Book contents

- Frontmatter

- Contents

- Preface

- Contributors

- PART ONE THE LAW AND POLITICS OF FISCAL POLICY

- 1 The Congressional Budget Process

- 2 Budget Gimmicks

- 3 Transparency in the U.S. Budget Process

- 4 European Experiences with Fiscal Rules and Institutions

- Part One Bibliography

- PART TWO UNDERSTANDING FEDERAL DEFICITS AND PUBLIC DEBT

- PART THREE BUDGETING AND FISCAL CONSTRAINTS AT THE STATE LEVEL

- PART FOUR INTERGOVERNMENTAL ASPECTS OF BUDGET POLICY

- PART FIVE JUDICIAL POWERS AND BUDGET POLICY

- Index

- References

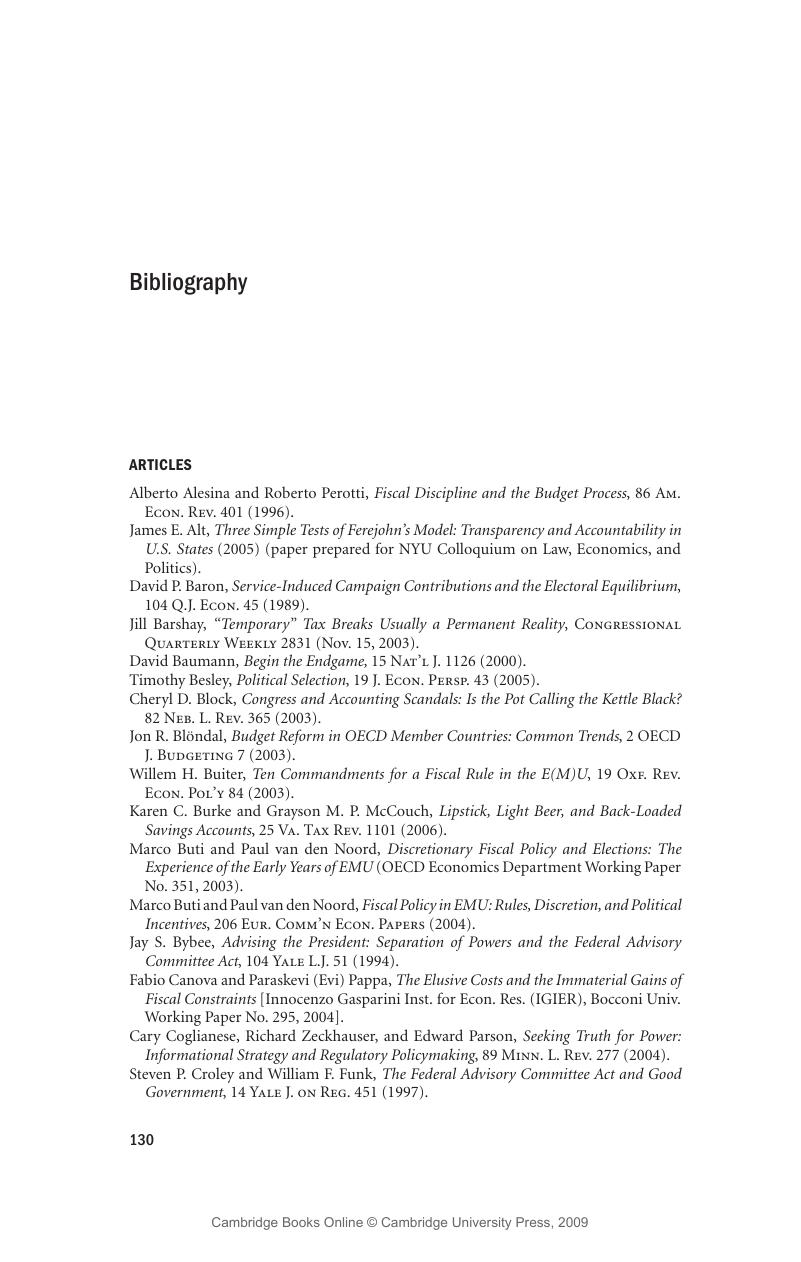

Part One Bibliography

Published online by Cambridge University Press: 23 December 2009

- Frontmatter

- Contents

- Preface

- Contributors

- PART ONE THE LAW AND POLITICS OF FISCAL POLICY

- 1 The Congressional Budget Process

- 2 Budget Gimmicks

- 3 Transparency in the U.S. Budget Process

- 4 European Experiences with Fiscal Rules and Institutions

- Part One Bibliography

- PART TWO UNDERSTANDING FEDERAL DEFICITS AND PUBLIC DEBT

- PART THREE BUDGETING AND FISCAL CONSTRAINTS AT THE STATE LEVEL

- PART FOUR INTERGOVERNMENTAL ASPECTS OF BUDGET POLICY

- PART FIVE JUDICIAL POWERS AND BUDGET POLICY

- Index

- References

Summary

Information

- Type

- Chapter

- Information

- Fiscal ChallengesAn Interdisciplinary Approach to Budget Policy, pp. 130 - 138Publisher: Cambridge University PressPrint publication year: 2008