Introduction

Corporate diversification is central to strategy research (Hoskisson & Hitt, Reference Hoskisson and Hitt1990). In the past, scholars have offered a variety of theoretical perspectives to explain why firms undertake corporate diversification and the performance implications of such moves (Ahuja & Novelli, Reference Ahuja and Novelli2017; Hoskisson & Hitt, Reference Hoskisson and Hitt1990). For instance, the resource-based view suggests that firms diversify into new business segments to leverage existing firm-specific resources and capabilities (Penrose, Reference Penrose1959; Teece, Reference Teece1982). Agency theory predicts that top executives will pursue diversification to reduce idiosyncratic risks they face (Amihud & Lev, Reference Amihud and Lev1999) and attain private benefits in the form of power and prestige achieved through diversification (Jensen & Murphy, Reference Jensen and Murphy1990; Shi, Zhang, & Hoskisson, Reference Shi, Zhang and Hoskisson2017; Shleifer & Vishny, Reference Shleifer and Vishny1989). Although these existing theoretical perspectives have offered distinct explanations for why firms undertake diversification, they have done so by focusing on how diversification can benefit the firm's shareholders or how it serves only top executives’ interests. Yet, in many cases, it is hard to disentangle whether shareholders or top executives benefit more from corporate diversification.

Drawing on the behavioral theory of the firm (BTOF) (Cyert & March, Reference Cyert and March1963; Gavetti, Greve, Levinthal, & Ocasio, Reference Gavetti, Greve, Levinthal and Ocasio2012) and social comparison theory (Festinger, Reference Festinger1954; Suls & Wheeler, Reference Suls, Wheeler, Lange, Kruglanski and Higgins2012), we argue that top executives compare the profit margin of their firm's main business with the performance of peer firms’ high-profitability business segments. When top managers see their own organizations falling behind peer firms, they will undertake problemistic search that can lead to increased levels of diversification investment in a high-profitability business segment. We define such diversification as ‘opportunistic diversification’ that aims to improve the firm's short-term financial performance, regardless of the strategic fit between the new business and the firm's existing business. In contrast, non-opportunistic diversification does not have an embedded time horizon. If a firm experiences a performance shortfall and undertakes investment in an unrelated industry in an effort to improve its performance, such a move does not necessarily qualify as opportunistic diversification if a lengthy time span is required for this investment to come to fruition. Indeed, once the impact of time is taken into consideration, this kind of diversification decision is not an opportunistic one.

We test our theory on a panel dataset of non-real-estate Chinese firms that diversified into the real estate business. China has witnessed phenomenal growth in the real estate industry; by some accounts, investment in real estate in that country increased from 4% of GDP in 1997 to 15% of GDP in 2014 (Chivakul, Lam, Liu, Maliszewski, & Schipke, Reference Chivakul, Lam, Liu, Maliszewski and Schipke2015). Real estate has thus become one of the highest-profitability business segments in China. We argue that when executives compare the profit margin of their firm's main business with peer firms’ real estate business and observe a large performance shortfall for their own organization, they will opportunistically invest in the real estate business with the goal of reducing this immediate performance gap. Moreover, this effect is stronger when focal firms are more similar to peer firms along key firm characteristics because such similarities facilitate social comparison (Festinger, Reference Festinger1954). Similarly, this effect is stronger when executives are underpaid relative to peer executives because underpaid executives are more strongly motivated to enhance short-term performance through diversification than are overpaid executives. Although investment in real estate can improve a firm's short-term financial performance, it can also signal a lack of strategic focus (Ocasio & Joseph, Reference Ocasio and Joseph2017) and be detrimental to long-term accounting performance.

This study contributes to management research in three ways. First, our study advances corporate strategy research by developing a behavioral account of firms’ pursuit of opportunistic diversification. Opportunistic diversification differs from diversification driven by managerial self-interest. The latter is an outcome of agency problems – that is, such diversification can harm shareholders’ interests. By comparison, opportunistic diversification is driven by managerial motives to improve short-term financial performance and may not harm the short-term interests of shareholders. Our findings not only indicate that performance shortfalls relative to peers can lead to opportunistic diversification but also unpack the implications of such diversification. By doing so, our study offers novel insights into the drivers and consequences of opportunistic diversification.

Second, our study advances research on the BTOF by suggesting a novel social aspiration target. Most previous studies concerning social comparison have focused on overall performance shortfalls with external marketplace competitors (Audia & Greve, Reference Audia and Greve2006; Chen & Miller, Reference Chen and Miller2007; Greve, Reference Greve1998, Reference Greve2008). Our findings suggest that performance gaps between focal firms and peer firms’ ‘diversified’ business can also trigger problemistic search and influence firms’ diversification investment decisions. Despite awareness of peer firms’ high performance, when deciding whether to increase their investment in a business segment, firms tend to pay more attention to the profitability of that targeted segment. Hence, compared with overall performance shortfalls, differences in targeted segment performance can be a more powerful driver of problemistic search.

Third, our study contributes to research on managerial short-termism from a BTOF's perspective. Prior research has explained managerial short-termism from the perspective of capital markets (Chen, Rhee, Veeraraghawan, & Zolotoy, Reference Chen, Rhee, Veeraraghavan and Zolotoy2015; Gigler, Kanodia, Sapra, & Venugopalan, Reference Gigler, Kanodia, Sapra and Venugopalan2014), firm performance measurement systems (Chen, Cheng, Lo, and Wang, Reference Chen, Cheng, Lo and Wang2015; Varas, Reference Varas2014), external or internal governance mechanisms (Gonzalez & André, Reference Gonzalez and André2014; Shi, Connelly, & Hoskisson, Reference Shi, Connelly and Hoskisson2017), or managers’ experience of role ambiguity (Marginson & Mcaulay, Reference Marginson and Mcaulay2008). Our findings enrich insights into antecedents to managerial short-termism by highlighting that performance shortfalls relative to peer firms can also give rise to managerial short-termism. Specifically, when the performance of a firm's main business relative to its peer firms’ real estate business segment is below aspirations, managers would engage in problemistic search, and choose to invest in high-profitability business to remedy such short-term performance shortfalls.

Theoretical Background

Antecedents and Performance Implications of Diversification

Which factors influence corporate diversification remains a question central to strategy research (Hoskisson & Hitt, Reference Hoskisson and Hitt1990; Rumelt, Schendel, & Teece, Reference Rumelt, Schendel and Teece1994). Scholars have offered diverse theoretical perspectives to explain why firms engage in corporate diversification (Ahuja & Novelli, Reference Ahuja and Novelli2017; Hoskisson & Hitt, Reference Hoskisson and Hitt1990). The resource-based view (Barney, Reference Barney1991; Wernerfelt, Reference Wernerfelt1984) suggests that firms allocate scarce resources to available product market opportunities in a descending order of value in an effort to maximize their overall financial returns (Levinthal & Wu, Reference Levinthal and Wu2010; Montgomery & Wernerfelt, Reference Montgomery and Wernerfelt1988). In addition, diversified firms have the opportunity to accumulate strategic assets more rapidly and at lower costs than their non-diversified competitors (Markides & Williamson, Reference Markides and Williamson1994). Consistent with the resource-based view, research has shown that diversification into a strategically related business can have a positive influence on firm performance (Markides & Williamson, Reference Markides and Williamson1994; Palich, Cardinal, & Miller, Reference Palich, Cardinal and Miller2000).

Scholars have cited transaction cost theory and strategic behavior theories to justify the rationale behind diversification. Transaction cost theory proposes that firms’ decisions to diversify into new business segments can be driven by the opportunity that internalization offers to reduce transaction costs associated with market exchanges (Jones & Hill, Reference Jones and Hill1988). Strategic behavior theories predict that a firm's simultaneous presence in multiple markets generates competition-related advantages, which then enables the firm to coordinate its strategies across these markets through multimarket contact (Edwards, Reference Edwards1955), cross-subsidization (Amit & Livnat, Reference Amit and Livnat1988), and limiting competitors’ access to customers and suppliers (Hart, Tirole, Carlton, & Williamson, Reference Hart, Tirole, Carlton and Williamson1990).

Agency theory provides yet another explanation why firms undertake diversification. Agency theory suggests that top executives engage in diversification to increase their own utility instead of the firm's utility. First, diversification can mitigate idiosyncratic risks that top executives incur (Amihud & Lev, Reference Amihud and Lev1999). Top executives develop firm-specific human capital over time, but hostile takeovers can lead managers to lose such human capital. As diversification can reduce the risk faced by firms and attenuate the threat of hostile takeovers (Hoskisson & Hitt, Reference Hoskisson and Hitt1990; Ji, Mauer, & Zhang, Reference Ji, Mauer and Zhang2020), it increases managerial job security. Second, diversification provides an effective way for firms to grow in size (Penrose, Reference Penrose1959), and managing larger firms is associated with higher power and prestige for top executives (Jensen, Reference Jensen1986). However, when top executives undertake diversification to pursue their own interests at the expense of the firm's interests, firm performance will deteriorate.

While the aforementioned theories assume that diversification decisions are the outcome of top executives’ careful cost–benefit analyses, other streams of research provide a behavioral account. For instance, bandwagon effects occur when firms undertake a strategic action due to social pressures created by other firms taking the same action. These pressures can involve both institutional and competitive elements (McNamara, Haleblian, & Dykes, Reference McNamara, Haleblian and Dykes2008). On the one hand, institutional bandwagon pressures arise when non-adopters perceive social pressures and choose to mimic the action of early adopters to avoid appearing different (DiMaggio & Powell, Reference DiMaggio and Powell1983). On the other hand, competitive bandwagon pressures are created when non-adopters feel pressure from missing out on competitive opportunities that early adopters appear to be seizing. Bandwagon pressures have been shown to influence firms’ strategic decision making, including diversification. Bandwagon pressures can motivate firms to ride rising diversification waves, while forgoing rational assessment of the strategic value diversification may bring (Abrahamson & Rosenkopf, Reference Abrahamson and Rosenkopf1993; Fiol & O'Connor, Reference Fiol and O'Connor2003).

Diversification can be associated with a range of benefits, such as greater market power (Caves, Reference Caves1981; Miller, Reference Miller1973), more efficient allocation of resources through internal capital markets (Wan & Hoskisson, Reference Wan and Hoskisson2003), utilization of excess productive factors (Kock & Guillen, Reference Kock and Guillen2001), more efficient utilization of existing resources in new settings (Chakrabarti, Singh, & Mahmood, Reference Chakrabarti, Singh and Mahmood2007), and reduced performance variability by virtue of a portfolio of imperfectly correlated set of businesses (Ji et al., Reference Ji, Mauer and Zhang2020). However, these benefits can be offset by the costs associated with an increasing scope of operations. Greater diversification increases managerial, structural, and organizational complexity, incurs greater coordination and integration costs, strains top management resources (Grant, Jammine, & Thomas, Reference Grant, Jammine and Thomas1988), limits ‘organizational attention’ (Ocasio, Reference Ocasio1997), and inhibits firms’ ability to respond to major external changes (Donaldson, Reference Donaldson2000). Other inefficiencies and costs arise from conflicting ‘dominant logics’ between businesses, internal capital market conflicts, and increased control and effort losses due to shirking (Markides, Reference Markides1992). In studies conducted in developed economies, empirical research has often concluded that diversification leads to poorer performance and therefore, carries a ‘diversification discount’ (Montgomery & Wernerfelt, Reference Montgomery and Wernerfelt1988). In contrast, in less munificent markets where factors and institutions are lacking, diversification can promote incremental value by creating substitutes for these factors and institutions (Wan & Hoskisson, Reference Wan and Hoskisson2003). Firms enjoy scope and scale advantages from internalizing functions provided by external intermediaries or institutions in advanced economies. A highly diversified firm is also in an advantageous position to exploit privileged access to information, licenses, and markets in developing countries (Chakrabarti et al., Reference Chakrabarti, Singh and Mahmood2007).

While prior research has devoted much attention to understanding the antecedents and consequences of diversification, it generally assumes that diversification is driven by either executives’ motives to pursue their self-interests or firms’ efforts to improve their financial performance. Yet, in some cases, executives may pursue diversification into high-profitability business segments with the goal of boosting the firm's short-term financial performance, a move that we term ‘opportunistic diversification’. As opportunistic diversification can enhance a firm's short-term performance, it is not necessarily an outcome of agency problems. However, opportunistic diversification is not oriented toward enhancing a firm's long-term competitiveness; in this sense, opportunistic diversification can harm the interests of shareholders. Our study draws upon the behavioral theory of firm to explore the antecedents and consequences of opportunistic diversification.

A Behavioral Perspective of Diversification Strategy

For decades, the BTOF has been a key theoretical framework used to explain firm strategic decisions (Bromiley, Reference Bromiley2004; Cyert & March, Reference Cyert and March1963; Gavetti et al., Reference Gavetti, Greve, Levinthal and Ocasio2012; Shi, Connelly, & Li, Reference Shi, Connelly and Li2022). Based on the notion of decision makers’ bounded rationality (March & Simon, Reference March and Simon1958), BTOF emphasizes firms’ strategic decision making predicated on the assessment of current performance. This theory suggests that when a firm's performance falls short of its aspiration level, it will pursue problemistic search to find a solution to address the performance shortfall (Shi, Chen, & Li, Reference Shi, Connelly and Li2022; Greve, Reference Greve1998; Harris & Bromiley, Reference Harris and Bromiley2007; Iyer & Miller, Reference Iyer and Miller2008). The search for solutions is initially local, as decision makers begin by considering incremental or familiar changes. If performance declines are severe or protracted, however, the search becomes more urgent and increasingly novel (Greve, Reference Greve1998). Consequently, a more distant search occurs when performance falls further below aspirations, whereas search efforts diminish as performance improves and returns to the desired aspiration level (Greve, Reference Greve1998). Thus, performance shortfalls (when firm performance is below the aspiration level) can lead to problemistic search activity (Desai, Reference Desai2016).

According to the BTOF, firms compare their current performance with their own prior performance (historical comparison) as well as with social referents (social comparison). These two types of performance shortfalls can have important implications for strategic decisions. A large body of research suggests that performance shortfalls can lead top executives to undertake risky investments in research and development (R&D) and innovation, as both areas are highly influential determinants of firms’ long-term competitiveness and performance (Chen & Miller, Reference Chen and Miller2007; Giachetti & Lampel, Reference Giachetti and Lampel2010; Greve, Reference Greve2003; Tyler & Caner, Reference Tyler and Caner2016; Vissa, Greve, & Chen, Reference Vissa, Greve and Chen2010). Recent studies also indicate that organizations may undertake alliance activities when performance falls short of their aspiration levels (Baum, Rowley, Shipilov, & Chuang, Reference Baum, Rowley, Shipilov and Chuang2005; Schwab & Miner, Reference Schwab and Miner2008; Shipilov, Li, & Greve, Reference Shipilov, Li and Greve2011). In addition, scholars have examined how performance feedback impacts firm mergers and acquisitions (Haleblian, Kim, & Rajagopalan, Reference Haleblian, Kim and Rajagopalan2006; Iyer & Miller, Reference Iyer and Miller2008; Kim, Finkelstein, & Haleblian, Reference Kim, Finkelstein and Haleblian2015), growth (Audia & Greve, Reference Audia and Greve2006; Desai, Reference Desai2008; Greve, Reference Greve2008, Reference Greve2011), diversification (McDonald & Westphal, Reference McDonald and Westphal2003), market position change (Park, Reference Park2007), and internationalization (Jung & Bansal, Reference Jung and Bansal2009).

Most prior literature on performance relative to aspirations has focused on overall performance shortfalls, with external marketplace competitors being cast as the reference group (Audia & Greve, Reference Audia and Greve2006; Chen & Miller, Reference Chen and Miller2007; Greve, Reference Greve1998, Reference Greve2008). However, more recent research has called for a more careful specification of social reference groups (Moliterno, Beck, Beckman, & Meyer, Reference Moliterno, Beck, Beckman and Meyer2014; Washburn & Bromiley, Reference Washburn and Bromiley2012). Research has demonstrated that firms can have different performance targets along the organizational hierarchy (March & Simon, Reference March and Simon1958) and among different business units within the same organization (Gaba & Joseph, Reference Gaba and Joseph2013; Hu, He, Blettner, & Bettis, Reference Hu, He, Blettner and Bettis2017; Vissa et al., Reference Vissa, Greve and Chen2010). Findings from these studies highlight the importance of considering the different social aspiration targets used by organizations. To date, however, research has not considered whether top executives compare the performance of their firm's main business with that of other firms’ high-profitability business segments, and how such comparisons can affect their problemistic search and opportunistic diversification decisions.

Empirical Context: Diversification to Real Estate

The empirical context used to test our theory is the diversification of non-real-estate firmsFootnote 1 into the real estate business in China. Prior to 1990, China possessed little in the way of a real estate market, as people lived in either communes in the countryside or work-unit housing in urban areas (Nunlist, Reference Nunlist2017). In 1978, however, economic reforms slowly gave rise to a sell-off of urban state-controlled housing to residents and signaled the beginning of a bustling property market. Since then, property value has skyrocketed as the Chinese economy continues to expand. For example, a 60-square-meter apartment in Beijing cost about $30,000 in 1995 but could command more than $810,000 in 2017 (Nunlist, Reference Nunlist2017). Driven by fiscal stimuli and massive credit expansion, average housing prices in China tripled from 2005 to 2009 (Dreger & Zhang, Reference Dreger and Zhang2013). Home mortgage loans, which have accounted for one-third of banks’ total lending activities, have played a significant role in propelling the rapid growth of the real estate market (Deng & Liu, Reference Deng and Liu2009).

The value of housing has become a crucial component of Chinese families’ wealth. A survey of 25,000 families across 25 provinces conducted by the Economic Daily newspaper found that real estate accounted for 65.61% of per capita household wealth in 2015 (Nunlist, Reference Nunlist2017). The real estate market is also crucial to the Chinese economy. As previously noted, investment in real estate in China increased to 15% of GDP in 2014 from 4% in 1997 (Chivakul et al., Reference Chivakul, Lam, Liu, Maliszewski and Schipke2015). According to The Economist (2015), China's property market now accounts for almost one-fifth of the country's economy. Moody's Investors Service reports that Chinese real estate companies have reaped high financial returns from the skyrocketing housing prices in most Chinese cities. In 2008, the average profit margin was 28.7% for real estate companies, but only 7.4% for manufacturing companies (Zhi, Li, Jiang, Wei, & Sornette, Reference Zhi, Li, Jiang, Wei and Sornette2019). Thus, the real estate industry was associated with high profitability over the last decade. The high profit margin of the real estate industry has propelled other firms to increase their diversification investments in real estate. Examples abound: China's high-end white liquor producer Kweichow Moutai diversified into real estate in 2011; Haier (the largest consumer electronics and home appliances company in China) ventured into real estate in 2008; Shanshan Group (one of the largest garment designers and makers) invested in real estate in 2011 despite founder Yonggang Zheng's claim it would not; LeTV (a China-based Internet company) made the leap into real estate through acquisitions – even though the firm had been an avid supporter of light-asset strategies and investment in real estate goes directly against such strategies.

Given the high-profitability of the real estate industry, many non-real-estate firms choose to diversify into the industry. The specific reasons why firms choose to increase their level of diversification investment in real estate vary, but the fundamental driver is the rapidly growing housing prices in many Chinese cities and the high profitability linked to the real estate industry. Increased levels of diversification investment in real estate have become an effective way for firms to achieve short-term financial windfalls. Yet, given that investment in the real estate business calls for large capital outlays, such investment involves high risks, particularly during market downturns.

Hypotheses

Performance Shortfalls and Real Estate Investment

BTOF argues that decision makers compare the organization's current performance with the firm's socially comparable peers (Gavetti et al., Reference Gavetti, Greve, Levinthal and Ocasio2012). When firm performance falls below aspiration levels, firms are compelled to engage in problemistic search to find suitable solutions to mitigate the performance gap (Hui, Gong, Cui, & Jiang, Reference Hui, Gong, Cui and Jiang2022). Solutions generated by problemistic search are evaluated for their risk and organizational fit, with decision makers accepting increasingly higher risk as the organization's performance falls even further below its aspirations. Such learning-based performance feedback is inherently about attention allocation, through which top managers dedicate their limited cognitive resources to specific problems and solutions at the expense of filtering out other issues and long-term planning (Ocasio, Rhee, & Milner, Reference Ocasio, Rhee, Milner, Argote and Levine2020).

The real estate business acts as an example of a high-profitability segment given its exponential growth and high returns. Hence, top executives of non-real-estate firms will direct much of their attention to the performance gap between the profit margin of their main business and that of peer firms’ real estate business. When the performance of a firm's main business relative to its peer firms’ real estate business segment is below aspirations, the firm's top managers will direct their attention to search for a solution to boost performance (Desai, Reference Desai2016). Although firms can invest in R&D and pursue acquisitions that can create synergistic value to improve firm performance, such gains may take a long time to materialize. In addition, payoffs from R&D and acquisitions are highly uncertain. In contrast, given its exponential growth and higher overall returns, investment in real estate can provide top executives with a timely and tangible solution to remedy such performance shortfalls. Therefore, increasing their level of diversification investment in real estate is a natural option for top executives given its high profitability and speedy payoffs. Meanwhile, opportunistic diversification in real estate can lead to an immediate performance boost. In contrast, non-opportunistic diversification may not guarantee such immediate performance enhancements given the length of time required to reap financial rewards.

This article considers performance shortfalls relative to social aspiration levels. We focus on two types of diversified peer firms: geographic peers and industry peers that have diversified into real estate business. Social comparison research has previously highlighted the importance of the geographic component of reference groups (Kulik & Ambrose, Reference Kulik and Ambrose1992; Luttmer, Reference Luttmer2005; Persky & Tam, Reference Persky and Tam1990). Firms located in the same province are not only geographically close but also face a similar institutional environment in terms of governmental regulations and economic development. As a result, the performance of other firms in the same geographic region serves as a more relevant referent than the performance of firms in distant geographic regions.

Hence, we focus on geographic peers whose main business is not real estate but have diversified into the real estate business (diversified geographic peers). If the profit margin of a focal firm's main business is much lower than the profit margin of the real estate business of diversified geographic peers, that firm may engage in problemistic search and decide to increase its level of diversification investment in real estate as a way to reduce performance shortfalls. In contrast, when geographic peers that have increased their level of diversification investment in real estate fail to achieve high financial returns from their real estate investment, the focal firm may not have the motivation to invest in real estate.

Hypothesis 1a (H1a): The difference between the profit margin of a non-real-estate firm's main business and the profit margin of the real estate business of its diversified geographic peers is positively associated with the firm's level of investment in the real estate business.

Firms in the same industry compete directly and hence serve as important reference points for one another (Fiegenbaum, Hart, & Schendel, Reference Fiegenbaum, Hart and Schendel1996). Given their competitive relationships, top executives of firms in the same industry pay special attention to each other (Connelly, Li, Shi, & Lee, Reference Connelly, Li, Shi and Lee2020). When top executives observe that competitors have increased their level of diversification investment in real estate (diversified industry peers) and achieved much higher financial returns than their own main business (i.e., high performance shortfall), such a shortfall can lead top executives to pursue problemistic search and increase their firm's own level of diversification investment in real estate. In contrast, when diversified industry peers fail to achieve high financial returns from increased levels of investment in real estate, top executives will be less motivated to invest in real estate.

Hypothesis 1b (H1b): The difference between the profit margin of a non-real-estate firm's main business and the profit margin of the real estate business of its diversified industry peers is positively associated with the firm's level of investment in the real estate business.

Moderating Effect of Firm Similarity and Top Managers’ Pay Deviation

The mechanism underlying Hypotheses 1a and 1b is top executives’ comparison of the performance of their main business with the performance of peer firms’ real estate business, with performance shortfalls identified through this comparison then leading top executives to increase their firm's level of diversification investment in real estate. To verify the underlying theoretical mechanism, we investigate the moderating effects of focal firms’ similarity with peer firms and top executives’ pay deviation from peers, both of which capture focal firms’ intention to compare their own performance with peer firms.

Social comparison theory suggests that humans have an innate drive to evaluate their own status against the status of similar others to assess their position in society (Festinger, Reference Festinger1954; Masters & Keil, Reference Masters, Keil, Masters and Smith1987). Individuals tend to select similar comparison targets because similarity between the comparer and referent reduces the complexity of comparison and gives rise to more precise information about themselves (Adams, Reference Adams1963; Festinger, Reference Festinger1954; Kulik & Ambrose, Reference Kulik and Ambrose1992). Therefore, a firm's intention to compare its own performance with peer firms is contingent on how similar the firm is to peer firms along key firm characteristics (e.g., firm size and firm age). When a firm exhibits a high degree of similarity to diversified geographic and industry peers, the firm will pay greater attention to the performance of these peers; in turn, problemistic search intensity becomes more salient once a performance shortfall is recognized. In such a case, the firm is more likely to initiate search and implement solutions to achieve performance parity relative to peer firms. Given the firm may also have a similar resource profile to peer firms, investment in real estate may be more likely.

In contrast, when firms exhibit sharp heterogeneity from their diversified geographic and industry peers, top executives of the former may find the high performance of those peers’ real estate business less relevant and may lack the awareness and motivation to invest in real estate. Even though the performance shortfall for the firm's main business relative to the peer firms’ real estate business appears to be large, the former may not implement problemistic search to close such a gap. Thus, the comparing firm would not undertake increased levels of investment in the real estate business.

Hypothesis 2a (H2a): The positive relationship proposed in Hypothesis 1a is stronger when the firm has a high level of similarity to diversified geographic peers.

Hypothesis 2b (H2b): The positive relationship proposed in Hypothesis 1b is stronger when the firm has a high level of similarity to diversified industry peers.

Top executives compare themselves to their peers along many dimensions. The relationship between social comparison theory and executive compensation has received much scholarly attention. For instance, compensation committee members tend to use their own compensation levels as a benchmark when making executive compensation decisions (O'Reilly, Main, & Crystal, Reference O'Reilly, Main and Crystal1988). Research also attests to the presence of social comparison and its influence on pay dispersion among executives (Fredrickson, Davis-Blake, & Sanders, Reference Fredrickson, Davis-Blake and Sanders2010; Henderson & Fredrickson, Reference Henderson and Fredrickson2001). In our context, we argue that the influence of performance shortfalls on firms’ investments in real estate will be stronger when top managers are underpaid relative to their peers (negative pay deviation). In essence, top executives’ motivation to reduce performance shortfalls should hinge on their relative compensation levels. Prior research suggests that top executives have a strong motivation to make strategic decisions to elevate their compensation when they find themselves underpaid relative to peer executives (Seo, Gamache, Devers, & Carpenter, Reference Seo, Gamache, Devers and Carpenter2015), given that compensation not only affects one's personal wealth but also reflects one's ability, worth, and social status (Mitchell & Mickel, Reference Mitchell and Mickel1999). Because firm performance is a crucial determinant of executive compensation (Murphy, Reference Murphy, Ashenfelter and Card1999), underpaid top executives will be more strongly incentivized to address performance shortfalls. When top executives become aware that the performance of their main business lags far behind that of their peers’ real estate business, they will engage in intensive search to mitigate performance gaps and subsequently increase their compensation. To accomplish this, top managers will increase the level of the firm's diversification investments in real estate as a means to achieve high profitability. In contrast, when top executives are overpaid relative to peer executives, their incentive to remedy their firm's performance shortfall relative to aspiration levels will be weak. In such a scenario, even if the profit margin of its main business lags behind that of peer firms in the real estate business, top executives may not invest in real estate to enhance overall firm performance.

Hypothesis 3a (H3a): The positive relationship proposed in Hypothesis 1a is stronger when the top executives of the non-real-estate business firm have a high level of negative pay deviation.

Hypothesis 3b (H3b): The positive relationship proposed in Hypothesis 1b is stronger when the top executives of the non-real-estate business firm have a high level of negative pay deviation.

Performance Implications of Real Estate Investment

Our last hypothesis focuses on the influence of real estate investment on firm accounting performance. A plethora of studies have examined the relationship between diversification and accounting performance. Based on a sample of 55 studies, a meta-analysis (Palich et al., Reference Palich, Cardinal and Miller2000) shows a curvilinear relationship between diversification and accounting performance (growth and profitability), with related diversifiers outperforming both focused firms and unrelated diversifiers.

Although increasing diversification investment in real estate can be a response to a performance shortfall and a result of problemistic search, such investment can also be linked to instant high returns and positive short-term financial performance. Every strategic decision has an opportunity cost, and the value of strategic opportunities lost is the opportunity cost associated with the strategy actually chosen (Mackey & Barney, Reference Mackey and Barney2013: 348). When the opportunity cost of increasing diversification investment in real estate is lower than the opportunity cost of making other investments, this choice should improve firm performance (Mackey & Barney, Reference Mackey and Barney2013). As the average profit margin of real estate firms is triple that of manufacturing firms, intensive investment in real estate should enhance the firm's short-term accounting performance. Therefore, we anticipate that non-real-estate firms’ investment in real estate will improve their short-term financial performance.

Hypothesis 4 (H4): The intensity of a non-real-estate firm's real estate investment is positively associated with its short-term financial performance.

Methods

Sample

The Chinese real estate market is an ideal setting to investigate these issues, given that it has yielded enormous profits for firms that have undertaken such investments in real estate. To test our hypotheses, we chose a sample of Chinese publicly traded firms that did not belong to the real estate industry but subsequently invested in real estate. Our sample included all A-share companies listed on mainland China's two stock exchanges (i.e., Shanghai Stock Exchange and Shenzhen Stock Exchange) between 2000 and 2014. Because our focus is on non-real-estate firms’ diversification investments in real estate, we excluded firms that belong to the real estate industry as classified by the China Securities Regulatory Commission (CSRC). We also excluded firms in the financial industry because these firms have different disclosure requirements and accounting rules. Lastly, we excluded those firms classified as ‘miscellaneous’ by the CSRC, as we were unable to pinpoint their core business. Our final sample consisted of 2,200 firms that do not belong to the real estate industry.

We obtained data on firms’ investments in the real estate industry from the WIND database. Firm financial data and data for other variables used in this study were collected from the China Securities Market and Accounting Research (CSMAR) database. These databases have been widely adopted in recent management research using Chinese data (Greve & Zhang, Reference Greve and Zhang2017; Li, Shi, Connelly, Yi, & Qin, Reference Li, Shi, Connelly, Yi and Qin2022; Shi et al., Reference Shi, Connelly and Li2022; Schuler, Shi, Hoskisson, & Chen, Reference Schuler, Shi, Hoskisson and Chen2017).

Measures

Dependent variables

Our first dependent variable is Real estate investment level, which was measured as the ratio of a firm's sales revenue from the real estate segment to its total sales revenue. This variable captures the level of firms’ investment in the real estate business. Approximately 12.8% of our firm-year observations involved some form of investment in real estate. Importantly, we focused on the level of diversification investment in real estate because this continuous variable captures the degree of focal firms’ commitment to rectify performance gaps relative to peer firms’ investments in real estate.

Our second dependent variable is related to firm accounting performance. Research on diversification has used different constructs to measure firm accounting performance (Ahuja & Novelli, Reference Ahuja and Novelli2017). Prior literature has noted that the profit margin of a specific business segment reflects the operating performance of that business and is, in part, the product of firm strategy (Fairfield & Yohn, Reference Fairfield and Yohn2001; Stickney & Brown, Reference Stickney and Brown1999). Consequently, profit margin has been widely adopted to measure operating performance or performance of a specific business in recent management research (Wassmer, Li, & Madhok, Reference Wassmer, Li and Madhok2017; Zatzick, Moliterno, & Fang, Reference Zatzick, Moliterno and Fang2012). We followed previous research and employed Industry-adjusted operating profit margin (OPM) to measure firm accounting performance. Industry-adjusted OPM was calculated as a focal firm's OPM adjusted by the mean level of OPM in its industry, where a firm's OPM was calculated as the ratio of the firm's operating profit to its operating revenue. Subtracting industry OPM from firm operating margin is a widely used method to rule out systematic differences across industries (Harrison, Hall, & Nargundkar, Reference Harrison, Hall and Nargundkar1993; Zhang & Rajagopalan, Reference Zhang and Rajagopalan2003).

Independent variables

We followed prior BTOF studies (Desai, Reference Desai2016; Hui et al., Reference Hui, Gong, Cui and Jiang2022) by calculating the difference between the firm's main business performance and two aspiration levels. The independent variable of Hypothesis 1a is Performance difference from diversified geographic peers, measured as the difference between the profit margin of a non-real-estate firm's main business and the average real-estate-business operating margin of firms in the same province that have increased their level of diversification investment in real estate. The independent variable of Hypothesis 1b is Performance difference from diversified industry peers, measured as the difference between the operating margin of a non-real-estate firm's main business and the average real-estate-business operating margin of firms that have increased their level of diversification investment in real estate in the same industry. We used the CSRC one-digit industry classification system to identify industry peers and the two-digit system to identify peers in the manufacturing industry (Jiang, Jiang, Huang, Kim, & Nofsinger, Reference Jiang, Jiang, Huang, Kim and Nofsinger2017), since manufacturing firms represent the bulk of Chinese listed firms (Sun et al., 2016) and more than 60% of our firms belonged to this industry. The independent variable for Hypotheses 4 is Real estate investment level, measured as the ratio of a firm's sales revenue from the real estate segment to its total sales revenue.

Moderators

The first moderator is firm Similarity to geographic or industry peers with investments in the real estate business. Following existing research (Hoberg & Phillips, Reference Hoberg and Phillips2010, Reference Hoberg and Phillips2016), we used the cosine similarity methodology to measure the extent of firm similarity. We defined a three-dimensional vector for each firm i in each year t, where the three dimensions included firm size (the natural logarithm of total assets), firm growth opportunity (the growth rate of total sales), and firm listing age. We defined the rankings of each dimension among diversified geographic and industry peers for year t as V loc,t and V ind,t. We then created a matrix showing the firm's relative position on each characteristic among its peers, and calculated the average of characteristic vectors among comparison firms to form two compared boilerplates (Hoberg & Phillips, Reference Hoberg and Phillips2016), defined as $\overline V _{{\rm loc}, t}$![]() and $\overline V _{{\rm ind}, t}$

and $\overline V _{{\rm ind}, t}$![]() , respectively. Finally, we obtained the similarity score between each firm and comparison groups (boilerplates) as follows:

, respectively. Finally, we obtained the similarity score between each firm and comparison groups (boilerplates) as follows:

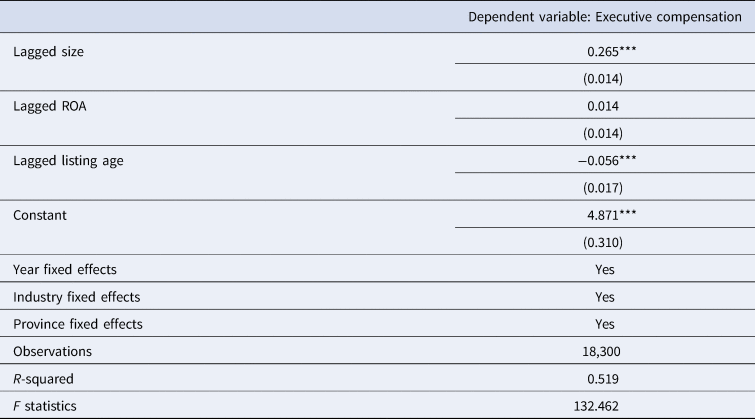

The second moderator regards the level of Top executives’ negative pay deviation from peer executives. To measure this moderator, we first ran an OLS regression to estimate the level of predicted executive compensation. Specifically, we estimate the following OLS regression:

where i indexes firm and t indexes time. Executive compensationi,t is the dependent variable, measured as the total compensation of the three highest-paid top executives (Conyon & He, Reference Conyon and He2011).Footnote 2 We took the natural logarithm of total compensation. X i,t–1 represents a vector of variables used to predict total executive compensation. It includes firm size (the natural logarithm of total assets), firm performance (return on assets [ROA]), firm age, year fixed effects, industry fixed effects, and province fixed effects. The regression results are presented in Table 1. We use the residual from the regression to measure top executives’ pay deviation from the expected value. A higher value of the residual implies a lower level of negative pay deviation from peer executives.

Table 1. Construction of top executives’ negative pay deviation

Notes: Standard errors clustered by firm are in parentheses.

***p < 0.01, **p < 0.05, *p < 0.10. Two-tailed tests. We use a sample period of 1999–2014 to estimate top executives’ negative pay deviation.

Control variables

In modeling the likelihood of a firm's increased level of diversification investment in real estate, we included several control variables. We controlled for Firm size using the natural logarithm of total assets and for firm performance using ROA. In addition, we controlled for Industry growth ratio because firms in fast-growing industries may not need to diversify. Industry growth rate was measured as the current-year industry total sales divided by the previous year's industry total sales minus one. We controlled for free cash flow because firms with a high level of free cash flow have more resources to increase their level of diversification investment in real estate (Jensen, Reference Jensen1986). Specifically, we controlled for Cash holding ratio, measured as the ratio of cash and cash equivalents to total assets. Firms with a strong long-term debt capacity tend to engage in unrelated diversification (Chatterjee & Wernerfelt, Reference Chatterjee and Wernerfelt1988). Therefore, we include Long-term debt ratio (measured as long-term liabilities divided by total assets) as a control variable.

Firms that make intensive investments in fixed assets may have fewer resources available for increasing the level of their diversification investments in real estate. Fixed asset investment was measured as the ratio of total fixed assets invested in a year to total assets. In addition, we controlled for Business diversification because firms with extensive diversification experiences are more inclined to diversify into a new business segment. Business diversification was measured as the sum of squared sales shares for all business segments in the same firm. We controlled for Industry concentration because firms in a competitive industry may diversify into other industries as a means to reduce competitive pressure. We used the Herfindahl–Hirschman index to measure industry concentration.

We also included a number of governance variables that may influence a firm's level of diversification investment in real estate. We controlled for Board independence and CEO duality because these two variables can influence how closely managers are monitored (Dalton, Hitt, Certo, & Dalton, Reference Dalton, Hitt, Certo and Dalton2007), which in turn can affect the firm's level of diversification investments in real estate. Board independence was measured as the ratio of outside directors to board size and CEO duality received a value of ‘1’ if a CEO was also board chair and ‘0’ otherwise. We controlled for Managerial ownership because managers with a high level of ownership may have a stronger motivation to increase their level of diversification investment in real estate to enhance firm performance. Managerial ownership was measured as the ratio of shares owned by top executives to total shares outstanding. We controlled for Ownership concentration because monitoring by shareholders can influence a firm's likelihood of increasing its level of diversification investments in real estate. Ownership concentration was measured as the Herfindahl–Hirschman index of percentages of ownership held by the 10 largest shareholders. We also included State ownership as a control variable because top executives of state-owned enterprises (SOEs) have less discretion in making strategic decisions compared to top executives of privately owned enterprises (Li & Tang, Reference Li and Tang2010). State ownership was measured as the percentage of ownership held by the government. Furthermore, because central and local governments have a substantial influence on both the demand and supply sides of the real estate market, firms with strong political connections tend to venture into real estate. Therefore, firm Political connections received a value of ‘1’ if one of top executives or board members had political connections and ‘0’ otherwise.

Institutional theory (DiMaggio & Powell, Reference DiMaggio and Powell1983) suggests that firms may diversify into the real estate business under mimetic pressure. Therefore, we controlled for Ratio of diversified geographic peers and Ratio of diversified industry peers. Ratio of diversified geographic (industry) peers was measured as the number of firms that had changed their level of diversification investment in real estate in the same province (industry) divided by the total number of listed firms in the province (industry). We also controlled for firm historical performance, given that a firm's own past performance is indicative of how well that firm can and should do in its environment. This variable, Difference from historical performance, was measured as the difference between the current profit margin of a non-real-estate firm's main business and that in year t–1.

In modeling firm accounting performance, we included the following control variables: firm size, industry growth rate, business diversification, fixed asset investment, industry concentration, prior main business profit margin, and prior firm performance. We excluded cash holding ratio and long-term debt ratio from the model because firm performance can influence these two variables. In addition, we controlled for all previous governance variables used to predict real estate investment.

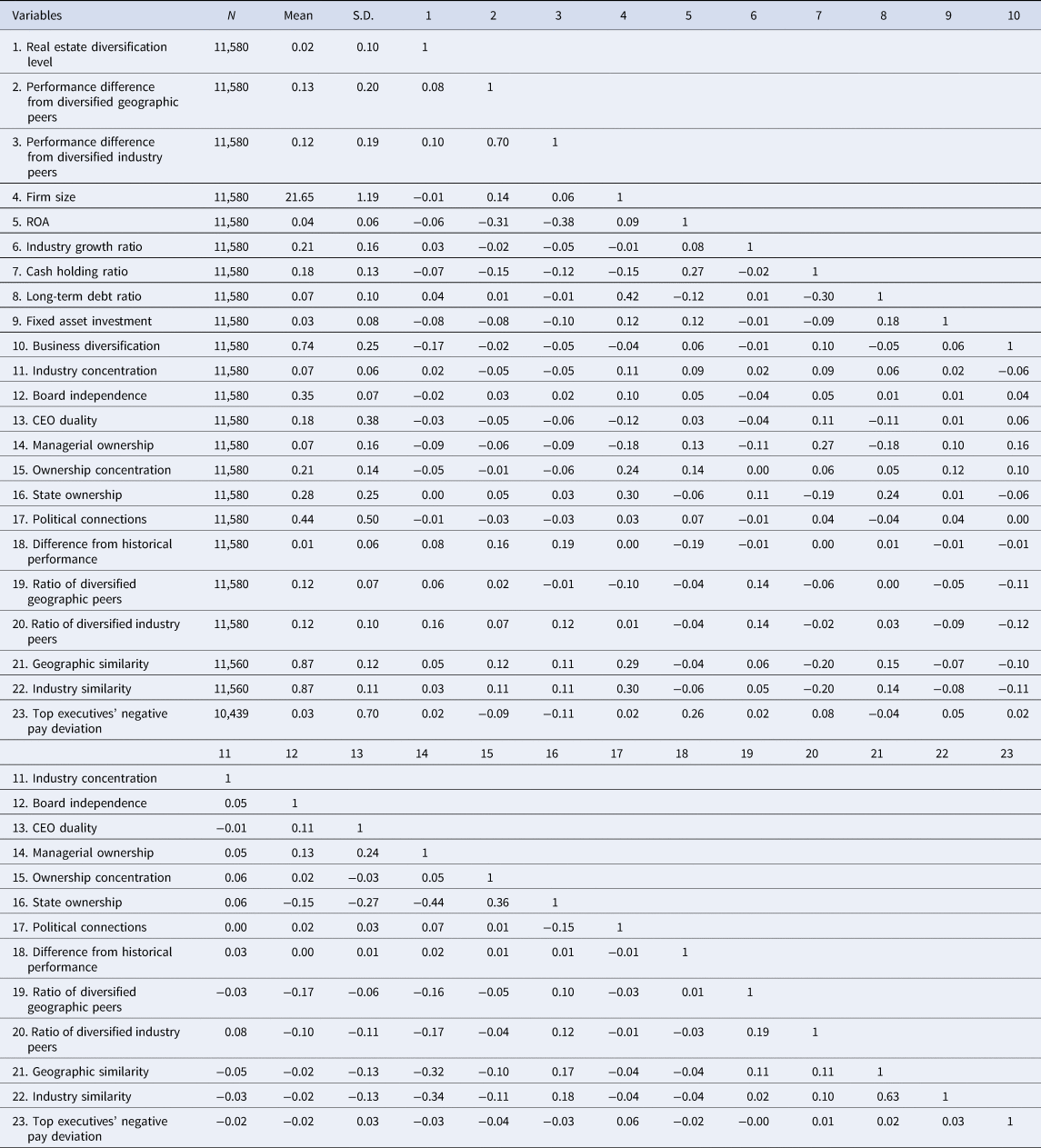

Summary statistics and correlations for all of the main variables in our research are presented in Table 2.

Table 2. Descriptive statistics and correlations

Note: Absolute values of correlations greater than 0.02 significant at p < 0.05.

Analyses and Results

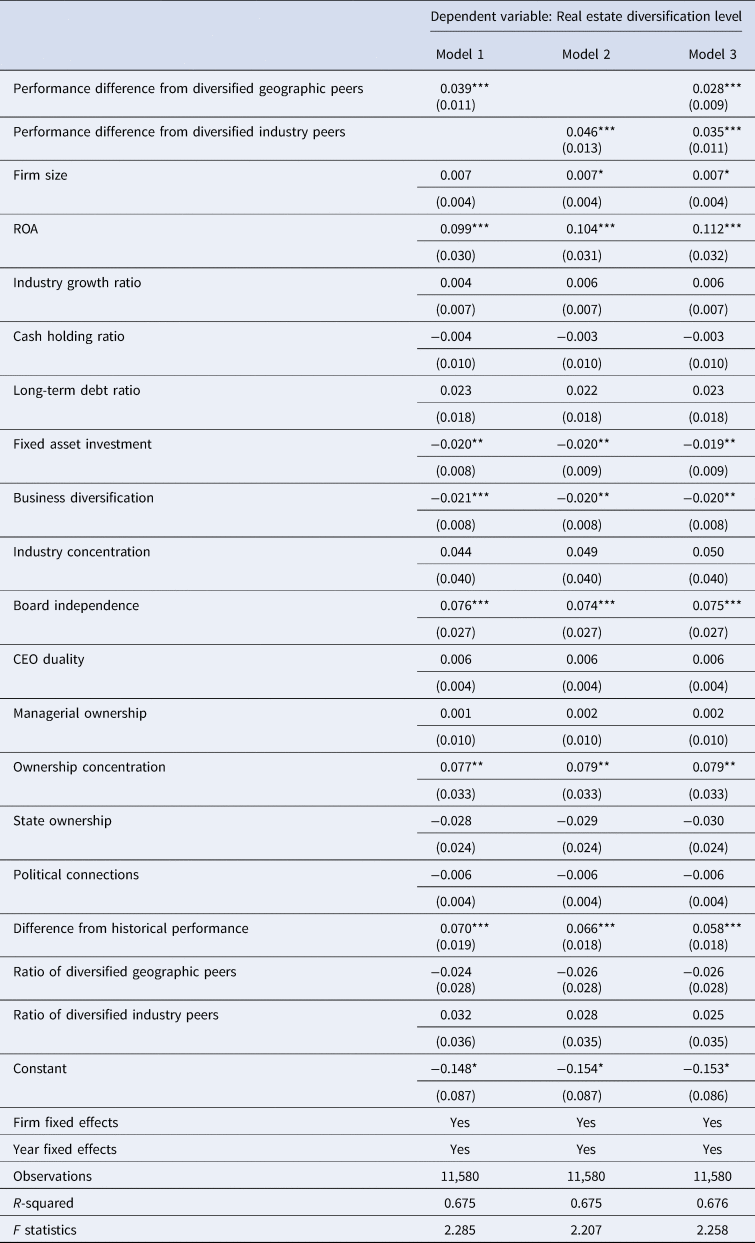

The dependent variable of Hypotheses 1a and 1b is a ratio variable, which is always greater than zero. To mitigate bias from firm-level heterogeneity on the dependent variable, we chose to use firm fixed-effects regressions. Our arguments suggest that a firm's diversification decisions can be driven by performance differences relative to its geographic and industry peers. Therefore, we measured our independent variables and predictors at time t–1 and our dependent variable at time t.

Results from firm fixed-effects OLS regressions are presented in Table 3. Model 1 was used to test Hypothesis 1a. The coefficient estimate of Performance difference from diversified geographic peers was positive (β = 0.039, p < 0.01), which was consistent with Hypothesis 1a. In terms of economic magnitude, when the difference between profit margin of a firm's main business and average profit margin of its diversified geographic peers’ real estate business increased from the mean minus one standard deviation to the mean plus one standard deviation, the firm's real estate investment intensity increased from 64.43% to 135.57% of its mean. We tested Hypothesis 1b in Model 2. The coefficient estimate of Performance difference from diversified industry peers was positive (β = 0.046, p < 0.01), supporting Hypothesis 1b. In terms of economic magnitude, when the difference between the profit margin of a firm's main business and the average profit margin of its diversified industry peers’ real estate business increased from the mean minus one standard deviation to the mean plus one standard deviation, the firm's real-estate investment intensity increased from 64.43% to 139.20% of its mean. In Model 3, we included both independent variables. The coefficient estimates of both predictors were positive and significant, which is consistent with prior results.

Table 3. Determinants of increased diversification investment in real estate

Notes: Standard errors clustered by firm are in parentheses. ***p < 0.01, **p < 0.05, *p < 0.10. Two-tailed tests.

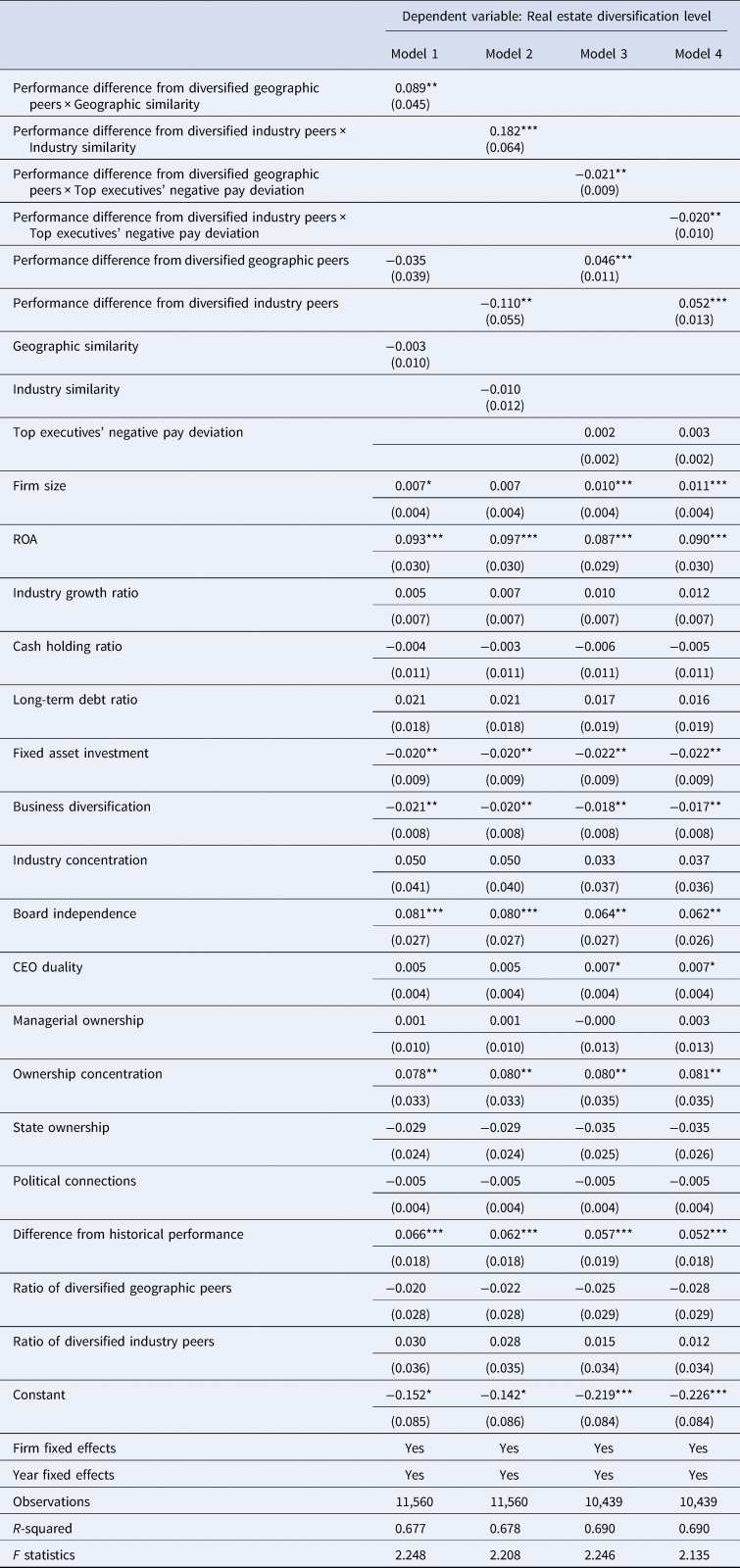

Hypotheses 2a and 2b predict that the relationships posited in Hypotheses 1a and 1b, respectively, will be stronger when the focal firm is more similar to its geographic or industry peers. The results of Hypotheses 2a and 2b tests are reported in Models 1 and 2 in Table 4.

Table 4. Firm fixed-effects OLS regressions used to test moderating hypotheses

Notes: Standard errors clustered by firm are in parentheses. ***p < 0.01, **p < 0.05, *p < 0.10. Two-tailed tests.

As shown in Model 1, the coefficient estimate of the interaction term between Performance difference from diversified geographic peers and Geographic similarity was positive (β = 0.089, p < 0.05), consistent with Hypothesis 2a. In terms of economic magnitude, when Geographic similarity took its mean minus one standard deviation and Performance difference from diversified geographic peers increased from the mean minus one standard deviation to the mean plus one standard deviation, a firm's real estate investment intensity increased from 64.96% to 124.05% of its mean. When Geographic similarity took its mean plus one standard deviation and Performance difference from diversified geographic peers increased from the mean minus one standard deviation to the mean plus one standard deviation, a firm's real-estate investment intensity increased from 54.90% to 151.44% of its mean.

As shown in Model 2, the coefficient estimate of the interaction term between Performance difference from diversified industry peers and Industry similarity was positive (β = 0.182, p < 0.01), which lends support to Hypothesis 2b. In terms of economic magnitude, when Industry similarity took its mean minus one standard deviation and Performance difference from diversified industry peers increased from the mean minus one standard deviation to the mean plus one standard deviation, a firm's real estate investment intensity increased from 67.28% to 115.73% of its mean; when Industry similarity took its mean plus one standard deviation and Performance difference from diversified industry peers increased from the mean minus one standard deviation to the mean plus one standard deviation, a firm's real estate investment intensity increased from 45.40% to 163.90% of its mean.

Hypotheses 3a and 3b postulate that the relationships proposed in Hypotheses 1a and 1b will be stronger when top executives are underpaid. The results of Hypotheses 3a and 3b tests are reported in Models 3 and 4 in Table 3.

Model 3 shows that the coefficient estimate of the interaction between Performance difference from diversified geographic peers and Top executives’ negative pay deviation was negative (β = −0.021, p < 0.05), supporting Hypothesis 3a. When Top executives’ negative pay deviation took its mean minus one standard deviation and Performance difference from diversified geographic peers increased from the mean minus one standard deviation to the mean plus one standard deviation, a firm's real estate investment intensity increased from 46.81% of the mean-level intensity to 156.31% of the mean-level intensity. However, when Top executives’ negative pay deviation took its mean plus one standard deviation and Performance difference from diversified geographic peers increased from the mean minus one standard deviation to the mean plus one standard deviation, a firm's real estate investment intensity increased from 70.61% to 125.67% of its mean.

As shown in Model 4, the coefficient estimate of the interaction term between Performance difference from diversified industry peers and Top executives’ negative pay deviation was negative (β = −0.020, p < 0.05), which lends support to Hypothesis 3b. In terms of economic magnitude, when Top executives’ negative pay deviation took its mean minus one standard deviation and Performance difference from diversified industry peers increased from the mean minus one standard deviation to the mean plus one standard deviation, a firm's real estate investment intensity increased from 44.29% to 151.60% of its mean; when Top executives’ negative pay deviation took its mean plus one standard deviation and Performance difference from diversified industry peers increased from the mean minus one standard deviation to the mean plus one standard deviation, a firm's real estate investment intensity increased from 68.71% to 130.20% of its mean.

Hypothesis 4 suggests that real estate diversification should be positively associated with short-term financial performance. We conducted firm fixed-effects OLS regressions to test this hypothesis. We measured Industry-adjusted OPM at t+1 since time is required for firms that have increased the level of their diversification investment in real estate to become profitable. The independent variable and all of the control variables were measured at t–1. The results of Hypothesis 4 tests are presented in Table 5.

Table 5. Relationship between real estate diversification and firm accounting performance

Notes: Standard errors clustered by firm are in parentheses. ***p < 0.01, **p < 0.05, *p < 0.10. Two-tailed tests.

As shown in Model 1, the coefficient estimate of Real estate diversification level was positive and statistically significant with Industry-adjusted OPM at t+1 as the dependent variable (β = 0.201, p < 0.05), consistent with Hypothesis 4. When a firm's real estate investment intensity increases from zero to the mean plus one standard deviation, its industry-adjusted OPM increased by 64.09%.

When top executives allocate firm resources and redirect their attention to new lines of business, they tend to neglect efforts geared toward developing the firm's main business and core competencies. Hence, despite earning short-term profits from altering the level of investment in real estate business, such diversification tends to be detrimental to the profitability of the firm's main business in the long run. Given that the performance losses from the firm's main business segment will gradually outweigh the short-term performance gains from its investment in real estate, long-run accounting performance will subsequently suffer. In Model 2 and Model 3 with Industry-adjusted OPM at t+2 and Industry-adjusted OPM at t+3 as the dependent variable, respectively, the coefficient estimates of Real estate diversification level were not significant. In Model 4, the dependent variable was Industry-adjusted OPM at t+4, and the coefficient estimate of Real estate diversification level became negative and marginally significant (β = −0.136, p < 0.10). In Model 5, where we employed the mean value of Industry-adjusted OPM at t+3 and t+4 as the dependent variable, the coefficient estimate of Real estate diversification level was still negative and significant (β = −0.157, p < 0.05). These results imply that although an increase in diversification investment in real estate is associated with an improvement in short-term financial performance, it does not promote the firm's financial performance in the long run and may even be harmful to that long-term performance.

Difference-in-Differences Analyses

Although our use of lagged independent variables and firm fixed-effects sought to mitigate bias from time-invariant firm heterogeneity, it is possible that our findings are subject to bias from reverse causality. Put differently, a firm's increased level of diversification investment in real estate could affect its performance, thereby directly influencing the performance gap between that firm and its peers. To mitigate this bias, we implemented a difference-in-differences (DID) approach to capture the effect of performance gaps more clearly after identifying control firms for each treatment firm using propensity score matching (PSM).

To this end, we defined a shock as the focal firm's performance gap with its peers that ranked in the highest 10th percentile. Because some firms experienced a shock in the form of a huge performance shortfall more than once in the study period, we focused on firms that had experienced such a shock for the first time. We then conducted PSM to identify control firms for the treatment group. Specifically, we first ran a logistic regression with all control variables in the main regression as predictors. The dependent variable of the logistic regression received a value of ‘1’ if a firm-year observation involved a performance gap ranking in the top 10th percentile (for the first time) and ‘0’ otherwise. Based on the propensity score calculated from the logistic regression, we were able to identify control firms for the treatment firms. Specifically, a control firm and a treatment firm should have the smallest difference in their propensity scores for a given year. We conducted t-tests to determine whether the treatment firms differed from the control firms along our matching dimensions but did not find any statistically significant difference.

The post-period for treatment firms was coded as ‘1’ for the two years after (including the year of) a firm experienced a shock (i.e., a performance gap) and ‘0’ for the two years prior to the shock. The pre-period and post-period for control firms were the same as those for their corresponding treatment firms. Choosing a five-year window represents a trade-off between relevance and accuracy (He & Tian, Reference He and Tian2013), in that a long window may introduce noise unrelated to the performance shortfall shock, while a narrow window could eliminate some of the possible changes resulting from the event.

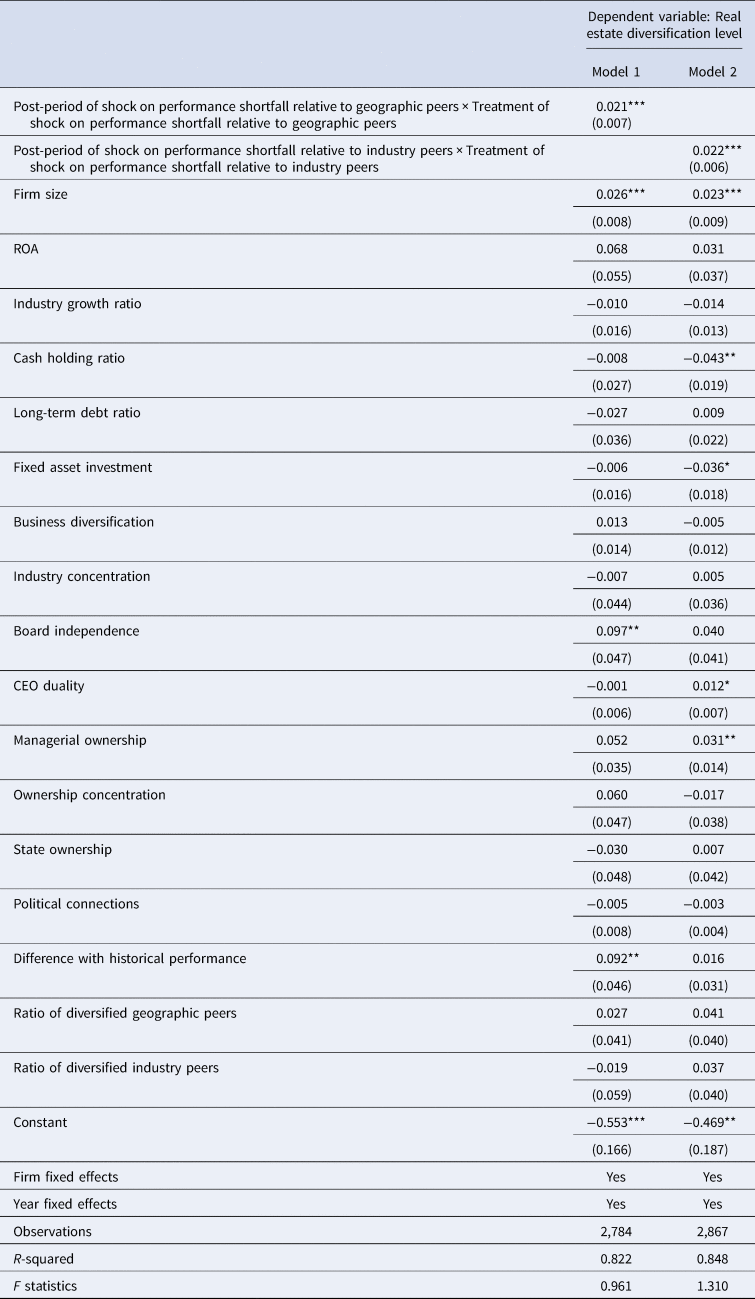

Based on the matched samples, we implemented firm fixed-effects OLS regressions to examine the influence of a performance shortfall shock on the level of diversification investment in real estate (represented by the interaction between the treatment and post-period). Results from DID regressions are reported in Table 6. In Model 1, the coefficient estimate of the interaction term Post-period of shock on performance shortfall relative to geographic peers × Treatment of shock on performance shortfall relative to geographic peers was positive and significant (β = 0.021, p < 0.01), which was consistent with Hypothesis 1a. Model 2 shows that the coefficient estimate of the interaction term Post-period of shock on performance shortfall relative to industry peers × Treatment of shock on performance shortfall relative to industry peers was positive and significant (β = 0.022, p < 0.01), providing support for Hypothesis 1b.

Table 6. Difference-in-differences analyses for Hypotheses 1a and 1b

Notes: Standard errors clustered by firm are in parentheses. ***p < 0.01, **p < 0.05, *p < 0.10. Two-tailed tests.

In examining the effect of increased level of diversification investment on firm performance, it is also possible that firms with undesirable accounting performance could choose to increase their level of diversification investment in real estate. Therefore, we also conducted DID analysis after matching each treatment firm with a similar control firm using the PSM method. Similar to the DID analysis for Hypotheses 1a and 1b, we first identified a group of control non-real-estate firms that did not expand their level of diversification investment during our sample frame. Some firms increased their investment, decreased their investment, and reinvested in real estate during the study period. We focused on those firms that increased their level of diversification investment for the first time. We then conducted PSM to identify control firms for the treatment group. The post-period for treatment firms was coded as ‘1’ for the two years after (including the year of) a firm had expanded its level of diversification investment in real estate and ‘0’ for the two years prior to its diversification expansion. The pre-period and post-period for control firms were the same as those for their corresponding treatment firms. Based on the matched samples, we implemented firm fixed-effects OLS regressions to examine the influence of an increase in the level of diversification investment in real estate on the firm's overall performance (represented by the interaction between treatment of diversification shock and post-period of diversification shock). In untabulated results, we found that when examining the effect of an increase in the level of diversification investment in real estate on industry-adjusted OPM, the coefficient estimate of the interaction term Post-period of diversification shock × Treatment of diversification shock was positive and statistically significant (β = 0.079, p < 0.05), which was consistent with Hypothesis 4.

Supplementary Analyses

Coarsened exact matching

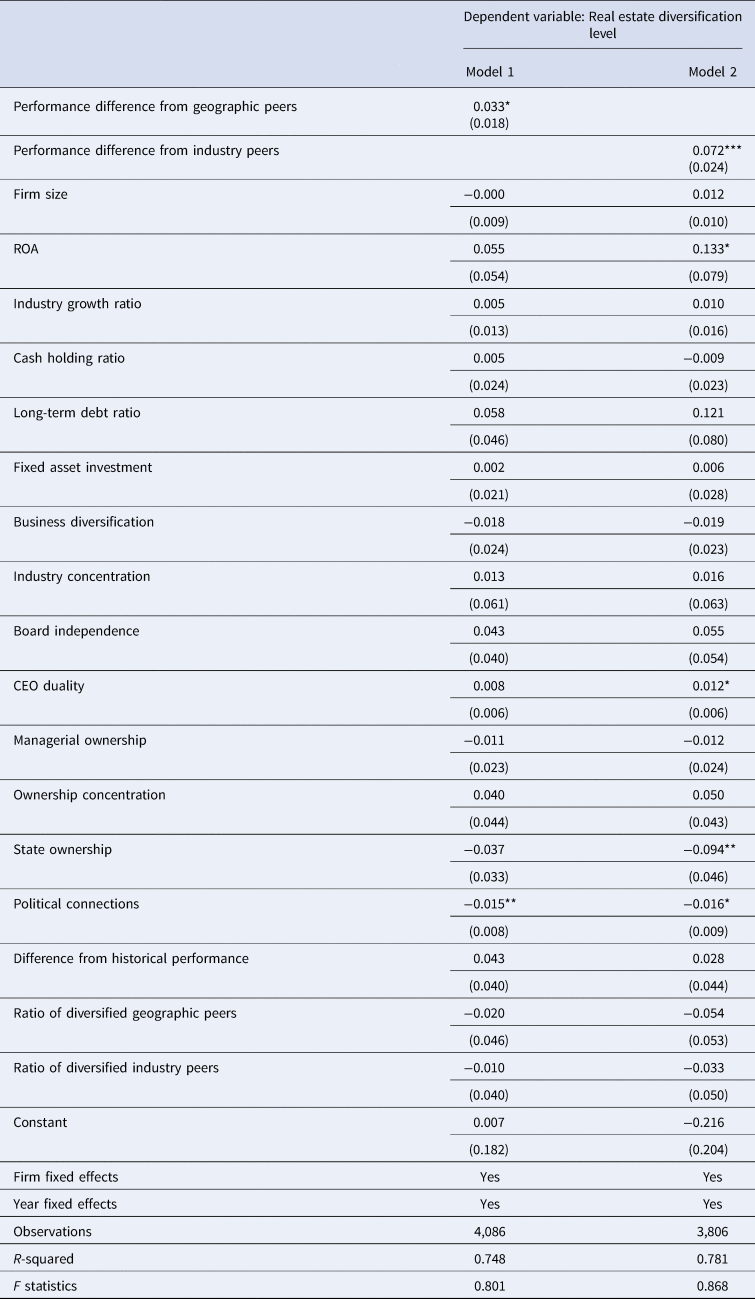

We also note that the choice of expanding the level of diversification in real estate could be driven by systematically different firm characteristics, instead of rectification of performance shortfalls. To mitigate this concern, we performed analyses based on coarsened exact matching (CEM). Specifically, we classified firm-year observations of positive performance shortfalls into the treatment group, while firm-year observations of negative performance shortfalls were control group members. We then conducted CEM to identify control observations for the treatment group. Factors used to implement the match procedure included Firm size, ROA, Long-term debt ratio, Business diversification, Managerial ownership, and Political connections. Incorporating the weights generated from CEM, we then reran our main regressions; the results are reported in Table 7. We found that the coefficient estimates of performance gaps with diversified geographic and industry peers were both positive and significant, implying that our main results were not affected by the incorporation of possible common factors.

Table 7. Coarsened exact matching analyses for Hypotheses 1a and 1b

Notes: Standard errors clustered by firm are in parentheses. ***p < 0.01, **p < 0.05, *p < 0.10. Two-tailed tests.

Survival analyses

Given that a firm's decision to increase the level of its diversification investment in real estate is a variable that was censored at the time of observation, we also used survival analysis to examine firms’ likelihood of making increased investments in real estate. As shown in Table 8, we found that the coefficient estimates of performance gaps were positive and significant. These results indicate that performance difference from diversified geographic/industry peers was positively associated with the hazard rate of a firm's increased level of diversification investment in real estate, which is mostly consistent with our main results.

Table 8. Survival analysis

Notes: Standard errors clustered by firm are in parentheses. ***p < 0.01, **p < 0.05, *p < 0.10. Two-tailed tests.

Leverage ratio

Since increasing the level of diversification investment in real estate requires large capital outlays, firms engaging in this course of action must raise external capital by issuing debt or applying for credit if their retained earnings cannot cover the expense. We, therefore, examined the change in the leverage ratio after firms increased their level of diversification investment in real estate. In untabulated results, we found that the coefficient estimate of Real estate diversification level was positive and significant (β = 0.059, p < 0.05), implying that an increased level of diversification investment in real estate results in higher firm leverage.

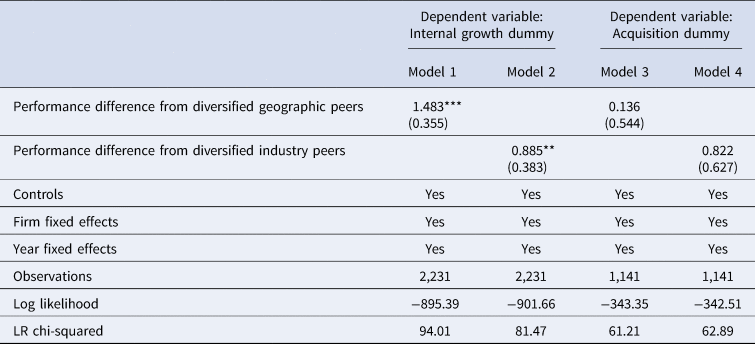

Differentiating diversification modes

To further illustrate a firm's entry into the real estate business, we distinguished between different entry modes and reran our regressions.Footnote 3 We found that entry into the real estate market through acquisitions accounted for 15.52% of all diversification firm-year observations, while internal growth was responsible for 84.48% of the observations. We constructed an Internal growth dummy, which equaled ‘1’ when the firm diversified into the real estate market through internal growth initiatives and ‘0’ otherwise. Similarly, we created the variable Acquisition dummy, which equaled ‘1’ when the firm diversified through acquisitions and ‘0’ otherwise. Table 9 shows the results of these analyses. We can deduce from Models 1 and 2 that the two types of performance gaps demonstrated significantly positive relationships with internal growth diversification. However, in terms of the determination of acquisition diversification in Models 3 and 4, the coefficient estimates of the two independent variables were both positive but not significant.

Table 9. Determinants of different modes of diversification

Notes: Standard errors clustered by firm are in parentheses. ***p < 0.01, **p < 0.05, *p <0.10. Two-tailed tests. Results for control variables are not tabulated to save space.

R&D investment, patent applications, and granted patents

If firms devote more resources to expanding their investment in real estate in an attempt to fix their performance shortfalls, they should have fewer resources available for R&D investment. R&D investment takes a long time to generate payoffs. Given that increased investment in real estate calls for substantial capital outlays, firms increasing their level of investment in this industry will have fewer resources left for other endeavors, including R&D. In other words, increasing the level of diversification investment in real estate can crowd out R&D investment.

To examine this prediction, we measured the dependent variable at time t and the independent variable and all of the control variables at time t–1. We conducted firm fixed-effects OLS regressions to test the relationship between increased level of diversification investment in real estate investment and R&D intensity (measured as the ratio of R&D expenditure to total revenues). In untabulated results, the coefficient estimate of Real estate diversification level was negative (β = −0.006, p < 0.05), which is consistent with our conjecture.

We also examined whether increasing the level of a firm's diversification investment in real estate might harm a firm's R&D output. Specifically, we used the number of patent applications and patents granted to capture firm R&D output (Acs & Audretsch, Reference Acs and Audretsch1989). Since it takes time to transform R&D investments into patents, we measured patent applications and patents granted at time t+2 separately. In untabulated results, we conducted firm fixed-effects OLS regressions to examine the relationship between level of real estate diversification investment and patent applications/patents granted. To address skewness associated with patent applications and patents granted, we used the natural logarithm of each variable in these analyses. With the number of patent applications measured at t+2 as the dependent variable, the coefficient estimate of Real estate diversification level was negative and statistically significant (β = −0.255, p < 0.05). With the number of patents granted as the dependent variable, the coefficient estimate of Real estate diversification level was also negative and statistically significant (β = −0.211, p < 0.10, two-tailed test). We obtained similar results when we measured patent applications and patents granted at t+3.

Discussion

This study seeks to provide a behavioral account of why firms engage in opportunistic diversification. Consistent with our arguments, we found that firms are more likely to increase their level of diversification investment in real estate when there is a large gap between the profit margin of their main business and the average profit margin of the real estate business of their diversified geographic and industry peers. This effect was particularly strong when firms were similar to peer firms and when top executives were underpaid. Moreover, we found that although increasing the level of diversification investment in real estate can improve a firm's accounting performance in the short run, it harms long-term accounting performance. These findings collectively imply that performance shortfalls can give rise to problemistic search and sow the seeds of increased corporate diversification.

This study has a number of theoretical and practical implications. First and foremost, our findings illustrate that performance shortfalls relative to their diversified peers can drive firms to engage in corporate diversification by investing in a high-profitability business segment. Scholars have provided distinct theoretical lenses to explain why firms engage in corporate diversification. Existing research suggests that corporate diversification is driven either by firms’ intentions to achieve high economic returns or by top executives’ motives to obtain private benefits (Ahuja & Novelli, Reference Ahuja and Novelli2017). While previous research has provided a behavioral account by proposing bandwagon pressures as one of the motivations behind firms’ strategic decisions (Abrahamson & Rosenkopf, Reference Abrahamson and Rosenkopf1993), little is known about how and why firms’ diversification strategies respond to social performance shortfalls. We argue that firms increase their level of diversification investment in real estate (i.e., a new business segment) because of top executives’ social comparisons with their diversified peers and problemistic search.

Importantly, we narrowed our theoretical contribution to opportunistic diversification for two reasons. First, top managers in the focal firms are more likely to assess geographic and industry peers’ enhanced diversification investments in real estate and subsequent positive financial returns as an immediate opportunity to remedy their own firm's performance shortfalls. In short, opportunistic firms want their own ‘slice of the pie’ in this high-profitability new business segment. Second, not only does increasing diversification investment in real estate offer opportunistic firms a source of passive income, stable cash flow, tax advantages, and a hedge against inflation, but expanding diversification investment in real estate increasingly offers portfolio diversification – due to its low correlation to other assets – beyond the appealing income and yield opportunities. Thus, opportunistic diversification differs from diversification driven solely by managerial self-motives.

Diversification driven by social comparison also differs from diversification driven by mimetic isomorphism (DiMaggio & Powell, Reference DiMaggio and Powell1983; Haveman, Reference Haveman1993). Bandwagon learning occurs when firms adopt a new strategy that has been prevalent among peer firms, with the goal of attaining or enhancing organizational legitimacy. Yet, in our context, a firm's decision to change its level of diversification investment in real estate can actually harm its legitimacy. Indeed, because skyrocketing housing prices can potentially cause an economic bubble, the Chinese government has taken various measures to prevent opportunistic investment in real estate (Nunlist, Reference Nunlist2017). An editorial in the state-run People's Daily newspaper warned that the real estate market was unable to generate sustainable long-term returns for firms and that investing in the real estate business might adversely affect their core competencies.

Prior research has acknowledged that firms conduct both within- and between-firm social comparisons based on performance, and noted that such comparisons can have differential influences on firms’ investment decisions (Hu et al., Reference Hu, He, Blettner and Bettis2017). Our findings indicate that top executives compare the performance of their main business with the performance of a high-profitability business segment, with this comparison potentially motivating the firm to increase its diversification investments in real estate (i.e., a new business segment), extending what we know about the targets of performance comparison.

Our moderating analyses provide further evidence that performance shortfalls can motivate top executives to expand the level of their firm's diversification investment in real estate. Underpaid executives will have a stronger motivation to engage in problemistic search to improve firm performance compared to overpaid top executives. This implies that problemistic search in the presence of performance shortfalls hinges on top executives’ motivation, enriching our insights into the boundary conditions of problemistic search.

Relatedly, our research explores the effects of diversification driven by social comparison on overall firm performance. Although increasing its level of diversification investment in real estate might improve the firm's accounting performance in the short term, it can adversely affect its long-term accounting performance. Our findings collectively help reconcile inconclusive findings with respect to the influence of diversification on firm performance.

Our findings also extend research on managerial myopia, defined as an overly keen focus on the firm's short-term results (Laverty, Reference Laverty1996, Reference Laverty2004). Whether it stems from flawed management practice (Laverty, Reference Laverty1996) or pressures from investors and financial analysts, managerial myopia encourages top executives to devote their attention and firm's resources to investment projects that can generate immediate financial returns. Our study implies that managerial myopia could interact with social comparison with peers who are associated with high-profitability business segments to stimulate an increase in the level of diversification investment in real estate. While expanded investment in real estate due to such interaction effects might boost the firm's short-term accounting performance, this practice is scorned by investors who prefer firms to have a focused strategy and sustained competitive advantage.

In addition to its theoretical implications, our study has important practical implications. First, our findings indicate that top executives choose to address short-term performance shortfalls at the expense of core competency development. As managers consistently respond to and learn from short-term performance feedback to determine whether the current strategies and practices are effective in the absence of long-term planning (Cyert & March, Reference Cyert and March1963), this calls for top executives to allocate more attention and resources to long-run competitiveness to find ‘best’ solutions instead of ‘satisfactory’ ones. Second, our findings may be of interest to policymakers. Innovation is crucial to a nation's long-term competitiveness, and R&D investments by firms are an indispensable component of innovation. Our supplementary results suggest that elevated levels of diversification investment in real estate divert firm resources away from R&D investment, which could reduce a nation's competitiveness in the long run.