Introduction

In Europe, charitable giving and its role in financing the public good have gained increased attention in recent years. In times of tense public budgets and welfare state retrenchment, governments all over Western Europe have become more interested in philanthropy as an alternative source for funding the welfare state under pressure (e.g. Bonoli et al. Reference Bonoli, George and Taylor-Gooby2000; European Commission 2013; Starke Reference Starke2008), going along with claims for a rise in private responsibility for the social cause (Harrow and Jung Reference Harrow and Jung2011; Villadsen Reference Villadsen2011). In some Western countries philanthropy already is an important pillar for funding public goods; in others, however, private giving plays a rather minor role. These distinctions are displayed when looking at individual rates of giving between nations. On top is the Netherlands with about 80 % of the Dutch making charitable donations, while only around 19 % of those living in Spain donate to non-profit organizations (European Commission 2012). Apart from that, another issue is striking as well: the preferred types of non-profit organizations people donate to diverge largely between countries. Whereas in the Netherlands, for example, almost 40 % of the adult population give to international organizations, only 4 % of people in Italy do so. This huge cross-country variation, which is apparent in data from Eurobarometer, but also in the European Value Survey and the Gallup World Poll (Bekkers Reference Bekkers, Harrow, Jung and Phillips2016), leads to the obvious question why people’s giving behaviour differs that much between nations and how the focus on distinct charitable causes in various nations can be explained.

Up to now, very little is known with regard to cross-national differences in charitable giving. The large majority of research on donations has addressed determinants of giving behaviour on the individual level (for an overview see Bekkers and Wiepking Reference Bekkers and Wiepking2011a, Reference Bekkers and Wiepkingb; Wiepking and Bekkers Reference Wiepking and Bekkers2012).

Even though studies that have focused on contextual factors such as the role of public funding (e.g. Brooks, Reference Brooks2004) do exist, the empirical research available has several limits. First and most notably, the large majority of studies on the impact of public funding on private donations, especially the crowding-out effect, refer to data from the US (de Wit and Bekkers Reference de Wit and Bekkers2014, p. 16). Thus, there is little knowledge on what this effect is like in the European (welfare state) context, although there is reason to assume that it is different for countries other than the US (de Wit and Bekkers Reference de Wit and Bekkers2014, p. 6). Second, empirical studies mostly focus on the non-profit sector as a whole, not discriminating for the various activities of non-profits within the sector. This is due to the fact that data often stem either from individuals’ income tax returns or expenditure surveys which do not necessarily include information about the type of charity for which a donation is reported. Due to this lack of information government support towards charitable subsectors cannot be matched with the donations for these causes. There is, however, reason to assume that government expenditure affects private donations to different types of non-profit organizations differently (Brooks Reference Brooks2004, p. 173; Payne Reference Payne1998, p. 332). A third limit of previous empirical research is the lack of cross-country comparisons (Bekkers Reference Bekkers, Harrow, Jung and Phillips2016). With the exception of the contribution of Gesthuizen et al. (Reference Gesthuizen, Meer and Scheepers2008) and Sokolowski (Reference Sokolowski2013), the relation between private giving and public funding of services delivered by non-profits so far has been tested within single countries only.

Against this backdrop, this study seeks to provide explanations for cross-national variations in private giving to specific charitable subsectors across Europe, particularly, on the question of how national welfare state policies are associated with private philanthropy. We make use of data on people’s inclination to donate from 23 European countries included in the 62.2 Eurobarometer survey from 2004. In analysing the interplay between governmental welfare and private philanthropy, we draw on two theoretical approaches: On the one hand we reinvestigate the well-known assumption that generous public expenditure “crowds-out” private philanthropy. On the other hand, we analyse whether a country’s relation between the government and the non-profit sector regarding the provision and the funding of welfare services affects charitable giving. We test the hypotheses drawn from these two strands of research by looking at donations to two specific causes: giving to non-profit organizations active in the field of social services providing mainly domestic welfare services on the one hand, and giving to non-profit organizations which focus on activities that are more outside the scope of (domestic) welfare state activity, namely international aid organizations.

Theories and Hypotheses on Determinants of Giving to Charitable Causes

In explaining differences in individiuals’ giving behaviour between nations we look for theories concerned with the relation between governments, non-profit organizations and individual donors. The crowding-out theory is an obvious starting point focusing on the question how government expenditure shapes charitable giving. Alternatively, we want to take a somewhat broader view that does not only consider the funding, but also the production of services, and therefore refer to the so-called “mixed economy of welfare”.

Non-profits’ Revenues from Government: The Crowding-Out Approach

Whether and how government grants to charitable organizations have a bearing on private donations is one of the most extensively discussed questions in public economics (Andreoni and Payne Reference Andreoni and Payne2011, p. 334). The prevailing assumption suggests that public expenditure, typically in the form of government grants, ‘crowd out’ private philanthropy (Brooks Reference Brooks2004, p. 168). Consequently, an increase in government grants may persuade donors to decrease their own contribution—and vice versa. The basic mechanism behind this so-called crowding-out effect is that donors treat their voluntary donations as substitutes for their contributions through taxation. Under some strong assumptions (e.g. donors are purely altruistic, motivated to give because they care about the well-being of the recipients and therefore the total provision of a charitable good) donors lower their contributions by the full amount by which others increase them (Andreoni and Payne Reference Andreoni and Payne2011, p. 334; Bekkers Reference Bekkers, Harrow, Jung and Phillips2016, p. 16). That is, an increase in government funding by one euro decreases private donations by one euro (Payne Reference Payne1998, p. 324).

In addition to the above-described mechanism, the crowding-out literature also proposes further reasons why public funds and donations are negatively correlated. Brooks (Reference Brooks2004, p. 172) argues that donors hesitate to make donations to organizations receiving public subsidies since public support makes them look less economically viable. Other authors claim that non-profits reduce their fundraising effort when receiving public support, resulting in fewer donations (Andreoni and Payne Reference Andreoni and Payne2011; Khanna and Sandler Reference Khanna and Sandler2000, p. 1545). Thus, governmental support does not only influence individual giving behaviour, but also non-profit behaviour.

Empirically, the crowding-out assumption has repeatedly been investigated (Payne Reference Payne1998, p. 324), with most of the research focusing on testing the hypothesis within a specific country (Bekkers Reference Bekkers, Harrow, Jung and Phillips2016). The results are rather mixed (for an overview, see the meta-analysis by de Wit and Bekkers Reference de Wit and Bekkers2014). The majority of prior studies find that there is some form of incomplete crowding-out, meaning that a dollar of public grants crowds-out donations by between 0.05 and 0.35 dollars (Brooks Reference Brooks2004, p. 173). The effect is shown to be stronger in laboratory experiments than in survey data, in addition, it is found to be stronger in the US than in Europe (de Wit and Bekkers Reference de Wit and Bekkers2014). Some studies find no significant relationship between government funding and private giving (Brooks Reference Brooks1999), and other studies find a crowding-in effect, i.e. that the level of government grants is positively correlated with private donations (Andreoni and Payne Reference Andreoni and Payne2011; Boberg-Fazlić and Sharp Reference Boberg-Fazlić and Sharp2015; Hughes and Luksetich Reference Hughes and Luksetich1999; Payne Reference Payne1998). This latter interrelation is explained by increased trustworthiness and reputation of a non-profit organization when receiving government funds. In addition, non-profits gain scaling advantages in their operations due to government support, which might motivate donors because their contributions become more effective (Anheier and Toepler Reference Anheier, Toepler, Anheier and Toepler1999; Khanna and Sandler Reference Khanna and Sandler2000, p. 1544; Rose-Ackerman Reference Rose-Ackerman and White1981). Moreover, some studies even find a curvilinear relationship, where low levels of government contributions encourage, but high levels discourage donations (Borgonovi Reference Borgonovi2006; Nikolova Reference Nikolova2015).

Considering the existing research, and given the gaps in empirical studies outlined above, we examine three hypotheses on the crowding-out effect in this paper. Hypotheses 1a and 1b propose that when government spending towards a certain cause is higher, charitable giving to this cause is lower. We take giving to non-profits active in the field of social aid as the first category, a cause in the core of welfare states. The second category we use is giving to international aid organizations, something that is outside the scope of the welfare state, particularly when referring to the European System of Integrated Social Protection Statistics (ESSPROS) in defining the “core” of a welfare state .Footnote 1 In addition, and this refers to hypothesis 1c, we assume some kind of crosswise crowding-in also called philanthropic flight (cf Sokolowski Reference Sokolowski2013). We hypothesize that public support to non-profits active in core-welfare fields such as social services increases donations for other, non-core welfare fields. This is due to the fact that people, when knowing that public funding covers core-welfare fields, may not necessarily reduce giving in total, but instead donate more to other, non-core welfare issues (Vamstad and von Essen Reference Vamstad and von Essen2013). The mechanism behind this crosswise effect is that public commitment does not dampen private initiatives per se, but shifts or, more precisely, structures civic engagement within the non-profit sector.

Non-profits’ Funding Structure in a Country’s Mixed Economy of Welfare

The literature on the ‘mixed economy of welfare’ points out that in providing welfare to a society, different institutional sectors are involved. Depending on the given welfare mix in a country, each of these sectors, the public, the for-profit, the non-profit and the informal (care) sector have different roles in both the delivery and funding of welfare services (see e.g. Powell Reference Powell2007; Ranci Reference Ranci, Ascoli and Ranci2002), including private charitable giving (Salamon and Anheier Reference Salamon and Anheier1998). This approach is used as an alternative to the crowding-out theory, taking the role of non-profit organizations, of governments and of individuals giving into account more broadly.

The evolution of different shapes of welfare states is determined by past political and economic struggles between social classes, as Moore (Reference Moore1966) and Esping-Andersen (Reference Esping-Andersen1990) have found in their pivotal works. Most notably, the power relations between the various classes (Rueschemeyer et al. Reference Rueschemeyer, Stephens and Stephens1992), the landed elites, rural peasantry, urban middleclass, and the state (Salamon and Anheier Reference Salamon and Anheier1998, p. 227; Smith and Gronbjerg Reference Smith, Gronbjerg, Powell and Steinberg2006, p. 234) have defined present welfare structures. To give an example, in countries with a strong urban middleclass, little aristocratic and thus little governmental power, a rather liberal and market-dominant regime has emerged (Esping-Andersen Reference Esping-Andersen1990). Other theoretical approaches that stress the importance of power relationships for forming present welfare states are historical institutionalism (Kerlin Reference Kerlin2013, p. 87) and the social origins theory (Salamon and Anheier Reference Salamon and Anheier1998, p. 226).

Various authors have sought to capture the international variations of the mixed economies of welfare empirically. Typically, they have created typologies and sorted the countries of study into categories. Esping-Andersen’s prominent “three worlds of welfare capitalism” (Reference Esping-Andersen1990) describes central institutions in the structure of the welfare system, which is the state in the social-democratic regime, the family in the corporatist regime, and the market in the liberal regime. This typology has ever since experienced expansions and also evoked much critique (for an overview see e.g. Arts and Gelissen Reference Arts and Gelissen2002; Gough Reference Gough and Kennett2013), since it fails to include the aspect of welfare service delivery and the role of non-profit providers, to name but a few. Extensions that are relevant for our research come from Alber (Reference Alber1995), Anttonen and Sipilä (Reference Anttonen and Sipilä1996), Ranci (Reference Ranci, Ascoli and Ranci2002) as well as Salamon and Anheier (Reference Salamon and Anheier1998). They draw attention to social care services and discuss the provider mix within these care systems. Both Ranci (Reference Ranci, Ascoli and Ranci2002, p. 35f.) as well as Salamon and Anheier (Reference Salamon and Anheier1998) focus on the role of the non-profit sector in the provision of social care and on the degree of state funding. They describe four different models and although the authors use different labels, the two typologies are similar with regards to content.

Salamon and Anheier (Reference Salamon and Anheier1998, p. 228) stick to the denomination of Esping-Andersen’s typology. They describe a first non-profit regime, the social-democratic one (e.g. Sweden), that is characterized by an extensive provision of social services, provided and sponsored by the state. This governmental takeover of social welfare services brings along a diminished social service role of non-profits. The size of the non-profit sector, measured by the share of employees working in non-profits, is quite small (Salamon and Anheier Reference Salamon and Anheier1998, p. 228), and its activities mostly lie outside the scope of the welfare state, such as international aid, recreation, sports, or advocacy. In contrast, in countries of the liberal non-profit regime (e.g. United Kingdom), low levels of government social welfare spending are accompanied with a rather large non-profit sector. Since liberal rights are more important than social rights (cf. Vamstad and von Essen Reference Vamstad and von Essen2013, p. 5), people cannot rely on public goods provided by the government. Thus, social services are predominately provided by non-profits, which themselves rely on private giving to a larger extent. Countries belonging to the third, the corporatist non-profit regime or welfare partnership (e.g. Germany) usually have a large, mainly government funded non-profit sector, which is the main provider of social services. This is the case due to government reliance on the non-profit sector for implementing its sizeable welfare state policies (Salamon and Anheier Reference Salamon and Anheier1998, p. 228). In the fourth model, labelled statist regime (Salamon and Anheier Reference Salamon and Anheier1998, p. 228) both welfare spending and the non-profit sector are small. We find a diverse range of countries assigned to this category and for that reason it has been criticized as not being one homogeneous group of “statist countries”. Instead, the non-profit sector in these countries is in a transition period with still developing state-non-profit relations (Einolf Reference Einolf, Wiepking and Handy2015, p. 520).

Due to the wide range of countries in this latter category, we split it into two separate ones: Mediterranean and Eastern European countries. In the former model the family and the informal sector have a very strong role in providing welfare services (Bonoli Reference Bonoli1997; Ferrera Reference Ferrera1996; Leibfried Reference Leibfried, Ferge and Kolberg1992). The non-profit sector plays a comparatively smaller role; it has often developed fairly recently because dictatorship prevented its development. In these countries, non-profit organizations are particularly active in the field of social services and education, and private donations are important (Einolf Reference Einolf, Wiepking and Handy2015). The Eastern European model consists of post-communist countries, and can be described as a category where the state had a strong role in social policy making, with little space left for non-profit activity in core-welfare activities. The formal non-profit sector in these countries is rather small and organizations are predominately active in culture and recreation (Salamon and Sokolowski Reference Salamon and Sokolowski2004, p. 298). Therefore giving to social causes is expected to be very low.

In our study we argue that the individual’s choice to give and to which cause to give is partly determined by the role of the non-profit sector within a welfare state and its funding (Salamon and Sokolowksi 2010, cited in Kerlin Reference Kerlin2013, p. 93). Put differently, if there are no (or hardly any) non-profit organizations providing social services, because the public sector provides and funds these services within a particular welfare state, individuals will not be very likely to donate to this specific cause in this regime.

Therefore, we expect that charitable giving differs across the various welfare regime types in Europe. We follow the categorisation of countries into regimes and use the above-described typology referring to “different types of state-nonprofit relationships” (Salamon and Anheier Reference Salamon and Anheier1998, p. 228). Following this, hypothesis 2a suggests that charitable giving to social causes is most common in countries belonging to the liberal model, moderately important in corporatist countries, and less common in countries belonging to the social-democratic regime and the Mediterranean regime. In the Eastern European regime donations to social causes are expected to be least common, because these have been provided by the public sector for a long time. The implications for the inclination to give to international aid organizations, however, follow a different pattern, as hypothesis 2b presumes: We expect the highest probability of philanthropic support for international aid activities in countries of the social-democratic non-profit model. In these countries giving to social services is expected to be very low, since people rather donate to causes outside the scope of the welfare state, such as international relief (cf. Sokolowski Reference Sokolowski2013). The hypothesized rank order is followed by the corporatist and liberal regimes, where non-profit provision of core-welfare services depends on philanthropic funds to a larger degree leaving less space for donations to international aid. The rank order is completed by the Mediterranean and Eastern European regimes.

Data and Method

For the empirical study we combine two different data sources. On the one hand, we utilize data on 23 countries from the 62.2 Eurobarometer survey, referring to 2004 (European Commission 2012). We make use of individual-level data containing information on people’s inclination to donate to a specific cause. Taking into account all common method biases in giving research (see for example Hall Reference Hall2001; Rooney et al. Reference Rooney, Steinberg and Schervish2001, Reference Rooney, Steinberg and Schervish2004; Wilhelm Reference Wilhelm2007), the Eurobarometer 62.2 survey seems to be by far the best data source of cross-national data on private giving to various charitable targets we have at the moment (Bekkers Reference Bekkers, Harrow, Jung and Phillips2016).

On the other hand, we use country-level information regarding public expenditure on social protection and official development assistance (ODA) available for 23 European welfare states from Eurostat, also referring to the year 2004. The countries included in our analyses are: Austria, Belgium, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, the Netherlands, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden and the United Kingdom. In total, our sample includes 23,999 individuals.

Estimation Method

In order to account for the data’s nested structure (individuals in countries), we follow Bryan and Jenkins (Reference Bryan and Jenkins2015) and use a two-step method. Usually, multi-level modelling is applied for analysing the potential influence of country-level variables on individual-level outcomes. Especially when variables on the country level are in the centre of interest, multi-level models with random effects (RE) are often employed for cross-country analyses. However, given the structure of the dataset in use (i.e. a high number of observations on the individual level, and a small number—in our case 23—of second level cases) using RE can lead to imprecise estimates, risking that one concludes “too often that a country effect exists when it does not” (Bryan and Jenkins Reference Bryan and Jenkins2015, p. 18). Therefore, we do not only follow the suggestions of Bryan and Jenkins by applying a two-step approach, but also use “less formal descriptive methods such as exploratory data analysis including graphs” (Bryan and Jenkins Reference Bryan and Jenkins2013, p. 11)Footnote 2

We start by estimating two different logit regressions in the first step including explanatory variables on the individual level and a fixed effect on the country level. In the second step the country-level intercepts from the first step serve as the dependent variable, and the country-level variables of interest serve as the independent variables in order to explain cross-country differences.

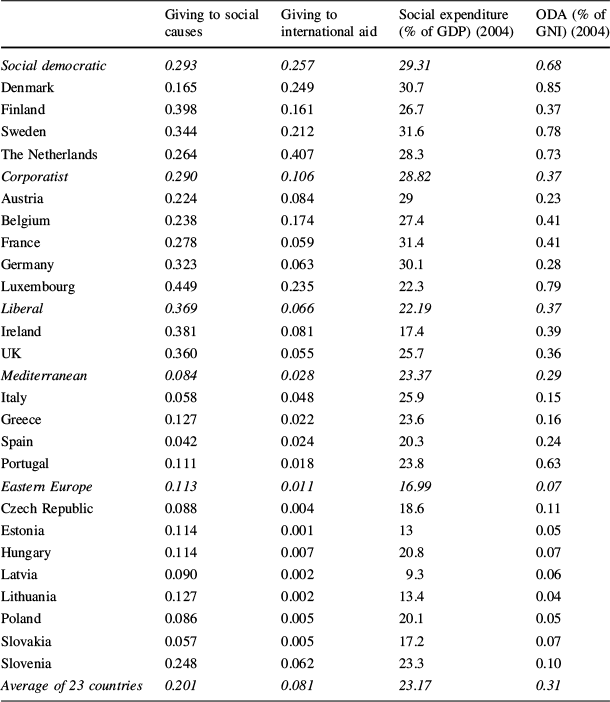

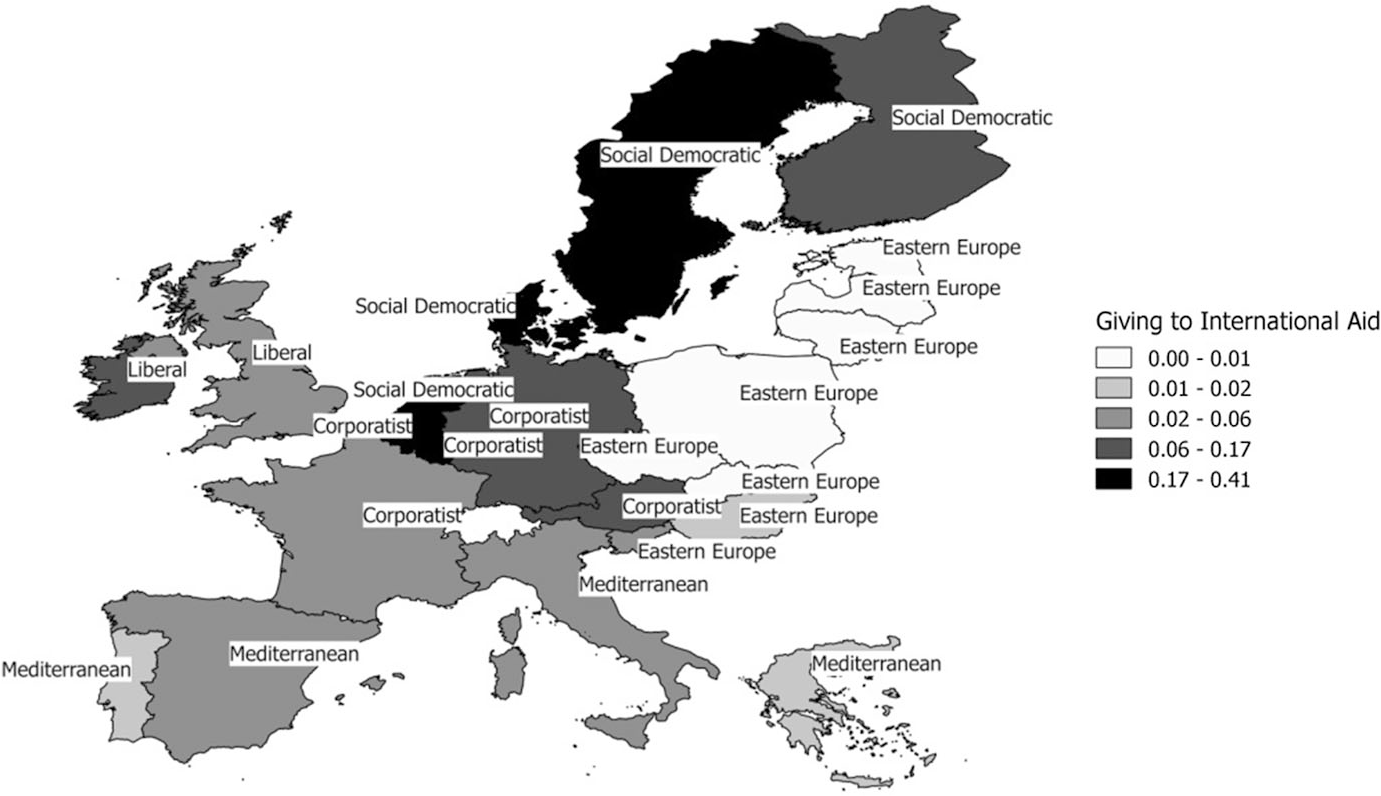

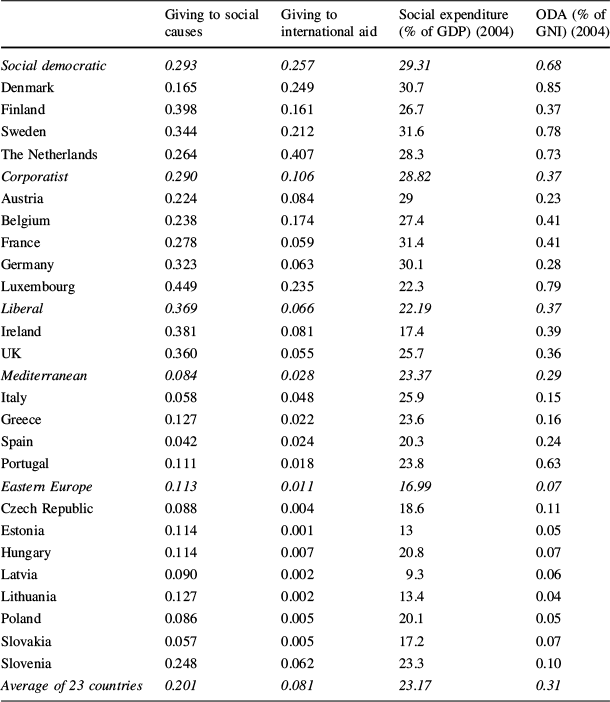

There are two dichotomous dependent variables in the first step of our analyses, all of them referring to people’s inclination to make donations. For this, we use two different categories specified in the Eurobarometer questionnaire: The first logit regression looks at the probability of whether a person has donated to “a charity organisation or social aid organisation” (further called “donation to social causes”) or not. The second logit regression focuses on the probability of a person having given to causes that lie outside the scope of the welfare state. In particular, we look at whether a person has donated money to “an international organisation such as development aid organisation or human rights organisation” (further called “donation to international aid”). On average, about 20 % of all individuals included in the survey donated to social service organizations and approximately eight per cent to international aid organisztions. Figures 1 and 2 depict the variation of giving levels for the two variables in use. Data indicates that giving behaviour hugely varies between the 23 countries. Moreover, we see that in many countries giving to social causes is more widespread than giving to international aid organizations. Exact figures can be found in Table 6 of the Appendix.

Fig. 1 Variation of giving levels to social causes across Europe

Fig. 2 Variation of giving levels to international aid across Europe

Explanatory Variables on the Country Level

As mentioned above, variables on the country level are used in the second step of our analyses in order to explain differences in giving behaviour between various welfare states. Firstly, for testing the crowding-out hypotheses 1a to 1c we use country information from Eurostat. For testing hypothesis 1a we use expenditure on social protection in percentage of GDP taken for the year 2004 for the various countries. For testing hypothesis 1b, expenditure on official development assistance given as a share of GNI taken for the year 2004 is used. The former variable is also applied in the analysis for hypothesis 1c. Figures for the two country-level variables can be found in Table 6 of the Appendix. For both variables, we find large differences between the countries. Countries of the social-democratic and corporatist regimes show the highest rates in both categories, whereas Eastern European countries have the lowest rates.

Secondly, to test for differences in philanthropic giving across various non-profit regimes (hypotheses 2a and 2b), we include regime dummies in the model. The liberal regime consists of the UK and Ireland and serves as the reference group. The social-democratic regime comprises Denmark, Finland, the Netherlands, and Sweden. The Netherlands are often regarded as a hybrid welfare state, having features of both the corporate and the social-democratic system (Wildeboer Schut et al. Reference Wildeboer Schut, Vrooman and de Beer2001). In existing studies the categorization of the Netherlands is therefore mixed. We decided to place the Netherlands within the social-democratic regime following Scheepers and Grotenhuis (Reference Scheepers and Grotenhuis2005), Wiepking and Bekkers (Reference Wiepking, Bekkers, Wiepking and Handy2015) as well as Muffels and Fouarge (Reference Muffels and Fouarge2004), who point out that the Netherlands have experienced a policy shift towards the social-democratic regime.Footnote 3 The corporate regime includes Austria, Belgium, France, Germany and Luxembourg. Greece, Italy, Spain and Portugal fall into the Mediterranean regime while the Eastern European regime consists of the Czech Republic, Estonia, Hungary, Lithuania, Latvia, Poland, Slovenia and Slovakia (cf.van Oorschot and Arts Reference van Oorschot and Arts2005, p. 12).Footnote 4

In order to check for robustness of the results, we include the logarithm of GDP to the second level estimations. GDP serves as an indicator for wealth and economic stability, both being important factors influencing the decision to donate. At the same time, however, it is necessary to note that GDP and the two other variables on the country level are not completely independent. There are a number of other variables that are known to help explain giving behaviour on a country level such as income inequality, educational expansion, generalized trust, or religion (Bekkers Reference Bekkers, Harrow, Jung and Phillips2016; Bekkers and Wiepking Reference Bekkers and Wiepking2011a, Reference Bekkers and Wiepkingb; Gesthuizen et al. Reference Gesthuizen, Meer and Scheepers2008). In order to check for a potential omitted variable bias, we also include these country-level variables in alternative models. Due to the low number of countries in the second step of the estimation we include them one by one and find that our results remain stable after addition of these variables. These results are available in the supplemental material (Tables B12–B14) .

Control Variables on the Individual Level

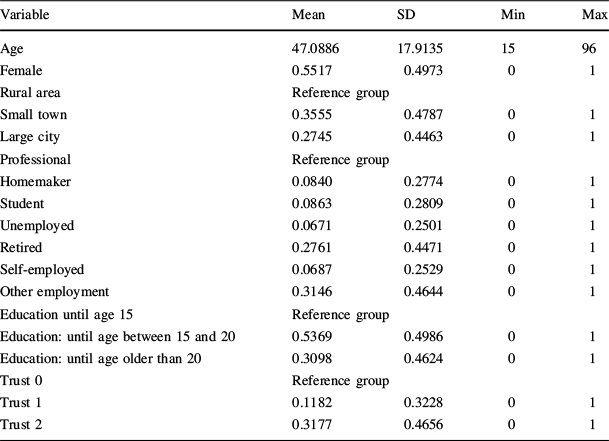

On the individual level we control for a number of characteristics known to influence charitable behaviour (see for example Bekkers and Wiepking Reference Bekkers and Wiepking2011b; Wiepking and Bekkers Reference Wiepking and Bekkers2012): Regarding socio-demographics we insert a dichotomous variable indicating whether the respondent is female or not and add the age in years (see Table 1). The level of urbanization is taken into account because studies show that people living in rather rural areas are more likely to donate (Bekkers Reference Bekkers2006, p. 350f). We control for this effect with three dummies, referring to rural areas or villages, to middle sized towns, and to large towns. Occupational status is measured by seven dummies with employed professionals serving as the category of reference. The six other categories refer to self-employed people, all other employed people, homemakers, students, unemployed, and retired people. We control for the level of education, measured by the age at which the respondents left full-time formal education. For this, we add two dummies, the first one for individuals who left full-time education between the age 15–20 years and the second one for individuals who left full-time education at the age of 21 or older with people leaving school at the age of 14 years or younger serving as the reference group. Another important predictor of charitable giving is the level of generalized trust (Bekkers Reference Bekkers2003; Brown and Ferris Reference Brown and Ferris2007). We operationalize the level of general trust with two dummy variables. The information for these variables stems from the question included in the Eurobarometer survey reading: “Generally speaking, would you say that most people can be trusted, or that you can’t be too careful in dealing with people”. The variable trust 1 is 1 if the person answered “Don’t know/it depends”, the variable trust 2 is 1 if the person answered “one can be trusted”, the reference category being “you can’t be too careful”.

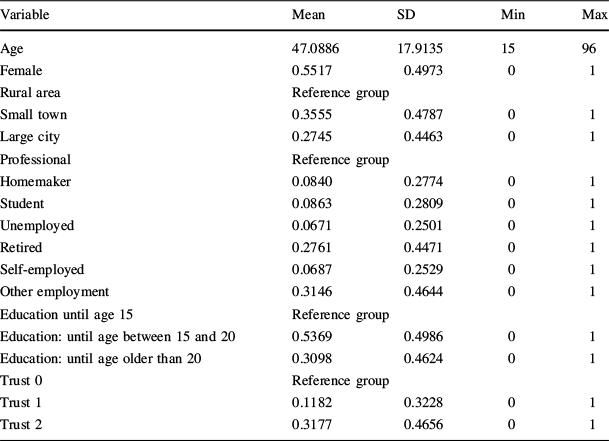

Table 1 Descriptive statistics of control variables on the individual level

|

Variable |

Mean |

SD |

Min |

Max |

|---|---|---|---|---|

|

Age |

47.0886 |

17.9135 |

15 |

96 |

|

Female |

0.5517 |

0.4973 |

0 |

1 |

|

Rural area |

Reference group |

|||

|

Small town |

0.3555 |

0.4787 |

0 |

1 |

|

Large city |

0.2745 |

0.4463 |

0 |

1 |

|

Professional |

Reference group |

|||

|

Homemaker |

0.0840 |

0.2774 |

0 |

1 |

|

Student |

0.0863 |

0.2809 |

0 |

1 |

|

Unemployed |

0.0671 |

0.2501 |

0 |

1 |

|

Retired |

0.2761 |

0.4471 |

0 |

1 |

|

Self-employed |

0.0687 |

0.2529 |

0 |

1 |

|

Other employment |

0.3146 |

0.4644 |

0 |

1 |

|

Education until age 15 |

Reference group |

|||

|

Education: until age between 15 and 20 |

0.5369 |

0.4986 |

0 |

1 |

|

Education: until age older than 20 |

0.3098 |

0.4624 |

0 |

1 |

|

Trust 0 |

Reference group |

|||

|

Trust 1 |

0.1182 |

0.3228 |

0 |

1 |

|

Trust 2 |

0.3177 |

0.4656 |

0 |

1 |

N = 23,468 (individuals), Source: Eurobarometer 62.2, own calculations

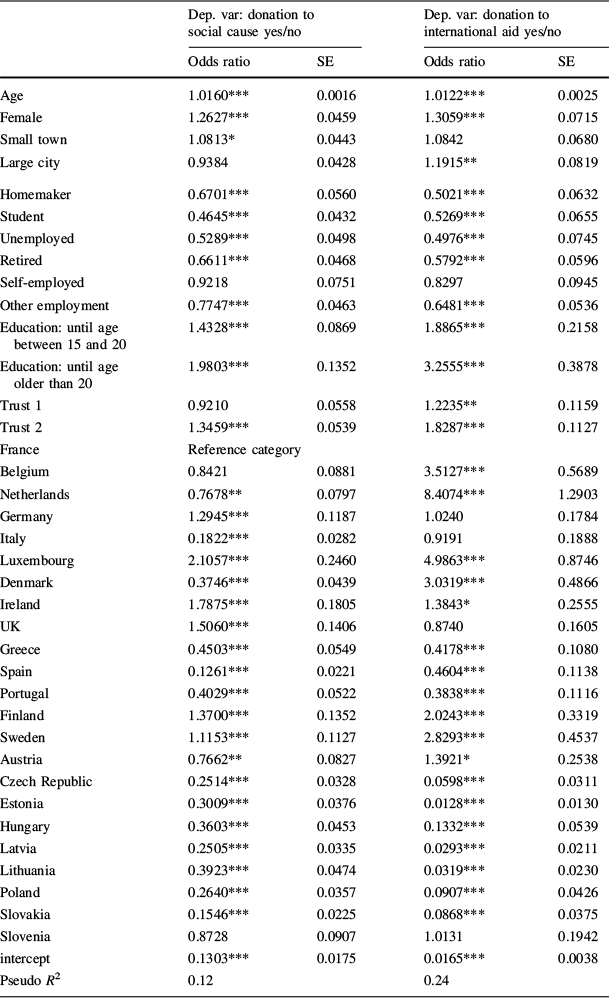

Findings

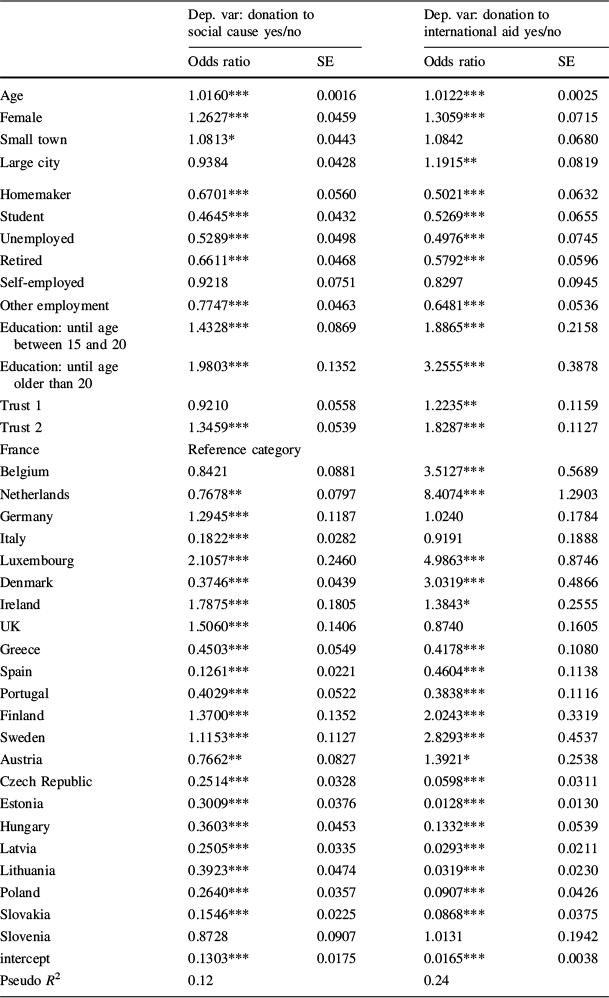

In the first step of the estimations, individual-level variables as well as country dummies are regressed on the two independent variables (see Table 7 in the Appendix). Most individual-level variables exhibit the expected results. The odds ratios for the country-level dummies also reflect the giving differences on the country level as shown in the descriptive overview. The intra-class correlation coefficients (ICCs) are 0.16 in the model with giving to social causes and 0.46 in the model with giving to international aid, suggesting that 16 and 46 % of the total variation depend on country differences.

Crowding-Out of Charitable Donations

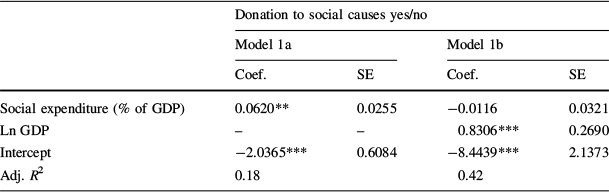

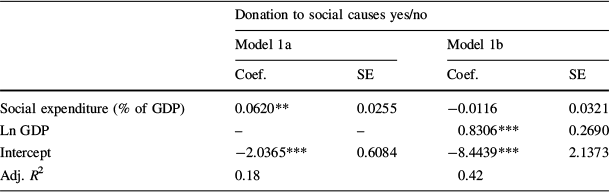

The results from the second step of the analyses concerning the crowding-out hypotheses are displayed in Tables 2 and 3. As explained above, here the country-level variables regarding state expenditure towards social causes or international aid are regressed on the country-intercepts of the first step.

Table 2 Crowding-out: results from second-step regressions: donations to social causes

|

Donation to social causes yes/no |

||||

|---|---|---|---|---|

|

Model 1a |

Model 1b |

|||

|

Coef. |

SE |

Coef. |

SE |

|

|

Social expenditure (% of GDP) |

0.0620** |

0.0255 |

−0.0116 |

0.0321 |

|

Ln GDP |

– |

– |

0.8306*** |

0.2690 |

|

Intercept |

−2.0365*** |

0.6084 |

−8.4439*** |

2.1373 |

|

Adj. R 2 |

0.18 |

0.42 |

||

Source: Eurobarometer 62.2.(2004); Eurostat (data for 2004); own calculations

N = 23 (countries), * p < 0.1; ** p < 0.05; *** p < 0.01

Table 3 Crowding-out: results from second-step regressions: donations to international aid

|

Donation to international aid yes/no |

||||||||

|---|---|---|---|---|---|---|---|---|

|

Model 2a |

Model 2b |

Model 2c |

Model 2d |

|||||

|

ODA (% of GNI) |

5.1427*** |

0.935 |

1.10604 |

0.8754 |

– |

– |

– |

– |

|

Social expenditure (% of GDP) |

– |

– |

– |

– |

0.2342*** |

0.0367 |

0.0839** |

0.0330 |

|

Ln GDP |

– |

– |

1.91495*** |

0.3158 |

– |

– |

1.6966*** |

0.2763 |

|

Intercept |

−2.304*** |

0.386 |

−19.698*** |

2.8781 |

−6.0616*** |

0.8735 |

−19.1496*** |

2.1957 |

|

Adj. R 2 |

0.57 |

0.84 |

0.64 |

0.87 |

||||

Source: Eurobarometer 62.2.(2004); Eurostat (data for 2004); own calculations

N = 23 (countries), * p < 0.1; ** p < 0.05; *** p < 0.01

Table 2 shows results for the impact of social expenditure on giving to social causes. Hypothesis 1a states that higher state expenditure for social causes leads to a lower probability that people donate money to this cause. Model 1a of Table 2 includes the variable of interest only, whereas model 1b additionally controls for the GDP of the country. The coefficient of the social expenditure variable is positive and significant on a 5 % level, meaning that a higher level of public social expenditure is accompanied by a higher probability that people in this country donate money to social causes. This coefficient, however, turns negative and statistically insignificant, once we include the country’s GDP. Thus, both models do not support hypothesis 1a.

Table 3 shows results for hypotheses 1b and 1c. Hypothesis 1b states that higher governmental spending towards international aid leads to lower donations to this cause. In contrast to this assumption, we find a positive coefficient in model 2a, meaning that more generous levels of official development aid in a country are associated with a higher probability that individuals in this country have also donated to international aid. This coefficient, however, does not remain statistically significant once GDP is added in model 2b.

Hypothesis 1c is reflected in models 2c and 2d. We assumed some kind of crosswise crowding-in, suggesting that higher levels of public social expenditure increases donations to non-core welfare fields such as international aid. The findings support this hypothesis. Higher social expenditure increases the probability of a donation to international aid. This effect remains even after controlling for GDP.

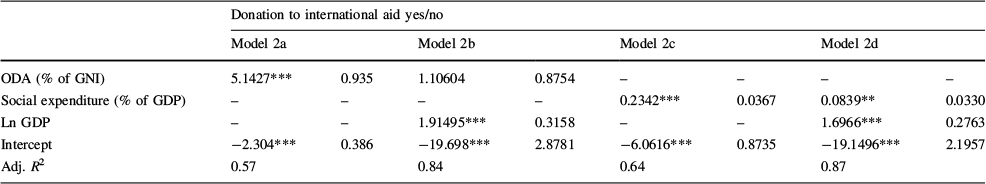

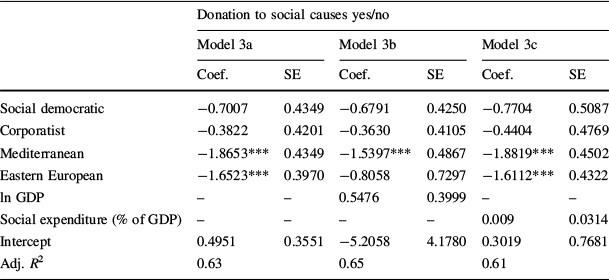

Charitable Donations and the Mixed Economy of Welfare

According to the second approach in this study, we investigate whether cross-country differences in giving behaviour can (in parts) be explained by the mixed economy of welfare in a country. We expect levels of giving to social causes being highest in liberal countries, followed by corporatist and social-democratic, Mediterranean and Eastern European countries (hypothesis 2a). For giving to international aid, we assume giving to be highest in social-democratic countries followed by corporatist, liberal, Mediterranean and Eastern European countries (hypothesis 2b).

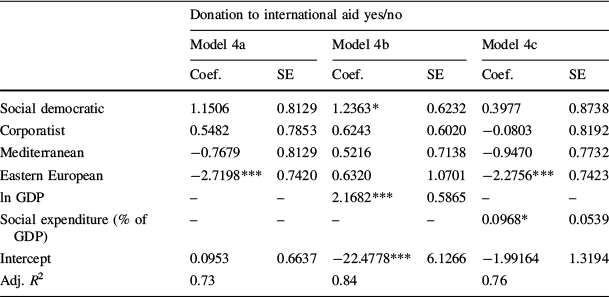

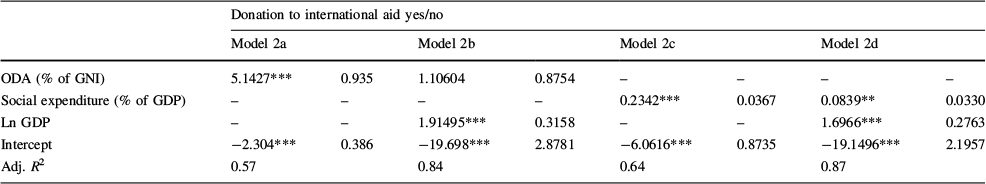

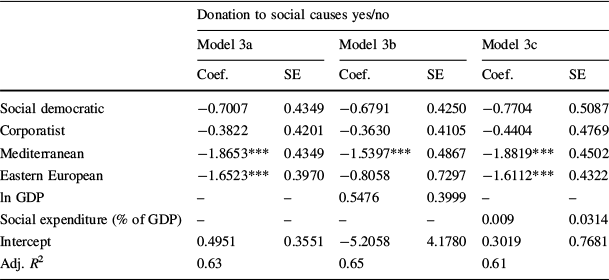

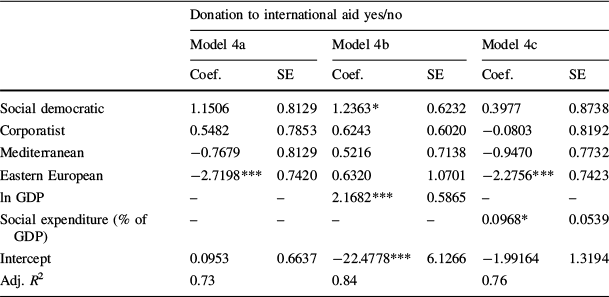

Table 4 presents results for hypothesis 2a. We estimate three different models. While model 3a only includes the welfare regimes, the logarithm of the GDP is additionally included to model 3b. Finally, in order to better integrate the two approaches of the paper, we also include the ratio of social expenditure to analyse whether the welfare state regimes have a predictive power once we control for differences in public spending. The coefficients for the social-democratic and the corporatist regime are in line with our hypothesis, however not statistically significant. In the Mediterranean and Eastern European regimes, as expected, giving to social causes is significantly lower than the liberal regime, the rank order to for these two regimes is different to our expectation. Table 5 presents a similar picture for hypothesis 2b. Most coefficients point towards the hypothesis, however only one of them is statistically significant.

Table 4 Non-profit regimes: results from second-step regressions: donations to social causes

|

Donation to social causes yes/no |

||||||

|---|---|---|---|---|---|---|

|

Model 3a |

Model 3b |

Model 3c |

||||

|

Coef. |

SE |

Coef. |

SE |

Coef. |

SE |

|

|

Social democratic |

−0.7007 |

0.4349 |

−0.6791 |

0.4250 |

−0.7704 |

0.5087 |

|

Corporatist |

−0.3822 |

0.4201 |

−0.3630 |

0.4105 |

−0.4404 |

0.4769 |

|

Mediterranean |

−1.8653*** |

0.4349 |

−1.5397*** |

0.4867 |

−1.8819*** |

0.4502 |

|

Eastern European |

−1.6523*** |

0.3970 |

−0.8058 |

0.7297 |

−1.6112*** |

0.4322 |

|

ln GDP |

– |

– |

0.5476 |

0.3999 |

– |

– |

|

Social expenditure (% of GDP) |

– |

– |

– |

– |

0.009 |

0.0314 |

|

Intercept |

0.4951 |

0.3551 |

−5.2058 |

4.1780 |

0.3019 |

0.7681 |

|

Adj. R 2 |

0.63 |

0.65 |

0.61 |

|||

Source: Eurobarometer 62.2.(2004); Eurostat (data for 2004); own calculations. N = 23 (countries), * p < 0.1; ** p < 0.05; *** p < 0.01

Table 5 Non-profit regimes: results from second-step regressions: donations to international aid

|

Donation to international aid yes/no |

||||||

|---|---|---|---|---|---|---|

|

Model 4a |

Model 4b |

Model 4c |

||||

|

Coef. |

SE |

Coef. |

SE |

Coef. |

SE |

|

|

Social democratic |

1.1506 |

0.8129 |

1.2363* |

0.6232 |

0.3977 |

0.8738 |

|

Corporatist |

0.5482 |

0.7853 |

0.6243 |

0.6020 |

−0.0803 |

0.8192 |

|

Mediterranean |

−0.7679 |

0.8129 |

0.5216 |

0.7138 |

−0.9470 |

0.7732 |

|

Eastern European |

−2.7198*** |

0.7420 |

0.6320 |

1.0701 |

−2.2756*** |

0.7423 |

|

ln GDP |

– |

– |

2.1682*** |

0.5865 |

– |

– |

|

Social expenditure (% of GDP) |

– |

– |

– |

– |

0.0968* |

0.0539 |

|

Intercept |

0.0953 |

0.6637 |

−22.4778*** |

6.1266 |

−1.99164 |

1.3194 |

|

Adj. R 2 |

0.73 |

0.84 |

0.76 |

|||

Source: Eurobarometer 62.2.(2004); Eurostat (data for 2004); own calculations N = 23 (countries), * p < 0.1; ** p < 0.05; *** p < 0.01

Given the small number of cases in the second step of the analyses, as mentioned in the method section, it is not too much of a surprise that we find very few statistically significant results. Estimations rely on relatively few cases and standard errors are accordingly large. Therefore, we look for country differences also on a descriptive level.

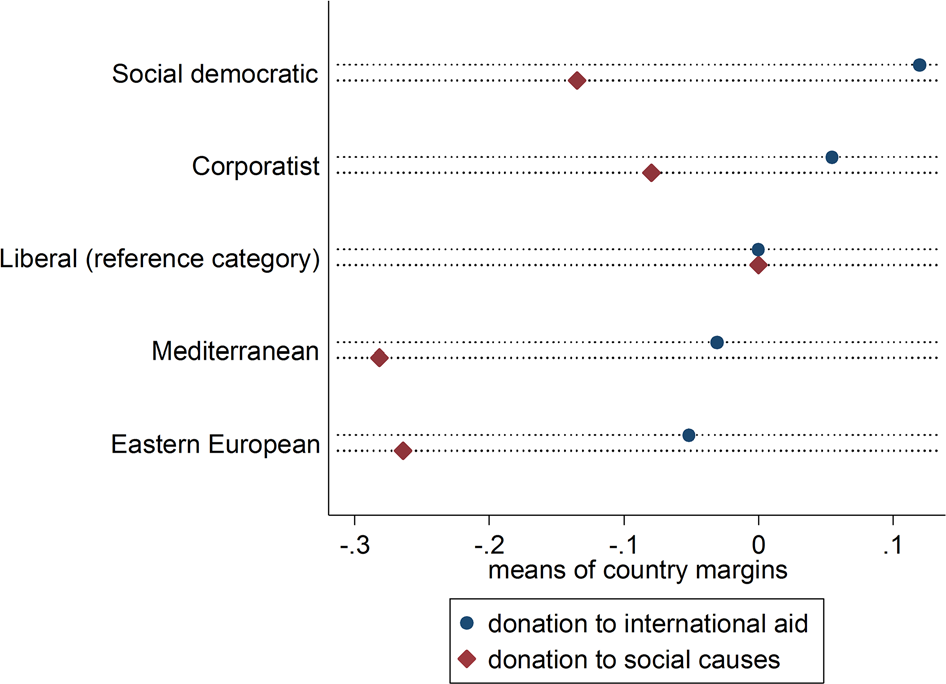

Figure 3 displays country differences in giving behaviour by regimes. More specifically, the figure illustrates the (unweighted) average of the marginal effects of the countries of the first-step regression for different regimes. These marginal effects are calculated at the means and hence describe the differences in the probability of giving across countries for an “average” individual in the sample. The marginal effects therefore depict country differences after control for differences at the individual level. The liberal regime serves as the reference category.

Fig. 3 Country differences by non-profit regime Note: Eurobarometer 62.2.(2004); Eurostat (data for 2004). Own calculations; N = 23 (countries)

Figure 3 shows that the hypothesized rank order for hypothesis 2a is almost corroborated by the results. Indeed, giving to social causes is highest in liberal countries followed by corporatist and social-democratic countries according to our data. Different to our expectation, people of Mediterranean countries give even less than people in Eastern European countries.

The proposed rank order of hypothesis 2b is also displayed in Fig. 3: giving to international aid is highest in the social-democratic welfare regime followed by the corporatist, the liberal, the Mediterranean and Eastern European regimes, just as expected.

Robustness

To check the robustness of the results we tested several alternative specifications. In one specification, the sample was restricted to donors (instead of all adults), taking the diverse shares of donors in the different countries into account. Unsurprisingly, this specification mitigated the effect of the GDP and the specified regimes were more often significant.Footnote 5 In another alternative specification, in which we have assigned the Netherlands to the corporatist regime instead of the social-democratic regime, the rank order between the corporatist and the social-democratic regime changes in all analyses. The relation to the liberal regime, however, remains the same in all models.Footnote 6 Finally, alternative independent country-level variables were used: Instead of government expenditure for social protection and official development assistance we used information on the income structure of non-profits in different subsectors for the various countries taken from the Johns Hopkins Comparative Non-profit Sector Project (Salamon and Sokolowski Reference Salamon and Sokolowski2004, p. 301). However, this information is solely available for 16 European countries restricting the explanatory power of the model even more due to the low number of cases in the second level. The results follow the same pattern as presented above.Footnote 7

Discussion

Against the background of welfare state retrenchment and tense public budgets, many Western countries repeatedly call for an increase in private responsibility regarding the welfare state. Overly generous welfare states, according to the assumption, would discourage civic engagement and therefore private philanthropy. Starting from this, this study investigates whether and how state/non-profit relations affect private charitable giving. Referring to theoretical considerations of the crowding-out approach and the mixed economy of welfare, it explores to what extent public spending towards certain causes as well as the relationship between government and the non-profit sector help explain the prevailing cross-country differences in private charitable giving. The study contributes to the literature by testing hypotheses regarding these issues for particular charitable subfields, namely social causes and international aid.

All in all, we find no evidence in favour of the well-known crowding-out hypothesis, in line with some previous literature. Instead, the results support the assumption of crosswise crowding-in, pointing towards a more complex relation between government spending and private donations to particular types of charity. Hence, public commitment does not suppress private initiatives per se, as the ‘traditional’ crowding-out thesis suggests. Rather, we experience a shift of private commitment within the non-profit sector. Vamstad and von Essen (Reference Vamstad and von Essen2013), who found a similar effect when studying private donations in Sweden, conclude that the welfare state does not seem to crowd-out private giving, but rather structures private philanthropic engagement, resulting in higher levels of giving in non-core welfare fields. Our study substantiates their finding.

The second approach used in this study in order to shed light on cross-national differences in giving behaviour refers to the mixed economy of welfare within a country. Whereas the crowding-out approach concentrates on welfare funding aspects, this approach also accounts for different institutional agents in the delivery of welfare and thus focuses on the provision of welfare services. Here, we hypothesized that private giving to social welfare causes is likely to be highest in countries with a big non-profit sector and with rather low levels of public funding of the non-profit sector, such as the liberal welfare regime. The results on a descriptive level underpin this argument. Likewise, the results of the multi-variate analyses are in line with these assumptions, however—possibly due to the small number of cases—they are not statistically significant. Our final hypothesis referring to giving to international aid proposes a reversed rank order for the liberal, social-democratic and corporatist regimes. Here, too, we find support on a more descriptive level, but limited statistical significance in the multi-variant setting. Looking at the liberal, the corporatist and social-democratic regimes, the reversed rank order between giving to social causes and giving to international aid also corroborates the found crosswise crowding-in effect.

When interpreting these findings, we have to be cautious because the measures we use refer to the incidence of giving. This is the share of the population that has made a donation. An even more meaningful variable would take into account the amount of money donated by individuals. However, the existing datasets that allow for cross-country comparison do not contain this information.

On a descriptive level we find that individuals’ giving preferences are somewhat related to the degree of public spending and the nature of the welfare state they live in. This is in line with previous literature (e.g. van Oorschot and Arts Reference van Oorschot and Arts2005, who analyse crowding-out in a more general way by looking at social capital). We interpret the regime dummies with the specific role of non-profit organizations in a welfare state. It is important to note that the variable in use (dummies for non-profit regimes) only crudely captures the institutional mix in the delivery of welfare services. For this purpose it would also be interesting to use the number of non-profit organizations in the examined fields as an alternative variable. Also, it is important to keep in mind that the composition of countries within a welfare regime might be decisive for the constructed rank order. This becomes evident when looking at findings of Einolf (Reference Einolf, Wiepking and Handy2015, p. 516f.), who found partly different results and questioned the usefulness of regimes when trying to explain differences in giving behaviour.

At the same time, other variables on the contextual level that might impact individual giving behaviour have not been taken into account, with the exception of income inequality, trust, religiosity and education—which we included in additional analyses in order to check whether our results would alter, which did not occur. Such further factors could be tax incentives for donations or the regulations for funding across the respective countries (Breeze and Scaife Reference Breeze, Scaife, Wiepking and Handy2015; Wiepking and Handy Reference Wiepking, Handy, Wiepking and Handy2015). The dummies for the non-profit regime we apply in our analyses might capture some of these issues, but to be sure about them examinations referring to each of them on its own would be necessary.

Moreover, it has to be stated that the data we use—although they are the best available for cross-country analysis in European giving research—are from 2004. The conclusions to be drawn from more than a decade old data might be somewhat limited, particularly because the welfare state regimes we refer to have shown major shift in the respective period of time (see for example Ferragina and Seeleib-Kaiser Reference Ferragina and Seeleib-Kaiser2011, discussing the reliability of the typologies over time). We strongly suggest further studies to apply more current data—as soon as they are available—and reinvestigate if welfare regimes still can help explain individual giving patterns in the second decade of the new millennium.

Still another suggestion for future research is examining the crosswise crowding-in effect for other donation causes. In this paper, we chose categories of the Eurobarometer questionnaire that (i) in line with our theoretical considerations can be categorized as “core welfare cause” and “non-core welfare cause” and (ii) have a matching and plausible funding variable on the country level. Other datasets with different categories of charitable causes might offer the possibility to analyse if the found effect also holds for further subfields.

The principal conclusion that can be drawn from this study is that the welfare state structures private giving. The fact that large shares of the population in social-democratic countries donate to international aid might be traced back to the comparatively more generous provision of core-welfare services by the state in these countries. This includes both funding and production aspects: A small number of non-profits in the field of social welfare as well as extensive state funding shift donations to other charitable fields—pointing towards crosswise crowding-in. This is a hint that differences in giving behaviour across nations are even more complex to explain than the crowding-out theory would suggest. Keeping that in mind, claims for the retrenchment of the welfare state and for more reliance on private funding and private provision of welfare services might not work in all countries the same way, but rather lead to quite different effects, depending on philanthropic traditions and values, but also on existing institutional arrangements. Moreover, referring to the found crosswise crowding-in, a call for increased private funding of welfare services could result in reduced resources and thus less activities in non-core welfare fields.

Acknowledgments

We thank Christopher Einolf, Johan Vamstad, Karin Heitzmann, Dieter Pennerstorfer, René Bekkers and an anonymous reviewer for helpful comments on earlier versions of this paper. Open access funding provided by Vienna University of Economics and Business (WU).

Funding

This research received no particular funding.

Compliance with Ethical Standard

Conflict of interest

The authors declare that they have no conflict of interest.

Appendix

Table 6 Descriptive statistics of dependent and explanatory variables by country and regime type

|

Giving to social causes |

Giving to international aid |

Social expenditure (% of GDP) (2004) |

ODA (% of GNI) (2004) |

|

|---|---|---|---|---|

|

Social democratic |

0.293 |

0.257 |

29.31 |

0.68 |

|

Denmark |

0.165 |

0.249 |

30.7 |

0.85 |

|

Finland |

0.398 |

0.161 |

26.7 |

0.37 |

|

Sweden |

0.344 |

0.212 |

31.6 |

0.78 |

|

The Netherlands |

0.264 |

0.407 |

28.3 |

0.73 |

|

Corporatist |

0.290 |

0.106 |

28.82 |

0.37 |

|

Austria |

0.224 |

0.084 |

29 |

0.23 |

|

Belgium |

0.238 |

0.174 |

27.4 |

0.41 |

|

France |

0.278 |

0.059 |

31.4 |

0.41 |

|

Germany |

0.323 |

0.063 |

30.1 |

0.28 |

|

Luxembourg |

0.449 |

0.235 |

22.3 |

0.79 |

|

Liberal |

0.369 |

0.066 |

22.19 |

0.37 |

|

Ireland |

0.381 |

0.081 |

17.4 |

0.39 |

|

UK |

0.360 |

0.055 |

25.7 |

0.36 |

|

Mediterranean |

0.084 |

0.028 |

23.37 |

0.29 |

|

Italy |

0.058 |

0.048 |

25.9 |

0.15 |

|

Greece |

0.127 |

0.022 |

23.6 |

0.16 |

|

Spain |

0.042 |

0.024 |

20.3 |

0.24 |

|

Portugal |

0.111 |

0.018 |

23.8 |

0.63 |

|

Eastern Europe |

0.113 |

0.011 |

16.99 |

0.07 |

|

Czech Republic |

0.088 |

0.004 |

18.6 |

0.11 |

|

Estonia |

0.114 |

0.001 |

13 |

0.05 |

|

Hungary |

0.114 |

0.007 |

20.8 |

0.07 |

|

Latvia |

0.090 |

0.002 |

9.3 |

0.06 |

|

Lithuania |

0.127 |

0.002 |

13.4 |

0.04 |

|

Poland |

0.086 |

0.005 |

20.1 |

0.05 |

|

Slovakia |

0.057 |

0.005 |

17.2 |

0.07 |

|

Slovenia |

0.248 |

0.062 |

23.3 |

0.10 |

|

Average of 23 countries |

0.201 |

0.081 |

23.17 |

0.31 |

Sources: Eurobarometer 62.2 (2004), Eurostat; own calculations

Table 7 Results of the first-step logit regressions: individual-level variables and country-level dummies

|

Dep. var: donation to social cause yes/no |

Dep. var: donation to international aid yes/no |

|||

|---|---|---|---|---|

|

Odds ratio |

SE |

Odds ratio |

SE |

|

|

Age |

1.0160*** |

0.0016 |

1.0122*** |

0.0025 |

|

Female |

1.2627*** |

0.0459 |

1.3059*** |

0.0715 |

|

Small town |

1.0813* |

0.0443 |

1.0842 |

0.0680 |

|

Large city |

0.9384 |

0.0428 |

1.1915** |

0.0819 |

|

Homemaker |

0.6701*** |

0.0560 |

0.5021*** |

0.0632 |

|

Student |

0.4645*** |

0.0432 |

0.5269*** |

0.0655 |

|

Unemployed |

0.5289*** |

0.0498 |

0.4976*** |

0.0745 |

|

Retired |

0.6611*** |

0.0468 |

0.5792*** |

0.0596 |

|

Self-employed |

0.9218 |

0.0751 |

0.8297 |

0.0945 |

|

Other employment |

0.7747*** |

0.0463 |

0.6481*** |

0.0536 |

|

Education: until age between 15 and 20 |

1.4328*** |

0.0869 |

1.8865*** |

0.2158 |

|

Education: until age older than 20 |

1.9803*** |

0.1352 |

3.2555*** |

0.3878 |

|

Trust 1 |

0.9210 |

0.0558 |

1.2235** |

0.1159 |

|

Trust 2 |

1.3459*** |

0.0539 |

1.8287*** |

0.1127 |

|

France |

Reference category |

|||

|

Belgium |

0.8421 |

0.0881 |

3.5127*** |

0.5689 |

|

Netherlands |

0.7678** |

0.0797 |

8.4074*** |

1.2903 |

|

Germany |

1.2945*** |

0.1187 |

1.0240 |

0.1784 |

|

Italy |

0.1822*** |

0.0282 |

0.9191 |

0.1888 |

|

Luxembourg |

2.1057*** |

0.2460 |

4.9863*** |

0.8746 |

|

Denmark |

0.3746*** |

0.0439 |

3.0319*** |

0.4866 |

|

Ireland |

1.7875*** |

0.1805 |

1.3843* |

0.2555 |

|

UK |

1.5060*** |

0.1406 |

0.8740 |

0.1605 |

|

Greece |

0.4503*** |

0.0549 |

0.4178*** |

0.1080 |

|

Spain |

0.1261*** |

0.0221 |

0.4604*** |

0.1138 |

|

Portugal |

0.4029*** |

0.0522 |

0.3838*** |

0.1116 |

|

Finland |

1.3700*** |

0.1352 |

2.0243*** |

0.3319 |

|

Sweden |

1.1153*** |

0.1127 |

2.8293*** |

0.4537 |

|

Austria |

0.7662** |

0.0827 |

1.3921* |

0.2538 |

|

Czech Republic |

0.2514*** |

0.0328 |

0.0598*** |

0.0311 |

|

Estonia |

0.3009*** |

0.0376 |

0.0128*** |

0.0130 |

|

Hungary |

0.3603*** |

0.0453 |

0.1332*** |

0.0539 |

|

Latvia |

0.2505*** |

0.0335 |

0.0293*** |

0.0211 |

|

Lithuania |

0.3923*** |

0.0474 |

0.0319*** |

0.0230 |

|

Poland |

0.2640*** |

0.0357 |

0.0907*** |

0.0426 |

|

Slovakia |

0.1546*** |

0.0225 |

0.0868*** |

0.0375 |

|

Slovenia |

0.8728 |

0.0907 |

1.0131 |

0.1942 |

|

intercept |

0.1303*** |

0.0175 |

0.0165*** |

0.0038 |

|

Pseudo R 2 |

0.12 |

0.24 |

||

Source: Eurobarometer 62.2.(2004); own calculations N = 24468, * z < 0.1; ** z < 0.05; *** z < 0.01. Odds ratios displayed