. Section 1 describes some Easy Cases—cases in which intuition provides clear, plausible answers. A good theory should cohere with our intuitions about Easy Cases (or, if it diverges with our intuition, provide a compelling reason for why our intuition should be revised) and help us think through harder cases where our intuitions give out. Section 2 presents the MFA and identifies a principle that the MFA provides for distinguishing between ethical and unethical (or preferred/nonpreferred) tactics. I call this the Perfect Competition Principle. Section 3 argues that the Perfect Competition Principle is inadequate because it has implausible implications about Easy Cases. It also explains more generally why the MFA goes astray by placing so much emphasis on Pareto efficiency. The Paretian MFA relies on a conception of efficiency that is static and neglects dynamic efficiency considerations. It thus cannot explain the desirability of competitive tactics that disrupt the equilibrating processes of the market. I invoke rival conceptions of entrepreneurship from Joseph Schumpeter and Israel Kirzner to help illustrate this point. Section 4 explains my positive proposal, which is to replace Pareto efficiency with wealth creation as a guiding value for market competition. I tentatively propose a conception of wealth based on the Kaldor–Hicks standard from economics, as well as a Wealth Creation Principle that places a strong ethical presumption against the use of profit-seeking tactics that appropriate more wealth than they create on net.

1. ETHICAL CONSTRAINTS ON PURSUING PROFIT IN A MARKET

Consider the following tactics that market actors might employ in pursuit of profit. I will refer to these as Easy Cases because we generally have clear, plausible, intuitive judgments about their permissibility. These judgments may not be completely ironclad, but we would need to be provided with strong reasons to seriously consider revising them, given their intuitive plausibility. To borrow a metaphor from Quine and Ullian (Reference Quine and Ullian1978), they are closer to the center than the periphery of our web of ethical beliefs:

-

1) A firm invests in new manufacturing technology that lowers costs by improving production efficiency.

-

2) A firm redesigns one of its products to improve quality and increase customer willingness to pay.

-

3) A firm attempts to tacitly collude with its competitors by sending signals that it will follow its rival’s lead setting prices in various local markets.

-

4) A firm attempts to deter entry into the market through a form of contrived deterrence: it seeks profit by investing in excess manufacturing capacity—beyond the manufacturing capacity it would build if it were simply trying to invest up to the point at which marginal cost equals marginal revenue—with the goal of credibly threatening to flood the market with products and drive down price in the event of entry.

Intuitively, both 1 and 2 are desirable: from the perspective of society overall, businesses competing with each other by improving the efficiency of their production or their product quality represent instances of the market working as it should and of market actors behaving as they should. Equally intuitively, 3 and 4 are not desirable: from the perspective of society overall, businesses competing with each other through tacit collusion or contrived deterrence represent instances of the market failing to work as it should and of market actors behaving poorly. We can arrive at these judgments without the aid of an elaborate theory of business or market ethics. Intuition, built on an edifice of basic economic theory about how market competition produces social benefits, gets us most of the way there.

To summarize: an important desideratum for an adequate theory of constraints on pursuing profit is coherence with (or persuasive justification of deviations from) basic intuitions regarding Easy Cases. Of course, a good theory should also help us think through more difficult, more complex cases where our intuitions either give out or conflict. First, though, it needs to account for our intuitions about Easy Cases.

2. THE MARKET FAILURES APPROACH TO BUSINESS ETHICS

Joseph Heath (Reference Heath2014) presents his market failures approach to business ethics as providing just the sorts of principles that it seems we would need for understanding constraints on pursuing profit in a market. Heath introduces the terms preferred and nonpreferred strategies to refer to the specific constraints on ethical pursuit of profit that the MFA provides. The question, then, becomes, what principle or set of principles does the MFA provide that can help us understand more specifically and precisely which sorts of tactics for pursuing profit are among the preferred, and which are among the nonpreferred?

2.1 Pareto Improvement

In recent refinements of his work on business ethics, Heath has insisted that his approach should be understood as “Paretian” (Heath, Reference Heath2013: 50; 2014: 5; 2019). Heath sometimes even appears to suggest that what is Paretian about his approach is that it is built on the principle of Pareto improvement (i.e., that we should pursue changes in the distribution of economic goods that make at least one person better off without making anyone worse off). In a recent response to Moriarty’s (Reference Moriarty2019) critique, Heath (Reference Heath2019: 22) writes, “I claim that markets institutionalize a commitment to Pareto efficiency … because the building-blocks of a market are individual exchanges, and each individual exchange is Pareto-improving for the transacting parties” (Heath, Reference Heath2019).Footnote 2

To avoid confusion, however, it is important to understand that Heath himself explicitly rejects Pareto improvement as the standard that market actors’ actions must meet to be judged desirable or permissible according to the MFA (Heath, Reference Heath2014). He is clearly right to do so—requiring that market actors’ actions meet a Pareto improvement standard would render impermissible conduct that is clearly desirable, like a firm lowering its prices to compete away customers from rival firms. When successful, price competition of this sort will make a firm’s rivals worse off and thus fail to qualify as Pareto improving. Whatever principle the MFA uses to distinguish preferred from nonpreferred tactics for pursuing profits, then, it cannot be Pareto improvement.

2.2 Pareto Efficiency

A state is Pareto efficient (or Pareto optimal) if nobody can be made better off without making someone else worse off. Pareto efficiency is thus related to Pareto improvement in the following way: a state is Pareto efficient if, and only if, it contains no potential Pareto improvements.

According to Heath, the connection between Pareto efficiency as a guiding value for market institutions, on one hand, and the distinction between preferred and nonpreferred tactics for seeking profit, on the other, is as follows. The first fundamental theorem of welfare economics proves that, under conditions of perfect competition (i.e., market actors are price-takers, market actors have access to perfect information, markets are complete, property rights are perfectly defined and enforced, and so on), any competitive market equilibrium is Pareto efficient (Arrow & Debreu, Reference Arrow and Debreu1954; Blaug, Reference Blaug2007).

The first fundamental theorem of welfare economics thus articulates a kind of ideal market, evaluated in terms of its capacity to achieve the goal of Pareto efficiency. When the conditions of perfect competition are met, self-interested actors pursuing profit in a market bring the market to a Pareto-efficient outcome. However, the conditions of perfect competition involve strong assumptions that markets in the real world essentially never completely satisfy. Real-world markets are afflicted by departures from the conditions of perfect competition that constitute market failures, for example, externalities, market power, imperfect and asymmetric information, and incomplete markets (Heath, Reference Heath2007: 369).

As a result, the connection between market actors competitively pursuing profit and the ultimate goal of achieving Pareto efficiency becomes ambiguous. On one hand, the competitive pursuit of profit by market actors is a vital mechanism that pushes the market toward Pareto efficiency by pushing “prices toward the levels at which markets clear” (Heath, Reference Heath2006: 541). On the other hand, when market failures are present, profit-seeking competitive behavior by market actors can exacerbate these failures and pull the market even further from Pareto efficiency. Thus, in actual markets, the convergence that holds under conditions of perfect competition between profit seeking on the part of market actors and moving the market closer to Pareto efficiency breaks down.

Heath’s view is that the ideal market articulated by the conditions of perfect competition can provide ethical guidance for actual market actors who occupy the imperfectly competitive markets that populate the real world. But what precisely can we infer from the desirability of reaching Pareto efficiency and from the insight of the first fundamental theorem of welfare economics that, under conditions of perfect competition, any competitive market equilibrium will be Pareto efficient? I claim that Heath has not provided a clear or plausible answer to this fundamental question. I argue later in the article that the MFA’s Paretian foundation makes the approach unsuitable for distinguishing between permissible and impermissible tactics for pursuing profit. For now, though, I simply want to make clear why Heath’s previous attempts to illustrate how the MFA can respond to the preceding question are unsuccessful.

Heath appears to address the permissibility question when he writes, “Under conditions of perfect competition, lower price, improved quality, and product innovation would be the only way that firms could compete with one another. We can refer to these as the set of preferred competitive strategies” (Heath, Reference Heath2006: 549). Examples of nonpreferred competitive strategies include “producing pollution, or selling products with hidden quality defects” (550).

Heath’s thought seems to be that we can specify deontic norms (see Heath, Reference Heath and Hodgson2004: 84) constraining how market actors may permissibly pursue profit based on an understanding of which competitive tactics the conditions of perfect competition would render impossible (Heath, Reference Heath2007). My best attempt to distill this thought into a principle that could be used to distinguish preferred from nonpreferred tacticsFootnote 3 yields the following:

Perfect Competition Principle: A strategic tactic is preferred if and only if it is possible for a market actor to employ under conditions of perfect competition and nonpreferred if and only if it is not possible for a market actor to employ under conditions of perfect competition.

It is important to recognize at this point in our discussion that, although Heath strongly suggests in several of his articles that the conditions of perfect competition link the goal of attaining Pareto efficiency to practical decision-making guidelines for market actors (see Heath, Reference Heath and Hodgson2004, Reference Heath2006, Reference Heath2007), he ultimately disavows the view that the MFA’s practical guidance flows directly from the conditions of perfect competition due to complications that arise from the economic “theory of the second best.”Footnote 4

Despite this, I believe that it is worth taking the time—as I do in the next section of the article—to clearly show why the Perfect Competition Principle cannot serve as a basis for distinguishing preferred tactics from nonpreferred tactics. This is worthwhile for two primary reasons. First, the closest Heath ever gets in his work on the MFA to providing a specific principle that could distinguish preferred tactics from nonpreferred tactics relies on something very similar to the Perfect Competition Principle (see Heath, Reference Heath and Hodgson2004: 83–84; 2006: 549–50). It would be unreasonable to focus my criticism on the Perfect Competition Principle if Heath provided an alternative principle that could be used to generate prescriptive guidance for market actors. However, I do not believe such an alternative principle can be found in Heath’s existing work. (And I have looked.) To readers who believe that Heath’s work provides a workable alternative to the Perfect Competition Principle that I have not considered, I would issue the following challenge: identify an alternative Paretian principle that is capable of distinguishing between product quality improvement, on one hand, and polluting (beyond the socially optimal amount), on the other. Why should the former be considered a preferred tactic and the latter nonpreferred? For reasons I explain in section 3, I am convinced that no Paretian principle is up to the task.

Second, the main reason the Perfect Competition Principle ultimately fails is closely related to the more general criticisms of Pareto efficiency as a guiding value for business ethics that I explain later in this article. Thus, even though Heath ultimately seems to disavow the Perfect Competition Principle, understanding why this principle fails to distinguish preferred tactics from nonpreferred tactics will help us understand why the alternative that Heath ultimately favors, Pareto efficiency, is not a promising basis for distinguishing preferred tactics from nonpreferred tactics either.

3. WHY THE PERFECT COMPETITION PRINCIPLE MUST BE REJECTED

The Perfect Competition Principle would appear to explain why attempting to profit by producing pollution (beyond the socially optimal amountFootnote 5) counts as a nonpreferred tactic. One condition of perfect competition is that property rights are perfectly defined and enforced. Hence, under perfect competition, property owners have the ability to prevent other actors from behaving in ways that negatively affect the use value of their property. If burning a fire on my land causes smoke that reduces the quality of the air above your land, then you can prevent me from burning fires without your assent. I, the would-be polluter, would thus have to bargain with you and all other property owners who would suffer the negative effects that my pollution would generate. I would only be able to pollute if we agreed to a price that I would pay you in exchange for your allowing me to emit a given quantity of pollution onto your property. This process will internalize costs associated with pollution, thereby making it impossible to profit by producing more than the socially optimal amount of pollution (i.e., the amount of pollution at which the marginal social cost of pollution is equal to the marginal social benefit).

A quick caveat about “second best” problems: Much of the commentary in response to the MFA (Moriarty, Reference Moriarty2019; Repp & Contat, Reference Repp and Contat2019; Steinberg, Reference Steinberg2017) as well as Heath’s own work (Heath, Reference Heath and Hodgson2004, Reference Heath2006, Reference Heath2014, Reference Heath2019) focuses on complications arising from the “theory of the second best” (Lipsey & Lancaster, Reference Lipsey and Lancaster1956). Because of these complications, we cannot justifiably presume that the tactics the Perfect Competition Principle identifies as preferred/nonpreferred also ought to be judged permissible/impermissible. However, my main point is distinct from second-best complications. Plus, as the citations at the beginning of this paragraph indicate, the complications for the MFA that the theory of the second best generates have already been extensively considered elsewhere. Thus I will set them aside and assume for the remainder of this article that preferred is equivalent to permissible and that nonpreferred is equivalent to impermissible.

Ignoring second-best complications, then, the Perfect Competition Principle appears to be just the sort of theoretical device we need to account for our intuitions about preferred/permissible and nonpreferred/impermissible tactics in Easy Cases and to help us think through more challenging cases. However, this appearance is deceiving: the Perfect Competition Principle fails to account for basic intuitions about Easy Cases.

Product quality improvement is an Easy Case. It clearly must be judged preferred/permissible. When firms compete with each other by making products that better meet consumer needs, they are obviously pursuing profit in a way we as a society want them to. Heath agrees, and he even insists that product quality improvement, along with lowering prices and product innovation, are the only preferred strategic tactics (Heath, Reference Heath2006: 549). However, the Perfect Competition Principle fails to support the judgment that product quality improvement is a preferred tactic.

3.1 Implications of the Perfect Competition Principle

Perfect competition requires (infinitely) many buyers and sellers exchanging homogeneous goods. These conditions preclude individual market actors from having any degree of market power (i.e., power to set the prices of the goods they buy and sell). Suppose that these and the other conditions of perfect competition all obtain. A firm, call it F, produces a homogeneous good. One day, F discovers a way to produce a higher-quality version of the good. F begins selling this improved version of the good at a price that will cause some customers to defect from F’s rivals to buy F’s new, higher-quality product.

The conditions of perfect competition are so restrictive that it is difficult to see how this product quality improvement strategy could be possible to pursue when they obtain. Recall that information under perfect competition is costless. This will enable F’s rivals to copy the improvement instantaneously and underbid F if F prices the improved good any higher than the price that will prevail when the perfectly competitive market reaches equilibrium (where price is equal to marginal cost of production and economic profit is zero). It is thus not clear how competing on product quality is possible under the conditions of perfect competition in a way that can be distinguished from the impossibility of competing using nonpreferred tactics.

One might attempt to object to this point by arguing that there is an understanding of “possibility” in the Perfect Competition Principle that avoids this problem. For example, there is a sense in which market actors under conditions of perfect competition may try to profit from product quality improvement. The relentless tendency of perfectly competitive markets to move toward Pareto-efficient equilibrium renders this effort futile, but market actors can still attempt it. Contrast this with attempting to shift costs from pollution onto third parties. This tactic appears to more inherently involve a violation of one of the conditions of perfect competition than competing on product quality, given that it entails a violation of property rights, which under conditions of perfect competition are perfectly defined and enforced.

However, it is not clear that the conditions of competition actually do preclude the possibility of attempting to profit from shifting costs of pollution onto third parties in the way proposed. What the conditions require is that polluters may not impose costs on third parties without compensating them. The costs and benefits of pollution are thus allocated in the same way that the costs and benefits of any product or good are allocated: through a competitive bidding process between buyers and sellers. This is why the Perfect Competition Principle forbids actors from polluting beyond the level at which they would pollute if they were forced to bear the overall social costs (rather than just private costs) of pollution. There is a sense, then, in which a polluter could attempt to pollute at a level beyond the amount a perfectly competitive market would bear, just as the seller of any other product could (like the seller pursuing profit by improving product quality) attempt to sell the product at a price above the competitive market price. But the result in either case would be the same: the polluter/seller would be left in possession of an unsold unit of pollution/goods, because no buyer will agree to accept it when other units of pollution/goods are available at a more attractive price. Under conditions of perfect competition, a firm could attempt to profit by either polluting or improving the quality of its products, but in either case, the firm will be unsuccessful due to the nature of the conditions of perfect competition. I therefore doubt that drawing distinctions between different notions of “possibility” under conditions of perfect competition will allow us to distinguish pursuing profit by polluting and pursuing profit by improving product quality in a way that will salvage the Perfect Competition Principle.Footnote 6

3.2 Static versus Dynamic Efficiency, Schumpeterian versus Kirznerian Conceptions of Entrepreneurship

If the Perfect Competition Principle cannot account for the ethical difference between competing on product quality and competing by polluting (beyond the socially optimal amount), then it clearly fails as a principle for identifying preferred and nonpreferred strategic tactics. Maybe there is some MFA-based principle other than the Perfect Competition Principle that can be used to draw this distinction. However, I am skeptical that a workable MFA-based principle can be found, at least if we understand the MFA to be Paretian in the way Heath insists it is. I attribute the problem I have identified not to the Perfect Competition Principle in particular but rather to the entire Paretian orientation of the MFA. To find a workable theory for distinguishing between preferred and nonpreferred strategic tactics, we must reject Paretianism entirely.

The fundamental problem with the MFA, at least insofar as it emphasizes the conditions of perfect competition that guarantee Pareto efficiency when the market reaches equilibrium, is that it focuses only on a certain sense in which market competition is beneficial. More specifically, the MFA’s Paretian orientation assumes a static conception of Pareto efficiency. However, an adequate theory of business ethics also must account for considerations related to Pareto efficiency in a dynamic sense.Footnote 7

Static efficiency “is usually defined as maximization of the output derived from given inputs” (Blaug, Reference Blaug2007: 190). The static conception of economic efficiency focuses on reaching a certain end state and on the nature of the equilibrium that holds in that end state (Blaug, Reference Blaug2001). Reaching static efficiency requires “refinement of existing products, process, or capabilities” (Ghemawat & Ricart Costa, Reference Ghemawat and Ricart Costa1993: 59). In other words, increasing static efficiency is about squeezing more value out of the technologies, processes, and business models that exist at a given point in time.

For an economy to become more efficient in the dynamic sense, by contrast, it must develop new products, processes, and capabilities that create more value than the ones previously in existence (Blaug, Reference Blaug2001, Reference Blaug2007; Ghemawat & Ricart Costa, Reference Ghemawat and Ricart Costa1993). If static efficiency is, to put it somewhat crudely, about squeezing all the potential value out of the economy’s existing machinery, dynamic efficiency is about altering the existing machinery of the economy so that it has the potential to create more value than in previous periods. Whereas static efficiency is concerned with maximizing economic value at a fixed point in time, dynamic efficiency is concerned with increasing value over time.

Recall that Heath builds the MFA on the desirability of attaining Pareto efficiency, combined with the finding of the first fundamental theorem of welfare economics that, under conditions of perfect competition, any competitive market equilibrium is Pareto efficient. What is crucial to recognize is that the notion of efficiency on which the first fundamental theorem relies is static (Blaug, Reference Blaug2001: 44). When the first fundamental theorem of welfare economics proves that, under conditions of perfect competition, any competitive market equilibrium is Pareto efficient, it proves this result in an austere world of simplifying theoretical assumptions in which tactics that drive dynamic efficiency—for instance, technical innovation, business model innovation, product quality improvement—do not exist. Thus, as a theoretical tool for generating insight relevant to evaluating the ethical permissibility of these sorts of tactics, the conditions of perfect competition are inadequate. Evaluating the permissibility of strategic tactics for market actors requires accounting for dynamic efficiency considerations.

Another useful way of understanding the distinction between dynamic and static efficiency is to compare the different conceptions of entrepreneurship defended by Israel Kirzner and Joseph Schumpeter. Kirzner (Reference Kirzner1997) argues that we should understand entrepreneurship as a process that pushes markets toward a hypothetical competitive equilibrium state. Entrepreneurs discover market inefficiencies, for example, products that consumers would want and are possible to make but are not being provided or producers who value a scarce resource more than those who are currently using it. These inefficiencies represent entrepreneurial opportunities, and the entrepreneurs who seize them are rewarded with profits as they iron inefficiencies out of the markets in which they participate. Thus entrepreneurship in the Kirznerian sense promotes static efficiency.

Schumpeter (Reference Schumpeter1947, Reference Schumpeter2010), by contrast, identifies entrepreneurship as a process that disrupts market equilibrium. Entrepreneurs carry out innovations—new goods, new methods of production, new forms of organization—that unsettle the markets in which they are introduced from their previous equilibrium state. Entrepreneurship is an example of the creative destruction (to use Schumpeter’s term) process by which market systems facilitate the displacement of outmoded, inefficient ways of doing business by new, improved ways of doing business. Thus entrepreneurship in the Schumpeterian sense promotes dynamic efficiency.

By relying on a static notion of efficiency, the MFA adopts a perspective about the benefits of market competition that reflects the Kirznerian understanding of entrepreneurship. Having actors in competitive markets pursue profit is desirable because it eliminates wasteful inefficiencies from the market, bringing the system as a whole closer to Pareto-efficient equilibrium. Eliminating inefficiencies is indeed a valuable feature of competitive markets; this I do not dispute. However, as Schumpeter teaches us, eliminating inefficiencies is not the only, or even the main, valuable feature of markets. Competitive markets are also valuable because they foster innovation. But we cannot account for the value of innovation by appealing to the desirability of getting closer to the Pareto frontier. Schumpeter emphasizes how successful entrepreneurs often bring the market, at least temporarily, away from its Pareto-efficient competitive equilibrium. Equilibrium-seeking, Kirznerian market processes will tend to draw the market back toward Pareto-efficient equilibrium in the wake of disruption. But disruptive innovation itself does not facilitate this—indeed, Pareto-efficient equilibrium is the very thing it disrupts. If we want to be able to explain the value of innovative activities, such as a firm’s discovery of a new product design that allows it to produce a better-quality product than its rivals, then we need to reference something other than the desirability of getting closer to Pareto-efficient market equilibrium in the static sense conceived of in the general equilibrium models on which the MFA relies.

3.3 The Pareto Frontier

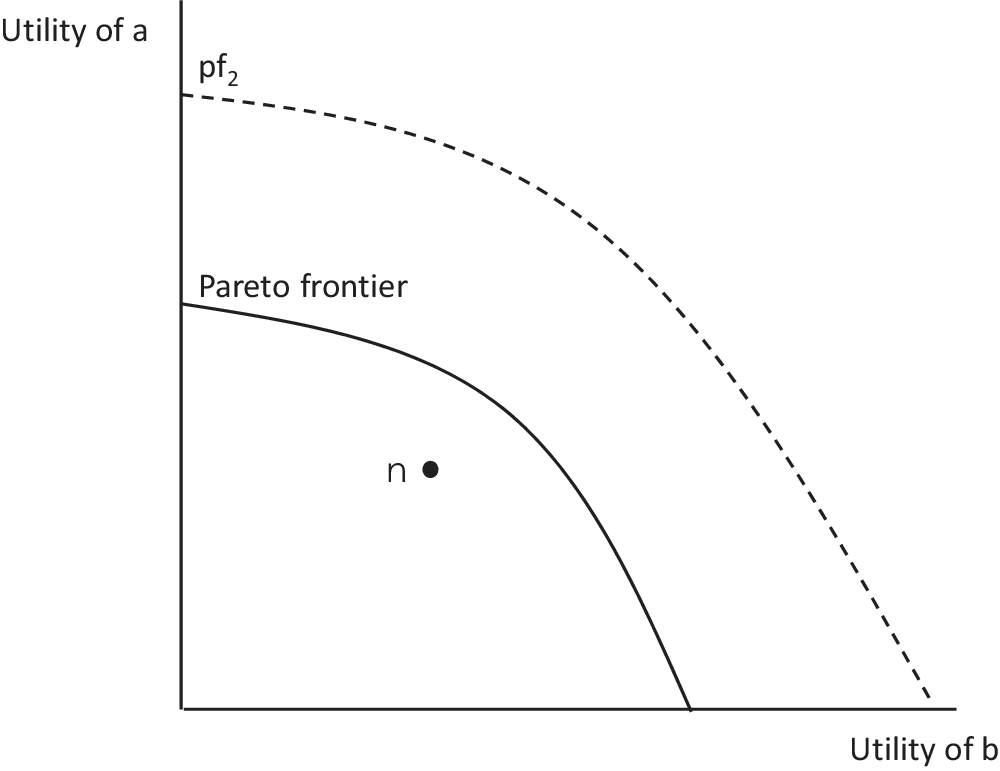

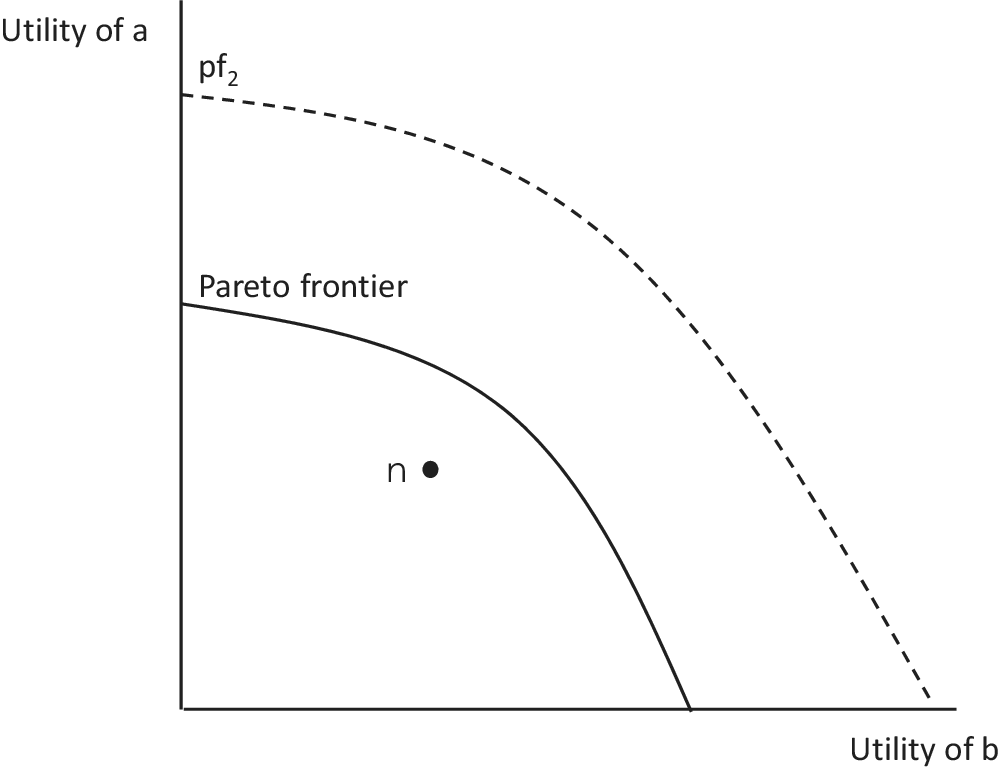

This point can be put slightly differently by appealing to the notion of a Pareto frontier. A Pareto frontier represents all possible Pareto-efficient allocations (see Figure 1). By identifying the goal or “point” of the market economy as the achievement of Pareto efficiency, the MFA justifies the restrictions it imposes on how market actors may pursue profit on the grounds that market actors’ adherence to them “gets us as close to the Pareto frontier as possible” (Singer, Reference Singer2018: 111). Desirable sets of restrictions will be those that move the economy from Pareto-suboptimal states like n in Figure 1 closer to the Pareto frontier.

Figure 1: The Pareto Frontier

Suppose the current state of the economy is at a Pareto-suboptimal state like n in Figure 1. Basic economics allows us to demonstrate how firms competing on price in a market like this will move the state of the economy closer to the Pareto frontier. (Note that this analysis is subject to second-best caveats, but again, for the sake of simplicity, I am ignoring those for now.)

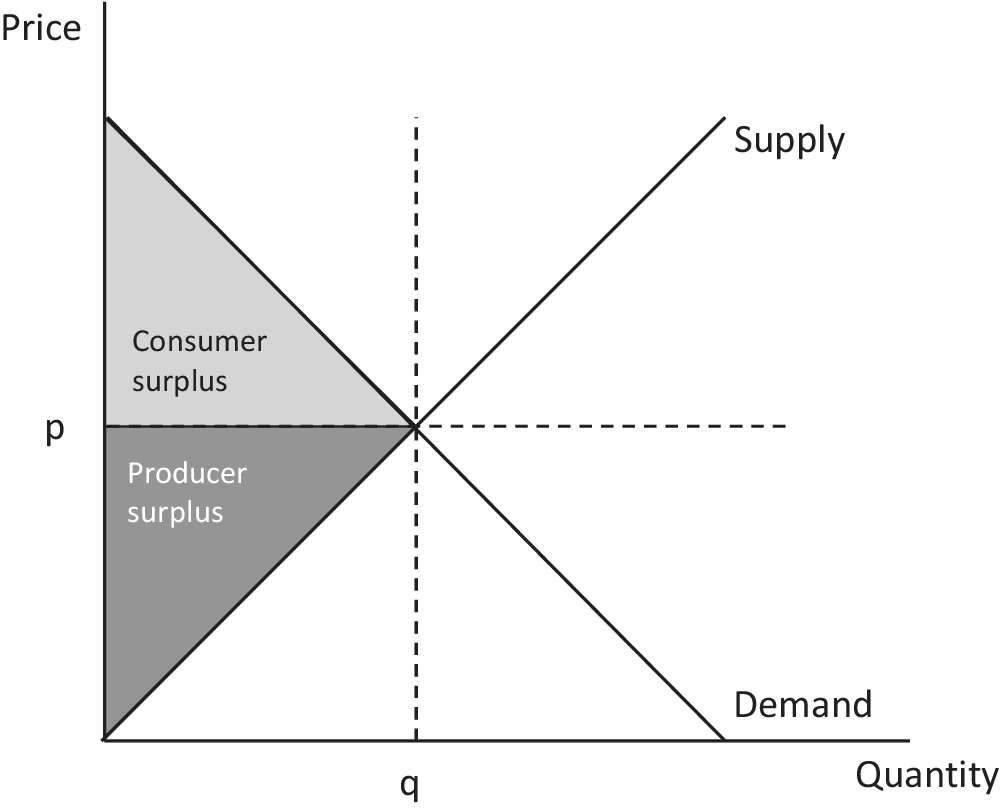

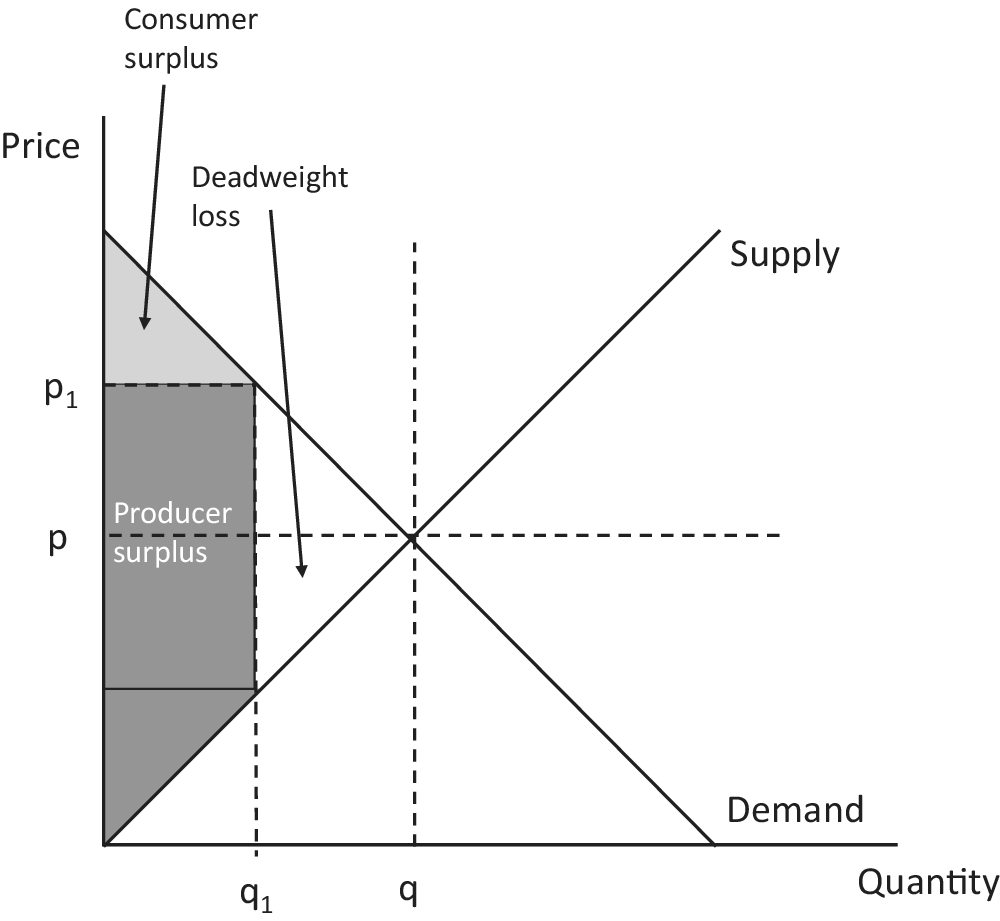

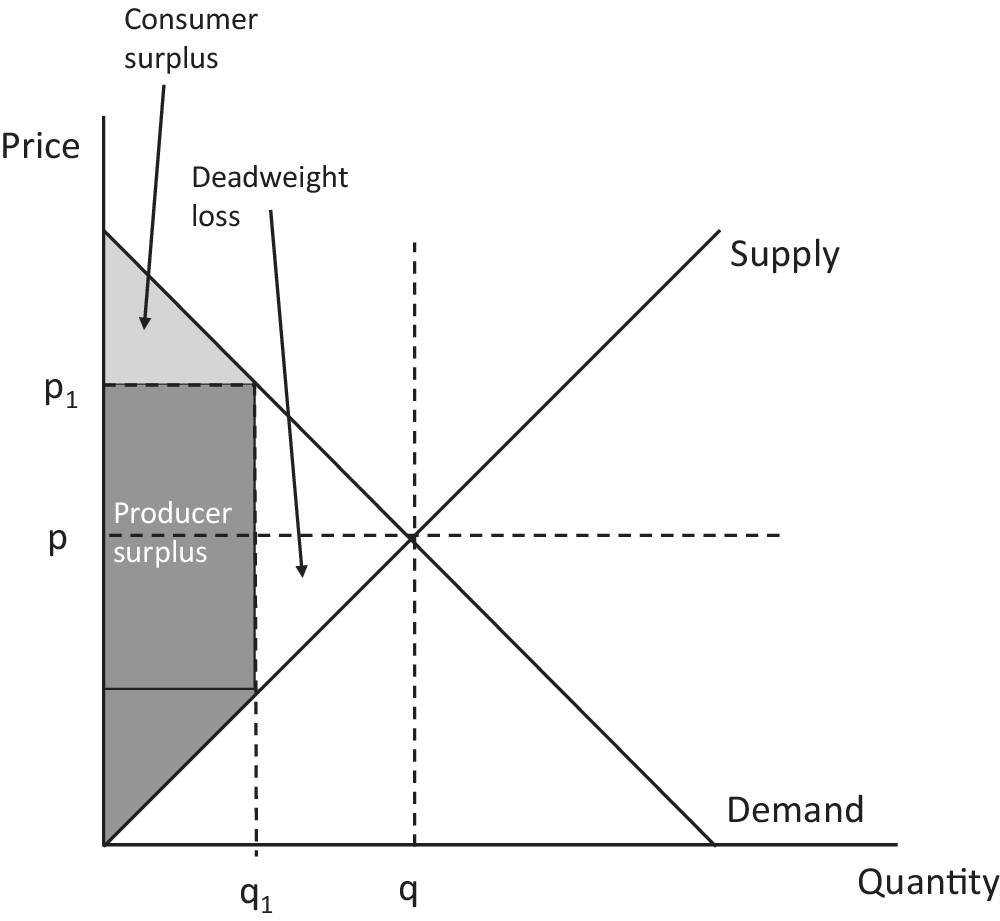

Figure 2 represents a Pareto-optimal market equilibrium in which buyers and sellers exchange a quantity q of goods at price p. Figure 3 represents a Pareto-suboptimal market in which buyers and sellers exchange quantity q 1 (which is lower than q) of goods at price p 1 (which is higher than perfectly competitive price level p).

Figure 2: Consumer and Producer Surplus under Perfect Competition

Figure 3: Deadweight Loss

Note that Figure 3 has deadweight loss in the triangle to the right of the vertical line representing q 1, whereas in Figure 2, this area is consumer and producer surplus. This represents the fact that there are consumers in Figure 3 (occupying points on the demand curve that lie between q 1 and q) who are willing to buy goods at a price at which sellers occupying the corresponding points on the supply curve would be willing to sell them. However, because in Figure 3, competitive market pressures have not yet pushed the price from p 1 to p and quantity from q 1 to q, there are unrealized mutually beneficial transactions in Figure 3. This analysis shows us why competing on price is a preferred strategy: it pushes markets occupying inefficient states like the one represented by Figure 3 or by point n in Figure 1 toward the efficient states represented in Figure 2 or by the Pareto frontier in Figure 1. The Paretian approach thus seems to be able to justify competing on price.

This sort of justification, however, is not available for product quality improvement. Improving product quality generally neither eliminates the deadweight loss in markets like the one depicted in Figure 3 nor moves the economy from suboptimal points like n in Figure 1 outward to the Pareto frontier. This is because product quality improvement contributes to efficiency in the dynamic sense, but not necessarily to efficiency in the static sense.

Instead, the economic effect of attempting to profit by introducing an improved-quality product is captured in Figure 1 by moving the Pareto frontier outward to pf 2. We cannot account for the value of this by appealing to the first fundamental theorem’s explanation of how markets at perfectly competitive equilibrium are Pareto efficient. Indeed, if suboptimal point n in Figure 1 represents the state of the economy, and successful employment of a product quality improvement tactic pushes the Pareto frontier outward to pf 2 without simultaneously moving point n outward by the same amount, then the state of the economy post–product quality improvement will be farther from the Pareto frontier than it was pre–product quality improvement. A firm in a perfectly competitive market at equilibrium like the one depicted in Figure 2 that successfully pursues a product quality improvement will create a situation with deadweight loss, like in Figure 3, where none existed before (assuming rivals cannot instantly copy the improvement and compete away the entrepreneurial profits of the firm that innovated the improved-quality product).

Let me be clear. My claim is not that Heath holds the (absurd on its face) position that product quality improvement is not a preferred tactic. His explicit claim to the contrary is strong evidence against interpreting him in this way. My claim, rather, is that the MFA’s reliance on the static efficiency universe of general equilibrium models, perfect competition, and the first fundamental theorem of welfare economics is fundamentally inadequate for the task of distinguishing between preferred and nonpreferred tactics for pursuing profit in a market. Heath claims that competitive market institutions are valuable because they eliminate deadweight loss, move the market closer to the Pareto frontier, and “ensure the smooth operation of the price system” (Heath, Reference Heath2006: 541). These are all different ways of appealing to the desirability of reaching Pareto efficiency in the static sense. But market institutions, I claim, are valuable not just because they promote static Pareto efficiency but also because they promote dynamic efficiency by pushing the Pareto frontier outward. An MFA based on a static conception of efficiency cannot account for this.Footnote 8

Heath himself is definitely aware of the distinction between static and dynamic efficiency. In the chapter titled “The History of the Invisible Hand” of his 2014 book Morality, Competition, and the Firm: The Market Failures Approach to Business Ethics, he writes,

One of the characteristics of the general equilibrium models, which emphasize the importance of prices, is that they are static. Some of the most striking features of real-world markets, however, are the effects that they have over time. This is particularly obvious when it comes to economic growth and technical change. Both of these seem to be unintended yet beneficial consequences of market interactions

(Heath, Reference Heath2014: 225).However, although this quotation appears in a book that is primarily comprised of essays on the MFA, Heath never considers the implications of this point for his theory of business ethics.

Because it is generated from the static efficiency world of the first fundamental theorem of welfare economics, the Perfect Competition Principle cannot account for the dynamic efficiency considerations that we have reason to want market institutions, and business activity, to promote. As theoretical devices, the conditions of perfect competition and the Perfect Competition Principle thus cannot account for the desirability of preferred tactics, such as product quality improvement, that further dynamic efficiency rather than static efficiency. Addressing this problem requires a different approach.

4. WEALTH CREATION

My positive proposal in this article is that we should look to the value of wealth creation, rather than to Pareto efficiency, to explain much of what the MFA purports to illuminate: the point of the market economy, what justifies the profit motive in the context of a market economic system, and how we should differentiate between preferred and nonpreferred tactics for pursuing profit. Wealth creation, unlike Pareto efficiency, can account for the value of dynamic efficiency considerations.

4.1 What Is Wealth?

Wealth refers to the all-purpose economic means that people may use to pursue their ends, usually by engaging in exchange with others. Thus something counts as wealth if it possesses economic value. Tangible examples of wealth include consumer goods, productive assets, and land. But wealth also includes intangible things like ideas, productive processes, social capital, and human capital.

This conception of wealth is fairly broad, but certainly not the broadest one available. Its main limit is that it only includes things and intangible assets with economic value. This limit might appear objectionable: clearly some things have moral value that cannot be (fully) captured by economic value (Sagoff, Reference Sagoff1981). (The converse is also true: not all economic value is morally valuable. I address this in my discussion of the shortcomings of a conventional Kaldor–Hicks standard later in this article.) However, I still maintain that this narrower conception of wealth makes sense as a guiding value for business ethics. Business and economic institutions are justified (in large part, though not entirely) because they facilitate the creation of general means that people can use to pursue their ends by engaging in productive activity and exchange with others. That does not mean that economic value exhausts moral value: noneconomic moral values can therefore still justify constraints on how market actors may pursue profit. But the main moral goals of business are much more closely connected to economic values than noneconomic values. Thus it is appropriate for a theory of business ethics to accord a large role to economic value even if this would be inappropriate in other domains of ethics.

If, as I claim, wealth considerations play an important role in justifying ethical norms governing pursuit of profit in a market, then wealth must itself have significant ethical importance. Some are skeptical that it does (Dworkin, Reference Dworkin1980; Jones et al., Reference Jones, Donaldson, Freeman, Harrison, Leana, Mahoney and Pearce2016; Jones & Felps, Reference Jones and Felps2013). I maintain that, as a society, we have stronger ethical reasons than such critics recognize for promoting wealth creation through our economic institutions and the business activity that occurs within them. The main reason I would offer in support of this claim is that, for individual persons, greater wealth constitutes greater positive freedom—that is, the freedom a person has when she enjoys the effective power to act or pursue her ends (Gaus, Courtland, & Schmidtz, Reference Gaus, Courtland, Schmidtz and Zalta2015)—and we have ethical reason to promote individuals’ positive freedom. Although the claim that wealth has ethical value is somewhat controversial, it has adherents from a variety of ideological perspectives: Economists occupying significantly different places on the political spectrum tend to accept it (Acemoglu & Robinson, Reference Acemoglu and Robinson2013; Cowen, Reference Cowen2018; Krugman, Reference Krugman1994), as do political philosophers ranging from libertarians (Schmidtz & Brennan, Reference Schmidtz and Brennan2011; Van der Vossen & Brennan, Reference Van der Vossen and Brennan2018) to the left-liberal icon John Rawls (Reference Rawls2001).Footnote 9 A more robust argument for the ethical importance of wealth is, unfortunately, beyond the scope of this article. I will thus proceed on the assumption that we have an ethical reason to promote the creation of wealth.

Because my discussion here focuses on the idea of creating wealth, it will be useful to identify two different ways we might try to measure wealth for the purpose of defining what it means to have more or less of it. We can measure wealth by focusing on either exchange value or use value (Bowman & Ambrosini, Reference Bowman and Ambrosini2000; Lepak, Smith, & Taylor, Reference Lepak, Smith and Taylor2007). The exchange value of a good is determined by the price it commands on a given market. The use value of a good is determined by the maximum amount that someone is willing to pay for it. Suppose you pay $1 for an apple at the supermarket and that you value the apple at $2 (i.e., you are indifferent between having $2 and having the apple). The exchange value of the apple in this example is $1, and the use value is $2.

Wealth is a stock rather than a flow. The economically valuable things (goods, services, intangibles) that an individual can exchange for other economically valuable things, not his or her annual income, constitutes the individual’s wealth. The economically valuable things that members of a country can exchange for other things of economic value, not gross domestic product, constitutes that country’s wealth. Of course, the quantity of economically valuable things to which an individual or country has access will usually be a function of how much value flows to that individual or country in the form of income. But strictly speaking, this income stream does not itself constitute a person’s, or country’s, wealth.

The general position I am defending is that wealth creation is an important guiding value for understanding ethical constraints on how profit may be pursued in markets. In the discussion that follows, I adopt a conception of wealth as potential preference satisfaction as specified by the Kaldor–Hicks standard and a conception of wealth creation as Kaldor–Hicks improvements. There are, however, some persuasive objections to the conventional economic understanding of welfare as subjective preference satisfaction upon which the conventional Kaldor–Hicks standard relies. As I show, a plausible view emerges if we accommodate some of these objections.

4.2 The Kaldor–Hicks Standard

Kaldor–Hicks improvements are defined in terms of hypothetical Pareto improvements. Imagine two states of the economy, A and B, both of which contain the same set of individual actors. Both A and B contain some quantity—not necessarily the same quantity—of (tangible and intangible) things that have economic value. Both A and B also feature different distributions of economic value among the individuals who inhabit each state. State B will qualify as a Kaldor–Hicks improvement compared to state A if and only if, through some combination of hypothetical transfers between the actors in B, it would be possible to reach a distribution in B where every actor in B is at least as well-off, and at least one actor in B is better off, than in A:

Kaldor–Hicks Improvement: A state of economic distribution B is a Kaldor–Hicks improvement over another state A if agents whose utilities are higher in B than in A could hypothetically compensate agents whose utilities are lower in B than in A so that B would qualify as a Pareto improvement compared to A.

The Kaldor–Hicks standard gives us a criterion for comparing the amount of wealth between different states. If state B represents a Kaldor–Hicks improvement over state A, then there is more wealth in B than in A. Wealth is thus a function of agents’ relative preference satisfactions, weighed against each other in the way the Kaldor–Hicks standard specifies. If an agent prefers a set of possessions Y over an alternative set of possessions Z, then that agent has more wealth if she has Y than Z. If a state of economic distribution B is a Kaldor–Hicks improvement over another state A, then there is more wealth in B than in A.

One inconvenient feature of the Pareto standard is that many states are Pareto incomparable (Buchanan, Reference Buchanan1985; Hausman, McPherson, & Satz, Reference Hausman, McPherson and Satz2016; Sen, Reference Sen1991). For example, if one agent has a higher utility in A than in B, and another agent has a higher utility in B than in A, then neither A nor B is a Pareto improvement over the other. The Kaldor–Hicks standard, by contrast, can make pairwise comparisons between all states of economic distribution that are inhabited by the same agents.

4.3 Reservations about Kaldor–Hicks

However, the conventional Kaldor–Hicks standard also has some drawbacks because of its reliance on the problematic theory of welfare that underlies much of modern economics. Given that I am looking for a standard that will inform ethical judgments about permissible and impermissible tactics for pursuing profit in a market, Kaldor–Hicks does not provide an entirely adequate understanding of wealth creation.

Conventional welfare economics measures welfare in terms of subjective preference satisfaction. However, if we understand wealth in this way, we cannot distinguish between the different ways people acquire their preferences. Such distinctions are crucial for any conception of wealth creation that bears ethical significance. For example, there is clearly an ethically relevant difference between a preference that cannot secure the rational endorsement of the preference holder (e.g., because it is the result of manipulative advertising) versus a preference that is rationally accepted (or at least not rejected) by the preference holder (Crisp, Reference Crisp1987). If Kaldor–Hicks cannot distinguish the former from the latter, it will overweight the ethical importance of fulfilling preferences that are irrational, that are nonautonomous, or the fulfillment of which would be against the interests of the preference holder.

Thus a fully developed wealth creation approach will need a theory of welfare that can make these sorts of distinctions. I cannot provide such an account here, but I am confident that one exists, at least in principle. One option, outlined by Arneson (Reference Arneson2000), would be to adopt an objective list of things that contribute to welfare—Arneson offers “engagement in relations of love and friendship and intellectual and cultural achievement” (514) as examples. One might add to the list some items that intersect more with economic life than Arneson’s examples, for instance, living a normal-length human life, maintaining good health, finding fulfillment, achieving valuable things, or acting autonomously and rationally. (This list roughly tracks some of the central human capabilities from Nussbaum [Reference Nussbaum2001], though her approach has some deeper theoretical differences from traditional welfarist theories.) Alternatively, one might choose to hew closer to a conventional Kaldor–Hicks account of wealth creation by limiting which subjective preferences are relevant, rather than discarding them altogether. For example, we could exclude subjective preferences that result from manipulative advertising on the grounds that they violate consumers’ autonomous desires, as Crisp (Reference Crisp1987) suggested.

4.4 The Wealth Creation Principle

I have spoken of product quality improvement as a tactic a firm may use to pursue profit. Strictly speaking, however, pursuing profit through product quality improvement involves at least two distinct tactics: 1) improving some aspect of a product in the eyes of some customers so that the willingness of those customers to pay for the product increases and 2) choosing the price at which the product is offered for sale. The former is a wealth creation tactic, whereas the latter is a wealth appropriation tactic (Lepak et al., Reference Lepak, Smith and Taylor2007). Wealth creation tactics create wealth by increasing customer willingness to pay for a firm’s products or by increasing the efficiency (thereby decreasing costs) associated with production and distribution. Wealth appropriation tactics appropriate wealth for the firm that would otherwise accrue to some other party.

In many cases, for it to be in a firm’s financial interest to implement a wealth creation tactic, that tactic will need to be combined with a wealth appropriation tactic. In the long run, a firm will only gain financially from selling a superior-quality product if it is at least able to set its prices high enough to cover its costs. In the likely event that the firm’s wealth creation tactic involves undertaking risky investments, the firm will also need to appropriate an additional risk premium for the investments to be ex ante financially justified. To pursue profit successfully, firms must adopt tactics for both wealth creation and wealth appropriation.

If our goal is to identify a wealth-based principle that distinguishes permissible tactics for pursuing profit from impermissible ones, we cannot consider wealth creation tactics and wealth appropriation tactics in isolation of each other. Wealth appropriation tactics often reduce overall wealth relative to if they were not employed at all. Consider the wealth appropriation tactic of increasing prices. In perfectly competitive equilibrium, all firms have total revenues that are just high enough to cover their costs (including costs of capital), but no higher. In other words, firms under perfect competition achieve zero economic profit (i.e., profit in excess of costs of capital). Imagine a zero-profit firm that prices its products just high enough to cover its costs. Suppose market conditions change so that the conditions of perfect competition no longer hold, allowing this firm to raise its prices and achieve positive economic profit (without making any improvement in product quality). Absent specific market conditions, this price increase will cause deadweight loss: potential mutually beneficial transactions will not occur, because buyers whose maximum willingness to pay was greater than the price level when the firm was just barely covering its costs, but lower than the increased price, will no longer purchase the product. There is less wealth after the firm employs its wealth appropriation tactic than before. Thus, if we apply a wealth standard to wealth appropriation tactics in isolation, we risk judging all or most wealth appropriation tactics as impermissible.

This seems overly restrictive. Perhaps there is something to be said, ethically speaking, for a firm that voluntarily forgoes profit and keeps its prices at a level just high enough to cover its costs. But making this an ethical requirement seems unintuitively demanding and prevents us from making the sorts of ethical distinctions between permissible and impermissible tactics for pursuing profit that motivated this article in the first place. Making zero profit an ethical requirement would also ignore the dynamic efficiency considerations for which section 3 argued any plausible view must be able to account. Fortunately, we can avoid this result by evaluating tactics for appropriating wealth in the context of the wealth creation tactics that often accompany them, rather than in isolation.

How wealth appropriation and wealth creation tactics should be combined is a tricky question. Precise answers are illusive. However, to gain some clarity on this issue, I propose that we group tactics into what I will call strategic sets. A strategic set of tactics contains one or more wealth creation tactics, plus wealth appropriation tactics that are necessary for the wealth creation tactics in the set to be in the strategic interest of the firm to employ. Thus, when a firm pursues profit by improving the quality of one of its products, the resulting strategic set of tactics will include 1) the wealth-creating tactic of improving the quality of the product and 2) the wealth-appropriating tactic of setting the price of that product so that the firm captures a portion of the value it creates. These two tactics should be evaluated together. They should also be evaluated separately from other strategic sets of tactics the firm employs. For example, if the firm undertakes another quality improvement for an unrelated product, the two strategic sets of tactics that constitute the two different product quality improvements should be evaluated separately.

Having defined strategic sets of tactics, I am now ready to propose the following principle for distinguishing permissible and impermissible tactics for pursuing profit:

Wealth Creation Principle: It is impermissible for a firm to employ strategic sets of tactics that are expected to appropriate more wealth than they create.

The Wealth Creation Principle can explain our intuitions regarding Easy Cases. It can also account for the value of moves that contribute to dynamic efficiency, in addition to moves that contribute to static efficiency. As the preceding remarks suggest, product quality improvements are judged permissible because, absent serious market failure (e.g., a quality improvement that introduces or exacerbates an especially costly negative externality), a firm that implements a product quality improvement will create more wealth than it appropriates. The wealth created by increasing some customers’ willingness to pay will be greater than the wealth the firm appropriates through its pricing (see Brandenburger & Stuart, Reference Brandenburger and Stuart1996).

Conversely, strategic sets of tactics involving collusion and contrived deterrence will typically be impermissible under the Wealth Creation Principle. When executed successfully, these tactics destroy wealth overall by introducing deadweight loss and failing to create additional wealth. They undermine static efficiency without furthering dynamic efficiency. Because firms that employ collusion and contrived deterrence successfully appropriate some wealth while creating negative wealth, they appropriate more wealth than they create and run afoul of the Wealth Creation Principle.

I am also optimistic that the Wealth Creation Principle points us in a plausible direction for analyzing more challenging cases. It tells us to identify each of the various tactics a firm employs and to determine, for each individual tactic, whether it creates wealth or appropriates wealth. It tells us to group the individual tactics into strategic sets according to which wealth appropriation tactics the firm employs are necessary for it to be in the firm’s strategic interest to employ accompanying wealth creation tactics. Finally, it tells us to compare wealth appropriated to wealth created for each strategic set.

Of course, these tasks will not be easy. The outcome will typically depend on empirical factors that are difficult to measure and estimate accurately. There is also a need for more theoretical work to specify more precisely than I have been able to do here exactly how individual tactics are apportioned into strategic sets. However, the Wealth Creation Principle at least highlights the main factors on which an ultimate judgment would depend, as well as the empirical information one would need to gather to support an ultimate judgment in more complex cases. This represents an improvement over the Paretian MFA, which thus far has not yielded any clear principle that could serve as a starting point for thinking through these harder cases.

The Wealth Creation Principle does have some important limits. It provides neither a necessary nor a sufficient condition for a strategic set of tactics being ethical overall. It is, rather, a supporting condition: the fact that a strategic set of tactics satisfies it counts in favor of its ethical permissibility, and the fact that a set violates it counts against its permissibility. This is as it should be. The principle is based on wealth, but wealth clearly cannot explain everything in business ethics. Lying is usually wrong, and a strategic set of tactics that included a serious lie would usually be wrong to employ even if it created wealth overall. Strategic business decisions will often implicate considerations apart from just wealth. Making such decisions in an ethical way will require more than simply abiding by the Wealth Creation Principle. Still, a wealth creation approach makes sense in the domain of business ethics because wealth is especially important for explaining and justifying ethical norms in business and market contexts. Part of the explanatory value of a wealth creation approach is that much of what it explains is counterintuitive. People often have difficulty understanding how competitive, profit-oriented market activity could possibly be ethical—this may explain the common suggestion that business ethics involves an inherent contradiction or oxymoron. An appreciation of the ethical value of wealth creation, and the way in which profit-seeking actors in reasonably competitive market institutions facilitate wealth creation, helps resolve this apparent tension. It is true that wealth creation cannot explain everything in business ethics. On the other hand, what it does explain is important.

Moral philosophers distinguish between ethical principles as criteria of the right versus ethical principles as decision procedures. Criteria of the right tell us what the conditions are for an act to count as morally right (e.g., that it maximize overall utility or that it follow from Kant’s categorical imperative). Decision procedures provide practical guidance to people that is supposed to induce them to engage in better moral behavior (Brink, Reference Brink1986; Railton, Reference Railton1984; Rawls, Reference Rawls1951). As I understand the Wealth Creation Principle, it falls somewhere between the poles of this spectrum. Unlike a pure decision procedure, the principle does not give detailed prescriptive guidance that could plausibly replace an individual’s moral judgment regarding what to do and care about. Like a decision procedure, the principle does serve as a source of practical guidance. It highlights certain contours of the moral terrain that are especially important for decisions in business and market contexts. Unlike a pure criterion of the right, the principle does not provide necessary or sufficient conditions for an act to qualify as ethically right. However, the principle does track moral considerations that are intrinsically important. It is not a noble lie whose aim is purely to induce better behavior in people who adopt it (Plato, Reference Reeve2004). The Wealth Creation Principle identifies an important moral consideration that is relevant to what agents ought to do, particularly in business and market domains. Competing moral considerations can outweigh it, but absent competing moral considerations, compliance with the principle becomes morally obligatory.

Now that I have explained these clarifications and refinements, I hope it is clear that, by permitting sets of tactics that further dynamic efficiency even when they temporarily pull markets further away from static efficiency, the Wealth Creation Principle at the very least succeeds where the MFA fails:Footnote 10 it provides a plausible way of distinguishing between preferred and nonpreferred tactics for pursuing profit in a market. Preferred strategic sets of tactics create more wealth than they appropriate, whereas nonpreferred strategic sets of tactics appropriate more wealth than they create.

5. CONCLUSION

In this article, I have argued that business ethics cannot be Paretian in the way contemplated by Heath’s MFA. Because of its reliance on a static notion of Pareto efficiency, and its neglect of dynamic efficiency considerations, the MFA fails to provide a plausible way of distinguishing between permissible and impermissible tactics for pursuing profit in a market. Focusing on wealth creation provides a better way of understanding the ethics of market competition.

Of course, one could accept all this and still maintain a broadly Paretian view about the overall political and economic institutions of society. Over time, these institutions should generate broad prosperity, finding ways to make most members of society (especially the less well-off) better off, and not doing so at the expense of any particular individual or group. Having a society that is Paretian in this broad, dynamic efficiency–encompassing sense, however, requires a capacity to create wealth. Creating wealth requires market institutions. And market institutions cannot function effectively if market actors are only permitted to employ tactics that satisfy a Paretian standard.

If this is right, then having a broadly Paretian society requires something closer to the Wealth Creation Principle than any principle that is recognizably Paretian for determining the ethical constraints on market competition. The Wealth Creation Principle may seem lax in comparison to Paretian principles, but it places important restrictions on the tactics managers may use to pursue profit for their firms. Though it is by no means a sufficient principle for business ethics, it does forbid some especially problematic kinds of business behavior that scholars of institutions have shown can inhibit societies’ efforts to become peaceful, prosperous, and just. The Wealth Creation Principle requires that business firms conduct themselves as inclusive institutions that produce wealth for society, rather than as extractive institutions that use their power to appropriate wealth that others produce (Acemoglu & Robinson, Reference Acemoglu and Robinson2013). It requires that business firms seek economic success through productive, rather than unproductive or destructive, entrepreneurship (Baumol, Reference Baumol1996). To comply with the principle, managers must ensure that their firms’ business activities contribute to the overall prosperity of society, rather than immiserating it for private gain. That may not be all that business ethics is (or should be) about, but it is surely an important part of it.

Acknowledgements

This research was made possible in part thanks to funding from the Institute for Humane Studies and from the Carol and Lawrence Zicklin Center for Business Ethics Research. I thank editor Bruce Barry and two anonymous reviewers for their challenging, constructive comments throughout the review process. This article also benefited from written comments from Brian Berkey, Matthew Caulfield, Thomas Donaldson, Keith Hankins, Joseph Heath, Wayne Norman, Diana Robertson, and Bas van der Vossen and from conversations with Sandrine Blanc, Jason Brennan, Vincent Buccola, Nicolas Cornell, William English, Cameron Harwick, Robert Hughes, Julian Jonker, Jooho Lee, Sareh Pouryousefi, Chris MacDonald, Grant Rozeboom, Abraham Singer, and Alan Strudler. I am also grateful for feedback I received from audiences at the Institute for Humane Studies Graduate Student Colloquium at Chapman University, the Zicklin Center Normative Business Ethics Workshop at the University of Pennsylvania’s Wharton School, the Georgetown Institute for the Study of Markets and Ethics at the McDonough School of Business, the Grossman School of Business at the University of Vermont, and the 2019 Society for Business Ethics annual conference in Boston. This article is based on a chapter from my doctoral dissertation.

Carson Young (cyoung@brockport.edu) is an assistant professor of management in the School of Business and Management at SUNY Brockport. He received his PhD in 2019 from the University of Pennsylvania’s Wharton School.