Scientific evidence is clear: human activities have released enough greenhouse gases (GHG) into the atmosphere to have already altered the climate, with already strong effects on ecosystems, societies and economies. On current emissions paths, climate change is set to become dramatically worse. To limit global warming, and hence avoid the worst-case scenarios predicted by climate science, the world economy must rapidly reduce its GHG emissions and reach climate neutrality within the next three decades.

This will not be an easy journey. Shifting away from carbon-intensive production will require a historic transformation of the structure of our economies. Capital and labour will have to be reallocated from brown to green activities. Many needed technologies are still under development and cannot yet be deployed. Some of the major changes that will need to take place are already clear: electricity production will need to be fully decarbonised, most economic activities will need to be electrified and energy will need to be used with much higher efficiency. But these changes will have major ramifications throughout the economy, which are less well understood.

In particular, as the time horizon of these adjustments has shrunk significantly, the decarbonisation path will impact the workings of the economy and even the business cycle in ways previously unaccounted for. In short, achieving climate neutrality by mid-century will have significant macroeconomic implications that need to be understood and adequately managed by policymakers.

Economic growth has so far driven emissions: higher levels of economic activity require more consumption of energy, of which 80 per cent globally is still produced by burning fossil fuels (IEA, 2021b). In 2019, annual global GHG emissions stood at 37 billion tons of CO2, 62 per cent higher than in 1990, the year of the first Intergovernmental Panel on Climate Change report, and 4 per cent higher than in 2015 when the Paris Agreement was signed (Friedlingstein et al., Reference Friedlingstein, O’Sullivan, Jones, Andrew, Hauck and Olsen2020). Even unprecedented circumstances such as the massive restrictions introduced to contain COVID-19 led only to a 6 per cent drop in emissions in 2020, from which a quick rebound to pre-pandemic levels promptly followed (IEA, 2021b).

In order to restrict global warming to 1.5°C and mitigate severe climate impacts, the global economy must swiftly cut greenhouse gas emissions and achieve climate neutrality by 2050. At current emissions levels, the global carbon budget that would still be compatible with the 1.5°C goal would be exhausted by 2030. Annual global GHG emissions currently show no sign of peaking. A far-reaching transformation of the global economy to reduce emissions is still needed.

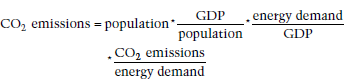

One of the most fascinating ways to appreciate this problem is to look at the identity formulated by Kaya and Yokoburi Reference Kaya and Yokoburi(1998), which decomposes total CO2 emissions into various components,Footnote 1 clearly illustrating the trade-offs implied in reducing emissions.

The identity illustrates how total CO2 emissions are the product of population, gross domestic product (GDP) per capita, the energy intensity of GDP and the CO2 intensity of energy. Acting on any of these levers would contribute to decreasing total emissions in this model.

What this identity also shows is that if improvements in energy efficiency (third component) or in the CO2 emissions from energy (fourth component) are too slow, then drastic reductions in emissions can come only from drastic reductions in economic activity or population. In practice, the main discussion centres around the emissions intensity of production (third and fourth components) and the level of GDP per capita (second component). This tension is at the heart of the macroeconomic impacts of decarbonisation. Population growth is usually set aside for good reasons. Much of population growth happens in parts of the world where per capita emissions are very low. Meanwhile population growth has stagnated in the regions of the world where emissions per capita are high.

In practice, improving the third component of the Kaya identity, energy use per unit of GDP, can be achieved through improvements in energy efficiency from using better technologies for production, transport or insulation; by behavioural change towards less energy-intensive consumption (e.g. increased use of public transport, a larger sharing economy and more re-use of durable goods); and by a changing economic structure towards a more ‘immaterial’ service-oriented economy. Improvements in the last component of the Kaya identity, CO2 emissions per unit of energy demand, are mostly achieved by shifting away from fossil fuels to renewable energy sources, which might imply electrifying certain uses, notably transport.

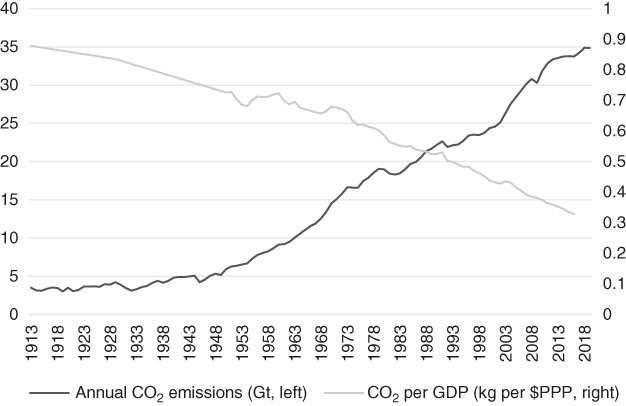

If the decline in these two factors outpaces economic growth, absolute decoupling of GDP and emissions will take place. This is a situation in which emissions go down while real GDP continues to grow. This is already happening, albeit modestly, in Europe and the United States. Globally however, there is no sign of absolute decoupling, but only of relative decoupling (CO2 emissions grow less than proportionately to real GDP). Explained in terms of the Kaya identity, while CO2 emissions per unit of GDP are falling (the third and fourth factors combined), the fall is slower than the increase in real GDP (the first and second factors) so that overall emissions continue to rise. Figure I.1 shows that in the last hundred years, annual CO2 emissions have risen tenfold, even though emissions per unit of GDP have been slashed by almost two thirds.

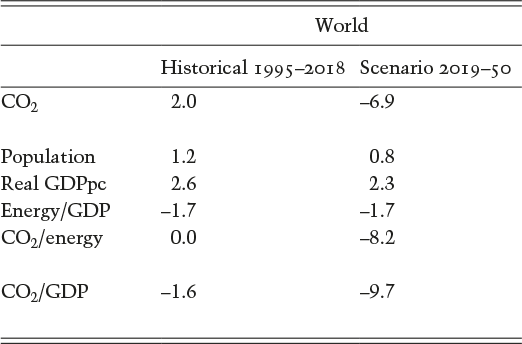

To understand how much the world still falls short of the required speed of decoupling, we use historical and projected data from the Organisation for Economic Co-operation and Development (OECD) on population and GPD per capita as well as historical International Energy Agency (IEA) data on energy and emissions to compare recent average rates of change of each factor of the Kaya identity to estimate what it would take to reach net zero emissions by 2050 (Table 1.1). We assume that the reduction of energy use to produce GDP will continue its current downward trend. We make this assumption not because energy efficiency does not play an important role in reducing emissions – on the contrary. Here, we want to illustrate the speed at which decarbonising the production of energy itself would have to accelerate if all else is assumed constant.

Table I.1 Factors of the Kaya identity, CO2 and CO2/GDP, average yearly rates of change (%) in 1995–2018 (historical data) and in net zero emission scenario 2019–50

| World | ||

|---|---|---|

| Historical 1995–2018 | Scenario 2019–50 | |

| CO2 | 2.0 | –6.9 |

| Population | 1.2 | 0.8 |

| Real GDPpc | 2.6 | 2.3 |

| Energy/GDP | –1.7 | –1.7 |

| CO2/energy | 0.0 | –8.2 |

| CO2/GDP | –1.6 | –9.7 |

This simulation suggests that the global decoupling rate between emissions and GDP (bottom row) needs to accelerate by a factor of six to reach net zero by 2050.Footnote 2 Annual emissions per unit of energy would have to fall by 8.2 per cent per year, compared with the current 0 per cent (Lenaerts et al., Reference Lenaerts, Tagliapietra and Wolff2022, provide more details).

The Kaya identity thus shows that achieving decarbonisation by mid-century would be a historic endeavour. Shifting away from carbon-intensive production will require a historic transformation of the structure of our economies. Electricity production will need to be fully decarbonised, most economic activities will need to be electrified and energy will need to be used with much higher efficiency (IEA, 2021b; IRENA, 2021). But these will have ramifications throughout the economy, which are less well understood (Pisani-Ferry, Reference Pisani-Ferry2021).

One example in the energy system is that the transition from burning fossil fuels to using renewable sources will have implications for the location of energy production, with knock-on effects on international trade and competitiveness (McWilliams & Zachmann, Reference McWilliams and Zachmann2021). Put together, achieving climate neutrality will likely have implications of macroeconomic importance.

The public policy debate on addressing climate change is shifting rapidly for at least three reasons. First, evidence from the climate science shows that non-linear climate developments are becoming more likely with even small changes in temperature.Footnote 3 Slow and long-term responses are simply inadequate as the costs of climate change may well explode much earlier than previous policymaking assumed. Second, there is an increasing public sense of urgency, also resulting from the very tangible extreme weather events that are being felt.Footnote 4 Many people in our societies increasingly want to act on climate change. Third, policy commitments to tackle climate change are becoming more credible. These factors are rapidly pushing the frontier of the debate among economists as well. While much previous research focussed on questions of the ‘optimal speed of decarbonisation’, weighing costs against benefits, economic research is increasingly focusing on the need to rapidly decarbonise to net zero in the next twenty-five years. How to successfully reach net zero emissions rapidly and what the economic consequences and policy requirements for such change are are the new frontiers of research.

The acceleration of climate action (necessary to still avoid catastrophic climate pathways) means that the macroeconomic implications of climate action become bigger. Rapidly adjusting the energy system requires major upfront investments in green infrastructure such as solar panels and wind parks, the electricity grid, storage facilities and new heating and cooling systems. The green energy system will likely be more capital intensive than the brown energy system, and the more rapid the transition is happening the faster brown assets, that are still functioning, will have to be depreciated. A macroeconomically relevant reduction of the capital stock will be combined with a major increase in investments into green, amounting to as much as 2 per cent of GDP per year over decades. How will these investments impact the cost of credit? And how will the ongoing tightening of monetary policy impact the cost of renewable investments? Since fossil fuel-based power plants have comparably low upfront costs, a rise in the cost of capital may discourage efforts to decarbonise our economies rapidly.Footnote 5 For example Monnin Reference Monnin(2015) finds that low interest rates increase the competitiveness of green energy technology relative to brown. On the other hand, green energy has relatively low variable costs. How will a macroeconomy look like when the cost of energy consumption significantly falls? The energy crisis of 2022 and the oil price shocks of the 1970s give some indication as to the macroeconomic implications of rapidly changing energy consumption costs.

Accelerating the transition to a climate-neutral economy and society requires major public policy interventions of macroeconomic relevance. Greenhouse gas emissions need to be penalised, for example by taxing them. How big are the government revenues generated from such taxes and what are the macroeconomic implications of such taxes? If new technologies need to be developed, what is the role for government in that process? What are the distributional implications of climate policies? Is our financial system structured appropriately to ensure the funding of green investments? Will green firms be able to hire the qualified staff they need? How can displaced workers successfully find new employment?

The purpose of this book is to advance the understanding on the macroeconomic fundamentals of decarbonisation. It identifies the major economic transformations and roadblocks requiring policy intervention. It develops a macroeconomic policy agenda for decarbonisation that would achieve the climate goals of the international community. While the book takes a global prospect on the issue, it provides specific insights into the European Green Deal, as one of the most ambitious decarbonisation agendas in the world.

Getting global decarbonisation right means that the macroeconomic implications of the process have to be understood and taken into account when designing climate policies. A costly and inefficiently done decarbonisation strategy will not be economically and socially viable while a wrong set of macroeconomic and structural policies may raise the cost of decarbonisation to unacceptable levels. The book seeks to shed light at this crucial intersection, reviewing systematically the existing evidence and reflecting on the key policy trade-offs and potential ways forward.

The book is written in the form of a textbook so as to be accessible to a wide readership. It adopts a simple language, avoiding the jargon that often characterises the debate in the field. In order not to compromise on rigour, it not only utilises the most authoritative data sources in the field but also has made plenty of references to primary literature for those who might wish to delve more deeply into the topics discussed. Each chapter has a set of review questions and key takeaways.

Chapter 1, ‘Understanding Deep Decarbonisation over the Long Run’, illustrates how economists have traditionally thought about decarbonisation. It notably provides an overview of the structure and key assumptions of Integrated Assessment Models, the main tool used by economists to model climate–economic interactions, with the aim of discussing their main policy lessons with regard to the macroeconomic implications of decarbonisation.

Chapter 2, ‘Understanding Decarbonisation’s Short-Term Disruptions to Economic Activity’, discusses a different analytical framework used by economists to understand the short-run effects of climate policy: Dynamic Stochastic General Equilibrium models. It presents recent empirical findings in this area and describes the main lessons learned from these models.

Chapter 3, ‘The Distributional Effects of Climate Policy’, first illustrates the risk of decarbonisation impacting low-income households more than high-income ones, as they devote a larger share of their income to energy consumption and as they face more difficulties in switching to green alternatives. It then discusses which kind of policies can be adopted in order to avoid such risks and to ensure a fair transition with no social and political backlash.

Chapter 4, ‘Public Finances and Decarbonisation’, discusses the role that fiscal policy can play in the transition to a carbon-neutral economy. In other words, it discusses how to design fiscal policy, both on the revenue and on the expenditure side, to reach net zero emissions by mid-century in a credible growth- and distribution-friendly way. Furthermore, the chapter discusses how decarbonisation is likely to impact public finances, shedding light on what change might be required in tax revenues/expenditures, and if debt sustainability risks might arise from the green transition.

Chapter 5, ‘Greening Innovation, Industrial and Competition Policies’, discusses the importance of technological progress for achieving climate goals and how innovation, industrial and competition policies can work as powerful engines to spur decarbonisation and what it would take to ensure that the decoupling of economic growth from GHG emissions occurs at the speed necessary to reach climate neutrality by 2050.

Chapter 6, ‘Mobilising the Financial System for Decarbonisation’, discusses how decarbonisation will affect capital markets and how capital markets can support decarbonisation. One notable focus is on the risk of ‘stranded assets’, that is assets that lose value because of decarbonisation, and the potential implications for financial stability. The chapter also analyses how capital markets can become a key enabler of decarbonisation, also thanks to new sustainable finance instruments such as green bonds.

Chapter 7, ‘Decarbonisation and Labour Markets’, explains the consequences on the labour market of the structural changes induced by decarbonisation policies. These policies are likely going to have consequences on labour income distribution given existing rigidities in the labour markets and their different impacts on sectors and job categories. The chapter notably discusses whether decarbonisation can be a net job creator or destroyer, illustrating how job losses can be managed in a fair manner and how green jobs creation can be incentivised.

Chapter 8, ‘Greening Central Banks’, illustrates how decarbonisation is likely to have implications for the business cycle. In this context, it discusses how decarbonisation can change the effectiveness of monetary policy. It also discusses what the scope is for monetary policy to be more actively engaged in decarbonisation efforts, both from an economic and from an institutional perspective.

The authors hope that this book will help the present and next generation of teachers, students, policymakers and citizens with an interest in economic and climate issues to develop a clearer understanding of the macroeconomic implications of decarbonisation, so that they may be better able to contribute to the resolution of the complex issues associated with this aspect of the historical climate challenge we all face. In conclusion, the authors would like to thank Bruegel’s research assistants Giulia Gotti, Catarina Martins, Kamil Sekut, Cecilia Trasi and Lennard Welslau for their excellent research support. They would also like to thank Bruegel’s data scientist Michal Krystyanczuk for his support in the preparation of the Index. Finally, the authors would like to sincerely thank the European Climate Foundation for providing the financial support that made this work possible.