Refine listing

Actions for selected content:

1838 results in 60Gxx

The Fokker–Planck equation for the time-changed fractional Ornstein–Uhlenbeck stochastic process

- Part of

-

- Journal:

- Proceedings of the Royal Society of Edinburgh. Section A: Mathematics / Volume 152 / Issue 4 / August 2022

- Published online by Cambridge University Press:

- 21 September 2021, pp. 1032-1057

- Print publication:

- August 2022

-

- Article

- Export citation

Non-Gaussian fluctuations of randomly trapped random walks

- Part of

-

- Journal:

- Advances in Applied Probability / Volume 53 / Issue 3 / September 2021

- Published online by Cambridge University Press:

- 08 October 2021, pp. 801-838

- Print publication:

- September 2021

-

- Article

- Export citation

Pathwise large deviations for the rough Bergomi model: Corrigendum

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 58 / Issue 3 / September 2021

- Published online by Cambridge University Press:

- 16 September 2021, pp. 849-850

- Print publication:

- September 2021

-

- Article

-

- You have access

- HTML

- Export citation

Estimating tails of independently stopped random walks using concave approximations of hazard functions

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 58 / Issue 3 / September 2021

- Published online by Cambridge University Press:

- 16 September 2021, pp. 773-793

- Print publication:

- September 2021

-

- Article

- Export citation

Extinction time of the logistic process

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 58 / Issue 3 / September 2021

- Published online by Cambridge University Press:

- 16 September 2021, pp. 637-676

- Print publication:

- September 2021

-

- Article

- Export citation

Diffusion approximation of multi-class Hawkes processes: Theoretical and numerical analysis

- Part of

-

- Journal:

- Advances in Applied Probability / Volume 53 / Issue 3 / September 2021

- Published online by Cambridge University Press:

- 08 October 2021, pp. 716-756

- Print publication:

- September 2021

-

- Article

- Export citation

Long range dependence of heavy-tailed random functions

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 58 / Issue 3 / September 2021

- Published online by Cambridge University Press:

- 16 September 2021, pp. 569-593

- Print publication:

- September 2021

-

- Article

- Export citation

A transient Cramér–Lundberg model with applications to credit risk

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 58 / Issue 3 / September 2021

- Published online by Cambridge University Press:

- 16 September 2021, pp. 721-745

- Print publication:

- September 2021

-

- Article

- Export citation

Rejection- and importance-sampling-based perfect simulation for Gibbs hard-sphere models

- Part of

-

- Journal:

- Advances in Applied Probability / Volume 53 / Issue 3 / September 2021

- Published online by Cambridge University Press:

- 08 October 2021, pp. 839-885

- Print publication:

- September 2021

-

- Article

- Export citation

Variations of the elephant random walk

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 58 / Issue 3 / September 2021

- Published online by Cambridge University Press:

- 16 September 2021, pp. 805-829

- Print publication:

- September 2021

-

- Article

- Export citation

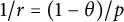

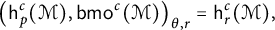

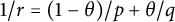

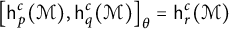

Interpolation between noncommutative martingale Hardy and BMO spaces: the case

$\textbf {0<p<1}$

$\textbf {0<p<1}$

- Part of

-

- Journal:

- Canadian Journal of Mathematics / Volume 74 / Issue 6 / December 2022

- Published online by Cambridge University Press:

- 25 August 2021, pp. 1700-1744

- Print publication:

- December 2022

-

- Article

- Export citation

OPTION PRICING UNDER THE FRACTIONAL STOCHASTIC VOLATILITY MODEL

- Part of

-

- Journal:

- The ANZIAM Journal / Volume 63 / Issue 2 / April 2021

- Published online by Cambridge University Press:

- 13 August 2021, pp. 123-142

-

- Article

- Export citation

Mixing rates for potentials of non-summable variations

- Part of

-

- Journal:

- Ergodic Theory and Dynamical Systems / Volume 42 / Issue 9 / September 2022

- Published online by Cambridge University Press:

- 16 July 2021, pp. 2823-2840

- Print publication:

- September 2022

-

- Article

- Export citation

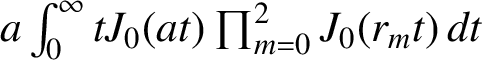

ON AN INTEGRAL OF

$\boldsymbol {J}$-BESSEL FUNCTIONS AND ITS APPLICATION TO MAHLER MEASURE

$\boldsymbol {J}$-BESSEL FUNCTIONS AND ITS APPLICATION TO MAHLER MEASURE

- Part of

-

- Journal:

- Bulletin of the Australian Mathematical Society / Volume 105 / Issue 2 / April 2022

- Published online by Cambridge University Press:

- 09 July 2021, pp. 223-235

- Print publication:

- April 2022

-

- Article

- Export citation

Continuum line-of-sight percolation on Poisson–Voronoi tessellations

- Part of

-

- Journal:

- Advances in Applied Probability / Volume 53 / Issue 2 / June 2021

- Published online by Cambridge University Press:

- 01 July 2021, pp. 510-536

- Print publication:

- June 2021

-

- Article

- Export citation

A generalised Dickman distribution and the number of species in a negative binomial process model

- Part of

-

- Journal:

- Advances in Applied Probability / Volume 53 / Issue 2 / June 2021

- Published online by Cambridge University Press:

- 01 July 2021, pp. 370-399

- Print publication:

- June 2021

-

- Article

- Export citation

Exact simulation of Ornstein–Uhlenbeck tempered stable processes

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 58 / Issue 2 / June 2021

- Published online by Cambridge University Press:

- 23 June 2021, pp. 347-371

- Print publication:

- June 2021

-

- Article

- Export citation

Population dynamics driven by truncated stable processes with Markovian switching

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 58 / Issue 2 / June 2021

- Published online by Cambridge University Press:

- 23 June 2021, pp. 505-522

- Print publication:

- June 2021

-

- Article

- Export citation

A class of solvable multidimensional stopping problems in the presence of Knightian uncertainty

- Part of

-

- Journal:

- Advances in Applied Probability / Volume 53 / Issue 2 / June 2021

- Published online by Cambridge University Press:

- 01 July 2021, pp. 400-424

- Print publication:

- June 2021

-

- Article

- Export citation

Couplings for determinantal point processes and their reduced Palm distributions with a view to quantifying repulsiveness

- Part of

-

- Journal:

- Journal of Applied Probability / Volume 58 / Issue 2 / June 2021

- Published online by Cambridge University Press:

- 23 June 2021, pp. 469-483

- Print publication:

- June 2021

-

- Article

- Export citation