1. Introduction

The equilibrium distribution (also named stationary renewal distribution) arises as the limiting distribution of the forward recurrence time in a renewal process, see Cox [Reference Cox7]. It represents a relevant concept in reliability theory and survival analysis (see, for instance, Section 1.A.5 in Shaked and Shanthikumar [Reference Shaked and Shanthikumar31]), actuarial and risk theory (see, for example, Willmot [Reference Willmot32]). Let X be a non-negative random variable, with survival function (SF) ![]() $\overline{F}(t)=\mathsf{P}(X \gt t)$, for

$\overline{F}(t)=\mathsf{P}(X \gt t)$, for ![]() $t\ge 0$, and mean

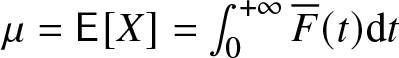

$t\ge 0$, and mean  $\mu=\mathsf{E}[X]=\int_{0}^{+\infty}\overline{F}(t){\rm d}t$ such that

$\mu=\mathsf{E}[X]=\int_{0}^{+\infty}\overline{F}(t){\rm d}t$ such that ![]() $0 \lt \mu \lt +\infty$. The equilibrium random variable of X, denoted as Xe, has (decreasing) probability density function (PDF)

$0 \lt \mu \lt +\infty$. The equilibrium random variable of X, denoted as Xe, has (decreasing) probability density function (PDF)

\begin{equation}

f^e(t)=\frac{\overline{F}(t)}{\mu},\qquad t\ge 0.

\end{equation}

\begin{equation}

f^e(t)=\frac{\overline{F}(t)}{\mu},\qquad t\ge 0.

\end{equation} Then, the SF of Xe is given by  $\overline{F}^e(t)=\pi(t)/\mu$, for

$\overline{F}^e(t)=\pi(t)/\mu$, for ![]() $t\ge 0$, where

$t\ge 0$, where

\begin{equation*}

\pi(t)=\mathsf{E}[(X-t)_+]=\int_{t}^{+\infty}\overline{F}(x){\rm d}x,\qquad t\ge 0,

\end{equation*}

\begin{equation*}

\pi(t)=\mathsf{E}[(X-t)_+]=\int_{t}^{+\infty}\overline{F}(x){\rm d}x,\qquad t\ge 0,

\end{equation*}denotes the stop-loss transform of X, see Section 1.7 in Denuit et al. [Reference Denuit, Dhaene, Goovaerts and Kaas9].

In the present work, we define a generalized version of the equilibrium PDF given in Eq. (1.1), for the case in which the baseline random variable X has a general support. We extend the probabilistic generalization of Taylor’s theorem (cf. Massey and Whitt [Reference Massey and Whitt20]) to this case. Conditions for which the mean, median, and mode of such PDF coincide and are equal to zero are illustrated too. Moreover, under suitable assumptions, we prove that many stochastic comparisons between baseline distributions are maintained by the corresponding generalized equilibrium ones. The sign of the median of the baseline distribution leads to the preservation of various aging properties.

We go further by extending to general supports the equilibrium PDF of two ordered random variables studied in Di Crescenzo [Reference Di Crescenzo11] and Psarrakos [Reference Psarrakos27] for non-negative random variables, and in Psarrakos [Reference Psarrakos28] for Poisson and Normal distributions. Along this line, a probabilistic analog of the mean value theorem is proved by using the new probabilistic generalization of Taylor’s theorem. Further results and stochastic comparisons are provided as well.

We often consider distortion-based models, that allow us to avoid conditions on the involved distributions. In particular, some illustrative examples deal with families of distortion functions related to the well-known proportional hazard rate (PHR) model (see Cox [Reference Cox8] and Kumar and Klefsjö [Reference Kumar and Klefsjö17]) and proportional reversed hazard rate (PRHR) model (see Di Crescenzo [Reference Di Crescenzo12] and Gupta and Gupta [Reference Gupta and Gupta14]).

The concept of unimodal PDF plays a relevant role throughout the paper. Under a (weak) suitable assumption on the baseline distribution, we emphasize that the proposed generalized equilibrium PDF is unimodal, with mode zero. In addition, we study conditions for the unimodality of the extended equilibrium PDF of two ordered random variables. Unimodality issues are relevant in actuarial science, since the distribution of insurance loss data is often unimodal, see Punzo et al. [Reference Punzo, Bagnato and Maruotti29] and references therein. Moreover, stochastic comparisons play a significant role in economics and insurance, see Belzunce et al. [Reference Belzunce, Pinar, Ruiz and Sordo4], Müller [Reference Müller18], and Sánchez-Sánchez et al. [Reference Sánchez-Sánchez, Sordo, Suárez-Llorens and Gómez-Déniz30]. Hence, we apply such equilibrium PDFs in risk theory by studying the connection with the Lorenz curve, stochastic orderings, and unimodality problems between risks and their truncated versions at the respective Value-at-Risk (VaR).

The paper is organized as follows. In Section 2, we recall some basic notions. Section 3 is devoted to the definition of the new equilibrium random variable, by describing related properties and results. Many stochastic orders and aging classes are preserved through generalized equilibrium transformations, as shown in Section 4. Various results concerning the equilibrium PDF of two ordered random variables with support in ![]() $\mathbb{R}$ are provided in Section 5. Finally, in Section 6, we apply the equilibrium PDFs described above in actuarial and insurance contexts. Some final remarks are given in Section 7.

$\mathbb{R}$ are provided in Section 5. Finally, in Section 6, we apply the equilibrium PDFs described above in actuarial and insurance contexts. Some final remarks are given in Section 7.

2. Background

In this section, we fix the notation and we recall some useful notions, such as unimodality, stochastic orders, aging classes, and distortion functions. Throughout the paper, the terms increasing and decreasing are used, respectively, as “non-decreasing” and “non-increasing,” while “iff” denotes “if and only if.”

Given a probability space ![]() $(\Omega,\mathcal{F},\mathsf{P})$, let

$(\Omega,\mathcal{F},\mathsf{P})$, let ![]() $X\colon\Omega\rightarrow\mathbb{R}$ be a random variable, with SF

$X\colon\Omega\rightarrow\mathbb{R}$ be a random variable, with SF ![]() $\overline{F}$ and cumulative distribution function (CDF)

$\overline{F}$ and cumulative distribution function (CDF) ![]() $F=1-\overline{F}$. The function

$F=1-\overline{F}$. The function ![]() $F^{-1}(u)=\sup\{t\colon F(t)\leq u\}$, for

$F^{-1}(u)=\sup\{t\colon F(t)\leq u\}$, for ![]() $u\in[0,1]$, represents the right-continuous version of the inverse of F, namely quantile function. Moreover, we denote by

$u\in[0,1]$, represents the right-continuous version of the inverse of F, namely quantile function. Moreover, we denote by  $\overline{F}^{-1}(u)=F^{-1}(1-u)$, for all

$\overline{F}^{-1}(u)=F^{-1}(1-u)$, for all ![]() $u\in[0,1]$.

$u\in[0,1]$.

It is well-known that ![]() $X=X^{+}-X^{-}$, where

$X=X^{+}-X^{-}$, where

are non-negative random variables that represent the positive and negative parts of X, respectively. Therefore, by denoting with

\begin{equation}\mu^{+}=\mathsf{E}[X^{+}]=\int_{0}^{+\infty}\overline{F}(t){\rm d}t\quad\text{and}\quad\mu^{-}=\mathsf{E}[X^{-}]=\int_{-\infty}^{0}F(t){\rm d}t,\end{equation}

\begin{equation}\mu^{+}=\mathsf{E}[X^{+}]=\int_{0}^{+\infty}\overline{F}(t){\rm d}t\quad\text{and}\quad\mu^{-}=\mathsf{E}[X^{-}]=\int_{-\infty}^{0}F(t){\rm d}t,\end{equation}the mean of X can be computed as

and µ exists (is finite) iff ![]() $\mu^{+},\mu^{-}\in\mathbb{R}$. In addition, since

$\mu^{+},\mu^{-}\in\mathbb{R}$. In addition, since ![]() $|X|=X^{+}+X^{-}$ one has

$|X|=X^{+}+X^{-}$ one has

The variance of X is  $\mathsf{V}[X]=\mathsf{E}\left[(X-\mu)^2\right]$. Moreover, every

$\mathsf{V}[X]=\mathsf{E}\left[(X-\mu)^2\right]$. Moreover, every ![]() $m\in\mathbb{R}$ such that

$m\in\mathbb{R}$ such that

\begin{equation*}

\frac12\le F(m)\le\frac12+\mathsf{P}(X=m)

\end{equation*}

\begin{equation*}

\frac12\le F(m)\le\frac12+\mathsf{P}(X=m)

\end{equation*} is named median of X and therefore, if ![]() $\mathsf{P}(X=m)=0$, then

$\mathsf{P}(X=m)=0$, then ![]() $F(m)=1/2$.

$F(m)=1/2$.

It is well-known that the mode of a given dataset is the value that appears most often. In particular, if X has a discrete distribution, then ![]() $\nu={\rm argmax}_{x}\mathsf{P}(X=x)$ denotes a mode of X. In the absolutely continuous case, a mode of X is any value ν in which its PDF

$\nu={\rm argmax}_{x}\mathsf{P}(X=x)$ denotes a mode of X. In the absolutely continuous case, a mode of X is any value ν in which its PDF ![]() $f=F'$ has a maximum. We consider the following formal definition of unimodality.

$f=F'$ has a maximum. We consider the following formal definition of unimodality.

Definition 2.1. Let X be a random variable with absolutely continuous CDF F. We say that X is unimodal about a unique mode ν if F is strictly convex on ![]() $(-\infty,\nu)$ and strictly concave on

$(-\infty,\nu)$ and strictly concave on ![]() $(\nu,+\infty)$.

$(\nu,+\infty)$.

In other words, due to Definition 2.1, X is unimodal iff it has a PDF ![]() $f$ with a single peak in

$f$ with a single peak in ![]() $f(\nu)$, with ν mode of X. In this sense, the Normal (or Gaussian) and the Cauchy distributions are both unimodal, while the continuous uniform distribution is not unimodal. For more details about unimodality we refer the reader to Dharmadhikari and Joag-Dev [Reference Dharmadhikari and Joag-Dev10].

$f(\nu)$, with ν mode of X. In this sense, the Normal (or Gaussian) and the Cauchy distributions are both unimodal, while the continuous uniform distribution is not unimodal. For more details about unimodality we refer the reader to Dharmadhikari and Joag-Dev [Reference Dharmadhikari and Joag-Dev10].

Hereafter, we recall a suitable version of the probabilistic generalization of Taylor’s theorem given in Massey and Whitt [Reference Massey and Whitt20] for non-negative random variables that involves the equilibrium PDF in Eq. (1.1).

Theorem 2.1. Let X be a non-negative random variable with CDF F and ![]() $0 \lt \mathsf{E}[X] \lt +\infty$. Let

$0 \lt \mathsf{E}[X] \lt +\infty$. Let ![]() $h:[0,+\infty)\rightarrow\mathbb{R}$ be a measurable and differentiable function for

$h:[0,+\infty)\rightarrow\mathbb{R}$ be a measurable and differentiable function for ![]() $t\in(0,+\infty)$ such that h(0) is finite. Let its derivative h′ be measurable and Riemann-integrable. If

$t\in(0,+\infty)$ such that h(0) is finite. Let its derivative h′ be measurable and Riemann-integrable. If ![]() $\mathsf{E}[h'(X^e)]$ is finite, then

$\mathsf{E}[h'(X^e)]$ is finite, then ![]() $\mathsf{E}[h(X)]$ is finite and

$\mathsf{E}[h(X)]$ is finite and ![]() $\mathsf{E}[h(X)]=h(0)+\mathsf{E}[X]\mathsf{E}[h'(X^e)]$.

$\mathsf{E}[h(X)]=h(0)+\mathsf{E}[X]\mathsf{E}[h'(X^e)]$.

Now we define some well-known aging functions that are useful in reliability theory and survival analysis, where a non-negative random variable describes the lifetime of a single component or a system built with some components. More in general, for a random variable X having support in ![]() $\mathbb{R}$, let

$\mathbb{R}$, let ![]() $X_t=\left[X-t|X \gt t\right]$ denote the residual lifetime of X at age

$X_t=\left[X-t|X \gt t\right]$ denote the residual lifetime of X at age ![]() $t\in\mathbb{R}$. The mean residual lifetime (MRL) of X is computed as

$t\in\mathbb{R}$. The mean residual lifetime (MRL) of X is computed as

\begin{equation*}

\zeta(t){\,:=\,}\mathsf{E}\left[X_t\right]=\frac1{\overline{F}(t)}\int_{t}^{+\infty}\overline{F}(x){\rm d}x,\qquad t\in\mathbb{R}:\, \overline{F}(t) \gt 0.

\end{equation*}

\begin{equation*}

\zeta(t){\,:=\,}\mathsf{E}\left[X_t\right]=\frac1{\overline{F}(t)}\int_{t}^{+\infty}\overline{F}(x){\rm d}x,\qquad t\in\mathbb{R}:\, \overline{F}(t) \gt 0.

\end{equation*} Moreover, if ![]() $X_{(t)}=\left[t-X|X\le t\right]$ denotes the inactivity time of X, then the mean inactivity time (MIT) of X is expressed as

$X_{(t)}=\left[t-X|X\le t\right]$ denotes the inactivity time of X, then the mean inactivity time (MIT) of X is expressed as

\begin{equation*}

\tilde{\zeta}(t){\,:=\,}\mathsf{E}\left[X_{(t)}\right]=\frac1{F(t)}\int_{-\infty}^{t}F(x){\rm d}x,\qquad t\in\mathbb{R}:\, F(t) \gt 0.

\end{equation*}

\begin{equation*}

\tilde{\zeta}(t){\,:=\,}\mathsf{E}\left[X_{(t)}\right]=\frac1{F(t)}\int_{-\infty}^{t}F(x){\rm d}x,\qquad t\in\mathbb{R}:\, F(t) \gt 0.

\end{equation*} Note that, from Eqs. (2.2) and (2.3), one has ![]() $\mu=\overline{F}(0)\zeta(0)-F(0)\tilde{\zeta}(0)$.

$\mu=\overline{F}(0)\zeta(0)-F(0)\tilde{\zeta}(0)$.

If X has an absolutely continuous distribution, then its hazard rate (HR) is defined as ![]() $\lambda(t){\,:=\,} f(t)/\overline{F}(t)$, for all

$\lambda(t){\,:=\,} f(t)/\overline{F}(t)$, for all ![]() $t\in\mathbb{R}$ such that

$t\in\mathbb{R}$ such that ![]() $\overline{F}(t) \gt 0$, while its reversed hazard rate (RHR) is defined as

$\overline{F}(t) \gt 0$, while its reversed hazard rate (RHR) is defined as ![]() $\tau(t){\,:=\,} f(t)/F(t)$, for all

$\tau(t){\,:=\,} f(t)/F(t)$, for all ![]() $t\in\mathbb{R}$ such that

$t\in\mathbb{R}$ such that ![]() $F(t) \gt 0$. Moreover, if X has differentiable PDF f, then the ratio

$F(t) \gt 0$. Moreover, if X has differentiable PDF f, then the ratio

\begin{equation*}

\eta(t){\,:=\,}-\frac{f'(t)}{f(t)},\qquad t\in\mathbb{R}:\, f(t) \gt 0,

\end{equation*}

\begin{equation*}

\eta(t){\,:=\,}-\frac{f'(t)}{f(t)},\qquad t\in\mathbb{R}:\, f(t) \gt 0,

\end{equation*}is the Glaser’s function of X, see Glaser [Reference Glaser13] and Navarro [Reference Navarro21].

We now are ready to recall some stochastic orders. Here ![]() $a/0$ is taken to be equal to

$a/0$ is taken to be equal to ![]() $+\infty$ whenever a > 0. Moreover, the subscript refers to the random variables.

$+\infty$ whenever a > 0. Moreover, the subscript refers to the random variables.

Definition 2.2. We say that X is smaller than Y in the

• usual stochastic order, denoted by

$X\le_{st}Y$, if

$X\le_{st}Y$, if  $\overline{F}_X(t)\le\overline{F}_Y(t)$ holds for all t. If there is equality in law, then we write

$\overline{F}_X(t)\le\overline{F}_Y(t)$ holds for all t. If there is equality in law, then we write  $X=_{st}Y$;

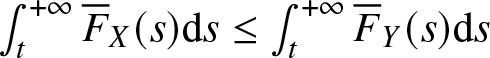

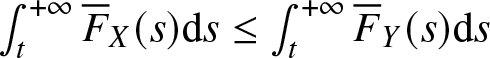

$X=_{st}Y$;• increasing convex order, denoted by

$X\le_{icx}Y$, if

$X\le_{icx}Y$, if  $\int_{t}^{+\infty}\overline{F}_X(s){\rm d}s\le\int_{t}^{+\infty}\overline{F}_Y(s){\rm d}s$ holds for all t;

$\int_{t}^{+\infty}\overline{F}_X(s){\rm d}s\le\int_{t}^{+\infty}\overline{F}_Y(s){\rm d}s$ holds for all t;• increasing concave order, denoted by

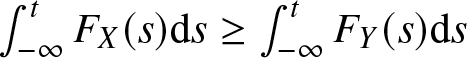

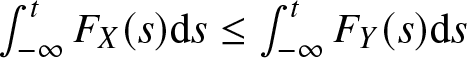

$X\le_{icv}Y$, if

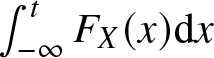

$X\le_{icv}Y$, if  $\int_{-\infty}^{t}F_X(s){\rm d}s\ge\int_{-\infty}^{t}F_Y(s){\rm d}s$ holds for all t;

$\int_{-\infty}^{t}F_X(s){\rm d}s\ge\int_{-\infty}^{t}F_Y(s){\rm d}s$ holds for all t;• convex order, denoted by

$X\le_{cx}Y$, if

$X\le_{cx}Y$, if  $\int_{t}^{+\infty}\overline{F}_X(s){\rm d}s\le\int_{t}^{+\infty}\overline{F}_Y(s){\rm d}s$ and

$\int_{t}^{+\infty}\overline{F}_X(s){\rm d}s\le\int_{t}^{+\infty}\overline{F}_Y(s){\rm d}s$ and  $\int_{-\infty}^{t}F_X(s){\rm d}s\le\int_{-\infty}^{t}F_Y(s){\rm d}s$ hold for all t;

$\int_{-\infty}^{t}F_X(s){\rm d}s\le\int_{-\infty}^{t}F_Y(s){\rm d}s$ hold for all t;• hazard rate order, denoted by

$X\le_{hr}Y$, if

$X\le_{hr}Y$, if  $\overline{F}_X(t)/\overline{F}_Y(t)$ is decreasing in t;

$\overline{F}_X(t)/\overline{F}_Y(t)$ is decreasing in t;• reversed hazard rate order, denoted by

$X\le_{rhr}Y$, if

$X\le_{rhr}Y$, if  $F_X(t)/F_Y(t)$ is decreasing in t;

$F_X(t)/F_Y(t)$ is decreasing in t;• mean residual lifetime order, denoted by

$X\le_{mrl}Y$, if

$X\le_{mrl}Y$, if  $\zeta_X(t)\le\zeta_Y(t)$ holds for all t;

$\zeta_X(t)\le\zeta_Y(t)$ holds for all t;• mean inactivity time order, denoted by

$X\le_{mit}Y$, if

$X\le_{mit}Y$, if  $\tilde{\zeta}_X(t)\ge\tilde{\zeta}_Y(t)$ holds for all t;

$\tilde{\zeta}_X(t)\ge\tilde{\zeta}_Y(t)$ holds for all t;• likelihood ratio order, denoted by

$X\le_{lr}Y$, if

$X\le_{lr}Y$, if  $f_X(t)/f_Y(t)$ is decreasing for t in the union of their supports, provided that X and Y have absolutely continuous distributions.

$f_X(t)/f_Y(t)$ is decreasing for t in the union of their supports, provided that X and Y have absolutely continuous distributions.

In the absolutely continuous case, one has ![]() $X\le_{hr}Y$ iff

$X\le_{hr}Y$ iff ![]() $\lambda_X(t)\ge\lambda_Y(t)$ for all t, while

$\lambda_X(t)\ge\lambda_Y(t)$ for all t, while ![]() $X\le_{rhr}Y$ iff

$X\le_{rhr}Y$ iff ![]() $\tau_X(t)\le\tau_Y(t)$ for all t. Moreover, when fX and fY are both differentiable, one has

$\tau_X(t)\le\tau_Y(t)$ for all t. Moreover, when fX and fY are both differentiable, one has ![]() $X\le_{lr}Y$ iff

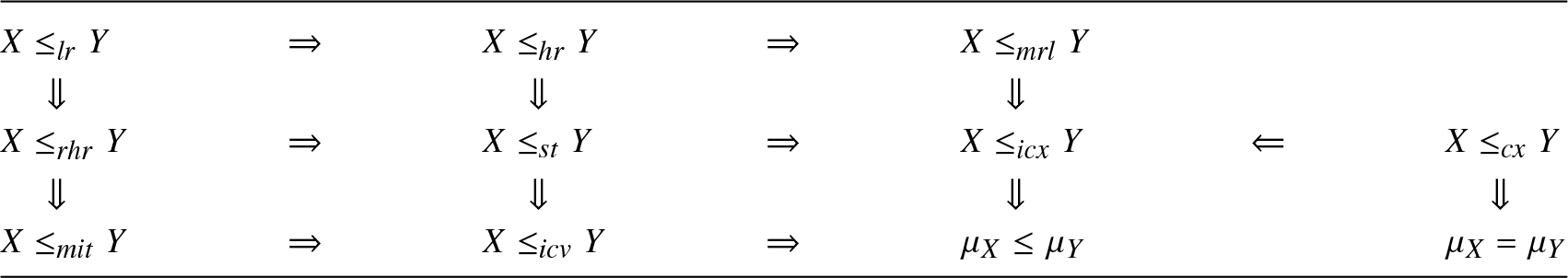

$X\le_{lr}Y$ iff ![]() $\eta_X(t)\ge\eta_Y(t)$ for all t in the union of their supports. In Table 1, we include the relationships among the stochastic orders introduced in Definition 2.2. The proof of these relationships with a detailed description of stochastic orders and applications can be found in Belzunce et al. [Reference Belzunce, Martínez-Riquelme and Mulero3], Denuit et al. [Reference Denuit, Dhaene, Goovaerts and Kaas9], Kochar [Reference Kochar16], Müller and Stoyan [Reference Müller and Stoyan19], and Shaked and Shanthikumar [Reference Shaked and Shanthikumar31] (in particular, for the mean inactivity time order, see Ahmad et al. [Reference Ahmad, Kayid and Pellerey1] and references therein).

$\eta_X(t)\ge\eta_Y(t)$ for all t in the union of their supports. In Table 1, we include the relationships among the stochastic orders introduced in Definition 2.2. The proof of these relationships with a detailed description of stochastic orders and applications can be found in Belzunce et al. [Reference Belzunce, Martínez-Riquelme and Mulero3], Denuit et al. [Reference Denuit, Dhaene, Goovaerts and Kaas9], Kochar [Reference Kochar16], Müller and Stoyan [Reference Müller and Stoyan19], and Shaked and Shanthikumar [Reference Shaked and Shanthikumar31] (in particular, for the mean inactivity time order, see Ahmad et al. [Reference Ahmad, Kayid and Pellerey1] and references therein).

Table 1. Relationships among the stochastic orders introduced in Definition 2.2, where µX and µY denote the mean of X and Y, respectively.

In the following, we define some useful aging classes.

Definition 2.3. A random variable X is

• increasing failure (or hazard) rate (IFR) if

$X_t\ge_{st}X_{s}$ whenever

$X_t\ge_{st}X_{s}$ whenever  $t\le s$ in

$t\le s$ in  $\mathbb{R}$. If

$\mathbb{R}$. If  $X_t\le_{st}X_{s}$ whenever

$X_t\le_{st}X_{s}$ whenever  $t\le s$ in

$t\le s$ in  $\mathbb{R}$, then X is decreasing failure rate (DFR);

$\mathbb{R}$, then X is decreasing failure rate (DFR);• decreasing reversed failure (or hazard) rate (DRFR) if

$X_{(t)}\le_{st}X_{(s)}$ whenever

$X_{(t)}\le_{st}X_{(s)}$ whenever  $t\le s$ in

$t\le s$ in  $\mathbb{R}$;

$\mathbb{R}$;• decreasing in mean residual lifetime (DMRL) if

$\zeta(t)$ is decreasing for

$\zeta(t)$ is decreasing for  $t\in\mathbb{R}$;

$t\in\mathbb{R}$;• increasing in mean inactivity time (IMIT) if

$\tilde{\zeta}(t)$ is increasing for

$\tilde{\zeta}(t)$ is increasing for  $t\in\mathbb{R}$;

$t\in\mathbb{R}$;• increasing in likelihood ratio (ILR) if f is log-concave, provided that X has an absolutely continuous distribution.

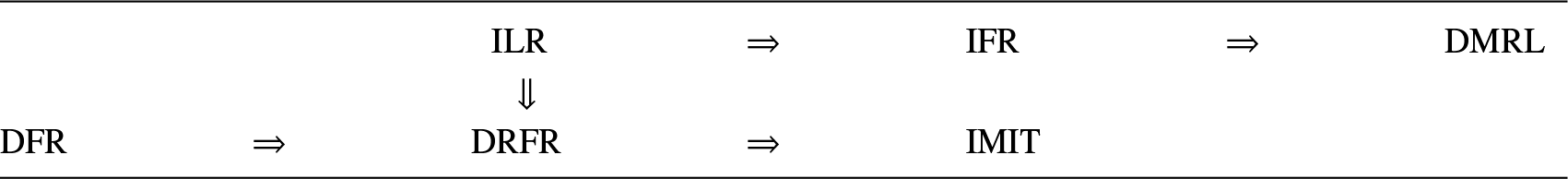

In the absolutely continuous case one can also say that X is IFR (DFR) iff ![]() $\overline{F}$ is log-concave (log-convex), i.e., its HR λ is increasing (decreasing), while X is DRFR iff F is log-concave, i.e., its RHR τ is decreasing. Moreover, if f is differentiable, then X is ILR iff its Glaser’s function η is increasing. The relationships among the aging classes introduced in Definition 2.3 are shown in Table 2. For more details about aging notions, we address the reader to Belzunce et al. [Reference Belzunce, Martínez-Riquelme and Mulero3], Kochar [Reference Kochar16], Section 4 in Navarro [Reference Navarro22], Navarro et al. [Reference Navarro, Ruiz and Del Aguila25] and Shaked and Shanthikumar [Reference Shaked and Shanthikumar31].

$\overline{F}$ is log-concave (log-convex), i.e., its HR λ is increasing (decreasing), while X is DRFR iff F is log-concave, i.e., its RHR τ is decreasing. Moreover, if f is differentiable, then X is ILR iff its Glaser’s function η is increasing. The relationships among the aging classes introduced in Definition 2.3 are shown in Table 2. For more details about aging notions, we address the reader to Belzunce et al. [Reference Belzunce, Martínez-Riquelme and Mulero3], Kochar [Reference Kochar16], Section 4 in Navarro [Reference Navarro22], Navarro et al. [Reference Navarro, Ruiz and Del Aguila25] and Shaked and Shanthikumar [Reference Shaked and Shanthikumar31].

Table 2. Relationships among the aging classes introduced in Definition 2.3.

We conclude this section by recalling the concept of distortion function, introduced by Yaari [Reference Yaari33] in the context of the theory of choice under risk. In particular, given F, a distorted CDF ![]() $F_q=q(F)$ can be obtained making use of an increasing continuous function

$F_q=q(F)$ can be obtained making use of an increasing continuous function ![]() $q:[0,1]\rightarrow[0,1]$, such that

$q:[0,1]\rightarrow[0,1]$, such that ![]() $q(0)=0$ and

$q(0)=0$ and ![]() $q(1)=1$, namely distortion function. Moreover, the function

$q(1)=1$, namely distortion function. Moreover, the function ![]() $\tilde{q}(u){\,:=\,}1-q(1-u)$, for

$\tilde{q}(u){\,:=\,}1-q(1-u)$, for ![]() $u\in[0,1]$, is called dual distortion function respect to q. Then

$u\in[0,1]$, is called dual distortion function respect to q. Then  $\overline{F}_q=\tilde{q}(\overline{F})$ is the distorted SF from

$\overline{F}_q=\tilde{q}(\overline{F})$ is the distorted SF from ![]() $\overline{F}$ through

$\overline{F}$ through ![]() $\tilde{q}$. Further details about distortion functions can be found in Section 2.4 in Navarro [Reference Navarro22].

$\tilde{q}$. Further details about distortion functions can be found in Section 2.4 in Navarro [Reference Navarro22].

3. Generalized equilibrium distribution

In this section, we introduce and study the generalized equilibrium distribution of a given random variable. In particular, we extend the definition of the equilibrium PDF given in Eq. (1.1) for non-negative random variables to the case in which the baseline random variable has a general support. Along this line, we provide a new probabilistic version of Taylor’s theorem and we discuss mean-median-mode relations. By recalling Eq. (2.2), the formal definition of generalized equilibrium random variable can be stated as follows.

Definition 3.1. Let X be a non-degenerate random variable, having CDF F, SF ![]() $\overline{F}$, and finite mean. The generalized equilibrium random variable of X, denoted as Xe, has the following PDF

$\overline{F}$, and finite mean. The generalized equilibrium random variable of X, denoted as Xe, has the following PDF

\begin{equation}

\displaystyle

f^{e}(t)=

\begin{cases}

\displaystyle\frac{F(t)}{\tilde{\mu}},& t \lt 0, \\[3mm]

\displaystyle\frac{\overline{F}(t)}{\tilde{\mu}},& t\ge0, \\

\end{cases}

\end{equation}

\begin{equation}

\displaystyle

f^{e}(t)=

\begin{cases}

\displaystyle\frac{F(t)}{\tilde{\mu}},& t \lt 0, \\[3mm]

\displaystyle\frac{\overline{F}(t)}{\tilde{\mu}},& t\ge0, \\

\end{cases}

\end{equation} where ![]() $\tilde{\mu}=\mu^{+}+\mu^{-} \gt 0$.

$\tilde{\mu}=\mu^{+}+\mu^{-} \gt 0$.

From Eq. (2.4), it is easy to see that the function ![]() $f^e$ in Eq. (3.1) is a proper PDF, which is increasing for t < 0 and decreasing for

$f^e$ in Eq. (3.1) is a proper PDF, which is increasing for t < 0 and decreasing for ![]() $t\ge0$. Clearly, if X is non-negative, then Eq. (3.1) reduces to Eq. (1.1).

$t\ge0$. Clearly, if X is non-negative, then Eq. (3.1) reduces to Eq. (1.1).

Given X, by recalling Eq. (2.1), the PDF of ![]() $(X^+)^e$ arises as limiting distribution of the age of a renewal process having independent and identically distributed interarrival times according to

$(X^+)^e$ arises as limiting distribution of the age of a renewal process having independent and identically distributed interarrival times according to ![]() $X^+$. Similar considerations follow for

$X^+$. Similar considerations follow for ![]() $X^-$. In this sense, the mixture representation provided in the following remark allows us to connect the generalized equilibrium PDF defined in Eq. (3.1) with Renewal Theory.

$X^-$. In this sense, the mixture representation provided in the following remark allows us to connect the generalized equilibrium PDF defined in Eq. (3.1) with Renewal Theory.

Remark 3.1. By recalling Eq. (2.1), let us denote with ![]() $f_{-}^e$ the PDF of

$f_{-}^e$ the PDF of ![]() $-(X^-)^e$, and with

$-(X^-)^e$, and with ![]() $f_{+}^e$ the PDF of

$f_{+}^e$ the PDF of ![]() $(X^+)^e$. Therefore, from Eqs. (2.2) and (3.1) one has

$(X^+)^e$. Therefore, from Eqs. (2.2) and (3.1) one has

\begin{equation*}

f^{e}(t)=

\begin{cases}

\displaystyle\frac{\mu^{-}}{\tilde{\mu}}f_{-}^e(t),& t \lt 0, \\[3mm]

\displaystyle\frac{\mu^{+}}{\tilde{\mu}}f^{e}_{+}(t),& t\ge0, \\

\end{cases}

\end{equation*}

\begin{equation*}

f^{e}(t)=

\begin{cases}

\displaystyle\frac{\mu^{-}}{\tilde{\mu}}f_{-}^e(t),& t \lt 0, \\[3mm]

\displaystyle\frac{\mu^{+}}{\tilde{\mu}}f^{e}_{+}(t),& t\ge0, \\

\end{cases}

\end{equation*}or, equivalently,

where ![]() $p=\mu^{-}/\tilde{\mu}\in[0,1]$. Hence, Xe is a mixture of

$p=\mu^{-}/\tilde{\mu}\in[0,1]$. Hence, Xe is a mixture of ![]() $-(X^-)^e$ and

$-(X^-)^e$ and ![]() $(X^+)^e$. Clearly, it holds that

$(X^+)^e$. Clearly, it holds that ![]() $-(X^-)^e$ is IFR, while

$-(X^-)^e$ is IFR, while ![]() $(X^+)^e$ is DRFR.

$(X^+)^e$ is DRFR.

Remark 3.2. Note that ![]() $\nu^{e}=0$ is a mode of Xe. Moreover, if there exists δ > 0 such that F(t) is strictly increasing for

$\nu^{e}=0$ is a mode of Xe. Moreover, if there exists δ > 0 such that F(t) is strictly increasing for ![]() $t\in(-\delta,\delta)$, then Xe is unimodal with mode

$t\in(-\delta,\delta)$, then Xe is unimodal with mode ![]() $\nu^{e}=0$.

$\nu^{e}=0$.

Under a suitable hypothesis the mean of X e is related to that of X, as illustrated below.

Proposition 3.1. Let µ denote the mean of X. If ![]() $\mathsf{E}[X^2] \lt +\infty$, then Xe has mean

$\mathsf{E}[X^2] \lt +\infty$, then Xe has mean

(i)

$\mu^e=\mathsf{E}[X\cdot|X|]/\left(2\tilde{\mu}\right)$;

$\mu^e=\mathsf{E}[X\cdot|X|]/\left(2\tilde{\mu}\right)$;(ii)

$\mu^e=\mu/2$, provided that

$\mu^e=\mu/2$, provided that  $\mathsf{V}[X^+]=\mathsf{V}[X^-]$.

$\mathsf{V}[X^+]=\mathsf{V}[X^-]$.

Proof. Since ![]() $\mathsf{E}[X^2] \lt +\infty$, from Eqs. (2.1) and (3.1), making use of integration by parts, the statement (i) follows since

$\mathsf{E}[X^2] \lt +\infty$, from Eqs. (2.1) and (3.1), making use of integration by parts, the statement (i) follows since

\begin{equation*}

\begin{aligned}

\mu^e &=\frac1{\tilde{\mu}}\left\{\int_{-\infty}^{0}tF(t){\rm d}t+\int_{0}^{+\infty}t\overline{F}(t){\rm d}t\right\}\\

&=\frac1{2\tilde{\mu}}\left\{\int_{0}^{+\infty}t^2{\rm d}F(t)-\int_{-\infty}^{0}t^2{\rm d}F(t)\right\}\\

&=\frac1{2\tilde{\mu}}\left\{\mathsf{E}\left[\left(X^+\right)^2\right]-\mathsf{E}\left[\left(X^-\right)^2\right]\right\}\\

&=\frac{\mathsf{E}[X\cdot|X|]}{2\tilde{\mu}},\\

\end{aligned}

\end{equation*}

\begin{equation*}

\begin{aligned}

\mu^e &=\frac1{\tilde{\mu}}\left\{\int_{-\infty}^{0}tF(t){\rm d}t+\int_{0}^{+\infty}t\overline{F}(t){\rm d}t\right\}\\

&=\frac1{2\tilde{\mu}}\left\{\int_{0}^{+\infty}t^2{\rm d}F(t)-\int_{-\infty}^{0}t^2{\rm d}F(t)\right\}\\

&=\frac1{2\tilde{\mu}}\left\{\mathsf{E}\left[\left(X^+\right)^2\right]-\mathsf{E}\left[\left(X^-\right)^2\right]\right\}\\

&=\frac{\mathsf{E}[X\cdot|X|]}{2\tilde{\mu}},\\

\end{aligned}

\end{equation*} where in the last equality we have applied the difference of squares formula. From Eqs. (2.3) and (2.4), if ![]() $\mathsf{V}[X^+]=\mathsf{V}[X^-]$, then

$\mathsf{V}[X^+]=\mathsf{V}[X^-]$, then ![]() $\mathsf{Cov}(X, |X|)=0$ and thus

$\mathsf{Cov}(X, |X|)=0$ and thus ![]() $\mathsf{E}[X\cdot|X|]=\mu\cdot\tilde{\mu}$. Hence, (ii) is obtained from (i) and the proof is completed.

$\mathsf{E}[X\cdot|X|]=\mu\cdot\tilde{\mu}$. Hence, (ii) is obtained from (i) and the proof is completed.

Proposition 3.2. If ![]() $\mathsf{E}[X]=0$, then

$\mathsf{E}[X]=0$, then ![]() $m^{e}=0$ is a median of Xe and one has

$m^{e}=0$ is a median of Xe and one has ![]() $|\mu^e|\le\sigma^e$, where µ e and σ e are the mean and the standard deviation of Xe, respectively.

$|\mu^e|\le\sigma^e$, where µ e and σ e are the mean and the standard deviation of Xe, respectively.

Proof. Under the stated assumptions, from Eq. (2.3), one has ![]() $\mu^{+}=\mu^{-}$. Therefore, from Eq. (3.1), one obtains

$\mu^{+}=\mu^{-}$. Therefore, from Eq. (3.1), one obtains

\begin{equation*}

\int_{-\infty}^{0}f^{e}(t){\rm d}t=\int_{0}^{+\infty}f^{e}(t){\rm d}t=\frac12,

\end{equation*}

\begin{equation*}

\int_{-\infty}^{0}f^{e}(t){\rm d}t=\int_{0}^{+\infty}f^{e}(t){\rm d}t=\frac12,

\end{equation*} that is ![]() $m^{e}=0$. Then, from Remark 1 in Capaldo and Navarro [Reference Capaldo and Navarro6], it follows

$m^{e}=0$. Then, from Remark 1 in Capaldo and Navarro [Reference Capaldo and Navarro6], it follows ![]() $|\mu^e|\le\sigma^e$ and the proof is completed.

$|\mu^e|\le\sigma^e$ and the proof is completed.

Below, by taking into account Remark 3.2, we use Proposition 3.1 and Proposition 3.2 to get sufficient conditions on the baseline distribution such that the corresponding equilibrium distribution has mean, median and mode coincident and equal to zero.

Theorem 3.1. If ![]() $\mathsf{E}[X]=0$ and

$\mathsf{E}[X]=0$ and ![]() $\mathsf{V}[X^+]=\mathsf{V}[X^-]$, then

$\mathsf{V}[X^+]=\mathsf{V}[X^-]$, then

where µe, me, νe denote mean, median and mode of Xe, respectively.

It is easy to see that, if X has mean zero, in Theorem 3.1 the condition ![]() $\mathsf{V}[X^+]=\mathsf{V}[X^-]$ is equivalent to require

$\mathsf{V}[X^+]=\mathsf{V}[X^-]$ is equivalent to require  $\mathsf{E}\left[\left(X^+\right)^2\right]=\mathsf{E}\left[\left(X^-\right)^2\right]$.

$\mathsf{E}\left[\left(X^+\right)^2\right]=\mathsf{E}\left[\left(X^-\right)^2\right]$.

Several relations between mean, median, and mode of a given random variable have been studied in the literature. In particular, if a random variable is unimodal, then

\begin{equation}

\frac{|\nu-\mu|}{\sigma}\le\sqrt{3},\qquad

\frac{|m-\mu|}{\sigma}\le\sqrt{0.6},\qquad

\frac{|\nu-m|}{\sigma}\le\sqrt{3},

\end{equation}

\begin{equation}

\frac{|\nu-\mu|}{\sigma}\le\sqrt{3},\qquad

\frac{|m-\mu|}{\sigma}\le\sqrt{0.6},\qquad

\frac{|\nu-m|}{\sigma}\le\sqrt{3},

\end{equation}where µ, m, ν, and σ are its mean, median, mode, and standard deviation, respectively (cf. Corollary 4 in Basu and DasGupta [Reference Basu and DasGupta2]). In the following, we use Proposition 3.2 and Eq. (3.2) aiming to obtain an attainable bound for the absolute value of the mean (or for the coefficient of variation) of Xe.

Proposition 3.3. If Xe is unimodal and if ![]() $\mathsf{E}[X]=0$, then

$\mathsf{E}[X]=0$, then ![]() $\vert\mu^{e}\vert\le\sqrt{0.6}\,\sigma^e$, where µe and σe are the mean and the standard deviation of Xe, respectively.

$\vert\mu^{e}\vert\le\sqrt{0.6}\,\sigma^e$, where µe and σe are the mean and the standard deviation of Xe, respectively.

Similarly to Theorem 2.1, by taking into account Definition 3.1, we provide below a probabilistic generalization of Taylor’s theorem for non-positive random variables.

Theorem 3.2. Let X be a random variable with support included in ![]() $(-\infty,0)$, CDF F and

$(-\infty,0)$, CDF F and ![]() $-\infty \lt \mathsf{E}[X] \lt 0$. Let

$-\infty \lt \mathsf{E}[X] \lt 0$. Let ![]() $g:(-\infty, 0]\rightarrow\mathbb{R}$ be a measurable and differentiable function for

$g:(-\infty, 0]\rightarrow\mathbb{R}$ be a measurable and differentiable function for ![]() $t\in(-\infty,0)$ such that g(0) is finite. Let its derivative g′ be measurable and Riemann-integrable. If

$t\in(-\infty,0)$ such that g(0) is finite. Let its derivative g′ be measurable and Riemann-integrable. If ![]() $\mathsf{E}[g'(X^e)]$ is finite, then

$\mathsf{E}[g'(X^e)]$ is finite, then ![]() $\mathsf{E}[g(X)]$ is finite and

$\mathsf{E}[g(X)]$ is finite and

Proof. By using the fundamental theorem of integral calculus and Fubini’s theorem, one has

\begin{equation*}

\begin{aligned}

g(0)-\mathsf{E}[g(X)]&=\mathsf{E}\left[\int_{X}^{0}g'(t){\rm d}t\right]\\

&=\int_{-\infty}^{0}\left(\int_{x}^{0}g'(t){\rm d}t\right){\rm d}F(x)\\

&=\int_{-\infty}^{0}\left(\int_{-\infty}^{t}{\rm d}F(x)\right)g'(t){\rm d}t\\

&=\int_{-\infty}^{0}g'(t)F(t){\rm d}t\\

&=-\mathsf{E}[X]\mathsf{E}[g'(X^e)]

\end{aligned}

\end{equation*}

\begin{equation*}

\begin{aligned}

g(0)-\mathsf{E}[g(X)]&=\mathsf{E}\left[\int_{X}^{0}g'(t){\rm d}t\right]\\

&=\int_{-\infty}^{0}\left(\int_{x}^{0}g'(t){\rm d}t\right){\rm d}F(x)\\

&=\int_{-\infty}^{0}\left(\int_{-\infty}^{t}{\rm d}F(x)\right)g'(t){\rm d}t\\

&=\int_{-\infty}^{0}g'(t)F(t){\rm d}t\\

&=-\mathsf{E}[X]\mathsf{E}[g'(X^e)]

\end{aligned}

\end{equation*}where in the last equality we have used Eq. (3.1) and that X is non-positive. This completes the proof.

Let us now extend the probabilistic generalization of Taylor’s theorem to random variables having general supports by using the generalized equilibrium PDF defined in Eq. (3.1).

Theorem 3.3. Let us assume that X has an absolutely continuous CDF F. Let Xt and ![]() $X_{(t)}$ be the residual lifetime and the inactivity time of X, respectively. Let

$X_{(t)}$ be the residual lifetime and the inactivity time of X, respectively. Let ![]() $g:\mathbb{R}\rightarrow\mathbb{R}$ be a measurable and differentiable function such that g(0) is finite. Let its derivative g′ be measurable and Riemann-integrable. If

$g:\mathbb{R}\rightarrow\mathbb{R}$ be a measurable and differentiable function such that g(0) is finite. Let its derivative g′ be measurable and Riemann-integrable. If  $\mathsf{E}\left[g'\left(X_0^e\right)\right]$ and

$\mathsf{E}\left[g'\left(X_0^e\right)\right]$ and  $\mathsf{E}\left[g'\left(\left(-X_{(0)}\right)^e\right)\right]$ are finite, then

$\mathsf{E}\left[g'\left(\left(-X_{(0)}\right)^e\right)\right]$ are finite, then ![]() $\mathsf{E}[g(X)]$ is finite and

$\mathsf{E}[g(X)]$ is finite and

\begin{equation}

\mathsf{E}[g(X)]=g(0)+\mu^+\mathsf{E}\left[g'\left(X_0^e\right)\right]-\mu^-\mathsf{E}\left[g'\left(\left(-X_{(0)}\right)^e\right)\right],

\end{equation}

\begin{equation}

\mathsf{E}[g(X)]=g(0)+\mu^+\mathsf{E}\left[g'\left(X_0^e\right)\right]-\mu^-\mathsf{E}\left[g'\left(\left(-X_{(0)}\right)^e\right)\right],

\end{equation} where ![]() $\mu^+,\mu^-\in\mathbb{R}$ are defined as in Eq. (2.2).

$\mu^+,\mu^-\in\mathbb{R}$ are defined as in Eq. (2.2).

Proof. The PDF of X can be written as

where ![]() $p=F(0)$ and

$p=F(0)$ and

\begin{equation*}

f_{-}(t)=\frac{f(t)\mathbb{1}_{[t\le0]}}p,\quad f_{+}(t)=\frac{f(t)\mathbb{1}_{[t \gt 0]}}{1-p},\qquad t\in\mathbb{R},

\end{equation*}

\begin{equation*}

f_{-}(t)=\frac{f(t)\mathbb{1}_{[t\le0]}}p,\quad f_{+}(t)=\frac{f(t)\mathbb{1}_{[t \gt 0]}}{1-p},\qquad t\in\mathbb{R},

\end{equation*} are, respectively, the PDFs of ![]() $-X_{(0)}=\left[X|X\le0\right]$ and

$-X_{(0)}=\left[X|X\le0\right]$ and ![]() $X_0=\left[X|X \gt 0\right]$. Therefore, with a few calculations, one has

$X_0=\left[X|X \gt 0\right]$. Therefore, with a few calculations, one has

\begin{align*}

\mathsf{E}[g(X)]&=p\,\mathsf{E}\left[g\left(-X_{(0)}\right)\right]+(1-p)\mathsf{E}[g(X_0)]\\

&=g(0)-p\,\mathsf{E}\left[X_{(0)}\right]\mathsf{E}\left[g'\left(\left(-X_{(0)}\right)^e\right)\right]+(1-p)\mathsf{E}\left[X_0\right]\mathsf{E}[g'(X_0^e)],

\end{align*}

\begin{align*}

\mathsf{E}[g(X)]&=p\,\mathsf{E}\left[g\left(-X_{(0)}\right)\right]+(1-p)\mathsf{E}[g(X_0)]\\

&=g(0)-p\,\mathsf{E}\left[X_{(0)}\right]\mathsf{E}\left[g'\left(\left(-X_{(0)}\right)^e\right)\right]+(1-p)\mathsf{E}\left[X_0\right]\mathsf{E}[g'(X_0^e)],

\end{align*} where in the last equality we have applied Theorem 3.2 to ![]() $-X_{(0)}$ and Theorem 2.1 to X0. Since

$-X_{(0)}$ and Theorem 2.1 to X0. Since

\begin{equation*}

\mathsf{E}\left[X_{(0)}\right]=\int_{-\infty}^{0}\int_{-\infty}^{t}f_{-}(x){\rm d}x{\rm d}t=\frac{\mu^-}{p},

\end{equation*}

\begin{equation*}

\mathsf{E}\left[X_{(0)}\right]=\int_{-\infty}^{0}\int_{-\infty}^{t}f_{-}(x){\rm d}x{\rm d}t=\frac{\mu^-}{p},

\end{equation*}and

\begin{equation*}

\mathsf{E}\left[X_0\right]=\int_{0}^{+\infty}\int_{t}^{+\infty}f_{+}(x){\rm d}x{\rm d}t=\frac{\mu^+}{1-p},

\end{equation*}

\begin{equation*}

\mathsf{E}\left[X_0\right]=\int_{0}^{+\infty}\int_{t}^{+\infty}f_{+}(x){\rm d}x{\rm d}t=\frac{\mu^+}{1-p},

\end{equation*}then Eq. (3.4) is obtained. This completes the proof.

Corollary 3.1. Under the assumptions of Theorem 3.3, if g(t) is strictly convex for ![]() $t\in\mathbb{R}$, having its minimum in t = 0, then

$t\in\mathbb{R}$, having its minimum in t = 0, then

Proof. From Eq. (3.4), with straightforward calculations one has

\begin{equation*}

\begin{aligned}

\mathsf{E}[g(X)]&=g(0)+\int_{0}^{+\infty}g'(t)\overline{F}(t){\rm d}t-\int_{-\infty}^{0}g'(t)F(t){\rm d}t\\

&=g(0)+\tilde{\mu}\left[\int_{0}^{+\infty}g'(t)f^e(t){\rm d}t-\int_{-\infty}^{0}g'(t)f^e(t){\rm d}t\right]\\

&=g(0)+\tilde{\mu}\left[\mathsf{E}\left[\left(g'\left(X^e\right)\right)^+\right]+\mathsf{E}\left[\left(g'\left(X^e\right)\right)^-\right]\right],

\end{aligned}

\end{equation*}

\begin{equation*}

\begin{aligned}

\mathsf{E}[g(X)]&=g(0)+\int_{0}^{+\infty}g'(t)\overline{F}(t){\rm d}t-\int_{-\infty}^{0}g'(t)F(t){\rm d}t\\

&=g(0)+\tilde{\mu}\left[\int_{0}^{+\infty}g'(t)f^e(t){\rm d}t-\int_{-\infty}^{0}g'(t)f^e(t){\rm d}t\right]\\

&=g(0)+\tilde{\mu}\left[\mathsf{E}\left[\left(g'\left(X^e\right)\right)^+\right]+\mathsf{E}\left[\left(g'\left(X^e\right)\right)^-\right]\right],

\end{aligned}

\end{equation*} where the last equality is obtained from Eq. (2.2) since, under the stated assumptions, g′ is invertible and such that ![]() $g'(t)\le 0$ for all

$g'(t)\le 0$ for all ![]() $t\le 0$ and

$t\le 0$ and ![]() $g'(t)\ge 0$ for all

$g'(t)\ge 0$ for all ![]() $t\ge 0$. Finally, the result follows by recalling Eq. (2.4).

$t\ge 0$. Finally, the result follows by recalling Eq. (2.4).

4. Stochastic comparisons and aging properties

This section is devoted to investigate how stochastic orderings and aging properties are preserved through generalized equilibrium transformations, by taking into account the implications given in Tables 1 and 2, respectively. Distortion-based conditions for likelihood ratio comparisons between two generalized equilibrium random variables are included as well.

First we provide several results regarding stochastic comparisons. More in detail, we prove that many ordering conditions between baseline distributions are preserved by the corresponding generalized equilibrium distributions (sometimes by getting a stronger order).

Proposition 4.1. If ![]() $X\le_{hr}Y$ and

$X\le_{hr}Y$ and ![]() $X\le_{rhr}Y$, then

$X\le_{rhr}Y$, then ![]() $X^e\le_{lr}Y^e$.

$X^e\le_{lr}Y^e$.

Proof. By recalling Eq. (3.1), under the stated assumptions, one has ![]() $F_X(0)\geq F_Y(0)$ and the likelihood ratio function

$F_X(0)\geq F_Y(0)$ and the likelihood ratio function

\begin{equation*}

\frac{f^e_X(t)}{f^e_Y(t)}=

\begin{cases}

\displaystyle\frac{\tilde{\mu}_Y}{\tilde{\mu}_X}\,\frac{F_X(t)}{F_Y(t)},& t \lt 0, \\[3mm]

\displaystyle\frac{\tilde{\mu}_Y}{\tilde{\mu}_X}\,\frac{\overline{F}_X(t)}{\overline{F}_Y(t)},& t\ge0, \\

\end{cases}

\end{equation*}

\begin{equation*}

\frac{f^e_X(t)}{f^e_Y(t)}=

\begin{cases}

\displaystyle\frac{\tilde{\mu}_Y}{\tilde{\mu}_X}\,\frac{F_X(t)}{F_Y(t)},& t \lt 0, \\[3mm]

\displaystyle\frac{\tilde{\mu}_Y}{\tilde{\mu}_X}\,\frac{\overline{F}_X(t)}{\overline{F}_Y(t)},& t\ge0, \\

\end{cases}

\end{equation*} is decreasing in t, that is ![]() $X^e\le_{lr}Y^e$.

$X^e\le_{lr}Y^e$.

From Proposition 4.1 and from the implications given in Table 1, below we show that the likelihood ratio order between two random variables is preserved by the corresponding generalized equilibrium ones. The same happens for the hazard rate and reversed hazard rate orders, when both hold.

Corollary 4.1. Let X and Y be random variables.

• If

$X\le_{hr}Y$ and

$X\le_{hr}Y$ and  $X\le_{rhr}Y$, then

$X\le_{rhr}Y$, then  $X^e\le_{hr}Y^e$ and

$X^e\le_{hr}Y^e$ and  $X^e\le_{rhr}Y^e$.

$X^e\le_{rhr}Y^e$.• If X and Y have absolutely continuous distributions and

$X\le_{lr}Y$, then

$X\le_{lr}Y$, then  $X^e\le_{lr}Y^e$.

$X^e\le_{lr}Y^e$.

If Y has distorted CDF from the one of X, then the likelihood ratio order between the corresponding generalized equilibrium random variables does not depend on the distribution of X, as shown below.

Theorem 4.1. Let X and Y be random variables having absolutely continuous distributions and such that the CDF of Y is distorted from the one of X, through a differentiable distortion function ![]() $q$. Let us denote with

$q$. Let us denote with ![]() $\tilde{q}$ the dual distortion function. Then anyone of the following statements implies

$\tilde{q}$ the dual distortion function. Then anyone of the following statements implies ![]() $X^e\le_{lr}Y^e$:

$X^e\le_{lr}Y^e$:

(i)

$\tilde{q}(u)/u$ is decreasing in

$\tilde{q}(u)/u$ is decreasing in  $u\in(0,1]$ and

$u\in(0,1]$ and  $q(u)/u$ is increasing in

$q(u)/u$ is increasing in  $u\in(0,1]$;

$u\in(0,1]$;(ii)

$q$ is convex.

$q$ is convex.

Proof. Regarding the assertion (i), the ratio ![]() $\tilde{q}(u)/u$ is decreasing for

$\tilde{q}(u)/u$ is decreasing for ![]() $u\in(0,1]$ iff

$u\in(0,1]$ iff ![]() $X\le_{hr}Y$, while

$X\le_{hr}Y$, while ![]() $q(u)/u$ is increasing for

$q(u)/u$ is increasing for ![]() $u\in(0,1]$ iff

$u\in(0,1]$ iff ![]() $X\le_{rhr}Y$ (cf. Proposition 2 in Navarro et al. [Reference Navarro, Durante and Fernández-Sánchez23]). Then, the result follows from Proposition 4.1. Moreover, with a few calculations, when (ii) holds, then

$X\le_{rhr}Y$ (cf. Proposition 2 in Navarro et al. [Reference Navarro, Durante and Fernández-Sánchez23]). Then, the result follows from Proposition 4.1. Moreover, with a few calculations, when (ii) holds, then ![]() $X\le_{lr}Y$, and the thesis follows from Corollary 4.1.

$X\le_{lr}Y$, and the thesis follows from Corollary 4.1.

Example 4.1. Let X be a random variable uniformly distributed in ![]() $(-1,1)$, with CDF

$(-1,1)$, with CDF ![]() $F_X(t)=(t+1)/2$, for

$F_X(t)=(t+1)/2$, for ![]() $t\in(-1,1)$. Let us assume that Y has distorted CDF

$t\in(-1,1)$. Let us assume that Y has distorted CDF ![]() $F_Y=q_{\alpha,\beta}(F_X)$, where

$F_Y=q_{\alpha,\beta}(F_X)$, where

\begin{equation}

q_{\alpha,\beta}(u)=\frac12 u^{\alpha}+\frac12 u^{\beta},\qquad u\in[0,1],

\end{equation}

\begin{equation}

q_{\alpha,\beta}(u)=\frac12 u^{\alpha}+\frac12 u^{\beta},\qquad u\in[0,1],

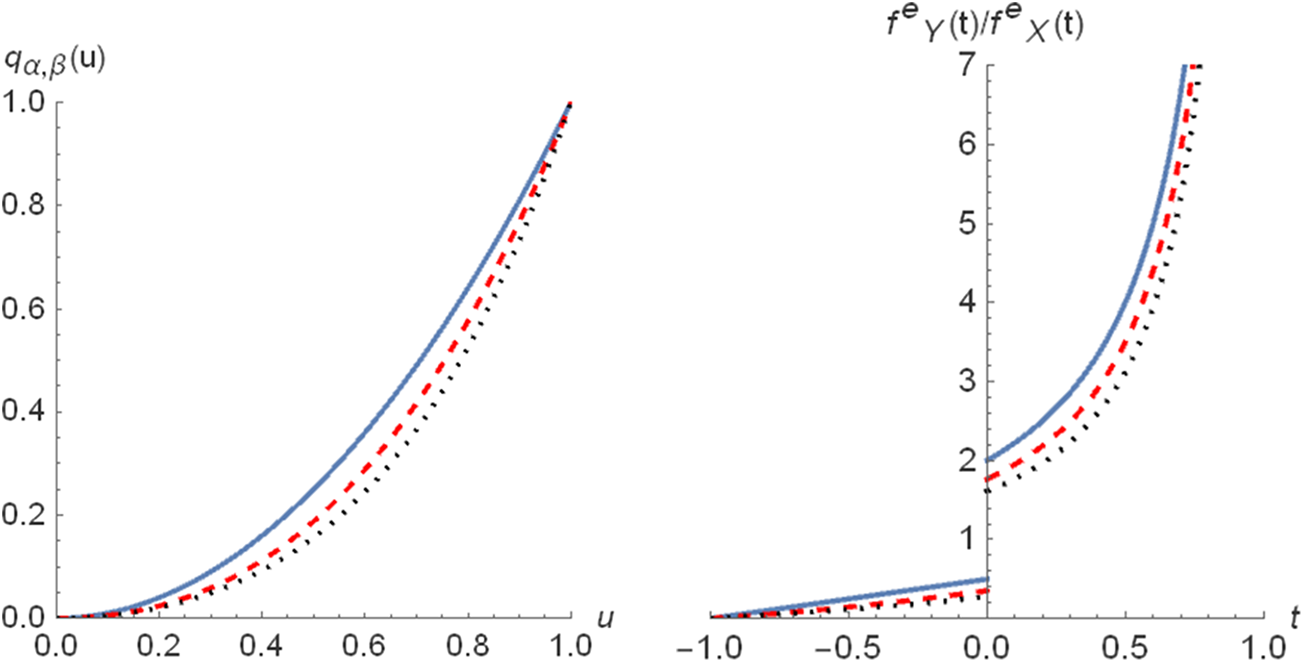

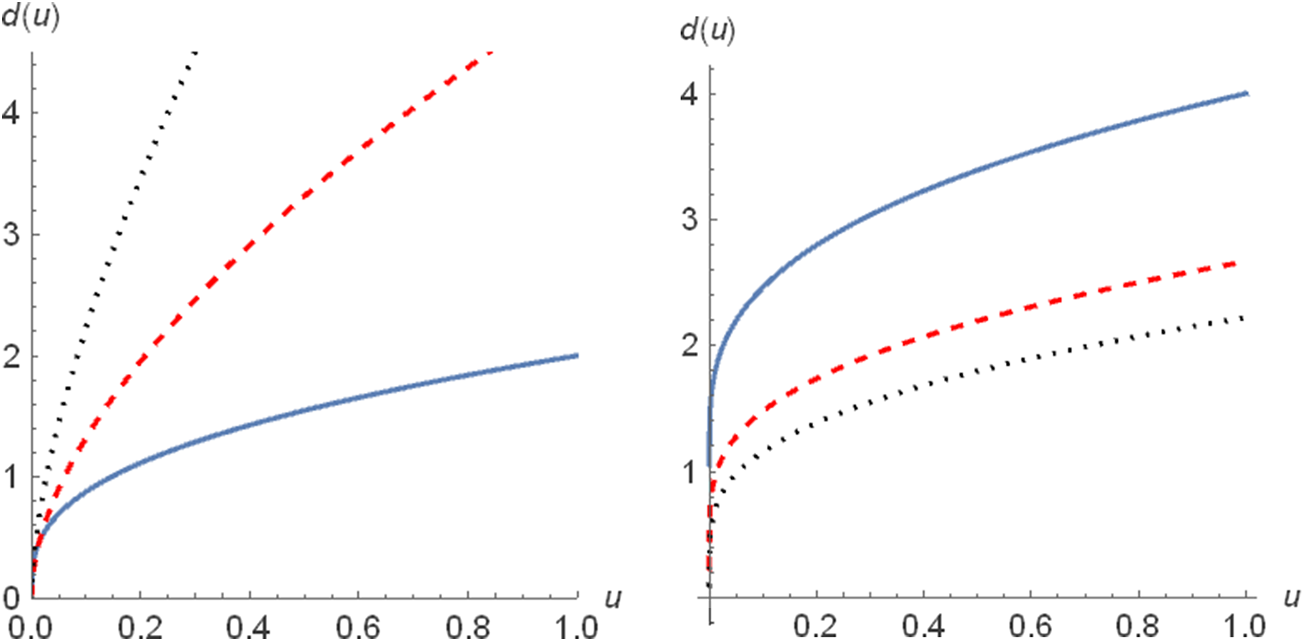

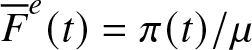

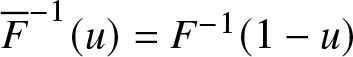

\end{equation} is a convex distortion function for ![]() $\alpha,\beta \gt 1$, as shown in the LHS of Figure 1 for suitable choices of α and β. Hence, from (ii) of Theorem 4.1, it follows

$\alpha,\beta \gt 1$, as shown in the LHS of Figure 1 for suitable choices of α and β. Hence, from (ii) of Theorem 4.1, it follows ![]() $X^e\le_{lr}Y^e$. Indeed, from Eq. (3.1) and by denoting with

$X^e\le_{lr}Y^e$. Indeed, from Eq. (3.1) and by denoting with ![]() $c_{\alpha,\beta}=(\alpha+1)(\beta+1)/[2^{\alpha+\beta}(\alpha\beta-1)+2^\beta(\beta+1)+2^\alpha(\alpha+1)]$, the likelihood ratio function

$c_{\alpha,\beta}=(\alpha+1)(\beta+1)/[2^{\alpha+\beta}(\alpha\beta-1)+2^\beta(\beta+1)+2^\alpha(\alpha+1)]$, the likelihood ratio function

\begin{equation}

\frac{f^e_Y(t)}{f^e_X(t)}=

\begin{cases}

\displaystyle c_{\alpha,\beta}\left[2^{\beta-1}(t+1)^{\alpha-1}+2^{\alpha-1}(t+1)^{\beta-1}\right],& t\in(-1,0), \\

\displaystyle c_{\alpha,\beta}\frac{2^{\alpha+\beta}-2^{\beta-1}(t+1)^\alpha-2^{\alpha-1}(t+1)^\beta}{1-t},& t\in[0,1), \\

\end{cases}

\end{equation}

\begin{equation}

\frac{f^e_Y(t)}{f^e_X(t)}=

\begin{cases}

\displaystyle c_{\alpha,\beta}\left[2^{\beta-1}(t+1)^{\alpha-1}+2^{\alpha-1}(t+1)^{\beta-1}\right],& t\in(-1,0), \\

\displaystyle c_{\alpha,\beta}\frac{2^{\alpha+\beta}-2^{\beta-1}(t+1)^\alpha-2^{\alpha-1}(t+1)^\beta}{1-t},& t\in[0,1), \\

\end{cases}

\end{equation} is increasing in ![]() $t\in(-1,1)$, as depicted in the RHS of Figure 1 for some choices of α and β.

$t\in(-1,1)$, as depicted in the RHS of Figure 1 for some choices of α and β.

Note that, if ![]() $\alpha=\beta$, then the distortion given in Eq. (4.1) leads to the PRHR model.

$\alpha=\beta$, then the distortion given in Eq. (4.1) leads to the PRHR model.

Below we obtain sufficient ordering conditions on baseline distributions aiming to compare in the hazard rate order the corresponding generalized equilibrium distributions.

Proposition 4.2. If ![]() $X\le_{mrl}Y$,

$X\le_{mrl}Y$, ![]() $X\le_{mit}Y$,

$X\le_{mit}Y$, ![]() $Y^-\le_{st}X^-$ and

$Y^-\le_{st}X^-$ and ![]() $\tilde{\mu}_X\le\tilde{\mu}_Y$, then

$\tilde{\mu}_X\le\tilde{\mu}_Y$, then ![]() $X^e\le_{hr}Y^e$.

$X^e\le_{hr}Y^e$.

Proof. Let us denote with ζX and ζY the MRL functions of X and Y, while with ![]() $\tilde{\zeta}_X$ and

$\tilde{\zeta}_X$ and ![]() $\tilde{\zeta}_Y$ their MIT functions, respectively. Recalling Eq. (3.1), by adding and subtracting

$\tilde{\zeta}_Y$ their MIT functions, respectively. Recalling Eq. (3.1), by adding and subtracting  $\int_{-\infty}^{t}F_X(x){\rm d}x$ for t < 0, the HR of Xe becomes

$\int_{-\infty}^{t}F_X(x){\rm d}x$ for t < 0, the HR of Xe becomes

\begin{equation*}

\lambda_X^{e}(t)=

\begin{cases}

\displaystyle\left[\frac{\tilde{\mu}_X}{F_X(t)}-\tilde{\zeta}_X(t)\right]^{-1},& t \lt 0, \\[3mm]

\displaystyle\left[\zeta_X(t)\right]^{-1},& t\ge0.\\

\end{cases}

\end{equation*}

\begin{equation*}

\lambda_X^{e}(t)=

\begin{cases}

\displaystyle\left[\frac{\tilde{\mu}_X}{F_X(t)}-\tilde{\zeta}_X(t)\right]^{-1},& t \lt 0, \\[3mm]

\displaystyle\left[\zeta_X(t)\right]^{-1},& t\ge0.\\

\end{cases}

\end{equation*}With similar calculations, the HR of Ye can be expressed as

\begin{equation*}

\lambda_Y^{e}(t)=

\begin{cases}

\displaystyle\left[\frac{\tilde{\mu}_Y}{F_Y(t)}-\tilde{\zeta}_Y(t)\right]^{-1},& t \lt 0, \\[3mm]

\displaystyle\left[\zeta_Y(t)\right]^{-1},& t\ge0.\\

\end{cases}

\end{equation*}

\begin{equation*}

\lambda_Y^{e}(t)=

\begin{cases}

\displaystyle\left[\frac{\tilde{\mu}_Y}{F_Y(t)}-\tilde{\zeta}_Y(t)\right]^{-1},& t \lt 0, \\[3mm]

\displaystyle\left[\zeta_Y(t)\right]^{-1},& t\ge0.\\

\end{cases}

\end{equation*} Therefore, if ![]() $X\le_{mrl}Y$, then

$X\le_{mrl}Y$, then ![]() $\lambda_X^{e}(t)\ge\lambda_Y^{e}(t)$ for all

$\lambda_X^{e}(t)\ge\lambda_Y^{e}(t)$ for all ![]() $t\ge 0$. Moreover, since

$t\ge 0$. Moreover, since ![]() $Y^-\le_{st}X^-$ one has

$Y^-\le_{st}X^-$ one has ![]() $F_X(t)\ge F_Y(t)$ for all t < 0. Hence, under the condition

$F_X(t)\ge F_Y(t)$ for all t < 0. Hence, under the condition ![]() $\tilde{\mu}_X\le\tilde{\mu}_Y$, if

$\tilde{\mu}_X\le\tilde{\mu}_Y$, if ![]() $X\le_{mit}Y$, then

$X\le_{mit}Y$, then ![]() $\lambda_X^{e}(t)\ge\lambda_Y^{e}(t)$ also holds for all t < 0, and the thesis follows.

$\lambda_X^{e}(t)\ge\lambda_Y^{e}(t)$ also holds for all t < 0, and the thesis follows.

Let us consider an example that satisfies the assumptions of Proposition 4.2.

Example 4.2. Let X be uniformly distributed in ![]() $(-1,1/2)$, with CDF

$(-1,1/2)$, with CDF ![]() $F_X(t)=2(t+1)/3$, for

$F_X(t)=2(t+1)/3$, for ![]() $t\in(-1,1/2)$. Let Y be uniformly distributed in

$t\in(-1,1/2)$. Let Y be uniformly distributed in ![]() $(-1,1)$, having CDF

$(-1,1)$, having CDF ![]() $F_Y(t)=(t+1)/2$, for

$F_Y(t)=(t+1)/2$, for ![]() $t\in(-1,1)$. The likelihood ratio function

$t\in(-1,1)$. The likelihood ratio function

\begin{equation*}

\frac{f_X(t)}{f_Y(t)}=

\begin{cases}

\displaystyle \frac43,& t\in(-1,\frac12], \\[3mm]

\displaystyle 0,& t\in(\frac12,1),\\

\end{cases}

\end{equation*}

\begin{equation*}

\frac{f_X(t)}{f_Y(t)}=

\begin{cases}

\displaystyle \frac43,& t\in(-1,\frac12], \\[3mm]

\displaystyle 0,& t\in(\frac12,1),\\

\end{cases}

\end{equation*} is decreasing in t, that is ![]() $X\le_{lr}Y$. Then, from Table 1, one has

$X\le_{lr}Y$. Then, from Table 1, one has ![]() $X\le_{mrl}Y$ and

$X\le_{mrl}Y$ and ![]() $X\le_{mit}Y$. From Eq. (2.1), one gets

$X\le_{mit}Y$. From Eq. (2.1), one gets ![]() $Y^-\le_{st}X^-$. By recalling Eq. (2.4), it holds

$Y^-\le_{st}X^-$. By recalling Eq. (2.4), it holds ![]() $5/12=\tilde{\mu}_X \lt \tilde{\mu}_Y=1/2$. Hence, by applying Proposition 4.2, it follows

$5/12=\tilde{\mu}_X \lt \tilde{\mu}_Y=1/2$. Hence, by applying Proposition 4.2, it follows ![]() $X^e\le_{hr}Y^e$.

$X^e\le_{hr}Y^e$.

An analogous result to Proposition 4.2 holds for the reversed hazard rate order.

Proposition 4.3. If ![]() $X\le_{mrl}Y$,

$X\le_{mrl}Y$, ![]() $X\le_{mit}Y$,

$X\le_{mit}Y$, ![]() $X^+\le_{st}Y^+$ and

$X^+\le_{st}Y^+$ and ![]() $\tilde{\mu}_X\ge\tilde{\mu}_Y$, then

$\tilde{\mu}_X\ge\tilde{\mu}_Y$, then ![]() $X^e\le_{rhr}Y^e$.

$X^e\le_{rhr}Y^e$.

Proof. Let us denote with ζX and ζY the MRL of X and Y, while with ![]() $\tilde{\zeta}_X$ and

$\tilde{\zeta}_X$ and ![]() $\tilde{\zeta}_Y$ their MIT, respectively. Recalling Eq. (3.1), by adding and subtracting

$\tilde{\zeta}_Y$ their MIT, respectively. Recalling Eq. (3.1), by adding and subtracting  $\int_{t}^{+\infty}\overline{F}_X(x){\rm d}x$ for

$\int_{t}^{+\infty}\overline{F}_X(x){\rm d}x$ for ![]() $t\ge0$, the RHR of Xe becomes

$t\ge0$, the RHR of Xe becomes

\begin{equation*}

\tau_X^{e}(t)=

\begin{cases}

\displaystyle\left[\tilde\zeta_X(t)\right]^{-1},& t \lt 0, \\[3mm]

\displaystyle\left[\frac{\tilde{\mu}_X}{\overline{F}_X(t)}-\zeta_X(t)\right]^{-1} ,& t\ge0\\

\end{cases}

\end{equation*}

\begin{equation*}

\tau_X^{e}(t)=

\begin{cases}

\displaystyle\left[\tilde\zeta_X(t)\right]^{-1},& t \lt 0, \\[3mm]

\displaystyle\left[\frac{\tilde{\mu}_X}{\overline{F}_X(t)}-\zeta_X(t)\right]^{-1} ,& t\ge0\\

\end{cases}

\end{equation*} and similarly for the RHR ![]() $\tau_Y^{e}$ of Ye. Hence, if

$\tau_Y^{e}$ of Ye. Hence, if ![]() $X\le_{mit}Y$, then

$X\le_{mit}Y$, then ![]() $\tau_X^{e}(t)\le\tau_Y^{e}(t)$ for all t < 0. In addition,

$\tau_X^{e}(t)\le\tau_Y^{e}(t)$ for all t < 0. In addition, ![]() $X^+\le_{st}Y^+$ implies

$X^+\le_{st}Y^+$ implies ![]() $\overline{F}_X(t)\le\overline{F}_Y(t)$ for all

$\overline{F}_X(t)\le\overline{F}_Y(t)$ for all ![]() $t\ge 0$. Therefore, under the condition

$t\ge 0$. Therefore, under the condition ![]() $\tilde{\mu}_X\ge\tilde{\mu}_Y$, if

$\tilde{\mu}_X\ge\tilde{\mu}_Y$, if ![]() $X\le_{mrl}Y$, then

$X\le_{mrl}Y$, then ![]() $\tau_X^{e}(t)\le\tau_Y^{e}(t)$ also holds for all

$\tau_X^{e}(t)\le\tau_Y^{e}(t)$ also holds for all ![]() $t\ge 0$. This completes the proof.

$t\ge 0$. This completes the proof.

The random variables in the following example satisfy the conditions of Proposition 4.3.

Example 4.3. Let X be uniformly distributed in ![]() $(-1,1)$, with CDF

$(-1,1)$, with CDF ![]() $F_X(t)=(t+1)/2$, for

$F_X(t)=(t+1)/2$, for ![]() $t\in(-1,1)$. Let Y be standard uniformly distributed. The likelihood ratio function

$t\in(-1,1)$. Let Y be standard uniformly distributed. The likelihood ratio function

\begin{equation*}

\frac{f_X(t)}{f_Y(t)}=

\begin{cases}

\displaystyle +\infty,& t\in(-1,0), \\[3mm]

\displaystyle \frac12,& t\in[0,1),\\

\end{cases}

\end{equation*}

\begin{equation*}

\frac{f_X(t)}{f_Y(t)}=

\begin{cases}

\displaystyle +\infty,& t\in(-1,0), \\[3mm]

\displaystyle \frac12,& t\in[0,1),\\

\end{cases}

\end{equation*} is decreasing in t, that is ![]() $X\le_{lr}Y$. Then, from Table 1, one has

$X\le_{lr}Y$. Then, from Table 1, one has ![]() $X\le_{mrl}Y$ and

$X\le_{mrl}Y$ and ![]() $X\le_{mit}Y$. From Eq. (2.1), one gets

$X\le_{mit}Y$. From Eq. (2.1), one gets ![]() $X^+\le_{st}Y^+$. By recalling Eq. (2.4), it holds

$X^+\le_{st}Y^+$. By recalling Eq. (2.4), it holds ![]() $\tilde{\mu}_X=\tilde{\mu}_Y=1/2$. Hence, by applying Proposition 4.3, it follows

$\tilde{\mu}_X=\tilde{\mu}_Y=1/2$. Hence, by applying Proposition 4.3, it follows ![]() $X^e\le_{rhr}Y^e$.

$X^e\le_{rhr}Y^e$.

By combining Propositions 4.2 and 4.3 we get the next result.

Corollary 4.2. Let X and Y be random variables such that ![]() $X\le_{st}Y$ and

$X\le_{st}Y$ and ![]() $\tilde{\mu}_X=\tilde{\mu}_Y$.

$\tilde{\mu}_X=\tilde{\mu}_Y$.

• If

$X\le_{mrl}Y$ and

$X\le_{mrl}Y$ and  $X\le_{mit}Y$, then

$X\le_{mit}Y$, then  $X^e\le_{hr}Y^e$ and

$X^e\le_{hr}Y^e$ and  $X^e\le_{rhr}Y^e$

$X^e\le_{rhr}Y^e$

and therefore

• If

$X\le_{mrl}Y$ and

$X\le_{mrl}Y$ and  $X\le_{mit}Y$, then

$X\le_{mit}Y$, then  $X^e\le_{mrl}Y^e$ and

$X^e\le_{mrl}Y^e$ and  $X^e\le_{mit}Y^e$.

$X^e\le_{mit}Y^e$.

In the following, we obtain sufficient conditions on the baseline distributions in order to compare in the usual stochastic order the corresponding generalized equilibrium distributions.

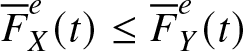

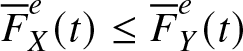

Proposition 4.4. If ![]() $X\le_{icx}Y$,

$X\le_{icx}Y$, ![]() $X\le_{icv}Y$ and

$X\le_{icv}Y$ and ![]() $\tilde{\mu}_X=\tilde{\mu}_Y$, then

$\tilde{\mu}_X=\tilde{\mu}_Y$, then ![]() $X^e\le_{st}Y^e$.

$X^e\le_{st}Y^e$.

Proof. Let us denote ![]() $\tilde{\mu}_X=\tilde{\mu}_Y=\tilde{\mu}$. From Eq. (3.1), the SF of Xe can be expressed as

$\tilde{\mu}_X=\tilde{\mu}_Y=\tilde{\mu}$. From Eq. (3.1), the SF of Xe can be expressed as

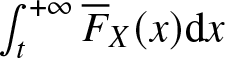

\begin{equation}

\overline{F}_X^{e}(t)=

\begin{cases}

\displaystyle1-\frac1{\tilde{\mu}}\int_{-\infty}^{t}F_X(s){\rm d}s,& t \lt 0, \\[3mm]

\displaystyle\frac1{\tilde{\mu}}\int_{t}^{+\infty}\overline{F}_X(s){\rm d}s,& t\ge0\\

\end{cases}

\end{equation}

\begin{equation}

\overline{F}_X^{e}(t)=

\begin{cases}

\displaystyle1-\frac1{\tilde{\mu}}\int_{-\infty}^{t}F_X(s){\rm d}s,& t \lt 0, \\[3mm]

\displaystyle\frac1{\tilde{\mu}}\int_{t}^{+\infty}\overline{F}_X(s){\rm d}s,& t\ge0\\

\end{cases}

\end{equation} and similarly for the SF ![]() $\overline{F}_Y^{e}$ of Ye. Hence, if

$\overline{F}_Y^{e}$ of Ye. Hence, if ![]() $X\le_{icx}Y$, then

$X\le_{icx}Y$, then  $\overline{F}_X^{e}(t)\le\overline{F}_Y^e(t)$ for all

$\overline{F}_X^{e}(t)\le\overline{F}_Y^e(t)$ for all ![]() $t\ge 0$, and since

$t\ge 0$, and since ![]() $X\le_{icv}Y$, it follows

$X\le_{icv}Y$, it follows  $\overline{F}_X^{e}(t)\le\overline{F}_Y^e(t)$ also for all t < 0. This concludes the proof.

$\overline{F}_X^{e}(t)\le\overline{F}_Y^e(t)$ also for all t < 0. This concludes the proof.

Note that in Proposition 4.4 the assumption ![]() $X\le_{icv}Y$ can be replaced by

$X\le_{icv}Y$ can be replaced by ![]() $X^-\le_{st}Y^-$.

$X^-\le_{st}Y^-$.

Proposition 4.5. If ![]() $X\le_{cx}Y$ and

$X\le_{cx}Y$ and ![]() $\mu^-_X=\mu^-_Y$, then

$\mu^-_X=\mu^-_Y$, then ![]() $(X^e)^-\le_{st}(Y^e)^-$ and

$(X^e)^-\le_{st}(Y^e)^-$ and ![]() $(X^e)^+\le_{st}(Y^e)^+$.

$(X^e)^+\le_{st}(Y^e)^+$.

Proof. If ![]() $X\le_{cx}Y$, then

$X\le_{cx}Y$, then ![]() $\mu_X=\mu_Y$. Therefore, by recalling Eqs. (2.3) and (2.4), if

$\mu_X=\mu_Y$. Therefore, by recalling Eqs. (2.3) and (2.4), if ![]() $\mu^-_X=\mu^-_Y$, then

$\mu^-_X=\mu^-_Y$, then ![]() $\tilde{\mu}_X=\tilde{\mu}_Y=\tilde{\mu}$. Hence, from Eq. (4.3), since

$\tilde{\mu}_X=\tilde{\mu}_Y=\tilde{\mu}$. Hence, from Eq. (4.3), since ![]() $X\le_{cx}Y$, then

$X\le_{cx}Y$, then  $\overline{F}_X^{e}(t)\ge(\le)\overline{F}_Y^{e}(t)$ for all

$\overline{F}_X^{e}(t)\ge(\le)\overline{F}_Y^{e}(t)$ for all ![]() $t \lt (\ge)0$. The thesis follows by recalling Eq. (2.1).

$t \lt (\ge)0$. The thesis follows by recalling Eq. (2.1).

Hereafter, we obtain a sufficient condition for which the usual stochastic order is preserved under generalized equilibrium transformations.

Proposition 4.6. Let X and Y be random variables such that ![]() $\tilde{\mu}_X=\tilde{\mu}_Y$. If

$\tilde{\mu}_X=\tilde{\mu}_Y$. If ![]() $X\le_{st}Y$, then

$X\le_{st}Y$, then ![]() $X^e\le_{st}Y^e$.

$X^e\le_{st}Y^e$.

Proof. From Eq. (3.1), if ![]() $\tilde{\mu}_X=\tilde{\mu}_Y$ and

$\tilde{\mu}_X=\tilde{\mu}_Y$ and ![]() $X\le_{st}Y$, then

$X\le_{st}Y$, then ![]() $f^e_X(t)\ge f^e_Y(t)$ for all

$f^e_X(t)\ge f^e_Y(t)$ for all ![]() $t\le0$ and

$t\le0$ and ![]() $f^e_X(t)\le f^e_Y(t)$ for all

$f^e_X(t)\le f^e_Y(t)$ for all ![]() $t\ge0$. Hence, the thesis follows from Lemma 2.2 in Kochar [Reference Kochar16].

$t\ge0$. Hence, the thesis follows from Lemma 2.2 in Kochar [Reference Kochar16].

Below we obtain aging conditions on a given random variable aiming to perform likelihood ratio comparisons with its generalized equilibrium version.

Proposition 4.7. Let X be a random variable with absolutely continuous distribution having support containing 0 and with median ![]() $m\ge0$. If X is DFR, then

$m\ge0$. If X is DFR, then ![]() $X\le_{lr}X^{e}$.

$X\le_{lr}X^{e}$.

Proof. Let us denote with f, λ and τ the PDF, HR and RHR of X, respectively. If X is DFR, then it is DRFR (cf. Table 2). Moreover, since ![]() $m\ge0$, then

$m\ge0$, then ![]() $F(0)\leq 1/2$ and one has

$F(0)\leq 1/2$ and one has

\begin{equation*}

\tau(0)-\lambda(0)=\tau(0)\, \frac{1-2\,F(0)}{\overline F(0)}\geq 0.

\end{equation*}

\begin{equation*}

\tau(0)-\lambda(0)=\tau(0)\, \frac{1-2\,F(0)}{\overline F(0)}\geq 0.

\end{equation*}Hence, from Eq. (3.1) and the DFR and DRFR properties, the ratio

\begin{equation*}

\frac{f(t)}{f^{e}(t)}=

\begin{cases}

\displaystyle\tilde{\mu}\,\tau(t),& t \lt 0, \\

\displaystyle\tilde{\mu}\,\lambda(t),& t\ge0, \\

\end{cases}

\end{equation*}

\begin{equation*}

\frac{f(t)}{f^{e}(t)}=

\begin{cases}

\displaystyle\tilde{\mu}\,\tau(t),& t \lt 0, \\

\displaystyle\tilde{\mu}\,\lambda(t),& t\ge0, \\

\end{cases}

\end{equation*} is decreasing in t, i.e., ![]() $X\le_{lr}X^{e}$.

$X\le_{lr}X^{e}$.

We now provide further results involving aging notions. More in detail, we prove that some aging classes are preserved through generalized equilibrium transformations. Note that, from Remark 3.1, Xe cannot be DFR in ![]() $\mathbb{R}$ since its HR is always increasing for

$\mathbb{R}$ since its HR is always increasing for ![]() $t\in(-\infty,0)$.

$t\in(-\infty,0)$.

Proposition 4.8. Let X be a random variable with absolutely continuous distribution. If X is IFR and DRFR, then Xe is ILR.

Proof. Let us denote with f the PDF of X. From Eq. (3.1) one has

\begin{equation*}

\frac{\rm{d}}{\rm{d}t}f^e(t)=

\begin{cases}

\displaystyle\frac{f(t)}{\tilde{\mu}},& t \lt 0, \\[3mm]

\displaystyle-\frac{f(t)}{\tilde{\mu}},& t\ge0 \\

\end{cases}

\end{equation*}

\begin{equation*}

\frac{\rm{d}}{\rm{d}t}f^e(t)=

\begin{cases}

\displaystyle\frac{f(t)}{\tilde{\mu}},& t \lt 0, \\[3mm]

\displaystyle-\frac{f(t)}{\tilde{\mu}},& t\ge0 \\

\end{cases}

\end{equation*}and therefore Glaser’s function of Xe is

\begin{equation*}

\eta^e(t)=

\begin{cases}

\displaystyle-\tau(t),& t \lt 0, \\[3mm]

\displaystyle\lambda(t),& t\ge0, \\

\end{cases}

\end{equation*}

\begin{equation*}

\eta^e(t)=

\begin{cases}

\displaystyle-\tau(t),& t \lt 0, \\[3mm]

\displaystyle\lambda(t),& t\ge0, \\

\end{cases}

\end{equation*} where λ and τ denote the HR and RHR of X, respectively. Hence, since ![]() $\eta^e(0^+)-\eta^e(0^-)=\lambda(0^+)+\tau(0^-)\ge0$, if X is IFR and DRFR, then

$\eta^e(0^+)-\eta^e(0^-)=\lambda(0^+)+\tau(0^-)\ge0$, if X is IFR and DRFR, then ![]() $\eta^e(t)$ is increasing in t. This completes the proof.

$\eta^e(t)$ is increasing in t. This completes the proof.

In the following, from Proposition 4.8 and from the implications given in Table 2, we show that the generalized equilibrium distribution preserves the ILR property of the baseline random variable. The same for IFR and DRFR properties, whenever they hold simultaneously.

Corollary 4.3. Let X be a random variable with absolutely continuous distribution.

• If X is ILR, then Xe is ILR.

• If X is IFR and DRFR, then Xe is IFR and DRFR.

Hereafter, we provide further aging results under suitable assumptions on the median of the baseline distribution.

Proposition 4.9. Let X be a random variable with median m.

(i) If

$m\ge0$ and X is DMRL, then Xe is IFR.

$m\ge0$ and X is DMRL, then Xe is IFR.(ii) If

$m\le0$ and X is IMIT, then Xe is DRFR.

$m\le0$ and X is IMIT, then Xe is DRFR.

Proof. Making use of Eq. (3.1), by denoting with ζ the MRL of X, the HR of Xe

\begin{equation*}

\lambda^{e}(t)=

\begin{cases}

\displaystyle\frac{F(t)}{\int_{t}^{0}F(x){\rm d}x+\mu^{+}},& t \lt 0, \\[3mm]

\displaystyle\left[\zeta(t)\right]^{-1},& t\ge0, \\

\end{cases}

\end{equation*}

\begin{equation*}

\lambda^{e}(t)=

\begin{cases}

\displaystyle\frac{F(t)}{\int_{t}^{0}F(x){\rm d}x+\mu^{+}},& t \lt 0, \\[3mm]

\displaystyle\left[\zeta(t)\right]^{-1},& t\ge0, \\

\end{cases}

\end{equation*} is increasing for t < 0. If X is DMRL, then ![]() $\lambda^{e}(t)$ is also increasing for

$\lambda^{e}(t)$ is also increasing for ![]() $t\ge0$. If

$t\ge0$. If ![]() $m\ge0$, then

$m\ge0$, then

\begin{equation*}

\lambda^{e}(0^+)-\lambda^{e}(0^-)=\frac{\overline{F}(0)-F(0^-)}{\mu^{+}}\ge0

\end{equation*}

\begin{equation*}

\lambda^{e}(0^+)-\lambda^{e}(0^-)=\frac{\overline{F}(0)-F(0^-)}{\mu^{+}}\ge0

\end{equation*} and the statement (i) follows. Similarly, from Eq. (3.1), by denoting with ![]() $\tilde{\zeta}$ the MIT of X, the RHR of Xe

$\tilde{\zeta}$ the MIT of X, the RHR of Xe

\begin{equation*}

\tau^{e}(t)=

\begin{cases}

\displaystyle\left[\tilde{\zeta}(t)\right]^{-1},& t \lt 0, \\[3mm]

\displaystyle\frac{\overline{F}(t)}{\mu^{-}+\int_{0}^{t}\overline{F}(x){\rm d}x},& t\ge0, \\

\end{cases}

\end{equation*}

\begin{equation*}

\tau^{e}(t)=

\begin{cases}

\displaystyle\left[\tilde{\zeta}(t)\right]^{-1},& t \lt 0, \\[3mm]

\displaystyle\frac{\overline{F}(t)}{\mu^{-}+\int_{0}^{t}\overline{F}(x){\rm d}x},& t\ge0, \\

\end{cases}

\end{equation*} is decreasing for ![]() $t\ge0$ and if X is IMIT, then it is also decreasing for t < 0. If

$t\ge0$ and if X is IMIT, then it is also decreasing for t < 0. If ![]() $m\le0$, then one has

$m\le0$, then one has

\begin{equation*}

\tau^{e}(0^+)-\tau^{e}(0^-)=\frac{\overline{F}(0)-F(0^-)}{\mu^{-}}\le0

\end{equation*}

\begin{equation*}

\tau^{e}(0^+)-\tau^{e}(0^-)=\frac{\overline{F}(0)-F(0^-)}{\mu^{-}}\le0

\end{equation*}and the statement (ii) follows. This concludes the proof.

If X is non-negative, then from Eq. (1.1) one has that Xe is IFR iff X is DMRL. However, the reverse implication in (i) of Proposition 4.9 does not hold in general. Indeed, if X has support ![]() $\left[-1/2,+\infty\right)$ with the following SF

$\left[-1/2,+\infty\right)$ with the following SF

\begin{equation*}

\overline{F}(t)=

\begin{cases}

\displaystyle\frac1{2+2t},& t\in\left[-\frac12,0\right], \\[3mm]

\displaystyle\frac{e^{-t}}{2},& t\ge0, \\

\end{cases}

\end{equation*}

\begin{equation*}

\overline{F}(t)=

\begin{cases}

\displaystyle\frac1{2+2t},& t\in\left[-\frac12,0\right], \\[3mm]

\displaystyle\frac{e^{-t}}{2},& t\ge0, \\

\end{cases}

\end{equation*}then its median is zero. A straightforward calculation shows that Xe is IFR but X is not DMRL.

By recalling the implications given in Table 2, from (i) of Proposition 4.9, the generalized equilibrium distribution maintains the IFR and DMRL properties of the original distribution. Similarly, the DRFR and IMIT properties are preserved according to (ii) of Proposition 4.9, as it is stated below.

Corollary 4.4. Let X be a random variable having median m.

• If

$m\ge0$ and X is IFR, then Xe is IFR.

$m\ge0$ and X is IFR, then Xe is IFR.• If

$m\ge0$ and X is DMRL, then Xe is DMRL.

$m\ge0$ and X is DMRL, then Xe is DMRL.• If

$m\le0$ and X is DRFR, then Xe is DRFR.

$m\le0$ and X is DRFR, then Xe is DRFR.• If

$m\le0$ and X is IMIT, then Xe is IMIT.

$m\le0$ and X is IMIT, then Xe is IMIT.

5. Equilibrium density of two ordered random variables

In this section, we study the equilibrium PDF of two ordered random variables that are not necessarily non-negative. In particular, we prove a probabilistic analog of the mean value theorem in the proposed case of study. We investigate conditions for the unimodality of this new equilibrium PDF. Further results are provided too, some of them regarding stochastic comparisons. In particular, for the likelihood ratio order, special attention is devoted to the case in which the involved random variables are connected through suitable distortion functions.

The following result extends Proposition 5.1 provided in Di Crescenzo [Reference Di Crescenzo11] for the case of non-negative random variables.

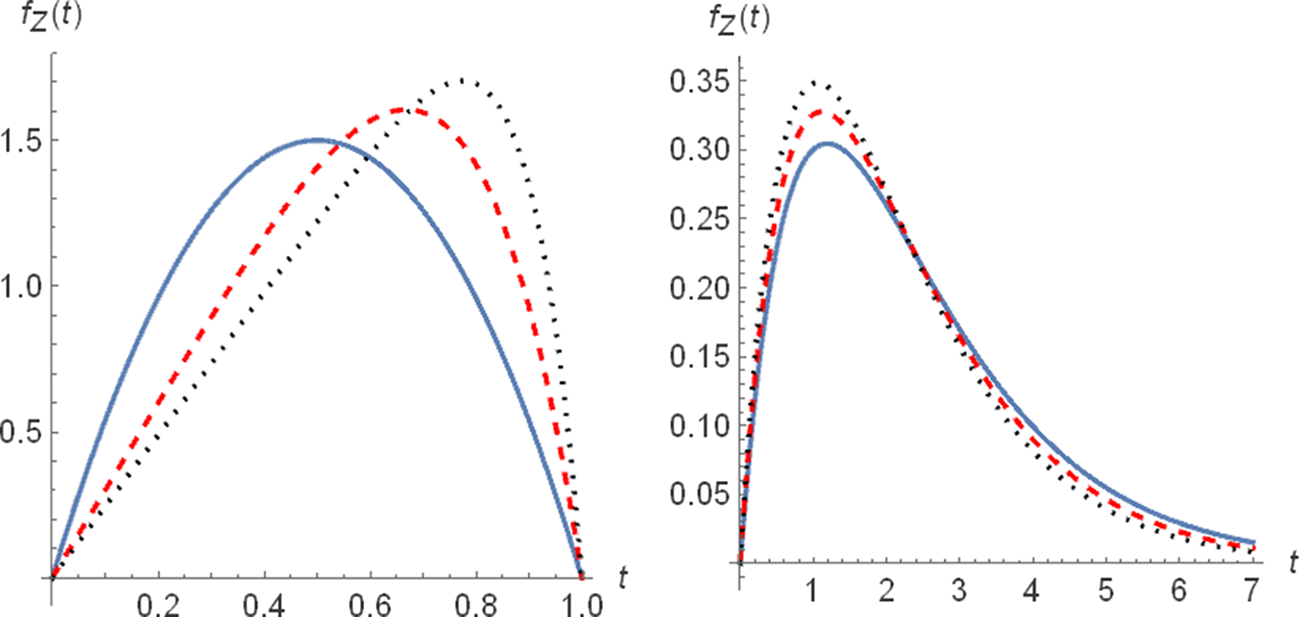

Proposition 5.1. Let X and Y be random variables such that ![]() $-\infty \lt \mathsf{E}[X] \lt \mathsf{E}[Y] \lt +\infty$. Then

$-\infty \lt \mathsf{E}[X] \lt \mathsf{E}[Y] \lt +\infty$. Then

\begin{equation}

f_Z(t)=\frac{\overline{F}_Y(t)-\overline{F}_X(t)}{\mathsf{E}[Y]-\mathsf{E}[X]}=\frac{F_X(t)-F_Y(t)}{\mathsf{E}[Y]-\mathsf{E}[X]},\qquad t\in\mathbb{R},

\end{equation}

\begin{equation}

f_Z(t)=\frac{\overline{F}_Y(t)-\overline{F}_X(t)}{\mathsf{E}[Y]-\mathsf{E}[X]}=\frac{F_X(t)-F_Y(t)}{\mathsf{E}[Y]-\mathsf{E}[X]},\qquad t\in\mathbb{R},

\end{equation} is the PDF of a random variable Z with an absolutely continuous distribution iff ![]() $X\le_{st}Y$.

$X\le_{st}Y$.

Proof. One has ![]() $f_Z(t)\ge 0$, for all

$f_Z(t)\ge 0$, for all ![]() $t\in\mathbb{R}$, iff

$t\in\mathbb{R}$, iff ![]() $X\le_{st}Y$. Moreover, from Eqs. (2.2) and (2.3) it follows

$X\le_{st}Y$. Moreover, from Eqs. (2.2) and (2.3) it follows

\begin{equation*}

\begin{aligned}

\int_{-\infty}^{+\infty}f_Z(t){\rm d}t&=\int_{-\infty}^{0}\frac{F_X(t)-F_Y(t)}{\mathsf{E}[Y]-\mathsf{E}[X]}{\rm d}t+\int_{0}^{+\infty}\frac{\overline{F}_Y(t)-\overline{F}_X(t)}{\mathsf{E}[Y]-\mathsf{E}[X]}{\rm d}t\\

&=\frac{\mu^-_X-\mu^-_Y}{\mathsf{E}[Y]-\mathsf{E}[X]}+\frac{\mu^+_Y-\mu^+_X}{\mathsf{E}[Y]-\mathsf{E}[X]}=1

\end{aligned}

\end{equation*}

\begin{equation*}

\begin{aligned}

\int_{-\infty}^{+\infty}f_Z(t){\rm d}t&=\int_{-\infty}^{0}\frac{F_X(t)-F_Y(t)}{\mathsf{E}[Y]-\mathsf{E}[X]}{\rm d}t+\int_{0}^{+\infty}\frac{\overline{F}_Y(t)-\overline{F}_X(t)}{\mathsf{E}[Y]-\mathsf{E}[X]}{\rm d}t\\

&=\frac{\mu^-_X-\mu^-_Y}{\mathsf{E}[Y]-\mathsf{E}[X]}+\frac{\mu^+_Y-\mu^+_X}{\mathsf{E}[Y]-\mathsf{E}[X]}=1

\end{aligned}

\end{equation*}and this completes the proof.

Definition 5.1. Under the assumptions of Proposition 5.1, a random variable Z having absolutely continuous distribution according to the equilibrium PDF given in Eq. (5.1), is denoted as ![]() $Z\equiv\Psi(X,Y)$.

$Z\equiv\Psi(X,Y)$.

We can connect ![]() $Z\equiv\Psi(X,Y)$ with the generalized equilibrium distribution defined in Section 3. Indeed, if X and Y are non-negative (non-positive), then from Eq. (3.1) and Proposition 5.1 one has

$Z\equiv\Psi(X,Y)$ with the generalized equilibrium distribution defined in Section 3. Indeed, if X and Y are non-negative (non-positive), then from Eq. (3.1) and Proposition 5.1 one has

\begin{equation}

f_Z(t)=\frac{\mathsf{E}[Y]}{\mathsf{E}[Y]-\mathsf{E}[X]}f^e_Y(t)-\frac{\mathsf{E}[X]}{\mathsf{E}[Y]-\mathsf{E}[X]}f^e_X(t),\qquad t\ge(\le) 0

\end{equation}

\begin{equation}

f_Z(t)=\frac{\mathsf{E}[Y]}{\mathsf{E}[Y]-\mathsf{E}[X]}f^e_Y(t)-\frac{\mathsf{E}[X]}{\mathsf{E}[Y]-\mathsf{E}[X]}f^e_X(t),\qquad t\ge(\le) 0

\end{equation} and therefore fZ is a generalized mixture between ![]() $f^e_X$ and

$f^e_X$ and ![]() $f^e_Y$. We recall that the generalized mixtures are defined as the classic ones but they might contain negative coefficients, as in Eq. (5.2). Note that, if X is non-positive and Y is non-negative, then Eq. (5.2) holds again, and in this case fZ is a classical mixture between

$f^e_Y$. We recall that the generalized mixtures are defined as the classic ones but they might contain negative coefficients, as in Eq. (5.2). Note that, if X is non-positive and Y is non-negative, then Eq. (5.2) holds again, and in this case fZ is a classical mixture between ![]() $f^e_X$ and

$f^e_X$ and ![]() $f^e_Y$. Hence, in all the mentioned cases, FZ,

$f^e_Y$. Hence, in all the mentioned cases, FZ, ![]() $\overline{F}_Z$,

$\overline{F}_Z$, ![]() $\mathsf{E}(Z)$ and other moments of Z can be also obtained from the ones of Xe and Ye by using Eq. (5.2).

$\mathsf{E}(Z)$ and other moments of Z can be also obtained from the ones of Xe and Ye by using Eq. (5.2).

Remark 5.1. Let X and Y be non-negative (non-positive) random variables, such that ![]() $X\le_{st}Y$. From Eq. (5.2), by setting

$X\le_{st}Y$. From Eq. (5.2), by setting ![]() $p=\mathsf{E}[X]/\mathsf{E}[Y]\in(0,1)$, it follows

$p=\mathsf{E}[X]/\mathsf{E}[Y]\in(0,1)$, it follows

i.e., ![]() $f^e_Y$ is a mixture between

$f^e_Y$ is a mixture between ![]() $f^e_X$ and fZ, and therefore

$f^e_X$ and fZ, and therefore ![]() $f^e_Y$ takes values between

$f^e_Y$ takes values between ![]() $f^e_X$ and fZ.

$f^e_X$ and fZ.

Recently, the bivariate Gini’s mean difference has been defined and studied in Capaldo and Navarro [Reference Capaldo and Navarro6]. The formal definition is stated as follows.

Definition 5.2. Let (X, Y) be a random vector. The bivariate Gini’s mean difference of (X, Y) is defined as

provided that X and Y have finite means.

Note that, while the bivariate Gini’s mean difference in Eq. (5.3) can measure the expected absolute distance between X and Y, the PDF of ![]() $Z\equiv\Psi(X,Y)$ can measure the distance between the SFs of X and Y. Indeed, the PDF given in Eq. (5.1) is related with the Kolmogorov distance, which is defined for any pairs of random variables

$Z\equiv\Psi(X,Y)$ can measure the distance between the SFs of X and Y. Indeed, the PDF given in Eq. (5.1) is related with the Kolmogorov distance, which is defined for any pairs of random variables ![]() $X$ and Y as

$X$ and Y as

\begin{equation}

K(X,Y)=\sup_{t\in\mathbb{R}}|\overline{F}_Y(t)-\overline{F}_X(t)|,

\end{equation}

\begin{equation}

K(X,Y)=\sup_{t\in\mathbb{R}}|\overline{F}_Y(t)-\overline{F}_X(t)|,

\end{equation}see, for instance, Denuit et al. [Reference Denuit, Dhaene, Goovaerts and Kaas9], p. 396.

Remark 5.2. We recall that ![]() $X\le_{st}Y$ iff there exist two random variables

$X\le_{st}Y$ iff there exist two random variables ![]() $\tilde{X}$ and

$\tilde{X}$ and ![]() $\tilde{Y}$ defined on the same probability space, such that

$\tilde{Y}$ defined on the same probability space, such that ![]() $X=_{st}\tilde{X}$,

$X=_{st}\tilde{X}$, ![]() $Y=_{st}\tilde{Y}$ and

$Y=_{st}\tilde{Y}$ and  $\mathsf{P}\left(\tilde{X}\le \tilde{Y}\right)=1$ (see Theorem 1.A.1 in Shaked and Shanthikumar [Reference Shaked and Shanthikumar31]). Therefore, from Eqs. (5.1) and (5.3), one has

$\mathsf{P}\left(\tilde{X}\le \tilde{Y}\right)=1$ (see Theorem 1.A.1 in Shaked and Shanthikumar [Reference Shaked and Shanthikumar31]). Therefore, from Eqs. (5.1) and (5.3), one has

\begin{equation*}

f_Z(t)=\frac{\overline{F}_Y(t)-\overline{F}_X(t)}{\mathsf{GMD}(\tilde{X},\tilde{Y})},\qquad t\ge 0.

\end{equation*}

\begin{equation*}

f_Z(t)=\frac{\overline{F}_Y(t)-\overline{F}_X(t)}{\mathsf{GMD}(\tilde{X},\tilde{Y})},\qquad t\ge 0.

\end{equation*}The following result extends Proposition 3.3 in Di Crescenzo [Reference Di Crescenzo11], given for non-negative random variables, to the case of general supports. Hence, the proof is omitted for brevity.

Proposition 5.2. Let X and Y be random variables such that ![]() $X\le_{st}Y$ and

$X\le_{st}Y$ and ![]() $-\infty \lt \mathsf{E}[X] \lt \mathsf{E}[Y] \lt +\infty$. Let W be a random variable with finite mean, independent from

$-\infty \lt \mathsf{E}[X] \lt \mathsf{E}[Y] \lt +\infty$. Let W be a random variable with finite mean, independent from ![]() $X$ and

$X$ and ![]() $Y$. Then, it follows

$Y$. Then, it follows

Hereafter, by using Theorem 3.3, we prove a probabilistic version of the mean value theorem in our case of study.

Theorem 5.1. Let X and Y be random variables such that ![]() $X\le_{st}Y$ and

$X\le_{st}Y$ and ![]() $-\infty \lt \mathsf{E}[X] \lt \mathsf{E}[Y] \lt +\infty$. Let

$-\infty \lt \mathsf{E}[X] \lt \mathsf{E}[Y] \lt +\infty$. Let ![]() $Z\equiv\Psi(X,Y)$. Let

$Z\equiv\Psi(X,Y)$. Let ![]() $g:\mathbb{R}\rightarrow\mathbb{R}$ be a measurable and differentiable function such that

$g:\mathbb{R}\rightarrow\mathbb{R}$ be a measurable and differentiable function such that ![]() $\mathsf{E}[g(X)]$ and

$\mathsf{E}[g(X)]$ and ![]() $\mathsf{E}[g(Y)]$ are finite, and let its derivative g′ be measurable and Riemann-integrable. Then

$\mathsf{E}[g(Y)]$ are finite, and let its derivative g′ be measurable and Riemann-integrable. Then ![]() $\mathsf{E}[g'(Z)]$ is finite and

$\mathsf{E}[g'(Z)]$ is finite and

\begin{equation}

\mathsf{E}[g'(Z)]=\frac{\mathsf{E}[g(Y)]-\mathsf{E}[g(X)]}{\mathsf{E}[Y]-\mathsf{E}[X]}.

\end{equation}

\begin{equation}

\mathsf{E}[g'(Z)]=\frac{\mathsf{E}[g(Y)]-\mathsf{E}[g(X)]}{\mathsf{E}[Y]-\mathsf{E}[X]}.

\end{equation}Proof. From Eq. (3.4) with straightforward calculations one has

\begin{equation*}

\mathsf{E}[g(X)]=g(0)+\int_{0}^{+\infty}g'(t)\overline{F}_X(t){\rm d}t-\int_{-\infty}^{0}g'(t)F_X(t){\rm d}t

\end{equation*}

\begin{equation*}

\mathsf{E}[g(X)]=g(0)+\int_{0}^{+\infty}g'(t)\overline{F}_X(t){\rm d}t-\int_{-\infty}^{0}g'(t)F_X(t){\rm d}t

\end{equation*} and similarly for ![]() $\mathsf{E}[g(Y)]$. Therefore, by recalling Eq. (5.1), it follows

$\mathsf{E}[g(Y)]$. Therefore, by recalling Eq. (5.1), it follows

\begin{equation*}

\begin{aligned}

\mathsf{E}[g(Y)]-\mathsf{E}[g(X)]&=\int_{0}^{+\infty}g'(t)\left[\overline{F}_Y(t)-\overline{F}_X(t)\right]{\rm d}t+\int_{-\infty}^{0}g'(t)\left[F_X(t)-F_Y(t)\right]{\rm d}t\\

&=\left\{\mathsf{E}[Y]-\mathsf{E}[X]\right\}\int_{-\infty}^{+\infty}g'(t)f_Z(t){\rm d}t

\end{aligned}

\end{equation*}

\begin{equation*}

\begin{aligned}

\mathsf{E}[g(Y)]-\mathsf{E}[g(X)]&=\int_{0}^{+\infty}g'(t)\left[\overline{F}_Y(t)-\overline{F}_X(t)\right]{\rm d}t+\int_{-\infty}^{0}g'(t)\left[F_X(t)-F_Y(t)\right]{\rm d}t\\

&=\left\{\mathsf{E}[Y]-\mathsf{E}[X]\right\}\int_{-\infty}^{+\infty}g'(t)f_Z(t){\rm d}t

\end{aligned}

\end{equation*}and the proof is completed.

Note that, if X and Y have absolutely continuous distributions, then Theorem 5.1 can be also proved by making use of integration by parts in the computation of ![]() $\mathsf{E}[g'(Z)]$ and by using the following assumption

$\mathsf{E}[g'(Z)]$ and by using the following assumption

\begin{equation*}

\lim_{t\to-\infty}g(t)\left[\overline{F}_Y(t)-\overline{F}_X(t)\right]=\lim_{t\to+\infty} g(t)\left[\overline{F}_Y(t)-\overline{F}_X(t)\right]=0,

\end{equation*}

\begin{equation*}

\lim_{t\to-\infty}g(t)\left[\overline{F}_Y(t)-\overline{F}_X(t)\right]=\lim_{t\to+\infty} g(t)\left[\overline{F}_Y(t)-\overline{F}_X(t)\right]=0,

\end{equation*} see Lemma 2.1 in Psarrakos [Reference Psarrakos28]. We also remark that, under appropriate assumptions, Di Crescenzo [Reference Di Crescenzo11] showed that Eq. (5.5) holds for non-negative random variables by using Theorem 2.1. Moreover, Proposition 4.1 in [Reference Di Crescenzo11] can be straightforwardly extended to the case of random variables having support in ![]() $\mathbb{R}$ by using Theorem 5.1.

$\mathbb{R}$ by using Theorem 5.1.

In the next result, we obtain conditions for which ![]() $Z\equiv\Psi(X,Y)$ has median zero.