Book contents

- Frontmatter

- Contents

- Introduction

- 1 The Black–Scholes Theory of Derivative Pricing

- 2 Introduction to Stochastic Volatility Models

- 3 Volatility Time Scales

- 4 First-Order Perturbation Theory

- 5 Implied Volatility Formulas and Calibration

- 6 Application to Exotic Derivatives

- 7 Application to American Derivatives

- 8 Hedging Strategies

- 9 Extensions

- 10 Around the Heston Model

- 11 Other Applications

- 12 Interest Rate Models

- 13 Credit Risk I: Structural Models with Stochastic Volatility

- 14 Credit Risk II: Multiscale Intensity-Based Models

- 15 Epilogue

- References

- Index

- References

References

Published online by Cambridge University Press: 07 October 2011

- Frontmatter

- Contents

- Introduction

- 1 The Black–Scholes Theory of Derivative Pricing

- 2 Introduction to Stochastic Volatility Models

- 3 Volatility Time Scales

- 4 First-Order Perturbation Theory

- 5 Implied Volatility Formulas and Calibration

- 6 Application to Exotic Derivatives

- 7 Application to American Derivatives

- 8 Hedging Strategies

- 9 Extensions

- 10 Around the Heston Model

- 11 Other Applications

- 12 Interest Rate Models

- 13 Credit Risk I: Structural Models with Stochastic Volatility

- 14 Credit Risk II: Multiscale Intensity-Based Models

- 15 Epilogue

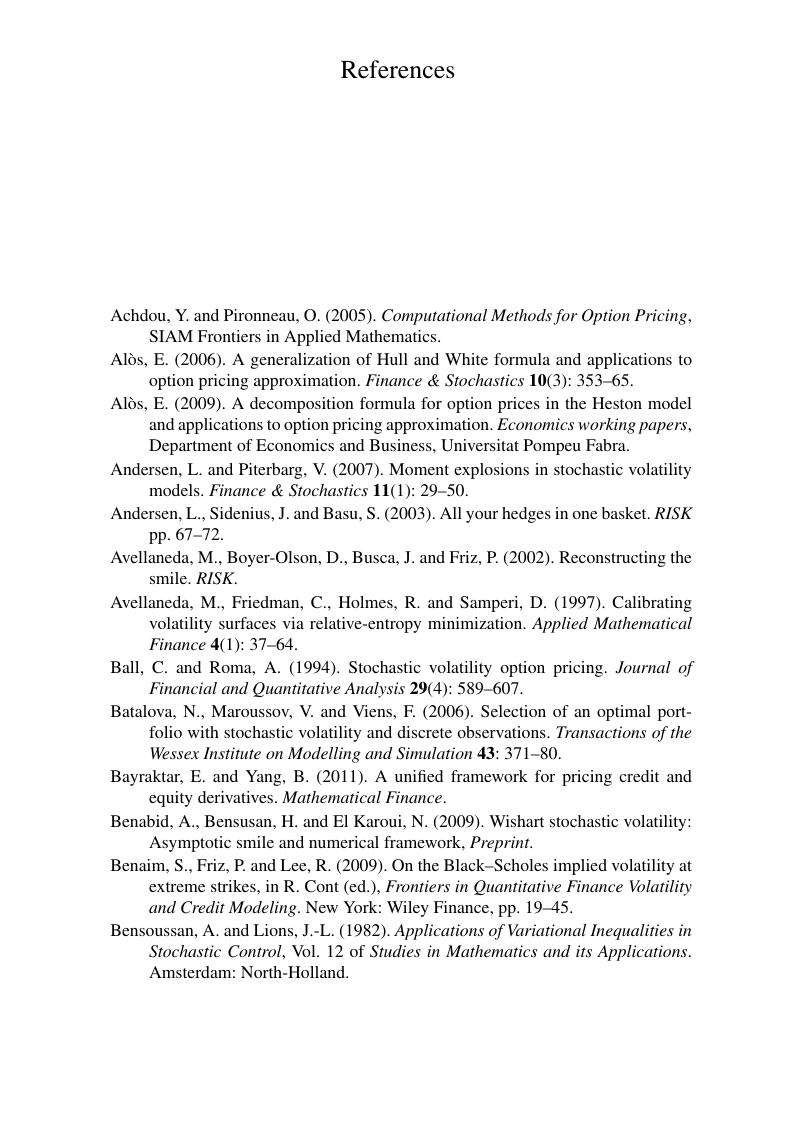

- References

- Index

- References

Summary

- Type

- Chapter

- Information

- Publisher: Cambridge University PressPrint publication year: 2011