In the Paris agreement, countries have committed themselves to decrease their carbon emissions drastically. Against this background, in transport policy aviation has become an emblematic bone of contention since it is proven to be the most polluting mode of transport (Rothengatter Reference Rothengatter, Fichert, Forsyth and Niemeier2020). In sum, around 2.5 % of global carbon emissions are caused by global aviation transport, although different studies indicate a potentially higher greenhouse gas effect of up to 5 % or even beyond due to more influential non-CO2-emissions, e.g., nitrogen oxides (Lee et al. Reference Lee, Fahey, Forster, Newton, Wit, Lim, Owen and Sausen2009, Reference Lee, Fahey, Skowron, Allen, Burkhardt, Chen, Doherty, Freeman, Forster, Fuglestvedt, Gettelman, De León, Lim, Lund, Millar, Owen, Penner, Pitari, Prather, Sausen and Wilcox2021). At the same time, global aviation traffic is deemed essential for global interactions and trade, and it has continuously grown in the years until 2020. While the number of flights has decreased significantly in the COVID-19 pandemic, the sector is expected to return to its growth trajectory after the pandemic (Gössling and Humpe Reference Gössling and Humpe2020). As this growth regularly entails a substantial increase of emissions, the regulation of aviation transport epitomises general characteristics of environmental policies representing the classic conflict between ecological and economic interests. For aviation transport, in principle, policymakers have a number of instruments at their disposal which aim at technological innovations of airplanes, the development and use of alternative low-carbon fuels or the reduction of the absolute number of flights (Larsson et al. Reference Larsson, Elofsson, Sterner and Åkerman2019; Fichert et al. Reference Fichert, Forsyth, Niemeier, Fichert, Forsyth and Niemeier2020). In our study, we focus only on instruments targeting the latter goal, for which – if governments have taken action at all – the introduction of aviation taxesFootnote 1 is the policy that as our analysis shows is the only nationally available and, accordingly, the one that has been chosen most. While it is rather evident, why national governments, generally, have been reluctant to regulate the aviation sector regarding specific institutional settings like the Chicago Convention (Conrady et al. Reference Conrady, Fichert and Sterzenbach2019; see below), the factors accounting for variations in national political handling of aviation transport have hardly been addressed by political scientists so far (Forsyth Reference Forsyth, Fichert, Forsyth and Niemeier2020). Thus, it is striking that some countries have successfully implemented regulations of aviation transport in form of an aviation tax while other countries have not. As “successful,” we understand legislative implementation that has remained in place throughout our period of investigation (policy output) irrespective of its actual problem-solving or sideeffects (policy outcome). Within the harmonised European Economic Area, this situation represents an interesting puzzle, in particular as this variance of output is present even among environmental pioneer states (Liefferink et al. Reference Liefferink, Arts, Kamstra and Ooijevaar2009; Duit Reference Duit2016). This, ultimately, yields our research question why did some European countries successfully adopt an aviation tax?

For exploring our research question, we concentrate on the Netherlands and Germany which showed a substantially different handling of the aviation tax in a comparable period of time (from 2008 until 2021). Specifically, we focus on the processes of policy-making in these two countries since these provide us with consistent explanations for causal backgrounds of national instrument choice (Hall Reference Hall, Rueschemeyer and Mahoney2003; Blatter and Haverland Reference Blatter, Haverland, Engeli and Allison2014).

In our work, we follow research on instrument choice in environmental policy and apply the heuristics of the Political Process-inherent Dynamics Approach (PIDA) (Böcher and Töller Reference Böcher and Töller2015). As this approach integrates explanatory factors of policy analysis and has been used to study instrument choice and change (Böcher and Töller Reference Böcher, Töller, Jacob, Biermann, Busch and Feindt2007; Böcher Reference Böcher2012), it suits our main research interest to explore possible explanations and their related causal configurations for the variance in the taxation of aviation transport among European countries. Methodologically, our research design applies a causes-of-effect-perspective and represents a case-oriented research approach (Goertz and Mahoney Reference Goertz and Mahoney2012, ch. 3, Rohlfing Reference Rohlfing2012, ch. 2).

As central findings, in our comparative case study, we identify temporally and nationally diverging conceptions of problem structures as well as different configurations of party competition as main explanatory factors for instrument choice and aviation policy evolution.

Our contribution proceeds as follows: in the next sections, we outline foundations of instrument choice research and present the PIDA. After that, we explain our general research approach including the selection of the illustrative case studies; before, we explore specific factors shaping instrument choice in aviation policy in a comparative case analysis. In the final section, we summarise the main conclusions and put these into perspective of current debates on environmental and economic rationales of policy-making.

Instrument choice in environmental policy

The choice of policy instruments has long been an important research question in policy research and especially in environmental policy (Salamon Reference Salamon2002; Böcher Reference Böcher2012; Howlett Reference Howlett2019; Capano and Howlett Reference Capano and Howlett2020; Capano et al. Reference Capano, Pritoni and Vicentini2020). Research on instrument choice, which developed as early as the 1980s, initially assumes that the state can use different instruments to achieve policy goals, including regulation, taxation or persuasion (Böcher Reference Böcher2012). Even in this early literature, it was argued that instruments are not chosen based on whether they best solve the policy problem, but that instrument choice often depends on political processes including institutional background, power relations and conflicts between different interests (Woodside Reference Woodside1986). Especially in environmental policy, instrument choice has been for long a major research topic: starting point was here the observation that the state mainly relied on command-and-control instead of more efficient market-based instruments suggested by environmental economists (Larrue Reference Larrue and Dente1995). Thus, in research on instrument choice, importantly, “choice” does not mean that the state always selects the “best” alternative between different available instruments, but rather that an instrument is often used for political reasons without really considering other instruments, or that alternative instruments are often only theoretically available. Instrument choice is an umbrella term for research that deals with questions of why an instrument was designed exactly the way it was, why it was chosen and not another or even what differences exist between similar instruments introduced in different countries or policy fields (Hahn Reference Hahn1989; Jordan et al. Reference Jordan, Wurzel and Zito2003; Bähr Reference Bähr2010; Mann and Roberts Reference Mann and Roberts2018). At that early stage of instrument research, it became clear that instrument choice deals with considering “how policy makers select instruments in practice” (Bressers and Klok Reference Bressers and Klok1988, p. 22) and that “perceptions of the proper “tool to do the job” intervenes between context and choice” (Linder and Peters Reference Linder and Peters1989, p. 35). The idea behind eco-taxes as a market-based environmental policy instrument is that ecologically undesirable actions (e.g. emissions) are priced by the introduction of a tax. An eco-tax, therefore, should help as a price signal to confront polluters with the ecological consequences of their economic action (Böcher Reference Böcher, Mulvaney and Robbins2010). However, research on the introduction of such market-based instruments showed early on that such instruments were rarely introduced in their “textbook” version (Hahn Reference Hahn1989). Regarding eco-taxes, key findings were as follows: (1) the tax rate, often, is too low to stimulate behavioural change, as the taxes were not imposed to provide incentives for more environmentally friendly behaviour, but to generate revenue for the state budget (Bressers and Huitema Reference Bressers and Huitema1999; Hahn Reference Hahn2013). (2) When economic incentives are implemented, they encounter institutional paths of environmental policy that endure. Market-based instruments then exist parallelly to other regulations and complement but do not replace them. In practice, economic instruments compete with long-standing regulations and are often only added to the range of existing instruments (Hahn Reference Hahn1989; Bressers and Huitema Reference Bressers and Huitema1999). More recent instrument research refers to this as “layering” or the incremental emergence of policy mixes (Jordan et al. Reference Jordan, Wurzel and Zito2013; Wurzel et al. Reference Wurzel, Zito and Jordan2013). (3) Another important finding is that the rate of an introduced tax is often very low at the beginning and only slowly moves to the direction of economic incentives mainly to tame political resistance (Hahn Reference Hahn2013). Based on these findings, an open question is how to analyse and explain these observed deviations from textbook rationality regarding the introduction of new market-based instruments. In our article, we want to examine to what extent we can identify similar empirical phenomena in the case of aviation taxes and scrutinise concrete policy choices on the basis of PIDA.

Analytical framework political process-inherent dynamics approach (PIDA)

The PIDA has been developed to analyse environmental policy processes and explain their outputs, like policies or emerging instruments (Böcher Reference Böcher2012; Böcher and Töller Reference Böcher and Töller2012, Reference Böcher and Töller2015). PIDA was inspired by an early version of the Institutional Analysis and Development (IAD) framework by Kiser and Ostrom (Kiser and Ostrom Reference Kiser, Ostrom and Ostrom1982). Like the IAD, PIDA serves as an analytical framework integrating different factors as independent variables influencing policy processes and the emergence of policies. PIDA highlights, like IAD, the role of actors and institutions. However, PIDA does not examine the emergence of institutional rules as answers to collective action problems and derive recommendations from them, such as conditions that lead to successful governance of the commons (Ostrom Reference Ostrom1990). The biggest difference, and the reason why we use PIDA, is that IAD has mostly been applied to decentralised common good problems (Clement Reference Clement2010). Unlike IAD, PIDA explicitly takes into account different factors of the overarching policy processes that shape institutions and policy instruments “politically” and particularly emphasises the conflicts between, e.g., political interest groups and political parties that are central to explaining policies but do not play a particularly important role in IAD (Clement Reference Clement2010; Tosun and Workman Reference Tosun, Workman, Weible and Sabatier2017). PIDA emphasises the interests of parties and political actors, the role of institutions as enabling or hindering factors, and above all highlights chance, dynamics and power-determined aspects that may even lead to “suboptimal” policies not solving problems. Since PIDA also integrates the actual availability of alternative measures as an explanatory factor and has already been successfully applied in instrument choice studies, this approach is particularly well suited for our study (see for a recent application of PIDA: Pelaez Jara Reference Pelaez Jara2020). Another alternative to PIDA could be policy design approaches (Eliadis et al. Reference Eliadis, Hill and Howlett2005; Peters Reference Peters2018; Howlett Reference Howlett2019). Such approaches, however, in our view, assume too strongly as if policymakers, when confronted with a policy problem, could draw on a “toolbox” of instruments from which to choose the most appropriate one based on (nearly) complete information. Since we, first, do not take it for granted that politicians are necessarily interested in problem-solving and second, assume that lobbying interests and other politico-economic factors strongly influence the selection of aviation taxes and that the instrument does not correspond to ideal design, we do not apply policy design approaches here. For PIDA, policy-making is “characterized rather by developments that are the outcome of chance and inherent dynamics than (mainly) by formal-rational, public-good-orientated problem solving” (Böcher and Töller Reference Böcher and Töller2015, p. 16). Power and the interests of powerful groups often prevent “rational” policy design, which is particularly evident in environmental policy in view of the countless discussions about climate policy that is too weakly designed (Cullenward and Victor Reference Cullenward and Victor2020). In a recent contribution, Howlett writes precisely that policy design research assumes a government that serves public interests and often overlooks the “dark side” of politics (Howlett Reference Howlett2021). Howlett therefore proposes a new research agenda that also looks much more closely at such power-driven aspects of policy (Howlett Reference Howlett2021). In this context, PIDA could inform policy design research in the future.

The main argument of PIDA is that policies are neither the result of rational problem-solving processes nor the result of pure interest aggregation (Böcher and Töller Reference Böcher and Töller2012, Reference Böcher and Töller2015). The central factor determining political processes are actors and their interests. Individual or collective actors’ activities take place under certain institutional framework conditions, which can be formal or informal and action-constraining or action-enabling. These institutions, understood as formal or informal rules, affect the possible implementation of policy alternatives by either extending or limiting the options available for policymakers’ choices (Scharpf Reference Scharpf2000). Important are institutional path dependencies, meaning that political decisions determine a long-term path that political actors cannot leave or easily change (Peters Reference Peters2019). Another influencing factor is the problem structure that affects different aspects of the policy process. Is there a clear political problem with a clear solution or are there contested problems leading to political conflicts about how to solve them? Are there distributional conflicts between different societal groups resulting from different policy alternatives? Another factor is that of available instrumental alternatives. Can all theoretically conceivable instrument alternatives really be selected in a political decision-making situation, or do institutional path dependencies, political interests and power relations, or dominant social discourses, unfold a restricting effect? Actual possible instrument choice often diverges from theoretical options in policy. Furthermore, unexpected situational aspects representing external factors like scandals and catastrophes can change the course of a political debate and open new windows of opportunity (Böcher Reference Böcher2012; Böcher and Töller Reference Böcher and Töller2015). PIDA aims to explain policies in which the institutional framework plays a major role and conflicts and changes in actor behaviour occur in the political process because of their inherent dynamics and problem structures. So far, the approach has been used to analyse different cases in environmental policy (Vogelpohl et al. Reference Vogelpohl, Beer, Ewert, Perbandt, Töller and Böcher2021a, Reference Vogelpohl, Töller, Beer and Böcher2021b) and more recently in housing policy (Slavici Reference Slavici2021) or governance of European genome editing (Ladu Reference Ladu2020).

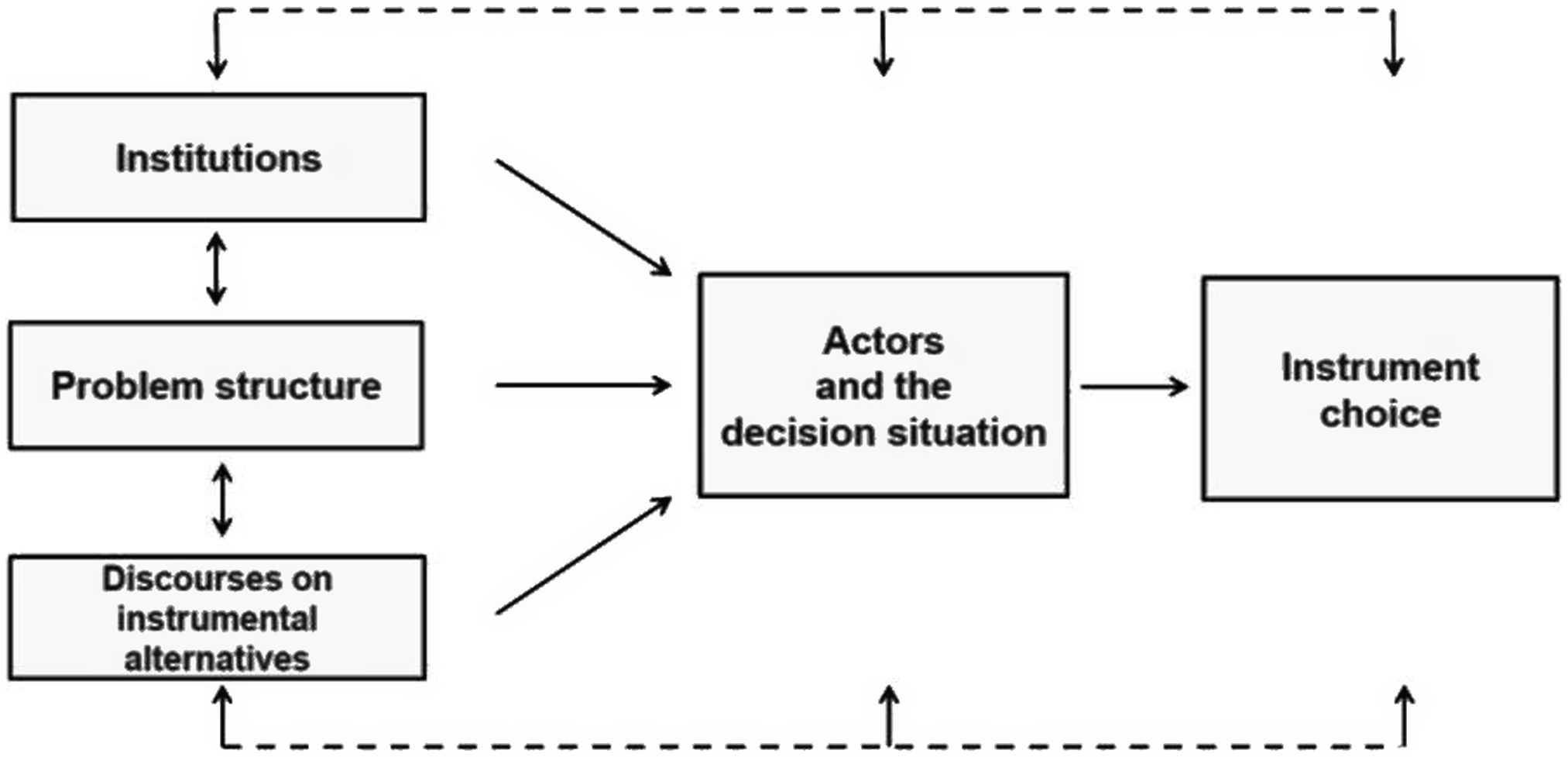

PIDA helps to analyse and explain instrument choice in environmental policy (Böcher and Töller Reference Böcher, Töller, Jacob, Biermann, Busch and Feindt2007; Böcher Reference Böcher2012). It is here argued that the choice of environmental policy instruments does not follow straightforward problem-solving, after which politicians select the instrument that seems best suited for the solution. Furthermore, policy instruments are neither the result of the power and interests of political actors alone, nor the result of comprehensive political learning processes. Rather, in the policy-making process, we identify elements of political rationality that act as restricting or enabling filters and thereby reduce the theoretically available range of policy instruments before governments adopt a specific instrument and not another or a special variation of an instrument (Figure 1).

Figure 1. PIDA as analytical framework for studying instrument choice (Böcher and Töller Reference Böcher, Töller, Jacob, Biermann, Busch and Feindt2007, adapted from Böcher Reference Böcher2012).

According to PIDA, policy instrument choice is the result of the interaction of different factors which leads to two contradictory consequences: on the one hand, the range of available policy instruments increases (Böcher and Töller Reference Böcher, Töller, Jacob, Biermann, Busch and Feindt2007, Reference Böcher and Töller2012). This is the case, e.g., when, due to societal discourses and the influence of scientific policy advice, alternative instruments are more strongly taken up and discussed in the political process. On the other hand, some factors like institutions, the problem structure or power and interests of political actors limit the degree of instrumental change. This is the case when distributional effects of a possible introduction of new instruments become known and groups that are negatively affected by the consequences of a new instrument, e.g., higher costs due to a new tax, engage in lobbying or when institutions such as constitutional law oppose the introduction of new instruments. Due to different political systems, these factors may differ between countries and may lead to variations in the policy output (Böcher and Töller Reference Böcher, Töller, Jacob, Biermann, Busch and Feindt2007, Reference Böcher and Töller2012).

Methodology

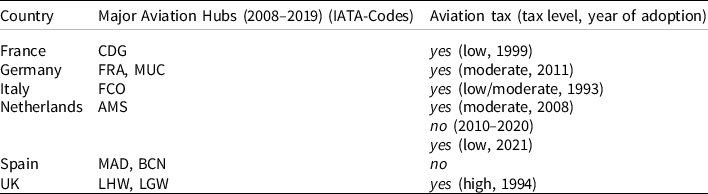

For our study, all countries are relevant in which the introduction of a ticket tax for international aviation passenger transport has been on the agenda at some point of time irrespective of the ultimate status of the taxFootnote 2 (for an overview, see Faber and Huigen Reference Faber and Huigen2018). Exploring policy-making processes in an underresearched area of policy analysis, however, we rely on a case-sensitive research design and therefore could not include all cases in our study. Instead, we opted for a paired comparison which grants us a maximum of case intimacy and helps us to avoid looking only at national idiosyncrasies (Tarrow Reference Tarrow2010). The Netherlands, here, is particularly interesting since it had introduced an aviation tax, which was abolished only one year later, and most recently reintroduced such a tax. Considering this variety, we deem it most suitable for our purposes to explore and illustrate explanations for specific aviation policy instrument choice. By including Germany as a second case, we examined a positive case selection as we looked for relevant cases that discussed the issue within a comparable period of time and share further scope conditions (especially EU membership and presence of a major aviation hubFootnote 3 ) but differ most on the dependent variable. The development in the German case displays stability (positive case) whereas the Netherlands has long represented a case of failed implementation (negative but possible case) (Blatter and Haverland Reference Blatter and Haverland2012, ch. 3) (Table 1). Furthermore, the two countries are interesting since they mutually are main point of references in public debates on the aviation taxes. In terms of research design, this case selection, ultimately, forms a most similar cases with different outcomes design (Berg-Schlosser and De Meur Reference Berg-Schlosser, De Meur, Rihoux and Ragin2009).

Table 1. Presence of aviation taxes in EU countries with major aviation hubs as of July 2021

The data collection relied on the analysis of a comprehensive number of documents including election programmes, coalition agreements, parliamentary documents as well as media reports. Based on the terms commonly used for the tax in the two countries (“vliegbelasting” and “Luftverkehrsabgabe”), national parliamentary databases have been scrutinised in order to reproduce the policy-making processes around the ticket taxes in an inclusive manner. To identify the relevant media articles, two media databases have been used (Dow Jones Factiva and Nexis Uni). The research has been complemented by a literature review on aviation transport policy. For data analysis, we applied an “inductive process tracing” (Falleti and Mahoney Reference Falleti, Mahoney, Mahoney and Thelen2015) as we sifted relevant information from the various documents, put this information in chronological order and first afterwards sorted it guided by the PIDA-dimensions. Gerring (Reference Gerring2017, ch. 8.2) refers to this mode of analysis quite generally as “qualitative analysis,” and it has been applied successfully elsewhere (see e.g. Müller and Thurner Reference Müller and Thurner2017). Thus, we produced “thick” chronological case descriptions (Blatter and Blume Reference Blatter and Blume2008) on the policy evolutions in both countries.

The Dutch Vliegbelasting: A policy round trip that ultimately looped the loop

The Netherlands is considered a busy bee regarding environmental policy-making (Liefferink, et al. Reference Liefferink, Arts, Kamstra and Ooijevaar2009; Duit Reference Duit2016). Therefore, it is no surprise that they were among the first movers in Europe regulating the national aviation sector. Following the elections from 2006, the new government of the conservative Christen-Democratisch Appèl (CDA), the social democratic Partij van de Arbeid (PvdA) and the Christian-orthodox ChristenUnie (CU) agreed in their coalition contract on the introduction of an aviation tax (Source: NL01Footnote 4 ). This vliegbelasting (English: aviation tax) was part of a governmental programme aimed at an environmental “greening” of the Dutch tax system based on the polluter-pays-principle (NL02, NL03, NL07). The Ministry of Finance stressed the need to create incentives for environmentally friendly behaviour among citizens and to internalise environmental costs into prices (NL07, NL17). From the beginning, the argumentation was related first and foremost to environmental reasons, and only secondly – and to a much smaller extent – to the fiscal argument of tax revenue (NL05, NL17). At the end of 2007, the tax was adopted in both chambers and supported by multiple parties with onlyFootnote 5 the liberal Volkspartij voor Vrijheid en Democratie (VVD) and the populist radical right Partij voor de Vrijheid (PVV) as opposers (Source: NL21, NL31). The tax was finally implemented by 1 July 2008 providing tax rates differentiated by two categories: € 11.25 for destinations that lie within the European Union or that are less than 2,500 km from the Dutch airport of departure; and € 45.00 for all other destinations (Vliegbelasting, Art. 36re, NL04). For the next years, the revenue of the tax was expected to amount € 350 million per year (estimated for 2009–2011) and € 179 million for the remaining half in 2008 (NL17). In socioeconomic terms, the government estimated that the growth of the aviation sector is only to be delayed but that no losses of existent jobs will occurFootnote 6 (NL17, NL22). Ecologically, the tax should lead to a decreasing number of passengers, less flight movements and less harmful emissions (NL17). From the beginning of the legislative process, the vliegbelasting was very contested.

In parliament, above all, the VVD and the PVV argued persistently against the tax seeing it as part of “de groene manie van dit cabinet” (English: “the green obsession of the cabinet,” Mark Rutte, VVD, NL26). Implying its negative economic and environmental impacts, the parties stimulated parliamentary debates on and submitted (unsuccessful) motions against the tax (NL05, NL06, NL19, NL23, NL24, NL25). One main argument was that the tax would not even have a positive environmental effect since higher ticket prices made Dutch passengers rather go to foreign airports (by car) instead of flying less (NL19, NL30).

Most naturally, the entire aviation industry but also the tourism sector opposed the tax and campaigned against it before and after its implementation applying the whole portfolio of lobbying such as begging letters, commission of scientific studies and protests of the employees of the aviation and tourist branch which was supported by the big Dutch trade unions (NL25, NL33Footnote 7 ). In February 2008, Ryanair and the airport Maastricht-Aachen took legal actions and brought the debate over the aviation tax to the court (Faber and Huigen Reference Faber and Huigen2018). The plaintiffs perceived the tax as unlawful state aid as the exceptions made for transfer and transit passengers favour certain airports and airlines and therefore suggested its incompatibility with European law. Additionally, the two parties, more generally, questioned the compatibility with the Chicago Convention (see below), but, in the end, the court decided in line with the governmental argumentation (Faber and Huigen Reference Faber and Huigen2018).

Despite this overall headwind, the government had held its official line of argumentation and defended the tax referring to its environmental benefits and the lack of alternatives (NL06, NL07, NL30, NL23), even after first figures had showed a severe decrease of passengers at Schiphol (NL08, NL10, NL27). However, in February 2009, in the view of an intensifying global economic crisis, the Minister of Transport and Water management stated in the media that the aviation tax must be put under scrutiny to support the aviation sector (NL28). He specified his concerns and announced the government’s decision to establish an inter-ministerial working group to investigate options to release pressure from the aviation sector and make Schiphol competitive again (NL28). The State Secretary of Finance, who had been responsible for introducing the tax, conceded such an examination of the tax, yet confirmed upon request clearly that the government had no intention to abolish the tax (NL28). In contrast, in March 2009, the government presented a stimulation package which among others measures led to the reset of the vliegbelasting to zero by 1 July 2009 and its abolishment later that year in the annual budget 2010 (NL12, NL29).

In 2017, the Dutch story of aviation taxes took another turn as the new cabinet under minister president Rutte revealed plans to reintroduce the vliegbelasting in its coalition agreement. This decision was unexpected as none of the four coalition parties had included the tax in their election manifestos – although some authors suggest an agenda-setting effect of the rising Green party, GroenLinks, which opted out of the coalition talks earlier that year (Buijtendijk and Eijgelaar Reference Buijtendijk and Eijgelaar2020). In contrast, it is evident that it has been a state secretary from the liberal party D66 who pressed ahead with the tax so that it has been introduced by 1 January 2021. During the legislative term, the tax has been adjusted several timesFootnote 8 and at the end was set at a flat rate of € 7.45 per passenger per flight irrespective of other factors such as the flight distance and thus obtains a considerably lower level than the original tax from 2008 (NL16). From statements of the government, it becomes strikingly clear that this low tax level was motivated by political pragmatism in order to secure a parliamentary majority for the basic idea of greening taxation (NL15, NL30). Interestingly, even the experiences from the failed 2008 policy had been brought forward by government’s representatives (NL15, NL30). Furthermore, parliamentary discussions reveal that the aviation tax was only the third-best policy choice for the government to realise its plans of regulating the civil aviation sector. First, they looked into possibilities of promoting technological innovations of airplanes, e.g., by taxing airplanes according to their efficiency and fuels, and especially they investigated solutions on the pan-European level, e.g., by repeatedly addressing the respective commissioners and holding a conference on the specific topic of aviation taxes (NL13, NL14, NL15, NL30). Only as these efforts failed, they opted for the reintroduction of the aviation tax.

The German Luftverkehrsteuer: A policy that stayed the course

In 2010, the Ministry of Finance presented the Luftverkehrsteuer (English: aviation transport tax) in a draft, that represented a quite comprehensive policy package to tackle the ramifications of the global economic crisis (Source: DE01). As part of this package, the main goal of the aviation tax was budget consolidation (DE01). Environmental motives have – if at all – been secondary for the conservative-liberal government and have been voiced only occasionally in parliamentary debates (e.g. DE05).

Against the votes of the three opposition parties, the policy package was adopted by the first chamber, the Bundestag, in October 2010 (DE05). It is important to note that the major target of the opposition’s criticism was not the aviation tax but rather other elements of the policy package. In contrast, the three German Länder Rhineland-Palatinate, Berlin and Brandenburg sought to stop the tax in the second chamber and brought forward a number of legal and economic objections, among others by referring to the recent negative experiences in the Netherlands (DE08). However, they could not win the majority for their motion so that the law was finally adopted in December 2010 (DE02). By 1 January 2011 an aviation tax has come into force which in many aspects resembled the Dutch predecessor as it is calculated for each passenger departing from a German airport (LuftVStG §5, DE02) differentiated by three levels of distance and corresponding prices: € 8.00 for short-haul, € 25.00 for medium-haul and € 45.00 for long-haul flights (DE02). Since 2010, the tax rates have been adapted several times at slightly lower ratesFootnote 9 and until April 2020 amounted around € 7.38, € 23.05 and € 41.49.

Although the aviation tax was not a particularly controversial issue in the Bundestag, it has been contested in the following years. While there have been most natural disagreements between environmental NGOs and aviation sector’s businesses (i.e. Lufthansa, Air Berlin, Ryanair, airport operators) as well as their associations, an increasingly severe resistance has originated from federal state representations. In particular, Rhineland-Palatinate stands out in this regard as it has continuously promoted motions against the tax, initiated a resolution in cooperation with the aviation industry and in 2014 even went to the constitutional court against the law. The court, however, followed earlier jurisdiction (e.g. in the Netherlands, see above), dismissed the case and thereby confirmed the legal position around the tax (DE11) (Faber and Huigen Reference Faber and Huigen2018). However, the coalition of opponents in the Bundesrat had grown, so that following an initiative of Bayern, Hesse, Lower Saxony and Saxony, in November 2012, the chamber urged the government to abolish the tax immediately (DE10). The government, however, adhered to its position, and, especially, the attitude of the Ministry of Finance can be described as uncompromising since the annual tax revenue of around € 1 billion was an important element of its overall consolidation policy (Saalfeld and Zohlnhöfer Reference Saalfeld, Zohlnhöfer, Zohlnhöfer and Thomas2015). Critical voices by other Ministers (of Economic Affairs or Transport) did not carry enough weight in comparison to the Minister of Finance’s influential position (e.g. Murswieck Reference Murswieck, Zohlnhöfer and Saalfeld2015).

The new coalition of Christian Democrats and Social Democrats committed themselves to continue the consolidation course and, in this context, also has kept the aviation tax. Since the tax is hardly an issue in the following legislation and neither in the election 2017 (DE15-18), it persists with only some already indicated adaptations of its actual rates. First, in 2019, in light of an intensifying discussion on climate mitigation policies the aviation tax regained attention and, from April 2020 on, the federal government raised the rates considerably to € 12.90, € 32.67 and € 58.82 as part of its climate programme (DE03, DE04).

Analysis

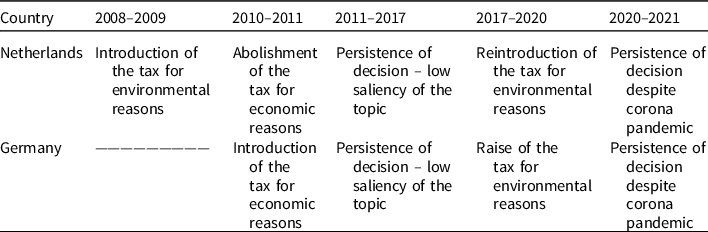

Comparing the policy developments in the two countries (Table 2), two questions are interesting for our analysis of instrument choice from the PIDA perspective: why was the tax introduced in the first place and why did the tax, which was so similarly designed in both countries, persist in Germany while it was quickly abolished in the Netherlands and reintroduced on a considerably lower tax level more than 10 years later?

Table 2. Evolutions of aviation taxes in the Netherlands and Germany 2008–2021

The explanatory factor instrumental alternatives refers to the question whether political actors have real and realisable policy alternatives at hand. It is closely interconnected with the factor of institutions which regularly limits available national policy options. For the regulation of aviation transport, a number of alternative instrumentsFootnote 10 might be discussed in the political discourse but in the decision situation the scope for instrument change is limited due to its global and European institutional embedding and resulting path dependency.

One of the most important institutions for aviation policy is the Chicago Convention on International Civil Aviation (CICA). In 1944, this convention established rules for civil aviation that are binding under international law to facilitate the international exchange of people in peacetime and to boost air traffic. Thus, the convention acts as a strong institutional filter in the sense of path dependency, and by its contradictory motive, makes the introduction of political instruments aimed at restricting air traffic more difficult. Among other things, it stipulates that kerosene on board of landed aircrafts may not be taxed (CICA, Art. 24a). Following this provision, it also has become a standard clause in the important air service agreements (ASA) that aircrafts from the contracting countries are allowed to refuel tax-free (Conrady et al. Reference Conrady, Fichert and Sterzenbach2019). Hence, comprehensive tax solutions for international aviation are practically ruled out. However, within-states taxes are allowed and regularly applied, e.g., in the United States, Norway or Japan. In the EU, since 2005 the Energy Taxation Directive (2003/96/EC) entitles EU-member states to implement taxes on kerosene within their territories but also in bilateral agreements (Art. 14b) while at the same time in its preamble it advises against doing so in light of international agreements (§ 23) (Conrady et al. Reference Conrady, Fichert and Sterzenbach2019).

Concerning climate change mitigation measures specifically, it is striking that the pioneering Kyoto protocol conceded measures for the international aviation to the International Civil Aviation Organisation (ICAO) and not to national governments (Art. 2, paragraph 2 UNFCCC 1997)Footnote 11 . Nevertheless – or even in response to the ICAO’s inertia (Birchfield Reference Birchfield2015) – from 2012 on the EU has integrated the inner-European aviation transport in the European Emission Trading System (ETS) (2008/101/EC) (Efthymiou and Papatheodorou Reference Efthymiou and Papatheodorou2019) which institutionally limits member states’ options to adopt national measures. The more recent efforts of the Dutch government to enforce further pan-European regulation are here illustrative. Thus, despite some easing tendencies in most recent timesFootnote 12 , institutionally, we may conclude a tenacious path dependency that is relevant for aviation policy in both countries and that in both cases made policymakers choose very similarly designed policies. Seen through the lens of PIDA, institutional factors limit the range of actually available policy options for policymakers.

Interestingly, the actually addressed problem structures differ clearly between the countries and over the course of the years, whereas the Dutch government at both occasions primarily has targeted a greening of the tax system and only secondarily refers to tax revenue (in the context of an even more ambitious overall goal to advance Dutch society, Wilp Reference Wilp2012), the German government explains the introduction of the aviation tax essentially with reference to its general goal of budget consolidation in the face of the economic crisis (Saalfeld and Zohlnhöfer Reference Saalfeld, Zohlnhöfer, Zohlnhöfer and Thomas2015). If at all, environmental considerations have played only a minor role in the German case. This reversed hierarchy of goals is interesting as it prestructures governmental lines of reasoning in the view of similar external perturbations and sets different benchmarks for the public assessment of the policy, which in turn generate different feedback loops for policymakers. Focusing more recent developments, it is striking that, nowadays, both countries have adopted an environmental reasoning in order to justify the aviation tax or its raise. However, if we look at the considerably differing tax rates, path dependency has clearly played its role. Since the tax had been established in the German case on a medium level, it needed to be raised in order to unfold an emblematic effect, whereas in the Netherlands previous experiences let the government apply an only symbolic flat rate at a low level. Both stories highlight the primacy of economic interests in their own way and reveal highly conflicting arguments for the same tax. This not only corresponds to the fundamentals of PIDA which suggest that “already existent policy solutions seek their problems” (Töller and Böcher Reference Töller, Böcher, Schroeder and Weßels2017, 548; authors’ own translation) but it also confirms Hahn’s ideas on eco-tax choices (2013), that taxes were not imposed to provide incentives for more environmentally friendly behaviour, but to generate revenue for the state budget and that economic motives engender institutional paths for environmental policy that endure (see above).

Regarding situational aspects, the global economic crisis, which climaxed from the end of 2008 until spring 2009, must be seen as the central event in the beginning of the period of investigation. In both the Netherlands and Germany, the overall GDP per capita growth had substantially decreased. If one looks only at the Dutch case, the simple argument could be that the tax was introduced in sound economic times and as these had changed, conflicting goals had to be reassessed and, ultimately, the tax had to be removed. However, the insights of the German case, where a very similar policy not only was adopted first in the very same economic crisis but also survived these times of crisis, make the picture more complicated and rather dismiss this argument. Equally, it would not explain why both governments stick to their decisions to reintroduce or raise the tax for environmental reasons in the midst of another tense economic situation caused by the COVID-19 pandemic.

As one domestic institutional factor, we already identified previous policy decisions which begot path dependencies for instrument choice and their specific design, whereas international and supranational institutions are most similar for the two countries (EU and ICAO membership); it is worth looking at other national institutional differences and in particular at the actors involved in the process since PIDA indicates that it is important how external perturbations exert influence on and are filtered by endogenous factors, i.e., processed by domestic actors.

A major difference between the countries is its degree of federalism. Lijphart (Reference Lijphart2012) classifies Germany as a federal state whereas the Netherlands is semi-federal. In particular, it is relevant, that German Länder keep their public budgets partly independent from the federal level (e.g. Von Beyme Reference Von Beyme2017) and, therefore, are interested in independent revenues and economic activities as potentially stimulated by regional airports. These idiosyncrasies are most evidently reflected in the constellation of actors participating in the policy process.

Actors and their interests are at the centre of PIDA and may represent the main explanatory variable. According to classical partisan theory, key actors in national policy-making processes are the incumbent political parties so that a change in the composition of government likewise results in a change in policies (Hibbs Reference Hibbs1977; Schmidt Reference Schmidt1996). Empirically, left parties have been affiliated with more state-interventionist approaches of policy-making, whereas right parties generally avoid state interventions such as taxes (ibid.). In the Dutch case, the initial introduction of the aviation tax corresponds to these assumptions of classical partisan theory. Although the CDA was the strongest party in government and Jan Peter Balkenende stayed prime minister for the fourth time in a row, the formation of the Christian-social government meant a serious shift to the left, especially in terms of economic issues and in contrast to the former coalition between CDA and the liberal VVD (Wilp Reference Wilp2012). The three-party-coalition was by no means a planned coalition as, in particular, CDA and PvdA had contested each other fiercely in the election campaign and the personal relation between the party leaders Balkenende and Bos was difficult (Wilp Reference Wilp2012), but setting a sustainable course for the aviation transport sector was something all parties had agreed on beforeFootnote 13 (Source: NL37-40). Yet, the abolishment of such a tax through the same coalition contradicts classical partisan theory. Equally contradicting are the findings from the German case where a conservative-liberal coalition introduced an entirely new tax and thus produced a significant policy change (Rixen Reference Rixen, Zohlnhöfer and Saalfeld2015) – and, furthermore, this tax is kept under the continuous governmental dominance of the Christian Democratic party up until 2021.

A basis for explaining this puzzle can certainly be found in the special economic situation as well as in the different targets of the taxes in the two countries. However, the actual effects of the tax, i.e., higher tax revenue and burden of the aviation industry, as well as the reaction of the affected sectors had been quite similar so that it is still unclear why the tax could persist in Germany under difficult economic conditions while it did not in the Netherlands under similar conditions.

Approaches that go beyond classical partisan theory and include opposition parties in their analysis can help to shed light on this question (Seeberg Reference Seeberg2013; Zohlnhöfer and Engler Reference Zohlnhöfer and Engler2014; Abou-Chadi et al. Reference Abou-Chadi, Green-Pedersen and Mortensen2020). Interestingly, from the beginning the Dutch government was confronted with a quite strong opposition against the tax by the VVD and the PVV which helped to keep the topic up on the political agenda both inside and outside the parliament. In the German case, such a parliamentary opposition was missing completely since all three left opposition parties programmatically consented to the tax and could criticise only details from an environmental perspective (e.g. DE06, DE07). Only the Liberals openly opposed the aviation tax but were voted out the Bundestag in 2013. Therefore, a nucleus for a coalition against the tax never came into being.

This could not even be compensated by German state governments which expand the range of relevant actors in German federalism and, as described above, made serious efforts to fight the tax before and after its introductionFootnote 14 . Instead, German federalism had a reverse effect in this matter. In the German political system, the federal government and the Länder rely on quite independent budgets and since the German federation had sold most of its stakes in airlines and airports, it was, in contrast to some of the Länder, less dependent on the aviation industry’s growth (FIS 2016). Taking first and foremost care of the federal budget, the Federal Minister of Finance, therefore, could neglect negative sector-specific developments resulting from the aviation tax. In the Netherlands, the situation was the exact opposite as the Dutch state has held considerable shares in Schiphol so that the government felt the negative effects of its own action in a direct and facing an economic crisis also intense mannerFootnote 15 .

Additionally, the durability of the aviation tax in Germany can be connected to the Nixon-goes-to-China-argument. The fact, that in particular the traditionally business-friendly Christian Democrats advocated the tax, has made it extraordinary difficult for lobby organisations to deploy any influence on the government. In the Dutch case, the ties between aviation industry and the government appeared considerably closer forming an “iron triangle” between Schiphol, the Royal Dutch Airlines (KLM) and the ministry of infrastructure (Buijtendijk and Eijgelaar Reference Buijtendijk and Eijgelaar2020). In any case, this held true for the policy round trip in 2008 and 2009. However, in the beginning of the 2020s, three things have changed that provide explanation for the reintroduction of the tax: first, aviation interests seem to have lost their leverage on the ministry (Buijtendijk and Eijgelaar Reference Buijtendijk and Eijgelaar2020); second, as in the German case, parties taking strong environmental positions have increasingly gained influence; and third, the Nixon-goes-to-China-argument could equally be applied to the cabinet led by the VVD and especially prime minister Rutte who took a strong stand against the original tax from 2008.

The effect of lobbyism, overall, remains a rather intangible subject for research. Since in both cases, representatives of the aviation and tourist sectors took action against the tax and the threat potential of the two national aviation sectors can be deemed similar, from a comparative perspective we are inclined to relate any possible impact back to party behaviour reflecting the dependence of interest organisations on governments’ responsiveness (Woll Reference Woll2007). However, any further independent influence can be neither rejected nor confirmed within the scope of this article.

Conclusion

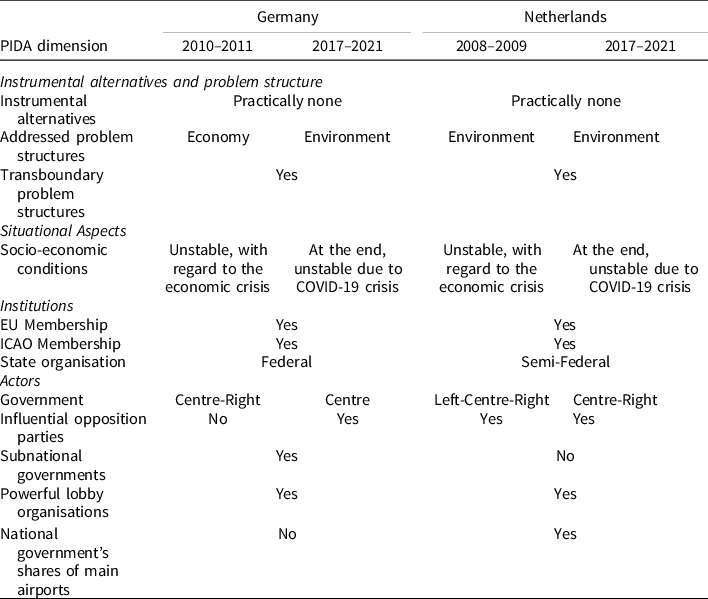

Our comparative analysis shows that environmental policy instrument choice depends on several factors. The PIDA has proved useful in analysing the different policy outputs in the two states and reveals a configurational causality that can explain aviation policy instrument choice in two European countries (Table 3). Firstly, it is striking that the same policy was applied to address different problems and that actual options change over the course of time so that environmental rationales seemingly have become more influential. Secondly, however, these environmental rationales still have to be embedded in economic reasoning. The considerable raise of the German aviation tax in 2019 has only been possible as it continues the path of an economically motivated policy and the reintroduction of the vliegbelasting in the Netherlands has evidently been shaped by economically derived constraints. Thus, in line with classic instrument choice literature (see above, e.g. Hahn Reference Hahn2013) the primacy of economy appears to be continuously valid. Thirdly, different configurations of party competition have played a pivotal role and underscore the importance of looking at partisan effects beyond governmental parties (e.g. Seeberg Reference Seeberg2013). As well, new instruments like the aviation tax by no means replace other existing regulations – here the aviation taxes in both countries have been added to existing aviation policy like the European ETS.

Table 3. PIDA explanatory factors for variances in the evolution of aviation taxes in Germany and the Netherlands

Fundamentally, it is evident that instrument choice with the objective of regulating transport volume in the aviation sector is strongly shaped by institutional factors that constrain the number of instruments available. However, as environmental concerns have gained considerably in political importance, these institutions are getting in a state of flux. In the EU, a revision of the energy taxation directive and the ETS is on the agenda calling for future research to address the interactions of EU- and nation-state level in more depth and examine if a “regulatory cooperation” in aviation transport policy will take place (Holzinger and Knill Reference Holzinger and Knill2004). Furthermore, the external validity of our investigation is clearly limited, although potentially a generalisation across other cases in which an aviation tax has been discussed is possible, so that an examination of the identified factors beyond the two cases at hand is most appealing. Thus, our study can be understood as a first part of a layered generalisation (Rohlfing Reference Rohlfing2012, ch. 9.3) which increases the generalisability step by step by transforming scope conditions to variables in order to add a new layer of cases to the study. A promising step would be to relax the scope condition of time or problem structure, i.e., presence of a major aviation hub, and apply the findings to further positive EU-cases in which an aviation tax has been introduced (time: France, Italy; problem structure: Austria, Sweden).

As our analysis shows, this future research can be fruitfully guided by the PIDA which has revealed the political aspects of instrument choice and elucidated that governments can by no means carry out rational policy design here. Thus, the factors described by PIDA can also be used to further develop policy design approaches as they especially integrated aspects of what Howlett recently called the often neglected “dark side” of policy-making (Howlett Reference Howlett2021). Regarding its limitations, just as other heuristics, PIDA leaves some vagueness about specific causal mechanisms of the individual factors but also their interactions. This has to be investigated deductively with support of specific theories (Slavici Reference Slavici2021) or inductively as in this study.

Finally, our comparative case study contributes to the broader research on sustainable transitions in which despite positive recent developments a deeper understanding of the policy process and related constellations of power interests and institutions, is still needed (Normann Reference Normann2015; Köhler et al. Reference Köhler, Geels, Kern, Onsongo and Wieczorek2017). Aviation transport, in particular, can be understood as an increasingly symbolic area for this (Becken et al. Reference Becken, Friedl, Stantic, Connolly and Chen2021) pointing to questions of to which extent and for what reasons the state enforces environmentally oriented regulation. From our analysis, explanations do not indicate any further turnaround in the ongoing priority struggle between environmental and economic considerations, while the back and forth on aviation taxes actually shows that politics here is by no means always problem-solving-oriented, but follows other rationalities. A factually rational choice of instruments is not to be expected.

Supplementary material

To view supplementary material for this article, please visit https://doi.org/10.1017/S0143814X22000034

Data availability statement

Data available within the article or its supplementary materials.

Competing interests

The authors declare none.

Funding Sources

No funding received.

Declaration of Interest

No potential conflict of interest was reported by the authors who have contributed equally to this article.

Lars E. Berker is a PhD researcher at Otto-von-Guericke University Magdeburg, Germany. His research focuses on comparative environmental policy and politics, political parties and socio-ecological transitions.

Michael Böcher is Professor of Political Science and Sustainable Development at the Otto-von-Guericke University Magdeburg, Germany. His main research topics are environmental policy analysis (instruments, nature conservation policy, sustainable rural development) and scientific knowledge transfer in environmental and sustainability sciences.