1. Introduction

The current global economy is marked by diverging trends – on the one hand, rapid wealth and job creation, high return on investment and labour mobility; on the other hand, dwindling benefits, concentration of wealth and insecure employment and retirement for large parts of the population. The outcome of these diverging trends is a polarised economy, where the benefits of growth and innovation are reaped by a small number of firms and individuals, while pushing a large percentage of people down the social hierarchy and hallowing out the middle class.Footnote 1 These developments have led to an ongoing discussion at the academic and policy circles in competition policy on the need (or not), for a drastic transformation of competition law.Footnote 2 The current mainstream in competition law, which is inspired by the paradigm of neoliberal lawFootnote 3 and the separability thesis between matters of economic efficiency and distribution in neoclassical economics,Footnote 4 but also more broadly the legal system that has emerged from the so called ‘Twentieth Century Synthesis’Footnote 5, is perceived as not providing an adequate response to the complex challenges of ‘the world of the polycrisis’Footnote 6 and the disruptive transformations this brings to the current political and social order. Its emphasis on economic efficiency marginalises questions of power, failing to account for the multiple dimensions of power in the digital era and its multiple intersecting with socio-economic and political inequalitiesFootnote 7. The ‘objectivity’ and ‘neutrality’ of the ‘regulatory science’Footnote 8 it employs (neoclassical economics) does not pay sufficient attention, because of the separability thesis, to questions of equality (including ‘complex equality’Footnote 9). The apolitical (or ‘antipolitical’) nature of its focus on consumer welfare maximisationFootnote 10 seems to underestimate the need to promote the mechanisms of democratic accountability and seems to disregard the interests of various under-represented in the political process and vulnerable stakeholders.Footnote 11 In contrast to the traditional Law and neoclassical Economics synthesis, the Law and Political Economy (LPE) perspective instead revolves around issues of power, multi-level governance and pluralism, equality and democracy.Footnote 12

Hence, in contrast to the traditional law and economics approach that starts from the goal of economic efficiency/wealth maximisation to explore any ‘deviation’ of the legal system from this ideal (moral imaginary),Footnote 13 this paper examines how the economic and legal institutions and processes of digital capitalism are like in realityFootnote 14, and aims to explore the underlying values that shape the process and outcomes of competition in the era of digital capitalism. To advance our understanding, we need to examine social and economic developments at the macro and meso levels in a cohesive and integrated manner, focusing both on value creation/extraction but also on value capture, and on the role the legal system plays in this context. This paper seeks to improve our understanding of these processes by exploring the simultaneous operation of various dynamics that shape the modern digital capitalist system and its broader socio-economic foundations. We first examine the issue of value generation and extraction in the digital economy. We consider four important developments that are of relevance for the proper understanding of the challenges currently faced by competition law and which have been ignored by the traditional competition law and economics framework:

The acceleration of the transition of the economy towards financialisation and the logic of futurity, in particular in the digital economy, which gives rise to new competitive strategies of undertakings, structured around the ‘shareholder value’ principle.Footnote 15

The extraction of economic value through new types of labour, which fall outside traditional employment relationships and hence affect the scope of competition law in the digital economy.Footnote 16

The emergence of digital value chains that rely on multi-sided platforms, and the formation of digital ecosystems, where value is co-produced and exchanged between different categories of users, allowing platform owners to extract monopolistic rent, which challenge the usual focus of competition law on markets.Footnote 17

The generation and extraction of value through new types of commodities and natural and artificial scarcities, that shape new types of social relations of production in the digital economy in accordance with the logic of futurity, giving rise to new scarcities and thus leading to the emergence of competitive bottlenecks.

Based on these observations, we seek to emphasise the need for a comprehensive theory-building for competition law and regulation that addresses these new processes of value generation and capture, enables more opportunities of participation in the production process and allows for greater investment and influx of capital to the economic and social periphery, in line with the LPE focus on issues of distribution and inequality. These developments should also make us think more carefully, first in general, about the underlying theories of ‘value’ that provide to all these processes their inherent directionality, and second, more specifically, about the interplay of competition law with other fields of law, either old or emerging, that attempt to tackle the digital revolution phenomenon. We acknowledge the fact that existing institutions (including competition law) were unable to respond to these new changes. This has led to the initiation of significant institutional reforms in the EU, broadening up its remit to values other than consumer welfare maximisation and extending the kind of externalities (and market imperfections) competition law, or its regulatory alternatives, may take into account.

At the macro level, we start in Section 2 by discussing the financialisation of the economy and theories of value that are profoundly geared towards the interests of some stakeholders, as a major driving force behind the above trends. Then we turn in Section 3 to the meso level, where we analyse the extraction of economic value through new forms of labour and outside traditional work environments, as well the emergence of digital value chains and business ecosystems that serve as vehicles of value extraction from a more heterogeneous group of stakeholders (gig workers, users, customers, as well as waged labourers). We then return to the macro level and explore the development of new commodities on which specific ‘market agencements’ support the guiding frameworks for individual actions while channelling collective action towards the extraction of value.Footnote 18 We emphasise the fact that these ‘market agencements’ do not only rely on ‘market devices’ but also result from the contribution of the legal regime/coding that structures and prompts economic activity.Footnote 19 Taking a legal institutionalism perspective, Section 4 of the study explains how the processes of value extraction and capture in the digital economy have been facilitated or even enhanced by strategies of legal action or inaction. These diverse economic and technological mechanisms work in synch and intertwine. Therefore, they have to be analysed in an integrated/holistic way. Nevertheless, we leave the micro level, the psychosocial mechanisms of persuasion and participation in an increasingly computerised economy shaped by futurity to future studies in order to not exceed the scope of the Article.

The paper concludes in Section 5 by analysing how the emerging competition and regulatory compass for the digital economy in the EU contributes to the dialectic between value generation/capture and institutional choice, and how the current institutional architecture (the toolkit approach) breaks with the piecemeal approach of a narrowly focused consumer welfare oriented competition law (and its perceived tensions with regulatory alternatives), which has ultimately failed to take into account the complexity of the process of value extraction in digital capitalism. This LPE inspired reconstruction of the challenges of this regulatory field supports the development of a new synthesis, in some respects complementary to the traditional neoclassical approach, in some others substitutive, and calls for a greater engagement with new sources of learning and the methodological tools of the new ‘regulatory science’ of complexity studies.

2. The macro level: futurity, financialisation and shareholder value maximisation

Financialisation is one of the defining features of the current global economy. Broadly understood as ‘the increasing role of financial motives, financial markets, financial actors and financial institutions in the operation of the domestic and international economies’,Footnote 20 it has changed societies around the world, shifting the centre of economic activity from investment in production, infrastructure and job creation – the hallmarks of industrial capitalism well into the 20th century – to stock value maximisation, securitisation, and foreign exchange transactions.Footnote 21

This development predates the emergence of digital capitalism. The transformation of corporate control since the 1970s has led to the development of the multiproduct firm, in which managers seek to spread risks across various product lines to achieve greater profitability and to grow through mergers financed by leveraged buyouts. This process led to a significant increase of the profits of the finance sector (finance, insurance and real estate), but also to a significant increase in the share of financial assets held by the non-financial sector of the economy and in the importance of financial revenue for non-financial businesses.Footnote 22

The period coincides with the prevalence of the ‘shareholder value principle’,Footnote 23 which has dominated corporate governance discourse since the 1970s: disciplined by a corporate market for control dominated by financial interests, in particular institutional investors, corporate managers became increasingly aligned with the interests of shareholders. It became the ultimate goal of all corporate strategies to increase the price of the short-term value of corporate stocks (strategy of asset re-evaluation), in particular by creating an artificial scarcity of shares through extensive buybacks (share repurchase).Footnote 24 They also downsized their corporations (in particular by cutting labour costs through strategies of ‘heteromation’Footnote 25) and distributing the freed up corporate revenues to the shareholders (principle of ‘downsize and distribute’), instead of re-investing them in the long-term productive potential of the corporation (principle of ‘retain and re-invest’).Footnote 26 Larger firms became increasingly focused on stock market performance, while smaller and medium firms that were not public slowly de-leveraged their balance sheets.Footnote 27 Financialisation has expanded in all sectors of the economy, from commodities to elaborate digital value chains.Footnote 28

These developments hint at an important transformation of the value generation process in the economy, linked to financialisation. Industrial capitalism theories of value put emphasis either on value determined and generated, in the Jevons tradition, through a process of current exchange or spot markets for products, in which the factors of production are ideally priced according to their marginal or incremental productivity the economy being treated as an ‘isolated system’. Alternatively, in the Marxian tradition, value depends on social relations of production and/or income distribution that relate to socio-economic and institutional factors, for instance unequal distribution of property rights that spawns a system of unequal exchanges, which lead to exploitation.Footnote 29

These approaches do not adequately describe the process of value generation in a financialized economy, which is marked by intangible property or ownership (eg IP rights, reputation, trade secrets, know how, data), the dominant role of futures markets and consequently the central position of financial markets. In this new economic setting, value is not determined and generated by present exchanges, or present social relations of production, but by an expected succession of events. John R. Commons coined the term ‘futurity’ to describe this reorientation of economies towards the future and its underlying theory of value.Footnote 30 This futurity is linked to the emerging practice of treating businesses as ‘going concerns’, measuring their value in terms of their anticipated future profits.Footnote 31

In today’s financialized digital economy, the most important driver of value creation is indeed related not to present scarcity but to future expected scarcity that will result from the control of bottlenecks which may become a source of expected monopolistic rents in the future. Digital platforms have seen their financial markets’ valuation skyrocket in less than a decade. This valuation is, however, not justified by their current cash flow. Their tremendous value results from financial markets’ expectations for high profits derived from their position as gatekeepers controlling important bottlenecks in the networks that power and shape the digital economy (eg operating systems, search engines, app stores, the cloud), as well as their ability to canalise the activity of their broader ecosystems and users for their own use.Footnote 32

The underlying theory of value of the ‘shareholder value maximisation’ principle also almost uniquely focuses on the interests of the shareholders of the corporation. All other stakeholders such as workers, business partners (eg suppliers of inputs), consumers, the local community, citizens, are ignored in this process of value generation (for shareholders). At best, it is considered that they may benefit indirectly by the economic prosperity of the shareholders that would trickle down to them, for instance in the form of better job and trade opportunities or by additional tax income for the State and consequently higher levels of social welfare transfers. For this ‘shareholder value’ to also become ‘consumer value’, it has to be accompanied by a counter-movement,Footnote 33 focusing on consumer welfare, in which competition operates so as to bring down the ‘price’ to the consumer’s willingness to pay. This explains the simultaneous development of the ‘shareholder value maximisation principle’ and ‘consumer welfare’ oriented approaches in competition law. The latter work under the assumption of a ‘representative consumer’,Footnote 34 although it is clear that ‘consumers’ are highly heterogeneous, in terms of tastes, financial resources, and other defining characteristics, for each type of trade.Footnote 35 The primacy of the ‘shareholder value maximisation’ remains the key determinant for value: efficiency gains may outweigh the price effects and avoid intervention by competition authorities when the value created for shareholders overcompensates the loss of consumer surplus. Corrective measures to compensate the ‘losers’ through social policies (corporate taxation, subsidies, the welfare state) operate as an afterthought.

This reductionist theory of value does not adequately describe the new processes of value generation in the digital economy. It does not integrate the development of broader communities of co-production of value, in the form of ‘heteromated labor’ and business ecosystems or broader alliances between the public and the private sector. This broad conception of value communities is not new. Acknowledging the various dimensions of value, and the various theories that have been put forward in order to tackle this complex issue, Pitelis suggests a broader definition of ‘value’, as ‘perceived worthiness of a subject matter to a socio-economic agent that is exposed to and/or can make use of the subject matter in question’.Footnote 36 More than focusing on the subjective ‘perception’ of value, Pitelis’ definition departs from the neoclassical approach that defines value as something that relies on the idea of ‘willingness to pay’ and thus either directly or indirectly (through hedonic pricing) presupposes the existence of market prices.Footnote 37 He puts instead emphasis on the ‘organisation value’ that might also exist for ‘subject matters’ (concepts such as reliability) that have ‘value’ ‘even if there is no market and/or someone who is willing to pay for them’.Footnote 38 Indeed, as he explains, organisation value ‘can be conjectured or realised’.Footnote 39

One may conceive the stock market that appreciates the expected profits of a specific firm and through that arrives at a re-evaluation of its stocks (assets), as a process aiming to ‘realize’ that ‘conjectured value’. In this context, organisation value is conjectured and realised. At the individual level value is ‘created’, and ‘manifests itself as value captured’.Footnote 40 In neoclassical theory, ‘capture’ appears in the form of monopoly rents, ‘given the potential value creation encapsulated by the cost and demand curves’.Footnote 41 However, value can also be captured from conjectured value, through the joint operation of innovativeness, firm-level infrastructure and strategy, and the use of (human) resources that build the competitive advantage of firms. In this case value at the individual level will be ‘realised’ by the calculation by the stock market of the ‘anticipated future income streams of this advantage’.Footnote 42

The development in the era of digital capitalism of organisations beyond the core corporation, such as supply chains, integrated value systems, value chains and/or business ecosystems, also enables firms ‘to capture value created by others, such as suppliers, customers and distributors. These may help co-create value by appreciating (valuing) and/or improving and promoting the product or service in question’,Footnote 43 as they develop investments in assets complementary to those of the organisation. By ‘orchestrating’ ecosystems and controlling ‘industry architectures’, firms essentially aim to reach some balance between organisational value generation/creation and individual value capture based on their ‘architectural competitive advantage’.Footnote 44

In conclusion, ‘organisation value’ cannot be limited to ‘shareholder value’ but should also include the ‘value’ generated by all the other socio-economic agents involved in the value creation/capture process. Such value may be ‘realized’, not because of any ownership rights the agents dispose on the assets/infrastructure, but through their participation in the process of value creation. As it is nicely put by Ben Letaifa, ‘with the emergence of the new service- and knowledge-based economy, the concept of value is becoming more knowledge based, social, subjective, intangible, and complex and is shifting away from a post-industrial economic mantra (cost, efficiency, customer expectations)’.Footnote 45 Business ecosystems provide the ‘experience space’ in which ‘socio-economic value’ is co-created and ‘co-captured’ by the different actors involved. Hence, we need to embrace a broader ‘ecosystemic mindset’ that is very much based on the social relationships that develop between the ecosystems’ actors (but also those outside it). This likewise leads to a multidimensional definition of ‘value’ recognising the subjective assessment of the various socioeconomic dimensions in play.Footnote 46 From this perspective, emphasising only shareholders’ value would constitute an exceedingly reductionist view of ‘organisation value’ in digital capitalism.

3. The meso level: value generation and extraction in digital capitalism

The combination of financial capitalism with digital technology has given rise to new sources of value creation/extraction and capture. This increases the level of complexity in understanding the strategies of the various actors, as well as in designing appropriate public policies that promote the common good. To the extent that creating ‘value’ for all stakeholders, and not just for some of them (eg shareholders, consumers), may at least encompass the economic dimension of the common good, it is important to explore new sources of value that should be acknowledged when assessing the effects of alternative policy choices. This section examines three of these sources.

First, digitalisation engendered a profound transformation of labour relations and consequently of labour markets, with the development of new forms of ‘work’ but also, more generally, contributions to the co-creation of value in the digital economy. Financialisation enables the conceptualisation of each contributor to the value creation process as a would-be (small-scale) entrepreneur, making use of some personal ‘capital’ (eg an asset, time, specialised knowledge) in the context of a labour platform, generating rents through the coordination of the effort of other people or maximising conjectured value ‘in use’ through the operation of network effects. These relationships between the different actors are intermediated through data markets that are specifically constituted in order to translate into financial value the various features of human activity involved.

Second, digitalisation has accelerated the move towards modularisation of production, and the constitution of business ecosystems in which groups of autonomous firms and individuals take advantage of different sorts of complementary investments and capabilities to co-create value.Footnote 47 Not only value creation in the digital economy takes place across actors in ecosystems, but also this ‘organisation value’ is very much linked to the financialisation of the future prospects and the competitive advantage of each ecosystem to capture innovation rents.

Third, the logic of futurity and financialisation in digital capitalism drives an expansion of market ideology to (human) activities that either were not previously considered as commodities, or, if already commodified, were not subject to the process of commensuration that is intrinsic to the development of markets and exchange.Footnote 48 This expansion of the market logic is facilitated by the development of technologies enabling the observation and, consequently, the measurement of various dimensions of human activity, which had previously escaped commodification, or which could not be conceived, because of expectations resulting from specific socio-economic conditions, as being wilfully exchanged in markets, these being translated into financial value. We should not also forget that the process of commensuration, which is key in the formation of financial markets,Footnote 49 is by essence a social process.Footnote 50 These new tools of observation and measurement expand the possibilities of creating new categories of intangible assets that are then valued by financial markets according to the logic of futurity. These new objects of valuation rely on natural or artificial scarcities that shape the value of exchanges in the present but also future, and consequently create expectations about future return on investments and consequently competitive strategies.

A. Heteromation and value generation

As mentioned earlier, engaging with value capture requires an understanding of what value is and how it can be measured. Classical economics and Marxist perspectives define value objectively, by analysing the costs of production of a commodity. According to the labour theory of value, ‘the value of a commodity(is) strictly proportional to the amount of labor time needed to produce it’.Footnote 51 Where labourers work more than what is needed for restoring their labour power (eg their capacity to work, that is, the resources essential for their maintenance and reproduction), this generates ‘surplus value’.Footnote 52 This surplus value enables the payment of wages to workers (covering the costs of their subsistence) and profits to the capitalists, the exact proportion of each being determined by bargaining. Hence, the social relations of power between these two groups affect the rate of profit. The rate of profit refers to the rate of return on the company’s assets (its ‘variable’ capital, used to pay wages for workers, and ‘constant’ capital, which is employed to invest in other means of production). To these profits, one may also add ‘surplus profits’ or ‘rents’ derived from the control or ownership of scarce assets or essential resources (monopoly rents).

However, the labour theory of value does not fully account the process of value generation in modern digital and financialized capitalism, in particular considering the phenomenon of ‘heteromation’.Footnote 53 Heteromation refers to the extraction of economic value, not only from the labour of others, or more narrowly from their waged work, but also from their simple participation in the process of production or by value generated from their simple use of the product(s) (value in use).

The changing nature of ‘work’ and the new economy business model (NEBM)

The predominance of the shareholder-value perspective leads firms and corporations to be largely accountable for maximising the short-term benefits of their shareholders through IPOs, collective ownership, stock buybacks, and other financial instruments. Starting in the 1980s, firms reversed from the allocation regime of ‘retain and reinvest’, where companies invested their revenues in job-creating innovations in organisation and technology, to a regime of ‘downsize and redistribute’ which focused on the allocation of revenues to shareholders. Lazonick traces these developments in terms of a shift from an ‘old-economy business model’ (OEBM) to ‘new-economy business model’ (NEBM).Footnote 54 This shift, according to Lazonick, took place at different levels and in various dimensions, including models and practices of technological innovation, corporate governance, and capital investment, particularly in the high-tech world of Silicon Valley. In brief outline, the adoption of open-systems standards by major players of the computer industry led to the weakening or abandonment of internal R&D within major corporations in favour of patenting, cross-licensing, outsourcing, and the takeover of startups. Technically, this was accompanied by the design and development of modular components that were manufactured by offshore companies and vertically integrated in niche markets. Financially, the shift was made possible through the rise of organised venture capital, cushioned by investment from large retirement and pension funds. These had important implications for the nature of work and led to changes in the patterns of employment in these large corporations from the late 1970s, a process that accentuated with the development of personal computing and the Internet in the 1980s and 1990s.

The most important shift was in the areas of employment, labour organisation, and labour benefits. The dismantling of life-long and secure employment built on mutual loyalty and commitment of employers and employees in favour of short-term and insecure employment of a mobile workforce that is always on lookout for new opportunities is a well-documented and well-understood story of labour in the latter part of the 20th century.Footnote 55 In a broad outline, this was a story of precariousness, the decoupling of benefits (health, retirement, etc.) from employment, and the turning of individuals and households into units of risk management and entrepreneurship.Footnote 56 In light of this story, the rise of platforms and the emergence of so-called gig economy in the first part of the 21st century can be considered ‘natural’ and ‘logical’ extensions of the developments of the earlier decades.

To this end, we observe that a great deal of value in the current economy is extracted outside of traditional work environments, where the dominant form of relationship between capital and labour are wages. While waged labour still remains a key form of work, it is increasingly supplemented and/or replaced by other types of labour such as alternative work arrangements (AWA) and gig work, as well as by various forms of labour contributed by uncompensated labour of users of modern technology. In order to account for the value extracted from these different varieties of labour, we have to draw distinctions among them from a political economy perspective.

Of particular interest is the development of alternative work arrangements facilitated by digital platforms, which create new digital marketplaces to supply labour for temporary use (‘labor value platforms’),Footnote 57 eventually increasing precarious work.Footnote 58 This work may sometimes be categorised under the wide umbrella of Non-Standard and contingent work (self-employed own account workers not hiring other individuals, temporary or fixed term contracts, and part-time work), although the way the work is organised and the lack of alternatives, in view of the dominance of these platforms, may be compared to the relation between employer and employee in traditional and long-term forms of employment.Footnote 59 An increasing number of people provide services through online intermediaries such as Uber, Lyft, TaskRabbit and Upwork.

In conclusion, the introduction of computing into work environments has profound implications on the nature of the working relation and requires a more functional perspective in envisioning the concept of ‘work’. This should integrate the change from OEBM to NEBM, as well as the reality of the technological dependence of labourers to ‘matching’ platforms. Those involved in alternative work arrangements often find themselves in the role of entrepreneurs, drawing on their own personal assets, with all the attendant risks and rewards to this kind of economic activity.Footnote 60 Gig workers find themselves in the grip of the so-called platform economy, controlled by machines and managed by algorithms, into the working of which they do not have any access or insight, and with no recourse to legal labour protections.Footnote 61 These changes also affect labour in different ways: low-skilled workers are facing stagnant or declining wages with an increasing prospect of intensified work through computer-coordinated mechanisms, while high-skilled professionals might be cognitively augmented in carrying out their work, and mid-level workers face the risk of job loss through technologies of automation. The net effect of these developments on waged labour is the ‘hollowing out’ of middle class, as observed in various societies.Footnote 62

Heteromation and users-value

A lot of value in the digital economy is extracted not from work, traditional or AWA, but from simple use. Digital platforms derive value from network effects, as the use of a product or technology by any user increases the product’s or technology’s value for other users (sometimes even all users). Therefore, a large installed base of users is positively valued by financial markets. These varieties of human activity do not only generate different forms of value that go beyond the traditional labour theory of value, but they also involve different social roles and different forms of relations to modern technology. We will separate the concept of ‘use’ from those of labour and consumption. The human activity of ‘use’ cannot only be characterised as productive, to the extent that the production of value involves some act of consumption for own purposes, as opposed to the consumption of an input in order to produce an output that is considered as a production activity. The fact that ‘use’ may generate value questions the idea that value may only be generated by a social relation of production. Similarly, ‘use’ cannot be confined to an act of consumption, precisely because it generates value.

One may distinguish between different forms of ‘use’. The first consists in activities that were previously undertaken by waged workers, labourers with alternative working arrangements, or other types of value-creating labour, but were heteromated to the users by using modern computing technology and digitalisation. We will broadly refer to this as ‘heteromated labor’.Footnote 63 A classic example is that of the self-serving customer of an airline checking in for his flight online, instead of completing this at the airport assisted by airline staff. This self-check-in constitutes a moment of heteromation. The process cannot be compared to automation, as human intervention is still required. However, this human activity is that of the customer who auto-checks in. The customer offering this ‘labor’ remains uncompensated and the value generated is captured by the airline company.

The situation becomes more complex if the activity is new and there is no possibility to compare with an activity previously exercised by labourers. One may envisage the example of a ‘You Tube’ user, who produces and shares videos on ‘You Tube’ for everyone to watch. If this activity is compensated, it may constitute entrepreneurship, while if it is uncompensated, it can be characterised as heteromated ‘labor’ or ‘heteromated use’. These activities are commoditised, in the sense that, before being heteromated, they were exchanged in a market for a price.

Another example are player versus player (PvP) online gaming platforms, where human players compete against each other. The use of the platform by different players contributes to the gaming service provided by the platform, as the PvP platform would have no use had there not be a sufficient number of players to play against each other. To the extent that the gaming platform charges for its services, part of this value is captured by the platform. However, the platform is also able to collect data on how players are using the games in real time, data harvested not only for the purpose of improving their gaming experience, but also in order to be monetised in various ways in data markets, thus constituting another example of ‘heteromated use’. This surplus value is entirely captured by the gaming platform.

Finally, one may refer to the situation of a user of a search engine, such as Google Search. The user is not charged a price for the use of the search engine, but Google harvests the data of the user, not only with the purpose to improve the user experience but to sell predictions made on the basis of this raw data to advertisers at the other side of the platform. One may consider that this also constitutes an example of ‘heteromated use’, to the extent that the simple use of the search engine generates surplus value as well as network value, which is almost exclusively captured by the digital platforms and not by the users.

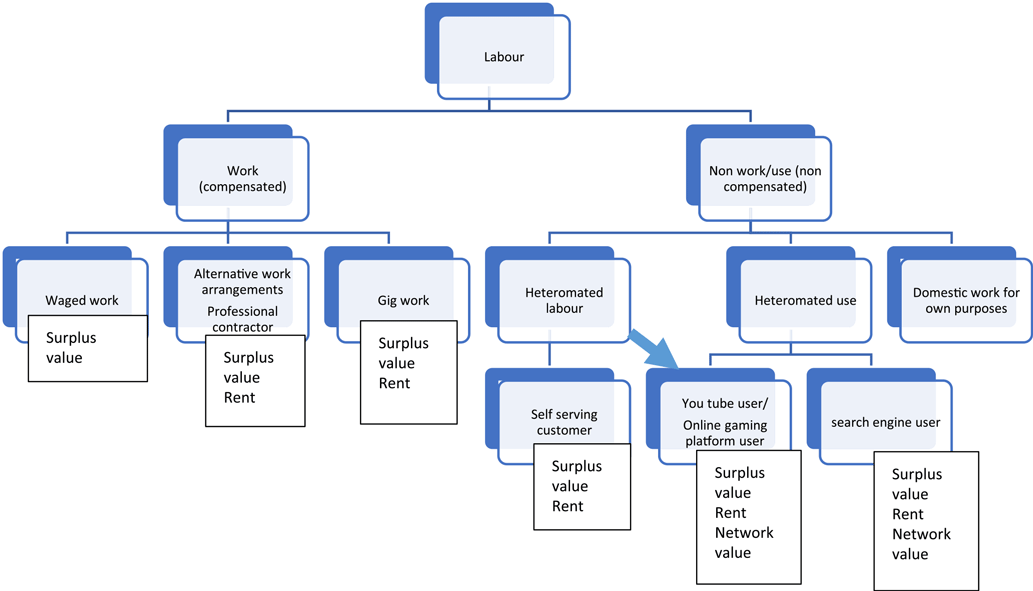

Figure 1 attempts to present a simplistic scheme of the sources of surplus value for each of the processes we examined.

Figure 1. Sources of value in the digital economy and human activity.

The examples above illustrate, that the mechanisms of value extraction vary in each specific case – advertising on social media and search platforms, creative labour in gaming, and data capture and analysis in many of them. They raise important questions as to the qualification of such activity as ‘economic’, therefore enabling the application of competition law,Footnote 64 as well as possible strategies of exploitation and exclusion that may be adopted by the economic actors driving this process of ‘heteromation’.

B. Value extraction in digital ecosystems – the new frontiers of exploitation?

Digital platforms may also capture a significant part of the value generated from the capital invested by independent firms that co-create value (with them) and form part of their business ecosystem. These are often technologically dependent on the platform for their access to the final consumers. The constitution of business ecosystems in which the (digital) platforms operate as the ‘lead firm’, to use the terminology of global value chains,Footnote 65 has become a distinct characteristic of modern digital capitalism. This shift from competition and value capture to more complex mixed strategies of value capture and value creation, involving strategies of competition, have added an additional ‘field’ of competition-related activity, the ‘eco-system’.

Porter and Heppelmann take note of the development of these complementary capabilities, which widens the competitive boundaries of an industry ‘to encompass a set of related products that together meet a broader underlying need’, to argue that ‘(t)he basis of competition shifts from discrete products, to product systems consisting of closely related products, to systems of systems that link an array of product systems together’, and in which ‘the firm is just one actor’ among others.Footnote 66 Ecosystems may be distinguished from supply chains or value chains, because the value of the ecosystem (the complements and the core functions) is greater than the sum of the values of the different parts and their development. There is a balance to achieve between the centripetal forces that push the firms exercising these various related activities toward integration because of greater complementarity and the centrifugal forces that pull the units of the ecosystem apart, because, for instance, of dispersed knowledge and the dominance of a logic of individual profit maximisation rather than ecosystemic profit maximisation.Footnote 67 Also, contrary to supply and value chains, there is not always the equivalent of the ‘lead firm’ in value chains,Footnote 68 as an ecosystem may be characterised by a looser structure, in which value is optimised internally through external interaction across the ecosystem,Footnote 69 and in which various firms may compete for dominance.

Developed in the early 1990s,Footnote 70 the concept of an ‘ecosystem’ has been defined in broad terms as ‘a group of interacting firms that depend on each other’s activities’.Footnote 71 Teece notes that a characteristic of eco-systems is their ‘co-evolution’ in the sense that the ‘attributes of two or more organisations become more closely complementary’, ‘the system being typically reliant on the technological leadership of one or two firms that provide a platform around which other system members, providing inputs and complementary goods, align their investments and strategies’. Teece also notes that ‘co-creation’ is a characteristic of eco-systems as two or more organisations ‘combine forces to pioneer new markets’.Footnote 72 Adner observes that ‘the ecosystem is defined by the alignment structure of the multilateral set of partners that need to interact in order for a focal value proposition to materialize’. Holgersson and others emphasise the importance of ‘organisation value’: as in ecosystems, ‘investments are complementary in the sense that their value as a system is greater than the sum of the values of the separate parts’.Footnote 73 Adner proceeds to define this ‘alignment structure’ as ‘the extent to which there is mutual agreement among the members regarding positions and flows’.Footnote 74 The ‘eco-system orchestator’ determines the elements of the value chain that will need to be internalised and those which will be supported externally so as to capture value.

Most studies on eco-systems focus on the role of the eco-system as a ‘hub’ of inter-firm relations taking place within the context of a platform, often referred to as the ‘lead firm’ or ‘ecosystem captain’, which ‘defines the hierarchical differentiation of members’ roles and establishes standards and interfaces, a number of formal mechanisms, such as the management of standards and interfaces, platform governance, IP rights etc. forming the ‘key tools that hubs use to discipline and motivate ecosystem members’.Footnote 75 However, ecosystems may also be considered as ‘value systems’,Footnote 76 where different firms producing mostly complementary products cooperate in order to produce surplus value, by using their capital (including physical, human and organisational assets), and idiosyncratic capabilities in order to implement the ecosystem’s strategy and achieve a sustainable competitive advantage that could constitute a source of abnormal profits. The contribution of each of the parties in the value system may be mapped by drawing a value chain in which all contributions to the input and output process can be included.Footnote 77 Such a map may provide a picture of the process of vertical competition of the various actors within the ecosystem for capturing the highest percentage of the surplus value generated by the ecosystem.

The capture capacity is determined by (i) diminished horizontal competition at a specific segment of the value chain, thus providing the ability to a firm to increase prices while squeezing the margin of its vertical competitors upstream and downstream (reducing horizontal competition), (ii) the control of a bottleneck, or of an indispensable asset or competence, outside the core competences of the other members of the ecosystem, or protected through ownership rights (including IP rights), which may provide this firm absolute or relational power vis-à-vis its partners in the ecosystem (thus limiting both horizontal and vertical competition), (iii) the capacity to determine the architecture of the ecosystem, enabling the industry architect to capture the largest percentage of the surplus value generated by the value chain for a considerable period of time (diminishing vertical competition).

The capture of value through suppression of vertical (intra-ecosystem or intra-platform) competition is to a certain extent a ‘normal’ dimension of the market economy.Footnote 78 Traditionally, it is considered that in the presence of strong horizontal (ecosystem or platform) competition, this should not be much of a concern, and may be considered as part of the normal risks of business cooperation. A more dynamic perspective will also view vertical integration as a way for firms to leverage their internal capabilities in related markets or to exploit their superior management capabilities.Footnote 79 These approaches emphasise horizontal competition as the main source of competitive constraint that merits to be preserved by competition law, to the extent that in case there is intense horizontal competition, vertical integration and vertical restraints are more likely to serve benign rather than malign objectives. Certainly, vertical integration or vertical restraints may limit vertical competition, but it is thought that vertical competition relates more to distributional effects (relating to the allocation of the surplus value) or ‘pecuniary externalities’ that, according to neoclassical price theory, should be ignored if one focuses on economic efficiency.Footnote 80 However, one may take a distributive justice perspective, in which case the ‘fair’ distribution of the total surplus value between the different segments of the value chain becomes an important issue. Focusing on vertical competition is also necessary if one adopts equality of opportunity as an important goal of competition law, or structural inequality as an important concern justifying some form of collective action.Footnote 81

Certainly, substantial restrictions to vertical competition may impact productivity, as an overwhelming percentage of the total surplus value is captured by ‘superstar’ large firms that enjoy tremendous levels of profitability, without however these accumulated profits being always used for productive investments, that could ultimately generate value.Footnote 82 These abnormal profits are instead distributed to shareholders or used to buy back stocks in order to inflate corporate management compensation. They can also suppress the incentive and capacity of the other members of the eco-system to invest on R&D or increase their productivity. Checking who exercises power in the ecosystem and how this power may impact, not just on consumers, but also on all those that contribute socio-economic value to the ecosystem, requires the development of new approaches that do not only focus, as mainstream consumer–welfare competition law does, on the assessment of the outcomes of the exercise of power in terms of prices or output, but also, more pragmatically, emphasise the relational element of power, to the extent that ecosystems ‘are based on social relationships that generate value through knowledge sharing and social experiences’.Footnote 83

C. Value capture through the exploitation of ‘fictitious commodities’

The expansion of market boundaries through the development of what Karl Polanyi calls ‘fictitious commodities’ provides a different source of surplus-value in the digital economy; these are embedded in wider social relations and have their own sovereign logic, which cannot be fully subsumed in them being treated as market commodities.Footnote 84 The discussion has so far focused on the harvesting and possession of personal and non-personal data. However, the emphasis of control over data can lead to overlooking the real competitive game in the platform economy. Of course, the development of data value chains, with a number of intermediaries, sometimes operating in the shadow of regulation through private stock markets for data, called ‘dark pools’, is a feature of the digital economy.Footnote 85 But data, as an input for production, may not be the core aspect of the business model, in particular for the leading digital predictive platforms (ie Google, Facebook).Footnote 86 We will focus here on the process of value extraction from attention markets and the development of ‘behavioural surplus’ through the commodification of the future behaviour of consumers, and more broadly human consciousness.

Extracting value in attention markets

Digital platforms aim to attract and hold the attention of the users, not only to harvest data, but also more generally to get insights that would enable them to engage in economic activity that may go from making predictions on the preferences of consumers: for instance, to place/design a specific product or to influencing and manipulating consumers’ choice through some (insidious) process of choice architecture. In the classic multi-sided model of network economics, these platforms are thought of as matching, advertisers (the money side) and users (on the subsidised side). Data harvesting is indispensable for matching to work. However, digital platforms do not only sell access to raw user data, but may also sell insights from the data, that is inferences on the preferences of the users, or more generally their personality. Advertisers value these insights, as they enable them to offer targeted advertising, which is more likely to attract the attention of the users on the products/services they promote. From this perspective, data is an indispensable input for an output sold in these ‘attention markets’.

The real value of these insights becomes clear if one realises that attention is a scare and rivalrous resource. An individual has a limited attention span and the systematic use of smartphones, individuals being ‘always connected’ and receiving increasing amounts of information, may have also resulted in reducing their attention span even more.Footnote 87 Empirical research has documented the ‘accelerating dynamics’ of shorter attention cycles that has been mainly driven by ‘increasing information flows’ both in terms of content production and consumption rates through the use of smartphones.Footnote 88 Research has also noted the value of the scarce period of ‘high’ ‘attention bursts’ that are extremely valuable for advertisers and/or companies and other entities aiming to attract consumers’ attention and influence consumer behaviour.Footnote 89 Some media may be more efficient than others in attracting this attention.

Following Sohlberg and Mateer’s theoretical framework for analysing attention,Footnote 90 research has shown how overall, ‘digital lifestyles have a negative impact on prolonged focus’.Footnote 91 As a result, consumers are trained to become better at processing and encoding information through these highly valuable ‘short bursts of high attention’.Footnote 92 Digital lifestyles also have implications on selective attention. Multiple devices (PCs, smartphones, tablets, virtual assistants or combinations) have become the ‘gatekeepers of an infinite number of distractions and sources of instant gratification’, but also important gateways to consumers’ attention. Users attempt to simplify their lives by disconnecting or switching off these devices, or by relying on these devices’ suggestions, expressing their wish to filter out distractions.Footnote 93 This need for simplification leads to the finding that ‘(w)hat consumers can see in one glance has everything to do with what they’ll do next’.Footnote 94 This research has important implications on companies’ strategies to attract attention and indicates the existence of important leverage and tipping points for attention. These are usually ignored by neoclassical price theory which has a more linear understanding of consumer behaviour.

Attention can be captured in different ways, depending on the form of the ‘attentional decision’ of the user.Footnote 95 In reviewing the attention scholarship, Tim Wu distinguishes broadly between two different mechanisms for making these attentional decisions: the first is when attention can be seized in voluntary manner, and the second when attention is captured without a voluntary decision being made by the agent. He includes in the second category ‘bottom-up’ or ‘stimulus-driven’ attention ‘activated by lower parts of the brain outside of conscious control’, to the extent that our brains are ‘involuntarily responsive to properties inherent in certain forms of information’ or stimuli (eg food, familiar faces, sex targets). These different mechanisms to capture attention, sometimes involuntarily, are well known by the ‘management of specific demand industry’, whose purpose is to ‘shift the locus of decision in the purchase of goods from the consumer where it is beyond control to the firm where it is subject to control’.Footnote 96 This includes according to the description given to it by John K. Galbraith, not only the advertising industry but also ‘a huge network of communications, a great array of merchandising and selling organisations’, ‘numerous ancillary research training and other related services’Footnote 97 in these economics of ‘increasing affluence’Footnote 98 (but also of limited attention). What has changed with the emergence of digitalisation and personalisation is that the management of demand is no longer targeted to the mass, but to individual consumers by personalising not only the contact but also the product.

The business model of some of the leading digital platforms relies on advertising revenue, collected at the money side of the platforms, which partly subsidises the content received by users on the other side, to the extent that users do not pay a monetary price (free content).Footnote 99 Users nevertheless pay a price in a reduction of their privacy, as their personal data is harvested by the platform. The business model is particularly ingenious as the ‘free’ content from which the consumers may benefit, and which acts as bait (the ‘honey’) to attract their attention, at the same time adds to the information they receive and therefore narrows down their attention span. This makes the attention of the users even more valuable for advertisers, which are then ready to pay increasingly high amounts for their ads to be placed at a more valuable attention-grabbing position, or for benefiting from specialised advice on what would better attract a specific user’s attention.

This process of value extraction is self-reinforcing as it contributes to the scarcity of attention that generates the surplus value captured by the various business actors involved in this process. Firms do not only compete for consumer expenditure, which may constitute the main incentive of firms present in advertising markets to be matched to consumers, but also for consumer attention.Footnote 100 This form of scarcity has its proper intermediaries: the so called ‘attention merchants’.Footnote 101 The development of digital advertising markets attests of the value of the attention captured by the digital platforms, the market rising from $152 billion in 2015 to 521.02 billion in 2021.Footnote 102

The discussion over the effects of digital platforms on attention markets also raises the potential for the exploitation of consumers and their broader socio-economic well-being.Footnote 103 First, harvesting personal data may affect privacy and produce consumer harm, privacy being an important parameter of competition in these markets. Second, by proceeding to frequent ‘attentional intrusions’ digital platforms may commit ‘attention theft’, defined as ‘the non-consensual seizure of the scarce resource of attention, yielding cognitive impairment’, thus producing consumer harm.Footnote 104 Thirdly, digital technology offers enhanced possibilities of personalisation, which may in turn lead to abuses, such as algorithmic discrimination and welfare-reducing personalised pricing.

Behavioural surplus and commodification of human consciousness in the surveillance economy

The manipulative dimension of targeted advertising hints to a process of value generation and capture in the digital era that is different from advertising in the era of industrial capitalism, what Zuboff explains by the expression ‘surveillance capitalism’.Footnote 105 As previously mentioned, data constitute the raw material that are necessary for ‘surveillance capitalism’s novel manufacturing processes’. Digital platforms harvest a considerable amount of data, not always with the aim to recycle this for the benefit of their users with service improvements, but with the aim to constitute what Zuboff calls ‘behavioral surplus’.Footnote 106 This is often camouflaged as ‘digital exhaust’, the equivalent of industrial waste for the digital economy. It is the leftover from the production process, which for efficiency reasons instead of being left into the ‘atmosphere’ is captured in order to be recycled in ‘useful data’. Computer mediation is thus repurposed on ‘extraction architecture’, with various devices (fixed, portable or wearable technology) enabling and/or effectuating the harvesting.

From this harvesting emerges a ‘full-blown logic of accumulation’. In the dynamic online advertising marketplace, digital platforms auction to advertisers, not the attention of the users as such, as these are still free not to click through the ad, but ‘derivatives of behavioral surplus’ on the basis of behavioural predictions made by Google as to the likelihood that a specific user will click through the ad and proceed to a purchase.Footnote 107 Digital platforms also share these ‘surveillance assets’ with the partners in their ecosystems, thus increasing the dependence of the latter on them. They may also commercialise the predictions in order to gather ‘surveillance revenues’ that are then accumulated in ‘surveillance capital’.Footnote 108

Zuboff notes that ‘advertising is “the beginning of the surveillance project, not the end”.Footnote 109 The data is used in order to develop the digital platforms’ evolving AI capabilities, often protected by IP rights. These enable them to make better predictions about the individuals’ future behaviour and to develop specific prediction products offered on new kind of markets trading exclusively in future behaviour, thus developing a superior competitive advantage to reach users.

In this surveillance capitalism era, monopolies and bottlenecks are not constituted with the aim to raise prices, as traditional neoclassical theory assumes, but to ‘corner’ ‘user-derived raw material supplies’ and protect ‘critical supply routes for the unregulated commodity that is behavioural surplus’.Footnote 110 Competitive struggles are not just for market shares in delimited markets, but for dominance of the dispossession cycle and the generation of behavioural surplus that will itself be highly valued in behavioural futures markets. This ‘dispossession cycle’ relies on incursion practices into ‘undefended spaces’ (a laptop, an email to a friend, a web page, the street you live), undefended because of the expectations that these will be unobservable to a third party and therefore out of the commodification and market logic, in order to ‘kidnap’ behavioural surplus.Footnote 111 It then develops because of an ‘habituation’ process, in which, these practices of incursion become normal and are ‘rapidly bolstered by growing ecosystems of stakeholders’.Footnote 112 The market frontier is pushed to the extreme, all predictable behaviour becoming a source of behavioural surplus.Footnote 113

These ‘behavioral futures markets’ are personalised, to the extent that more than just personal data, the surveillance capitalists will trade ‘human consciousness’, which may well be the next territory of commodification, after that of land, labour, personal information and attention, the extraction architecture reaching further and deeper into ‘new territories of human experience’.Footnote 114 The ‘prediction imperative’ pushes also the boundaries of what can be considered as a voluntary exchange to the extent that the digital platforms devise ‘means of behavioural modification’Footnote 115 though nudging, herding and other forms of influence, a new ‘execution architecture’ with the aim to generate surveillance revenues by challenging the individuals’ ‘elemental right to the future tense’.Footnote 116

In the era of ‘machine learning’ and artificial intelligence-assisted pricing the risks of ‘digital’ consumer manipulation increase at an industrial scale.Footnote 117 Digital markets exacerbate the above risks, in view of the possibilities they offer ‘a vast psychological audit, discovering and representing the desires of society’Footnote 118 and of each individual separately, offering sophisticated evaluation methods that are closely linked to the direct observation of consumer preferences, but also more broadly of a whole range of preferences expressed in social, and private life, through the means of sociometric analysis.Footnote 119 Big data and AI enable us to observe, allegedly more accurately, the inner mental states of people and potentially influence the way these form their core preferences.Footnote 120 Emotion detection becomes possible through the emergence of ‘affective computing’, ‘computing that relates to, arises from, or influences emotions’, any conscious, or even unconscious emotion becoming observable behaviour for coding.Footnote 121 ‘Emotion scanning’ is in the process of becoming the new form of tracking to which are subject users,Footnote 122 in particular should their interactions with the digital platform multiply in the context of the ‘metaverse’ turn.

This suppression of the unpredictable enables the emergence of a computational economy in which humans (and their autonomous choice) ‘are not essential to the market action’.Footnote 123 This economy is not driven by autonomous consumer choices, but is managed top-to-bottom by digital platforms and the extraction architecture they have put in place through a sophisticated mix of incentives, coercion, surveillance and prediction. This raises important questions as to the sufficiency of the consumer welfare oriented competition law, that takes revealed preferences as a given, to provide a good diagnosis of the formation of such preferences and the exploitative potential of digital platforms, let alone limit it.

It becomes however important to understand that these new spaces of commodification and different extractions strategies did not develop organically but are the result of institutional choices.

4. Back to the macro level: the institutional foundations of value extraction in digital capitalism

Examining the different sources of surplus value in the financialized digital economy provides insights on the socio-economic structures in which digital markets are embedded. What is missing from the picture is the institutional embeddedness of these markets.Footnote 124

This section therefore aims to uncover the contribution of the institutional framework, or the absence of it, to the rise of Big Tech and other (digital) platforms. The control these platforms exercise over important digital infrastructures, gives rise to situations of economic or technological dependence. This transforms these ecosystems to ‘idiosyncratic interfirm linkages’, that may become the source of relational rents and lasting competitive advantage.Footnote 125 In the absence of regulation and an effective public governance regime enhancing the creation of socio-economic value (instead of pure shareholder value), these relational rents may become a sensitive political issue.

This is a possible reading of the recent emergence of the field of digital regulation, with the adoption of various proposals establishing an elaborate digital regulatory framework, whose impact is to yet to assess. A different take, which is that put forward by this paper, would be to focus on the paradigmatic shift of the policy framework as a by-product of the realisation that the issues raised require complexity thinking, with the development of new units of analysis, new metrics and a new imaginative but also relatively ‘fuzzy’, and thus flexible regulatory frameworks.

This section will first analyse how the intellectual ‘baggage’ from the era of the second industrial revolution has resulted in the development of the present ‘disciplinary’ boundaries between various fields of law. We will then assess how this institutional framework, developed for a simple economy, failed to account for the complexity of the digital revolution and the progressive dissipation of the old boundaries. The last sub-section engages with the pragmatic perspective of digital regulation for a complex economy. All sub-sections focus on the analysis of factors relevant for the regulation of competition in the digital economy. However, the analysis may be expanded to other fields of public interest.

A. Monopolies, competition, competition law and regulation

The recent emphasis on economic efficiency and ‘consumer welfare’, at first sight, limits the policy discretion of the competition law enforcers, in comparison to the previous situation, although in reality the interpretation of the concept of ‘consumer welfare’ in Europe provides a broader scope for the intervention of competition authorities than in the USA,Footnote 126 where it has been gradually interpreted by some as strictly limited to economic efficiency and ‘consumer surplus’.

However, this progressive narrowing down of competition law to ‘consumer welfare’ and ‘economic efficiency’, which can be observed in both the EU and the USA, needs to be situated in the broader context of competition policy regulation. Competition law has never been an isolated legal instrument but interacts with other forms of direct economic regulation that have the aim to promote market contestability and the competitive process by opening markets. These other forms of competition regulation may eventually be inspired by broader conceptions of competition than ‘consumer welfare’ and also integrate other policy values (eg fairness) that take into account the specificities of the economic sector and its contribution to social welfare.

This interplay is not immediately visible to the bystander as competition law and economic regulation have traditionally been thought of as two alternative tools of market design. The legal ‘code’ applied in each context is different: Economic regulation denotes the government intervention in a sector to correct a market failure arising from, for example, a natural monopoly (telecom, energy) or asymmetric information. It acts a priori, requires continuous monitoring, may integrate broader concerns than competition law and is intrusive in the management of the undertakings (as it may constraint their freedom to set their prices and quantities). In contrast, competition law consists in a set of rules for market operation that mostly acts a posteriori, once behaviour has been observed, and relies on the dissuasive power of sanctions. From this perspective, it is a less intrusive tool for market management in comparison to regulation.

This dichotomy between competition law and regulation makes sense for the simple economy of neoclassical price theory, but it does not adequately take into account the complexity of modern digital economy. The digital economy gives rise to four difficulties in applying this analytical framework.

First, it is impossible to think of a but-for scenario marked by perfect competition, in order to make comparisons and determine which profits are ‘abnormal’, essentially due to the existence of network effects.Footnote 127 These ensure that perfect competition cannot be the optimal market structure in these markets. A market has network effects when, everything else being equal, a consumer’s willingness to pay increases with the number of units sold or expected to be sold. In contrast, in markets not marked by network effects, the willingness to pay for the last unit of a good decreases with the number of units sold, thus violating the fundamental law of demand.Footnote 128 Network effects arise because of complementarities. These complementarities increase the value of the components (or the different sides) of the network through positive feedback loops, therefore by the same increasing economic efficiency. However, despite the cycle of positive feedbacks, the value of a component (or a side of the market) does not increase infinitely because the additional positive feedback is expected to decrease with increases in the size of the network.

Second, monopolistic positions and the control of essential assets is quite prevalent in the digital economy, in view of network effects, also learning by doing effects because of access to data, but also more generally the ‘winner takes most’ nature of digital competition. One may claim that such positions of monopoly were ‘duly’ earned through superior acumen and following intense competition for the specific monopolised market(s).

Third, the more traditional perspective on the competition/regulation dichotomy does not take into account the blurring of boundaries between markets as a consequence of digitalisation and the development of broader business ecosystems in which is structured most of the economic activity taking place worldwide nowadays.Footnote 129

Fourth, contrary to the assumptions of the first theorem of welfare economics, there is no complete set of markets for some products (such as data and attention) which are demanded and supplied to be traded at publicly known prices.Footnote 130 Data is harvested by search engines for free, as users are not paid any compensation for the data they contribute, with the exception of the free use of the search engine, for which in any case the marginal costs are close to zero. In reality, the digital economy is characterised by missing markets, either because of the lack of property rights on data or because of the incomplete and ethically contested nature of commodification of some scarce resources, such as the attention of users. This brings forward the need to explore in more depth the institutional choices that frame the market agencements in operation in these spheres of economic activity.

B. A legal institutionalism perspective

One of the tenets of the emerging new legal institutionalism is the role of law as a ‘constitutive part of the institutionalised power structureFootnote 131’ that provides the substratum on which a particular variety of capitalism develops, legal institutions framing the direction of such development. By defining and protecting property rights, ensuring the enforceability of contracts, allocating liability for harmful activities, imposing duties and burdens through regulation, law plays a central position in the organisation of economic and social life and therefore significantly affects the development of capitalism.Footnote 132 There is an increasing interest in the role of legal rights and obligations in shaping value generation but also the competitive struggles for value capture in the digital economy.

Legal institutionalism adopts a relatively narrow definition of ‘law’, as it recognises that ‘law in complex societies depends on spontaneously evolved custom’ but also ‘typically requires the powers and institutions of the state’. Although ‘distributional differences and power asymmetries’ play a defining role in these various forms of competitive struggles, the monopoly of force from which the state benefits provides the overall framework in which these various struggles are shaped and therefore contributes to the rise and evolution of capitalism.Footnote 133 This emphasis on the active role of the state in shaping the conditions of success, but also the overall direction, of the development of capitalism, is reminiscent of some recent literature on innovation policy, which emphasises the determining role of the state, either in its traditional role of enforcing rights and obligations, or in the more ‘entrepreneurial’ role of funding innovation and R&D that led to the emergence of the digital economy.Footnote 134 Contrary to the classic Marxist idea of the legal system ‘mirroring’ the existing economic and social conditions of production (the superficial and lower order superstructure), legal institutionalists emphasise the constitutive role of law in empowering or taming actors, and therefore, highlight the influence of law on the distribution of power in the economy.Footnote 135 Legal institutionalism starts from the premise that ‘(c)apitalism is much more than material objects and forces, it is a complex system for processing information and allocating and protecting rights to tangible and intangible assets’,Footnote 136 thus emphasising the centrality of the legal system in the structuring of the social and economic relations that shape capitalism.

We fully embrace this view on the constitutive role of law, but we further argue that it is not only the active contribution of the legal system in recognising and implementing rights and liabilities that is of importance, but also the lack of such, or, more generally, the silence of the law, that also plays an important role in shaping the balance of power in these competitive struggles. The fact that the legal system did not specifically address these challenges by adapting its existing scope or expanding it accordingly cannot be conceptualised as embracing neutrality or passivity. The state’s monopoly of force is often replaced by private governance regimes based on relations of trust or power. This is an active choice made in favour of a new vision of the State or a new vision of its role (or the absence of it) in the markets in question.

The above becomes salient if one looks at the way the various legal systems have dealt with the important economic and social changes resulting from digitalisation and the emergence of AI technologies. Three main approaches can be identified.

First, a Schumpeterian approach that accommodates the vision of a State that actively promotes product, process, organisation and market innovation and that conceives its role as the enhancement of structural competitiveness of open economies to competition, what some have named ‘the Schumpeterian workfare state’.Footnote 137 However, even a regime of ‘permissionless innovation’ would require at least a (state) system, that ensures the adjudication and enforcement of property rights.

Second, an approach inspired by the precautionary principle, with a pro-active intervention of the State in order to deter possibly harmful activities and to ensure that the principles and values of the Regulatory State, as it has emerged following the New Deal in the US and the post-War liberal and socio-democratic consensus in Europe, will not be jeopardised.

Third, an approach that would promote safe spaces for experimentation and personalised law, for instance through the constitution of sandboxes, the State keeping away from implementing the law to pre-selected partners in a specific context (defined in terms of time, space, field of activity), while using this experience as a source of learning that would shape normative activity and implementation of the law (in general but also bespoke regulation) in the future.Footnote 138

Strategies of legal action/inaction

These regulatory strategies of action (or inaction) have of course important implications for the balance achieved between the interests of the various stakeholders and presumably the weight of their claims to capture a more significant part of the surplus value generated by digital innovation. The pre-eminent role of digital platforms in digital capitalism and the subsequent implications this had on the falling labour share and the resulting economic inequality may indeed be explained by a conscious choice to expand the scope of application of a specific area of law, while receding from implementing another, or even adopting policies that would completely exclude the specific field from the legal forms of adjudication of disputes in favor of some other forms of self-regulation or self-governance.Footnote 139 We will focus here on some examples.

Property rights and data

A good example of a strategy of legal inaction is the lack of a proper regime of property rights on (personal) data. This lack of a property regime for personal data has enabled digital platforms to harvest this valuable raw material, without any corresponding protection of the interests of the users, just relying on their consent to their terms and conditions in order to get access to services, often provided for free. The possession of this data does not rely on a properly defined property regime (hence the distinction between possession and property rights) but on the control by these digital platforms of important bottlenecks in the way consumers access the Internet and the various services this may provide them. Although the GDPR recognises some property rights-like entitlements on personal data, such as data portability,Footnote 140 or the right erasure or to be forgotten,Footnote 141 it still does not put into place a proper property rights regime for personal data, that would have granted formal rights sanctioned by a public authority, would have delimited the boundaries of these rights, or put in place a system to adjudicate disputes as to the ownership of these rights. Having possession of the item, in the sense of physically controlling it, constitutes just one of the bundle-of-rights provided by property and ownership, but does not confer the ability to use and manage the property, the right to receive income from it, the possibility to use it as capital for the production of income, or finally the possibility to use it as security in order to borrow against it (eg as a collateral for raising debt).

While the fact that it is impossible to use (personal) data as a collateral may affect their characterisation as capital, and thus does not help for the conceptualisation of the activity of the user to provide this data as a form of entrepreneurship, it is also not conceived of as a form of labour that would ignite the possible application of labour law standards in order to protect the users’/digital value labourer’s interests, nor as a form of consumption that would have led to the application of the consumer protection standards, for instance protecting the consumers from the asymmetrical bargaining power of digital platforms. This lack of legal protection may have motivated some competition authorities to intervene and bring some instances of unfair and exploitative conduct by digital platforms in the remit of competition law enforcement,Footnote 142 and more generally can be seen to argue for some form of complementary protection to the GDPR, which is a regime that does not take into account the power differential between digital platforms and their users.Footnote 143

The complexity of the property arrangements in the digital economy, with consumers purchasing ‘smart devices’ that collect their data, also leads to the emergence of new conflicts between various stakeholders. Fairfield analyses the tensions that may arise between the ownership of the device (traditional tangible property) and the residual power of the creator of the software embedded in the device who benefits from IP rights on the technology and may use its power over the software embedded in the device in order to control the use of that device in ways that may be incompatible with the will or the long-term interest of the owner of the device.Footnote 144 Perzanowski and Shultz describe the ‘end of ownership’ in the digital economy, as technologies and the use of take-it-or-leave it contractual terms extend the manufacturers’ power of control over assets that they have already sold in terms in license agreements and other contracts.Footnote 145 Contracts are indeed replacing/limiting property, by imposing conditions on its use and ensuring their enforcement, not through the traditional monopoly of the state, but through technological means of enforcement. These were spearheaded by digital rights’ management and more recently by technological means of system incompatibility and ‘smart’ enforcement through ‘boilerplate provisionsFootnote 146’ or automatic processes of enforcement integrated in ‘smart contracts’ which made some commentators observe the emergence of ‘regulation by machine’.Footnote 147

Intellectual property rights on databases, algorithms and technology, contracts, including terms of service, and ‘smart’ enforcement technology enable digital platforms to force users to buy ‘compatible’ extras and add-ons from them but also to control the right of the users to sell or repair the product. The debate over the scope of the first sale doctrine and the possible limitation it may set to IP rights’ holder ability to prohibit the future sale or re-use of the patented productFootnote 148 illustrates the tensions between the different legal regimes that may enter in collision course in the digital economy.Footnote 149 These legal regimes, as they are currently interpreted, constitute the default legal framework which in its turn determines the production of various ‘value regimes’, the transfer of value from some stakeholders to others occurring silently and naturally through the market process. However, this should not conceal the role of the State, which by enabling some legal options, while obstructing others, is actively involved in the process of value capture in the digital economy favouring certain interests over others.