Refine listing

Actions for selected content:

526 results in 60Exx

A non-convex optimization approach of searching algebraic degree phase-type representations for general phase-type distributions

- Part of

-

- Journal:

- Advances in Applied Probability / Volume 57 / Issue 3 / September 2025

- Published online by Cambridge University Press:

- 03 March 2025, pp. 1101-1137

- Print publication:

- September 2025

-

- Article

- Export citation

Some generalized information and divergence generating functions: properties, estimation, validation, and applications

- Part of

-

- Journal:

- Probability in the Engineering and Informational Sciences / Volume 39 / Issue 3 / July 2025

- Published online by Cambridge University Press:

- 25 February 2025, pp. 397-430

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

Barlow and Proschan principle for coherent systems with statistically dependent component and redundancy lifetimes

- Part of

-

- Journal:

- Probability in the Engineering and Informational Sciences / Volume 39 / Issue 2 / April 2025

- Published online by Cambridge University Press:

- 09 December 2024, pp. 141-155

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

A new weighted means of failure rate and associated quantile versions

- Part of

-

- Journal:

- Probability in the Engineering and Informational Sciences / Volume 39 / Issue 1 / January 2025

- Published online by Cambridge University Press:

- 15 November 2024, pp. 64-82

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

STABILITY ANALYSIS FOR STOCHASTIC MCKEAN–VLASOV EQUATION

- Part of

-

- Journal:

- The ANZIAM Journal / Volume 67 / 2025

- Published online by Cambridge University Press:

- 06 November 2024, e6

-

- Article

- Export citation

Majorization and randomness measures

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 62 / Issue 2 / June 2025

- Published online by Cambridge University Press:

- 16 October 2024, pp. 541-557

- Print publication:

- June 2025

-

- Article

- Export citation

The impact of pinning points on memorylessness in Lévy random bridges

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 62 / Issue 1 / March 2025

- Published online by Cambridge University Press:

- 15 October 2024, pp. 172-187

- Print publication:

- March 2025

-

- Article

- Export citation

On the rate of convergence for an α-stable central limit theorem under sublinear expectation

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 62 / Issue 1 / March 2025

- Published online by Cambridge University Press:

- 03 October 2024, pp. 209-233

- Print publication:

- March 2025

-

- Article

- Export citation

Tail variance and confidence of using tail conditional expectation: Analytical representation, capital adequacy, and asymptotics

- Part of

-

- Journal:

- Advances in Applied Probability / Volume 57 / Issue 1 / March 2025

- Published online by Cambridge University Press:

- 31 July 2024, pp. 346-369

- Print publication:

- March 2025

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

Bivariate tempered space-fractional Poisson process and shock models

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 61 / Issue 4 / December 2024

- Published online by Cambridge University Press:

- 23 May 2024, pp. 1485-1501

- Print publication:

- December 2024

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

Orderings of extremes among dependent extended Weibull random variables

- Part of

-

- Journal:

- Probability in the Engineering and Informational Sciences / Volume 38 / Issue 4 / October 2024

- Published online by Cambridge University Press:

- 07 May 2024, pp. 705-732

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

A remark on exact simulation of tempered stable Ornstein–Uhlenbeck processes

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 61 / Issue 4 / December 2024

- Published online by Cambridge University Press:

- 02 May 2024, pp. 1196-1198

- Print publication:

- December 2024

-

- Article

-

- You have access

- HTML

- Export citation

A remark on a conjecture on the symmetric Gaussian problem

- Part of

-

- Journal:

- Proceedings of the Edinburgh Mathematical Society / Volume 67 / Issue 2 / May 2024

- Published online by Cambridge University Press:

- 15 April 2024, pp. 643-661

-

- Article

- Export citation

Coherent distributions on the square–extreme points and asymptotics

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 61 / Issue 4 / December 2024

- Published online by Cambridge University Press:

- 05 April 2024, pp. 1240-1262

- Print publication:

- December 2024

-

- Article

- Export citation

Skew Ornstein–Uhlenbeck processes with sticky reflection and their applications to bond pricing

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 61 / Issue 4 / December 2024

- Published online by Cambridge University Press:

- 06 March 2024, pp. 1172-1195

- Print publication:

- December 2024

-

- Article

- Export citation

Connectivity of random graphs after centrality-based vertex removal

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 61 / Issue 3 / September 2024

- Published online by Cambridge University Press:

- 23 February 2024, pp. 967-998

- Print publication:

- September 2024

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

On some semi-parametric estimates for European option prices

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 61 / Issue 3 / September 2024

- Published online by Cambridge University Press:

- 14 February 2024, pp. 999-1009

- Print publication:

- September 2024

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

Log-concavity and relative log-concave ordering of compound distributions

- Part of

-

- Journal:

- Probability in the Engineering and Informational Sciences / Volume 38 / Issue 3 / July 2024

- Published online by Cambridge University Press:

- 29 January 2024, pp. 579-593

-

- Article

-

- You have access

- Open access

- HTML

- Export citation

ON THE CUMULATIVE DISTRIBUTION FUNCTION OF THE VARIANCE-GAMMA DISTRIBUTION

- Part of

-

- Journal:

- Bulletin of the Australian Mathematical Society / Volume 110 / Issue 2 / October 2024

- Published online by Cambridge University Press:

- 29 January 2024, pp. 389-397

- Print publication:

- October 2024

-

- Article

- Export citation

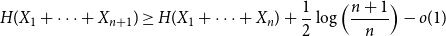

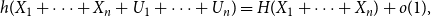

Approximate discrete entropy monotonicity for log-concave sums

- Part of

-

- Journal:

- Combinatorics, Probability and Computing / Volume 33 / Issue 2 / March 2024

- Published online by Cambridge University Press:

- 13 November 2023, pp. 196-209

-

- Article

- Export citation