INTRODUCTION

Incumbents usually have great difficulties in adapting to a technology transition, which is defined as ‘a fundamental change in the nature of a product and the core technology that underpins that product’ (Taylor & Helfat, Reference Taylor and Helfat2009: 719). Extant literature has suggested ‘cannibalization effect’ and ‘bias effect’ to be two possible accounts for incumbents’ failure. The ‘cannibalization effect’ suggests that incumbents may invest less in radical technologies compared to new entrants, because their investment in the radical technology will cannibalize their existing products or competence (Handerson & Clark, Reference Henderson and Clark1990). The ‘bias effect’ suggests that some incumbents, such as Plaroid, NCR, and Kodak, failed in the mainstream market because they have chosen a biased technological trajectory or problematic business model based on their old cognitive frames, even though they invested heavily in the new technology (Wu, Wan, & Levinthal, Reference Wu, Wan and Levinthal2014).

In response to these two causes of incumbents’ failure, two solutions have been proposed. The organizational ambidexterity literature proposes to set up a separate organizational unit (O'Reilly & Tushman, Reference O'Reilly and Tushman2008). Scholars agree that the challenge posed by technological transition is essentially the challenge of maintaining a balance between exploitation and exploration (O'Reilly & Tushman, Reference O'Reilly and Tushman2013; Taylor & Helfat, Reference Taylor and Helfat2009). While exploration deviates the original learning trajectory to experiment, try out, and test new opportunities, exploitation refines, consolidates, and strengthens the original learning trajectory (March, Reference March1991). Within a single unit, incumbents are likely to over ‘exploit’ their existing resources and capabilities at the expense of ‘exploring’ new technological trajectories or new business models due to the aforementioned ‘cannibalization effect’ and ‘bias effect’. By contrast, the separation solution allows exploration and exploitation to occur without interfering with each other, and different competencies, systems, incentives, processes, and cultures can be internally aligned (O'Reilly & Tushman, Reference O'Reilly and Tushman2008).

The technology strategy literature proposes to leverage complementary assets as another solution (Roy & Cohen, Reference Roy and Cohen2017; Tripsas, Reference Tripsas1997; Wu et al., Reference Wu, Wan and Levinthal2014). Compared to new entrants, incumbents are likely to have an array of complementary assets that facilitate them to realize or amplify their innovative efforts (Wu et al., Reference Wu, Wan and Levinthal2014). Extant studies provide fascinating insights on the role of complementary assets during technology transition (Roy & Cohen, Reference Roy and Cohen2017; Tripsas, Reference Tripsas1997; Wu et al., Reference Wu, Wan and Levinthal2014). Some scholars focus on their role in buffering incumbents from technology changes, affording them more time to adapt their products and processes (Tripsas, Reference Tripsas1997; Wu et al., Reference Wu, Wan and Levinthal2014). Some scholars focus on their role in affecting choices and investments in alternative technology trajectories (Roy & Cohen, Reference Roy and Cohen2017; Wu et al., Reference Wu, Wan and Levinthal2014).

Despite these fruitful advancements, we notice two areas where there are still opportunities to contribute. The first opportunity is related to a particular type of technology transition. Since technology transitions are closely associated with new product development, most existing studies discuss ambidexterity only in the product domain (Soh & Yu, Reference Soh and Yu2010; Taylor & Helfat, Reference Taylor and Helfat2009). Moreover, studies on complementary assets often assume resources and capabilities in the market domain retain their value during technology transition (Roy & Cohen, Reference Roy and Cohen2017; Tripsas, Reference Tripsas1997; Wu et al., Reference Wu, Wan and Levinthal2014). However, technology transitions sometimes also trigger radical changes in the market domain (Rosenbloom, Reference Rosenbloom2000; Tripsas & Gavatti, Reference Tripsas and Gavetti2000). For example, with the advent of 3G/4G technology and Apple's smartphone products around 2008, incumbents of the mobile phone industry not only faced the challenge of shifting products from functional phones to smartphones, but also faced the challenge of shifting markets from carriers to individual customers. During this particular type of technology transition, the product and market domains represent two core dimensions of incumbents’ exploration and exploitation (Qaiyum & Wang, Reference Qaiyum and Wang2016; Voss & Voss, Reference Voss and Voss2013; Zhang, Wang, Li, & Cui, Reference Zhang, Wang, Li and Cui2017). As a result, new product performance not only requires efforts from the product domain but also requires efforts from the market domain, as well as collaboration between the two domains (Su, Peng, Shen, & Xiao, Reference Su, Peng, Shen and Xiao2013). In this work, we follow Voss and Voss (Reference Voss and Voss2013) and use ‘cross-functional ambidexterity’ to refer to the ability of pursuing exploration and exploitation simultaneously across the product and market domains.

The second opportunity lies in the types and roles of complementary assets during such a particular type of technology transition. In prior studies where technology transitions only trigger radical changes in the product domain, resources such as sales and distribution channels in the market domain are frequently considered as complementary assets (Tripsas, Reference Tripsas1997). However, when the existing marketing-based resources undergo radical changes during technology transition, the types and roles of complementary assets are unclear in the extant studies. In addition, although cross-functional ambidexterity captures the efforts across the product and market domains at the business-unit level and complementary assets offer insights at the organization level, it is unclear how incumbents achieve extraordinary new product performance by combining unit and organizational efforts, especially when a technology transition causes radical changes in both product and market domains.

Accordingly, this work aims to answer the following two research questions with a longitudinal case study on Huawei Mobile, a business unit of a leading Chinese firm in the mobile industry.

1. In the context of technology transitions that cause radical changes in both product and market domains, how do incumbents achieve new product development performance by developing cross-functional ambidexterity?

2. During the development of cross-functional ambidexterity, what roles do different types of complementary assets play?

In the following sections, we first propose an initial research framework based on a review of related studies on technology transition, cross-functional ambidexterity, and complementary assets. Then we follow Gioia's method to present our qualitative data analysis (Gioia, Corley, & Hamilton, Reference Gioia, Corley and Hamilton2013). Next, we describe the case company's evolutionary path of cross-functional ambidexterity in two phases. In the discussion section, we answer our research questions. Finally, we conclude this work with implications and future directions.

THEORETICAL BACKGROUND AND RESEARCH FRAMEWORK

Technology Transitions

Technology transition is defined as ‘a fundamental change in the nature of a product and the core technology that underpins that product’ (Taylor & Helfat, Reference Taylor and Helfat2009: 719). Since it is frequently associated with technology development and product innovation, the majority of previous studies investigate technology transition by focusing solely on the product domain (Danneels, Verona, & Provera, Reference Danneels, Verona and Provera2017; Soh & Yu, Reference Soh and Yu2010; Taylor & Helfat, Reference Taylor and Helfat2009).

However, when the external environment changes rapidly, technology transition also triggers radical changes in the market domain. Companies ignoring these changes or failing to take responsive actions are not able to survive the transition. For example, when the NCR Corporation made its transition from mechanical technology to electronic technology, the hierarchical, ineffective, and slow marketing processes, as well as the established selling habits, created crisis for its adaptation (Rosenbloom, Reference Rosenbloom2000). When the Polaroid Corporation shifted from analog to digital imaging, despite its early substantial investment into the right technology, senior managers’ belief in the ‘razor/blade business model delayed the commercialization of a standalone digital camera product’ (Tripsas & Gavatti, Reference Tripsas and Gavetti2000: 1149). Similarly, when the world's leading manufacturer of typewriters, Smith Corona, shifted from mechanical technology to electronic technology, managers’ schemas about their brand and their customer understandings led the company down unfruitful paths (Danneels, Reference Danneels2011).

This work focuses on a particular type of technology transition that triggers radical changes in both the product and market domains and aims to answer how incumbents survive this type of technology transition. Based on an in-depth literature review on incumbents’ technology transition, we find both the ambidexterity literature and the literature on complementary assets provide valuable insights. Therefore, we elaborate on each of them in the following.

Cross-Functional Ambidexterity

The ambidexterity perspective has been suggested as a useful lens to study technology transition because it sheds light on how firms explore new opportunities while exploiting their existing resources (Birkinshaw, Zimmermann, & Raisch, Reference Birkinshaw, Zimmermann and Raisch2016; Hansen, Wicki, & Schaltegger, Reference Hansen, Wicki and Schaltegger2018; Taylor & Helfat, Reference Taylor and Helfat2009; Wu et al., Reference Wu, Wan and Levinthal2014).

When a technology transition triggers radical changes only in the product domain, setting up a separate organizational unit for exploration in the product domain is recommended as a solution (O'Reilly & Tushman, Reference O'Reilly and Tushman2013; Taylor & Helfat, Reference Taylor and Helfat2009). Ambidexterity scholars argue that ‘the mindsets and organizational routines needed for exploration are radically different from those needed for exploitation’ (Gupta, Reference Gupta, Smith and Shalley2006: 695). Following this logic, unit separation creates a favorable environment for exploring a new business, allowing distinct leadership, structure, incentives, systems, and culture to be internally aligned within the separated unit (O'Reilly & Tushman, Reference O'Reilly and Tushman2008). This approach is typically characterized as structural ambidexterity. Subsequent studies point out that the difficulty of building structural ambidexterity lies in the integration mechanisms that link the spatially dispersed separated units (Jansen, Tempelaar, Van Den Bosch, & Volberda, Reference Jansen, Tempelaar, Van Den Bosch and Volberda2009; O'Reilly & Tushman, Reference O'Reilly and Tushman2013). Representative integration mechanisms include ‘a common strategic intent, an overarching set of values, and targeted linking mechanism to leverage shared assets’ (O'Reilly & Tushman, Reference O'Reilly and Tushman2013).

When a technology transition triggers radical changes in both the product and market domains, it is inadequate to separate an organizational unit for exploration activities in the product domain. The product and market domains need to be considered as important dimensions of exploration and exploitation activities in the separated unit. And this is where cross-functional ambidexterity becomes a particularly useful approach to address the technology transition challenge (Voss & Voss, Reference Voss and Voss2013; Zhang et al., Reference Zhang, Wang, Li and Cui2017; Zimmermann, Raisch, & Cardinal, Reference Zimmermann, Raisch and Cardinal2018).

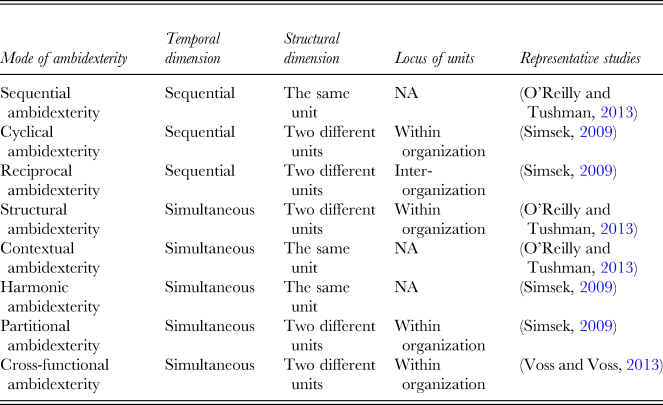

Extant literature has suggested various modes of ambidexterity based on whether ambidexterity is pursued sequentially or simultaneously (the temporal dimension), within or across units (the structural dimension), and whether units are located within or beyond the organizational boundary (the organizational dimension) (Birkinshaw, Reference Birkinshaw, Zimmermann and Raisch2016; Simsek, Heavey, Veiga, & Souder, Reference Simsek, Heavey, Veiga and Souder2009). Table 1 provides an overview of the concepts and representative studies. In this work, we focus on cross-functional ambidexterity that is pursued simultaneously, across the product and market domains, and within the organizational boundary (Voss & Voss, Reference Voss and Voss2013; Zhang et al., Reference Zhang, Wang, Li and Cui2017). The product domain involves activities in technology development and product design, while the market domain involves activities in distributing channels and branding strategies (Atuahene-Gima & Evangelista, Reference Atuahene-Gima and Evangelista2000). Cross-functional ambidexterity takes two forms. One is product exploration combined with market exploitation, the other is product exploitation combined with market exploration; each is termed as product development strategy and market development strategy in Voss and Voss (Reference Voss and Voss2013).

Table 1. Different types of ambidexterity

Similar to structural ambidexterity, cross-functional ambidexterity reduces the conflicts arising from competing cultures, incentives, and competencies of exploration and exploitation by leveraging functional boundary as a separation (Voss & Voss, Reference Voss and Voss2013). Meanwhile, differences in perception and self-interests across the product and market domains cause functional conflicts (Atuahene-Gima & Evangelista, Reference Atuahene-Gima and Evangelista2000). As a result, the difficulty of building cross-functional ambidexterity lies in the integration mechanisms between the spatially separated functional domains.

Extant studies have shown a positive relationship between cross-functional ambidexterity and firm performance and have provided insights on the integration mechanisms in developing cross-functional ambidexterity (Voss & Voss, 2013; Zhang et al., Reference Zhang, Wang, Li and Cui2017). For example, Voss and Voss (Reference Voss and Voss2013) stress cross-functional or unit-level synergies between the product and market domains based on the learning theory. In a strategic combination of product exploration and market exploitation, stable market resources provide explicit and quick feedback loops for product exploration, thus simplifying the learning process in the product domain. Similarly, in a strategic combination of product exploitation and market exploration, extending product capabilities simplify and direct the market exploration search and selection routines. Atuahene-Gima and Evangelista (2000) stress organizational-level synergies based on the resource dependency and information processing theory. They argue that the market and product functions act on shared meanings to reduce technology and market uncertainty. Studies on cross-functional integration also indicate that organizational vision, structure, culture, and people development arrangements are conducive to managing functional conflicts (Birkinshaw et al., Reference Birkinshaw, Zimmermann and Raisch2016; Troy, Hirunyawipada, & Paswan, Reference Troy, Hirunyawipada and Paswan2008).

However, few studies examine the development of cross-functional ambidexterity by combining unit-level and organizational-level synergies. Moreover, it is not clear how cross-functional ambidexterity is dynamically constructed over time.

Complementary Assets

Previous literature has provided a wide variety of definitions and typologies towards complementary assets (Colombo, Reference Colombo, Dawid, Piva and Vivarelli2017; Hopkins & Nightingale, Reference Hopkins and Nightingale2006; Soh & Yu, Reference Soh and Yu2010; Teece, Reference Teece1986; Tripsas, Reference Tripsas1997). These studies indicate two features of complementary assets. First, complementary assets can be associated with specific organizational resources (such as human resources, financial resources) or different elements of organization context (such as organizational structure, culture, vision) (Birkinshaw et al., Reference Birkinshaw, Zimmermann and Raisch2016; Riley, Reference Riley, Michael and Mahoney2017; Taylor & Helfat, Reference Taylor and Helfat2009). Taylor and Helfat (Reference Taylor and Helfat2009: 720) defined complementary assets to encompass ‘not only physical and intangible assets, but also organizational capabilities to perform complementary activities to a core technology’. Often, complementary assets are mature and established, so that they can be quickly deployed and appropriated by incumbents when facing technology transitions (Soh & Yu, Reference Soh and Yu2010; Teece, Reference Teece1986; Tripsas, Reference Tripsas1997). Second, the exact type of complementary assets depends on the core subject which the author(s) are intended to work on. For example, in the technology transition context where activities in the product domain are considered core activities, complementary assets are referred to as ‘marketing, competitive manufacturing, after-sales support, and complementary technologies’ (Tripsas, Reference Tripsas1997: 288). When a firm's human capital management investments and policies are considered core activities, complementary assets may include R&D, physical capital, and advertising investment (Riley, Michael, & Mahoney, Reference Riley, Michael and Mahoney2017).

In our work, we define complementary assets as organizational-level resources and capabilities that serve to support core activities in the product and market domains. It's worth noting that previous studies on technology transition mainly focus on the radical changes occurring in the product domain but ignore those occurring in the market domain, thus market channels and brands are frequently considered as complementary assets for the transition (Taylor & Helfat, Reference Taylor and Helfat2009; Tripsas, Reference Tripsas1997). In contrast, this study focuses on a type of technology transition that causes radical changes in both the product and market domains. As a result, activities concerning market channels and brands are considered core activities rather than complementary assets.

In terms of the role played by complementary assets during technology transition, the extant literature has provided rich insights (Roy & Cohen, Reference Roy and Cohen2017; Taylor & Helfat, Reference Taylor and Helfat2009; Tripsas, Reference Tripsas1997; Wu et al., Reference Wu, Wan and Levinthal2014). For example, Teece (Reference Teece1986) stresses their roles in appropriating the return to innovative efforts, Tripsas (Reference Tripsas1997) stresses their roles in buffering incumbents and affording them more time to adapt their products and processes, and Roy and Chen (Reference Roy and Cohen2017) find downstream complementary assets act as catalysts for product innovation by providing credible information about market conditions and competitor's strategies. Wu and colleagues (2014: 1257) summarize that ‘complementary assets play a dual role in incumbents’ investment behavior toward radical technological change: they are not only resources (pipes) that can buffer firms from technology change, but also prisms through which firms view those changes, influencing both the magnitude of resources that should be invested and the trajectory to which these resources should be directed’.

Extant studies frequently consider the resources and capabilities in the market domain as complementary assets. However, when the market domain resources lose their value during the technology transition, the types and roles of complementary assets remain to be uncovered.

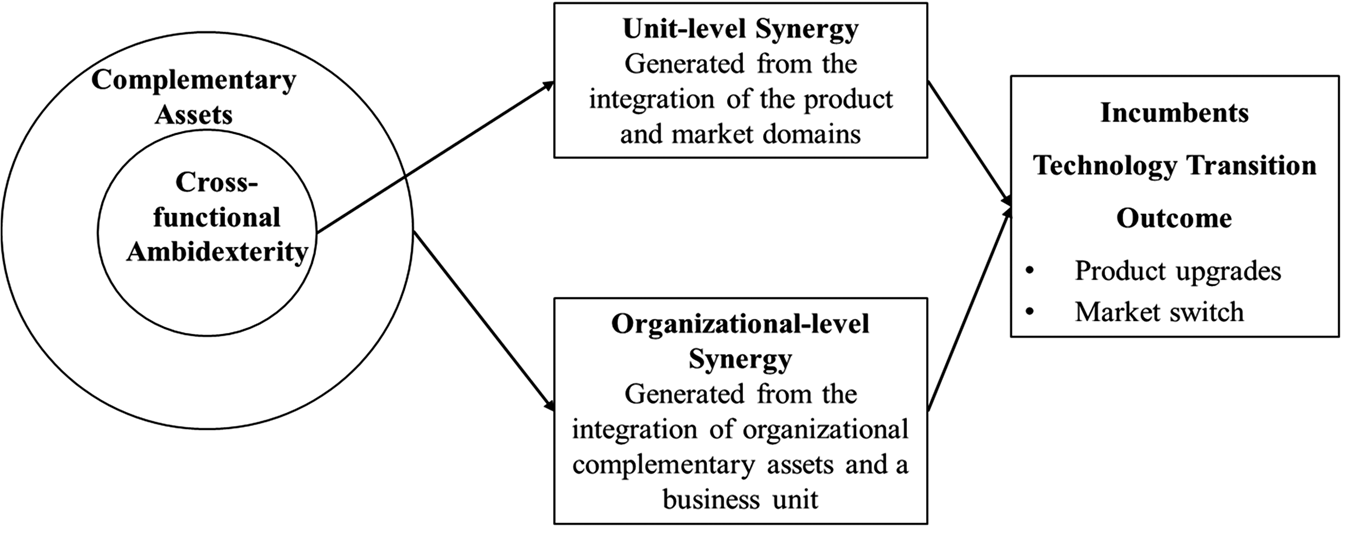

Based on a brief review on technology transition, cross-functional ambidexterity, and complementary assets, this work proposes a preliminary research framework in Figure 1, where unit-level synergy generated by cross-functional ambidexterity, and organization-level synergy facilitated by complementary assets together lead to incumbents’ technology transition outcomes.

Figure 1. Preliminary theoretical framework

METHODS

Because we are interested in uncovering the evolutionary path of cross-functional ambidexterity and in understanding the role played by complementary assets during this process, we consider a longitudinal case study design to be the most suitable in this context (Tsang, Reference Tsang2014).

Around 2007, the introduction of smartphones in the mass market and other related technological changes transformed the competitive landscape of the global cellphone market. While incumbents such as Nokia and Motorola gradually withdrew from the market, new entrants such as Samsung and Apple became the pioneers of the new era. Surprisingly, Huawei Mobile, an incumbent at that time, was able to seize the opportunity and transform its products from low-end cellphones to high-end smartphones in a few years, thus creating a profitable business. This type of transformation is rare and adds value to the extant literature.

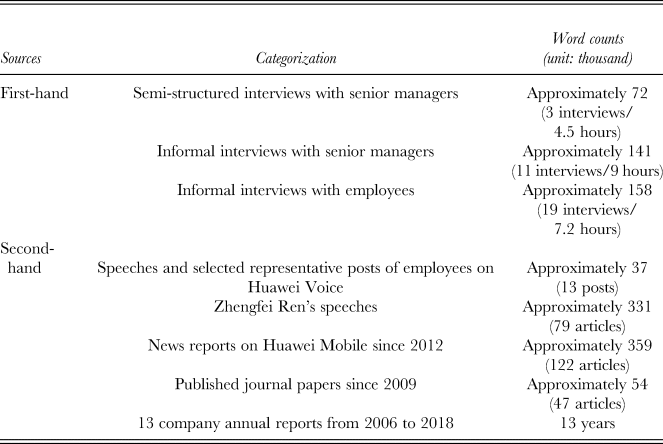

We collected qualitative data primarily through semi-structured interviews with senior managers of Huawei Mobile from December 2015 to July 2019. We used convenience sampling to identify the interviewees. One of the authors of this manuscript has been teaching executive MBA for a long time and has maintained good relationships with a number of Huawei's middle and senior managers. We contacted managers and employees who were personally involved in the transformation of Huawei Mobile through our network of acquaintances. After several initial interviews, the list of interviewees expanded by snow-ball recommendation. Finally, we selected the personnel for interview who are both familiar with the situation at some point and available to connect. The selected interviewees were key decision-makers and informants during the company's strategic transformation. We contacted them via cell phones, emails, or by arranging face-to-face meetings to collect information related to our case. On the whole, the interviews with the company's employees involved 19 people and lasted 20.7 hours in total. The interviewees included employees working in the Huawei 2012 Lab R&D department, the Huawei supply chain, the Huawei government affairs department, the Huawei Beijing Research Institute research and development, the Huawei data platform, and so on. More detailed information about the interviewees can be found in Table 2.

Table 2. An overview of data sources and character counts

All three authors participated in these interviews. One author asked the main questions in the interview protocol and the other two authors complemented her questions with follow-up questions. All of the interviews were recorded and professionally transcribed. We complemented the interview data with other qualitative data, including internal speeches of members of the top management team (TMT), related posts on Huawei Voice (the company's internal online forum for employee discussion), and other published studies on Huawei and Huawei Mobile. To ensure the validity and reliability of our qualitative data, we followed the rule of researcher and data triangulation (Yin, Reference Yin2002). Appendix I (supplementary material) provides an overview of the different data sources, the character counts, and the corresponding coding symbols.

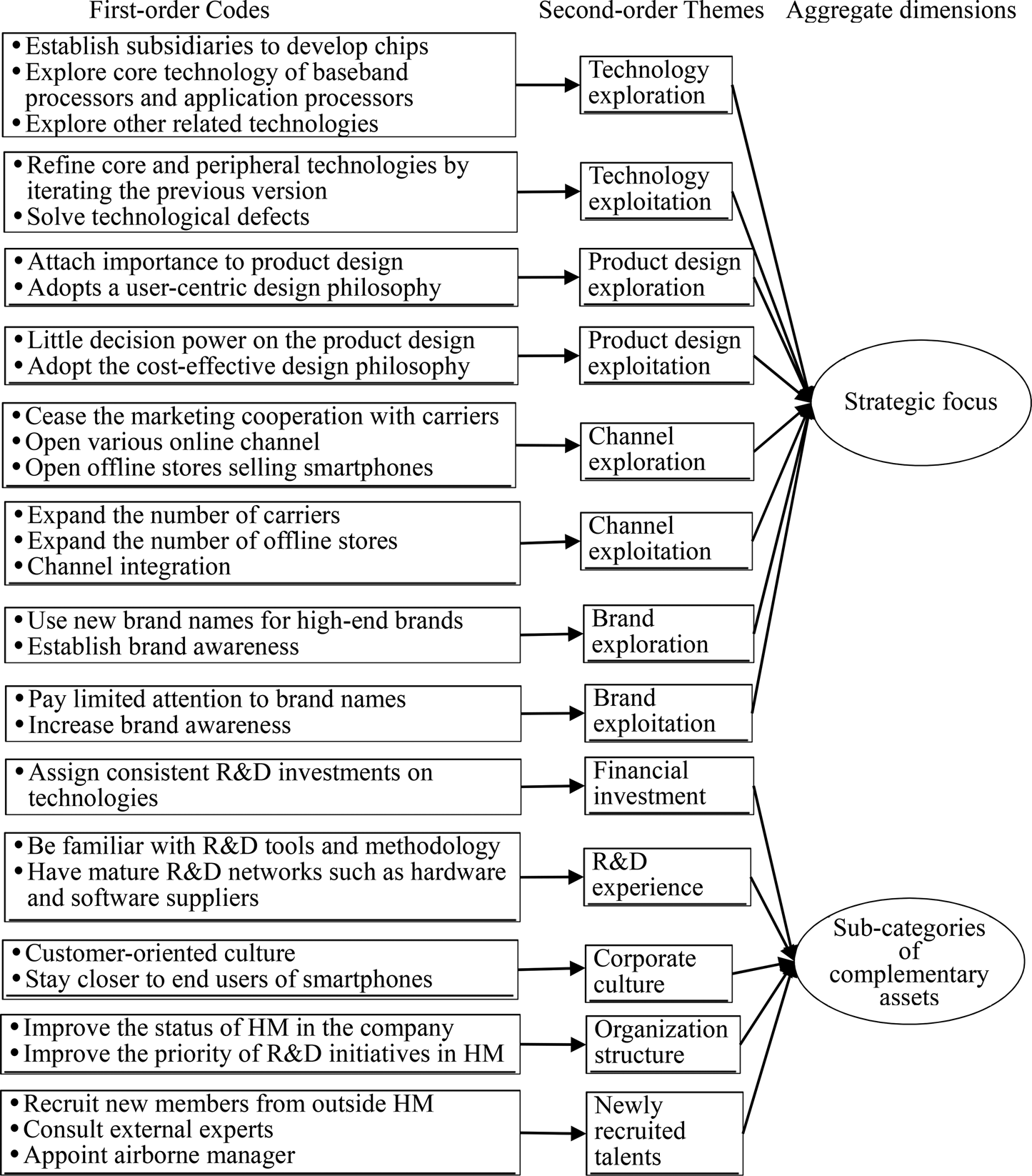

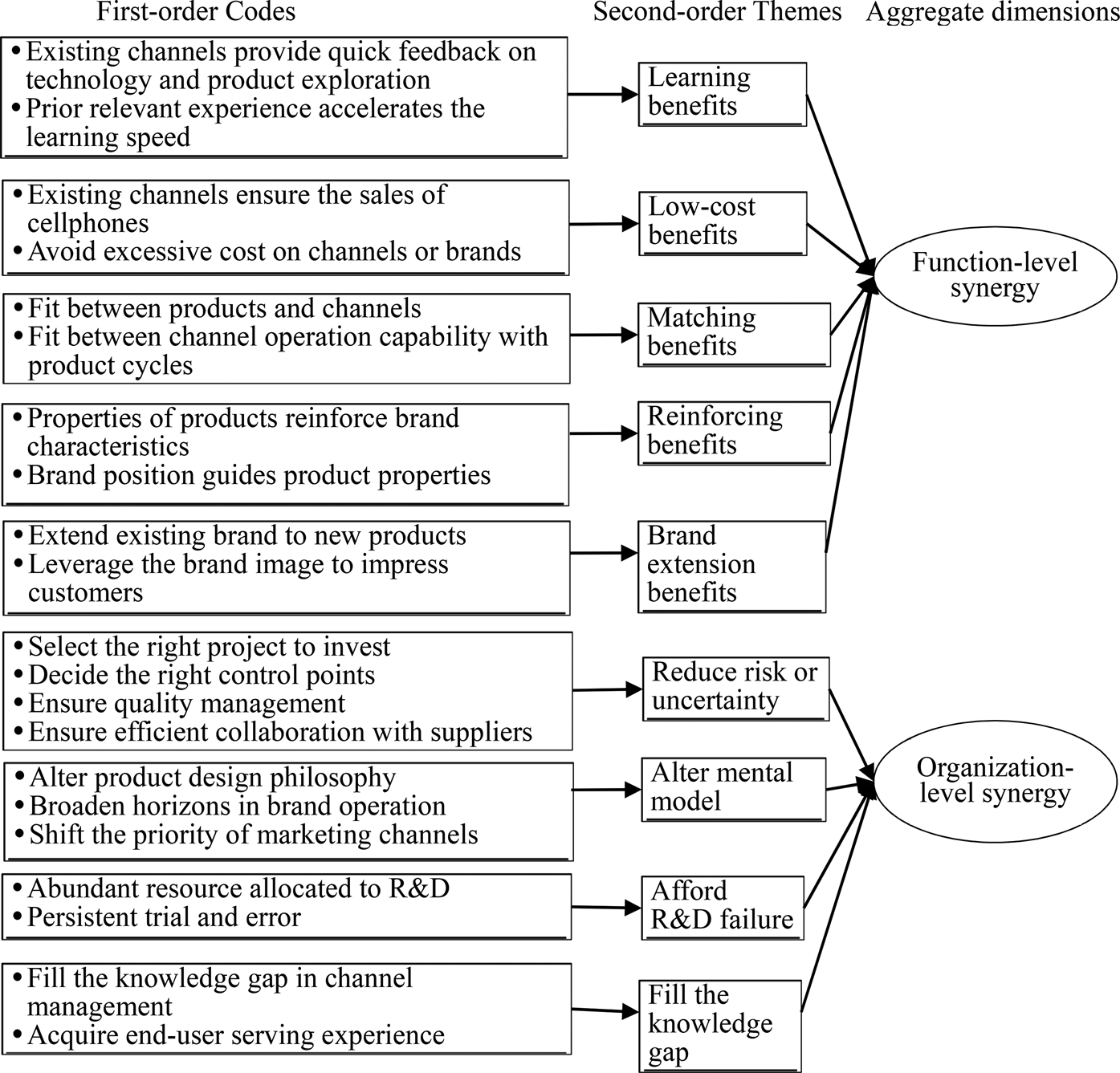

We followed the steps and suggestions of the Gioia method to carry out the data analysis (Gioia et al., Reference Gioia, Corley and Hamilton2013). Having gained access to the case, we started to identify how the informants understand the transformation of Huawei Mobile through first-order analysis. Each of the three researchers spent sufficient time coding all the collected case materials. The coding was double-checked by all three authors and all the disputes were resolved through discussion until reconciled. Thus, we derived a set of first-order concepts that represented informants’ views of how and why Huawei Mobile survived radical technological change. Then the authors related the first-order concepts to relevant theories to find theoretical interpretations for the derived first-order concepts. We put forth much effort to identify theoretical similarities and differences between the concepts to group and congregate similar first-order concepts into second-order themes. As the second-order themes emerged, we began to distil them further into aggregate dimensions. We communicated with the interviewees about the main findings and conclusions of the study and received positive feedback from some of them. For example, we communicated with three senior managers separately via email, WeChat, and face-to-face communication about the transformation path we sorted out and received positive feedback. We also communicated with two middle managers face-to-face on the theoretical model and key literature concepts, and also received positive feedback (Plakoyiannaki, Wei, & Prashantham, Reference Plakoyiannaki, Wei and Prashantham2019). The data structure presented in Figure 2 summarizes the first-order concepts, second-order themes, and aggregate dimensions we derived from the above steps. We found cross-functional ambidexterity and complementary assets to be useful concepts for explaining the drivers of the transformation of Huawei Mobile.

Figure 2a. Data structure for strategic focus and sub-categories of complementary assets

Figure 2b. Data structure for function-level and organization-level synergy

Once the initial theoretical framework, consisting of cross-functional ambidexterity and complementary assets, was established, we entered the augmenting cycle by validating the proposed theoretical framework with additional data. The causal relationships between key concepts were supported by follow-up interviews with middle managers and employees. In addition, we found that the case company leveraged different types of complementary assets during different evolutionary stages. After several rounds of coding, reflection, and explanation, the proposed theoretical model and the qualitative data reached saturation, where additional data would make little difference to the model. Our conclusions are based on repeated coding, comparison, abstraction, and theorization of first-hand and second-hand data.

CASE DESCRIPTION

Company Background

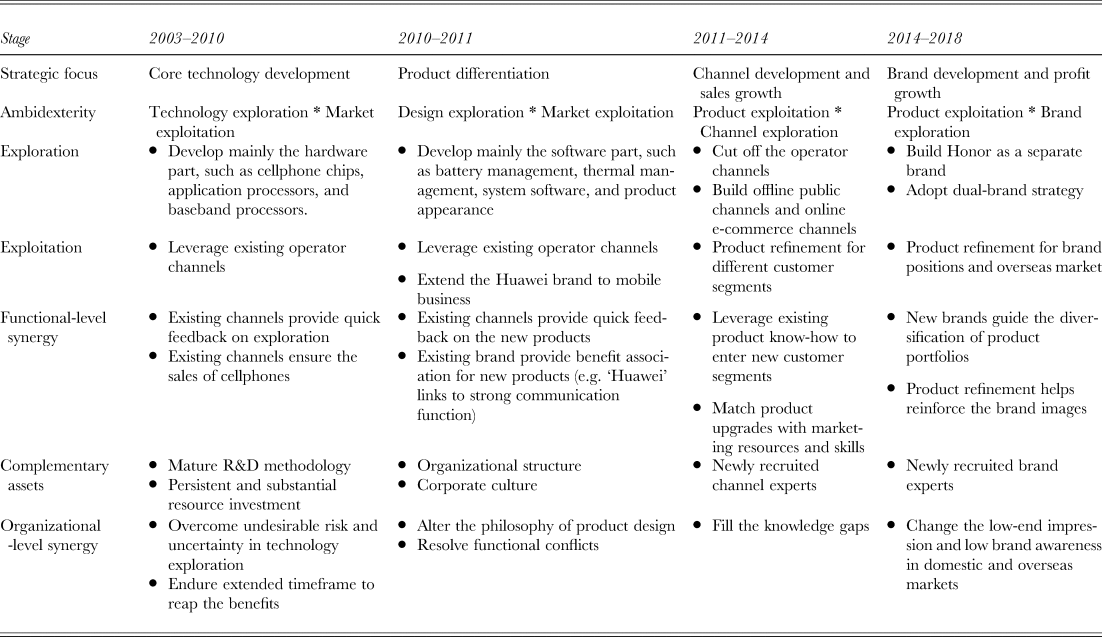

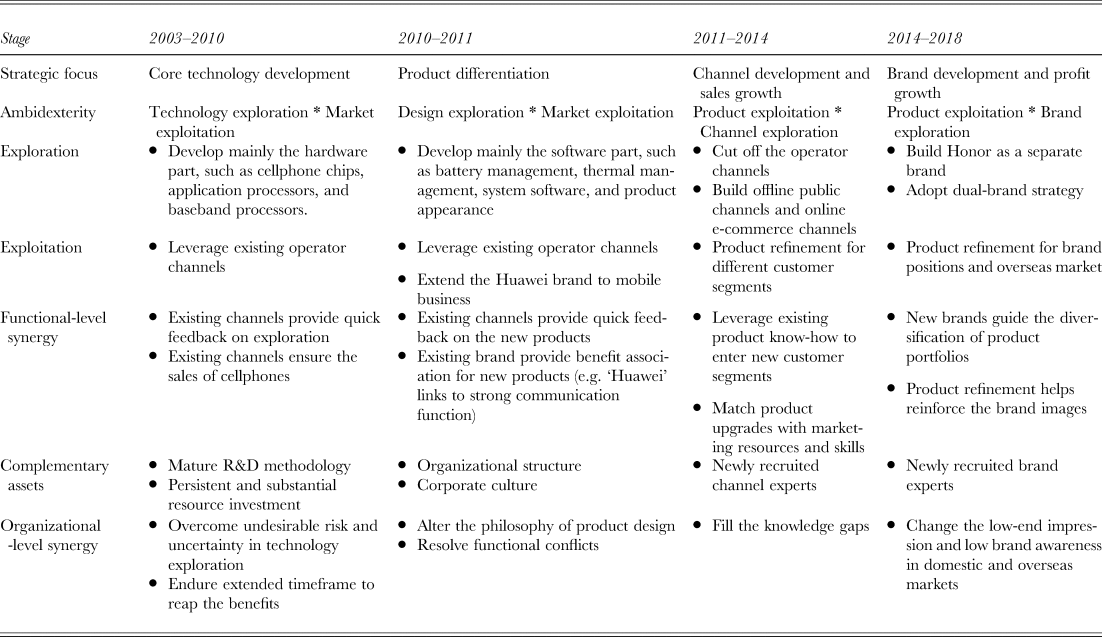

Headquartered in Shenzhen, China, Huawei is the world's largest information and communications technology (ICT) solutions provider. With approximately 194,000 employees, Huawei serves one-third of the world's population and covers more than 170 countries and regions (Huawei Annual Report, 2019). Its consumer Business Group, Huawei Mobile, experienced radical change during the transformation of the global mobile phone industry starting in 2007. When the core technology shifted from 2G to 3G/4G technology, the case company was faced with the challenge of transforming its product from feature phones to smartphones and transforming the market from corporate customers such as carriers to individual consumers. Based on its strategic intentions and business-critical activities (see Appendix II in the supplementary material), we divide the evolutionary process of Huawei Mobile into two distinct phases, each with two distinct stages. A comment from Chengdong Yu, CEO of Huawei Mobile, supports our idea: ‘the first goal is to roll out the product; the subsequent goals are working out market channels and brands, which needs the longest time, as impacting the consumer and changing people's thinking are extremely difficult’ (FSM2). The strategic focus, configurations of cross-functional ambidexterity, complementary assets, function-level and organization-level synergy across the four stages in Huawei Mobile are summarized in Table 3. The organizational structure of Huawei in 2009 and 2014 supports that the R&D and marketing departments serve as the core activities, while other organizational activities serve as supporting activities, which provide empirical support for the theoretical model of this work (Huawei Annual Report, 2009; Huawei Annual Report, 2014).

Table 3. An overview of the technological transition processes of HM

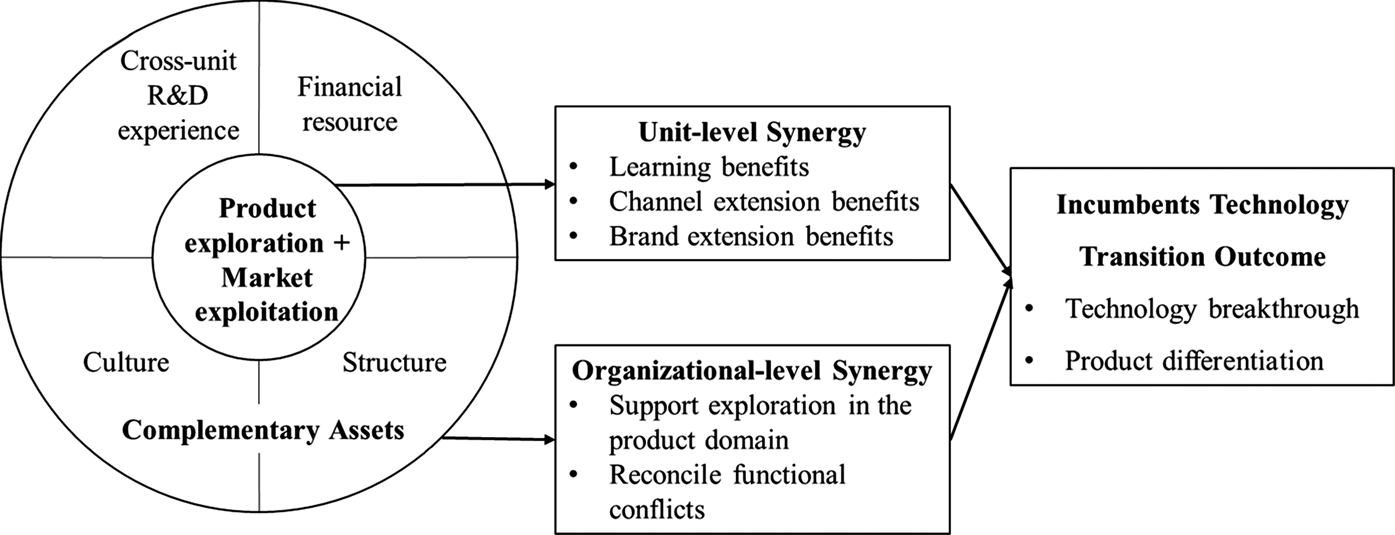

Phase 1: Cross-Functional Ambidexterity of Product Exploration and Market Exploitation

During 2003 to 2011, Huawei Mobile explored primarily in the product domain. As is illustrated in Figure 3, the market resources accumulated by Huawei's carrier business, including the carrier product brands and carrier channel networks were leveraged to provide rapid R&D feedback and low-cost brand extensions (Yu, 2012). Meanwhile, financial resources, organizational culture, organizational structure, and cross-unit R&D experience are complementary assets that support the reduction of risks of exploration in the product domain. As a result, Huawei Mobile made breakthroughs in core technologies and products.

Figure 3. The building processes cross-functional ambidexterity in Phase I

Stage 1: Technology Development (2003–2010)

In March 2003, Huawei Mobile started the mobile business by customizing low-end and nonbrand cellphones for carriers, which also helped to promote the sales of the company's major business, the communication equipment aiming at carriers (Wu, Murmann, Huang, & Guo, Reference Wu, Murmann, Huang and Guo2020). At that time, Huawei Mobile was a marginalized business unit within the company (He, Reference He2018; Ren, Reference Ren2017, Reference Ren2018, January 1). Its senior executives were essentially ‘banished’ from other departments since Huawei did not attach much importance to this business. In 2007, when Apple released its first smartphone and triggered a revolution in the mobile industry, many mobile phone manufacturers, including Huawei, started to position the smartphone business as a potential strategic growth point. Meanwhile, Huawei's industrial experience in the information and telecommunication industry made it easy to become aware of the value and significance of 3G/4G technology, which underlies smartphone products (Yu, Reference Yu2012).

In the following years, until 2010, the mobile business was devoted to product exploration and market exploitation. Representative exploratory activities include investing heavily in 3G/4G technology, working on core hardware of cellphones, developing cellphone chips, application processors, and baseband processors. Representative exploitation includes expanding the number of carriers as marketing channels and bundling its cellphone products with its carrier business. Typical codes at this stage are shown in Appendix III (supplementary material).

Huawei Mobile adhered to this strategic combination to get rid of its reliance on foreign-made chips (Ren, Reference Ren2012). This decision dated back to Huawei Mobile's early failure experience and senior managers’ belief in the primacy of technology. Around 2003, due to inadequate supply of baseband processors (a key component of the mobile phone chip that deals with the terminal signal transceiver) by a foreign chip manufacturer, Huawei experienced a competitive disadvantage on its data card business (a business that enables the network connection among personal computers). As a result, Huawei Mobile realized that the market opportunity can be easily killed when the key technology relies on others (IFE4; Ren, Reference Ren2012). In October 2004, Huawei set up a wholly-owned subsidiary, HiSilicon, to specifically work on smartphone chips. In 2009, Huawei Mobile introduced its first smartphone chip, K3V1. And in early 2010, HiSilicon introduced its own baseband processor, Balong 700. The successful development of technology enabled Huawei Mobile to continue its exploration in the smartphone processor field, while its strong competitors, including NVIDIA, TI, Ericson, had to give up on the research and development of smartphone processors because of the patent and technology monopoly of Qualcomm. A product line manager comments on the development of the mobile phone processor, ‘without technical expertise, it is impossible to obtain core competitiveness. This makes us different from many manufacturers. Developing of the processor is regarded as a cornerstone in the mid-to-high end market’ (IFE 10). In fact, the founder and former CEO Zhengfei Ren has repeatedly emphasized that technology is the basis of survival (Ren, Reference Ren1995, Reference Ren1996, December 13, Reference Ren1998, July 27, Reference Ren2000, July 20; Ren & Xu, Reference Ren2017).

The configuration of technology exploration and market exploitation brings about channel-extension benefits and learning benefits as unit-level synergies (Ren, 2017). During 2003 to 2010, the number of Huawei Mobile's collaborated top 50 international carriers has increased from 22 in 2004 to 47 in 2010. Since most mobile phones were bundled with Huawei's carrier business, the increasing number of collaborated carriers increased the shipment of its mobile phones. One staff member working at HiSilicon said, ‘at that time, we had stable carrier customers, so the shipments of our products were guaranteed. We didn't need to worry too much about market issues. The market department mainly helped us to feedback the voices of the carriers and see what performance needs to be improved’ (IFE4). Learning benefits were evident when Huawei released its early versions of smartphones. Carrier customers reported high power consumption issues associated with the P1 product series and complained about the low speed of document transfer. As a result, the R&D team spent 1 year solving these problems.

Financial resources and cross-unit R&D experience are two important types of complementary assets that supported Huawei Mobile to overcome the most difficult industry barriers – chip technologies – thus creating core competitiveness (Ren, Reference Ren2008, Reference Ren2011, Reference Ren2018). In 2004, Zhengfei Ren said to Tingbo He, CEO of HiSilicon, ‘I assure you 400 million USD per year and 20,000 employees for the development of chips, make sure that we can gradually reduce our reliance on the American firms’ (IFSM2). Take the development of Kirin 920, its first successful smartphone chips, as an example: Huawei had invested 200 million USD. As a network equipment manufacturer, Huawei Mobile had easy access to the systematic methodology, mature R&D tools, and supply networks accumulated by other business units of the company. In 1997, after visiting IBM, Zhengfei Ren started the transformation of Huawei's R&D system. The IPD (Integrated Product Development) was introduced from IBM to transform its product development processes from a small workshop mode to a large-scale mode that is process oriented, manageable, and repeatable (Wu et al., Reference Wu, Murmann, Huang and Guo2020). These systems and processes were also applied in the R&D of smartphone chips. As a former R&D staff said, ‘We've known the R&D process of mobile phones quite well when we were selling the customized phones for carriers. We know who has the strongest technology capability, where to find each component in the supply chain, how to negotiate with our partners, and the cost of each step’ (FSM2). This cross-unit R&D experience enabled Huawei Mobile to allocate proper number of resources, decide the right directions of exploration, and lower the risk of R&D experiments.

Stage 2: Product Development (2010–2011)

In 2010, Huawei had a 30% market share of the USD 100 billion global ICT industry. Its shipments and sales of the old functional phones had reached its celling. By 2009, the shipment of 2G cellphones had reached 30 million, which ranked third globally and second domestically. By 2010, Huawei had covered 47 out of 50 (94%) top international carriers to serve as its potential marketing channels for its functional mobile phones. Moving forward, how did the company ensure sustainable growth? The new market for high-end smartphones seemed attractive and promising (Yu, Reference Yu2012). As the 3G network became more and more mature and widespread, senior managers of Huawei realized that smartphones will soon replace functional phones in the future market. Huawei's experience in the carrier business might account for this strategic intuition (Yu, Reference Yu2012).

During 2010 and 2011, the mobile business adopted a strategic combination of product exploration and market exploitation. Representative exploration focuses on the development of cellphone software (such as battery management, thermal management, and system software) and product appearance. Representative exploitation includes leveraging carrier channels as the main marketing channels and extending the Huawei brand from a carrier business to a mobile business. Typical codes at this stage are shown in Appendix IV (supplementary material). Despite the cutting-edge technology developed in stage 1, Huawei Mobile faced a great challenge in attracting individual customers with its outdated product design and unknown brand.

The configuration of product exploration and market exploitation generates similar learning benefits and channel extension benefits as the first stage. When Huawei Mobile made its first attempt to produce high-end cellphones, positive feedback from the Japanese carrier eMobile encouraged Huawei to continue the exploratory effort on thinner product appearance. In addition, the configuration also enabled brand extension benefits. One staff member said, ‘no one in the world remembers the second, they all remember the first. To survive, the mobile phone business must be high-end. We hope to take advantage of our brand in the telecommunications field to create a high-end image of mobile phones’ (IFE7).

Customer-oriented culture and organization structure serve as complementary assets of this stage (Ren, Reference Ren2009, Reference Ren2010a). Huawei Mobile reinterpreted the culture and adjusted the organizational structure in order to support exploration in product design and reconcile functional conflicts between the product and market domains (Ren, Reference Ren2009, October 14, Reference Ren2010a, Reference Ren2010b; Yu, Reference Yu2017).

Senior managers’ reinterpretation of the customer-oriented culture supported product design exploration by altering the design philosophy from a cost-centric approach to a customer-centric approach (Yu, Reference Yu2012). Before 2011, Huawei Mobile's products only catered to the requirements of carriers who were price sensitive. A former employee of Huawei Mobile commented on the cost-centric approach, ‘Huawei Mobile previously made products by setting a price target, and then decomposing how much you can buy the screen, how much the battery, how much the exterior structural parts, how much the RF processor and so on' (IFE12). In 2011, senior managers explicitly targeted the customer of the mobile business unit from carriers to individual smartphone users (FSM2). Huawei Mobile's managers are required to be promoters of the smartphone for at least one day a year, and engineers are required to be receptionists that listen to consumer complaints (He, Reference He2018; Xu, Reference Xu2017; Yu, Reference Yu2017). Otherwise, they are barred from promotion (IFSM4).

The customer-centric culture also helped to settle disputes between the product and market domains. The market director once proposed downsizing the number of feature phones and devoting more human and financial resources to the high-end product, but this proposal was opposed by two-thirds of the company. Many employees in the product domain were reluctant to change the status quo, since the company's existing cooperation with carriers guaranteed cellphone shipments and the products were updated easily and efficiently. Senior managers finally agreed to downsize the old business since Huawei Mobile consider individual smartphone users were the customers who demand more resources to support (IFSM2). When developing Mate 7, the mobile unit sampled 40,000 customers to collect the details of customer preference, reconciling the conflicts between the market and product domains on product design ideas (IFE8).

Adjustment in organization structure also facilitated product exploration by ensuring adequate and best organizational resources. In 2011, Huawei formally established its consumer BG (Business Group), which significantly enhanced the strategic position of the mobile department within the company. ‘He (Zhengfei Ren) incorporated smartphones as one of the company's most important businesses. For product development, the benefits are obvious. There are some outstanding managers from Huawei's big platform to supplement our strength, and the resource are also abundant’ (IFE4). With the support from the CEO of Huawei, the CEO of the consumer BG, Yu, encouraged a bold trial-and-error process at Huawei Mobile, and he was willing to ‘write big checks’. ‘He mobilizes company resources to the largest extent in order to support a flagship product. Sometimes, he is even willing to spend up to five times the amount of Huawei's highest recorded investment on a flagship product’ (FSM1).

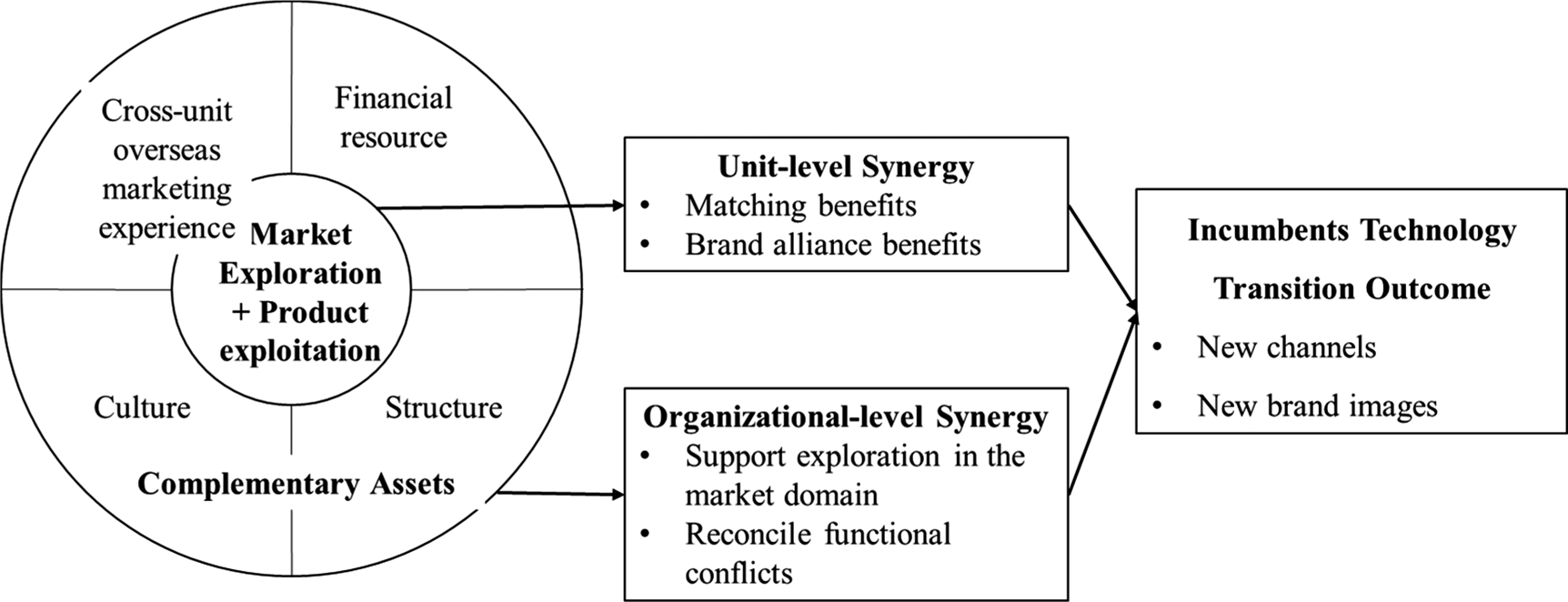

Phase 2: Cross-Functional Ambidexterity of Product Exploitation and Market Exploration

During 2011 to 2018, Huawei Mobile primarily explored the market domain. As is illustrated in Figure 4, product diversification helps to match new market segments, while product optimization enables Huawei Mobile to form partnerships with well-known big brands to enhance its brand position (Ren & Xu, Reference Ren and Xu2017). Furthermore, financial resources, organizational culture, organizational structure, and cross-unit overseas marketing experience also facilitate market exploration. As a result, Huawei Mobile made breakthroughs in shaping channels and brands.

Figure 4. The building processes cross-functional ambidexterity in Phase II

Stage 3: Channel Development (2011–2014)

Although Huawei Mobile enjoyed a relatively stable shipment with the Huawei brand, 80% of the shipment relies on carrier channels (FSM1). However, these channels only generated meager profits and were not considered sustainable in the long-run (Ren, Reference Ren2014). A senior manager commented on the cooperation experience: ‘product managers have to deal with the strict price requirements of carriers. The most frequently used words in all product proposals are “ultra-low prices”, “super-low prices”, and “ultra-low-end”. It's extremely painful to say the unit price of each mobile phone is only $ 75. And we have to pay the entire transportation cost and buy insurance in some overseas market’ (IFE7). In 2012, the Xiaomi Corporation had achieved great success with online shipments, which triggered a heated debate about whether Huawei Mobile should shift to e-commerce channels or focus on offline channels.

In response to the internal debate over channel choices, Huawei Mobile finally decided to adopt a dual-channel strategy that developed both online and offline channels, aiming to expand market shares. In 2012, Huawei Mobile established VMall as its online channels, aiming to learn from and compete with Xiaomi (IFSM6). In the same year, offline channels were established by cooperating with distributors, including domestic electronics market Suning and Guomei, and other smaller agencies, aiming to compete with Vivo and Oppo (IFE10). By the end of 2013, Huawei Mobile established a separate product line, Honor, devoted to online channel exploration. ‘The Honor line was spun off on its own with the goal of creating a pixel-perfect imitation of Xiaomi and setting the stage for online channel exploration’ (FSM2).

In order to get rid of the low-profit channel and to stay closer to its end users, Huawei Mobile pursued the cross-functional ambidexterity of market exploration and product exploitation. Representative exploratory activities include reducing reliance on the carrier channels, developing new marketing channels, such as offline experience stores and online e-commerce channels, and enhancing channel operating capability. Representative exploitation includes product diversification for online and offline customer segments. Typical codes at this stage are shown in Appendix V (supplementary material).

At first, market exploration of Huawei Mobile encountered several failures due to lack of channel management knowledge and weak collaboration between the market and product domains. Although Huawei Mobile had released a series of high-end products since 2011, such as D and P series, none of them were successful in the market. An employee commented on the mismatch between product release and channel management, indicating Huawei Mobile's insufficient marketing knowledge at the time. ‘CEO (of the consumer business group) Yu once entrusted the first product P1, but the sales are not ideal… When the market is hot, the supply is insufficient, and when P1 can be supplied with large amount, the market heat has passed’ (IFE2). Another employee commented on the abnormal short product life cycle, indicating weak price control over the channels: ‘P1 was sold in the European market for about one year, but it was sold in the Chinese market for less than three months, D1 was even shorter. The arbitrary price reduction behavior of our channels shortens the product life cycle’ (IFSM5).

To fill the knowledge gap in channel management, Huawei Mobile recruited a number of channel experts from outside. Since 2012, Yang Zhe, Zhao Kelin, Lan Tongming, and other experts were brought in from outside Huawei Mobile under the lobbying of Chengdong Yu (IFE7). Yang Zhe was the former president of Samsung China brand department; he helped reposition Huawei Mobile's high-end image with the Chinese culture. Zhao Kelin was the former marketing director of Nokia in the Asia Pacific region, and Lan Tongming was the former senior manager of supply chain in Nokia. The joining of these channel experts quickly filled Huawei's gap in market channel operations (IFE7).

More importantly, the configuration of market exploration and product exploitation provides matching benefits between the product and market domains. On the one hand, it enabled the fit between product upgrade speed with channel management capability. On the other hand, it enabled the fit between product categories and target channels. Online and offline channels suggest different preferences of product features. ‘Generally, cellphones sold by the online channel are 30% cheaper than that in the offline channels’ (IFE2). The product line team decided to stress cost-effective features for products sold via the online channel, and flagship high-end features for products sold via the offline channels. One of our interviewees gave an example of the match between product features and channels: ‘we beat our competitors online by providing slightly better camera pixel with lower price, while in our flagship products selling in the experience store, we have to do show something our competitors cannot afford, say the parallel dual lens, comparable to SLR camera, with large aperture supporting the background blur effect’ (IFE1).

By the end of 2014, Huawei Mobile had established a total of 630 brand image stores around the world, which greatly enhanced the consumer brand retail experience. Meanwhile, shipments through the old carrier channels had been reduced from 80% in 2012 to less than 50%, and shipments through the newly established offline channels increased to 40%, and e-commerce channels accounted for about 10% (Huawei Annual Report, 2014, FSM1).

Stage 4: Brand Development (2014–2018)

Due to fierce market competition, Huawei Mobile's profits remained low despite significant market share gains in the previous phase. As the smartphone market shifted from initial purchases to replacements, the demand for high-end smartphones increased sharply, which created unprecedented opportunities for Huawei Mobile. Therefore, increasing profits became one of the key challenges at stage 4.

The solution to the profit challenge is brand premium. Senior management of Huawei Mobile considered using dual brands, with ‘Huawei’ and ‘Honor’ brands serving high-end and low-end products, respectively. Compared to a single brand, dual brands attract more sales with price discrimination. And compared to multi-brands, dual-brands ensure that the differences between product lines are adequate enough to impress, rather than confuse, customers. Besides, with clearer product boundaries, these two brands can be sold within all online and offline channels. In 2017, Rotating CEO of Huawei Zhijun Xu said in an internal meeting, ‘Several years ago, my focus is on pushing consumer BG to unswervingly turn to the open market, to firmly establish retail and channels, and to build a service system…Now we need to build a strong brand to drive our revenue growth and price increase’ (Xu, Reference Xu2017).

At this stage, Huawei Mobile adopted a strategic combination of market exploration and production exploitation. Representative exploratory activities included shaping Huawei as a high-end mobile phone brand, and establishing a dual-brand strategy where Huawei and Honor serve distinct customers with distinct functions and features. Before this stage, Huawei Mobile had Huawei and Honor as two separate brands, but none of them were recognized as a high-end brand by the market. Moreover, these two brands overlaped with each other in terms of functions, customers, and prices. Shaping a high-end brand and selling smartphones with two distinct brands are activities that ‘captured by terms such as search, variation, risk taking, experimentation, play, flexibility, discovery, and innovation’ (March, Reference March1991: 71). Representative exploitative activities include product diversification for different brands and overseas markets. Typical codes at this stage are shown in Appendix VI (supplementary material).

Although Huawei aimed to produce high-end smartphones, its cellphone products lacked a high-end identity. As a staff put it, ‘customers are not able to recognize the Huawei brand if we remove the logo’ (FSM1). Chengdong Yu had introduced a number of high-end designers and brand experts, who had deep understanding in designing fashionable high-end products. He hired former Samsung mobile creative director Joonsuh Kim and Apple's former creative director, Abigail Sarah Brody, to lead Huawei Mobile's brand exploration. Kim once talked about his idea, ‘I think Huawei should learn the trend from the luxury industry, collaborate with independent designer, and work with partners outside the industry’ (IFSM7). They broadened the horizon of Huawei Mobile's design with international top design tastes.

Huawei Mobile carried out two actions to shape its high-end brand image. One was to make a clearer distinction between its high-end and low-end products (Ren & Xu, Reference Ren2017). The other was to collaborate with established high-end brands. Both actions required collaboration between the product and market domains, generating matching benefits and brand alliance benefits, respectively.

Matching benefits were generated because product diversification helped to establish distinct brands. While the ‘Huawei’ brand aims at attracting businessmen who value quality and taste, the ‘Honor’ brand focuses on young people who value a sense of fashion and entertainment. In order to create a fashionable appearance, engineers of the ‘Honor’ brand had to take fashion classes and pay attention to fashion colors. They also added games, music, and sports elements in the ‘Honor’ products as entertainment features. By contrast, to cater to the business context, the ‘Huawei’ products stressed large screens for business communication and active noise cancelling headphones for business trips.

Brand alliance benefits were generated because outstanding product performance and quality achieved by the product domain set the basis for cooperation with big global brands (Ren & Xu, Reference Ren2017). For example, Huawei Mobile cooperated with Leica to establish the Max Becker Innovation Lab to jointly develop and enhance camera technology for smartphones. This cooperation not only enabled the ‘Huawei’ products to have cameras comparable to professional cameras, but also improved the international reputation of the ‘Huawei’ brand (IFE5). After that, Huawei Mobile partnered with Harman Kardon (top brand in the world's leading audio manufacturing industry) to improve sound quality, with Pantone (a world-renowned authority on the development and study of color) to achieve a trendy color, and with Porsche (world famous luxury car brand) to create a luxurious product appearance, all aiming at improving its high-end brand image. These cross-border and high-end partnerships were supported by a generous financial resource allocation from the company.

In terms of exploring new international markets, customer-oriented culture and cross-unit overseas marketing experiences are considered important complementary assets. In countries that are familiar with Huawei's carrier business but not with its mobile phone products, market exploration went relatively smoothly because cross-unit overseas marketing experience could be leveraged. ‘Huawei achieved high growth in the Latin American smartphone market thanks to its breakthroughs in the mid- to high-end handset market, good channel retail placement, and the hard work of Huawei's Carrier Business Unit since 1998’ (IFSM7). In countries that are unfamiliar with Huawei's carrier business and mobile phone offerings, the customer-oriented culture guides the company to pay close attention to user preferences and habits during overseas market exploration, thus boosting sales of high-end mobile phones in overseas markets (Ren, Reference Ren2016, Reference Ren2017). A sales representative of country X said, ‘we all know that product is a prerequisite for sales success. However, only by asking our users, we know that they are buying mobile phones in end retail stores rather than shopping malls, and they especially like the camera function rather than the big screen. We need to stay close to consumer demand’ (IFE3).

As a result, the report released by Strategy Analytics shows that in 2018, Apple still topped the global mobile phone profit rankings, while Huawei became the world's second-most profitable Android smartphone manufacturer. In the Interbrand Best Global Brands List and the BrandZ Global Top 100 Most Valuable Brands, Huawei ranked 72 and 50, respectively.

RESULTS

The theoretical lens of cross-functional ambidexterity and complementary assets provide valuable insights on the transformation of incumbents facing technology transition. In the following, we respond to the two research questions we proposed above.

The Evolutionary Path of Cross-Functional Ambidexterity

When the core technology in the mobile industry shifted from 2G to 3G/4G, incumbents were faced with the challenge of product transition from feature phones to smartphones and market transition from enterprise customers to individual customers. Our study shows that the case company survived the technology transition by sequentially pursuing product exploration and market exploitation in separate phases. In Phase I, Huawei Mobile achieved a core technology breakthrough and product differentiation, and in Phase II, Huawei Mobile achieved significant sales growth and profit growth with new channels and brand images. Each of the phased objectives was supported by a different type of cross-functional ambidexterity, where unit-level synergies between the product and market domains were generated. This dynamic path of cross-functional ambidexterity is worth analyzing within phases across domains and within domains across phases.

When examining the path within phases across domains, we notice that exploration and exploitation across the product and market domains are configured into different types of cross-functional ambidexterity, generating different types of unit-level synergies and leading to different transition outcomes.

The configuration of product exploration and market exploitation generates learning benefits, channel extension benefits, and brand extension benefits that are conducive to exploration in the product domain. Learning benefits exist when the mature channel network in the market domain provides quick and reliable feedback on technology or product exploratory activities, which helps the product domain reflect on the direction of exploration (Voss & Voss, Reference Voss and Voss2013). For example, when Huawei Mobile applied the first version of smartphone chips to its early high-end smartphones, carriers reported high power consumption issues that guided the direction of technology exploration. Similarly, when Huawei Mobile made its first attempt to produce high-end cellphones, positive feedback from the Japanese carrier eMobile encouraged Huawei Mobile to continue the exploratory effort on thinner product appearance. Channel extension benefits exist when mature channels can be leveraged to sell new products, thus avoiding additional expenditure on marketing. For example, Huawei Mobile relied on carrier channels to sell its early smartphone products, the resulting revenue almost covered the R&D expenditure. Brand extension benefits exist when the brand name is leveraged to enter new product categories (Keller & Aaker, Reference Keller and Aaker1992). The extension of the Huawei brand to the smartphone product creates positive product category associations (e.g., Huawei–mobile phone), benefit associations (e.g., Huawei–strong communication signal). Learning benefits, channel extension benefits, and brand extension benefits enable the focal company to concentrate on exploratory activities in the product domain with the support of marketing resources.

The configuration of product exploitation and market exploration generates matching benefits and brand alliance benefits that are conducive to exploration in the market domain. Matching benefits exist when product upgrade speed meets channel management capability and when product features suit the requirements of customer segments. For example, Huawei Mobile slowed down product updates in the early stages of establishing online channels. Also, Huawei Mobile catered to offline consumers by improving product performance, while it catered to online consumers by offering cost-effective products. Matching benefits help to achieve marketing synergy, defined as ‘the extent to which the resources and skills required for a new product development project fit the current marketing resources and skills of the firm’ (Atuahene-Gima & Ko, Reference Atuahene-Gima and Ko2001: 60).

When examining the path within domains across phases, we notice that the case company shifts its strategic focus between exploration and exploitation within the same functional domain. This behavior pattern is referred to as sequential ambidexterity (O'Reilly & Tushman, Reference O'Reilly and Tushman2013) or cyclic ambidexterity (Simsek et al., Reference Simsek, Heavey, Veiga and Souder2009). By focusing on exploration in one functional domain at a given time, incumbents have a higher probability in making breakthroughs (Lavie & Rosenkoph, Reference Lavie and Rosenkopf2006). This pattern of behavior is closely related to Huawei's overall R&D Investment Strategy and the Principle of Pressure, which are stated in the Huawei Basic Law (Wu et al., Reference Wu, Murmann, Huang and Guo2020; Xu, Reference Xu2019).

We guarantee that 10% of our sales will be allocated to research and development, and if necessary, we will increase the allocation (R&D Investment Strategy).

On key success factors and selected strategic growth points, we allocate resources at a strength that exceeds the strength of major competitors. Either we decide not to do it, but if we decide to do it, we will greatly concentrate manpower, material, and financial resources to achieve a breakthrough (The Principle of Pressure).

It is also worth noting that the case company prioritizes exploration in the product domain ahead of that in the market domain (He, 2018; Ren, Reference Ren2015, September 24; Xu, Reference Xu2017). This particular sequence can be interpreted by organizational routines (Cohen et al., Reference Cohen, Burkhart, Dosi, Egidi, Marengo, Warglien and Winter1996) and the demand-side approaches to technology transition (Priem, Butler, & Li, Reference Priem, Butler and Li2013).

Related literatures suggest organizational routines that are passively formed under pressure will become a repetitive rule to follow (Cohen et al., Reference Cohen, Burkhart, Dosi, Egidi, Marengo, Warglien and Winter1996). This priority is rooted in Huawei's early failure experience due to technology reliance on foreign companies, and aligns with the company's firm belief in the primacy of core technologies. Huawei's emphasis on core technologies in the product domain permeates all business units (Ren Reference Ren1995, Reference Ren1996, Reference Ren1998, Reference Ren2000; Ren & Xu, Reference Ren2017; Yu, Reference Yu2017). As is said by Chengdong Yu, the CEO of Huawei's Consumer Business Group, ‘today, when developing Huawei's own brand of cell phones, carrier partnerships are still an important foundation for us, and the understanding and accumulation of communication networks are still our strengths…our chips reflect an understanding of communication networks, and our terminals are more power efficient, have higher Internet speeds, and perform better…’ (Yu, Reference Yu2012).

Literature on the demand-side approaches to technology transition argues that value must be created for consumers before it can be captured by firms upstream in the value system (Priem, Li, & Carr, Reference Priem, Li and Carr2012). According to Priem and colleagues (Reference Priem, Butler and Li2013: 473), ‘value creation is determined by consumers’ evaluations of the benefits they expect to receive from a purchase, indicated by willingness to pay… value capture by any individual firm in a value system is determined by the structure and resource ownership in that value system’. In the case of Huawei Mobile, exploration in the product domain represents a type of value creation for consumers, and exploration in the market domain represents a type of value capture activity. The case company attempted to make breakthroughs on core technology and products, which determines consumers’ willingness to pay for the mobile phones. Value creation ‘increase the size of the pie’ (Gulati & Wang, Reference Gulati and Wang2002), and set the basis for long-term profit. This is evident by Huawei Mobile's profit growth in stage 4 when the demand for high-end smartphones increased sharply. The R&D Investment Strategy, the Principle of Pressure, and the belief in the primacy of technology are the genes that lead Huawei Mobile to exert long-term transitional efforts during technology transition (Wu et al., Reference Wu, Murmann, Huang and Guo2020). As Zhengfei Ren said, ‘you are in a long run, run with patience, always run to win, people will eventually know the quality of your products good’ (Ren, 2015).

Along the development path, technology development at stage 1 and product differentiation at stage 2 are driven by the company strategy, since they root in Huawei's organizational routines and are essentially driven by consumers’ latent demand on smartphones with high-performance hardware and attractive appearance. By contrast, sales growth at stage 3 and profit growth at stage 4 are dependent on external market conditions. Channel development at stage 3 was triggered by domestic competition from Xiaomi, Oppo, and Vivo, and brand development at stage 4 was triggered by exploded demands for high-end cellphones since 2014.

The Role of Complementary Assets in Building Cross-Functional Ambidexterity

When radical changes occur in both product and market domains, financial resources, cross-unit experience, organizational culture, and organizational structure serve as complementary assets that support cross-functional ambidexterity at the organizational-level (Yu, Reference Yu2012). Cross-functional ambidexterity of product exploration and market exploitation is often associated with undesirable risk and uncertainty in technology exploration and extended timeframe to reap the benefits (Lavie & Rosenkopf, Reference Lavie and Rosenkopf2006). In general, complementary assets serve two roles: ‘catalyst’ and ‘lubricants’. The ‘catalyst’ role serves to provide organizational-level resources and experience support for exploration activities in specific functional domains, reducing risk and resistance to exploration. The ‘lubricant’ role serves to reconcile conflicts between functional domains, allowing different functions to develop a unified view or common understandings. Financial resources, cross-unit experience, and organizational structures can be used as a catalyst for functional exploration.

Persistent and abundant financial support enabled multiple trials and errors during exploration. In the case of Huawei Mobile, the R&D investment on the mobile business has exceeded 1.2 billion USD dollars by the end of 2014. Its partnerships with premium brands and overseas marketing incur significant marketing expenses. Adequate financial resources not only ensure consistent exploratory efforts, but also make a strong signal that the company attaches critical importance to the focal exploratory activity (Hansen et al., Reference Hansen, Wicki and Schaltegger2018). These financial supports guarantee the intensity of exploratory learning and increase the probability of making breakthroughs on bottlenecks in specific functional domains.

Cross-unit experience provides guidance for exploratory activities, thus accelerating the timeframe to reap the benefits. The rich R&D experience and mature methodology accumulated by other business units of the case company help to reduce uncertainty and risk in technology and product exploration in Huawei Mobile (Yu, Reference Yu2012). For example, Huawei Mobile draws on its established IPD (Integrated Production Development) processes to decide the amount of resources invested in each new product series and to evaluate the outcomes of new product development. Similarly, the overseas marketing experience accumulated by the carrier business group help Huawei Mobile penetrate overseas markets rapidly.

The role of organizational structure in supporting exploration has been discussed in the existing literature (O'Reilly and Tushman, Reference O'Reilly and Tushman2008). In the case of Huawei Mobile, the organizational structure was adjusted twice to guarantee adequate attention and support for the exploration. In 2011, Huawei formally established its consumer BG (Business Group), which significantly enhanced the strategic position of the mobile department within the company. And in 2013, Huawei Mobile spun off the ‘Honor’ product line to support the exploration of online channels.

Organizational culture can be used as a lubricant for functional conflicts. Conflicts between departments are also frequently occuring issues in constructing cross-functional ambidexterity, since organizational collaboration is replete with self-interests and struggles for power (Atuahene-Gima & Evangelista, Reference Atuahene-Gima and Evangelista2000; Voss & Voss, Reference Voss and Voss2013). The organizational culture serves as a lubricant that combines divergent self-interests of each department to aim in the same direction. For example, when the product and marketing departments diverged on whether to cut off the feature phones, customer-oriented culture helped to settle the functional disputes by aligning the self-interests of each function with customer experience.

DISCUSSION

With the Huawei Mobile case, this study aims to answer how incumbents survive the technology transition that triggered radical changes in both the product and market domains by building cross-functional ambidexterity and what roles complementary assets play during the process. Four key findings are concluded. First, incumbents can survive technology transitions by pursuing a cross-functional ambidexterity of product exploration and market exploitation and a cross-functional ambidexterity of product exploitation and market exploration sequentially. Second, while synergies between the product and market domains support cross-functional ambidexterity at the unit level, complementary assets support cross-functional ambidexterity at the organizational level. Third, the strategic combination of product exploration and market exploitation generates learning benefits, channel and brand extension benefits, and the strategic combination of product exploitation and market exploration generates matching benefits and brand alliance benefits. Fourth, financial resources, cross-unit experience, organizational structure, and culture serve as complementary assets and play dual roles in facilitating functional exploration and reconciling functional conflicts. Theoretical contribution, practical implications, and future research directions are discussed in the following.

Theoretical Contribution

We relate our findings to three streams of literature, namely technology transition, organizational ambidexterity, and complementary assets. We show that the key theoretical arguments are reflected or confirmed in established theory and literature, which suggest theoretical generalizability to some extent (Tsang, Reference Tsang2014). Based on these connections, we further state our theoretical contributions.

This study contributes to the technology transition literature by focusing on a particular type of technology transition that triggers radical changes in both the product and market domains. While extant studies suggest organizational separation and complementary assets as two solutions to address the challenges of technology transition, little is known about when, how, and why to integrate these two solutions (Zhang et al., Reference Zhang, Wang, Li and Cui2017). This work shows that product-based preformation like core technology breakthrough and product design upgradation and market-based performance, like new channels and new brand images, can be achieved sequentially by pursuing two types of cross-functional ambidexterity. Besides, we theorize unit-level synergy and organization-level synergy as underlying mechanisms to explain these positive relationships. Our study responds to calls for research examining multiple levels of analysis in new product performance (O'Cass, Heirati, & Ngo, Reference O'Cass, Heirati and Ngo2014; Troy, Hirunyawipada, & Paswan, Reference Troy, Hirunyawipada and Paswan2008).

This study also contributes to our understanding towards complementary assets during technology transitions. Firstly, we identify the types of complementary assets when radical changes occur in both the product and market domains. Previous work on technology transition mainly identifies market-related resources as complementary assets due to their overwhelming focus on activities in the product domain (Taylor & Helfat, Reference Taylor and Helfat2009; Tripsas, Reference Tripsas1997; Tripsas & Gavetti, Reference Tripsas and Gavetti2000). By contrast, this work renders marketing resources as core resources when organizations have to respond to the radical changes occurring in the market domain. As a result, we identify financial resources, cross-unit R&D experience, organizational culture, and organizational structures as important types of complementary assets. Secondly, we identified ‘catalyst’ and ‘lubricant’ as two roles played by complementary assets during such technology transition. Extant studies suggest that complementary assets buffer incumbents from competition (Tripsas et al., Reference Tripsas1997; Wu et al., Reference Wu, Wan and Levinthal2014), or affect their choices and investments in alternative technology trajectories (Roy & Cohen, Reference Roy and Cohen2017). Our work suggests that complementary assets help to create organization-level synergy by overcoming potential risks of exploration and resolving functional conflicts at the organizational level. Thirdly, we reveal the dynamism of complementary assets. As is suggested by Taylor and Helfat (Reference Taylor and Helfat2009: 720), ‘preexisting complementary assets of an organization may retain their full usefulness, or they may require adaptation, or they may lose value entirely’. In addition to appropriate existing internal resources as they are, such as financial resources (Colombo, Reference Colombo, Dawid, Piva and Vivarelli2017), and cross-unit experience (Allvarez-Garrido, Reference Alvarez-Garrido and Dushnitsky2016), we find that organizations can modify existing resources, for example, by adjusting organizational structure or by reinterpreting the culture.

Finally, this study contributes to the ambidexterity literature by investigating the building processes of cross-functional ambidexterity. Firstly, while Voss and Voss (Reference Voss and Voss2013) and Zhang et al. (Reference Zhang, Wang, Li and Cui2017) examine the positive relationships between cross-functional ambidexterity and new product development performance, we uncover the phased and multi-level building process. Different configurations of cross-functional ambidexterity are constructed by generating unit-level synergies and organization-level synergies, leading to different phased strategic objectives of technology transition. Secondly, we add to the types of synergies generated by cross-functional ambidexterity. The Huawei Mobile case confirmed Voss and Voss (Reference Voss and Voss2013) on the learning benefits generated from the strategic combination of product exploration and market exploitation. We further suggest brand extension benefits and channel extension benefits from the combination of product exploration and market exploitation, and matching benefits and brand alliance benefits from the combination of product exploitation and market exploration. Thirdly, the ambidexterity literature has suggested that construction of ambidexterity requires organizational resources, but the resources for cross-functional ambidexterity remain unclear (Birkinshaw et al., Reference Birkinshaw, Zimmermann and Raisch2016; Simsek et al., Reference Simsek, Heavey, Veiga and Souder2009). This study suggests that cross-unit experience, organizational culture and structure, and financial resources are valuable organizational assets for cross-functional ambidexterity.

Practical Implications

We note two practical implications for incumbents facing technology transitions that cause radical changes in both product and market domains. First, multi-level efforts are needed to survive the transition. At the unit level, configuring exploration and exploitation across the market and the product domains would generate learning benefits, brand and channel extension benefits, matching benefits, and brand alliance benefits. At the organizational level, cross-unit experience, organizational structure, organizational culture, and financial resources may reduce the risk of exploration and resolving functional conflicts. Second, the new product development performance during technology transitions can be broken down into multiple phased goals, such as technology breakthroughs and product differentiation in the product domain, channel expansion, and brand image upgrade in the market domains. And prioritizing exploration in the product domain ahead of that in the market domain is proven to be a feasible path for companies with solid technology backgrounds.

Limitations and Future Research Directions

Although the longitudinal single case design helps to reveal the causal relationships between our key constructs, the theoretical generalizability should be treated with caution (Tsang, Reference Tsang2014). Firstly, due to the difficulties in gaining access to the case sites and respondents, our data collection relied on convenience sampling. Secondly, although our case indicates a transitional path of technology development, product differentiation, sales growth, and profit growth in the case company. This might not be the optimal sequence, because this sequence is rooted in Huawei's specific characteristics, including Huawei's early failure experience, overall R&D Investment Strategy, and firm belief in the primacy of core technologies. To further increase theoretical generalization, future research is encouraged to adopt a multi-case study design (Tsang, Reference Tsang2014). Thirdly, the theoretical model proposed in this work is considered not applicable to Huawei's strategy after 2018. This is due to US-China trade tensions since March 2018, which have negatively affected Huawei's businesses and made Huawei's future strategy unpredictable. In November 2020, Huawei divested the Honor product line, not because Honor was losing money, but in an attempt to keep Honor's products and markets from the fluctuations of international trade. As Zhengfei Ren said in an internal speech at the farewell party of Honor, ‘Honor produces mid- and low-end products. After the divestiture, it can quickly resume production under the leadership of Zhixin to solve the difficulties of upstream and downstream partners’ (Ren, Reference Ren2020).

Supplementary Material

The supplementary material for this article can be found at https://doi.org/10.1017/mor.2021.22

Target article

Managing Complementary Assets to Build Cross-Functional Ambidexterity: The Transformation of Huawei Mobile

Related commentaries (1)

A Dynamic Perspective on Huawei