1 Introduction

Over a decade ago, cultural anthropologist and sociolegal scholar Bill Maurer called for attention to “the act and infrastructure of value transfer” – that is, to payment, a domain long neglected in social studies of finance (2012a, p. 19). Payment, he argued, was important to understand both because it was a key cultural, economic, and technological form and because its cultures, economies, and technologies were rapidly changing. In other words, it served the infrastructural functions of money.

In the first decades of the 2000s in the United States, payment infrastructures are rapidly becoming more powerful. As scholars such as O’Dwyer (Reference O’Dwyer2023) and Westermeier (Reference Westermeier2020) demonstrate, finances are increasingly becoming platformized, with large, data-driven companies working to embed payments within their platforms and seeking to profit from access to users’ transactional data.

Understanding payment as an act and infrastructure underscores that money is a communication medium, a way of transmitting information that produces shared meaning (Swartz, Reference Swartz2020). Payment technologies – cash, cards, checks, or apps – do not simply transmit value. They communicate the nature of the relationship between two parties and reveal information about how we see ourselves and how we are viewed by powerful institutions (Zelizer, Reference Zelizer1997). As a communication infrastructure, payment binds us together in a transactional community, a shared economic world, and this shores up new and existing inequalities.

Payment infrastructures are increasingly being understood as a form of “social media.” In the broader communication context, there is a sense that the era of mass media (characterized by unidirectional broadcast and print technologies) has given way to one of social media (digital media that is niche, participatory, peer-to-peer, globalized, and surveilled). So too, mass money media have shifted to social money media. If, as geographer Emily Gilbert suggests, state currency was designed to enact “mass” transactional communities at the scope of the nation-state, what kinds of transactional communities do new “social” payment systems entail?

Of course, there is no way to neatly segment the two; most critical scholars are uncomfortable even using the terms “mass media” and “social media” (see, e.g., Papacharissi, Reference Papacharissi2015) as though they describe discrete phases. Similarly, the shift from mass money media to social money media is more complicated than it sounds. The mass medium of cash has always been accompanied by other money tokens, including foreign currency, coupons, and checks (Carruthers and Babb, Reference Carruthers and Babb1996; Henkin, Reference Henkin1998).

Yet social media money is helpful shorthand for an industry, a way of describing a certain set of technologies and a series of norms and engagements. To be sure, money has always been social and money has always been media. As a media technology, payment infrastructure is currently being redesigned to look more like social media, largely by Silicon Valley.

But this redesign brings up new questions: Who gets to control payment? Communication technologies come with constraints that can exclude potential users from the transactional communities produced by those forms of payment. Despite being a state technology, cash is difficult to control or surveil and has a low barrier to entry. New money media, created in the image and footsteps of social media, will not be equally accessible. As we move from mass transactional communities to social transactional communities, what are the implications of this shift? Who will monitor, control, and restrict these new payment rails?

2 Transactional Memories: Social Payments and Data Economies

The media studies scholar Josh Lauer (Reference Lauer2017) demonstrates that the concept of “financial identities” is centuries old: credit bureaus of the nineteenth and early twentieth centuries collected information and stories to determine borrowers’ ability to repay. These reports, Lauer says, made modern people into “legible economic actors” (p. 35).

But in recent years, there has been a shift from these aggregations of financial data to what I call transactional identities, shaped by how, where, when, and with whom we transact. If the former constituted identity via credit, the latter constitutes identity via payment infrastructure. We perform these transactional identities through payment, and they shape how others view us, whether as Amex Black card holders or electronic benefits welfare card users.

These transactional identities are being shaped in real time by social money media, as exemplified by Venmo, a peer-to-peer mobile payment app that is especially popular in the United States, where bank transfers are expensive and cumbersome. Venmo includes a social “feed” of transactions, visible to friends, similar to a Facebook news feed or Instagram post. The app requires users to annotate their transactions with notes and encourages them to use emojis: pizza, taxi, clinking wine glasses.

In this way, Venmo illustrates what sociologists Alya Guseva and Akos Rona-Tas (2017) call the “new sociability of money”: The ability of digital money technologies to “preserve the details of economic transactions, to capture our geographic movements, to infer our tastes and routines” (p. 204). The app also gives rise to new forms of social communication, including playful interactions and coded messages (Acker and Murthy, Reference Acker and Murthy2018). Its social streams reinforce, memorialize, and even potentially strain social relationships (Drenten, Reference Drenten, Belk and Llamas2022).

Venmo reveals that money has always been social, but it also encloses that sociality within its platform and records it for perpetuity (O’Dwyer, Reference O’Dwyer2019). Scholars across fields have argued that money is a technology of memory (see, e.g., Kocherlakota, Reference Kocherlakota1998). Social media is also a technology of memory; it is part of what the media scholar Jordan Frith has called “a new memory ecology” assembled on mobile phones (2015, pp. 90–91).

These transactional memories can also be used for surveillance and control. Nigel Dodd writes that “a device for remembering cannot be divorced from the criticism that it is also a vehicle for political and commercial surveillance, above all, as long as the technology involved is controlled by corporations and states” (2014, p. 296, original emphasis). Kelsi Barkway (Reference Barkway2023) documents how even seemingly benign technologies (in this case, benefits cards for distributing welfare payments) can be perceived as tools of surveillance and social control, inciting fears in users that their spending is being monitored and they will be judged as undeserving.

Digital transactions are, in fact, being used for control and punishment. Police in Atlanta have used access to an activist’s PayPal account to bring criminal charges against a bail fund that has supported protests against the construction of a large police training facility (Lennard, Reference Lennard2023). Consumers may not be aware that their transactional memories can be used to cause them trouble, as in the case of mobile-phone borrowers in Kenya, whose phones offer them access to credit while simultaneously generating a stream of financial and personal data that can harm their credit scores. Social scientists Kevin P. Donovan and Emma Park (Reference Donovan and Park2022a, 2022b) note that many of these borrowers end up seeking expensive short-term credit to prevent damage to their credit scores, ensnaring them in a cycle of debt that is difficult to exit, a form of “predatory inclusion.”

In fact, many of our experiments with digital payment technologies are being enacted on the world’s most vulnerable people. Aaron Martin (Reference Martin2019) documents how mobile money platforms facilitate both familiar and novel forms of surveillance of users by government entities and service providers. Similarly, anthropologist Margie Cheesman notes that companies and aid organizations providing support in refugee camps are testing out web3 technologies such as blockchain wallets to distribute various kinds of payments. In this environment, where users have limited choices, rights, and protection, forced use of these technologies requires them to generate financial data over which they have little control (Cheesman, Reference Cheesman2022a). Thus, she recommends that web3 technologies not be used experimentally among vulnerable populations (Cheesman, Reference Cheesman2022b).

3 Chokepoint Power: How Controlling Payment Infrastructure Controls Users’ Lives

The systems that allow us to get paid, like many other critical infrastructures, are largely invisible until they stop working (Star, Reference Star1999; Edwards, Reference Edwards, Misa, Brey and Feenberg2003). And when those systems stop working, it often comes as an account that is frozen without warning, perhaps for opaque reasons. Users may have little recourse, and the consequences of an account freeze can be severe.

In response to the 2008 financial crisis, the US Department of Justice and the Financial Fraud Enforcement Task Force launched Operation Choke Point. The name of the project is notable: The task force had the power to constrain merchants’ ability to get paid, targeting fraudulent institutions by “choking them off from the very air they need to survive” (Zibell and Kendall, Reference Zibell and Kendall2013). To fully participate in a transactional community – to be a “citizen” of that community – you need unobstructed access to a system of payment, because a system that can suddenly cut you off is more dangerous than not having access at all.

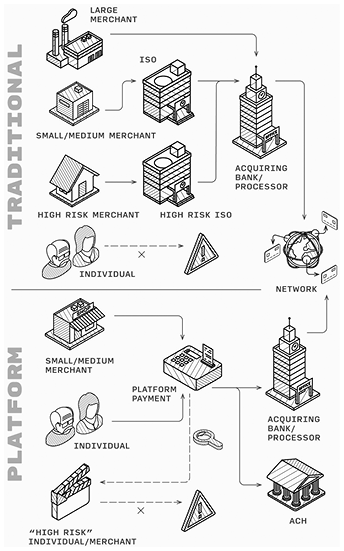

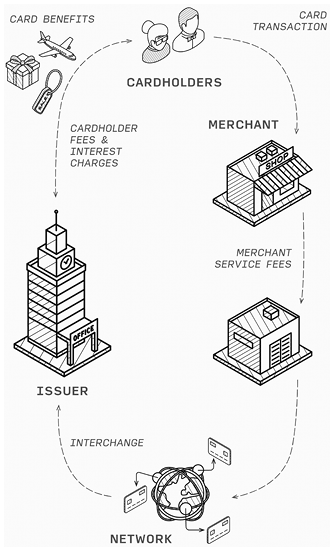

In recent decades, the business of getting paid has been changing in critical ways. In the United States, for example, payment acquisition systems are shifting from traditional independent sales organizations or ISOs (middlemen organizations that serve as payment service wholesalers), to tech startups looking to disrupt the payments system (see Figures 24.1 and 24.2). Payment cards were originally designed for an economy in which the line between buyers and sellers was clear; modern payments companies facilitate peer-to-peer payments in a geographically dispersed communication system.

Figure 24.1 Traditional and platform models of how payments are acquired.

Figure 24.2 The communication of a card payment.

In the 1990s, an emerging set of payment service providers (PSPs) overlaid new systems on existing infrastructure, bridging old and new technologies and policies (some more successfully than others). The first of these providers, and likely still the most successful, was PayPal, which created parity between users. Its primary innovation was to bypass the old payment acquisition system by keeping money in a closed loop on its platform for as long as possible. This has become the predominant model for PSPs coming out of the tech sector, such as WePay, Square, Venmo (now owned by PayPal), and most of the embedded social media payment systems, such as Facebook Messenger Payments.

However, in the midst of this shift, the way that payment providers manage risk has also changed, in ways that do not benefit – and indeed, can imperil – consumers. This is a shift in what sociologists call “riskwork” – how risk is imagined and managed – that can lead to payment shutoffs for vulnerable users. Managing payments means managing risk, and managing risk is inherently political.

In the traditional ISO model, issuers represent the interests of cardholders, while acquirers represent the interest of merchants and there is a marketplace for payments in high-risk industries. In contrast, within the new payments model, the PSP’s client is the platform, not the parties who are transacting. Risk is managed, not through a marketplace model, but a standard tech-industry mechanism: the terms of service (TOS) agreement, which users must agree to (but don’t usually read) when they sign up for an account, TOS agreements can change at any time. and there is no compelling interest for tech companies to find a way to manage risk when they can simply ban any transactions they deem “too risky.”

As is common in the realm of social media, these peer-to-peer payment systems use surveillance and automation to enforce TOS agreements and mitigate risk. Surveillance scholars have noted that the power of surveillance extends beyond watching to identifying, classifying, and assessing (Gandy, Reference Gandy1993; Lyon, Reference Lyon2002), making surveillance a form of “social sorting.” As Fourcade and Healy point out, the “classification situations” produced by the wrangling of “big data” are “presented, and experienced, as moral-ized systems of opportunities and just deserts.” They “have learned to ‘see’ in a new way and are teaching us to see ourselves that way, too” (2017, p. 10).

Although the tech industry could, theoretically, develop systems that profit from varied appetites for risk, like traditional ISOs, there has instead been a shift toward probabilistic modeling and monitoring, using machine learning to monitor users’ social media presence to flag “high-risk” transactions and ban them.

But this gives rise to a variety of mistakes, like bans on users who tag a Venmo purchase “Cuban” for a sandwich, or playfully use a bomb emoji. Predictive analytics systems are always experimental and designed to live in “perpetual beta,” in which products are “developed in the open, with new features slipstreamed in on a monthly, weekly, or even daily basis” (O’Reilly, 2005). This makes it even harder for users to predict what might earn them an account freeze.

To make things more confusing for users – and more perilous for users with fewer resources – TOS agreements tend to be unevenly enforced. As the internet researcher Tarleton Gillespie (Reference Gillespie2018) points out, platforms of all kinds routinely make seemingly arbitrary calls about what does and does not violate TOS. For banned users, often their only form of recourse is a byzantine and ineffective process, while, in the meantime, they have lost access to their stored funds, as well as to the transactional community of the platform.

This has been notably true for sex workers. As of 2018, the sex-worker activist Liara Roux has collected dozens of examples of discrimination against sex workers by financial services companies (Lake and Roux, Reference Lake and Roux2018; see also Blue, Reference Blue2015). Legislation and policies intended to reduce human trafficking also constrain sex workers, denying them access to the websites they use to work and make a living (Blunt and Wolf, Reference Blunt and Wolf2020).

We still haven’t created payment infrastructures that move at the pace of our modern world but maintain all of the key affordances of cash. Cash is anti-surveillant, self-clearing, immediate, and reliable (O’Brien, Reference O’Brien2017; Scott, Reference Scott2022). But the most vulnerable are often forced to choose between payment channels that are unreliable or totally inappropriate for the digital nature of their work. We are still not getting payments right – not for everyone, and not all of the time.

4 Money (and Everything Else): Increasingly Private, Segregated, Siloed

In recent decades, the card-issuing business in the United States has become increasingly competitive and stratified, producing niche transactional identities. Although payment card products are mandated to look similar and use the same infrastructure, they are imbricated in different infrastructural, economic, and discursive assemblages (see Deville, Reference Deville, Gabrys, Hawkins and Michael2013; Gießmann, Reference Gießmann2018). Some cards pay users back; others charge usage fees. Some are more expensive than others for merchants to accept. The architecture of the modern card network is marked by hierarchy, difference, and communication.

Merchants agree to pay slightly more in interchange fees to receive payment from rewards cards and other luxury credit cards designed for the most “desirable” consumers than they do from standard cards. But because merchants then increase their costs to account for interchange, some consumer advocates argue that customers wind up paying for their own – or other people’s – rewards (see, e.g., Schuh, Shy, and Stavins, Reference Schuh, Shy and Stavins2010). As Maurer (Reference Maurer2012b) has pointed out, this system doesn’t exactly fit the picture of the capitalist economy; it is a rare situation where competition among issuers for the “best customers” drives prices up for everyone.

Universally accepted payment cards are relatively new (see Swartz and Stearns, Reference Swartz, Stearns, Nelms and Peterson2019; Swartz, Reference Swartz2020). The earliest precursor to credit cards, Charga-Plates, emerged in the 1930s. Resembling dog tags, these metal rectangles could be used by department stores to quickly imprint a customer’s account information on a payment slip.

By the 1950s, the Diners Club charge card had emerged as the first universal third-party payment card in the US, although it did not give customers access to credit, and in fact preceded the first credit card by at least fifteen years. The club functioned like a membership organization, offering a range of services beyond credit. Merchants paid a fee to be able to accept Diners Club card payments (a closed-loop system), but were assured by the organization that these members would likely spend. Indeed, having a Diners Club card was seen as a ticket to an elite group who had access to “country club style billing” or receiving a folio bill (Sutton, Reference Sutton1958). By the end of the 1960s, these elite customers were flocking to American Express, another closed-loop charge card. An AmEx card was initially difficult to get, and the company made a name for itself over the next several decades as a product for the elite, conferring privileges and status (Grossman, Reference Grossman1987).

In the late 1960s, beginning with Bank of America’s BankAmericard, banks began to issue payment cards linked to consumer credit accounts (Evans and Schmalensee, Reference Evans and Schmalensee2001). These credit cards, unlike Diners Club and American Express, were easy for bank customers to access; even with poor credit, most Americans could be approved for some kind of credit card (Nocera, Reference Nocera1994), which meant that paying by card was no longer reserved for elite customers. The BankAmericard network was eventually licensed to other banks and became the Visa Network, an open-loop system that acted as an intermediary among a variety of banks, merchants, and cardholders. As the historian of technology David L. Stearns (Reference Stearns2011) explains, opening the loop – making it possible to pay across banks, card types, and indeed transactional identity classes – was the key innovation of the bank card system.

When regulations against interstate banking loosened, beginning in 1978, banks in open-loop networks started to issue credit cards on a national level, competing for customers on a much wider geographical scale. By the early 2000s, the payment card market had become differentiated enough to create a wide range of stratified transactional identities – from “ultrapremium” cards for wealthy (or at least choosy) consumers, to small-business credit cards, debit cards, secured credit cards for those with poor credit, and prepaid cards for consumers who were unbanked or underbanked.

Just as payment methods have become increasingly stratified, so too have our visions of the future of money. A variety of scholars, activists, and entrepreneurs have described futures in which money is digital and issued by nongovernment entities (Maurer, Reference Maurer2005; Brunton, Reference Brunton2019). In the wake of the 2008 financial crisis, many people were eager to try anything other than money as usual (Maurer, Reference Maurer2011).

One of these imagined futures is cryptocurrency. Beginning with Bitcoin, first theorized in 2008, these digital currencies intentionally create new transactional communities, rethinking the value, identity, space, time, and politics of money. Designed to be a kind of “digital gold,” Bitcoin took hold of the public imagination as a kind of “Magic Internet Money,” backed not by the government but by cryptographic scarcity, able to move at the speed of the Internet without the drawbacks of traditional payment systems like fees and surveillance (Maurer, Nelms, and Swartz, Reference Maurer, Nelms and Swartz2013; Swartz, Reference Swartz and Castells2017). Bitcoin has been joined by thousands of other cryptocurrencies, few of which have ever been accepted by vendors, but all of which are ways to reimagine nongovernment-issued money, which might outcompete and outlast state-issued currency (Swartz, Reference Swartz2018; Brunton, Reference Brunton2019).

The future of money might also look something like corporate currency, a reality that is already playing out in the forms of rewards programs and social media payments. Starbucks, for example, now issues something that hews very close to a private digital currency: Starbucks Rewards, a loyalty program in which members can earn “stars” for purchases and can load and reload funds on Starbucks gift cards for perks. As of 2023, the program had 30.4 million members and funds loaded on cards had reached US$3.3 billion (Starbucks, 2023).

Facebook has also dabbled in creating a corporate currency, first with the announcement in 2019 of Libra, envisioned as a universal, global digital currency: a one-world money. Rather than being niche and segmented, Libra was described as connecting users across currencies and payment systems. Unlike cryptocurrencies, Libra’s design involved large corporations managing its monetary policy and infrastructure. Although the project was eventually shut down, in 2019 Facebook also announced the launch of Facebook Pay (now Meta Pay), which integrated payments with the company’s suite of social media products.

Some new forms of currency seek to be more universally accessible, but whether they will be able to achieve this is uncertain. Central bank digital currencies (CBDC) are currently being “explored” by many of the world’s central banks. While designs for these currencies vary widely, they are by definition a liability of the central bank, accessible to the public. However, since central banks do not have the digital infrastructure to provide financial services directly to consumers, these currencies must be intermediated, and the questions of by whom and how are crucial. If CBDC are to be truly accessible, rather than replicating existing systems that lock some consumers out, they must be very carefully designed (Narula, Swartz, and Frizzo-Barker, Reference Narula, Swartz and Frizzo-Barker2023; see also Swartz and Westermeier, Reference Swartz and Westermeier2023).

The future of payment infrastructures seems increasingly stratified. Customers who are members of loyalty programs or who carry “ultrapremium” cards often have access to a differentiated experience, with a separate customer service portal, lavish treatment, and even different physical spaces within a hotel or sports arena. The flipside is true for shoppers using state benefits cards, who can only buy certain foods at the grocery store. Technology and culture scholar Nathaniel Tkacz (Reference Tkacz2019) argues that payment apps compete on the basis of offering not just payment but, perhaps more importantly, “experience” of the world. He explains that such “experience money” takes up ordinary transactions and “deliberately infuse[s]” them “with a coherent value proposition” (p. 277).

As our money becomes more plural, so too do our transactional identities. We may find ourselves using multiple monies, bouncing between different payment infrastructures, and thus oscillating in and out of a variety of transactional identities (Maurer, Reference Maurer2005, p. 13). We don’t know the shape of tomorrow’s transaction media: What is emerging is social media money: private, surveilled, and data-driven. Some new money forms are hierarchical and segmented; others are universal. It is likely that we will be asked to trust corporations with our money and our data and our ability to get paid. The segmentation of these money forms means that you could be living in a separate transactional community than the person sitting next to you, while their plurality means that we will be constantly shifting between different communities and different forms of money.

And it is worth noting that some marginalized communities are experimenting with cryptocurrency to express resistance to the imposition of colonial economics, even though most cryptocurrency projects ultimately fail (Cordes, Reference Cordes2022).

5 The “Social” Future of Payments

Venmo users with public feeds broadcast a lot of personal information without realizing it. Friends can watch each other meet cute, fall in love, and break up in the course of a few months’ transactions. See, for example, the 2017 art project by Han Thi Duc, Public By Default, which finds poignant stories in the Venmo lives of others.

But Venmo can also be used to conduct social experiments, like the one that unfolded in June 2020, as the USA convulsed with anger over the killing of George Floyd, a Black man, at the hands of White police officers. As tensions simmered, a handful of people, separately, in diverse geographic locations, began to experiment with a kind of informal reparations: peer-to-peer payments to Black people, either friends or strangers.

In Vermont, activists Moirha Smith and Jas Wheeler crowdsourced a list of Black people’s Cash App and Venmo accounts, titled “Wealth Redistribution for Black People in Vermont,” and posted it on Facebook. The accompanying “Letter to White People” noted that “one of the easiest … ways to support Black life, Black joy, Black safety, Black community is to give your money to Black people.” The list ultimately grew to over 300 names, and its organizers estimate that $65,000 was transferred in varying amounts.

Recipients reported that they felt weird about getting money from strangers, but did appreciate the funds (NPR, 2021). Meanwhile, a few Black people in other parts of the USA began to receive notifications that White friends and acquaintances had sent them small amounts of money, presumably as a form of reparation – but without any kind of organized campaign. These transfers tended to be small amounts of money, and recipients said they found them baffling and insulting (Gimlet, 2020).

Just as people are always finding new ways to communicate, we are also finding new ways to pay. Money is inherently social and new forms of sociality will necessarily be reflected in our payment systems. New money technologies, then, will offer an opportunity to make new kinds of transactional communities and also to make mistakes, forging a messy path toward an unknowable payments future.