Financial infrastructure is of decisive importance in efforts to enhance financial efficiency and promote economic growth (Amable and Chatelain, Reference Amable and Chatelain2001; Bossone, Mahajan, and Zahir, Reference Bossone, Mahajan and Zahir2003). This chapter explores how the development of China’s financial infrastructure also affects financial inclusion. For a long time China had lagged behind in terms of conventional financial inclusion, but China’s digital financial inclusion (DFI) is rapidly developing (Bei, Reference Bei2017; Jiao, Reference Jiao2019).1 One of the most important catalysts has been the development of digital financial infrastructure, particularly digital credit infrastructure and digital payment infrastructure. This chapter first examines the concepts of financial infrastructure and financial inclusion and their Chinese contexts. It then traces the historical evolution of financial inclusion in China since 1949 and lastly dissects the significant role of digital financial infrastructure in promoting Chinese DFI since around 2013.

1 Financial Inclusion and Financial Infrastructure in the Chinese Context

1.1 Financial Inclusion: International and Chinese Perceptions

Before examining the empirical impacts of financial infrastructure on financial inclusion, it is necessary to clarify several concepts. The origin of the concept “financial inclusion” is usually traced back to 2005 when the United Nations (UN) adopted the term “inclusive financial system” to publicize the International Year of Microcredit 2005. The idea’s empirical origin can be seen in the establishment of rural credit cooperatives (RCCs) in China (early 1950s), the Grameen Bank in Bangladesh (1976), the People’s Bank of Indonesia, and similar institutions. The pioneer of advocating financial inclusion, the World Bank Group (WBG), defines financial inclusion as “individuals and businesses hav[ing] access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way” (World Bank, 2019). This definition emphasizes accessibility, affordability, commercial sustainability, and responsibility. Accessibility in this context means “a consumer has sufficient physical proximity to access points – including branches, agents, automated teller machines (ATMs), and other outlets or devices – to enable him or her to easily select and use a range of financial products and services” (WBG and PBOC, 2018, p. 5). Affordability means that these financial products and services are affordable for most customers, particularly low-income consumers. Commercial sustainability implies that the goal of providing these products and services is not to increase the level of social welfare, but to seek business profit. Responsibility requires that these products and services “be responsibly delivered to consumers and that the policy objectives of financial inclusion align with those of financial stability and market integrity.” The four features provide benchmarks for measuring financial inclusion.

Drawing on this definition and adding to these four key elements, the Chinese government also stresses “opportunity equality” by noting that “financial inclusion means providing financial service for all social strata and groups with appropriate and valid financial services, at affordable cost, based on the principle of opportunity equality and commercial sustainability” (State Council of China, 2015; WBG and PBOC, 2018, p. 6). Here, opportunity refers to the possibility for potential customers to use financial services, as determined by their accessibility and affordability, and opportunity equality means that all customers ideally have an equal possibility to use the same financial services.

Financial inclusion has both normative and commercial objectives. Normatively, financial inclusion is the opposite of financial exclusion and targets the unbanked. Commercially, financial inclusion, unlike charity and social welfare, seeks economic gain. The two objectives would appear to be conflicting since the majority of the business profits in the financial sector comes from a small percentage of customers, as the Pareto principle would lead us to expect. The traditional financial system in China had not found an efficient way and sufficient justification to simultaneously ensure the accessibility, affordability, commercial sustainability, responsibility, and opportunity equality of the financial services that are provided – that is, until the emergence of financial infrastructure innovation.

1.2 Financial Infrastructure: Narrow and Broad Understandings

Financial infrastructure has narrow and broad meanings. In its narrow sense, financial infrastructure has been widely regarded as a synonym for financial market infrastructure (FMI). As the Bank for International Settlements (BIS) and International Organization of Securities Commissions (IOSCO) jointly pointed out, “an FMI (financial market infrastructure) is defined as a multilateral system among participating institutions, including the operator of the system, used for the purposes of clearing, settling, or recording payments, securities, derivatives, or other financial transactions” (BIS and IOSCO, 2012). FMIs explicitly include five key types: payment systems (PSs), central securities depositories, securities settlement systems, central counterparties, and trade repositories (BIS and IOSCO, 2012). In a broad sense, as emphasized in this book, financial infrastructure refers to all tangible facilities and intangible rules and arrangements relating to financial activities.

Drawing on this definition and classification, in the Work Plan for Coordinated Supervision of Financial Infrastructure jointly released by the People’s Bank of China (PBOC) and other government departments, “financial infrastructure refers to the system and institutional arrangement that provides basic public services for all kinds of financial activities, with a pivotal position in the operation of financial markets.” Furthermore, “China’s overall supervision of financial infrastructure includes [the] financial assets registration and depositories system, clearing and settlement system (including central counterparties carrying out centralized clearing business), trade facilities, trade repositories, important payment system and basic credit system” (PBOC, 2020). Thus, China’s official definition of financial infrastructure tends to be narrower, along the lines of the definition of BIS and IOSCO. This chapter and book adopt the broader meaning of financial infrastructures, which encompasses both object and relations.

2 Evolution of Financial Inclusion in China: Effects of Conventional Financial Infrastructures

The evolution of China’s financial inclusion can be divided into five stages, and the five features of financial inclusion (accessibility, affordability, commercial sustainability, responsibility, and opportunity equality) can be used to evaluate and compare these stages. In addition to detailing the development of China’s financial inclusion, this section will discuss the role of conventional financial infrastructures, specifically credit infrastructure and payment infrastructure, during these stages. Credit infrastructure includes laws, management, institutions, standards, and markets related to credit reporting. By providing third-party evaluation, credit infrastructure can reduce information asymmetry and transaction costs, thereby indirectly improving the level of financial inclusion (Huang, Reference Huang2018). As the cornerstone of any financial system, payment infrastructure generally encompasses the accounts, instruments, systems, organizations, and regulations that support payments. Payment infrastructure has a direct effect on financial inclusion by, for example, expanding coverage of financial services and improving settlement efficiency. This section reviews the evolution of financial inclusion in China and examines the impacts of financial infrastructure on financial inclusion.

2.1 “Planned” Exclusion (1949–1978)

At this stage, from the founding of the People’s Republic of China in 1949 to the implementation of the Reform and Opening-up policy in 1978, credit infrastructure was nearly absent and payment infrastructure was relatively backward. In addition to the agriculture department of the PBOC and the establishment of the People’s Construction Bank of China in 1954 as a subsidiary of the Ministry of Finance, two other institutions contributed during this stage to promoting financial inclusion by providing rural financial services. One was the RCCs, a new type of financial institution launched in 1951 that developed quickly thereafter.2 The other was the establishment of the Agricultural Bank of China (ABC) in 1955.

Under the planned economy system, government departments had full access to personal information and there was no urgent need to create a credit infrastructure (Huang, Reference Huang2018). The PBOC performed the dual functions of central bank and commercial bank, playing the roles of clearing, settlement, and supervision simultaneously. It thus established a highly centralized “National Interbank” three-stage clearing system (Guo, Reference Guo2014). A notable feature of this system was a manually operating interbank, which means “people fill in the payment information by hand and deal with different payment and capital settlement business through postal delivery” (Li, Reference Li2017, p. 348). This system was highly inefficient: The average transit time to complete wire transfer business was 3.4 days; the average transit time of letter transfer business within the province was 5.5 days; the average transit time outside the province was 7.8 days, and the longest was 15 days (Liu and Wang, Reference Liu and Wang1996). It was not until the early 1990s that the manually operating interbank was gradually replaced by an electronic one. Overall, the backwardness of financial infrastructure, especially payment infrastructure, largely restricted financial inclusion during this period.

Even though under the slogan “one village, one cooperative” the number of RCCs had quickly increased and they covered nearly 100 million rural households by 1956 (Zhang et al., Reference Zhang, Xu, Minggao and Enjiang2010), accessibility was still low because of the geographic size of China and the great distances between villages. Rural finance in this period provided only basic services, mainly saving. There were few appropriate financial services for rural farmers, and they were hardly affordable. Under the centrally planned economic system, the only objective of the financial system was to fulfill the political and economic tasks allocated by the central or local governments, rather than operate as if in a market economy and survive market competition. Therefore, commercial sustainability was low and the responsibility these limited financial services had was likewise low. Under the socialist political economic ideology that stresses social equality and collective ownership, equality was relatively high.

2.2 Initial Institutional Construction (1979–1992)

From 1979 on, China’s credit infrastructure began to develop, but it was not yet able to really contribute to financial inclusion. In February 1985, the Shanghai Branch of the Industrial and Commercial Bank of China established the Shanghai Economic Information Consulting Company, the first credit information agency in China. In March 1988, the Shanghai Far East Credit Rating Co., Ltd. was established, which was the first professional credit rating agency independent of the banking system of China. Nonetheless, these agencies mainly targeted big companies, so credit systems for small and medium-sized enterprises (SMEs) and individuals were still underdeveloped.

Meanwhile, payment infrastructures were under construction, contributing to financial inclusion in some ways. The development of payment infrastructure in this period was mainly reflected in bank cards and PSs. In the late 1970s, bank card business was introduced to China. In March 1985, the Zhuhai Branch of the Bank of China (BOC) issued the Pearl River Card, the first bank card in China. In 1986, the BOC’s Beijing Branch issued China’s first credit card, the Great Wall Card. As for PSs, the PBOC began to construct a national electronic network based on a professional satellite communication network in 1989. On April 1, 1991, the electronic interbank system (EIS) was put into trial operation, initially realizing the electronic processing of cross-bank payment and clearing business in China (Li, Reference Li2017). Compared with the manually operating interbank, the EIS greatly enhanced financial efficiency, as well as financial inclusion (Wu, Reference Wu1995).

Consequently, the situation of financial inclusion during this period was largely and generally improved compared to the one under the command economy. The diversification and increase of bank and nonbank financial service providers, with each assigned a distinct service realm, increased the accessibility and responsibility of financial services. Examples include the then newly created rural cooperative foundations targeting local village farmers and the postal savings schemes (resumed in 1986), which mainly focused on absorbing loans and facilitating savings and remittance in rural areas (Zhang et al., Reference Zhang, Xu, Minggao and Enjiang2010). The market-oriented reform and the resulting rise in competition increased the sustainability of the financial system and the affordability of financial services to some degree, though the competition was still insufficient. Banks operated under the administrative “priority sector guidance,” a significant part of financial resources was distributed to state-owned banks in the form of policy loans, and local governments steered bank lending to state-owned enterprises (Sparreboom and Duflos, Reference Sparreboom and Duflos2012, p. 8). The introduction of market competition, though at an initial stage, broke the faith in absolute collective ownership and social equality, released forces of economic growth, and thus created higher demand for financial services.

2.3 Financial Inclusion 1.0 (1993–2004)

Credit infrastructures for SMEs started to develop after 1999 when the former State Economic and Trade Commission issued the “Guidance on Establishing a Pilot SME Credit Guarantee System” (Credit China, 2012). For individuals, however, the credit infrastructure started from a weaker base. Not until 1997 was Shanghai approved by the PBOC as the first city to pilot personal credit reporting (Huo, Reference Huo2015). In April 2000, the real-name savings deposit system was put into effect in China, which, by requiring the depositor’s name, helped restrain dishonest financial activities and promote the development of consumer credit (Shen, Reference Shen1999). After entering the new century, Chinese authorities paid unprecedented attention to credit investigation. In November 2003, the Credit Information System Bureau of the PBOC was established, marking the official launch of the construction of a modern credit system.

China’s PS advanced significantly in this stage as well. In 1995, the PBOC implemented the “Sky–Earth Connection” project to improve the processing speed of the EIS. Another milestone was the establishment in 2002 of China UnionPay, led by the PBOC. In December 2004, the first generation of the China UnionPay System was officially put into operation. The system “aimed to build a wide coverage area, the full range of business, handling powerful, stable and efficient integration of bank card information exchange platform” (Li, Reference Li2017, p. 380), and has had a far-reaching impact on financial inclusion.

Corresponding changes related to financial inclusion at this stage mainly include the following aspects. First, the degree of commercialization of the financial sector had been further increased with the purpose of enhancing its sustainability. Consequently, the policy-driven operations that sought primarily to improve financial inclusion began to commercialize. For instance, the ABC separated its policy-related functions from its commercial operations in 1994; the four state-owned banks were restructured into four state-owned commercial banks (SOCBs) in 1995; the RCCs separated from the ABC in 1996 and began to operate more independently. These commercialization efforts, however, did not essentially enhance the commercial sustainability of the financial sector. Though RCCs had been playing a significant role in providing rural financial services, they “were left with heavy historical burdens, poor asset quality, and high potential risks” (Zhang et al., Reference Zhang, Xu, Minggao and Enjiang2010, p. 23). Furthermore, the total burden of nonperforming loans (NPLs) in the SOCBs was estimated at 3.3 trillion yuan by 1999 (Jiang and Yao, Reference Jiang, Yao, Jiang and Yao2017, p. 21).

Second, despite the lackluster performance of the financial sector characterized by poor asset quality, high NPLs, and low profitability, the coverage of financial services in both rural and urban areas had been further expanded during this stage. RCCs’ credit and payment infrastructures had spread to most rural areas. By 1995, the number of financially independent RCCs reached 50,000 and RCCs’ loans accounted for more than 60% of total agriculture loans (Zhang et al., Reference Zhang, Xu, Minggao and Enjiang2010, p. 21). The central bank PBOC adopted more monetary policy tools, instead of administrative orders or interventions, to increase rural enterprises’ and households’ access to credit. City commercial banks were created in the mid-1990s to restructure and consolidate urban credit cooperatives, and thus increased the financial service coverage of the SMEs and local residents (Jiang and Yao, Reference Jiang, Yao, Jiang and Yao2017, p. 21).

Third, a remarkable change related to financial inclusion in this period was the emergence and development of bank and nonbank microfinance infrastructure. Learned from international experiences, microfinance was first brought to China in 1993. For example, the Rural Development Institute of the Chinese Academy of Social Sciences introduced the microfinance model of the Grameen Bank and established the first microfinance poverty alleviation model in China. Subsequently, policy-driven microfinance programs initiated by local and national governments began to develop, and state-owned financial institutions also expanded their conventional business to microcredit services. It was not until the end of the twentieth century that the microfinance development and regulation policy was formally put forward as an important part of the national poverty alleviation initiative (Du, Reference Du2005).

2.4 Financial Inclusion 2.0: Comprehensive Development (2005–2012)

During this stage, the government-led credit agencies rapidly developed. In March 2006, the Credit Reference Center of the PBOC was formally established. China began to form a credit investigation model dominated by the PBOC (Jiao, Reference Jiao2019). By the end of March 2008, the population of individual persons recorded in the database was 600 million, of which 109 million had credit records, and, by the end of 2010, information had been collected on 2.15 million SMEs and 134 million farmers had established credit files (Huo, Reference Huo2015). In terms of legislation, at the end of December 2012, the State Council of China (2013) passed the “Regulations on the Management of the Credit Reporting Industry,” which marked acknowledgment of the legal status of the credit-reporting industry (Huang, Reference Huang2018).

Payment infrastructure continued to develop rapidly in this period as well, thus providing a strong impetus for financial inclusion. Most notably, China established modern PSs on the basis of the EIS. In June 2005, the High Value Payment System was launched and promoted nationwide; in June 2006, the Bulk Electronic Payment System (BEPS) was popularized throughout the country; and in June 2007, the Cheque Image System was also launched nationwide. Of the three systems, the BEPS is most critical for financial inclusion, as micropayments are often the first step for vulnerable groups to access financial services (Wu, Reference Wu2013). In July 2009, the PBOC issued the “Guidance on Improving the Payment Service Environment in Rural Areas” (PBOC, 2015a), which proposed for the first time to develop a payment instrument system suitable for rural areas. The financial tools include bank cards, noncash payment tools, mobile payments, telephone payments, TV network payments, and the like.

From around 2005, China’s financial inclusion practices entered a new age, now under the banner of “financial inclusion” as formally conceptualized by the World Bank. Though the concept “financial inclusion” was translated and introduced into China shortly after its international debut, the Chinese government had not officially adopted it, let alone incorporated it into formal policies, until 2012, as will be discussed later.

The further modernization of China’s banking sector expanded the coverage and diversified the types of financial products and services offered, thus enhancing the commercial sustainability of China’s banking system. Among many achievements, the remarkable ones of this round of modernization include the restructuring of the SOCBs into joint-stock entities and purely commercial institutions, the establishment of the China Development Bank Cooperation as an ordinary commercial bank in 2008, the market-oriented reform of two other policy banks (the Export–Import Bank of China and the ABC of China), the reform of the RCCs between 2004 and 2006, and the creation of the Postal Saving Bank of China.

In addition to the modernization of traditional financial institutions and services, notable driving forces pushing forward financial inclusion in this period also included the rapid growth of microfinance and the initial development of digital finance. Since 2005, when the government encouraged nongovernment and overseas funds to engage in commercial microfinance, China’s microfinance quickly developed, as evidenced by the sharp increase in the number of microfinance companies. The legalization of informal credit was another important facilitating factor for the boom of microfinance in China, as this enabled the subsequent development of nonbank financial institutions, such as loan companies, mutual financial organizations, and private microfinance companies.

The initial development of internet finance emerged in this period as a potentially important force for improving financial inclusion. Although traditional financial institutions had already adopted financial technologies to upgrade their management and services before 2005, these developments were essentially limited to the partial digitalization of the traditional banking sector, and competition and challenges from nonbank financial institutions had not yet been evident. By contrast, in the period up to 2012, in addition to the further digitalization of the traditional financial system, various forms of digital financial services emerged in China, mainly including nonbank third-party payment, peer-to-peer lending, crowdfunding, and internet insurance, which laid the foundation for the era of DFI in China.

3 Digital Financial Infrastructure since 2013: A New Stage of China’s Financial Inclusion

The normative and commercial objectives of financial inclusion are hard to realize simultaneously through the traditional means of providing financial services, largely because of the Pareto principle mentioned earlier in this chapter. For instance, the flaws of microfinance in improving financial inclusion become prominent, and skepticism emerges (as discussed by Shakya and Rankin, Reference Shakya and Rankin2008; Duvendack et al., Reference Duvendack, Palmer-Jones, Copestake, Hooper, Loke and Rao2011; Bateman, Reference Bateman2014). In the period since 2013, China’s financial inclusion has greatly improved (Guo et al., Reference Guo, Wang, Wang, Kong, Zhang and Cheng2020), from the country being far behind the international pioneers to gradually becoming a global leader of DFI. This achievement has been mainly driven by the advances in digital financial infrastructures, including digital credit infrastructure and digital payment infrastructure.

3.1 Digital Credit Infrastructure: Indirectly Facilitating Inclusion

Digital credit infrastructure is the combination of digital technology with credit infrastructure, especially market-oriented credit-reporting agencies. The digital technologies include artificial intelligence, cloud computing, big-data analytics, machine learning, blockchain, and 5G, among others. Digital market credit agencies have gradually emerged since 2013. In January 2015, the PBOC issued the “Notice on Preparing for Personal Credit Reporting Business,” allowing eight agencies, including Zhima Credit and Tencent Credit Information to prepare for personal credit-reporting business for the first time in history (PBOC, 2015b). This in turn marked the beginning of the marketization of China’s credit-reporting business. It was not until May 2018 that China’s first personal credit business license was issued – to Baihang Credit Services Corporation, shares of which were owned by the National Internet Finance Association of China (36%) and eight personal credit agencies, including Zhima Credit (each holding 8%) (Credit Shanxi, 2018). As of February 2022, there were 2 personal credit agencies (Baihang Credit and Pudao Credit) and 136 enterprise credit agencies in China (PBOC, 2022a). China’s credit-reporting market has formed a two-wheeled development model of “government + market” (PBOC, 2018). The market agencies not only complement the role of the PBOC’s Credit Reference Center but also significantly improve credit reporting through utilizing digital technologies.

The application of big-data analytics in the market-oriented credit-reporting agencies has shown significant advantages over traditional agencies represented by the Credit Reference Center of PBOC in promoting financial inclusion. Take personal credit reporting as an example. Here advantages for inclusion are mainly reflected in two respects. First, market-oriented agencies can collect and access more personal credit data and other information. As of early 2019, while the PBOC’s Credit Reference Center recorded 990 million individuals, only 530 million people had loan records (Lei, Reference Lei2021). Moreover, the Center focuses mostly on large loan customers and largely ignores small loans (Lei, Reference Lei2021). By contrast, with access to information on a huge number of users, market-oriented agencies can easily obtain a variety of data, such as social relations and online shopping records. Notably, these agencies pay more attention to the people lacking or having no credit records in the traditional credit system. By 2020, among those without credit records were 40 million college students, 35 million graduates who had worked for less than five years, about 60 million people with minimum living allowances, and more than 80 million SMEs in China (Zhang, Reference Zhang2020). Leveraging digital technologies, particularly big data, market-oriented agencies have by now included most of them in the credit-reporting system (Zhang, Reference Zhang2020), thus remarkably improving the level of China’s financial inclusion.

Second, relying on digital-scoring models, the market-oriented credit agencies have dramatically improved the efficiency and reduced the cost of credit reporting. Unlike the traditional regression-scoring models, the credit evaluation based on big data is more about building neural networks, decision trees, random forests, machine-learning, and other models to process all kinds of information about borrowers, including consumption records and information related to travel, accommodation, property, vehicles, occupation, and the like (Yao et al., Reference Yao, Xie, Liu and Liu2018). The traditional credit investigation mainly depends on historical data, which is quickly out of date (Peng and Wu, Reference Peng and Wu2018). In contrast, big-data credit reports can be updated online in real time (He and Che, Reference He and Che2017), and large-scale data can be processed efficiently and economically through big-data computing software (Peng and Wu, Reference Peng and Wu2018).

3.2 Digital Payment Infrastructure: Explicit Impact on Inclusion

Digital payment infrastructure has had a more direct impact on transforming China’s financial inclusion in DFI. As discussed, the digital development of payment infrastructure is the result of the application of a series of digital technologies in the payment field, including cloud computing, bio-identification, QR (quick response) codes, and blockchain. In China, two digital payment infrastructures have the potentially greatest impacts on financial inclusion: third-party mobile payments and digital RMB. As the latter is still in the pilot stage, we will focus mainly on the former.

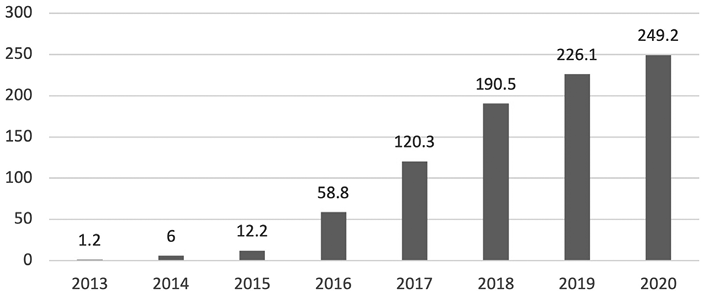

Third-party mobile payments mainly refer to the mobile payment services offered by nonbank payment companies, especially internet payment companies. In China, Alipay and Tencent Finance together account for more than 90% of the third-party payment industry (Yang, Reference Yang2019). Since 2013, mobile payments have experienced dramatic development in China. As shown in Figure 30.1, the total volume of third-party mobile payments increased more than 200 times, from 1.2 trillion yuan in 2013 to 249.2 trillion yuan in 2020.

Figure 30.1 Third-party mobile payment transactions in China (1 trillion yuan).

The explosive growth of third-party mobile payments has revolutionized Chinese financial inclusion in terms of the five core features of financial inclusion mentioned: namely, accessibility, affordability, commercial sustainability, responsibility, and opportunity equality.

First, third-party mobile payments have greatly enhanced the accessibility of financial services. Although traditional payment infrastructures such as bank outlets, ATM, and POS (point-of-sale) terminals still play an important role, use of these traditional infrastructures has been shrinking. By the end of 2021, China had 947,800 ATM terminals, a decrease of 66,000 from the previous year (PBOC, 2022b). In contrast, by the end of June 2022, the total number of cell phone subscribers in China reached 1.67 billion, a net increase of 25.52 million over 2021, twice as many as in 2010 (Ministry of Industry and Information Technology, 2010, 2022). Besides, as of June 2022, the number of internet users in China was 1.05 billion, with the internet penetration rate reaching 74.4% and the proportion of mobile internet access reaching 99.6% (CNNIC, 2022). According to PricewaterhouseCoopers, China’s mobile payment penetration rate reached 86%, ranking first in the world in 2019 (PwC, 2019). Third-party mobile payments have made financial services significantly more accessible.

Second, third-party mobile payments and the digital technologies behind them have also enhanced the affordability of financial services. One of the key factors for affordability lies in reducing the operating costs of financial service providers. On one hand, the improved accessibility of mobile payments also reduces the cost of many financial services. In the field of rural credit, the annual interest rate of microfinance institutions and informal credit was relatively high, reaching 18% or 19%, or even 20%, due to traffic restrictions and other factors (Bei and Li, Reference Li2017). In contrast, the annual interest rates of Alipay’s Jiebei and Tencent Finance’s Weilidai are usually 14.6% and 10.95%, respectively (Wu, Reference Wu2019). On the other hand, digital technologies can directly lower the cost of financial services. For example, based on cloud-computing technology, Alipay’s single payment cost is 0.02 yuan, which is ten times lower than traditional payment methods (Bei, Reference Bei2017).

Third, third-party mobile payments have more potential for business sustainability. Due to the aforementioned improvements in accessibility and affordability, these mobile payment agencies can achieve boliduoxiao (a sales strategy to increase total revenue by selling goods at a low profit per unit price). In 2021, nonbank payment institutions processed 827.3 billion online transactions worth 294.56 trillion yuan (PBOC, 2021), including 249.2 trillion yuan in third-party mobile payments (see Figure 30.1). The profits of the third-party payment platforms are mainly from sinking funds, handling fees, advertising revenue, and other value-added service income (Guo, Reference Guo2021). Taking Alipay as an example, after the launch of Yu’E Bao in 2013, it absorbed 400 billion yuan of investment in less than a year (Lu, Reference Lu2018). The revenue of Jiebei was 3.8 billion yuan, 11.2 billion yuan, and 11.8 billion yuan in 2016, 2017, and 2018, respectively, and the net profit was 1.8 billion yuan, 6.1 billion yuan, and 3.5 billion yuan, respectively (Zhongtai Securities, 2020).

Fourth, the third-party mobile payment agencies and the regulatory authorities have jointly safeguarded the responsibility of financial services. From the perspective of third-party mobile payment agencies, digital technology and companies’ self-regulatory mechanisms are two important aspects to protect the interests of customers. Fintech companies establish risk control and prevention systems through technologies such as the Internet, big data, and cloud computing, as well as through internal regulatory institutions, thus reducing the risk of financial services (Peng and Wu, Reference Peng and Wu2018). For example, Ant Group has established a consumer rights protection and management system based on architectural guarantees, internal control mechanisms, and platform construction (Ant Group, 2021). From the perspective of regulatory authorities, the PBOC and other government agencies have played critical roles. One of the representative events was the establishment of a common clearing platform for nonbank and third-party payment institutions, the NetsUnion Clearing Corporation, in August 2017. Another regulatory action was the Shanghai Stock Exchange’s suspension of Ant Group from listing on the Science and Technology Innovation Board in November 2020.

Fifth, third-party mobile payments have technically promoted opportunity equality. Opportunity equality emphasizes breaking the Pareto principle and building solid financial systems and a more equal society. As mentioned, third-party mobile payments create more opportunities by improving accessibility and affordability. They can also contribute to increasing equality between users and regions. For users, as the Ant Group claims, “we strive to enable all consumers and small businesses to have equal access to financial and other services through technology” (Ant Group, 2022). In particular, vulnerable groups can enjoy the same financial services as others, as long as they or their families have a cell phone. For regions, third-party mobile payments largely eliminate geographical and spatial limitations, enabling remote areas such as small mountain villages with less developed transportation links but good internet connections to have better access to financial services.

To conclude, the extent of financial inclusion is determined by many factors, among which financial infrastructure is most decisive. Digital financial infrastructures have transformed the conventional ways of conducting financial interactions and activities and made financial services more accessible. Meanwhile, financial infrastructures are not purely neutral and value-free at either the domestic or the international level. Within society, digitalization of the financial industry brings new redistribution effects, leading to new winners and losers. In the international system, the redistribution effects also exist among states, which has resulted in new forms of international power competition, such as the digital RMB versus other central bank digital currencies. The importance of financial infrastructures in domestic societies and international systems, as emphasized in this book, needs further exploration.