I. Introduction

Financial technology or “fintech” is one of the fastest-growing sectors of the last decade. We define fintech as the use of the latest technology in solving problems in financial services, often relating to improved customer experience and insight (see, e.g., Chemmanur, Imerman, Rajaiya, and Yu (Reference Yu2020), Thakor (Reference Thakor2020)). In 2010, the total funding raised by fintech firms was just over 1 billion dollars, whereas in 2018, it rose to around 40 billion dollars, highlighting the rapid growth in funding in this industry (Chemmanur et al. (Reference Chemmanur, Imerman, Rajaiya and Yu2020)). In particular, we are witnessing a greater degree of direct investment in fintech firms by corporate investors. Unlike venture capitalists (VCs) or investment funds, the primary line of business of these corporate investors is not private equity investment. Further, they make direct investment in fintech startups rather than through their corporate venture capital (CVC) arms or through other divisions. For example, U.S. banks directly invested in 45 funding rounds of fintech firms in 2018 alone.Footnote 1 Other than banks, nonfinancial services firms, such as Amazon and IBM, have also made direct investments in fintech firms. For example, Amazon invested in the payment company, Bill Me Later, which was later acquired by PayPal in 2008.

The above observations give rise to several interesting and important research questions, which we address in this article. The first set of research questions deals with the motivation of fintech startups to accept direct investment from corporate investors and the effect of such investments on the future performance of these startups. On the one hand, these fintech startups often compete with corporate investors in the product market, so that accepting investments from corporate investors may lead to a deterioration in their future performance. On the other hand, fintech startups may have synergies with their corporate investors, and thus corporate investors may provide value-adding services to the fintech startups. If this is the case, corporate investment may lead to improvements in the future performance of fintech startups. In sum, the effect of corporate direct investments on the performance of fintech startups is an empirical question.Footnote 2 We answer this question by analyzing the effect of corporate direct investments on three outcome variables of fintech firms: the likelihood of future successful exit, the innovation output of fintech startups, and the net inflow of inventors into these fintech startups.

In the event that we find that corporate direct investment creates value for fintech startups, we will move on to analyzing potential channels through which such value creation occurs. While multiple channels may exist, we propose and empirically test two in this study. The first channel is strategic alliance formation: direct investment made by corporate investors in fintech startups may be a prelude to the formation of a strategic alliance between the two. Such strategic alliances may provide fintech startups with critical resources—such as mentorship and strategic advice, tech infrastructure, talent networks, market access, and established customer bases—that can accelerate the growth and innovation of these startups, making them more successful in the financial market, more productive, and more attractive to talent. The second channel is monitoring through board representation by corporate investors: corporate direct investors may be able to obtain board seats in fintech startups upon or after investment and thereby more effectively monitor the fintech startups to help them perform better.

Assuming that we do find that corporate direct investment improves the outcomes of fintech startups through the strategic alliance and monitoring channels, we will further explore the optimal form of investment that is more conducive to such value creation. An alternative to corporate direct investment is for the corporation to invest in the fintech startup indirectly through its CVC arm. We conjecture that corporate direct investment is more effective in creating value for fintech startups through the strategic alliance and monitoring channels, compared with indirect investment through the corporate investor’s CVC arm. In making this conjecture, we rely on the concept of “organizational distance,” which has been advanced in the strategy literature, for example, by Belenzon, Hashai, and Patacconi (Reference Belenzon, Hashai and Patacconi2019), who argue that a corporate parent will devote less attention to and have less control over a focal subsidiary if there are more intermediaries in the corporate structure between the parent and the focal subsidiary. Applied to our setting, a corporation is likely to be organizationally closer to a fintech startup in terms of allocating attention and resources and exerting control if it invests directly in the fintech startup rather than indirectly investing in the fintech startup through a CVC subsidiary (since the latter form of investment creates a greater organizational distance between the corporation and the fintech startup it invests in).Footnote 3 We thus empirically investigate whether corporate direct investors have a higher likelihood and faster speed of forming strategic alliances with the fintech startups they invest in and whether they are more likely to obtain board seats in these startups due to the shorter organizational distance (compared to corporations that invest indirectly through their CVC arms).

The second set of research questions that we address in this article is the mirror image of our first set of research questions: does investment in fintech startups help corporate investors improve their own operating performance and equity valuation, or is it merely an empire-building exercise by corporate CEOs (Jensen (Reference Jensen1986))? Whether investing in fintech startups negatively impacts the performance of corporate investors (e.g., through increasing product-market competition from these startups) or improves their performance (e.g., through the exploitation of potential synergies between investors and fintech startups) is ultimately an empirical question. We address this question by analyzing the effect of such investment on the operating performance of corporate investors (as measured by profitability and market share), as well as their equity-market valuation (as measured by Tobin’s Q). Further, are the effects of such direct investments in fintech startups on corporate investors’ own performance different for those in the financial services sector (e.g., Bank of America), which may have greater synergies with fintech startups, and for those outside the financial services sector (e.g., Amazon), which may have less synergies with fintech startups?Footnote 4

Finally, in case we do find performance improvements for at least a subset of corporate investors following their investment in fintech startups, then it is important to understand the possible channels through which such performance improvement occurs. We explore one such channel, namely, the formation of strategic alliances. Strategic alliances with fintech startups may bring various benefits to corporate investors, particularly those in the financial services sector who have greater potential for synergies with fintech startups. For example, corporate investors may gain access to innovative technologies and solutions that help them respond to customer demands more quickly, expand their market reach, and attract new customers.Footnote 5 Further, they may improve efficiency and reduce costs through integrating the fintech solutions into their operations.Footnote 6 Given this, we expect corporate investors who form strategic alliances with fintech startups they have invested in to achieve greater improvements in their performance compared with those that have not formed such alliances.

For our empirical analyses, we obtain our data on fintech startups from the Crunchbase database, which provides funding information on startups. We verify the accuracy of our data set using Venture Scanner and later match the verified data set with the VentureXpert data set. We obtain information on the sales and employment of private firms from the National Establishment Time Series (NETS) database and patent and inventor information from the PatentsView database of the U.S. Patent and Trademark Office. We focus on publicly listed corporate investors in our empirical analyses addressing the second set of research questions, since their performance can be measured using Compustat data.

The results of our empirical analyses can be summarized as follows: we first discuss the results of our analyses addressing the first set of research questions, namely, the effect of corporate investment on the future performance of fintech startups. First, we show that corporate direct investment is associated with a significantly greater probability of successful exit of such startups, as measured by IPOs or acquisitions. In economic terms, corporate direct investment is associated with a 6.2-percentage-point increase in the probability of successful exits of fintech startups. Second, we show that corporate investment is associated with a significantly greater quantity and higher quality of innovation output (as measured by patent counts and patent citations, respectively). Economically, corporate direct investment is associated with a 2.1-percentage-point increase in the quantity of patents produced by firms in the third year after corporate investment. Third, we show that corporate investors help fintech startups attract human capital/talent (as measured by the net inflow of inventors to these startups) and also help them attract top-tier talent (as measured by the net inflow of highly cited superstar inventors). Collectively, our results demonstrate that corporate investment enhances the future performance of fintech startups.

Next, we show that synergy plays an important role when corporate investors invest in fintech startups. We conduct separate baseline analyses to study the effect of corporate investment by firms in the financial and nonfinancial services sectors, respectively, on the future outcomes of fintech startups. We find that direct investment by corporate investors in the financial services sector in fintech startups is associated with a significantly higher likelihood of successful exit for these startups. However, direct investment by corporate investors in the nonfinancial services sector has no such impact. These results suggest that the improvement in the performance of fintech startups after corporate direct investments is primarily driven by value addition by corporate investors in the financial services sector, who have a greater potential to achieve synergies with these startups.

We then analyze two channels through which corporate direct investment may help fintech startups perform better. The first channel we explore is the formation of strategic alliances between corporate investors and fintech startups. We hand-collect information on whether and when corporate investors and fintech startups form strategic alliances upon or after corporate direct investment through an extensive search of media coverage on the Internet. We document that the performance improvement of fintech startups due to corporate direct investment is greater if their corporate investors form a strategic alliance with them upon or after their direct investments. The second channel that we propose through which corporate direct investors help fintech startups to perform better is by obtaining board seats in these startups, thereby facilitating better monitoring of these startups (over and above any monitoring by other intermediaries such as VCs). We document that the improvement in the performance of fintech startups due to corporate direct investment is greater if their corporate investors obtain at least one board seat in these startups. Further, consistent with the notion that corporate direct investment leads to a shorter organizational distance between investors and their fintech investees, we find that corporate direct investors are more likely to form strategic alliances with fintech startups upon or after investment, compared with corporations that invest indirectly through their CVC arms. Finally, conditional on the formation of strategic alliances, corporate investors tend to form such alliances significantly faster.Footnote 7 We also show that corporate direct investors are more likely to obtain board seats in their fintech investees, compared with corporations that invest indirectly through their CVC arms.

We now summarize the results of our empirical analyses addressing our second set of research questions, namely, the effect of corporate direct investments on the future performance of these corporate investors themselves. We consider a sample of publicly listed corporate investors (treated firms) that have made direct investments in fintech startups. Out of all corporate investors in our sample, roughly half are financial services firms, whereas the remainder are nonfinancial services firms. Further, among corporate investors from the financial services sector, less than half are banks, whereas the rest include insurance companies, mortgage lending companies, and so forth. For each corporate investor, we form a group of control firms in the same industry that have not invested in a fintech startup using propensity score matching based on their size, age, and R&D expenditure.

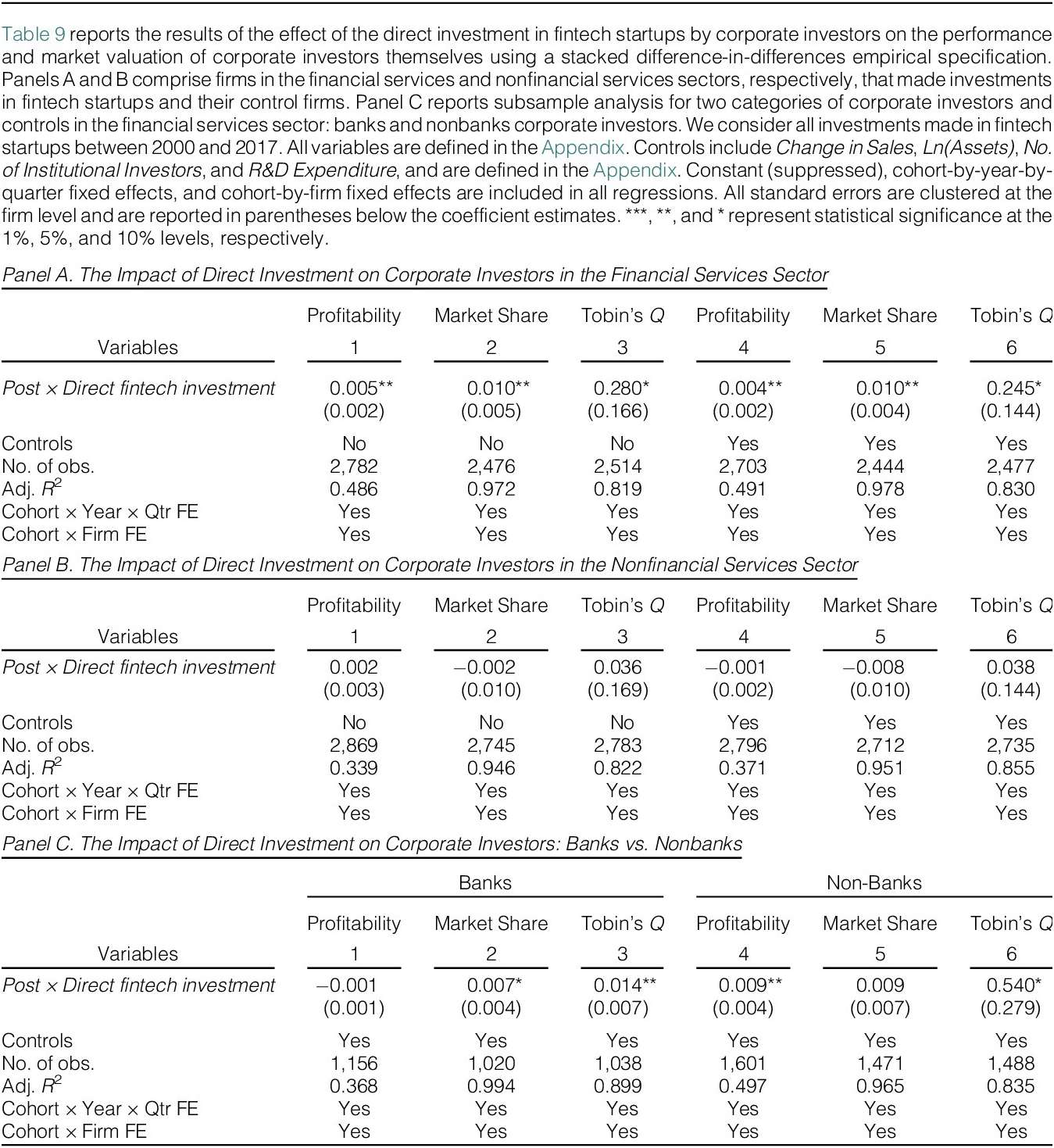

We examine the effect of investments in fintech startups on the performance of corporate investors using the above matched sample in a stacked difference-in-differences (DiD) framework. We find the following results: first, corporate direct investors in the financial services sector that made investments in fintech startups experience an increase in their profitability and market share compared with control firms that did not invest in fintech startups. Economically, we find that such corporate direct investors experience an average increase of 50.2% in their profitability and an average increase of 8.5% in their market share, respectively. We, however, do not find any such effect for corporate direct investors from the nonfinancial services sector. Second, we show that corporate investors from the financial services sector that made investments in fintech startups experience an increase in their equity-market valuation (as measured by Tobin’s Q) compared to their control firms. Economically, we find that such corporate investors experience an average increase of 18.3% in their market valuation. Again, we do not find such an effect for corporate investors in the nonfinancial services sector. Since the synergy between corporate investors in the financial services sector and the fintech startups they invest in is likely to be greater than that between corporate investors in the nonfinancial services sector and fintech startups, the above results point to synergy as the main source of the performance and value enhancements of corporate investors following their direct fintech investments. Splitting corporate investors in the financial services sector into banks and nonbank corporations (e.g., insurance companies and mortgage lending companies), our results reveal that, while both nonbank corporate investors and banks benefit from making direct investment in fintech startups, such benefits are greater for nonbank corporate investors.

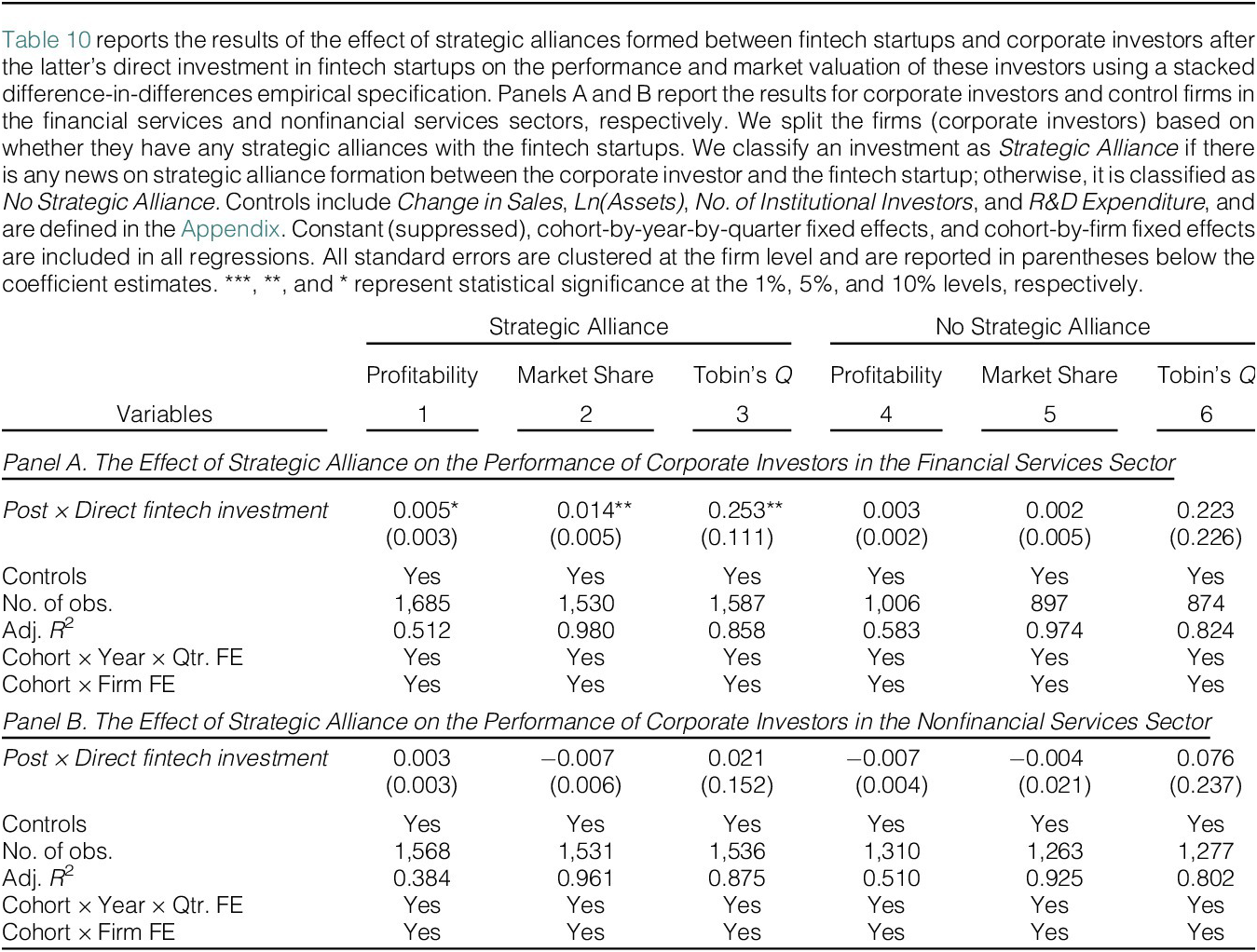

We next investigate a possible channel through which direct investment in fintech startups may enhance the operating performance and equity-market valuation of corporate investors, namely, forming strategic alliances with their fintech investees. We analyze the impact of such strategic alliance formation for corporate investors in the financial services sector and in the nonfinancial services sector separately. We find that only corporate investors in the financial services sector that have established strategic alliances with fintech startups experience an increase in product-market performance (profitability and market share) and in equity-market valuation (Tobin’s Q). We, however, do not find any such effect for corporate investors in the financial services sector that did not establish strategic alliances with their investees. Further, we do not find any such improvements in operating performance or equity-market valuation for corporate investors in the nonfinancial services sector (regardless of whether or not they have formed a strategic alliance with their fintech investees). Taken together, our results suggest that strategic alliance formation between corporate investors and fintech startups is an important channel through which corporate investors in the financial services sector realize the benefits of potential synergies with fintech startups, thereby improving their operating performance and financial market valuation.

II. Related Literature and Contribution

Our article contributes to several strands in the literature. First, we contribute to the broader entrepreneurial finance literature. Most of the papers in the existing literature study the impact of VC (either independent venture capital (IVC) or CVC, or both) investment on startups’ performance (e.g., Kortum and Lerner (Reference Kortum and Lerner2001), Chemmanur, Loutskina, and Tian (Reference Chemmanur, Loutskina and Tian2014), Tian and Wang (Reference Tian and Wang2014), Ewens, Nanda, and Rhodes-Kropf (Reference Ewens, Nanda and Rhodes-Kropf2018), and Ma (Reference Ma2020), among others). In particular, Chemmanur et al. (Reference Chemmanur, Loutskina and Tian2014) show that CVC-backed firms are more innovative and riskier, and generate less profit than IVC-backed firms, whereas Ma (Reference Ma2020) shows that corporations set up their CVC programs when they experience a decline in their innovation output and terminate their CVC programs once their (parent firms’) innovation output improves. In contrast to this literature, we focus on the effect of direct investments by corporate investors in fintech startups on the performance of these startups. By controlling for IVC and CVC investments in our empirical analyses, we demonstrate that corporate direct investment provides additional benefits to fintech startups over and above any effects due to IVC and CVC investments. Specifically, we find that corporate direct investment leads to a higher probability of successful exit of these startups, more and higher-quality innovation output, and a greater net inflow of inventors into these startups. Further, we also investigate the advantages of corporate direct investment compared to indirect investment through corporate CVC arms in affecting the performance of fintech startups. We hypothesize and find supporting evidence that a key advantage of corporate direct investment lies in reducing the organizational distance between the investors and fintech startups, thereby facilitating the formation of strategic alliances between the two and enhancing monitoring of the fintech startups through increased board representation by corporate direct investors. Finally, we show that direct investments in fintech startups also benefit corporate investors in the financial services sector themselves.

Two papers somewhat more closely related to our article are Li, Mao, Zhang, and Zheng (Reference Li, Mao, Zhang and Zheng2023) and Puri, Qian, and Zheng (Reference Puri, Qian and Zheng2023). Li et al. (Reference Li, Mao, Zhang and Zheng2023) study the patterns of bank investment in fintech startups. They show that banks are more likely to invest in fintech startups compared with IVCs and that fintech startups funded by banks have a higher likelihood of IPO compared with those funded by IVCs. They argue that this effect is due to selection (screening). Our article is different from Li et al. (Reference Li, Mao, Zhang and Zheng2023) in several important ways. First, we document a positive effect of direct investment in fintech startups by corporate investors on the future outcomes of these startups and establish causality using instrumental variable (IV) analyses. We also demonstrate that these effects are primarily driven by corporate investors in the financial services sector, which includes not only banks but also insurance companies and mortgage lenders, among others. Further, we establish two key channels through which corporate direct investors add value to fintech startups: the formation of strategic alliances and greater monitoring through board representation. Finally, we also show that direct investment made by both banks and nonbank corporate investors in the financial services sector significantly increases the likelihood of successful exit of fintech startups.

Puri et al. (Reference Puri, Qian and Zheng2023) show that banks are more likely to invest in fintech startups when there is greater technological and business relatedness between them and when they face greater competition to invest in fintech startups. Their paper considers both direct and indirect investments by banks but does not investigate the differential effect of these two forms of investments. In other words, they are agnostic about the form of investment: direct versus indirect investment. In contrast, our study focuses specifically on direct investments made by all categories of corporate investors, extending beyond the banking sector. To the best of our knowledge, this is the first article to study the effect of corporate direct investment on the outcomes of fintech startups and to explore two possible channels through which this occurs: namely, forming strategic alliances with fintech startups and better monitoring these startups through greater board representation in these startups. Furthermore, this is also the first article to analyze the advantage of corporate direct investment compared to indirect investment through CVC arms in affecting the performance of fintech investees. We conjecture that corporate direct investment leads to a shorter organizational distance to the fintech investee compared with indirect investment through corporations’ CVC arms, which, in turn, increases the likelihood that corporate direct investors will form strategic alliances with fintech startups and obtain board representation, compared to the corporate parents of CVC investors. Finally, this is also the first article to analyze how direct investment in fintech startups affects the performance of corporate investors themselves (as measured by profitability, market share, and equity valuation) and the role of strategic alliance formation in this process.

Second, we contribute to the growing literature on fintech firms. A number of papers have analyzed peer-to-peer lending (e.g., Duarte, Siegel, and Young (Reference Duarte, Siegel and Young2012), Hertzberg, Liberman, and Paravisini (Reference Hertzberg, Liberman and Paravisini2018), Tang (Reference Tang2019), and Vallee and Zeng (Reference Vallee and Zeng2019), among others). There are also several other papers comparing fintech lenders and banks (e.g., Buchak, Matvos, Piskorski, and Seru (Reference Buchak, Matvos, Piskorski and Seru2018), Fuster, Plosser, Schnabl, and Vickery (Reference Fuster, Plosser, Schnabl and Vickery2019), and Allen, Shan, and Shen (Reference Allen, Shan and Shen2023)). Gopal and Schnabl (Reference Gopal and Schnabl2022) show that fintech lenders are a major source of credit for small businesses especially after the 2008 financial crisis.Footnote 8 In contrast to the above literature, this is the first article to analyze the role of direct investments by corporate investors on fintech startups’ future performance. It is also the first to study the effect of direct investments in fintech startups on the product and financial market performance of corporate investors themselves.

Our article is also related, albeit more distantly, to the literature on minority acquisitions. For example, Ouimet (Reference Ouimet2013) studies the motivation for minority acquisitions (less than 50% acquisition of target shares) and shows that minority acquisitions are more likely when acquirers do not want to dilute the incentives of target firms’ management teams. Nain and Wang (Reference Nain and Wang2018) show that minority acquisitions lead to lower product market competition. In contrast to the above papers, the focus of our article is on the motivation of corporate investors to invest directly in fintech startups and the effect of such investment on the performance of both corporate investors and fintech startups.Footnote 9

III. Conceptual Framework and Hypothesis Development

The first research question we address here relates to whether fintech startups benefit from direct investments from corporate investors. On the one hand, corporate direct investors (especially those from the financial sector) may compete negatively with fintech startups (possibly by using the information gained from investing in these startups, such as insights into new products or business practices), thereby improving their own performance at the expense of the startups they invest in. After all, the motivation for corporate investors for investing in fintech startups may not necessarily be benign. If the effect of such competition dominates any value created due to corporate direct investment in the fintech startup, the overall effect of corporate investors’ investment in the fintech startups will be negative (H1A).Footnote 10 On the other hand, corporate investors may have synergies with fintech startups in the product market. If the effect of such synergies dominates any negative effects of competition between corporate investors and the fintech startups they are investing in, then this will be reflected in the performance of such startups, as captured by outcome variables such as successful exit (IPO or acquisition), innovation output, and the net inflow of inventors (and superstar inventors) into the fintech startup (H1B).

If, indeed, the positive effects of corporate investments in fintech startups dominate any negative effects of competition between the two, then understanding the source and channel of such value creation by corporate direct investment in fintech startups becomes crucial. It would be useful to analyze whether synergies between corporate investors and fintech startups they invest in are an important source of such value creation for fintech startups. In general, we would expect such synergies to exist to a much greater extent between corporate investors in the financial services sector and fintech startups than between corporate investors in the nonfinancial services sector and fintech startups. The effect of such synergies will therefore lead to greater value creation for fintech startups in the case where corporate investors in the financial services sector invest in such startups. This is the second hypothesis that we test here (H2).

If, indeed, corporate investment in fintech startups creates value for fintech startups, it is important to understand the channels through which such values are created. While such value creation may occur through multiple channels, we investigate two possible channels. The first channel through which a corporate investor may create value for a fintech startup they invest in may be through the formation of a strategic alliance between the corporate investor and the fintech startup. Such strategic alliances may provide fintech startups with critical strategic resources such as mentorship and strategic advice, tech infrastructure, talent networks, market access, and established customer bases that can accelerate growth and innovation of these startups, making them more successful in the financial market, more productive, and more attractive to talent. If, indeed, strategic alliance formation is a channel of value creation, we expect fintech startups forming strategic alliances with corporate investors to perform better in terms of our outcome variables than those that do not form such strategic alliances. This is the third hypothesis that we test here (H3).

A second channel through which we hypothesize that corporate investors create value for fintech startups they invest in is a monitoring channel: corporate investors may possess unique abilities (e.g., in-depth domain knowledge and an acute understanding of customer needs and market trends) to monitor and add value to the fintech startup over and above any monitoring provided by other intermediaries such as VCs. If, indeed, corporate investors are able to provide monitoring services to fintech startups, such monitoring would be facilitated by the corporate investor having board seats in such fintech startups. This means that fintech startups in which corporate investors have board seats will perform better than those in which corporate investors do not have board seats (H4).

Assuming that we do find that investment by corporate investors in fintech startups leads to value addition through the strategic alliance and monitoring channels, an important question that arises is regarding the optimal form of investment by corporate investors that may be conducive to such value addition. An alternative to corporate direct investment is for the corporation to invest in the fintech startup through its CVC arm. To distinguish between the economic effects of direct investment and indirect investment through a firm’s CVC arm, we appeal to the notion of “organizational distance,” which has been advanced in the strategy literature. For example, Belenzon et al. (Reference Belenzon, Hashai and Patacconi2019) argue that a corporate parent will devote less attention to and have less control over a focal subsidiary if there are more intermediaries in the corporate structure between the parent and the focal subsidiary. Applied to our setting, a corporation is likely to be organizationally closer to a fintech startup in terms of allocating attention and resources and exerting control if it invests directly in the fintech startup rather than indirectly investing in the fintech startup through a CVC subsidiary (since the latter form of investment creates a greater organizational distance between the corporation and the fintech startup it invests in).

The above notions are likely to have two implications in our setting. First, since investing indirectly through a CVC arm leads to a greater organizational distance between the investor and the fintech startup, there is a lower probability of the formation of a strategic alliance between the two compared with the case of corporate direct investment. Further, the amount of time it takes to form a strategic alliance will be greater in the case of investing in a fintech startup through a CVC arm compared with the case of a corporate direct investment.Footnote 11 This is the fifth hypothesis that we test here (H5).Footnote 12 Second, given their shorter organizational distance to the fintech startup, corporate investors who invest directly in fintech startups may be able to ask for (and obtain) greater board representation (more board seats) in fintech startups upon investment relative to firms that invest in fintech startups through their CVC arms. This is the next hypothesis that we test here (H6).

We now turn to developing testable hypotheses related to our second set of research questions (i.e., for analyzing the effect of corporations investing in fintech startups on the performance of these corporations themselves). Our main focus in the second part of the article is to examine whether corporate investors themselves benefit from making investments in fintech startups. As in the case of fintech startups receiving investments from corporate investors, whether corporations benefit from making such direct investments in fintech startups is an empirical question. The business models of many fintech startups involve disrupting the businesses of incumbent firms, so that encouraging such startups by investing in them (and helping them in other ways, e.g., by forming strategic alliances with them) may negatively impact the performance of corporate investors. If the effect of corporations making such investments in fintech startups is negative for corporate investors, we expect the operating performance of these firms (as measured by profitability or market share) to deteriorate subsequent to making these investments, and the equity-market valuation (as measured by Tobin’s Q) of these corporate investors to decline (H7A). Conversely, if making such investments is beneficial to the corporations investing in fintech startups due to the synergy benefits arising from the co-operation between these two firms dominating any negative effects due to increases in competition between the two, we should expect their operating performance to improve subsequent to their investments. Further, in this scenario, we also expect the equity-market valuation of corporate investors making investments in fintech startups to increase as well, reflecting the above anticipated improvements in operating performance (H7B).

If, indeed, investing in fintech startups improves the performance of at least a subset of corporate investors, understanding the source of such performance improvements becomes important. We conjecture that synergy between corporate investors and fintech startups is a potential source of this performance improvement. Clearly, the synergy between corporate investors in the financial services sector will be much greater than synergies between corporate investors outside the financial services sector and the fintech startups they invest in. This means that the operating performance improvements (and corresponding increase in equity-market valuations) for corporate investors in the financial services sector following investments in fintech startups can be expected to be greater than performance and value improvements for corporate investors outside the financial services sector. This is the next hypothesis that we test here (H8).

Finally, if synergies between corporate investors and fintech startups they invest in are, indeed, the source of performance improvements and equity-market value increases for corporate investors, then the channels through which they exploit such synergies become pertinent. We examine an important channel through which corporate investors may exploit such synergies, namely, through the formation of strategic alliances between the two. Strategic alliances with fintech startups may bring corporate investors various benefits. For example, corporate investors may gain access to innovative technologies and solutions that help them respond to customer demands more quickly, expand their market reach, and attract new customers. Further, they can improve efficiency and reduce costs through integrating the fintech solutions into their operations. If, indeed, the formation of strategic alliances between corporate investors and fintech firms is an important channel through which corporate investors and fintech firms share synergies between the two, we would expect the operating performance improvements and equity-market value increases for corporate investors that have formed strategic alliances with the fintech firms they invest in to be greater than such performance and value improvements for corporate investors who have invested in fintech firms but which have not formed such strategic alliances. This is the last hypothesis that we test here (H9).Footnote 13

IV. Data and Sample Selection

A. Sample of Fintech Startups

As mentioned in the Introduction, we define fintech startups as non-traditional intermediaries that provide financial services and products, such as peer-to-peer lending, robo-advisory and insurance technology, to their customers. Our data on fintech startups come from various sources. The primary data source for our article is Crunchbase, a leading open-source database collecting profiles of startups and information on their financing.Footnote 14 We identify startups from Crunchbase that are in the fintech sector, such as blockchain technology, insurance, business lending, digital assets, peer-to-peer lending, and other categories of fintech sector following Thakor (Reference Thakor2020). We also verify the coverage of this data set with Venture Scanner, which also contains data on fintech startups. Similar to Crunchbase, Venture Scanner has also sourced information from a wide variety of application programming interfaces (APIs) (including the API of AngelList) and web scraping of media articles, among others (Chemmanur et al. (Reference Chemmanur, Imerman, Rajaiya and Yu2020)). In this article, we focus on startup firms in the fintech sector from 2000 to 2017. Specifically, for each fintech startup, we obtain information on its founding date, location, the dates of investments across funding rounds, the names of investors involved in the funding rounds, and the aggregate amount of investments across all investors per funding round. The initial sample consists of around 1,300 fintech startups. We obtain information on VC investments in fintech startups from VentureXpert. Finally, we use Pitchbook to augment missing information on investments in the above startups.Footnote 15 We obtain data on board members in these startups from Pitchbook, the SEC Form D data set, and an extensive manual search on the Internet.

We obtain data on employment and sales for our sample of fintech startups from the NETS, which is a longitudinal database provided by Dun & Bradstreet and is widely used in research on private firms.Footnote 16 After matching firms covered in Crunchbase, VentureXpert, and the NETS databases, we are left with a final sample of 728 fintech startups. We use patent-based metrics to measure the innovation output of fintech startups and obtain patent information from the PatentsView database. Following Bernstein, Giroud, and Townsend (Reference Bernstein, Giroud and Townsend2016), we use a fuzzy name-matching algorithm to merge the PatentsView data set to our matched Crunchbase data set. Information on inventors also comes from the PatentsView database. Specifically, we retrieve information on inventors who have filed patents on behalf of their firms and track the movement of investors across firms, making use of the name and unique identification number of each inventor provided in the PatentsView database.

B. Sample of Corporate Investors

We obtain the names of investors who invest in the fintech startups from the Crunchbase database. We manually identify the category of each investor by searching their websites and news articles pertaining to such investors and collect their investor-category classifications from Crunchbase. However, Crunchbase does not have a separate classification for corporate investors. Therefore, we manually identify corporate investors, which we define as firms (either public or private) that make direct investments in startups (and not through any investment arm) and that do not have investment as their primary line of business. For example, Mastercard is categorized as a corporate investor, because it has made direct investments in fintech startup such as Mozido and its primary line of business is payment services. On the contrary, VCs such as Andreessen Horowitz or Bessemer Venture Partners are not considered corporate investors, because identifying and making investments in startups is their core business.

Note that corporate direct investors are different from corporate venture capitalists (CVCs), which are the venture divisions of corporations (e.g., Google Ventures and Intel Capital). CVCs are either standalone subsidiaries or separate divisions of corporations and often maintain a certain degree of freedom when making investment decisions, in which case the parent corporation may not exercise total control of the investment. Corporate investors, however, make direct investments in startups (i.e., not through CVCs) and exercise total control of the investment.Footnote 17 To ensure accuracy, we carefully go through company websites and also conduct additional online searches to manually verify whether the direct investors that have invested in fintech startups have a CVC division or not. Please see Table A1 in the Supplementary Material and our discussion in Section IV.E for more details.

In this article, our main focus is on the role of corporate direct investors in fintech startups. We merge investor names in the Crunchbase data set to Compustat using the name-matching technique employed in Bernstein et al. (Reference Bernstein, Giroud and Townsend2016). We are able to identify 65 publicly listed corporate investors that have invested in fintech startups by the year 2017, out of which 32 firms are in the financial services sector (i.e., with a 4-digit SIC code between 6000 and 6999). We use Compustat to obtain accounting information of publicly listed fintech investors from 1997 to 2020 at the quarterly frequency. We track information on corporate direct investors starting from 1997 to obtain a 3-year period prior to their investment in fintech startups, given that our fintech startup sample is from 2000 onward.

C. Measures of Innovation Output

We measure the extent of the innovation output by fintech startups using the quantity and quality of patents filed by (and eventually granted to) them in the years after the first round of financing. We measure the quantity of innovation using the natural logarithm of 1 plus the total number of technology class-adjusted patents applied by (and eventually granted to) a firm within 1 year, 2 years, and 3 years after a round of financing following Seru (Reference Seru2014). To measure the quality of innovation, we calculate the natural logarithm of 1 plus the total number of technology class-adjusted forward citations of the patents that were applied by a firm within 1 year, 2 years, and 3 years after a round of financing following Seru (Reference Seru2014).

D. Measures of Inventor Mobility

We construct our inventor mobility measures at the annual frequency for fintech startups following Marx, Strumsky, and Fleming (Reference Marx, Strumsky and Fleming2009) and Chemmanur, Kong, Krishnan, and Yu (Reference Chemmanur, Kong, Krishnan and Yu2019). For a given firm, an inventor’s move-in year is the year when she filed her first patent in this firm, and her move-out year is the year when she filed her first patent in a different firm. In case if the last patent filed by the inventor is for the same firm, we assume that she remains in the firm till the end of our sample period.Footnote 18 Once we identify each mobile inventor’s move-in and move-out years, we aggregate the number of mobile inventors that move in and move out at the firm-year level to obtain the total inflows and outflows of mobile inventors for a given firm in a year. We measure the net inflow of inventors into a fintech startup in a given year by computing the difference between the natural logarithm of 1 plus the inflow and the natural logarithm of 1 plus the outflow of inventors for the fintech startup in that year. We create measures of the net inflow of inventors over the 1-, 2-, and 3-year periods post investment.

We also categorize inventors into different groups based on their track records of patent citations to analyze the mobility of high-performing inventors. We classify inventors as “superstar inventors,” if they are in the top 10% based on the cumulative number of class-adjusted citations received over the patents filed by them over time. We also create measures of net inflow of superstar inventors over the 1-, 2-, and 3-year periods.

E. Summary Statistics

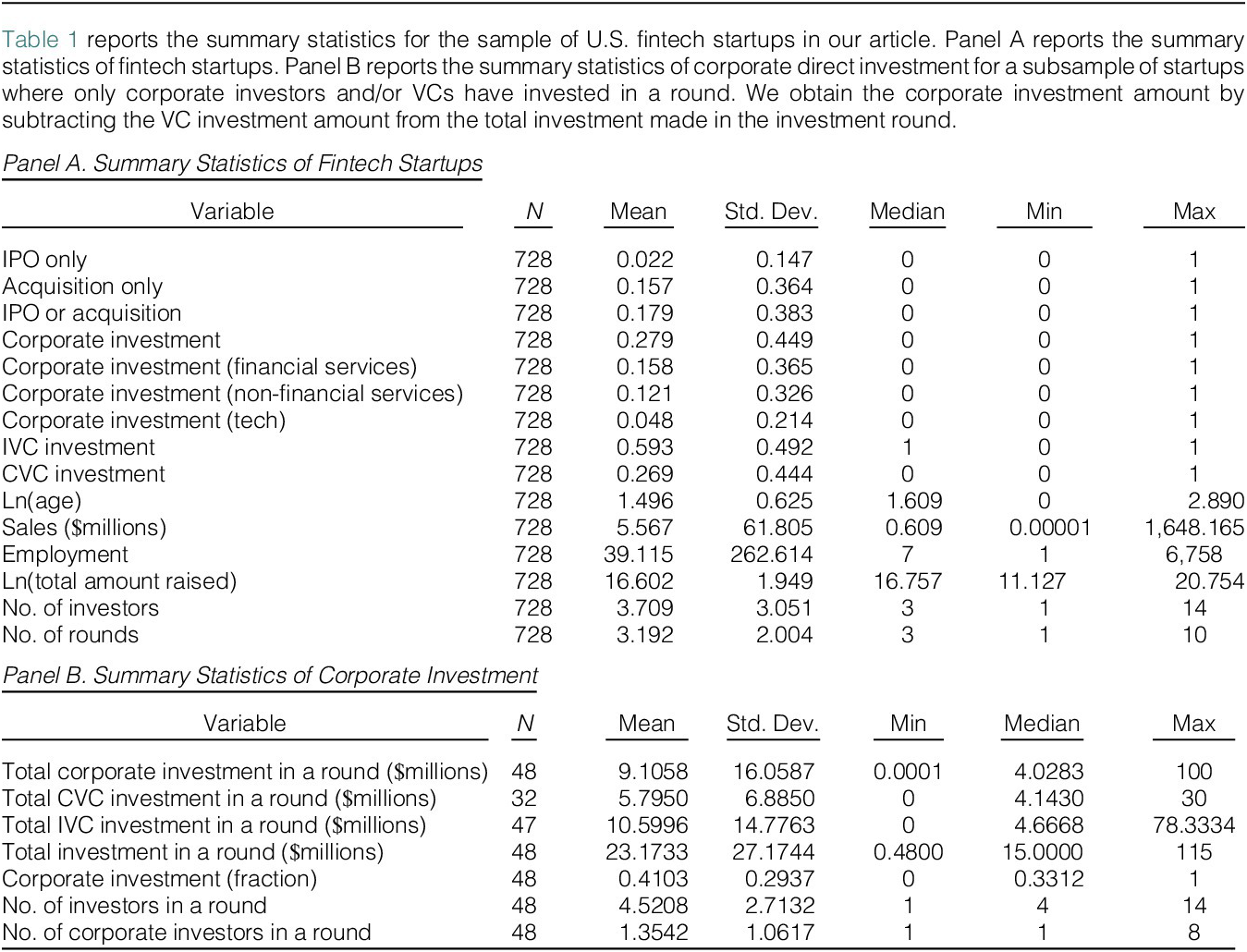

Panel A of Table 1 reports the summary statistics of U.S.-based fintech startups in our sample. We find that 2% of firms had a successful exit via an IPO, and about 16% of firms had a successful exit via an acquisition. The mean fraction of VC investment in our sample firms is 37%. On average, 28% of fintech startups receive at least one round of direct investment from corporate investors, 60% of them receive at least one round of investment from an independent VC (IVC), and 27% of firms receive at least one round of investment from a CVC. About 11% of the startups receive both corporate direct and CVC investments, typically from separate corporations. Our control variables are winsorized at the 1st and 99th percentiles in the regressions.

TABLE 1 Summary Statistics of Fintech Startups in the United States

Panel B of Table 1 reports the summary statistics of investment amount by corporate investors in fintech startups for a subsample of startups that received investment from either corporate investors or VCs (including IVCs and CVCs). Crunchbase provides the information on the aggregate investment amount in a funding round, whereas VentureXpert provides the information on the investment amount provided by VCs. Thus, we are able to back out the total investment amount provided by corporate investors by subtracting aggregate VC investment amount from the total investment amount in a funding round. This back-of-the-envelope calculation only applies to a subsample of fintech startups that received investment from either VCs or corporate investors (which does not include other types of investors such as accelerators or angel investors). Thus, we are able to show the total investment amount by corporate investors for 48 fintech startups (out of 203 fintech startups in our sample that have received corporate direct investment) in Panel B of Table 1. The average amount of total corporate direct investment is 9.1 million USD, which is 41.03% of the average total amount invested (23.17 million USD) in these rounds. The median number of corporate investors in the above subsample is 1. In comparison, we also find that the average amount of the total investment provided by CVCs and IVCs in the same subsample are 5.8 and 10.6 million USD, respectively. Thus, the above statistics show that corporate investors provide a significant amount of funding to startups, which is comparable to that provided by IVCs and CVCs.

In Table A1 in the Supplementary Material, we list out all the direct investors that have invested in fintech startups in our sample period. These investors consist of public and private firms in the United States and firms in other countries. We show that around 66% of direct investors do not have a CVC division. Further, we show in Supplementary Material Table A2 that only 8 out of 728 fintech startups in our sample have received investment from both direct investors and the CVC divisions of these direct investors. Table A3 in the Supplementary Material reports the breakdown of startups across various business categories in the fintech sector.

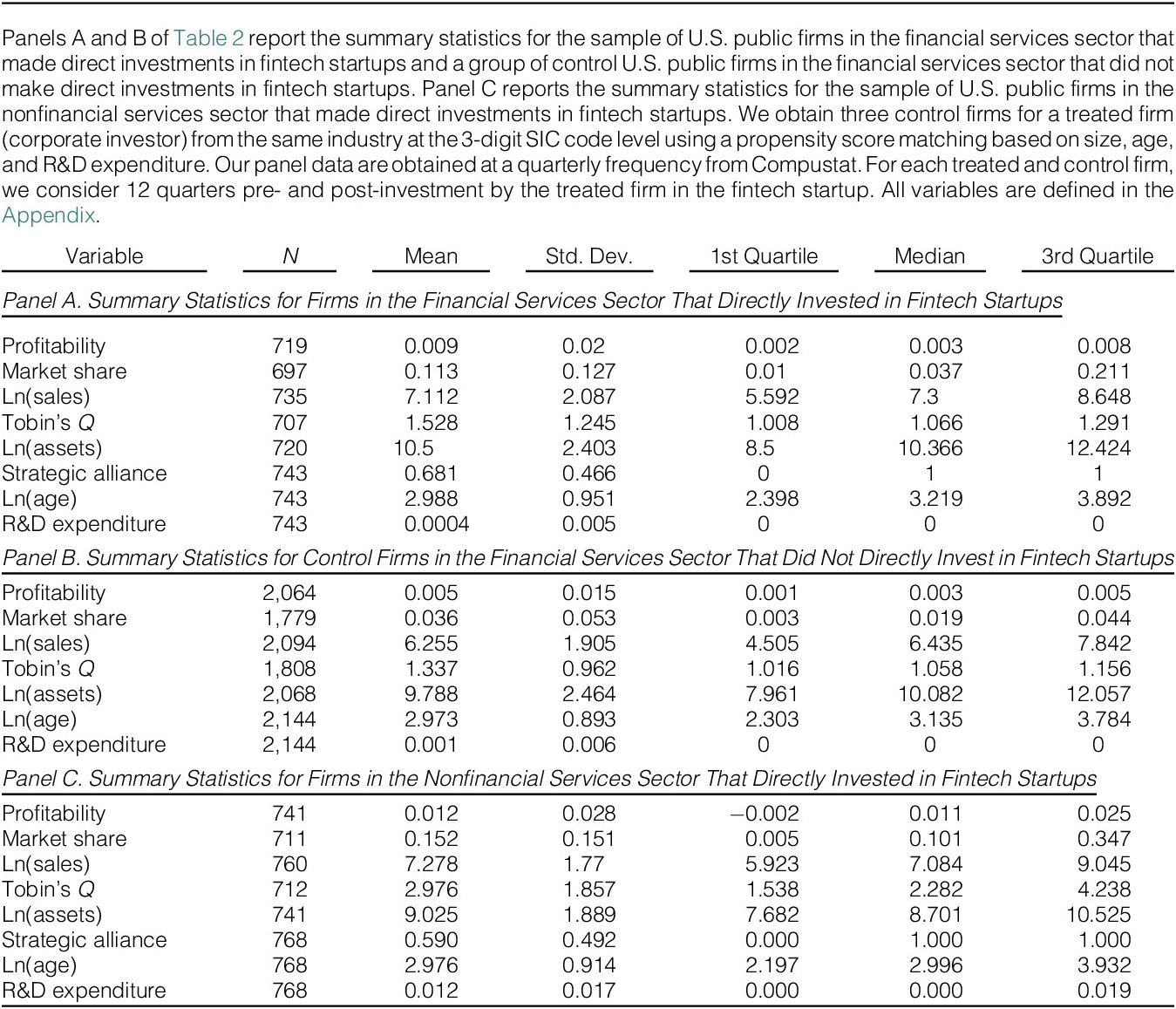

Table 2 presents the summary statistics for publicly listed corporate investors in the financial and nonfinancial services sectors in the United States that have invested in fintech startups. We consider financial services firms as firms with SIC codes between 6000 and 6999. We also show summary statistics for a group of control firms in the financial services sector that did not invest in fintech startups. We restrict our sample to investments made on or before 2017 so that we have sufficient observations in the post-investment period for these firms. We obtain three control firms for a treated firm (corporate investor) from the same 3-digit SIC code using a propensity score matching based on size, age, and R&D expenditure of firms in the immediate year prior to the investment year. Our panel data are obtained at quarterly frequency from Compustat. For each treated and control firm, we consider 12 quarters pre- and post-investment by the treated firm in the fintech startup. We have a final sample of 32 corporate investors (treated firms) and 71 control firms in the financial services sector. We present the summary statistics for corporate investors in the financial services sectors and respective control firms in Panels A and B, respectively. In Panel C, we present the summary statistics for corporate investors in the nonfinancial services sectors. In Table A4 in the Supplementary Material, we show that treated and control firms (including both financial and nonfinancial services sector firms) are similar in terms of age, size, R&D expenditures, and industry category.

TABLE 2 Summary Statistics of Corporate Investors and Control Firms

V. The Effect of Corporate Direct Investment on the Future Outcomes of Fintech Startups

In this section, we analyze the impact of corporate direct investment on the successful exits of fintech startups (IPO or acquisition), innovation output, and net inventor inflows using our sample of 728 fintech startups.

A. Corporate Direct Investment and Future Outcomes of Fintech Startups: Main Results

We first use OLS analyses to analyze the effect of corporate direct investment on the future outcomes of fintech startups. We use the following empirical specification:

where i indexes firm, j indexes industry, and t indexes time.

![]() $ {Outcomes}_i $

represents the three future outcomes of startups that we analyze: successful exits of fintech startups (IPO or acquisition), innovation output, and net inventor inflows, as defined in the Appendix. The independent variable of interest

$ {Outcomes}_i $

represents the three future outcomes of startups that we analyze: successful exits of fintech startups (IPO or acquisition), innovation output, and net inventor inflows, as defined in the Appendix. The independent variable of interest

![]() $ Corporate\;{Investment}_i $

is an indicator variable equal to 1 if a fintech firm receives its first-ever round of direct investment from at least one corporate investor. X

$ Corporate\;{Investment}_i $

is an indicator variable equal to 1 if a fintech firm receives its first-ever round of direct investment from at least one corporate investor. X

![]() $ {}_{\mathrm{i}} $

represents a vector of control variables, which includes an indicator variable capturing investment by IVCs, an indicator variable capturing investment by CVCs, firm age, sales and employment 1 year prior to the investment year, aggregate investment across all investment rounds in a firm, and the number of investors in the investment round. We also include 2-digit SIC code industry fixed effects and the investment year fixed effects in our regressions.Footnote 19 We define investment year as the year of the latest investment round in a fintech startup by any type of investor.

$ {}_{\mathrm{i}} $

represents a vector of control variables, which includes an indicator variable capturing investment by IVCs, an indicator variable capturing investment by CVCs, firm age, sales and employment 1 year prior to the investment year, aggregate investment across all investment rounds in a firm, and the number of investors in the investment round. We also include 2-digit SIC code industry fixed effects and the investment year fixed effects in our regressions.Footnote 19 We define investment year as the year of the latest investment round in a fintech startup by any type of investor.

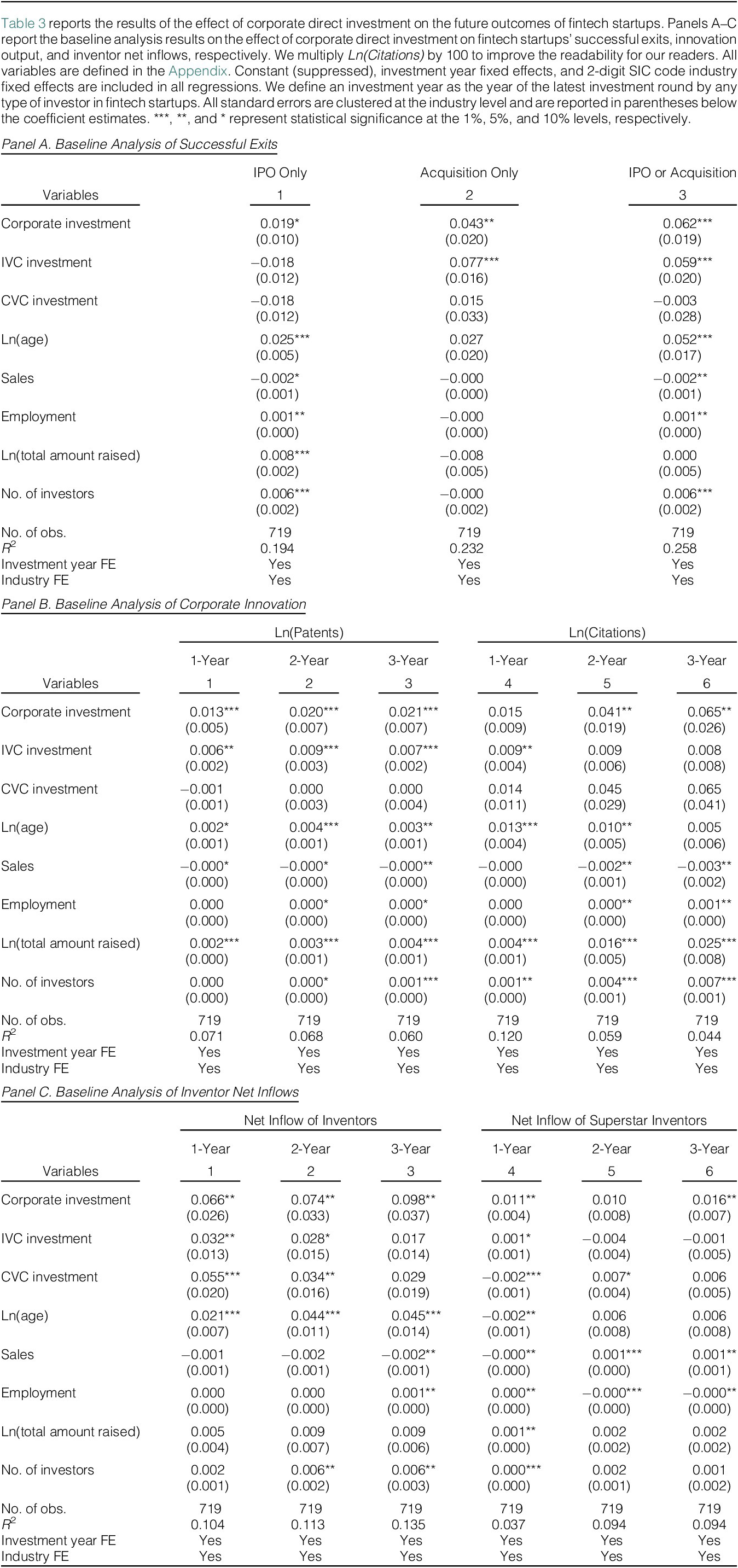

Table 3 reports the results of the effect of corporate direct investment on the future outcomes of startups. In Panel A, we show that corporate investment is associated with a higher likelihood of successful exit of startups. In columns 1–3, the coefficients of Corporate Investment are positive and significant at the 10%, 5%, and 1% levels, respectively. Our results are also economically significant. For example, corporate direct investment is associated with a 6.2-percentage-point increase in the probability of successful exits of fintech startups.Footnote 20 In comparison, IVC investment is associated with an increase of 5.9 percentage points in the probability of a successful exit of a startup, which is similar in magnitude to that of corporate direct investment. Further, the coefficients of CVC investment are negative and insignificant. Overall, our results suggest that corporate direct investment in fintech startups increases their probability of successful exit over and above any effect due to IVC or CVC investment. This result supports our hypothesis H1B.

TABLE 3 The Effect of Corporate Direct Investment on Successful Exits, Innovation Output, and the Net Inflows of Inventors into Fintech Startups: Baseline Analysis

Next, we analyze the effect of corporate direct investment on the innovation output of fintech startups and report these results in Panel B of Table 3. We find that corporate direct investment is associated with a higher quantity and quality of patents received by the fintech startup subsequent to receiving the corporate investment. As shown in columns 1–6, we find that the coefficients of Corporate Investment are positive and significant. Our results are also economically significant: for example, corporate investment is associated with a 2.1-percentage-point increase in the quantity of patents produced by firms in the third year after the investment round. This result also supports our hypothesis H1B.

We then examine the effect of corporate direct investment on the net inflows of inventors into fintech startups and report these test results in Panel C of Table 3. In columns 1–3, the dependent variable is the net inflow of inventors. In columns 4–6, the dependent variable is the net inflow of superstar inventors (i.e., inventors in the top 10 percent based on their cumulative aggregate of patent citations). For all columns, we find that the coefficients of the corporate investment variable are positive and significant. These results suggest that corporate investors help fintech startups attract high-quality talent (scientists and engineers) to their firms, thus lending support to our hypothesis H1B.

One may be concerned that our baseline (OLS) results may be confounded by endogeneity issues. For instance, the observed relationship may reflect both selection effects and value creation by corporate investors in fintech startups. In addition, omitted variables—such as startup quality or the resources and networks of founders and management—could also bias the baseline estimates. To mitigate such endogeneity concerns, we conduct an IV analysis using the change in technological breakthroughs (measured by the RETech variable in Bowen, Frésard, and Hoberg (Reference Bowen, Frésard and Hoberg2023)) of public companies in the same industry as a fintech startup in the past 3 years as an instrument for corporate direct investment in the fintech startup. The underlying rationale is that, when established (public) companies face challenges in achieving technological breakthroughs, they are likely to search for and make direct investments in fintech startups operating in their industry to gain access to and learn about new ideas and cutting-edge technologies (which may help these established companies improve their own performance).Footnote 21

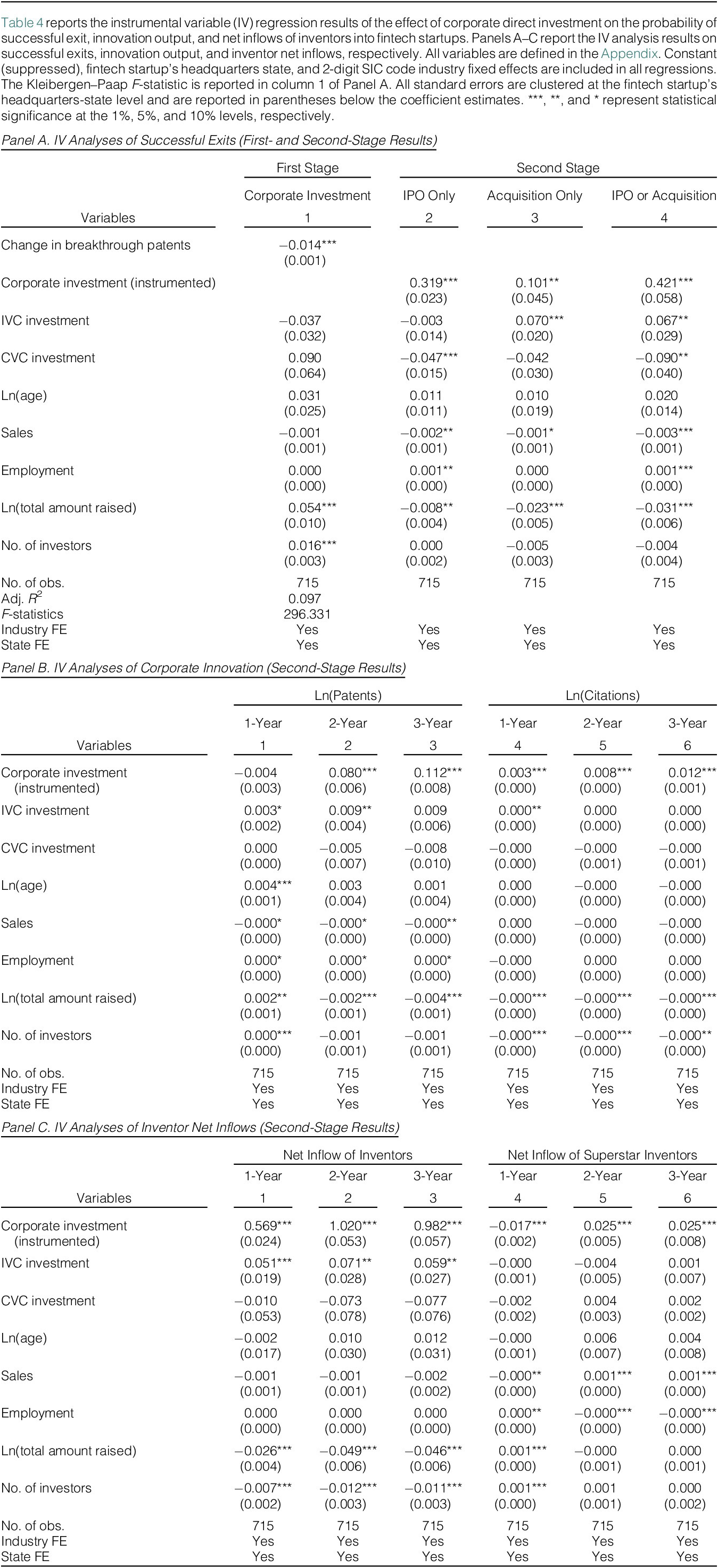

We report the results of our instrumental variable analyses in Table 4. In column 1 of Panel A, the first-stage result reveals that the instrument is negatively and significantly associated with direct investment in fintech startups in that industry and the first-stage F-statistic is greater than the critical value in Stock and Yogo (Reference Stock and Yogo2002), thereby satisfying the relevance condition. The remainder of Table 4 reports the second-stage results of our IV analyses. For most specifications, the IV results support the notion that corporate direct investment leads to a greater likelihood of successful exit, a greater quantity and quality of innovation output, and a greater net inflow of inventors.Footnote 22 In summary, the results reported in this section demonstrate that corporate direct investment improves the outcomes of fintech startups, lending support to our hypothesis H1B.

TABLE 4 The Effect of Corporate Direct Investment on the Probability of Successful Exit, Innovation Output, and the Net Inventor Inflow into Fintech Startups: IV Analyses

B. Value Creation by Corporate Investors in the Financial Services Versus Nonfinancial Services Sectors: Test of Synergy

In this section, we analyze value creation by corporate investors in the financial services versus nonfinancial services sectors (H2). We expect greater synergies between corporate investors in the financial services sector and fintech startups than between corporate investors in the nonfinancial services sector and fintech startups. We therefore conduct separate baseline analyses to analyze the effect of corporate investment by firms in the financial and nonfinancial services sectors, respectively, on the future outcomes of fintech startups.

As reported in Table A6 in the Supplementary Material (due to space limitations), we separately analyze the effect of direct investment by corporate investors in the financial services sector and that by corporate investors in nonfinancial services sector on the likelihood of successful exits of fintech startups. In Panel A, we show the effect of direct investment by corporate investors in the financial services sector on the likelihood of successful exit of startups. Our sample includes startups that received direct investments from at least one corporate investor in the financial services sector (i.e., treated startup) and a group of control startups. For each treated startup, we identify a control startup in the same 2-digit SIC industry and founded in the same year using one-to-one propensity score matching based on average sales and employment. We find that direct investment by corporations in the financial services sector in fintech startups is associated with a significantly higher likelihood of successful exit for these startups. Next, in Panel B, we analyze the effect of direct investment by corporate investors in the nonfinancial services sector on the likelihood of successful exit of fintech startups. Using the above approach, we identify a control startup for each startup that received corporate direct investment in the nonfinancial services sector. We show that direct investments in fintech startups by corporations in the nonfinancial services sector have no significant effect on the likelihood of successful exits of startups. Thus, the above results support our hypothesis H2.

Further, we analyze whether fintech startups benefit from receiving direct investments from banks or from nonbank corporate investors. Our sample comprises fintech startups that received investments from corporate investors in the financial services sector and control startups identified using the above approach. We classify corporate investors in the financial services sector into banks and nonbank investors (e.g., insurance companies and mortgage lending companies) and construct separate indicator variables for each category, respectively. We present the results of these analyses in Table A7 in the Supplementary Material. We find that direct investments from both banks and nonbank corporate investors are associated with a higher likelihood of successful exit for fintech startups.

Finally, we also conduct cross-sectional analysis to test whether fintech startups in more valuable technological areas derive greater benefit from corporate direct investment. We split our sample of fintech startups into two groups: startups operating in more valuable technological areas and those in less valuable areas. Similar to Chen, Wu, and Yang (Reference Chen, Wu and Yang2019), startups in more valuable technological areas include those in Blockchain, Robo-advising, Internet of Things, lending, and cyber-security industries, based on the data on business categories and business descriptions of fintech startups in our sample. In untabulated analysis, we find that corporate direct investment is associated with a higher likelihood of successful exit for startups in both more and less valuable technological areas. However, corporate direct investment seems to have a stronger positive impact on the successful exits for fintech startups in more valuable technological areas (compared to those in less valuable areas).

VI. Channels Through Which Corporate Direct Investment Improves the Outcomes of Fintech Startups

In this section, we explore two potential channels through which corporate direct investors may create value for fintech startups: namely, forming strategic alliances with fintech startups and obtaining board seats in these startups to better monitor them.

A. The Effect of Strategic Alliance Formation Between Corporate Direct Investors and Fintech Startups on Future Outcomes of Startups

In this section, we analyze whether corporate investors help fintech startups they invest in to achieve better future performance (at least partly) by forming strategic alliances with them. To empirically test this, we check whether there is an additional positive and significant impact of strategic alliances between corporate investors and fintech startups on the future outcomes of these startups, over and above any effect due to corporate investment alone (H3). We hand-collect data on strategic alliances between investors (both corporate direct investors and CVC parents) and fintech startups through an extensive search of news articles on the Internet. We consider an investment as leading to a strategic alliance if we can find at least one news article mentioning a strategic alliance or partnership between the investor and the fintech investee upon or after the investment. We take the date of the earliest news article that mentions the formation of such strategic alliance as the date of strategic alliance formation.

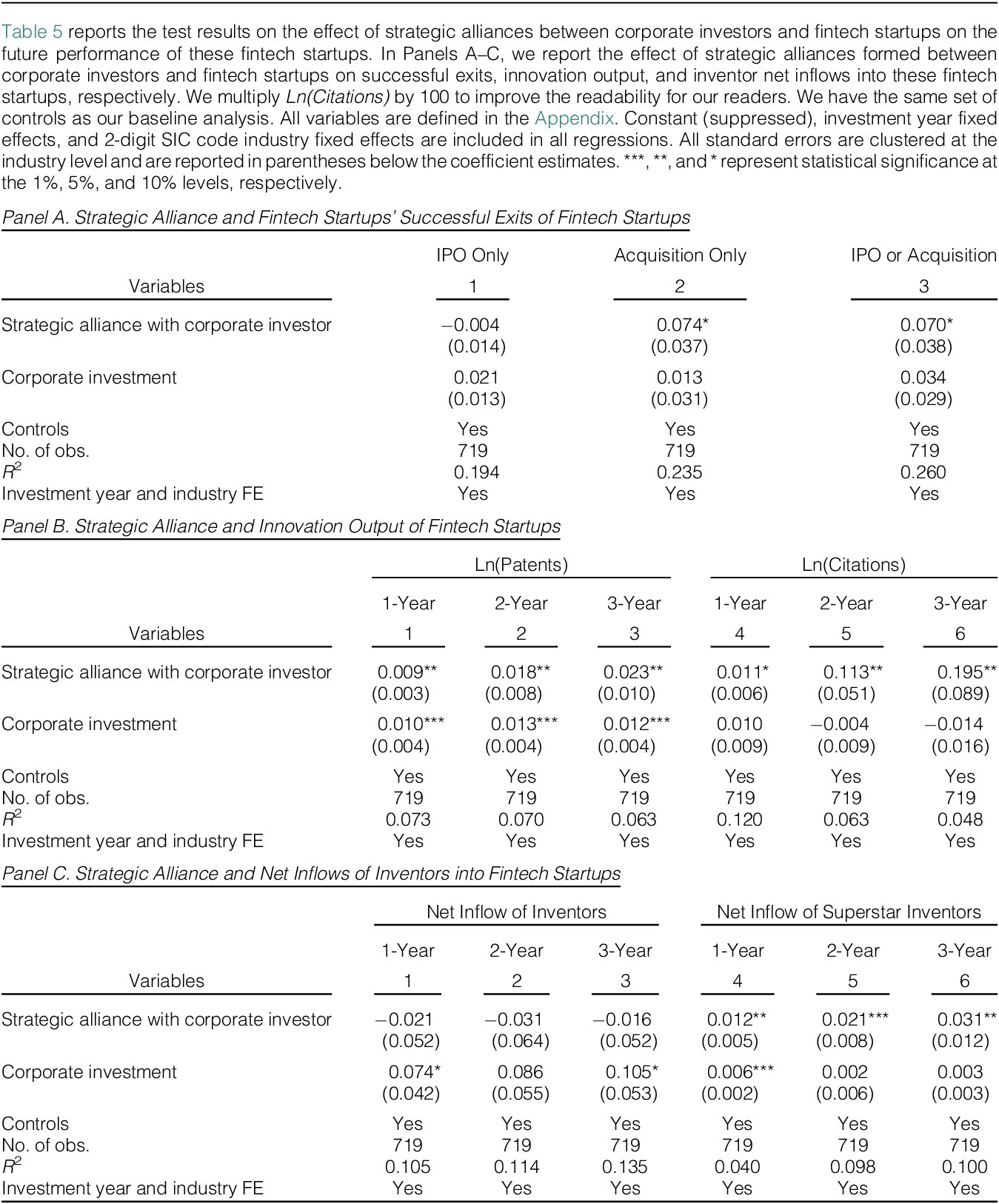

We present the results of the above analyses in Table 5. Our main independent variable of interest is an indicator variable equal to 1 if a strategic alliance is formed between a fintech startup and at least one corporate investor upon or after direct investment by the corporate investor (and 0 otherwise). We also include the corporate investment dummy in the regression so that we can capture the effect of strategic alliance formation between a corporate investor and fintech startup over and above the effect of direct investment by the corporate investor without the formation of a strategic alliance. In Panels A–C, we show that strategic alliance formation between corporate investors and fintech startups is significantly associated with a higher likelihood of successful exit, a higher quantity and quality of patents, and a higher net inflow of superstar inventors to these startups. Collectively, our results demonstrate that strategic alliance formation between corporate investors and fintech startups creates additional value to these startups over and above any benefits they obtain simply due to the direct investment by corporate investors without the formation of any strategic alliances, supporting H3.

TABLE 5 The Effect of Strategic Alliances Between Corporate Direct Investors and Fintech Startups on the Future Performance of Fintech Startups

B. The Effect of Board Representation by Corporate Direct Investors on the Future Outcomes of Fintech Startups

In this section, we study whether corporate direct investors help enhance the future performance of fintech startups (at least partly) by better monitoring these startups through obtaining board seats in them. Thus, we empirically check whether the corporate direct investment with board representation in fintech startups has an additional positive impact on the outcomes of these startups, over and beyond any positive impact due to corporate direct investment alone (H4). We collect information on board members in these fintech startups from Pitchbook, the SEC Form D data set, and through an extensive manual search on the Internet.

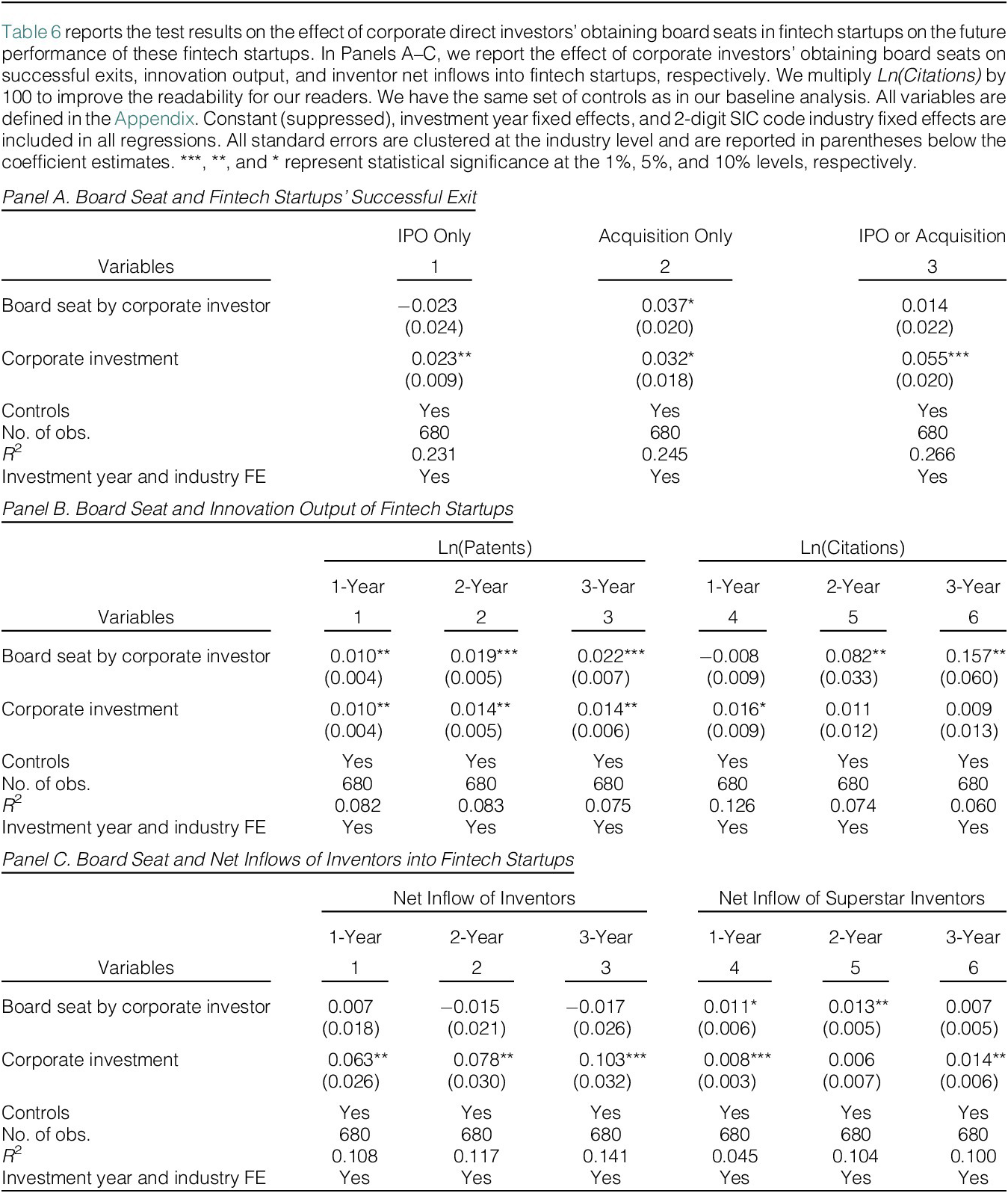

We present the results of these analyses in Table 6. Our main independent variable of interest is Board Seat by Corporate Investor, which is an indicator variable equal to 1 if a corporate investor obtains a board seat in the fintech startup upon or after direct investment, and 0 otherwise. We include the Corporate Investment dummy in all the regressions in Table 6, so that the coefficient of Board Seat by Corporate Investor captures the effect of corporate investors’ monitoring by obtaining board seats over and above any effect due to corporate direct investment alone. We include all other control variables used in our earlier analyses as well.

TABLE 6 The Effect of Board Representation by Corporate Direct Investors on the Future Performance of Fintech Startups

In Table 6, we find that corporate direct investors who obtain board seats in fintech startups are positively associated with the likelihood of successful exit through acquisitions for such fintech startups, the quantity and quality of innovation output (measured by patent counts and patent citations) of these startups, and the net inflow of superstar inventors to these startups. In summary, our results demonstrate that board representation by corporate direct investors helps fintech investees perform better, over and beyond any positive effects due to corporate investment alone. Thus, the above results support our hypothesis H4.

C. Is Corporate Direct Investment More Conducive to Strategic Alliance Formation Compared with Investment Through CVC Arms?

We showed earlier that one channel through which corporate direct investment improves the outcomes of fintech startups is through the formation of strategic alliances between corporate investors and fintech startups. Although both corporate direct investment and indirect investment through the corporation’s CVC arms may lead to the formation of strategic alliances with their fintech investees, we conjecture that direct investment leads to a smaller organizational distance between the corporate investor and the fintech startup. Therefore, compared with indirect investment in fintech startups through CVC arms, we expect that corporate direct investment leads to a higher likelihood of strategic alliance formation between investors and their fintech investees and helps form such alliances faster.

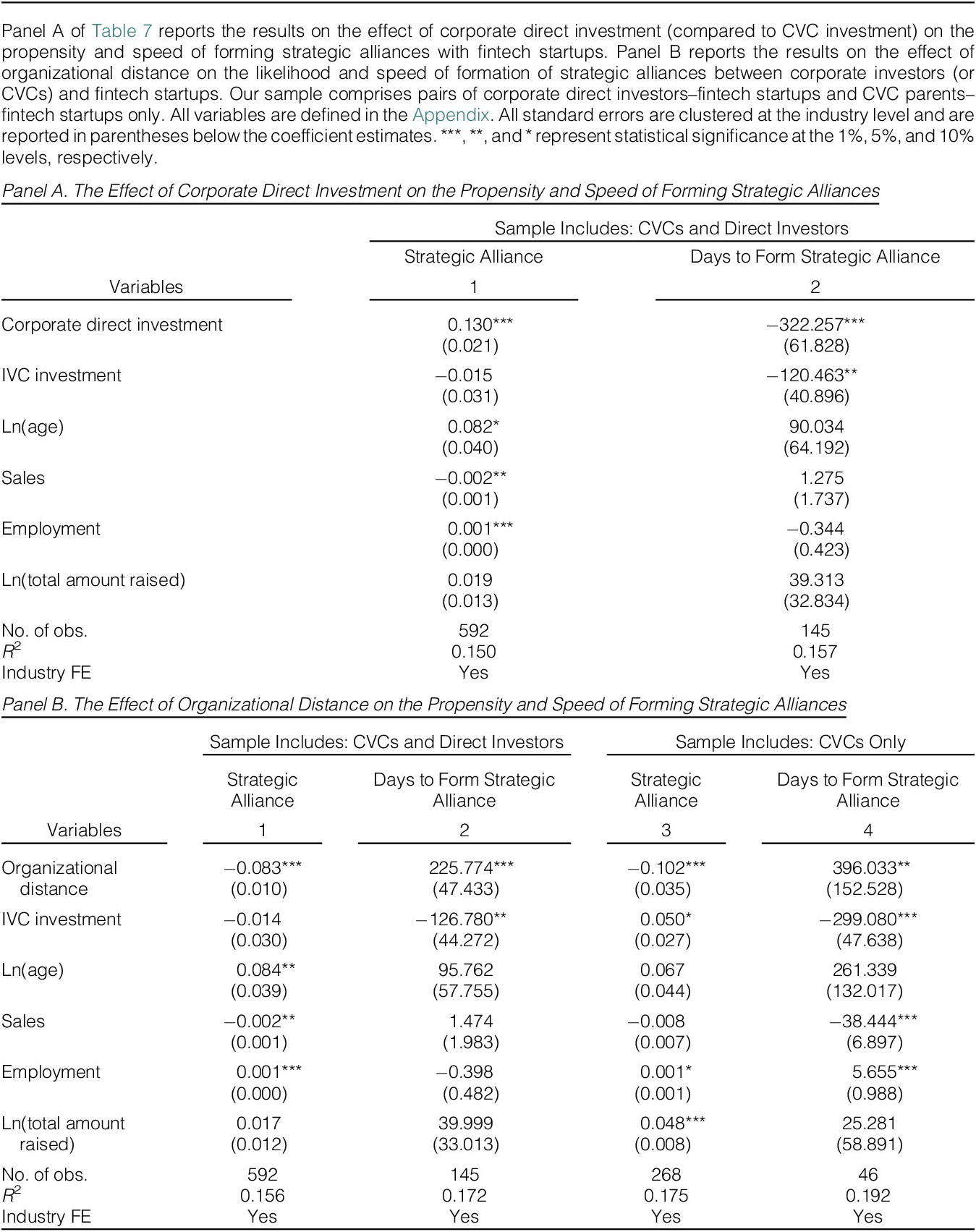

We empirically test these conjectures and present the results in Table 7. For the empirical analyses in Table 7, our sample consists of all pairs of corporate investors and their fintech investees, as well as pairs of CVC parents and their fintech investees. Thus, the benchmark case we consider in this test is a CVC investment. We consider two dependent variables: a dummy variable indicating whether a strategic alliance has been formed (Strategic Alliance) and the amount of time it takes (in days) to form the strategic alliance, conditional on the formation of such alliance (Days to Form Strategic Alliance).Footnote 23 In Panel A of Table 7, our independent variable of interest is Corporate Direct Investment, an indicator variable that takes a value of 1 if the investor is a corporate direct investor and is equal to 0 if the investor is a CVC parent. In column 1, we find that the coefficient of Corporate Direct Investment is positive and significant (at the 1% level), demonstrating that corporate direct investment (compared with CVC investment) is more conducive in the formation of strategic alliances between investors and their fintech investees. Our results are economically significant: corporate direct investment is associated with a 13-percentage-point greater likelihood of a strategic alliance formation between the investor and fintech startup, compared with a CVC investment. In column 2, we show that corporate direct investment is associated with a smaller amount of time (1% significance) to form a strategic alliance, conditional on the formation of the alliance.Footnote 24 On average, it takes corporate direct investors 322 days less to form strategic alliances with their fintech investees, compared to corporations that make indirect investments through their CVC arms.

TABLE 7 The Effect of Corporate Direct Investment (Compared to CVC Investment) on the Propensity and Speed of Forming Strategic Alliances with Fintech Startups

In Panel B of Table 7, we provide more insights into the conjecture that corporate direct investment is more conducive to strategic alliance formation between investors and their fintech investees due to a shorter organizational distance. To achieve this, we create a measure of organizational distance between corporate direct investors or CVC parents to their fintech investees, following Belenzon et al. (Reference Belenzon, Hashai and Patacconi2019), based on the chain of shareholder ownership of subsidiaries. We then examine the relationship between organizational distance and the propensity and speed of strategic alliance formation between the investors and their fintech investees. For corporate direct investment, we assign an organizational distance of zero between corporate direct investors and fintech startups (investees).Footnote 25 For CVC investment, we assign an organizational distance of one between the corporate parent of a CVC and the fintech startup (investee) if the CVC is a division of the corporate parent (and not a separately existing entity or subsidiary), two if the CVC is a separate entity (LLC or corporation), and three if the CVC is a subsidiary under the control of a separate subsidiary within the apex firm.Footnote 26

In columns 1 and 2 of Panel B of Table 7, our sample comprises pairs of corporate investors and fintech startups or pairs of CVC parents and fintech startups. We show that a greater organizational distance is associated with a lower likelihood of strategic alliance formation between investors and investees and a longer time to form such alliances. In economic terms, an increase in the organizational distance by a value of one is associated with a decrease of 8.3 percentage points in the likelihood of strategic alliance formation and an increase of 226 days in the amount of time taken to form the alliance upon or post-investment, respectively. In columns 3 and 4, we validate our measure of organizational distance by focusing only on CVC parents and startup pairs. We find that parent companies of CVCs that have a greater organizational distance to their fintech startups are less likely to form strategic alliances with these startups and take a greater amount of time to form strategic alliances, conditional on the formation of the alliance. In sum, our results demonstrate that corporate direct investment has an advantage in facilitating strategic alliance formation with fintech startups compared to CVCs due to the shorter organizational distance of corporate investors to these startups, supporting hypothesis H5.

D. Is Corporate Direct Investment More Conducive to Obtaining Board Seats in Fintech Startups Compared with Investment Through CVC Arms?

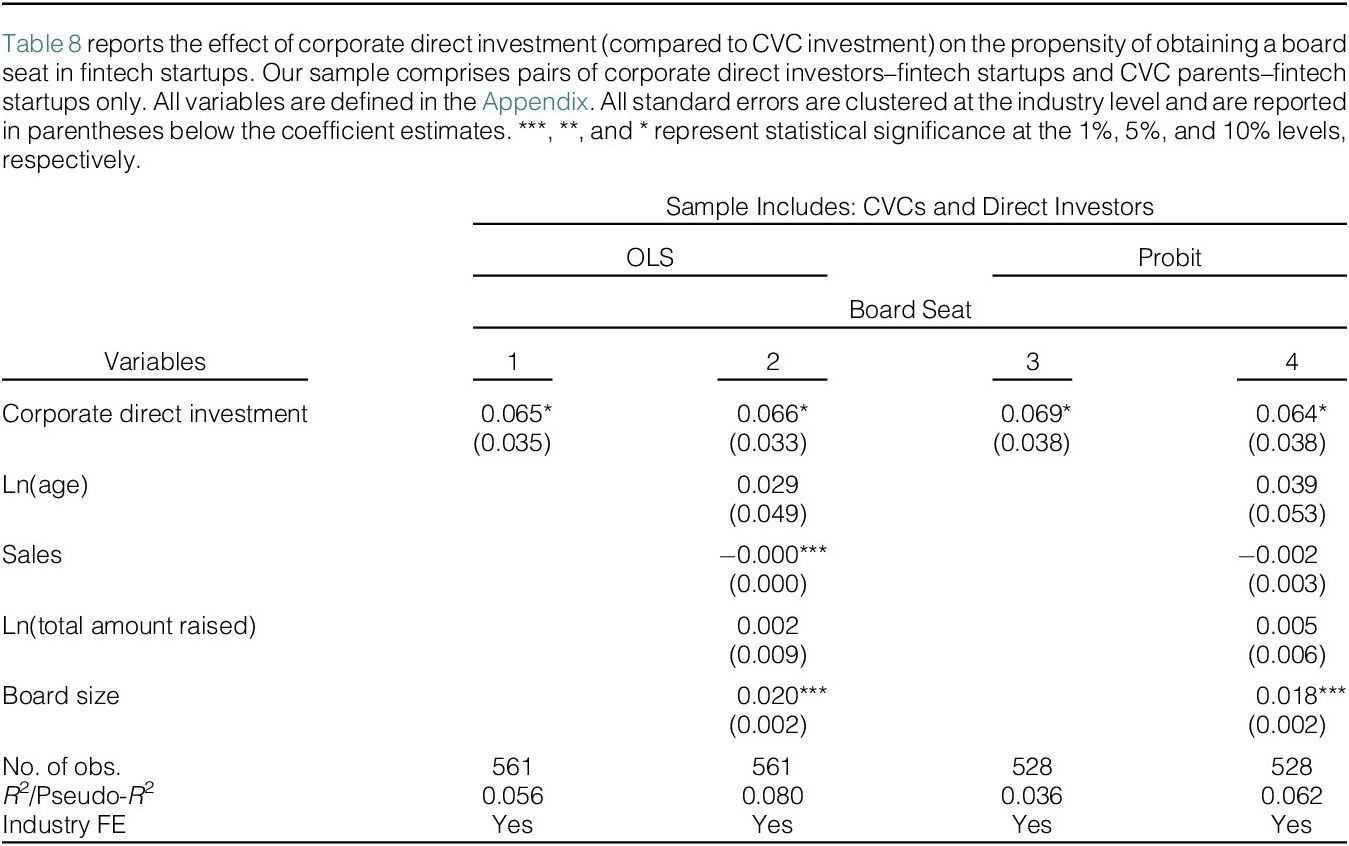

We now empirically analyze whether corporate direct investors are more likely to obtain a board seat in fintech startups compared with corporations that make indirect investments through their CVC arms (H6). For this empirical analysis, our sample consists of pairs of corporate investors and their fintech investees, as well as pairs of CVC parents and their fintech investees. As presented in Table 8, the dependent variable is Board Seat, a dummy variable that takes a value of 1 if the corporate investor or the CVC parent obtains a board seat in their fintech investees, and 0 otherwise. The independent variable of interest is Corporate Direct Investment, which is a dummy variable equal to 1 if a fintech startup received corporate direct investment, and 0 if it received investment from a CVC. Thus, the benchmark case we consider in this analysis is CVC investment. We find that the coefficients of Corporate Direct Investment are positive and significant using either OLS or probit regressions reported in Table 8. In economic terms, column 2 suggests that corporate direct investors have a 6.6-percentage-point higher probability of obtaining a board seat in fintech startups compared with corporations that make indirect investment through their CVC arms. Thus, our results demonstrate that corporate direct investment (compared with CVC investment) is more conducive to investors obtaining a board seat in their fintech investees, which supports our hypothesis H6.

TABLE 8 The Effect of Corporate Direct Investment (Compared to CVC Investment) on Board Seats

VII. The Effect of Direct Investments in Fintech Startups on the Outcomes Achieved by Corporate Investors Themselves

Our findings thus far indicate that fintech startups derive significant benefits from direct investments made by corporate investors. In this section, we empirically study whether corporate investors themselves gain from these direct investments.Footnote 27 We identify 65 publicly listed corporate investors that have made direct investment in fintech startups in our sample. Out of these 65 firms, 32 are in the financial services sector (including 15 banks and 17 nonbank investors, such as insurance companies and mortgage lending companies). In contrast to the previous part of the article where we consider investments by either public or private corporate investors, here we only focus on publicly listed corporate investors, since we need data on the performance of corporate investors for the analyses in this section (available only for publicly listed investors).

A. The Effect of Direct Investments in Fintech Startups on Future Outcomes Achieved by Corporate Investors: Empirical Strategy

In this section, we discuss our empirical strategy analyzing the relationship between direct investment in fintech startups and the subsequent performance of the corporate investors. We later describe our results in the following subsections. We examine the impact of direct investments in fintech startups on the future performance of corporate investors using a stacked DiD framework following Gormley and Matsa (Reference Gormley and Matsa2011). Although certain corporate investors in our sample invested in multiple fintech startups, we focus on the impact of their very first investment in a fintech startup on their operating performance and equity-market valuation. In other words, we focus on the effect of direct investment in fintech startups on the performance of corporate investors on the extensive margin.

For this analysis, we use a firm-quarter unbalanced panel from 1997 to the first quarter of 2020. We construct a cohort of corporate investors (i.e., treated firms) and control firms using firm-quarter observations for 12 quarters before and after the corporate investor’s first investment in a fintech startup. We only include treated firms that have made their first direct investment in fintech startups by 2017 so that we can track their performance over a 3-year window subsequent to the investment in a fintech startup.Footnote 28 A cohort is formed in a calendar year-quarter in which investments in fintech startups were made by corporate direct investors (i.e., treated firms). For each treated firm, we find three control firms in the same 3-digit SIC code industry based on nearest matches using propensity score matching. We match firms based on size, age, and R&D expenditure in the year immediately prior to the investment year.

We then use the following empirical specification to examine the impact of investments in fintech startups on the performance of corporate investors:

$$ \begin{array}{l}{Perf}_{i,c,t}={\alpha}_0+{\alpha}_1{Post}_{c,t}\times Direct\ Fintech\hskip0.42em {Investment}_{i,c}\\ {}+\hskip0.35em {\phi}_{i,c}+{\gamma}_{c,t}+{X}_{i,c,t}+{\unicode{x025B}}_{i,c,t},\end{array} $$

$$ \begin{array}{l}{Perf}_{i,c,t}={\alpha}_0+{\alpha}_1{Post}_{c,t}\times Direct\ Fintech\hskip0.42em {Investment}_{i,c}\\ {}+\hskip0.35em {\phi}_{i,c}+{\gamma}_{c,t}+{X}_{i,c,t}+{\unicode{x025B}}_{i,c,t},\end{array} $$

where i indexes the firm, c indexes the cohort, and t indexes the time of fiscal-quarters, which takes a value between

![]() $ -12 $

and

$ -12 $

and

![]() $ 12 $

, with t = 0 being the quarter in which the firm made its first investment in a fintech startup. Thus, we include observations for 12 quarters pre- and post-investment for corporate investors and their respective control firms.

$ 12 $

, with t = 0 being the quarter in which the firm made its first investment in a fintech startup. Thus, we include observations for 12 quarters pre- and post-investment for corporate investors and their respective control firms.

![]() $ {Perf}_{i,c,t} $

represents the following measures for a corporate investor: profitability, market share, and Tobin’s Q.

$ {Perf}_{i,c,t} $

represents the following measures for a corporate investor: profitability, market share, and Tobin’s Q.

![]() $ {Post}_{c,t} $

is an indicator variable equal to 1 for a quarter in which the corporate investor made its first direct investment in a fintech startup, as well as for all the quarters subsequently, and 0 otherwise. Direct Fintech Investment

$ {Post}_{c,t} $

is an indicator variable equal to 1 for a quarter in which the corporate investor made its first direct investment in a fintech startup, as well as for all the quarters subsequently, and 0 otherwise. Direct Fintech Investment

![]() $ {}_{i,c} $

is an indicator variable that takes the value of 1 for corporate investors (i.e., treated firms) and 0 for control firms.

$ {}_{i,c} $

is an indicator variable that takes the value of 1 for corporate investors (i.e., treated firms) and 0 for control firms.

![]() $ {X}_{i,c,t} $

represents the control variables, including the change in sales over the past 6 quarters, size, the number of institutional investors, and R&D expenditure. Following Gormley and Matsa (Reference Gormley and Matsa2011), we include cohort-by-firm fixed effects and cohort-by-calendar-year-by-quarter fixed effects in our regressions, which is a standard practice in a stacked DiD framework. Specifically, a cohort is a particular calendar year-quarter, where a group of corporate investors made their first investment in fintech startups. Thus, each cohort comprises corporate investors that made investments in fintech startups, as well as their respective control firms. We cluster our standard errors at the firm level.

$ {X}_{i,c,t} $

represents the control variables, including the change in sales over the past 6 quarters, size, the number of institutional investors, and R&D expenditure. Following Gormley and Matsa (Reference Gormley and Matsa2011), we include cohort-by-firm fixed effects and cohort-by-calendar-year-by-quarter fixed effects in our regressions, which is a standard practice in a stacked DiD framework. Specifically, a cohort is a particular calendar year-quarter, where a group of corporate investors made their first investment in fintech startups. Thus, each cohort comprises corporate investors that made investments in fintech startups, as well as their respective control firms. We cluster our standard errors at the firm level.