I. Introduction

Electronic, continuous, order-driven markets have recently dominated the trading of assets on almost all important exchanges in the world. This type of market structure is characterized by trading rules that allow traders to track order flows and extract vital information from buy and sell orders submitted in the order book. This information usually contains the price, volume, and origin of orders disclosed on both sides of the market, thus reflecting the current market situation and signaling possible market imbalances. In practice, by providing extra information and greater market transparency, the order book helps traders to make more informative trading decisions.

Therefore, order book dynamics isan important determinant of market quality, and information about order submissions and cancellations in the order book can help us to understand the trader behavior and asset price formation. Commonly, most studies on order book dynamics concentrate on high-frequency trading markets, such as equity markets (e.g., Biais, Hillion, and Spatt, Reference Biais, Hillion and Spatt1995; Large, Reference Large2007; Kercheval and Zhang, Reference Kercheval and Zhang2015), futures markets (Rambaldi, Bacry, and Lillo, Reference Rambaldi, Bacry and Lillo2017), or currency markets (Bień-Barkowska, Reference Bień-Barkowska2014; Lallouache and Abergel, Reference Lallouache and Abergel2014). However, it is also of paramount importance in markets with liquidity constraints.

Although the fine wine market is an example of such a market (Cardebat et al., Reference Cardebat, Faye, Le Fur and Storchmann2017; Masset and Weisskopf, Reference Masset and Weisskopf2018), technological innovations such as electronic trading platforms have improved its transparency and efficiency (Czupryna, Jakubczyk, and Oleksy, Reference Czupryna, Jakubczyk and Oleksy2020; Oleksy, Czupryna, Jakubczyk, Reference Oleksy, Czupryna and Jakubczyk2021). A clear sign of its evolution is the fine wine exchange, Liv-ex, which is a marketplace for around 475 major professional fine wine traders who interact globally via a trading platform with an implemented order book mechanism. This makes fine wine trading on the Liv-ex exchange similar to trading other financial assets on organized exchanges and allows traders to apply trading strategies based on current or expected order flow dynamics.

Fine wine, as a very specific asset type, significantly differs from financial assets. First, it does not provide any periodic cash flows but provides both consumption and investment value that change over time (Dimson, Rousseau, and Spaenjers, Reference Dimson, Rousseau and Spaenjers2015). Second, being a consumption good, its stocks decrease as it is consumed, and a scarcity effect starts to have a stronger impact on wine pricing as fine wine becomes older (Jones and Storchmann, Reference Jones and Storchmann2001). Third, wine is a heterogeneous product with numerous attributes (producer reputation, quality, bottle formats, case size, etc.), which may be evaluated differently by different types of traders (both profit- and utility-driven). Fourth, since quality assessment is a challenging task, expert endorsements are important price-determining factors (e.g., Luxen, Reference Luxen2018; Cyr, Kwong, and Sun, Reference Cyr, Kwong and Sun2019). Therefore, all these peculiarities serve to make price formation a rather complex process, with dynamics that may vary between particular fine wines.

In this study, we concentrate on modeling the order book dynamics on the Liv-ex fine wine exchange. More specifically, we investigate new buy and sell order submissions or cancellations in the Liv-ex order book and various factors that may have an effect on their intensity, measured by the number of bids and offers added to or withdrawn from the order book. In such a way, new insights on fine wine trading may be gained. In particular, by distinguishing between different types of orders placed in the order book and between different trade characteristics (producer, contract type, case size, day of trading, bottle size, order size, wine age), we provide a more detailed picture of liquidity formation and trader behavior in the fine wine market.

II. Liv-ex Order Book

The Liv-ex exchange provides all authorized traders (trading members) with access to an electronic trading platform through which they can place their buy or sell orders and observe the trading behavior of other participants. Each offer is a firm and unconditional offer to sell, and each bid is a firm and unconditional bid to buy. However, both types of orders may be withdrawn or amended by traders in accordance with applicable procedures before final acceptance on the part of Liv-ex, which intermediates each trade. In practice, according to paragraph 20.1 of Liv-ex membership terms, if Liv-ex receives an offer from a trading member to sell the wine at a price which another trader has bid to buy at, Liv-ex notifies the buyers by e-mail about bid acceptance, and the bid is removed from the trading platform (Liv-ex, 2019). All buy and sell orders that cannot be matched are disclosed in the order book until the relevant market order comes in. After three months of waiting, unrealized orders are automatically removed from the order book.

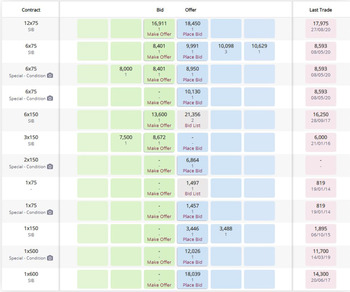

Interestingly, since 2019 Liv-ex has launched a trading automation system that enables traders to integrate their stock management systems or websites with the Liv-ex trading platform by the use of Application Programming Interface (API) technology. This innovation extends the trading opportunities by allowing traders to automatically post their stocks on the Liv-ex order book or to list wines from Liv-ex on their e-commerce websites, thereby making them accessible to their customers. Moreover, to advertise the full breadth of the wine market's order book, Liv-ex also shows non-live offers (“Bid List” offers) from a merchant's list that have been uploaded onto the platform. If the trader places a bid in that wine on the platform, the merchant showing the offer on their list receives a notification from Liv-ex to say that there is a bid (with price, quantity, contract type) in that wine on the platform. The offering merchant can match that bid or place a live (counter) offer on the platform. Figure 1 presents the screenshot of the Liv-ex order book for Mouton Rothschild 2000, which is an example of a relatively frequently traded fine wine. The offers annotated with “Place Bid” show the live Liv-ex offers (placed via automated APIs or manually), while the note “Bid List” indicates that Liv-ex does not have a live offer for that particular wine and pack size, but there is one showing on another member's list.

Figure 1 Liv-ex Order Book for Mouton Rothschild 2000. Prices in GBP

Source: Liv-ex Ltd. (July 10, 2020)

Figure 1 shows several interesting features of a fine wine order book, which make it different from an order book for financial assets. First, each wine may be offered in different assortments, including different bottle sizes (e.g., 75 cl, 150 cl, 300 cl), different cases (mostly 6-bottle or 12-bottle), or lots made up of single or non-standard sets of bottles. Second, each trade must be executed under one of the three separate trading agreements: SIB (standard in bond), SEP (standard en primeur), or X (special conditions), the last of which incorporates specific trading terms (e.g., torn labels, damaged case, duties paid). Third, transaction volume is a result of the unit size and order quantity, that is, some kind of conversion procedure needs to be applied to extract information about general market depth or the unit price for a standard 75 cl bottle of wine. Finally, besides the live offers placed by traders, the order book also contains non-live offers that represent the best list prices Liv-ex has collected from the merchant stock lists. Technically, all bids and offers of the same type are disclosed horizontally and are accompanied by information concerning the last transaction executed on the exchange.

III. Data and Methodology

A. Description of the Dataset

Our dataset includes daily snapshots of the Liv-ex order book for the period January 2, 2019 to June 7, 2020, with a recorded limit orderFootnote 1 of First Growth wines from Bordeaux. From the total number of 1,003,639 records, all orders marked as suspended (341,735), that is, those that were not visible to traders and could not be traded against at the particular time, have been removed, and only active orders (661,904) have been included in the analysis. Each order is characterized by a standardized wine name described by the Liv-ex Wine Identification Number (e.g., LWIN 1011247 stands for Chateau Haut-Brion), vintage, bottle size, number of bottles in a case, quantity (order size), contract type, and committed price.

Besides the record of buy and sell orders submitted with committed prices, our dataset also contains all transactions executed in this period, structured analogously to the orders data, though with transaction price (instead of committed price) and information concerning which side (buyer or seller) has triggered the transaction. The volume of transaction data amounts to 36,019 records.

Using the data covering both orders and transactions, we were able to obtain daily information covering the number of new limit bids and offers placed on a particular day, new market bids and offers that exactly matched the opposite orders (enabling transaction execution), and withdrawn bids and offers. The orders that were placed and immediately withdrawn on the same day, which may suggest possible errors in order placing, could not be identified but were very rare events.

Additionally, we restricted ourselves to the most commonly traded combinations: vintages 1988–2017 (87.12% of the dataset), contract type SIB and X marked as duty paid or special contract (99.04%), number of bottles in a case corresponding to 1, 3, 6, or 12 bottles (98.14%), and bottle sizes of 75 cl or 150 cl (94.46%).

As a result, our final dataset used for modeling purposes consisted of 1,875,600 observations (combinations of 5 producers, 30 vintages, 3 contract types, 4 case sizes, 2 bottle sizes, 521 days) for order submissions, and 169,539 or 143,658 observations for bid or offer withdrawals, respectively. In the latter case, the selection criterion was the positive number of active bids or offers on a given day, as only orders already submitted in the order book could have been potentially canceled.

B. Methodology

In our analysis, we use Poisson regression to examine the relationship between the number of occurrences of different order book related events (new limit bids or offers, new market bids or offers, withdrawals of buy or sell orders) and various wine or trade characteristics that may have an effect on the bid and offer order process. Importantly, in our model, we consider only events related to the order book and do not consider the quantities (order sizes) and committed prices, as is usual in modeling financial markets. The main reason for this is that in contrast to financial markets, the above-mentioned events are very rare and thus permit simple analysis.

Formally, our model takes the form of a Poisson log-linear regression, which can be expressed by the general formula:

where x is an (n + 1) – dimensional vector consisting of n independent variables, α − a constant, β′ − a vector of parameters of coefficients of covariates.

In practice, we consider six different response variables, which refer respectively to the expected number of new bids, new offers, new market bids, new market offers, bid withdrawals, or offer withdrawals, in a given time interval and are assumed to follow the Poisson distribution for a given set of values of the explanatory variables. The latter includes five wine producers (Lafite Rothschild, Latour, Margaux, Mouton Rothschild, and Haut Brion being a reference producer), three contract types (contract X-duty paid, contract X-special, and a reference contract type – SIB), four case sizes (consisting of 3, 6, or 12 bottles, or a single bottle, which is a reference case), two bottle sizes (reference size 75 cl and 150 cl), weekdays (from Monday to Sunday, with Thursday being the reference weekday), a monthly trend variable (where January 2019 has a value of 1, February 2019 a value of 2, and so forth) and two age-related variables, such as wine age and wine age squared, so as to take the nonlinear effects into consideration (where the age of wines from the 2017 vintage is assumed to be 0, 2016—one year old, 2015—two years old, and so forth). We identified the β coefficients through Maximum Likelihood Estimation.

IV. Results

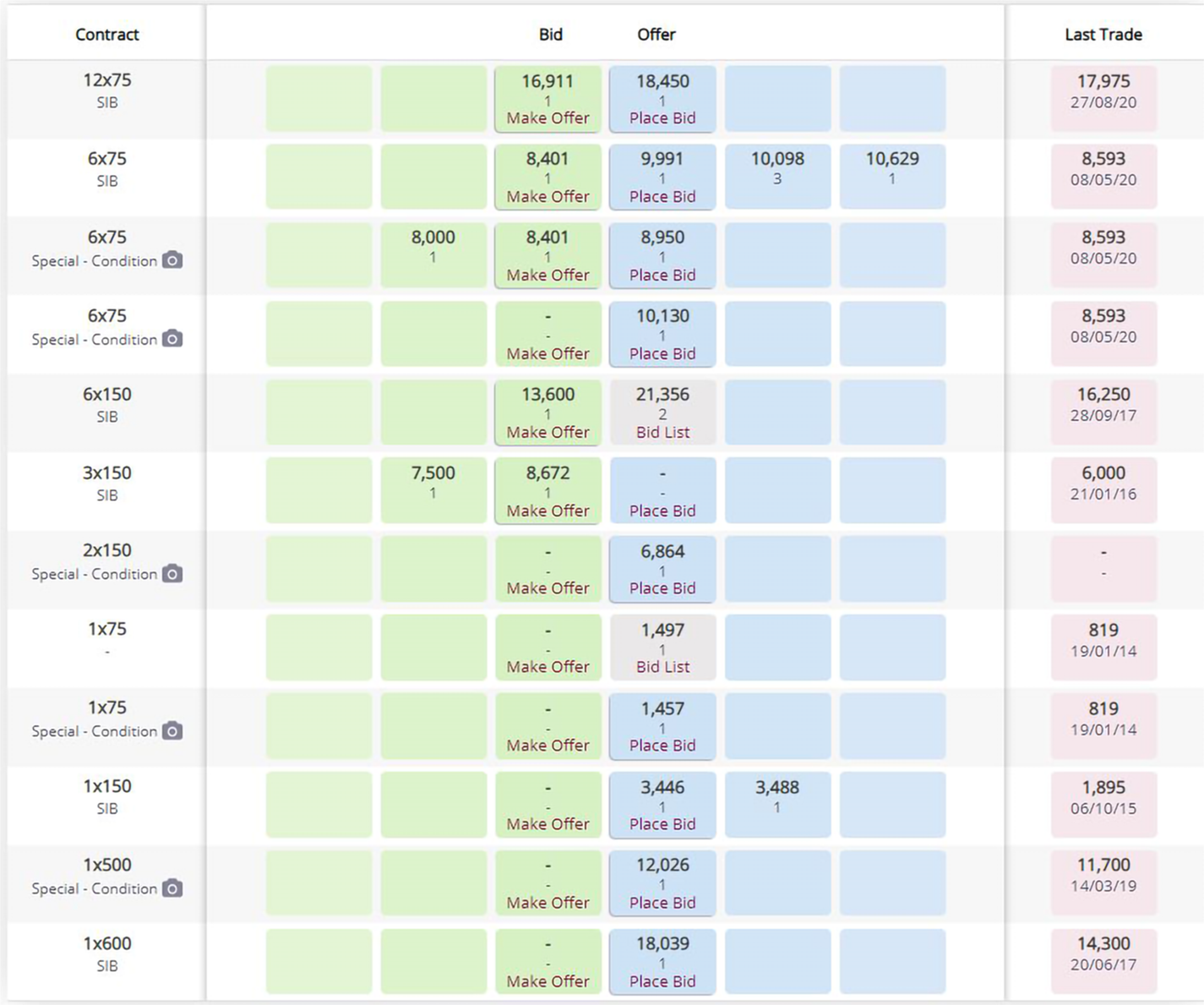

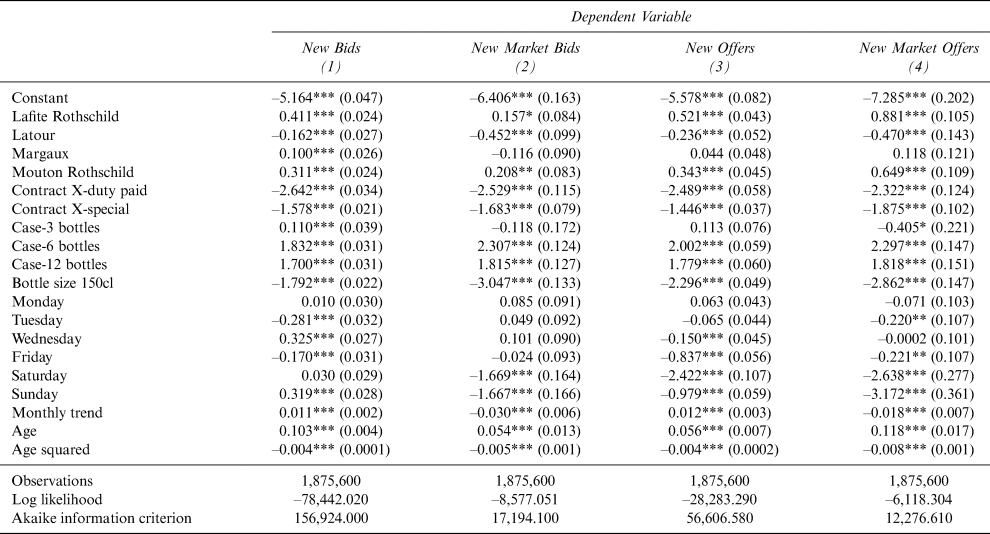

The estimated Poisson regression coefficients for the models of the effects of particular covariates on order book related events are presented in Table 1 (for order submissions) and Table 2 (for order withdrawals). The coefficients capture the change in the expected log counts of new limit orders, market orders, or order withdrawals, respectively, for every unit increase in particular regressors.

Table 1 Parameter Estimates for Response Variables Associated with Order Submissions

Note: Significance *p < 0.1, **p < 0.05, ***p < 0.01; standard errors in parentheses.

Table 2 Parameter Estimates for Bid and Offer Withdrawals

Note: Significance *p < 0.1, **p < 0.05, ***p < 0.01; standard errors in parentheses.

V. Conclusion

Fine wine trading infrastructure has been rapidly developing over recent years, and technological advancements, such as electronic trading platforms, have transformed the fine wine market into a more transparent and efficient marketplace. In particular, the order book implemented by the Liv-ex exchange has significantly extended the scope of information available to traders and allows them to make better informed trades.

In this paper, we examined how different factors affect trading activity, determined by the intensity of new buy and sell order submissions or withdrawals. The order book data allowed us to perform a novel and thorough analysis of both the demand and supply side of the market, which would not be possible with the use of typical transaction data. Therefore, our results reveal some interesting findings that may be useful to practitioners and researchers.

In particular, the wine age is a factor with a significant and positive impact on the buy and sell order submissions, although only up to a certain point, after which the expected number of orders starts to decrease. Some interesting calendar-related relationships occur between orders placed on different weekdays. For instance, new (limit) bids are more likely to be placed on Sundays than on Thursdays, whereas generally, on weekends, the trading activity on Liv-ex is significantly lower, as professional traders are engaged in trading. Similarly, the expected number of orders decreases when X contracts are the subject of a bid or offer, which may be linked to both the non-standard features of the wines traded under special conditions or to trader preferences for trading standard lots. Bid withdrawals are more likely to happen in the case of X contracts than SIB contracts.