1. INTRODUCTION

Sovereign defaults and debt negotiations have recently attracted a great deal of attention from both academics and policymakers. This interest has largely been driven by the recent debt payment difficulties and major economic crises that have affected the Eurozone since the global financial meltdown of 2007-2008. While most of the early research on the subject has analyzed the factors responsible for the sovereign debt problems in Southern Europe (Armingeon and Baccaro Reference Armingeon and Baccaro2012; Lane 2012), the discussion has increasingly focused on strategies used by European authorities and the International Monetary Fund (IMF) to handle the crises (Sapir et al. Reference Sapir, Wolff, De Sousa and Terzi2014). In particular, a growing debate has surrounded the austerity measures imposed on troubled countries, and the way the burden of the crises has been divided through debt renegotiations and rescheduling agreements (Featherstone Reference Featherstone2015; Sandbu Reference Sandbu2015).

The efficacy of debt settlement on crisis management has indeed moved to the forefront of discussions as debtor countries have been painfully striving to overcome the crisis (Park Reference Park2015). In fact, following several negotiating rounds and restructuring agreements, the economic and debt difficulties of Southern European countries, particularly Greece but also Italy, Ireland, Portugal and Spain, have not subsided after nearly a decade since the first crisis. However, aside from the visible and profound damage that debt negotiations have inflicted on these economies, debtor governments have made every effort to play by the rule of international creditors. Yet, the reasons why they have complied with rescheduling deals, despite of the large burdens involved when paying foreign debts, remain a matter of great controversy and speculation.

Although much neglected in most of recent research, the Latin American debt crisis of 1982 offers a unique historical mirror in which to consider the current European debt debate. During the 1980s, as the region entered into its worst development crisis in history—the well-known ‘lost decade’, Latin American governments struggled despite all odds to keep servicing its external debt and to fulfil the harsh rescheduling conditions demanded by the group of foreign creditor banks, the IMF and governments of developed countries (Diaz-Alejandro Reference Diaz-Alejandro1984; Sachs Reference Sachs1989; Bértola and Ocampo Reference Bértola and Ocampo2012). Notably, the approach developed to deal with indebted countries back then laid the foundation for a new system of international debt renegotiation and crisis management that ruled the settlement of sovereign debt payment problems from the 1980s onwards (Boughton Reference Boughton2000; Sgard Reference Sgard2002). During this time, the scale and extent of defaults was a major shock to the international financial system, becoming what was the first global debt crisis since the Great Depression of the 1930s.

This article examines the motives behind the rescheduling arrangements and debt repayment decisions agreed to by the Mexican government in the wake of the 1982 financial crisis. The choice of Mexico to address these issues makes immediate sense because it was one of the biggest Latin American borrowers in the sovereign debt markets, as well as the country whose moratorium declaration in August 1982 sent shock waves through the world financial system, unleashing crises at an international level (Cline Reference Cline1984, Reference Cline1995). Moreover, Mexico was the country at the forefront of debt negotiations and financial firefighting during most of the decade, with rescheduling deals that set a pattern of crisis management for other indebted countries (Krugman Reference Krugman1994; Boughton Reference Boughton2001). Finally, the outcome of the renegotiations severely penalised the country, generating the question that lies at the heart of this article: Why do debtors subject themselves to burdensome restructuring conditions?

Scholarly interpretations of the conforming behaviour of Latin American governments to debt repayment and rescheduling deals in the 1980s have highlighted causes such as the collective power of creditors and the links between domestic elites and the international financial establishmentFootnote 1 . This article takes a different approach and argues that in the case of Mexico, policymakers were in a structurally weak bargaining position due to the instability of the domestic economy, namely the banking system, which relied on continuous access to credit lines under the control of foreign creditors. Recent research has shown that heightened involvement with foreign funding and international lending by the largest Mexican banks prior to 1982 increased the vulnerability of the domestic banking sector during the lead-up to the financial fallout (Alvarez Reference Alvarez2017). This article extends that analysis by assessing the ex-post exposure of the Mexican banking system to the debt crisis, and examining the way this affected the negotiating strategy of the Mexican state vis-à-vis foreign creditors.

Until recently, scholars have paid little attention to the effects of the crises on debtor countries’ banking systems, as it was implicitly assumed that only creditor nations’ banks were involved with Mexican and Latin American debt. However, scholarship on the Latin American debt crisis of 1982 has demonstrated that in some countries, domestic banks were also responsible for the external indebtedness process that led into defaultsFootnote 2 . In this article, I show that the exposure of Mexican banks to its debt crisis was more severe than that of foreign creditor banks and that their solvency was much more seriously compromised. This meant that the Mexican government had little option but to repay its external debt obligations and accept the conditions that creditors demanded of it to protect its banking system. My analysis is based on recently disclosed data from Banco de Mexico and the Bank of England (BoE) archives, notably from the Apocalypse Now and Task Force collections. I also draw on minutes of the G10 central bankers’ meetings at the Bank for International Settlement (BIS) and other memorandums on debt negotiations found in the archives of the Federal Reserve Bank of New York (FRBNY).

The article begins by discussing the mechanisms that may be at work to encourage debtor countries to repay their debts, as suggested in the literature of sovereign debt and default and with special attention given to the domestic banking system. The third section examines the direct exposure of the top domestic banks to Mexican debt. The fourth section focuses on the effects of the crisis on the international money markets and interbank transactions. The fifth section analyses the funding and liquidity problems encountered by Mexican banks in the aftermath of the crisis. The sixth section shows how the dependence on external funding to secure the stability of the domestic banking system impaired the negotiating position of Mexican policymakers. Finally, the last section draws overarching conclusions regarding the way that the use of foreign finance by domestic banks allowed international creditors to enforce their claims and prevent unilateral defaults.

2. SOVEREIGN DEBT AND DEFAULT IN THEORY AND PRACTICE

Why do debtor countries agree to honour and renegotiate their external obligations when there is no formal mechanism compelling them to do so? This behaviour is so puzzling that a large body of research on sovereign debt and default has since explored the issue that was first raised in the classic article by Eaton and Gersovitz (Reference Eaton and Gersovitz1981). As these authors have observed, unlike domestic credit markets which operate with the support of a legal and judicial system, there is no institutional framework or general authority that regulates international lending and sovereign debt contracts. When a government defaults, legal recourse and enforcement remedies that are available to creditors become limited, leading to the question of why debt repudiation by heavily indebted countries is not commonplace, particularly during the post-Second World War periodFootnote 3 .

To explain the «sovereign debt puzzle» (i.e., why do countries ever choose to repay their debts?), the theory of sovereign debt and default proposes the existence of the so-called «costs of default». According to this theory, a unilateral decision to stop debt repayments entails negative consequences or costs, which function as incentives for debtor countries to continue servicing their outstanding foreign obligations. The fundamental principle of this approach is that defaults must be costly at least some of the time, otherwise countries would have strong incentives to repudiate their debts at any moment and sovereign debt markets would not even existFootnote 4 . The existence of costly sovereign defaults, as Borensztein and Panizza (Reference Borensztein and Panizza2009, p. 683) observe, is the mechanism that makes sovereign debt possible.

Within this academic literature, the loss of regular access to international capital markets has been accepted as a major cause for repayment. Following the work of Eaton and Gersovitz (Reference Eaton and Gersovitz1981), a first line of research argued that creditors who penalise a defaulting country by denying access to future credit might deter governments from repudiating their external debts. However, a main problem with this argument is that the threat of market exclusion is effective only if there are no other sources or potential lenders from whom debtors can borrow (Bulow and Rogoff Reference Bulow and Rogoff1989b). Moreover, because after a default both parties are often better off by renegotiating and resuming lending, the ability of creditors to commit to denying credit is questionable (Bulow and Rogoff Reference Bulow and Rogoff1989a). In fact, empirical work has shown that, although there is some exclusion from international borrowing by sovereigns in the aftermath of a default, this effect is generally temporary and only lasts until a rescheduling agreement with foreign creditors is made.

Subsequent research has relaxed the underlying assumption of permanent exclusion to consider the broader effects of defaults on the conditions of access to credit markets. In this view, Grossman and Van Huyck (Reference Grossman and Van Huyck1988) and others have argued that the reason why governments resist the temptation to repudiate their debts is because they want to maintain a good reputation, thus avoiding a downgrade in their credit standing which may cause higher borrowing costs in the international capital markets. However, this thinking is not easily reconciled with the findings of empirical research: defaulting countries are often charged higher spreads on new credits, but the size of the spread is not very large nor does the size difference last long (Sturzenegger and Zettelmeyer Reference Sturzenegger and Zettelmeyer2006, p. 51). Furthermore, historical research on international lending and sovereign debt demonstrates that past payment records have no significant influence on the financial conditions upon which debtor countries are able to borrow (Eichengreen Reference Eichengreen1989; Lindert and Morton Reference Lindert and Morton1989).

A third stream of research follows up on Bulow and Rogoff’s (Reference Bulow and Rogoff1988) claim that international trade provides incentives to debt repayment. In this vein, recent empirical work has shown that, either because of a retrenchment of credit facilities, retaliatory sanctions or other penalties, sovereign defaults have considerable adverse effects on bilateral trade between a debtor and its creditors (Rose Reference Rose2005; Borensztein and Panizza Reference Borensztein and Panizza2009, Reference Borensztein and Panizza2010). Nevertheless, whether trade contractions have served as a mechanism for deterring governments from repudiating their external debts throughout history is a matter of controversy. Diaz-Alejandro (Reference Diaz-Alejandro1983), for instance, states that Argentina’s determination to fulfil its payment obligations during the Great Depression of the 1930s aimed to protect trade relations with the United Kingdom, but Tomz (Reference Tomz2007) argues that the real motives were reputational concerns and the need for additional funding. In the case of Mexico in 1982, Kraft (1984) reports that Mexican officials were concerned with protecting trade relations and perceived a disruption of trade as a potential cost of default. However, the role of trade in the decision to avoid unilateral default in Mexico and agree to burdensome restructuring conditions is far from clear.

More recently, an increasing amount of literature has focused on the consequences of defaults for domestic economies, in particular banking sectors. As Reinhart and Rogoff (Reference Reinhart and Rogoff2009, Reference Reinhart and Rogoff2011) and others have demonstrated, and the current European crisis further confirmed, there is a close association between banking and sovereign debt problems in the economic histories of developing and developed nations. Defaults may have serious impact on the balance sheets of domestic banks and induce a banking crisis, with severe contractionary effects on financial intermediation and the national economic activity (Sturzenegger and Zettelmeyer Reference Sturzenegger and Zettelmeyer2006). The exposure of the banking sector to a default is particularly relevant because a banking meltdown can aggravate the domestic economic damage of a sovereign debt crisis, and thereby encourage governments to respond to and repay their external outstanding debts in order to avert exacerbation (Borensztein and Panizza Reference Borensztein and Panizza2009).

Although the presence of costs of default for the domestic banking system is widely accepted, the channels through which this enforces debt repayments are still not fully understood. The traditional models of sovereign debt and default have not even considered the banking sector, and the new theories that include it, such as those from Gennaioli et al. (Reference Gennaioli, Martin and Rossi2014) or Broner et al. (Reference Broner, Martin and Ventura2010), have mainly focused on domestic debts and the effects of defaults on the assets side of banks’ balance sheet. Yet, domestic banks are also able to hold government external debt in their portfolio, potentially affecting their foreign funding activities as observed in recent Irish and Icelandic crises. For the purposes of this article, incorporating the role of international businesses of domestic banks into this analytical framework proves useful for placing Mexico’s debt renegotiations after its 1982 financial crisis into context. What follows shows how domestic bank exposure to the debt crisis and dependence on foreign credit are crucial factors for understanding the repayment and renegotiation decisions of Mexican policymakers.

3. MEXICO’S BANK EXPOSURE TO ITS OWN EXTERNAL DEBT

The potential vulnerability of the international financial system to debt service failures and defaults was a main feature, and perhaps the biggest challenge, of the Latin American debt crises of the 1980s. After the oil shock of 1973, as large revenues from OPEC countries (the so-called petrodollars) were deposited in the Euromarkets, commercial banks became increasingly involved in international lending to the developing world, particularly to Mexico and other Latin American countries (Devlin Reference Devlin1989). During this period, funding from private international banks from industrialised countries became the most important source of foreign finance for Latin America, surpassing the prior predominant involvement of official entities such as multilateral organisations and the United States and European governments (Moffitt 1984).

Indeed, the exposure of international banks to Latin American debt was an issue of major concern for policymakers of creditor countries following the Mexican crisis in 1982. The United States was the country with the largest participation in foreign bank lending to Latin America, and Mexico was the place where the bulk of their claims were locatedFootnote 5 . By the end of 1982, Mexican debt held by U.S. banks reached a total of US$ 24.3 billion, equivalent to a third of the capital base of the U.S. banking systemFootnote 6 . Although relatively large at an aggregate level, the debt exposure was even greater for the biggest, most systematically important financial institutions: outstanding loans to Mexico made from Citibank and Bank of America, the two largest U.S. commercial banks, accounted for over half of their respective capital bases. In the case of Manufacturer Hanover and the Chemical Bank, outstanding loans made up as much as two-thirds of their capital base (see Table 1)Footnote 7 .

Table 1 Exposure of the six largest Mexican and US banks to Mexico, December 1982

Note: Foreign loans to Mexico for Mexican banks are the loans granted from their foreign agencies and branches to Mexican borrowers.

Source: Salomon Brothers, Comisión Nacional Bancaria y de Seguros, Call Report FFIEC 002 and BoE archive.

While the risks of the Mexican debt crisis for U.S. banks was apparent, the corresponding exposure of their banking counterparts in Mexico has been much less noticed. However, as recent research has demonstrated, in the years preceding the crisis, Mexican banks were actively involved in the Euromarkets and international lending to their home government and private firms through their network of foreign agencies and branches in major international financial centres (Alvarez Reference Alvarez2015). Domestic banks engaged in foreign financing included the country’s major private financial institutions, Banamex, Bancomer, Banca Serfin and Multibanco Comermex, as well as Banco Internacional and Banco Mexicano-Somex, which were both majority owned by the Mexican state. Together, these six banks were the largest commercial banking institutions in Mexico, representing up to three-quarters of all assets and deposit base of the banking system.

Historical records of Banco de Mexico show that by the time of the crisis, Mexican banks involved in foreign finance had considerable amounts of Mexican external debt, which was debt extended to Mexican public and private borrowers from their networks of foreign agencies and branches. By the end of 1982, their international loan portfolios totalled to US$ 4.68 billion, of which US$ 4.27 billion or 91.3 per cent were direct or syndicated credits. Banamex and Bancomer, the two largest domestic commercial banks with a 25 per cent market share each, accounted for US$ 2.3 billion in foreign loans to Mexico, or 54.6 per cent of the total, an amount that was 4 and 4.6 times their respective capital bases. Foreign outstanding claims in Mexico held by the other four Mexican banks were smaller in value, but, with the exception of Banca Serfin, the ratio of exposure to capital was even greater. For a comparative perspective, as Table 1 shows, the size of the exposure of the six major Mexican banks to their own country’s foreign debt was much larger than that of their U.S. counterparts.

Mexican banks exposure to home country’s external debt was high not only relative to capital, but also as a share of total bank loans. While, for instance, foreign loans to Mexico represented between 3.2 and 5 per cent of the total foreign loan portfolio value of the six largest U.S. creditor banks, the average for Mexican creditor banks was 31.3 per cent (and 14.9 per cent in terms of total bank assets). Banco Internacional was the Mexican bank where the concentration of loan exposure was the lowest with a ratio of 18.1 per cent, while Bancomer and Comermex were on the other extreme with corresponding values of loan exposure of 37.9 and 37.8 per cent, respectively (see Table 1). Additionally, the international loan portfolio itself was substantially less diversified: lending to Mexican borrowers represented about 6.9 per cent of the total foreign loan portfolio of all U.S. banks at an aggregate level, but as much as 76 per cent for Mexican banksFootnote 8 . It appears therefore evident that Mexico’s external debt payment problems posed substantial risks not only for U.S. banks, but also for the Mexican domestic banking sector itself.

These figures give a clear sense of the damage that a debt servicing failure by the Mexican government and private sector could inflict on the domestic banking system. If the country were to default and the government refused to agree to orderly rescheduling, then all banks with outstanding external loans in Mexico would have to make loan loss provisions. The potential losses not only represented a significant proportion of the loan portfolio of the country’s biggest banks, but their capital and reserve levels seem largely inadequate to withstand the impact of such loan loss provisions. Because most loans were syndicated or included cross-default clauses, a technical default declared by one bank would have triggered borrowers’ defaults among their other obligations. Therefore, a partial or selective default that excluded Mexican creditor banks was not feasible. Thus, for the domestic banking system as a whole, and for the largest banks in particular, direct exposure to Mexican external debt and the possibility of loan losses was a major problem.

4. THE INTERNATIONAL INTERBANK MARKET CHANNEL

Aside from direct exposure to Mexican debt, an additional source of vulnerability for creditor banks and banking systems came from the money markets and interbank transactions. Although often overlooked in the literature on the debt crisis of the 1980s, the Mexican default represented also a major shock to the Eurocurrency interbank market, affecting the ability of some institutions to access international wholesale liquidity (Guttentag and Herring Reference Guttentag and Herring1985, Reference Guttentag and Herring1986). Unlike in tranquil times when interbank placements were regarded as risk-free and trading volumes were large and automated, the crisis raised concerns about banks with exposure to countries having debt-servicing problems, which generated significant tensions and liquidity strains in the market. While prior to the crisis the spreads charged on interbank funding lines were relatively small and homogeneous (Giddy Reference Giddy1981), «increasing tiering among banks and banking systems» came about after the Mexican declaration of moratoriumFootnote 9 .

The loss of depth and liquidity in the international interbank market considerably affected the wholesale funding operations of Mexican banks operating abroad. These banks were not only heavily exposed to their home country’s debt as the previous section demonstrated, but their foreign agencies and branches were net debtors to the Eurocurrency interbank markets and highly reliant on international wholesale liquidity for the funding of its sovereign loans (Alvarez Reference Alvarez2015). Data from the Federal Financial Institutions Examination Council (FFIEC) and historical records from the BoE show that by June 1982, the funding raised by Mexican bank’s foreign agencies and branches in the United States, London and Caribbean offshore financial centres reached a total of US$ 7.7 billionFootnote 10 . According to a report from Centro de Información y Estudios Nacionales (CIEN), of this total, as much as 80 per cent consisted of funding facilities from foreign banking institutions or were interbank liabilities, while only 5 per cent came from deposits from the non-banking sectorFootnote 11 .

Indeed, when the crisis hit, international credit shrank not only for the Mexican government and the public and private companies, but also for its domestic banking sector. As the perception of country risk increased, the foreign agencies and branches of Mexican banks scrambled to secure their interbank funding transactions, confirmed overdraft, and advance and stand-by back-up lines with their correspondents in the United States and Europe, at the price of higher borrowing costsFootnote 12 . While prior to the crisis Mexican banks paid spreads of 1/8-1/4 per cent over LIBOR for interbank deposits, by September and October of 1982, they were paying up to 3/4-1 per centFootnote 13 . Moreover, lender banks also began to require an extra commission of 1/8-1/4 per cent, which contributed further to spread size and thereby rose the risk premium to as high as 2 per cent in some casesFootnote 14 .

Further funding difficulties encountered by Mexican banks in the international wholesale markets are also seen when looking at the maturity structure of relevant interbank transactions. Table 2 exhibits the net interbank position (liability «−» and claims «+») of the London agencies and branches of Mexican banks as the percentage of both interbank liabilities and claims for different maturity bands. As of mid-August 1982, the interbank obligations of these agencies reached US$ 1.48 billion, or 75.5 per cent of their total liabilities, and the correspondent assets values were US$ 369 million, or 18.7 per cent respectively, meaning that they were net takers of funds and owed US$ 1.1 billion to the Eurocurrency interbank market. The table makes evident the extent to which this interbank funding was essentially concentrated on short-term transactions (maturity bands between overnight and 6 months). More importantly, the figures illustrate how dramatically this source of funding shortened after the outbreak of the crisis on 20 August 1982: the proportion of interbank liabilities with maturity of less than 3 months doubled from 30 to 59.8 per cent between that time and mid-November 1982.

Table 2 Maturity analysis of the interbank position of Mexican agencies and branches in London, 1982

Note: The data are given as a proportion of both total interbank liabilities and claims, since total interbank liabilities of these branches are significantly larger than their total interbank claims.

Source: BoE archive.

Despite higher spreads and shorter maturities, lending banks still wanted to reduce their involvement in Mexican foreign agencies and stop placing interbank deposits with them to reduce exposure to risk. In fact, a panic broke out in the interbank market on 7 September 1982 and international banks refused to renew their lines of credits to Mexican banks, but the run was successfully controlled by the end of the day due to the intervention of the FRBNY and the BoE (Boughton Reference Boughton2001, p. 301)Footnote 15 . Despite this, during the months after, creditor banks continued to draw their money out of the Mexican banks, and although the withdrawals were mostly in modest amounts, the cumulative effect became substantial. According to an internal memorandum from the FRBNY, the network of foreign agencies and branches of Mexican banks lost about US$ 800 million in the interbank market between August and December 1982, an amount representing an erosion of 10-15 per cent of their total interbank deposits of around US$ 6.5 billion in mid-1982Footnote 16 .

While Mexican banks confronted serious funding strains in the wholesale Euromarkets, their U.S. counterparts were offered increasing amounts of interbank deposits. Leading U.S. commercial banks, such as Citibank, Bank of America, Chase Manhattan among others, were important players in the international interbank market, but they barely borrowed from other banks and had instead been prominent net suppliers of market liquidity during the 1970s and early 1980s. Nevertheless, the Mexican default had triggered a flight into quality within the market, leaving funds to flow towards the big U.S. money-centre banks. Quoting the head of the international money markets division of Citibank, Mike Rice, for them « the problem [was] not funding» since «people were so risk-averse that banks like Citibank [were] offered more [interbank] deposits than ever»Footnote 17 . Moreover, John Robertson from Citibank London emphasised that «they were still able to take in funds even when they underbid the market»Footnote 18 .

The importance of the international interbank market as a channel through which a default could affect banks was recognised by the international financial community for some time prior to the crisis. By 1977, the BoE started to prepare a report in anticipation of possible debt payment failure by a major borrowing country, a subject that was extensively debated with the G10 at the BIS meetings of the Standing Committee on the Eurocurrency Market and the Basel Committee on Banking SupervisionFootnote 19 . The report highlighted the direct exposure of commercial banks to debtor countries as an important problem, but it also asserted that «the main threat to the stability of the international banking system [was] likely to be lack of liquidity»Footnote 20 . Just as would be later observed in Mexican banks, the report stressed that «the banks that could face liquidity problems earliest would be banks without their own dollar base who primarily rely on the inter-bank market for their funds and have large amounts outstanding to the defaulting country or to countries felt to be in a similar position»Footnote 21 . Unlike their U.S. counterparts that could count on a large dollar deposits base or Federal Reserve discount facilities to fund their balance sheets, Mexican banks had very limited access to alternative non-interbank wholesale dollars, and therefore their exposure to funding risks was considerably higher.

5. THE STRUGGLE TO SECURE THE EXTERNAL FINANCIAL POSITION OF THE BANKS

The dire funding conditions that Mexican banks faced in the international interbank markets called into question the position of liquidity, and indeed solvency, of their foreign agencies and branches. Since the bulk of their assets were long-term, troubled loans to Mexican borrowers or illiquid claims, their capacity to reduce their portfolio and adjust their balance sheet position was very limited. Data submitted in August 1982 from banks to the Mexican Ministry of Finance shows that their foreign agencies and branches were about US$ 6-6.5 billion mismatched in terms of their dollar assets and liabilities. Furthermore, an estimated US$ 1.25 billion of this amount, owed exclusively to the wholesale interbank market, came due by mid-September with the remaining of US$ 4.75-5.25 billion due to mature in the following months until the end of December 1982Footnote 22 .

To address the financial difficulties of the foreign agencies and branches, some of the parent banks provided initial assistance with dollars that were gathered from foreign exchange conversions in Mexico. In 25 August 1982, for instance, Banamex New York agency vice president Clifton T. Hudgins informed the FRBNY that his agency had received a shipment of US$ 31 million from Mexico during the previous week, and that he would expect more currency to come in the following daysFootnote 23 . However, the parent banks had no realistic means of overcoming the potential liquidity needs of their foreign banking offices due to size of mismatch: their interbank mismatch represented as much as half of their total consolidated liabilities by the end of August 1982. More fundamentally, as previous research shows, these agencies and branches were working at the time for their head offices to raise dollars abroad, and the pass-through arrangement could not work the other way around (Alvarez Reference Alvarez2015)Footnote 24 .

Under such circumstances, Mexican policymakers eventually came to step in and secure the external financial position of Mexico’s largest domestic commercial banks. Specifically, after the nationalisation of the banking system by the federal government on 1 September 1982, the central bank decided to meet the dollar liquidity needs of the foreign banking offices of its domestic banks. Table 3 presents the («known») funding granted from Banco de Mexico to the foreign agencies and branches of the six Mexican banks operating overseas between Tuesday the 7th and Wednesday the 22th of September 1982 (the figures are given as reported by a FRBNY note of a G10 governors’ meeting at the BIS)Footnote 25 . The table shows that within this period of 16 days, Banco de Mexico assisted these banks with around US$ 311.3 million in funds, an amount representing nearly a quarter of the US$ 1.25 billion of interbank liabilities due within that timeFootnote 26 . Banamex was the main recipient of these funds with US$ 118.5 million, or 38 per cent of total funds, followed next by Multibanco Comermex and Bancomer with about US$ 62 million or 20 per cent each.

Table 3 Banco de Mexico’s known funding of Mexican agencies

Source: Federal Reserve Bank of New York archive (see text).

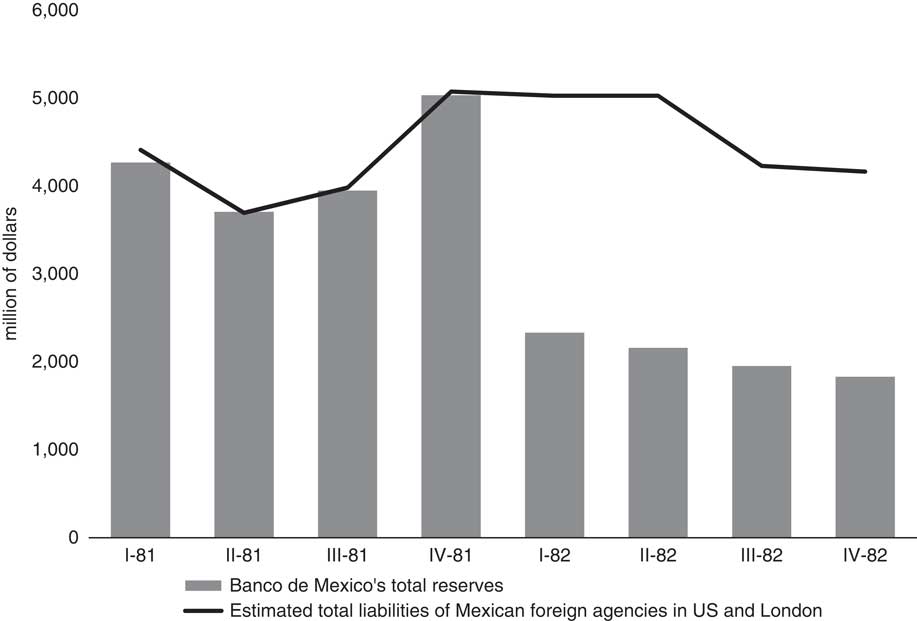

However, in the context of a balance of payment crisis and dwindling international reserves, Banco de Mexico did not have full resources to support any potential financial needs of the foreign agencies. Figure 1 plots the evolution at the dawn of the crisis of Banco de Mexico’s total reserves against the dollar liabilities of the London and U.S. agencies and branches of Mexican banks. The chart makes explicit the limited availability of the international reserves vs. the external obligations of these agencies, which becomes more acute in the aftermath of the devaluation of the peso in February 1982Footnote 27 . In particular, the US$ 6-6.5 billion mismatch on the dollar balance sheet of the total network of foreign banking offices represented about 3-3.5 times the volume of international reserves of Banco de Mexico between August and December 1982. Furthermore, the interbank obligations of Mexican banks represented only a small piece of all foreign exchange that the country was required to service from its US$ 92.8 billion of total external debt.

Figure 1 Mexico’s international reserves and banks’ foreign liabilities Source: Banco de Mexico’s Annual Report (1983), FFIEC 002 and BoE archive.

Given these constraints, Mexican policymakers turned to international creditors to obtain the foreign exchange they needed to stabilise the external financial position of domestic banks. As a matter of fact, a considerable part of the dollars delivered to cover the liquidity of the agencies came from the BIS and U.S. emergency facilities granted to Mexico after the moratoriumFootnote 28 . According to the FRBNY records, as much as US$ 218.3 million, or 70 per cent of the US$ 311.3 million sent by Banco de Mexico to the foreign banking offices during September 1982, came from Federal Reserve swap lines (see Table 3). In effect, when reviewing the Mexican situation with its G10 counterparts, BoE Governor Gordon Richard reported that «most of the BIS-U.S. swap drawings have been for the purpose of providing funds for the Mexican offshore agencies and branches», adding that «the use of the swaps, other than for the Mexican bank’s agencies, has been very modest»Footnote 29 .

Evidence of Mexican authorities relying on foreign capital for securing the stability of its international banks is also seen from the other sources of funding they appealed to in order to fulfil their dollar payments. Although the agencies and branches in the United States and London did not have access to lender of last resort facilities from the central banks of the host countries, after the outbreak of the crisis, they «were all acting to make sure that they [were] in a position to borrow from the discount window». Quoting a discussion with Sam Cross from the FRBNY, Angel Gurria, Mexico’s Director of Public Credit and leading external debt negotiator, explicitly stated that Mexican authorities were counting on Federal Reserve discount facilities to handle the possible dollar needs of these agencies. When referring to the availability of such funding, Cross said that «Mexicans might be wise to consider how best to deal with any problem with their own resources», to which Gurria replied that «they would be happy to support Mexican banks» but «[they were] a little short of cash»Footnote 30 .

In the end, Mexican negotiators and the group of international creditors devised an interim solution to the liquidity drain. As part of the rescheduling agreement and financial package of 1982-83, creditor banks agreed to maintain interbank deposits with Mexican agencies on par with August 1982 pre-moratorium levels. A covenant in the restructuring documentation declared that an event of default would be triggered if the aggregate level of interbank liabilities with the offshore agencies and branches dropped below US$ 5.2 billion. Although this did not convey any legal assurance to Mexican policymakers, it did raise the stakes for a creditor bank seeking to withdraw its deposits. On their part, the Mexican government committed to making sufficient funds available to make market interest payments on agencies’ interbank accounts and to provide dollars for domestic debtors to reimburse their external debts. The freezing of interbank deposits proved to be an effective solution and it was maintained for almost 10 yearsFootnote 31 .

6. BANK EXPOSURE AND INTERBANK DEBT AS A BARGAINING TOOL

Since the very beginning of the crisis, Mexican policymakers attached considerable importance to Mexican domestic banks and their interbank credit lines. In 20 August 1982, at the meeting where the moratorium was announced to the international financial community, Gurria specifically commented on the problem of the «short-term deposits with the Mexican banking system» and made clear his position that «the Mexican banking sector was the backbone of the country’s economic progress»Footnote 32 . In the next days, he requested «the Advisory Group to send out a telex asking the banks to show understanding and cooperation in this matter, and not to create a problem by drawing down credit lines»Footnote 33 . Moreover, even while most of the country’s external bank debt was to be periodically rescheduled during the decade, Mexican policymakers sought to protect the interbank credit lines by continuing to service them when due throughout the crisisFootnote 34 .

The nationalisation of commercial banks, declared by presidential decree on 1 September 1982, even if motivated by ideological and political reasons, served as a demonstration of support to the domestic banking system. The expropriation meant that the Mexican government assumed, as the President of the Association of Mexican Bankers Carlos Abedrop Dávila acknowledged, «the high dollar indebtedness of the private banks»Footnote 35 . Though extreme and controversial, the nationalisation measure was arguably beneficial for securing interbank financing because it was perceived by foreign creditor banks «as a way to ensure that the external debt of the Mexican banking sector would be paid»Footnote 36 . Likewise, American banking and finance journalist Robert A. Bennett, in his The New York Times column the day after the decision was taken, affirmed that «it [was] expected that, a result of the nationalization, international banks [would] be willing to place funds with Mexican banks because such investments would become obligations of the Government and not of private individuals»Footnote 37 .

The strong determination of Mexican authorities to protect Mexico’s banks, especially relying on foreign capital, seems to have been a useful bargaining tool for international banks to enforce their claims. Archival evidence shows that, in particular, the Advisory Group for Mexico raised the issue of interest payments on private sector external debt when it sought solutions for the drain of interbank deposits with Mexican banks during the renegotiations. Some companies, such as the Alfa Industrial Group, which was Mexico’s main economic conglomerate and its largest private international debtor, had suspended those payments well before the government’s moratoriumFootnote 38 . In that respect, Larry Miller, the official from Chemical Bank responsible for handling foreign agency problems for the Advisory Group, informed Sam Cross that «the fact that the banks were not getting any payment to speak of on private debts was tending to make them more aggressive in trying to draw money out of the agencies»Footnote 39 . Along the same lines, Chairman of Mexico’s Advisory Group William Rhodes of Citibank stressed that «partly as result of the small banks’ frustration over the private interest problem, the Mexican banks (all state owned) have lost about $500 million in deposits through the agencies»Footnote 40 .

Afterwards, the Advisory Group for Mexico made the solution of the private sector debt problem a necessary condition for addressing any requirement from the commercial banks. In 19 November 1982, during a meeting about Mexico with IMF officials, William Rhodes instructed Managing Director Jacques de Larosière that «the Mexicans had to deal with the private sector interest situation as a matter of urgency as it was of paramount importance to many banks and up to [that] time they had pushed the matter into the background», while adding that «it was a prerequisite to any further help from the banking system»Footnote 41 . Rhodes had this asserted to Fed authorities two days before, during which time Paul Volcker «agreed that it was essential to solve the private sector interest problem but he doubted this could happen until after December 1, for political reasons»Footnote 42 . In the end, as part of the debt rescheduling agreement and financial package signed with international banks in 1983, the Mexican government would eventually enact the FICORCA program, a subsidising foreign exchange mechanism that assisted private enterprises with both the pesos and the dollars they needed to serve their rescheduled foreign debt with international commercial banksFootnote 43 .

However, the threat of refusing to provide financial assistance to Mexico as a way to enforce debt repayment risked to backfire on foreign creditor banks. Notably, the refusal to maintain interbank deposits and stop the leakage of funds from Mexican banks could have potentially generated a payment disruption in the world money markets, with important negative repercussions on creditor banks and the international financial system. Indeed, the liquidity strains on Mexican agencies was an issue of major concern for financial authorities in G10 countries, since, as Governor Richardson informed at a BIS meeting, the Mexican interbank market situation «involved more than 1,000 banks» and it «did not affect just a few financial centres in the U.S., U.K., Switzerland, etc., but concerned everyone»Footnote 44 . In the same spirit, Antony Salomon from the FRBNY referred to «the widening problem of the branches and agencies, not only of Mexican banks but also Brazilian, Argentinian and Korean, and others, whose liabilities were owed to the interbank market and whose assets were not liquid»Footnote 45 . In the context of serious liquidity stress in the Eurocurrency wholesale markets, the worries were great about the systemic implications of a default of Mexican banks on their interbank debts.

More generally, by imposing burdensome requirements, creditors pushed the Mexican government to consider refusing to reschedule and repudiate its debts, which put in jeopardy their banking systems. But, as the previous discussion demonstrates, Mexican banks were comparatively more seriously exposed to, and compromised by, their own debt crisis than other foreign creditor counterparts. Not only was their capacity to withstand the impact of the potential losses on international loans weaker, but they were in considerably worse shape when it came to facing funding strains and dealing with a possible liquidity crisis in the international wholesale markets. It was clear that to survive, leading Mexican banks had to depend increasingly on foreign finance. In the middle of a severe economic and financial crisis, the collapse of the country’s major financial institutions and a potential systemic banking crisis was a price that Mexican policymakers were not willing to pay. From the perspective of the theory of sovereign debt and default, the situation of the domestic banking system served as an enforcement mechanism to encourage Mexico to honour and renegotiate its external debts and avoid unilateral default.

7. CONCLUSIONS

This study has provided a new interpretation behind the reasons why the Mexican government decided to respect and renegotiate its foreign debts in the wake of its 1982 debt crisis. While previous explanations have highlighted the role of the collective power and pressure of international banks, creditor governments and multilateral organisations, this article argues that a unilateral default or outright repudiation would have inflicted major damages to the Mexican domestic banking system. The nation’s most important banks displayed sizable amounts of Mexican external debt in their balance sheets and had to face serious liquidity strains in international wholesale markets at that time.

Yet why did Mexican policymakers accept to subscribe to burdensome rescheduling agreements, when they proved to be so unsuccessful and costly for the domestic economy? In a context where the world’s biggest banks and the international banking and financial system were threatened by the country’s debt payment problems, the Mexican government could presumably have had leverage to step up its negotiating power and drive rescheduling conditions in its favour. After all, the outcome of debt renegotiations is the result of a bargaining game between debtors who seeks forbearance and creditors who want full value for their claims. This article argues that it is difficult to think that Mexico could push creditors into concessions when the exposure of its own banks was larger than that of its foreign counterparts. More importantly, the financial stability of the domestic banking system depended greatly on continued access to external funding under the control of its international creditors. In the end, Mexican officials entered negotiations with their creditors from a structurally weak bargaining position and had little option but to accept the conditions demanded of them.

The dependence of debtor countries’ banking systems on foreign finance as a bargaining tool for international creditors finds echoes in the recent Eurozone debt crisis. Similarly to the Mexican crisis of 1982, the sovereign debt problems of Southern European countries have been closely intertwined with the foreign activities of large domestic banks. In addition, their governments have also subscribed to tough adjustments and austerity programs that have inflicted severe damage on their economies. Although the reasons why these countries subject themselves to harmful rescheduling conditions are still a matter of discussion, Martin Sandbu in a recent book argues that the chokehold by which international creditors made some countries accept their demands was indeed on the domestic banking systemFootnote 46 . He claims that the European central bank succeeded on a threat of cutting financial assistance to domestic banks when Greek and Irish authorities refused to agree to rescheduling conditions. The fact that debtor governments look to avoid a banking meltdown in times of crisis suggests a need for further research on the domestic cost of default, particularly the financial system, when examining the «enforcement problem» at the heart of many studies on sovereign debt.

This article also holds implications for future historical research on sovereign debt crisis. As a number of scholars have recognised, a salient feature of defaults in the post-era of Bretton Woods is the absence of widespread unilateral moratoriums. While repudiation was commonplace during the waves of sovereign defaults observed in the XIX and early XX centuries, today they are often replaced by voluntary rescheduling or negotiated settlements. In the case of the Latin American debt crisis of the 1980s, leading scholars in the field, such as Jeffrey Sachs and Carlos Diaz-Alejandro, have highlighted that the decision to continue servicing public external debts, and the provision of extraordinary facilities for the reimbursement of private external debt, contrasts sharply with the policies that most of the same countries adopted during the Great Depression of the 1930sFootnote 47 . This analysis suggests further investigating the domestic banking sector in defaulting countries and its involvement with international finance as a major potential difference, an issue that has been largely overlooked in previous explanations provided in the literature.

A final issue this article raises is about liquidity shocks and lending of last resort policies. The fact that the outbreak of the Latin American debt crisis of 1982 represented an important shock to the international interbank money markets begs the question of how policymakers managed to keep the market liquid and avoid major disruptions unlike in the aftermath of the Herstatt bank failure in June 1974. The freezing of interbank deposits resolved the problem for Mexican banks, but it became effective only later in time. It does not explain either how the funding stress of other banks was alleviated, or how the contagion or illiquidity-induced failures were prevented. These are important questions to consider in the context of G10 countries, whose central banks saw a possible liquidity crisis in the Eurocurrency markets as well as the financial problems of the foreign banking offices as main threats. Most foreign banking agencies at this time were in a regulatory limbo with important disagreements as to whom should act as lender of last resort in the event of a liquidity crisis.