The financing of international development organizations (IDOs) has changed remarkably since the end of the Cold War. Instead of giving aid bilaterally or multilaterally, donors increasingly resort to earmarked funding—“voluntary external assistance from donors for a multilateral agency, which is supplementary to core membership contributions and which is earmarked for specific purposes.”Footnote 1 Donors earmark funding for policy areas, regions, countries, or individual projects. The practice has taken the international development world by storm. The share of earmarked funding increased from almost none to more than 50 percent of IDO resources between 1990 and 2020.Footnote 2 Despite this trend, studies on the consequences of earmarking for the performance of IDO operations remain scarce. Therefore, we ask: to what extent does earmarked funding affect IDO performance?

Scholars differ on this issue. Principal–agent theorists have long argued that insufficient donor control over agencies can allow agency slack and slippage.Footnote 3 In this view, principals need to use control mechanisms to ensure that agents perform their tasks in accordance with their mandate. However, empirical studies indicate that donor control can be detrimental to IDO performance. IDOs that allow more donor influence score lower on independent evaluations of their performance,Footnote 4 and donor control has been linked to an inability to adapt development assistance to fragile contexts.Footnote 5 We use the rise of earmarked funding to revisit this debate by comparing IDO performance in earmarked projects (with more donor control) to core-funded projects (with less donor control). Our study ultimately contributes to the broader discussion of international organizations’ autonomy versus control by their member-state principals.

Donors’ aid allocation decisions are always subject to trade-offs.Footnote 6 One such trade-off is between the need to justify funding priorities to constituencies and the wish to maximize effectiveness.Footnote 7 By delegating to IDOs, donors gain from IDOs’ specialized workforces.Footnote 8 Yet, donors surrender control over how their money is spent under the traditional regime of (unearmarked) core contributions. In an attempt to resolve this trade-off, and as political differences between donors grew in recent decades, donors began prioritizing earmarked funding.Footnote 9 Earmarking allows donors to reap the delegation gains without losing control. By specifying the costs and benefits associated with the growth of earmarking, our study may inform decisions on how donors spend billions of dollars to target critical global cooperation problems like climate change, pandemics, poverty, or malnutrition.

We argue that earmarked funding weakens IDO performance and decreases cost-effectiveness because it increases IDOs’ administrative burden. Earmarking increases the time that staff need to spend raising funds, maintaining donor relations, and reporting back to donors—cannibalizing resources for engaging with emerging on-the-ground problems during the design and implementation of development projects.Footnote 10 Therefore, we expect that on average, IDOs perform worse in earmarked projects and that these projects are more costly.

We test our hypotheses on a sample of 7,571 projects approved by five IDOs—the African Development Bank (AfDB), Asian Development Bank (ADB), Caribbean Development Bank (CDB), International Fund for Agricultural Development (IFAD), and World Bank—in over 150 countries from 1990 to 2020. We find that, all else equal, earmarked projects perform worse than comparable core-funded projects. These performance losses imply a drain on resources. Donors and IDOs must invest more money in earmarked projects to achieve the same level of performance as in core-funded projects.

The Performance–Control Trade-Off in International Development Organizations

Our focus in this research note is the performance of IDO projects. The literature on international organizations has converged on two central dimensions of performance: process and outcome.Footnote 11 The process dimension emphasizes the “ability of the organization to mobilize resources and make internal operations more efficient,” and the outcome dimension highlights “an organization's ability to achieve agreed-upon objectives.”Footnote 12

By delegating to IDOs, aid donors can increase performance on both dimensions compared to allocating development assistance bilaterally.Footnote 13 The most important benefit is specialization.Footnote 14 As Hawkins and colleagues argue, “without some gains from specialization, there is little reason to delegate anything to anybody.”Footnote 15 Development assistance necessitates managing and supervising complex projects run in different country contexts and sectors. For example, typical World Bank projects range from large-scale expansion of primary education in the Democratic Republic of the Congo to financing filtering technology to desulfurize Chinese coal power plants.Footnote 16 Successful implementation of such varied projects requires vastly different knowledge about recipient countries, beneficiaries, and sectoral policy approaches.Footnote 17 To this end, IDOs employ thousands of staff who monitor developments in recipient countries and provide expertise on specific policy areas. This workforce gives donors access to specialized information on recipient countries,Footnote 18 allows IDOs to monitor implementation better,Footnote 19 and increases their ability to cope with complex problems during implementation.Footnote 20

In contrast, bilateral agencies in donor countries often do not have such sectoral or country-specific expertise without cooperating with IDOs. Large investments in staff training and retention are necessary to maintain a sizeable bureaucracy with skills on diverse countries and policy issues. Competing for a limited talent pool and maintaining such staffing would use up donor resources that could otherwise be spent on development assistance or domestic priorities.Footnote 21 By pooling resources with and through IDOs, donors can increase the cost-effectiveness of their development assistance in comparison to strictly bilateral efforts.

These arguments imply that delegation to IDOs reduces costs and increases performance for donors. However, delegation also reduces donors’ ability to attain their short-term political objectives and priorities in favor of more technocratic decisions made by IDO staff based on problem severity, country need, and the likelihood of successful implementation.Footnote 22 IDO agents have substantial discretion in spending donor money for three reasons: delegation contracts, multiple principals, and informational advantages.

First, delegation contracts allow considerable discretion for agents, which is necessary to reap the gains from delegation.Footnote 23 Delegation includes a “conditional grant of authority” from the principals to the agent.Footnote 24 Donors condition this authority through control mechanisms designed to limit slippage (minimizing efforts on principals’ behalf) and shirking (biasing policy away from the collective interests of the principals).Footnote 25 In doing so, donors need to strike a balance where control mechanisms constrain discretion enough to prevent slack, but do not undermine problem solving.Footnote 26

Second, donors pool their resources with other donors to share burdens. IDOs thus face multiple donor principals.Footnote 27 When principals’ preferences diverge, member states find it harder to exercise collective control on IDO agents, which give the IDO more autonomy to possibly bias policy away from donor preferences.Footnote 28 Agents gain discretion because donors might not agree on disciplining the agent.

Third, the informational advantages IDOs gain from specialization allow them to prime donors in line with IDO preferences. Verifying the information provided by IDOs is difficult or costly: “It is often impossible for state representatives to have the necessary expertise to craft complex, effective programs in a timely fashion. Thus, states rely heavily on staff memos and proposals.”Footnote 29 Principals’ reliance on agents’ information allows agents to selectively emphasize certain information, leading to decisions closer to agent preferences.

Donors cede control over how their money is spent in IDOs compared to bilateral aid. While powerful donors retain privileged access to IDOs due to outside options or institutional privileges,Footnote 30 they often limit interventions to setting broad policy agendas, leaving the day-to-day decision making to technocratic bodies.Footnote 31 They delegate more to agents that share their preferences, maximizing the possibility that their money is spent in accordance with their spending priorities,Footnote 32 while also retaining sizeable bilateral aid portfolios that allow them to allocate development assistance to countries and issue areas that are at the core of their political or economic interests.Footnote 33 Nevertheless, to reap the benefits from delegation, donors traditionally accept that IDOs will spend donors’ money as IDOs see fit.

However, the shift toward earmarked financing of IDOs over the last thirty years has changed this dynamic, reshaping the performance−control trade-off as donors seek to limit the incurred costs of delegating to IDOs. The following section develops this point more systematically by discussing the rise of earmarked funding and hypothesizing its consequences for the ability of IDOs to effectively deliver development assistance.

Control Despite Delegation: The Performance–Control Trade-Off in Earmarked Funding

While earmarking was almost nonexistent in 1990, it skyrocketed to approximately 50 percent of IDO funding by 2020. Almost all IDOs run projects that are partially funded by earmarked contributions. While core funding remained largely stable, increases in IDO resources since 1990 have been driven by earmarked funding (Figure 1).Footnote 34 That is, earmarked funds mainly add to core funding rather than replacing it. A major implication is that such donor practices reshape the performance–control trade-off for donors delegating to IDOs.

Figure 1. The rise of earmarked development assistance between 1990 and 2020

The rapid expansion of earmarked funding was driven by donor and IDO-specific factors.Footnote 35 Donors increased earmarked funding as a result of three trends emerging after the end of the Cold War. First, following the dissolution of the Soviet Union, donors were liberated from geopolitical constraints. Coupled with recessions in many donor countries and related pressures on aid budgets, donors became more assertive in pursuing their own development policy preferences. The increasing preference heterogeneity of donors made it more difficult to expand IDO mandates supported through core funding. Donor preference heterogeneity further increased with the ascent of China.Footnote 36 Increasing political differences among principals meant that they were incentivized to prioritize earmarked funding to assert their preferences and design funding rules that safeguard their power.Footnote 37

Second, the transformation of political objectives in foreign aid increased the diversity of donors’ spending priorities. While foreign aid had long addressed development needs and supported the commercial interests of donor countries, additional motives emerged, such as supporting democracy and human rights,Footnote 38 averting migration from crisis hot spots,Footnote 39 and providing global public goods.Footnote 40 An expanded agenda further reified donor preference heterogeneity over time.

Third, donor governments have come under increased scrutiny from domestic actors, including parliaments, auditors, and independent evaluators. Governments have passed on these accountability pressures to their multilateral agents by requiring detailed financial accountability and results reporting.Footnote 41 While core funding blends contributions so that use of specific funds can no longer be tracked, earmarked funding allows donors to claim results supported through their individual contributions.

For their part, IDOs were eager to capitalize on emerging funding opportunities because the proliferation of IDOs outpaced aid budgets, intensifying competition for funds among IDOs. Most IDOs, especially those in the UN system, traditionally lacked resources. When donors cut funding, for example, in the 1990s, IDOs needed to look beyond core funding to ensure they could continue their operations. IDOs were keen to capitalize on newly emerging sources of funding, like philanthropic foundations, and they set up trust funds for such purposes.Footnote 42

Ultimately, the expansion of earmarked funding reflects donor strategies for achieving delegation gains while minimizing loss of control. Earmarking allows donors to take advantage of the specialization gains associated with delegation, without relinquishing control over what their funds are used for.Footnote 43 Donors can take advantage of IDO staff expertise, their bargaining power, and their in-country networks to increase aid performance, while retaining control over spending priorities by micromanaging the country and issue-area focus of projects.Footnote 44 Earmarking allows donors to ensure that their money is spent according to their preferences, despite delegation.

However, to maintain control despite delegation, donors must earmark funds with additional control mechanisms that ensure IDOs use the money in line with the donor's priorities and do not engage in agency slack.Footnote 45 For example, donors can require regular reporting, additional evaluation procedures, or specific operational obligations. These requirements add to other control mechanisms, like board approval,Footnote 46 screening and selection of leadership,Footnote 47 transparency requirements,Footnote 48 or inspection panels.Footnote 49 As a result, IDO staff using earmarked funds have less leeway in adapting projects to realities on the ground and have a larger administrative burden. The benefits of specialization diminish as fewer decisions are up to the agent.Footnote 50

Hence, we expect IDO performance to decrease in earmarked projects compared to core-funded projects. Moreover, the additional administrative procedures required through earmarking increase the amount of time that staff need to spend on supervision of individual projects. Such additional staff time should increase the costs of these projects. Therefore, we also expect that trust-funded projects should be more expensive to supervise than comparable core-funded projects. Thus, our two hypotheses are:

H1: Earmarking decreases IDO performance in development projects.

H2: Earmarking increases the supervision costs of development projects.

Research Design

To test our hypotheses, we use data on 7,571 projects implemented between 1990 and 2020 by five IDOs: AfDB, ADB, DDB, IFAD, and the World Bank. We focus on 1990 to 2020 because earmarked projects rarely existed before then. Our unit of analysis is the individual project. We proceed in two steps. First, we test the hypotheses using detailed data on earmarking, performance, and supervision costs in World Bank projects. Second, we probe whether our findings plausibly generalize by extending our analysis to the other four IDOs.

Dependent Variables

We use three dependent variables: World Bank performance, IDO performance more generally, and World Bank cost-effectiveness. The first is a performance measure based on internal World Bank project evaluations. An emerging literature on aid effectiveness uses World Bank staff's own project evaluations to compare the performance of development projects.Footnote 51 This allows us to observe whether earmarked funding is associated with changes in World Bank performance as judged by the organization's Independent Evaluation Group. One limitation of this approach is that we cannot make objective judgments of World Bank performance, and other actors might have different assessments. Nevertheless, by exploiting variation across projects of the same IDO, we can learn whether performance changes due to the rise in earmarking relative to other projects.

Available ratings indicate performance in one of three categories: whether projects achieved their stated objectives;Footnote 52 whether recipients followed their obligations as specified in the aid agreement;Footnote 53 and whether the World Bank performed its functions effectively.Footnote 54 Because we are interested in organizational performance (rather than aid effectiveness or recipient performance), we draw on that third category to identify the quality of the project team's work in the project. Ratings range from 1 (very unsatisfactory) to 6 (very satisfactory).

Later, we rely on evaluations from four additional IDOs that focus on how well they performed, in the eyes of IDO evaluators, on two dimensions: the design of the project and implementation supervision. Projects were rated on a scale of 1 (very unsatisfactory) to 6 (very satisfactory) for IFAD, 1 to 4 for AfDB and ADB, and 1 to 5 for CDB. Our IDO performance variable uses a rescaled version of these ratings to harmonize them on a common scale from 1 to 6.Footnote 55

Our third dependent variable focuses on the cost-effectiveness of World Bank projects. The World Bank may be aware of increasing administrative burdens and might allocate more money and staff time to mitigate them. We need to account for this factor to appreciate the consequences of earmarking. To observe changes in cost-effectiveness, we draw on data recently acquired by Honig and colleagues via an Access to Information request.Footnote 56 The data, collected through regular internal processes that monitor project expenses, report the supervision costs (in thousands of USD) for 3,086 projects approved between 1990 and 2015.

Independent Variables

We use two main independent variables to understand the consequences of earmarking. The first measures earmarking at the project level. To identify earmarked World Bank projects, we draw on information about funders of individual projects in the World Bank's documents and reports database.Footnote 57 Specifically, we rely on the project-level trust-fund contributions included in Bank document metadata. Our interviews with Bank staff indicate that these data are the most comprehensive way to identify earmarked projects at the Bank.Footnote 58 For other IDOs, we rely on International Aid Transparency Initiative disclosure of project-level funding sources (AfDB), data disclosed as part of project evaluations (ADB and IFAD), and publicly available reports on individual project funding (CDB). This allows us to identify the funding sources of 7,571 IDO projects. We construct a binary measure coded 1 if a project was at least partly funded by earmarked contributions, and 0 otherwise.

Empirical Analysis of the Consequences of Earmarking

We estimate ordinary-least-squares (OLS) and instrumental-variable regressions that identify differences between earmarked projects and core-funded projects in each IDO. The models include country, sector, and year fixed effects to control for unobserved differences at these levels. Standard errors are clustered at the country-year level to correct for correlated errors.

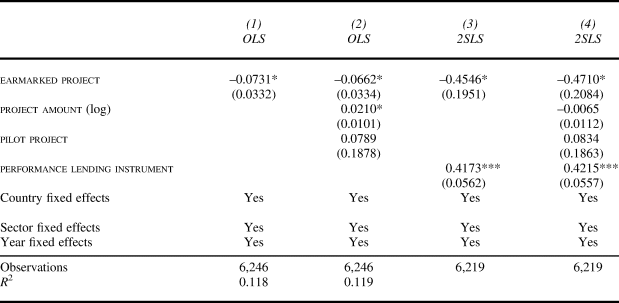

First, we analyze how earmarked funding through trust funds affects the performance of the World Bank (Table 1). In model 1, we include our main independent variable (earmarked projects), as well as country, sector, and year fixed effects.Footnote 59 Sector fixed effects are essential as earmarked projects are distributed across sectors differently from core-funded projects— more earmarked projects seem to go to sectors like agriculture, health, education, and water. We illustrate allocation patterns of earmarked and core-funded projects across sectors, regions, and income groups in the online appendix (Figures A1–A3).

Table 1. Earmarked funding and World Bank performance

Notes: Country-year clustered standard errors in parentheses; *p < .05; ***p < .001.

Model 2 includes two control variables: the (logged) project size in US dollars, and a dummy indicating whether this project was a pilot. We control for project size because earmarking increases project budgets and larger projects are harder to supervise. Meanwhile, earmarked projects are sometimes used as pilots to fund new types of risky interventions.Footnote 60 We would assume that such projects are also more challenging to supervise.

The main threat to the validity of the preceding models is the pet projects donors favor for political reasons regardless of their effectiveness or benefit for the recipient country. Research finds that pet projects are less effective in some circumstances.Footnote 61 Staff will be caught between technocratic and political objectives, which can undermine their ability to design high-quality projects and provide sound technical advice during monitoring and supervision. In both cases, we would observe a negative relationship between earmarked projects and World Bank performance not primarily driven by additional administrative requirements.

In models 3 and 4 we implement an instrumental-variable approach to address this potential confounding bias among projects. To be valid, an instrument must be related to the endogenous variable (relevance) but affect the dependent variable only through its relationship with this variable (excludability). In the period of observation, the World Bank allocated projects using seventeen different types of loans.Footnote 62 Qualitative evidence suggests that donors have strong preferences and suspicions regarding different types of loans.Footnote 63 Therefore, we use the share of approved earmarked projects in a loan type in the same year as an instrument. This instrument is relevant as donors’ allocation preferences vary between loan types. For instance, trust fund involvement in development policy loans is around 35 percent, and in Program-for-Results loans it is 40 percent,Footnote 64 while around 80 percent of more traditional loans (Specific Investment Loans) are funded by trust funds. Diagnostics confirm the relevance of the instrument: the F-statistic far exceeds critical values (it is 101.144 in the fully specified model 4).

The greater concern is excludability. Research has shown that lending instruments affect Bank performance.Footnote 65 We control for the average Bank performance in all other projects approved in the same year to account for the direct association of lending instruments with organizational performance in World Bank projects. With that control, our instrumental variable should be excludable.

The results presented in Table 1 align with the theoretical expectations formulated in H1. The coefficient for earmarked projects is negative and statistically significant (p < 0.05) in models 1 and 2. World Bank performance for earmarked projects is on average 0.06 lower than for core-funded projects. While this coefficient size is moderate, it is typical for studies using Independent Evaluation Group data.Footnote 66 Based on model 2, we estimate that the coefficient size decrease due to earmarking is comparable to a two-standard-deviation increase in the (logged) project amount.Footnote 67 Following Oster, we also conduct a validation exercise to understand the threat of omitted-variable bias.Footnote 68 The results imply that a potential confounder would need to account for 33 percent of the variation explained by the existing control variables and fixed effects in the model. Such a strong confounder appears unlikely given that the model includes demanding fixed effects on sector, country, and approval-year levels. The two-stage least-squares (2SLS) regression results are also consistent with our first hypothesis. Even when correcting for confounding bias using a plausibly excludable instrument, earmarked projects appear to have significantly worse World Bank performance than core-funded projects.

We now turn to a more policy-relevant test to understand the substantive importance of earmarking for IDO performance by testing H2. Table 2 uses the second main dependent variable, the (logged) number of US dollars the World Bank spent on yearly supervision in up to 3,093 projects. Model 5 is a simple regression accounting only for country, sector, and approval-year fixed effects. Model 6 adds the (logged) project amount and our measure of pilot projects as control variables. We use our instrumental-variable approach in models 7 and 8, controlling for the average costs for all other projects approved in the same year in a given lending instrument.

Table 2. Earmarked funding and cost-effectiveness of World Bank projects

Notes: Country-year clustered standard errors in parentheses; +p < .10; *** p < .001.

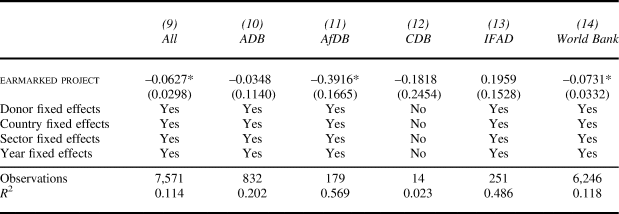

Table 3. Earmarked funding and IDO performance

Notes: Country-year clustered standard errors in parentheses; *p < .05.

The results strongly indicate that earmarked projects are more expensive to supervise than comparable core-funded projects (model 6). The coefficients are statistically significant (p < 0.001 or p < 0.10) and predict that earmarked projects are around 1.5 times as expensive as core-funded projects. Again, our validation exercise shows that the danger of omitted variable bias is not strong; an omitted variable would have to account for 46 percent of the variation explained by the existing control variables to nullify our results.Footnote 69 The supervision-cost models are also robust to using 2SLS, correcting for confounding bias. Hence, earmarked projects significantly increase supervision costs in World Bank projects. This finding implies two distinct yet simultaneous outcomes. Earmarking appears to undermine the World Bank's ability to deliver its tasks in projects (Table 1) and increases the cost of supervising these projects (Table 2). Thus, the additional organizational inefficiencies induced by earmarking appear to affect both the performance and cost-effectiveness of IDO projects.

Finally, we re-estimate separate models for five IDOs. These estimations may give an indication of the generalizability of our findings beyond the World Bank. The earmarking coefficients are negative for four of the five IDOs (ADB, AfDB, CDB, and World Bank). However, they attain statistical significance at conventional thresholds in models on the AfDB and World Bank only. One plausible explanation for this finding is sample restrictions, as CDB has a very small number of observations (14). We attain the only positive, albeit not statistically significant, coefficient for IFAD. This is likely due to IFAD's flexible replenishment mechanism for core funding, which is not constrained by burden-sharing norms, so IFAD's earmarked funding is not subject to our theoretical mechanism.Footnote 70 Given the direction of the coefficients across World Bank and IDO models, we are confident in the interpretation that to varying extents earmarked funding is associated with worse IDO performance.

Robustness Checks

The online appendix includes descriptive statistics for all variables (Table A1), the first-stage results from the 2SLS models estimated in the main analysis (Table A2), and additional robustness checks (Tables A3–A16). We show that our results are robust to a battery of alternative modeling choices, including additional fixed effects and control variables. The models presented in Table A3 show robustness to lower-level fixed effects (country-year, sector-year, and country-sector fixed effects, separately or simultaneously). The same is true for the model including all five IDOs, which is similarly robust to including lower-level fixed effects (Table A4). While country-year fixed effects ensure that results are not driven by different country conditions in the project start year, evaluations may still be biased for countries that undergo substantial changes during the project lifecycle. Therefore, we control for the change in countries’ geopolitical alignment with the US, UNSC membership, control of corruption, and GDP per capita between the project start date and end date (Table A5).Footnote 71 The results are also robust to clustering the standard errors at different levels (country, country-sector, sector-year, and evaluation-year—see Table A6). We also include average performance by lending instrument as a control variable in the OLS models (Table A7) and disaggregate findings for the two main lending instruments in our study: budget support and investment projects (Table A8). The coefficients go in the expected direction, though they fail to attain statistical significance for both subsamples, possibly due to sample restrictions.

Interestingly, when splitting the sample by instrument type, the earmarking-induced performance losses in budget-support projects appear to be larger than performance losses in investment projects. We also find the World Bank spends substantially more in earmarked investment projects than in non-earmarked investment projects. One interpretation of this combination of results is that budget-support projects do not allow the World Bank to allocate more staff time to compensate for increased transaction costs due to their explicit focus on borrower ownership and shorter loan lengths.Footnote 72 The performance of earmarked World Bank budget-support loans suffers though supervision costs stay lower. In contrast, in earmarked investment projects, the World Bank can counteract performance losses caused by earmarking by allocating more staff time to projects funded by trust funds. The Bank can compensate for (some) performance losses, but only at the expense of higher supervision costs.

We also test alternative dependent and independent variables. Regarding dependent variables, the results are robust to using alternative World Bank performance ratings focusing only on quality of project design and quality of supervision. However, they do not hold for project outcomes. Some have used binary ratings, either splitting the scale in the middleFootnote 73 or for projects rated satisfactory or highly satisfactory.Footnote 74 We estimate these binary models as linear probability models (Table A8) and as logistic regressions (Table A9). Results depend on the threshold used to distinguish successful projects from unsuccessful ones. The headline results hold for the more stringent rating coding only when highly successful and successful projects as 1 and all other projects as 0. However, the earmarking coefficient fails to attain statistical significance when also coding the moderately satisfactory ratings as 1. Table A10 further includes an ordered logit model, since performance evaluations are given on an ordinal scale. Regarding alternative independent variables, we include the (logged) number of trust-fund grants supporting a given project, capturing increasing complexity when multiple different trust funds are involved (Table A11). We also disaggregate our earmarking variable into binary indicators measuring whether donors co-finance a given projectFootnote 75 or provide supplementary assistance through trust funds. Winters shows that co-financing, particularly by local actors, decreases World Bank performance.Footnote 76 Co-financing requires less administrative work and is more akin to what some have called orchestration, while earmarked funding through trust funds implies delegation.Footnote 77 We extracted data on co-financing from project approval documents and do not find performance losses in the case of co-financing. However, project costs appear to increase for both types of financing. We also present results from Poisson pseudo-maximum likelihood models that outperform OLS when regressing count variables and on many fixed effects (Table A12).

Additionally, we probe the robustness of our estimates to violations of the exclusion restriction. Our instrumental-variable strategy is based on differences in donors’ preferences for different loan types offered by the World Bank. However, as discussed, these loan types also vary in their project performance.Footnote 78 To account for this impact, we controlled for World Bank performance on the same projects. We are not aware of any confounding factor that should affect World Bank project performance and the share of earmarking in a given loan type-year, when holding the performance of all projects in the same loan type-year constant. Nevertheless, one might still question the validity of the instrument—especially given the size difference between the instrumental variable and the OLS coefficients.Footnote 79 We employ the technique developed by Conley et al. to understand the robustness of our instrumental-variable approach to violations of the exclusion restriction (Tables A13–A14).Footnote 80 Our performance models are robust unless a confounder is responsible for 15 percent of the effect of earmarking on World Bank performance and 6 percent of the effect of earmarking on cost-effectiveness. Given that we control for World Bank performance in the same lending instrument-year, we believe that this is an acceptable degree of uncertainty. Furthermore, we demonstrate through extensive robustness checks that the conclusions we draw here do not depend only on the 2SLS models.

So far, our models take for granted that the ratings produced by IDO evaluations can be seen as meaningful measures of multiple aspects of project performance (IDO and recipient). However, scholars using similar evaluation data have questioned this notion because evaluators care more about outcome performance than other parts of the ratings. Kilby describes a “halo effect” where evaluators first decide on the project performance rating and then choose the recipient and World Bank performance accordingly.Footnote 81 Therefore, we control for the project outcome rating in Table A15. Controlling for project outcomes should also mitigate some concerns over confounding bias due to potential systematic differences between earmarked and core-funded projects in their ambition or focus. Results hold even in these demanding specifications. Finally, we test for the impact of earmarking on rating bias explicitly by using the more neutral performance indicator of Malik and Stone.Footnote 82 To minimize subjective judgment, they code Independent Evaluation Group reports according to the number of targets that were reached during the project. We show that evaluation ratings of earmarked projects do not deviate from these more objective measures of project success (Table A16).

Conclusion

This study examined how earmarked funding affects IDO performance in development projects. We argued that the rising prominence of earmarked funding reshapes delegation dynamics between donor governments and IDOs. Traditionally, donors face a trade-off between performance and control: while IDO delegation could increase aid performance, this typically required donors to surrender control over how their money was spent. With earmarked funding, donors hope for continued gains from delegation while minimizing loss of control. We hypothesized and found that, in seeking to increase control over how funds are used, earmarked funding ultimately weakens the ability of IDOs to cost effectively deliver on their mandates. Projects funded by earmarked contributions perform significantly worse than their core-funded counterparts. Furthermore, supervision costs for earmarked projects are larger than for core projects.

One limitation of our work is that we focus on the project level. Yet the burden associated with earmarked funding may also manifest at the organizational level. Indeed, the likelihood of difficult-to-observe overall organizational inefficiencies leads us to suspect we underestimate the effect of earmarking. A negative association between earmarking and effectiveness at the project level implies that earmarking affects the ability of IDOs to deliver on their mandate effectively. More research is needed to unpack the impact of earmarking at the organizational level.

Our findings indicate that donors may want to re-evaluate whether using earmarked contributions is the most efficient use of taxpayers’ money. Earmarked projects cost approximately 1.5 times as much to supervise as comparable core-funded projects. This cost increase seems particularly concerning as more performance-oriented donors tend to be more interested in earmarking.Footnote 83 Hence, donors may want to re-evaluate whether the additional costs justify the domestic political accountability benefits. Of course, it might be hard to reverse course on earmarking, given taxpayers’ preferences. Recent research has shown that donor constituencies prefer earmarked contributions due to concerns over how their money is spent.Footnote 84 However, such views do not account for the earmarking-induced waste of resources we discover. Furthermore, foreign aid policy is rarely salient enough that going against the wish of constituencies has electoral repercussions. Indeed, two donor countries, Sweden and Belgium, have already developed policies limiting the use of earmarked funding as much as possible.

In light of the performance loss and supervision costs of earmarked funds, our work also questions the value added when IDOs raise earmarked funds to address pressing global issues. Such performance losses can undermine IDOs’ legitimacy and authority.Footnote 85 Furthermore, earmarking shifts control over allocation decisions away from recipients, violating the normative emphasis on ownership and the principle that people affected by decisions should have a say in these decisions.Footnote 86 Ultimately, whether the potential performance and legitimacy losses of earmarking are an acceptable price to pay depends on whether earmarked funding is a necessary mechanism for expanding the scarce IDO resource base, or if the rise of earmarked funds substitutes for what could have been an increase in contributions to core resources.

Data Availability Statement

Replication files for this research note may be found at <https://doi.org/10.7910/DVN/W0FHQX>.

Supplementary Material

Supplementary material for this research note is available at <https://doi.org/10.1017/S0020818323000085>.

Acknowledgments

Previous versions of this research note were presented at workshops at the University of Geneva, University of Glasgow, and University of Potsdam, and the ECPR General Conference 2022. We thank Malte Brosig, Maria Debre, Simone Dietrich, Thomas Doerfler, Timon Forster, Philipp Genschel, Pawel Gmyrek, Tim Heinkelmann-Wild, Alice Iannantuoni, Vytautas Jankauskas, Andreas Kern, Andrea Liese, Tobias Pforr, Thomas Sommerer, Theresa Squatrito, Matthew Stephen, Ueli Staeger, Philip Tantow, Andreas Ullmann, and Catherine Weaver for helpful comments and suggestions. Christian Siauwijaya provided excellent research assistance.

Funding

Funding by UK Research and Innovation under grant number MR/V0222148/1 is gratefully acknowledged.